Pay Matrix 2016-17 version 2

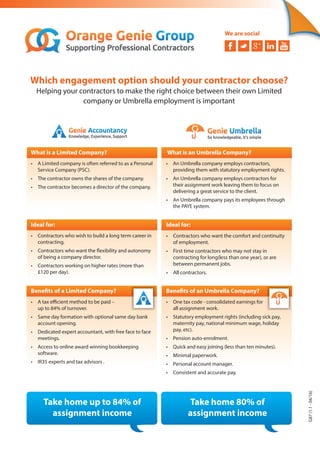

- 1. Which engagement option should your contractor choose? Helping your contractors to make the right choice between their own Limited company or Umbrella employment is important What is a Limited Company? • A Limited company is often referred to as a Personal Service Company (PSC). • The contractor owns the shares of the company. • The contractor becomes a director of the company. Ideal for: • Contractors who wish to build a long term career in contracting. • of being a company director. • Contractors working on higher rates (more than £120 per day). • up to 84% of turnover. • Same day formation with optional same day bank account opening. • Dedicated expert accountant, with free face to face meetings. • Access to online award winning bookkeeping software. • IR35 experts and tax advisors . What is an Umbrella Company? • An Umbrella company employs contractors, providing them with statutory employment rights. • An Umbrella company employs contractors for their assignment work leaving them to focus on delivering a great service to the client. • An Umbrella company pays its employees through the PAYE system. Ideal for: • Contractors who want the comfort and continuity of employment. • First time contractors who may not stay in contracting for long(less than one year), or are between permanent jobs. • All contractors. • One tax code - consolidated earnings for all assignment work. • Statutory employment rights (including sick pay, maternity pay, national minimum wage, holiday pay, etc). • Pension auto-enrolment. • Quick and easy joining (less than ten minutes). • Minimal paperwork. • Personal account manager. • Consistent and accurate pay. We are social G87(1.1-04/16) Take home 80% of assignment income Take home up to 84% of assignment income

- 2. Hourly Rate Paye take home pay* Umbrella take Limited Company home pay* take home pay** £10.00 £295.00 £322.89 £335.00 £12.50 £353.99 £396.27 £412.00 £15.00 £412.60 £456.03 £489.00 £17.50 £471.22 £515.78 £566.00 £20.00 £529.84 £575.53 £643.00 £25.00 £643.55 £695.04 £796.00 £30.00 £743.54 £801.11 £908.00 £40.00 £943.53 £1,004.98 £1,133.00 £50.00 £1,143.51 £1,208.84 £1,357.00 £80.00 £1,658.85 £1,735.83 £1,977.00 £100.00 £2,030.66 £2,116.71 £2,425.00 *Assumptions 1100L tax code Rate is Limited Company/Umbrella Rate 40 hours per week £100 allowable expenses included £27.50 margin **Assumptions 1100L tax code 40 hours per week £100 expenses plus £118.80 Accountancy fee per month FlatrateVAT13.5% We are social To refer your contractors to Orange Genie either…. Visit: www.orangegenie.com • Call: 01296 468 483 • Email: info@orangegenie.com