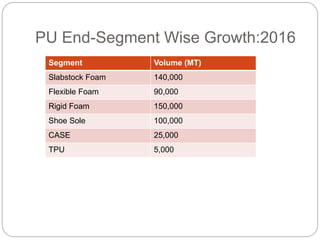

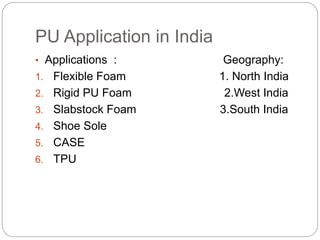

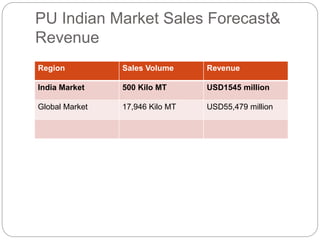

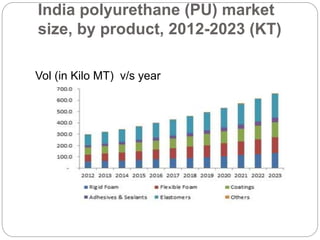

This document provides an analysis of the Indian polyurethane market in 2016, including market size, segmentation, applications, and forecasts. It finds that the Indian PU market was worth $1545 million USD and 500 kilo metric tons in volume in 2016. The market is segmented by raw material (MDI and TDI), applications, and end use segments. It also summarizes that the furniture and construction industries in India are major consumers of PU, and that North and Western India represent the largest PU consuming regions currently, though the South is developing rapidly as well.