Canadians Urgent Truth About Taxation

- 1. To: Rick Mercer c/o CBC Rick Mercer Report P.O. Box 500 Station A Toronto, ON M5W 1E6 From: Thane Heins President and CEO Potential Difference Inc. 2339 Ramsay Concession 6-D Almonte ON K0A1A0

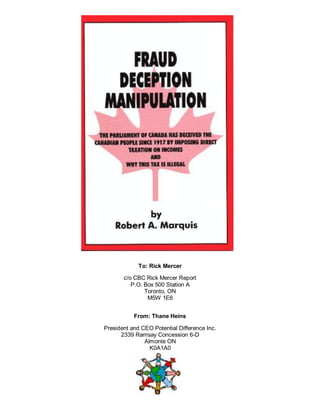

- 2. th Rick Mercer Nov. 25 , 2012 c/o Rick Mercer Report Hello Rick, I wonder if you might be able to help provide the following gift of Truth this year for Christmas? It may seem ironic but you are the best hope of getting this information presented to Canadians. My name is Thane Heins and I am an Ottawa businessman, former Federal and Provincial election candidate for the Ottawa Valley. I have been trying (and failing) since 1997 to make this information know because this truth “will set us free.” Freedom from deliberately designed and perpetual National Debt and all the human suffering that goes along with it. I will be sending you Robert Marquis’ book for Christmas. Robert was a proud Canadian who served his country, as a former government accountant, and a WWII veteran from Richmond Hill ON who I knew personally. Robert’s book contains all the evidence required to convict the Harper Government of criminal activity in the court of public opinion at least. I have notified the Minister of Justice, the RCMP and the OPP (and all members of Parliament) of this but unfortunately no one investigates criminal activity concerning the government regarding: fraud, My OPP complain file number concerning extortion, Extortion on behalf of Revenue Canada is; breach of trust, SP12293486 disobeying a statute, Presented to: disobeying order of court, Constable Paul on November 23, 2012 criminal negligence, theft, My RCMP complaint of Election Fraud was conspiracy provided to Superintendent D.B Jeggo of contempt of the Supreme Court of Canada misleading Parliament the RCMP Economic Crime Branch, Section participating in a criminal organization “1” on January 9th, 2001 The Truth is - the Supreme Court of Canada ruled in 1950 that the Federal Government was NOT allowed to collect personal income tax from individual Canadians and that this exclusive right was reserved solely for the Provincial legislatures at outlined by our Constitution Section 92, (in order that they would be able to fulfill their social service responsibilities to provide funding for education, schools, heath care, hospitals etc.) The Supreme Court of Canada gave the Federal Government until March 31st, 1962 to return the collection of income tax back to the provinces because the tax rental agreement and Revenue Canada’s charter EXPIRED at that time. In his 1961 Federal Provincial Conference, Prime Minister John Diefenbaker said; “Accordingly, the Federal Government proposes to discontinue the tax rental system when it expires on March st 31 , 1962.” (note: this requirement resulted from the Supreme Court of Canada ruling of 1950, the Lord Nelson Hotel Company Limited case) “They will exercise their constitutional right to impose, vary and adjust their levies from time to time as may be necessary in the light of their responsibilities to their Provincial taxpayers and without recourse to the Federal Government. Thus there will be a return to the active responsibilities which the Constitution confers upon both levels of government under the Federal System. It will, however withdraw progressively and substantially from the personal income tax field in favour of the provinces.” - Hansard, February 28, 1961. Address by the Right Honourable John G. Diefenbaker Every Federal and Provincial Government (except Quebec) has been in contempt of the Supreme Court of Canada since 28, 02, 1961 (an illegal act). This makes them a Criminal Organization according to the Criminal Code of Canada. What’s interesting is that if the NDP really wanted to run the country all they would have to do is follow up on this information and have the “Harper Government” thrown out of office and perhaps even the new jails Stephen is building.

- 3. Why is This Information so Critically Important to Canada’s Survival? According to STATSCAN in 1950 the personal tax burden was shared equally by individual Canadian citizens and Canadian corporations at roughly 35% each. The NET tax collected by the government was 70% at that time. By 1989 the corporate tax collected by Ottawa was down to less than 5% and continuing to diminish. According to the Constitution of Canada the Federal Government is only allowed to collect indirect taxes and taxes on corporate profits are one form of indirect taxation and the only area of taxation the Federal Government is legally allowed to operate in. Virtually the full tax burden has eventually been downloaded onto the average Canadian citizen while corporate tax evasion exists such as: 77 corporations with profits exceeding $25 million who paid zero tax on profits of $ 5.2 billion 1,079 corporations with profits between $1 million and $25 million who paid zero tax on profits of $4.3 billion. 62,480 corporations with profits who paid zero income tax – a loss of $3.5 billion in revenue for the Federal Government. Interest free “deferred” corporate income tax reached an alarming $40 billion in 1994. This corporate tax revenue can and is being deferred indefinitely while the Provinces suffer and Canada goes deeper and deeper into National Debt – a debt servitude which cleverly is designed to never be paid off. The facts contained in this letter can be easily verified by anyone by reading Robert Marquis’ book, FRAUD DECEPTION MANIPULATION as well as the 1940 Dominion Provincial Conference and the 1950 Supreme Court of Canada Ruling where… During the period of May 23rd to October 3rd 1950 the Supreme Court of Canada deliberated on a petition from the Province of Nova Scotia concerning the Province's authority to: "MAKE LAWS IN RELATION TO THE RAISING OF A REVENUE FOR PROVINCIAL PURPOSES BY THE IMPOSING OF A RETAIL SALES TAX OF THE NATURE OF INDIRECT TAXATION." The question that the highest court in Canada had to answer concerned a bill enacted by the Province of Nova Scotia giving it the right to collect taxes within the field of indirect taxation – which was an exclusive jurisdiction of the Federal Government. The Supreme Court of Canada ruled that indirect taxation is listed as an Exclusive Power of the Federal Legislature as outlined in the British North America Act of 1867 (the Canadian Constitution). The Province Nova Scotia therefore had no jurisdiction to collect indirect taxes and was forbidden to do so. The Constitution Section 91 gives the Exclusive Right of indirect taxation to the Federal Government. Modes or systems of indirect taxation include; import duties, tariffs and excise taxes. Indirect taxation is the most lucrative form of taxation. The Canadian Constitution Section 92 gives the exclusive right of direct taxation to the provincial government. The field of direct taxation includes; income tax, gas tax, PST, & GST. While the Supreme Court of Canada ruled that the Province of Nova Scotia could not invade the exclusive taxation area (of indirect or corporate taxes) which was reserved exclusively for the Federal Government, it also ruled that the Federal Government had no right to collect income tax from individual Canadians which were reserved for the Provinces.

- 4. From the 1950 Supreme Court of Canada Lord Nelson Hotel Company Limited Ruling "Each Province can legislate exclusively on the subject matters referred to it by section 92." "The country is entitled to insist that legislation adopted under section 91 should be passed exclusively by the Parliament of Canada in the same way as the people of each Province are entitled to insist that legislation concerning matters enumerated in section 92 should come exclusively from their respective legislatures." "The Parliament of Canada and the Legislatures of the several Provinces are sovereign within their sphere defined by The British North America Act, but none of them has the unlimited capacity of an individual..." "They can exercise only the legislative powers respectfully given to them by sections 91 and 92 of the Act, and these powers must be found in either of these sections..." “In each case the Members elected to Parliament or to the Legislatures are the only ones entrusted with the power and the duty to legislate concerning the subjects exclusively distributed by the constitutional Act to each of them..." “No power of delegation is expressed either in Section 91 or in section 92, nor, indeed, is there to be found the power of accepting delegation from one body to the other; and I have no doubt that if it had been the intention to give such powers it would have been expressed in clear and unequivocal language..." “Under the scheme of The British North America Act there were to be, in the words of Lord Atkin, "water tight compartments which are an essential part of the original structure..." “Neither legislative bodies, federal or provincial possess any portion of the powers respectfully vested in the other and they cannot receive it by delegation. In that connection the word "exclusively" used in both section 92 and in section 92 indicates a settled line of demarcation and it does not belong to either Parliament, or the Legislatures, to confer powers upon the other." The Chief Justice C.J. Rinfret 1950 Supreme Court of Canada Ruling On November 20th, 2000 I attended an election rally in Calabogie Ontario or Cheryl Gallant and I brought my tape recorder with me. I was also running in the same election as an independent candidate but Cheryl was unaware of who I was. Cheryl spoke about the gun registry and how the licensing of personal property was a Provincial jurisdiction and the Liberals were violating the Constitution with the gun registry and the Conservatives were going to fix it. This inspired me because she was actually telling the truth so I thought she would be open to some additional truths. I was very hopeful when I approached Cheryl after her speech and said that the government has been misleading Canadians about many other things such as income tax etc and I urged her to tell the whole truth to her audiences. Cheryl floored me when she said, "I know the truth, Stockwell Day knows the truth… but if we told Canadians the truth we would never get elected" - Cheryl Gallant I went home transcribed what I recorded and sent it to Stockwell Day, the Minsiter of Justice and the RCMP. Shortly after the election a detective from the Economic Crime Department of the RCMP sent me a letter informing me that they were following up.

- 5. 1941 Dominion Provincial Conference (when politicians actually knew their patriotic duty) In 1940 an attempt was made by the Federal Government to gain total control over the FIELD OF DIRECT TAXATION, Mackenzie King tried to convince the Provincial Premiers that it was their patriotic duty to amend the Constitution. Prime Minister King and his lawyers were fully aware that the Federal Government did not have the legal right in the field of direct taxation except during the time of war. The Second World War was the perfect opportunity to seize total financial control the First World War did not provide. (While women and men gave their lives fighting a dictator in Europe a new one was being created at home in Canada). The Prime Minister began the conference by stating... "The crux of the problem which faced the commission and which faces this conference is, of course the financial relationship between the federal and provincial governments." "These concerned, for example, provision of a systematic procedure for regular dominion-provincial conferences. Provision for the delegation of powers by the Dominion to the Provinces and vice versa." Prime Minister Mackenzie King January 14, 1941 Compare the statements above by the Prime Minister to the Supreme Court of Canada Ruling nine years later… “No power of delegation is expressed either in Section 91 or in section 92, nor, indeed, is there to be found the power of accepting delegation from one body to the other; and I have no doubt that if it had been the intention to give such powers it would have been expressed in clear and unequivocal language..." “Under the scheme of The British North America Act there were to be, in the words of Lord Atkin, "water tight compartments which are an essential part of the original structure..." “Neither legislative bodies, federal or provincial possess any portion of the powers respectfully vested in the other and they cannot receive it by delegation. In that connection the word "exclusively" used in both section 92 and in section 92 indicates a settled line of demarcation and it does not belong to either Parliament, or the Legislatures, to confer powers upon the other." The Chief Justice C.J. Rinfret 1950 Supreme Court of Canada Ruling It didn’t take the Premiers long to realize that Prime Minister Mackenzie King was trying to manipulate and trick the Provinces into abolishing the Constitutional Division of Powers. The Provincial Premiers essentially told the Prime Minister to "take a hike…" "We should then have to go to the dominion authorities with a tin cup in our hands saying-either contribute to the extent of our loss of revenue or pay for the SOCIAL SERVICES OF ONTARIO." "It has been admitted by former ministers of finance of Canada that for the dominion to levy an income tax at all is to invade provincial fields of taxation." “The effect of these added imposts was to seriously reduce the revenues of the Province of Ontario." "I solemnly warn those who are obviously pressing for such action that they may aggravate the suspicion and destroy public confidence in governments."

- 6. "Now I come to a subject of even greater importance- NATIONAL UNITY. By this deal, according to the best Constitutional advice I can get, Quebec and the rest of us will have to agree to surrender to a central authority of rights and privileges granted by the British North America Act." "So long as there is a British North America Act in its present form, which cannot be amended at will by a mushroom government that may in future take office in Ottawa, we shall as a sister Province stand solidly beside Quebec if at any time her minority rights are threatened. On this sound foundation of NATIONAL UNITY we stand firm and resolute as the Rock of Gibraltar itself." "To lay hands on the life work of Sir Wilfred Laurier and Sir John A. MacDonald is nothing short of NATIONAL VANDALISM." Premier of Ontario, M. F. Hepburn "Under the British North America Act, Manitoba was given, like the other provinces of Canada, the Constitutional right to discharge certain governmental functions, but administrative and legislative. To provide the province with the revenues with which to pay the cost of discharging these functions the province was empowered to impose direct taxation within the province." "The tendency of the course recommended by the commission would be to lower the general standard of development rather than to raise it. It would be a backward step instead of a forward one." Premier of Nova Scotia, A.S. MacMillan "We are here honorable chairman and gentlemen, I take it to make it possible at some near future date to formulate for Canadians a series of decisions which will give them security in old age and the right to enjoy, according to their needs, the abundance of food and clothing and the comforts of adequate and sanitary shelter which the limitless resources of this great Dominion can provide." "We are here, I assert to establish a heritage of EDUCATION for those who wish to learn; of HEALTH for those who suffer pain or disease; of SECURITY and DELIVERANCE FROM DEBT for those who have builded homes in their prime of life and who may face eviction and the loss of their sacred firesides when the lean years descend." "We are here, I believe to draft a scheme of things for the CANADA OF THE FUTURE, a scheme of things which will bring to Canada a standard of JUSTICE which shall place HUMAN VALUES ABOVE DOLLAR VALUES." "The statement that the acceptance of these proposals is an evidence of good faith and loyalty in this titanic struggle against the forces of TOTALITARIANISM is in my estimation so evidently misleading and far-fetched that it should be looked upon as DANGEROUS, DECEPTIVE AND DIABOLICAL PROPAGANDA. Both these proposals involve a centralization of power in direct opposition to the PRINCIPLES OF DEMOCRACY, for which we are fighting today and the British traditions which we cherish." "Never in the history of Canada has the need for complete national unity of purpose and of effort been more essential than it is at this time; I urge with all the sincerity of my soul, that we do nothing which will an any way jeopardize that essential unity." "IF IT IS NECESSARY, IN ORDER TO PAY THE INTEREST ON BONDS, TO DEPRIVE SCHOOL CHILDREN OF EDUCATION AND PEOPLE OF HEALTH, YOU CAN COUNT ME OUT." "It is hardly the kind of thing that responsible-minded leaders of democratic thought would allow themselves to be stampeded into doing."

- 7. "How will the adoption of these recommendations benefit the individual citizen? When they found out that the full burden of existing debts would still be upon them in no less degree, and that any control they have over these debts would be one step further removed from them; when they discovered that their taxes would be just as great or perhaps greater and that, with the reduction of provincial taxation powers, the only ones that could possibly benefit would be the LARGE CORPORATIONS and THE FINANCIAL INSTITUTIONS; when it became known to them that the standard of SOCIAL SERVICES WOULD BE VIRTUALLY REMOVED from the full autonomy of the provinces and placed largely under control of a semi-independent financial commission, many of our hard thinking and realistic minded citizens demanded to know in their vernacular, ‘what is all this row about at a time like this?' and ‘who is responsible for it?'" "AND THE WHISPER HAS GONE AROUND, ‘IT IS THE MONEY POWERS.'" "I maintain that it would be most unfortunate if the idea gains popular credence that there is a concerted and deliberate attempt being made by the MONEY POWERS to increase CENTRALIZED CONTROL of our national life while our attention is fully occupied with the prosecution of our war effort, and that thereby there is developing an endeavor to obtain an unfair advantage over the people by means of imposing upon them a CRUSHING DEBT STRUCTURE under which they will be further ENSLAVED." "Surely it must be evident to any loyal British subject that to sit calmly and indifferently by while we are being hoodwinked and inveigled into FINANCIAL DICTATORSHIP or FASCIST STATE, at a time when we are giving the best of our manhood to the empire and are sacrificing our all to overcome that foul thing which has raised its head in the world in many guises; - A TOTALITARIAN ORDER OF CENTRALIZED CONTROL AND REGIMENTATION-IS NOT ONLY RIDICULOUS BUT DANGEROUSLY CRIMINAL. Words almost fail me to convey to you the warning which must be voiced before it is too late." "Do not let us shut our eyes to those matters for we have been warned, EVIL is abroad in the world and we are fighting EVIL THINGS." "I repeat that the dominating difficulty out of which ALL OUR PROBLEMS ARISE is mainly economic, and not political, and the focus of that economic problem is financial. If we become sidetracked, down political or constitutional bypaths that have no ending WE SHALL LAND IN A WILDERNESS OF FAILURE." "In conclusion may I say that we in Alberta stand ready to allow our province to become the experimental ground to demonstrate scientifically the rich and glorious possibilities for living in contentment and security based on the principles of DEMOCRACY, not only in the political but economic sphere as well." Premier of Alberta, William Aberhart "As my friend from Alberta said, the SOCIAL SERVICES OF CANADA IN THE FUTURE MUST BE KEPT IN MIND. But we are doing something from which we may not be able to retrace our steps, and we shall be left in the hands of a BUREAUCRACY to be established in Ottawa, a bureaucracy which is criticized from one end of the country to the other. I myself will not SELL MY PROVINCE DOWN THE RIVER FOR ALL TIME TO COME, AND ALLOW OUR SOCIAL SERVICES TO REMAIN A VICTIM OF THE DICTATORIAL METHODS OF A BUREAUCRACY TO BE SET UP IN OTTAWA." "We leave it to the rest of the members to continue their efforts to do what we are bound to say would result in WRECKING CONFEDERATION, as we understand it, and in DESTROYING PROVINCIAL AUTONOMY RIGHTS." "If the Prime Minister insists that everything has to be predicated upon the principles of a report to which we object, then there is no alternative open to my colleagues and myself but to withdraw and leave these WRECKERS OF CONFEDERATION under the guise of patriotism, to continue to carry on their NEFARIOUS WORK." Province of Ontario, Honorable Mr. McQuesten

- 8. "Where are you going to get the money? I am asking this statement to the dominion government for the province of British Columbia. If the dominion government had not ENTERED OUR FIELD OF TAXATION, BRITISH COLUMBIA WOULD NEVER HAVE HAD TO BORROW ONE DOLLAR. British Columbia entered the income tax field in 1876. The dominion government did not enter this field until 1918, when Sir Thomas White, then Minister of Finance, stood on the floor of this chamber and said that he regretted very much the necessity of taking such action. He said it was intended as a TEMPORARY MEASURE. I am sure that Sir Thomas White will not mind my saying that when I was talking to him on one occasion he told me he was afraid it would be a FEDERAL TAX FOR GOOD. Those of us who have been trying to protect provincial rights and trying build up a strong province so that we may have a strong dominion of Canada have actually been accused of being unpatriotic and insolent because we dared to say that the INCOME TAX SHOULD BE MAINTAINED AS A PROVINCIAL TAX." "I DO NOT FEEL WE CAME HERE AS BEGGARS. We should not be tied down in perpetuity; we should not be circumscribed in our future development. We have been asked to come here on this very occasion to change our constitution for no purpose whatever." "AS I SAID YESTERDAY, I WOULD RATHER SEE OUR BOYS AND GIRLS HAVE AN EDUCATION, I WOULD RATHER SEE OUR PEOPLE RAISED IN HEALTH THAN HAVE BONDHOLDERS PAID INTEREST ON THEIR BONDS." "WE ARE THE TRUSTEES OF THE PEOPLE, NOT ONLY FOR OUR OWN DAY AND GENERATION, BUT FOR THE DAYS OF OTHERS, AND FOR GENERATIONS TO COME." Premier of British Columbia, T. D. Plattullo From problems in Heath Care, Education, and Social Spending to National Unity, all may be traced back to 1913. Twenty years after the signing of the Bank Act Mackenzie King was starting to see the light and he made this CBC radio address; "Once a nation parts with control of its currency and credit, it matters not who makes that nation's law. Until the control of the issue of currency and credit is restored to government and recognized as it's most conspicuous and sacred responsibility, all talk of the sovereignty of parliament and of democracy is idle and futile.” Prime Minister Mackenzie King

- 9. . The Parliament of Canada, affirming that the Canadian Nation is founded upon principles that acknowledge the supremacy of God, the dignity and worth of the human person and the position of family in a society of free men and free institutions. Affirming also that men and institutions remain free only when freedom is founded upon respect for moral and spiritual values and the rule of law. Each year at Christmas we celebrate the life of Jesus Christ who came to teach us that God is Love. By extension the Parliament of Canada acknowledges the supremacy of Love and the rule of law. Therefore, Love is the law in Canada…

- 10. PETITION TO The Legislative Assembly of Ontario: - WHEREAS the Government of Ontario has illegally abdicated its responsibility to the citizens of Ontario by allowing the Federal Government to usurp its EXCLUSIVE Constitutional authority in the area of income tax collection and has been in criminal contempt of the Supreme Court of Canada since March 31st, 1962. The Supreme Court of Canada ruled in 1950 that the Federal Government was NOT allowed to collect personal income tax from individual Canadians and that this exclusive right was reserved solely for the Provincial legislatures at outlined by our Constitution (in order that they would be able to fulfill their social service responsibilities to provide funding for education, schools, heath care, hospitals etc.) Constitution of Canada (Section 92) The Supreme Court of Canada also ruled that the Ontario Government was NOT allowed to delegate any of its exclusive Provincial Constitutional responsibilities to the Federal Government. The Supreme Court of Canada gave the Federal Government until March 31st, 1962 to return the collection of income tax back to the provinces because the tax rental agreement and Revenue Canada’s charter EXPIRED at that time. From the 1950 Supreme Court of Canada Lord Nelson Hotel Company Limited Ruling "Each Province can legislate exclusively on the subject matters referred to it by section 92." "The country is entitled to insist that legislation adopted under section 91 should be passed exclusively by the Parliament of Canada in the same way as the people of each Province are entitled to insist that legislation concerning matters enumerated in section 92 should come exclusively from their respective legislatures." "The Parliament of Canada and the Legislatures of the several Provinces are sovereign within their sphere defined by The British North America Act, but none of them has the unlimited capacity of an individual..." "They can exercise only the legislative powers respectfully given to them by sections 91 and 92 of the Act, and these powers must be found in either of these sections..." “In each case the Members elected to Parliament or to the Legislatures are the only ones entrusted with the power and the duty to legislate concerning the subjects exclusively distributed by the constitutional Act to each of them..." “No power of delegation is expressed either in Section 91 or in section 92, nor, indeed, is there to be found the power of accepting delegation from one body to the other; and I have no doubt that if it had been the intention to give such powers it would have been expressed in clear and unequivocal language..." “Under the scheme of The British North America Act there were to be, in the words of Lord Atkin, "water tight compartments which are an essential part of the original structure..."

- 11. “Neither legislative bodies, federal or provincial possess any portion of the powers respectfully vested in the other and they cannot receive it by delegation. In that connection the word "exclusively" used in both section 92 and in section 92 indicates a settled line of demarcation and it does not belong to either Parliament, or the Legislatures, to confer powers upon the other." The Chief Justice C.J. Rinfret 1950 Supreme Court of Canada Ruling In his 1961 Federal Provincial Conference, Prime Minister John Diefenbaker said; “Accordingly, the Federal Government proposes to discontinue the tax rental system when it expires on March 31st, 1962.” (note: this requirement resulted from the Supreme Court of Canada ruling of 1950, the Lord Nelson Hotel Company Limited case) “They will exercise their constitutional right to impose, vary and adjust their levies from time to time as may be necessary in the light of their responsibilities to their Provincial taxpayers and without recourse to the Federal Government. Thus there will be a return to the active responsibilities which the Constitution confers upon both levels of government under the Federal System. It will, however withdraw progressively and substantially from the personal income tax field in favour of the provinces.” - Hansard, February 28, 1961. Address by the Right Honourable John G. Diefenbaker WE the undersigned petition the Legislative Assembly of Ontario as follows: - We the people of the province of Ontario are entitled to insist that legislation concerning matters enumerated in section 92 of the Constitution of Canada should come exclusively from the Ontario legislatures. We the people of Ontario insist that the legislature of Ontario take back its Constitutional authority regarding the collection of personal income and all direct taxation within the Province which includes gas tax and all other forms of direct taxation. We the people of Ontario insist that the legislature of Ontario ceases its criminal breach and contempt of the Supreme Court of Canada. – Thank you. Name (printed) Address (printed) Signature