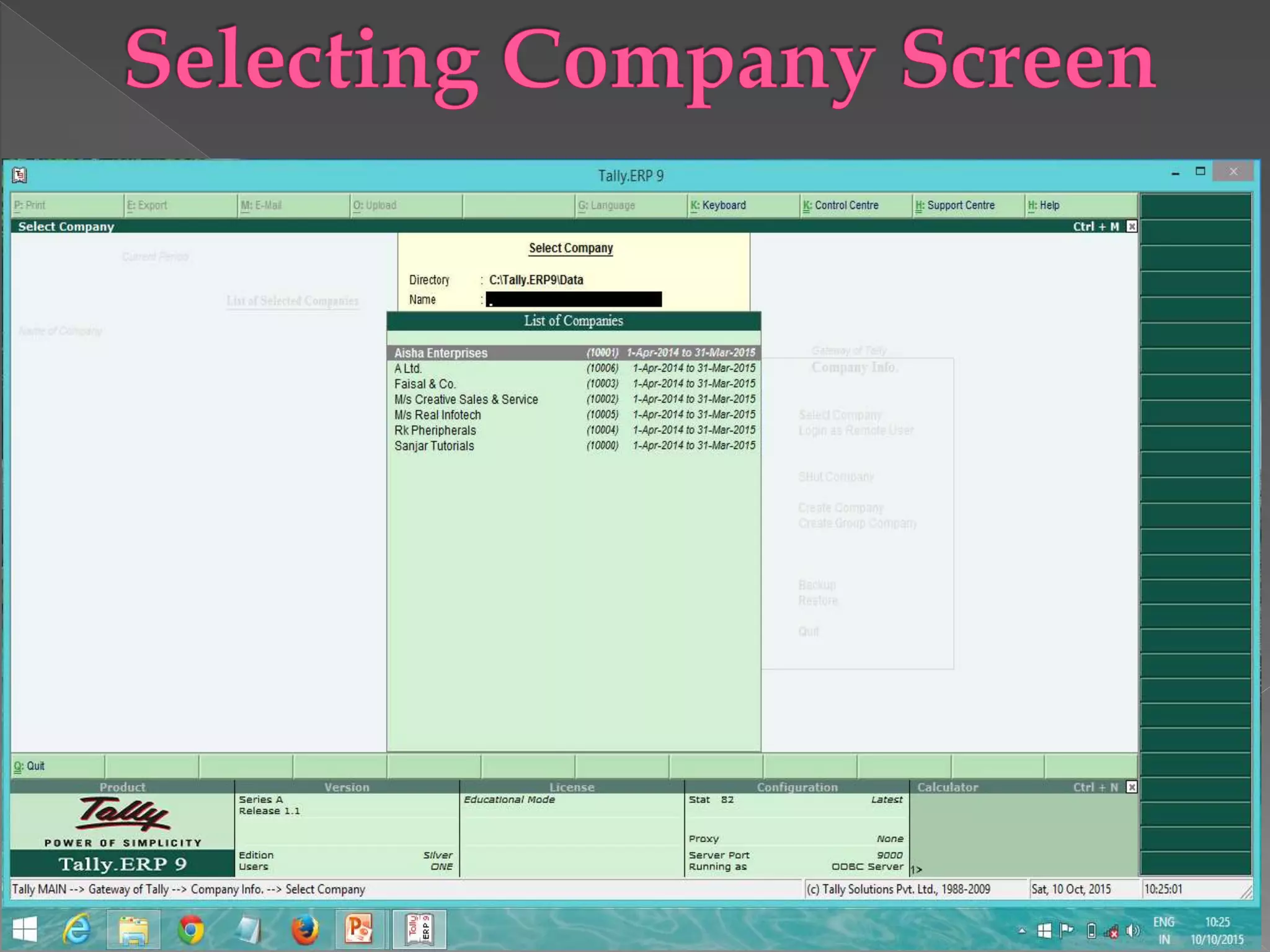

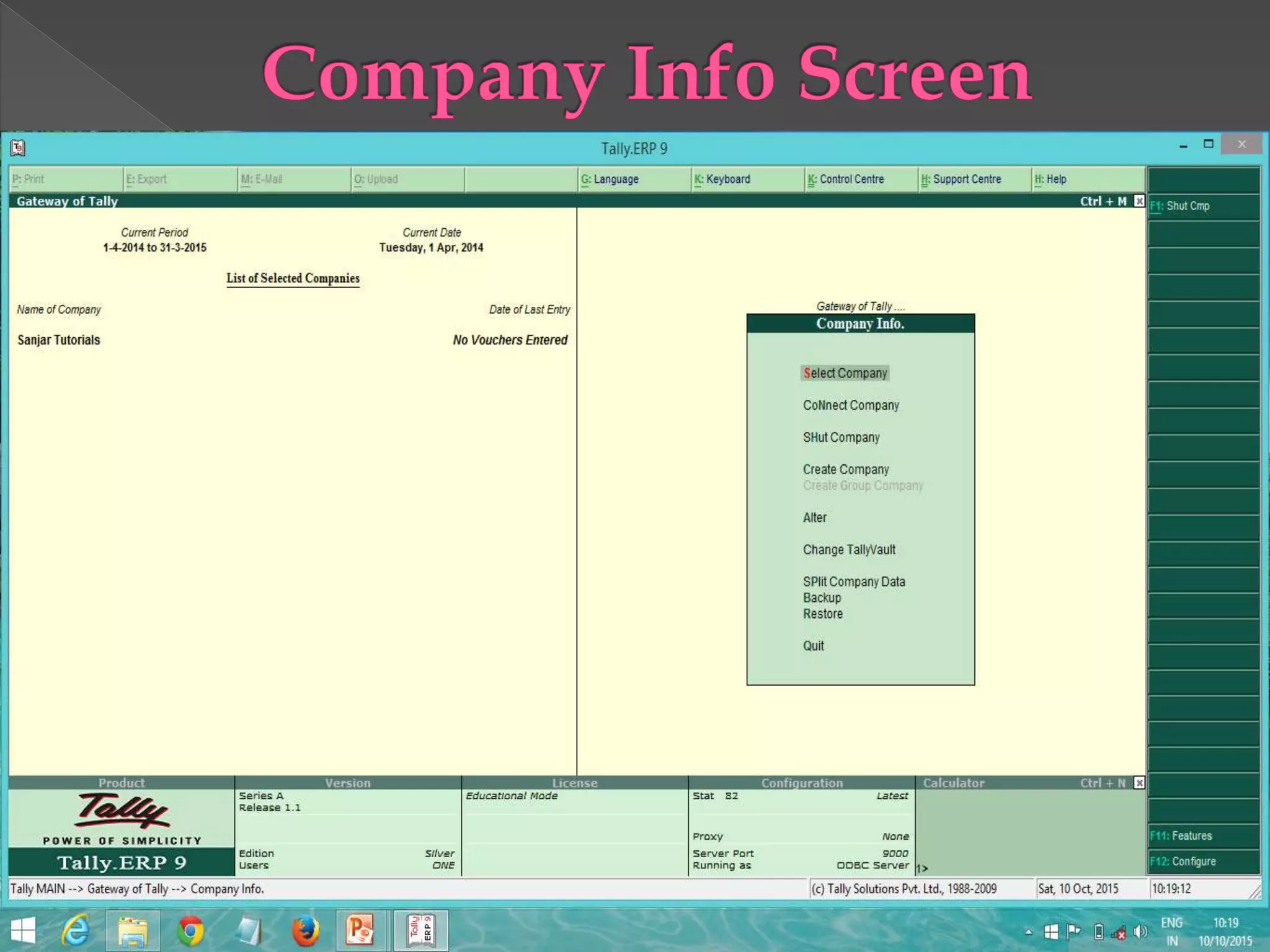

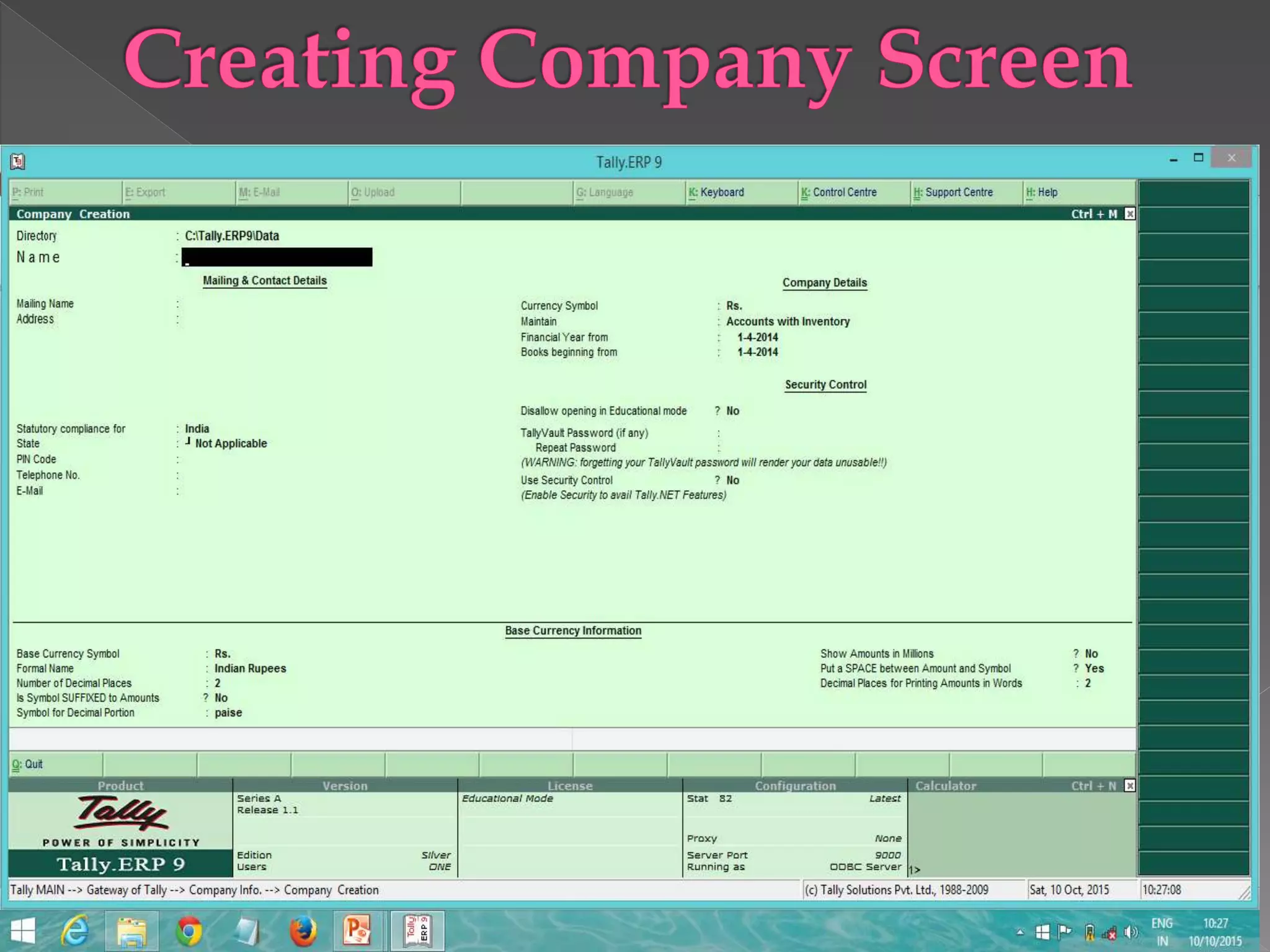

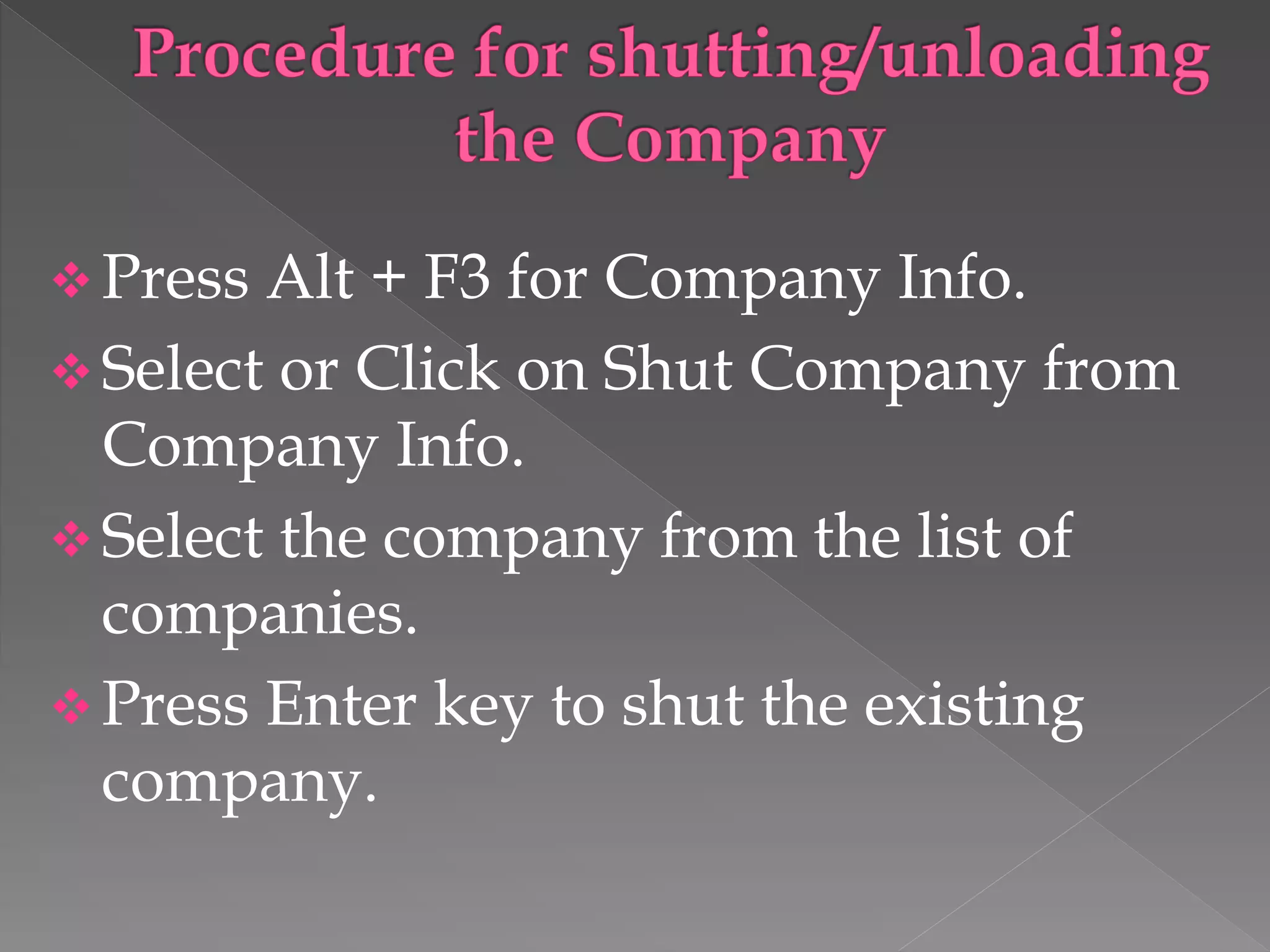

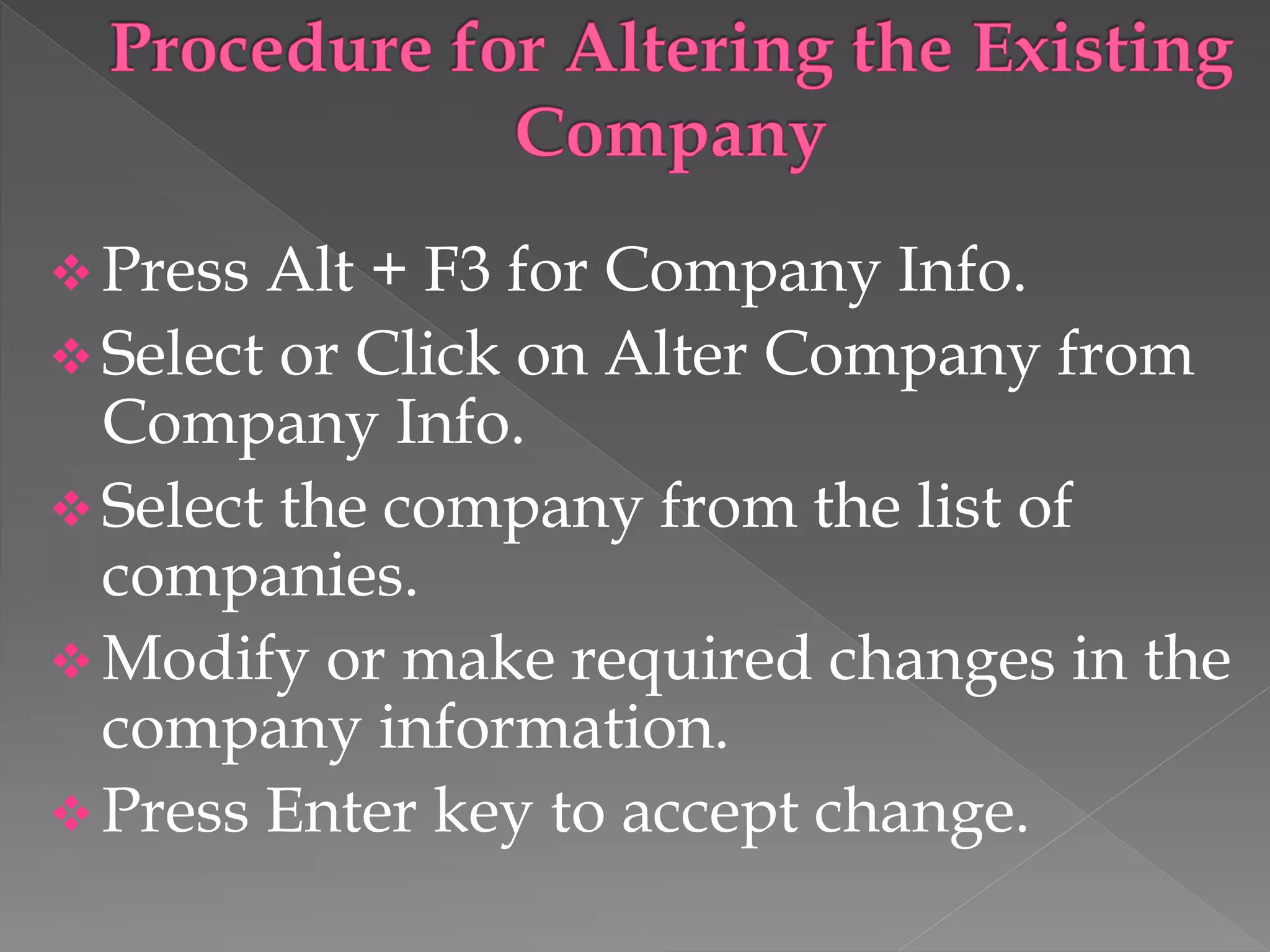

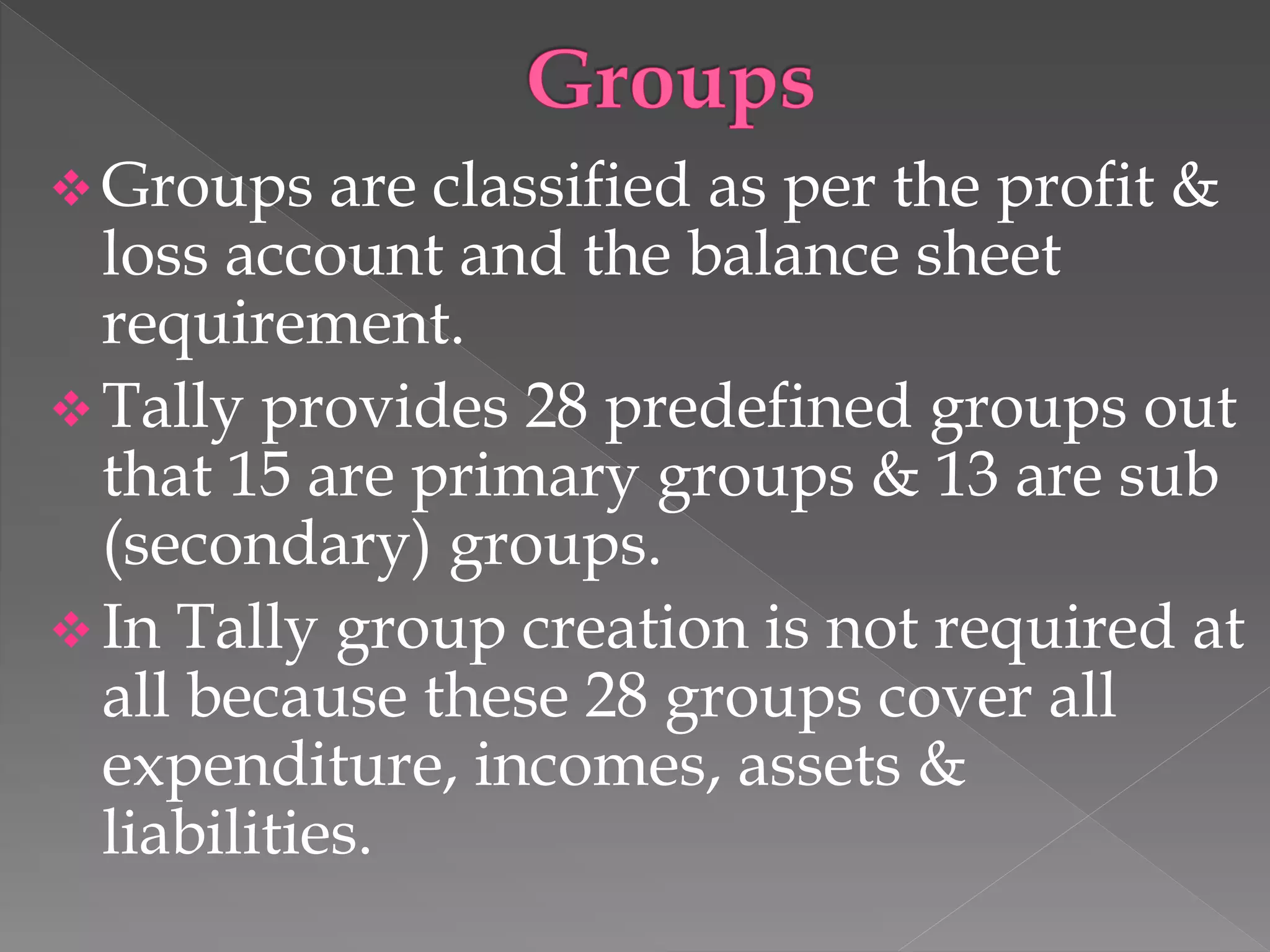

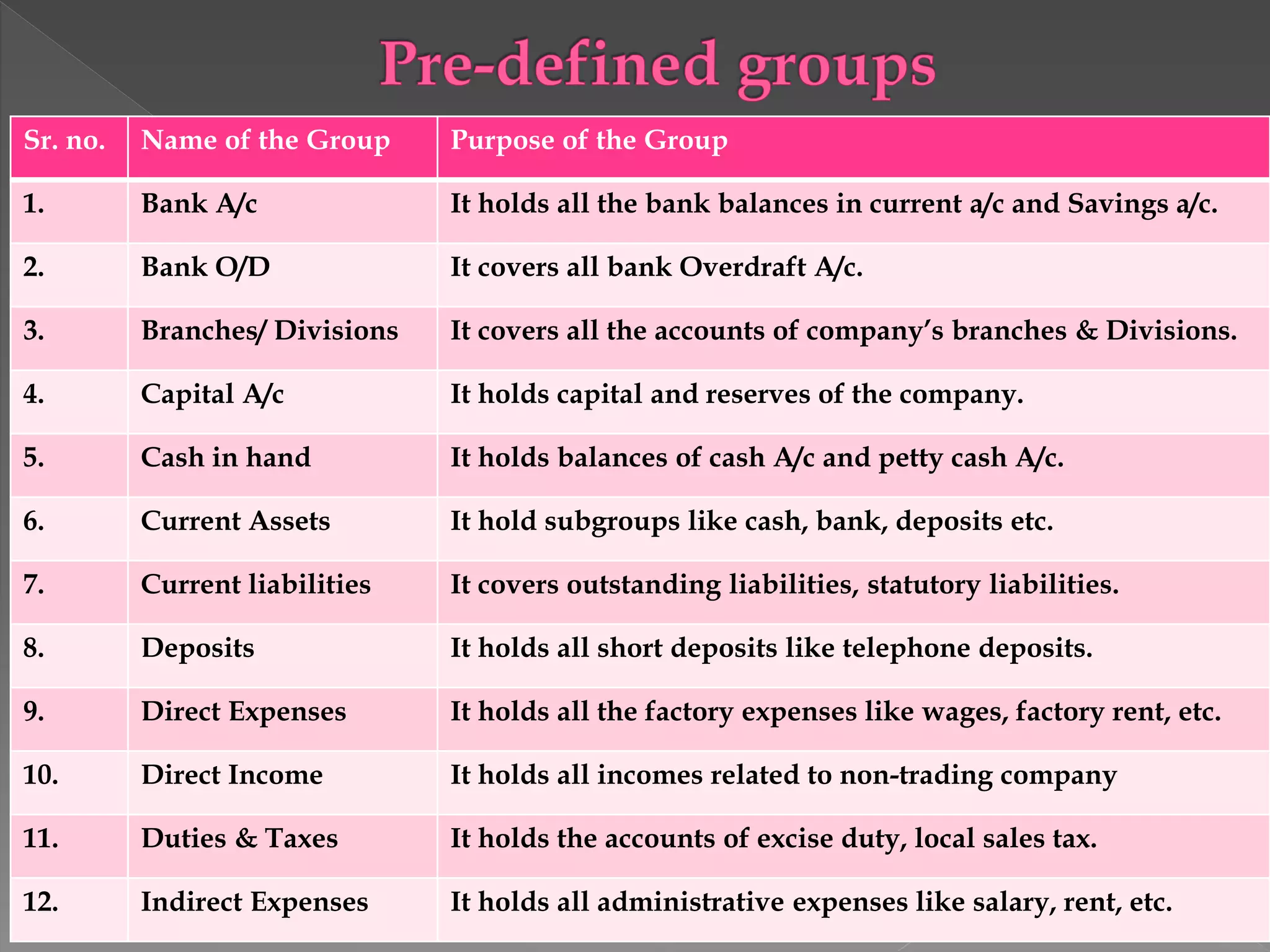

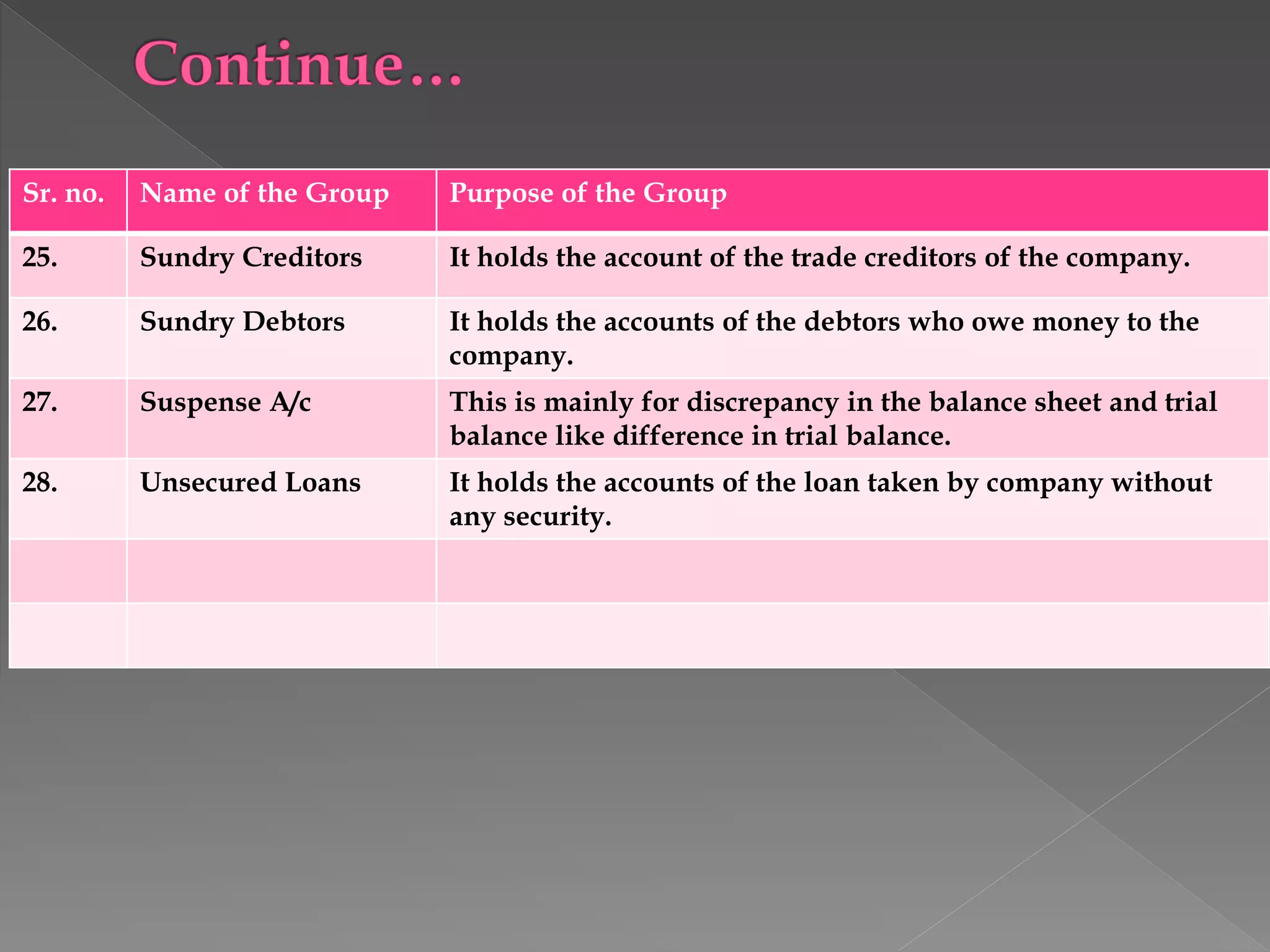

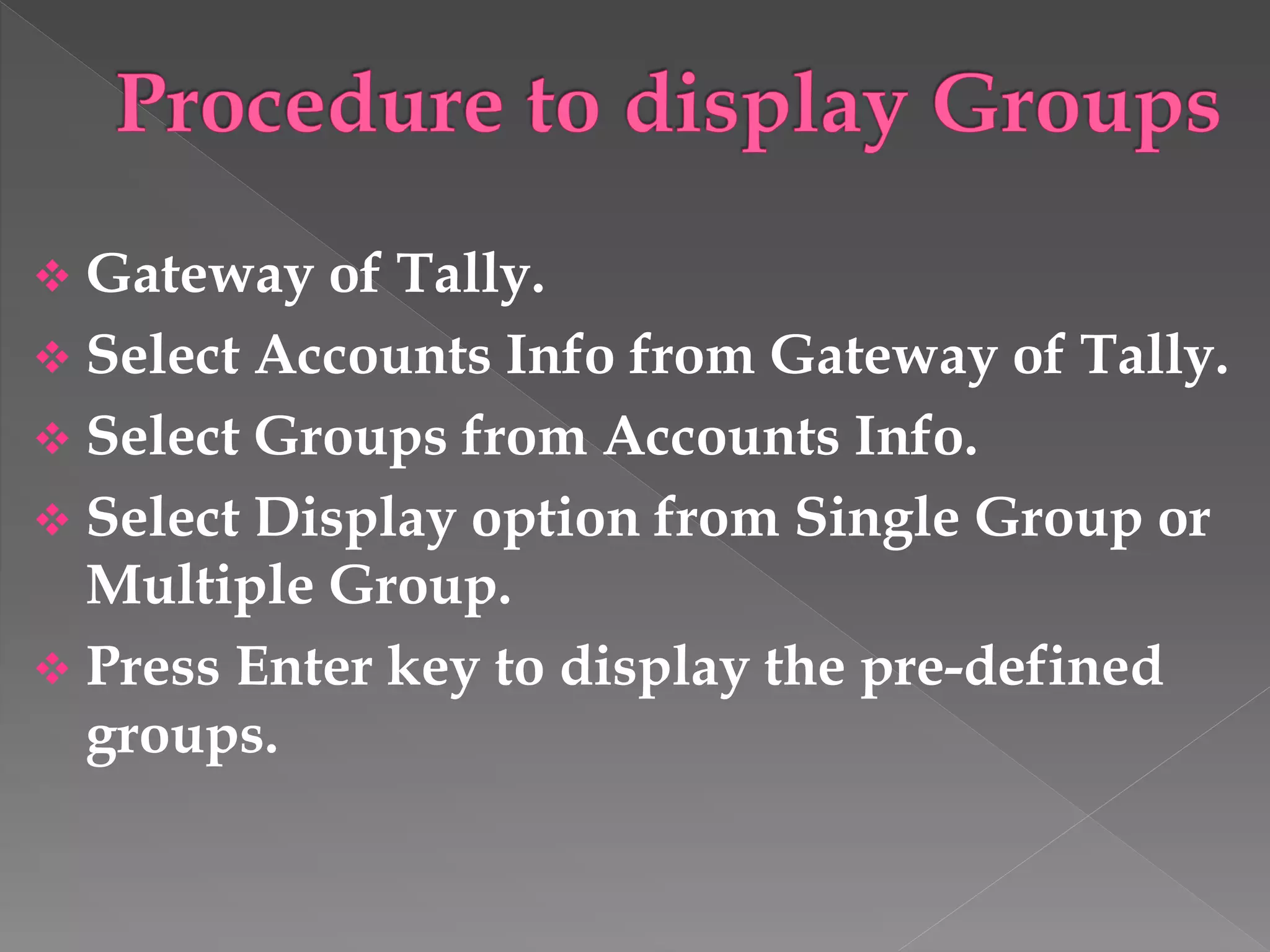

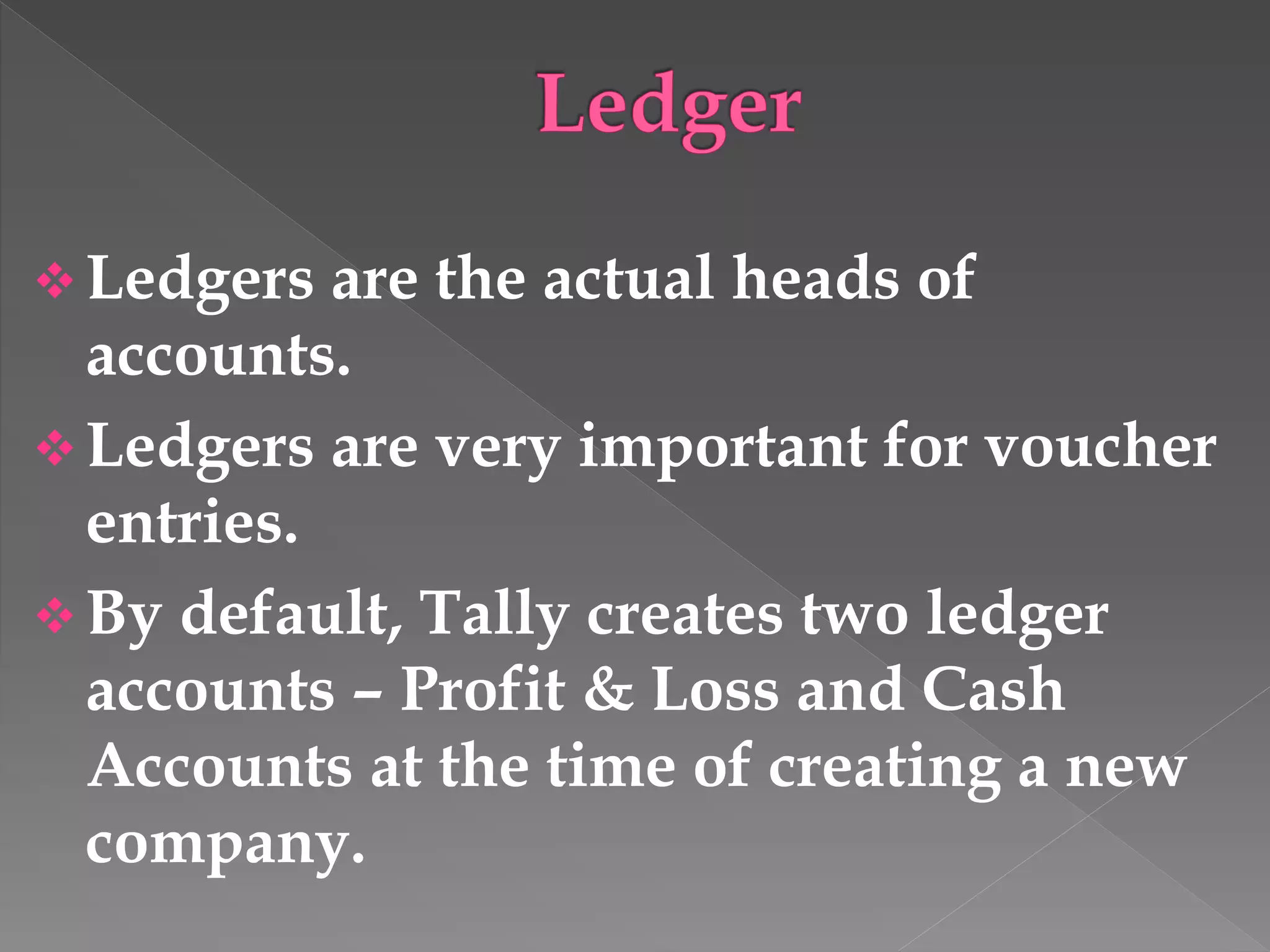

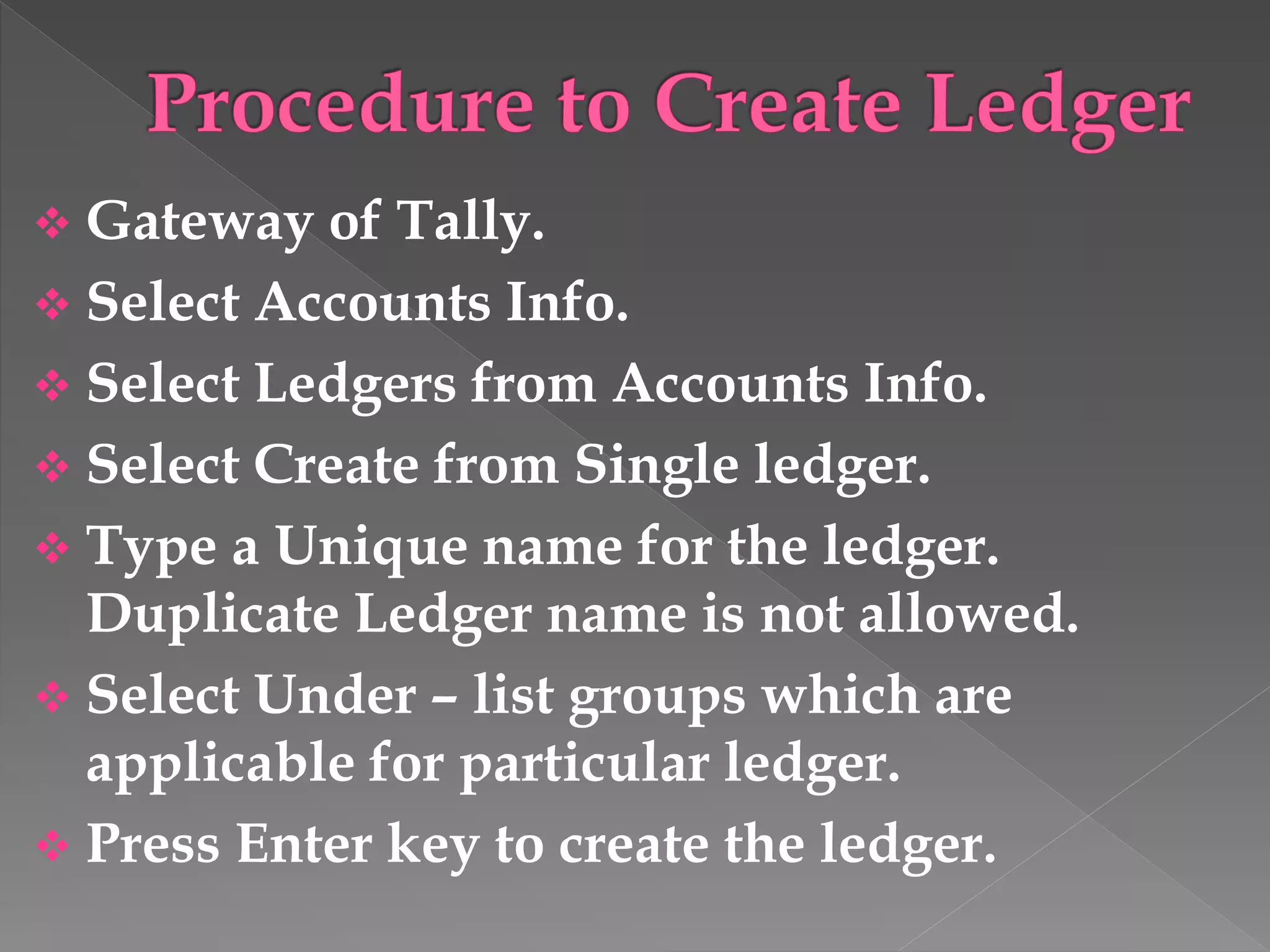

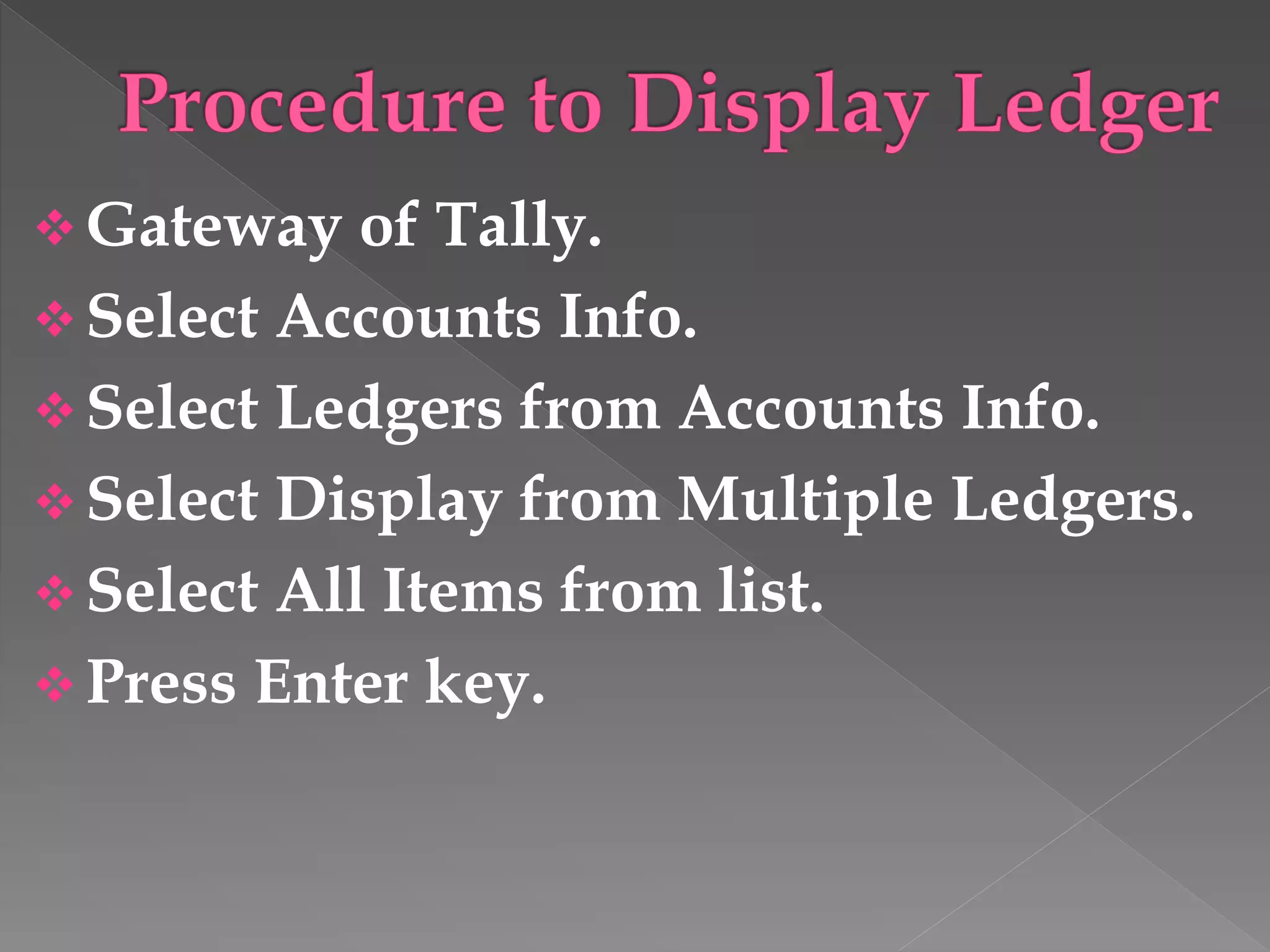

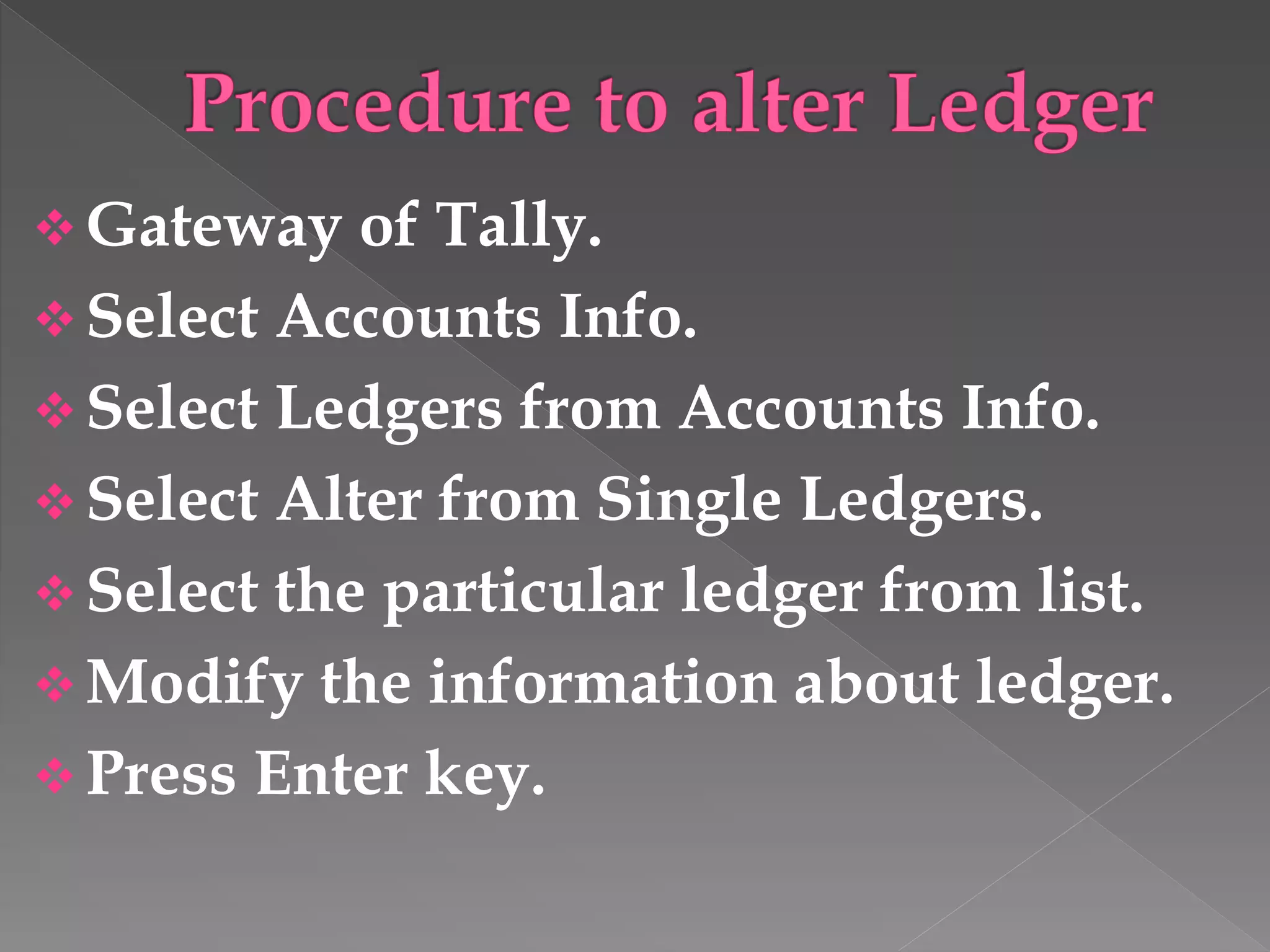

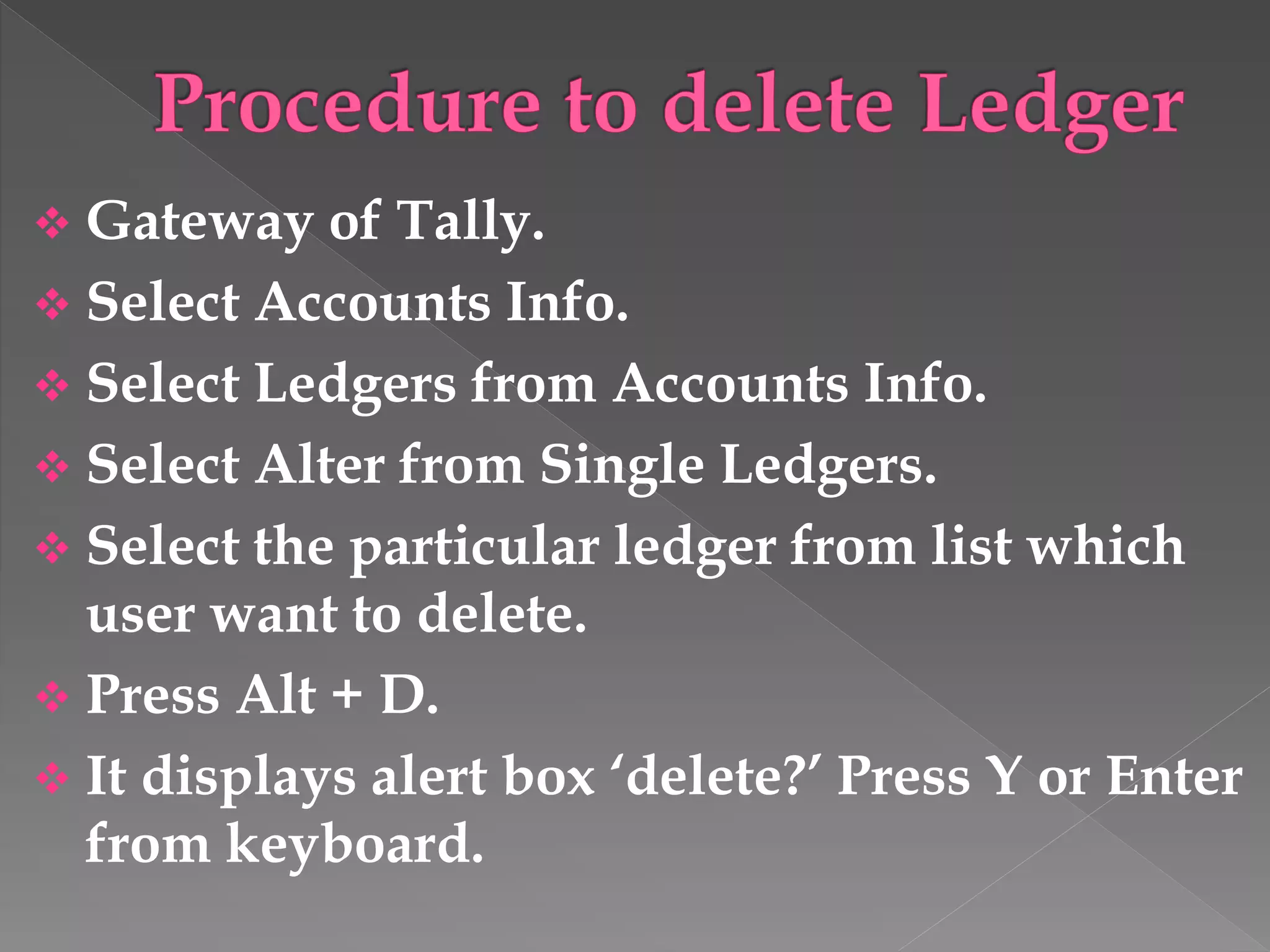

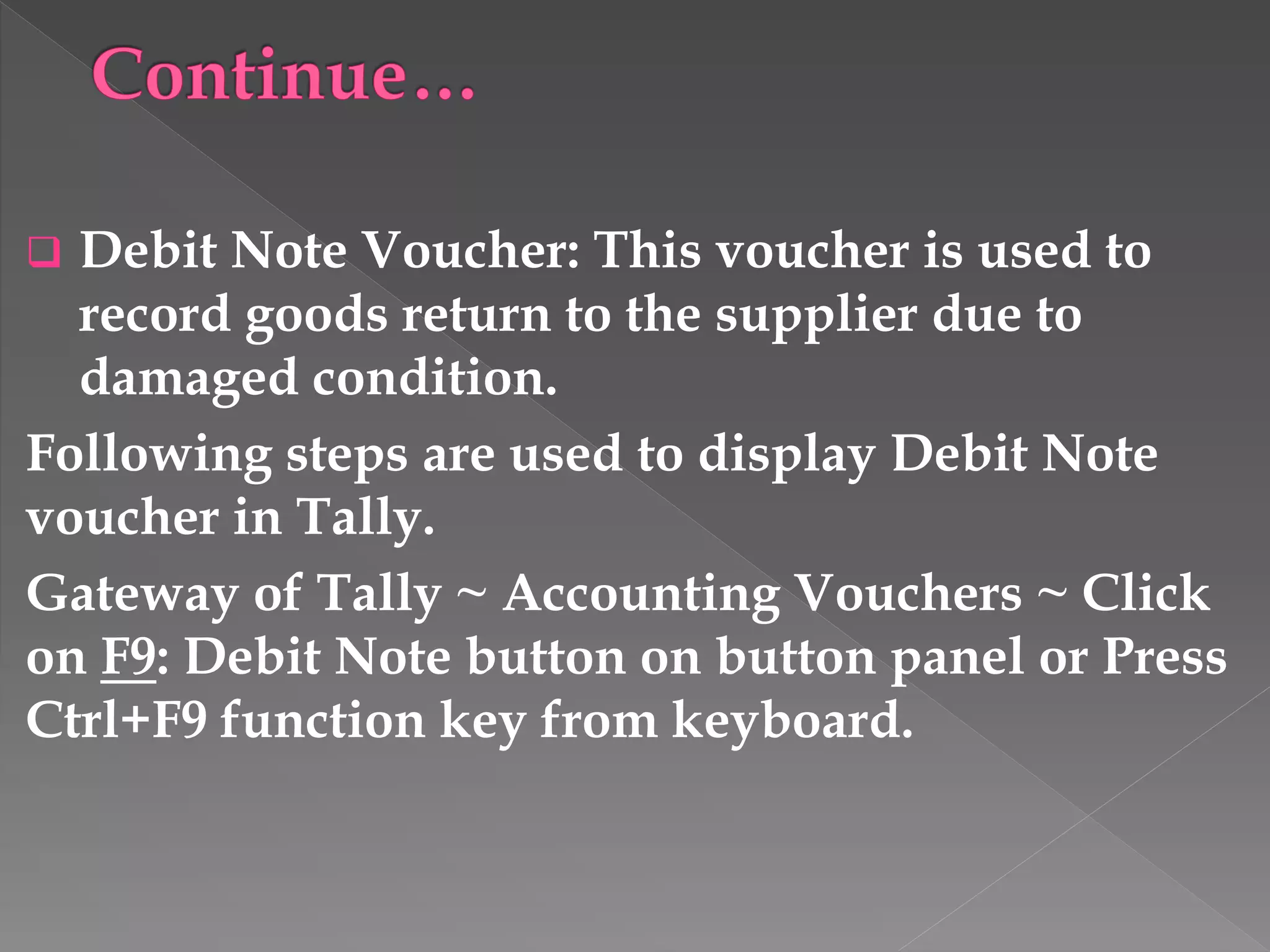

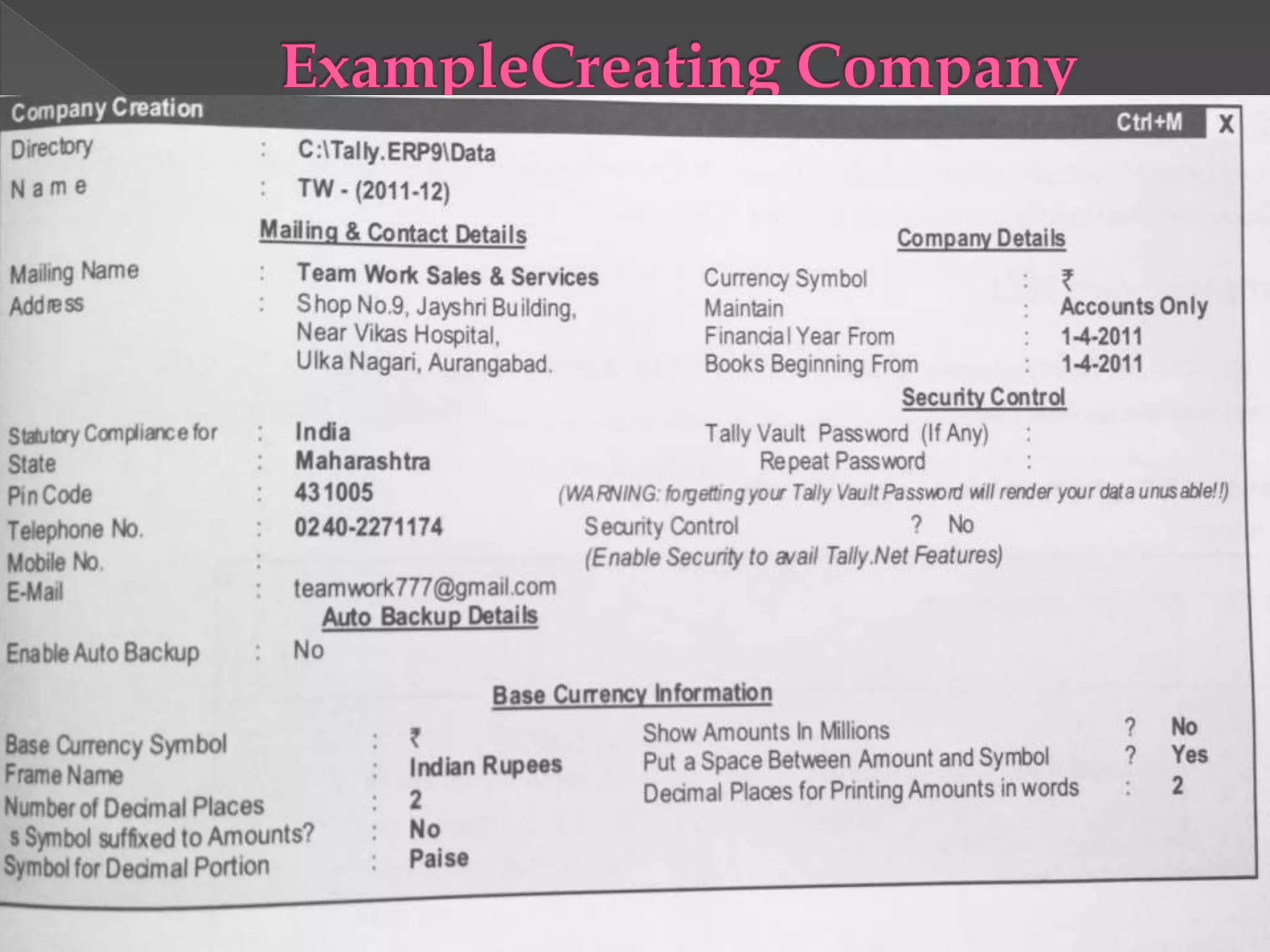

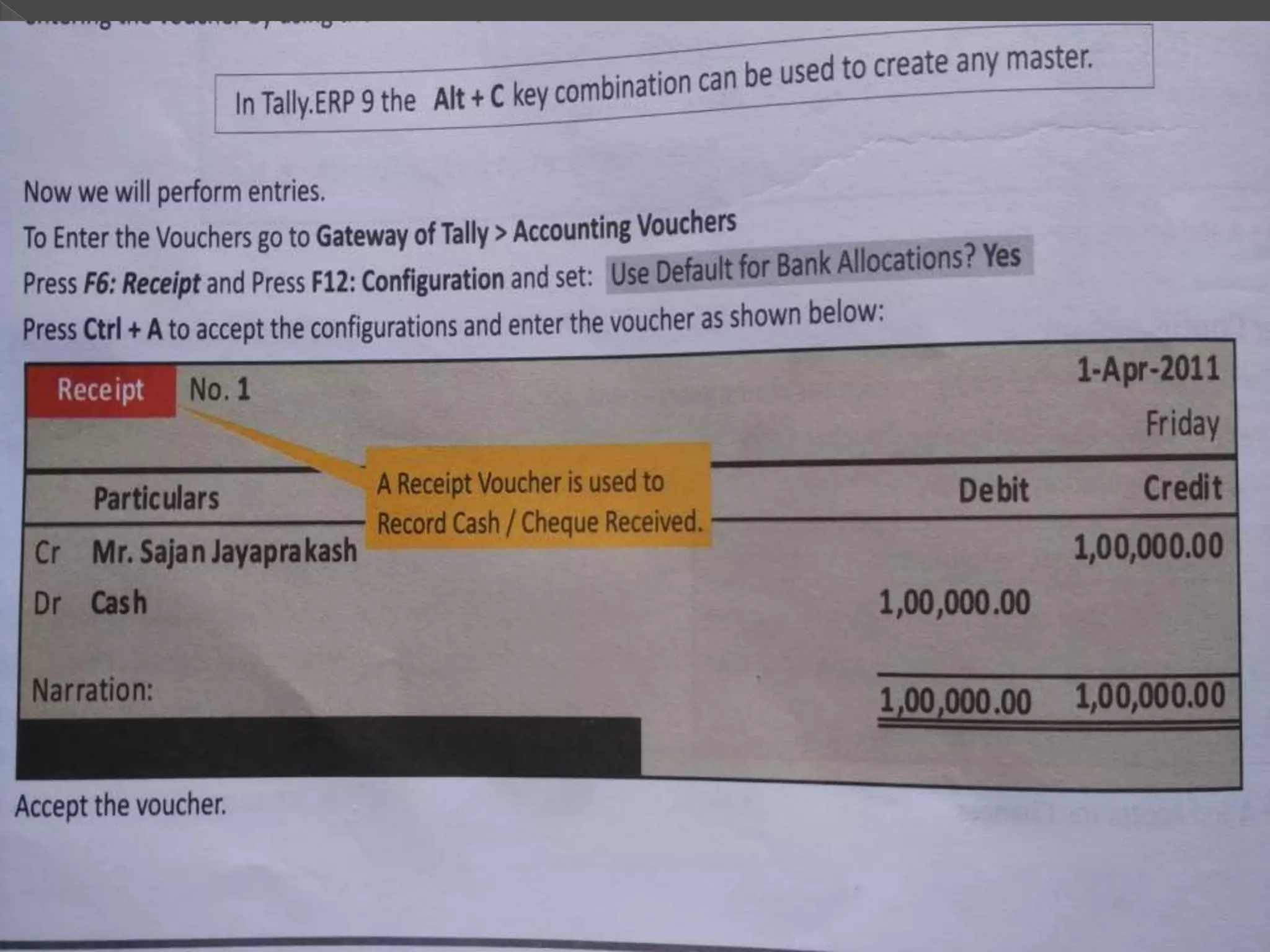

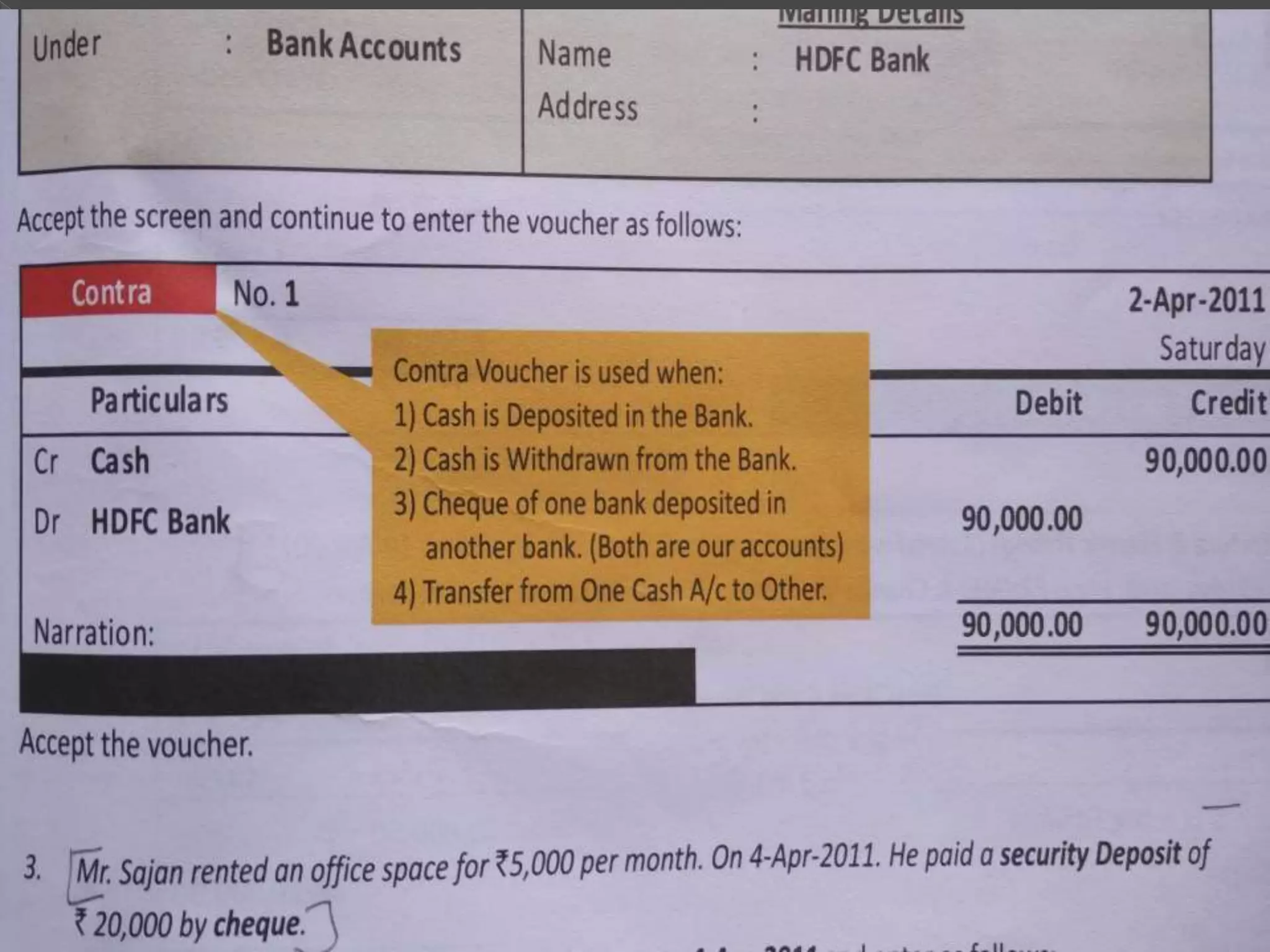

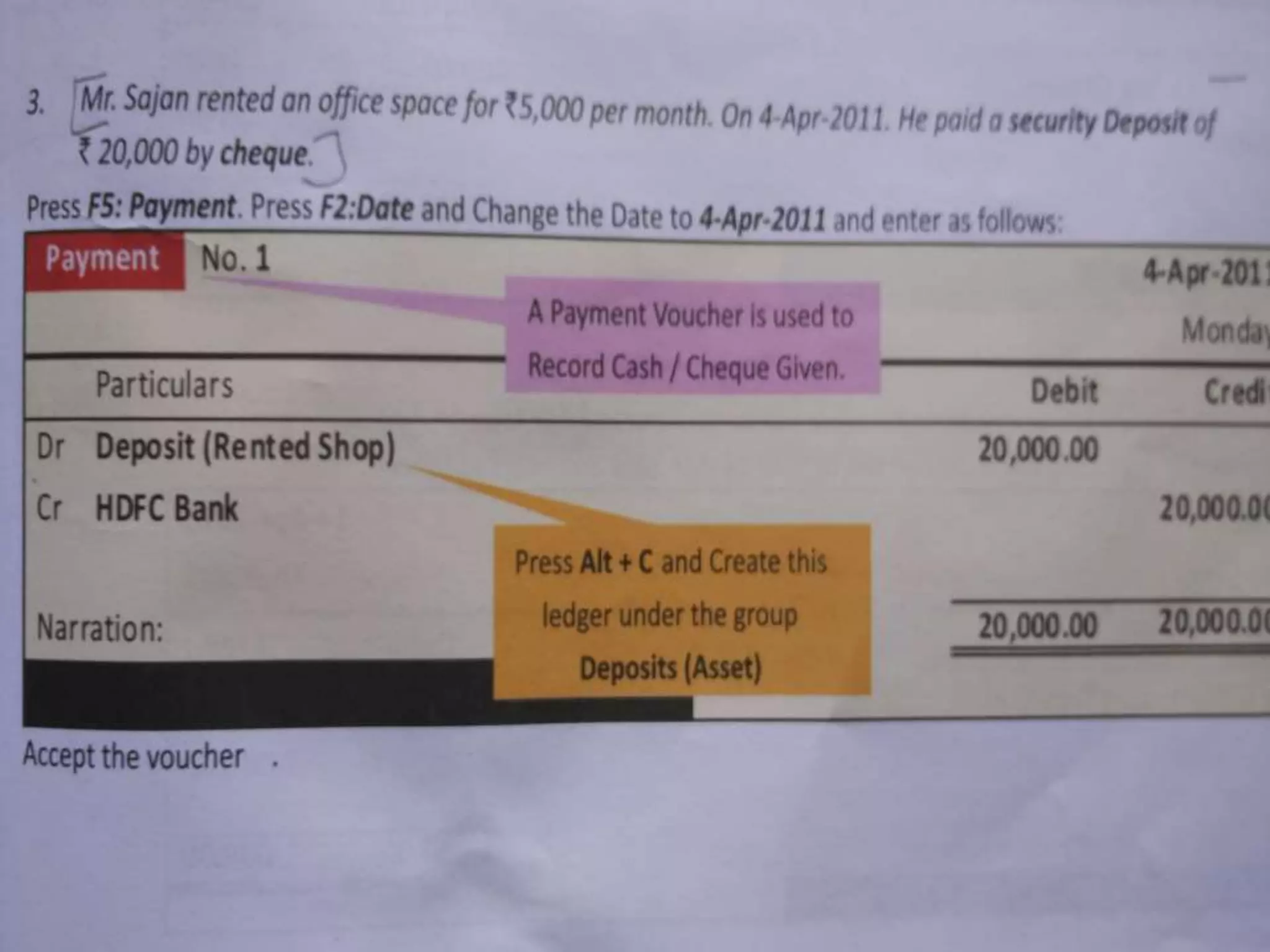

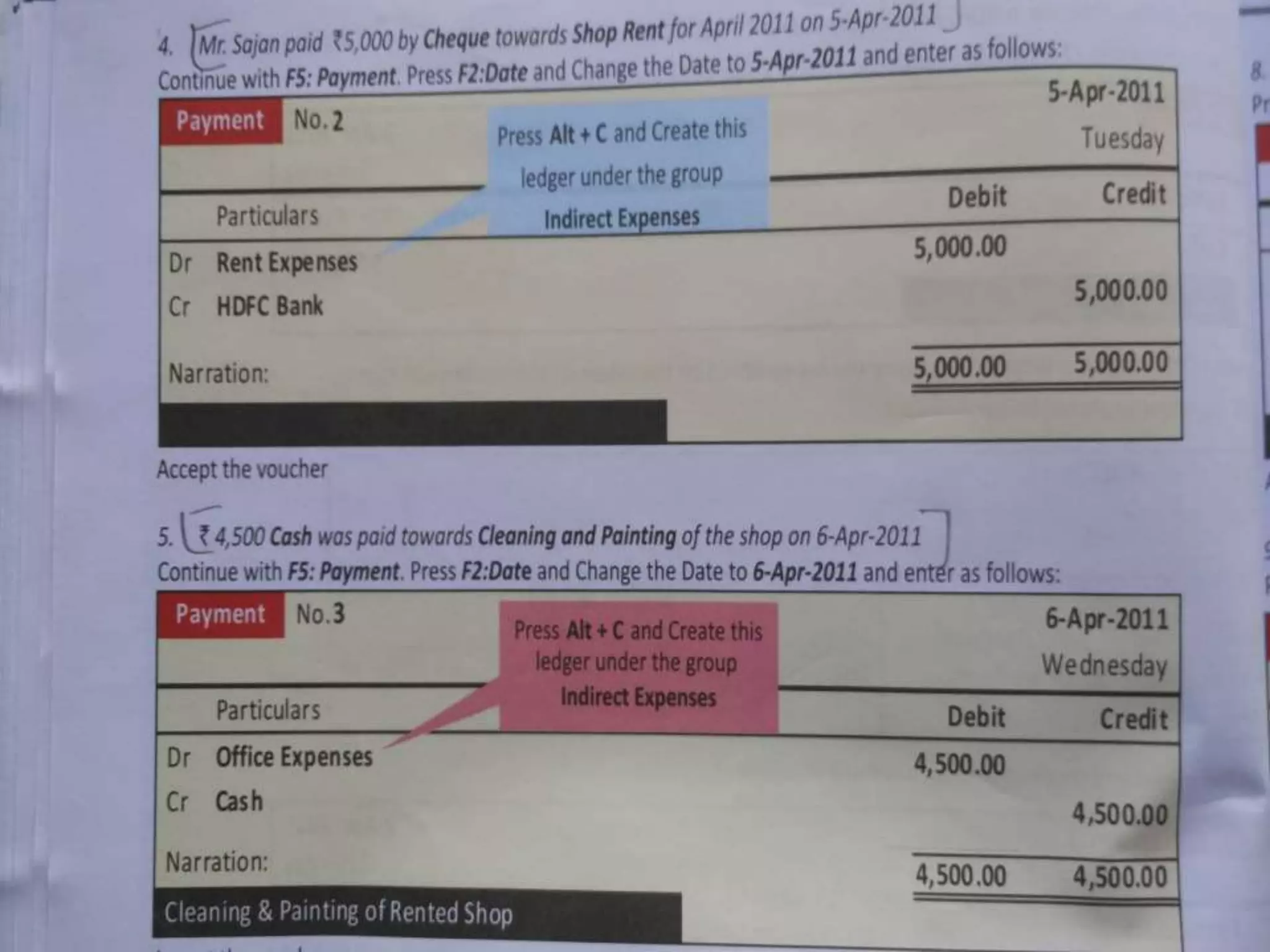

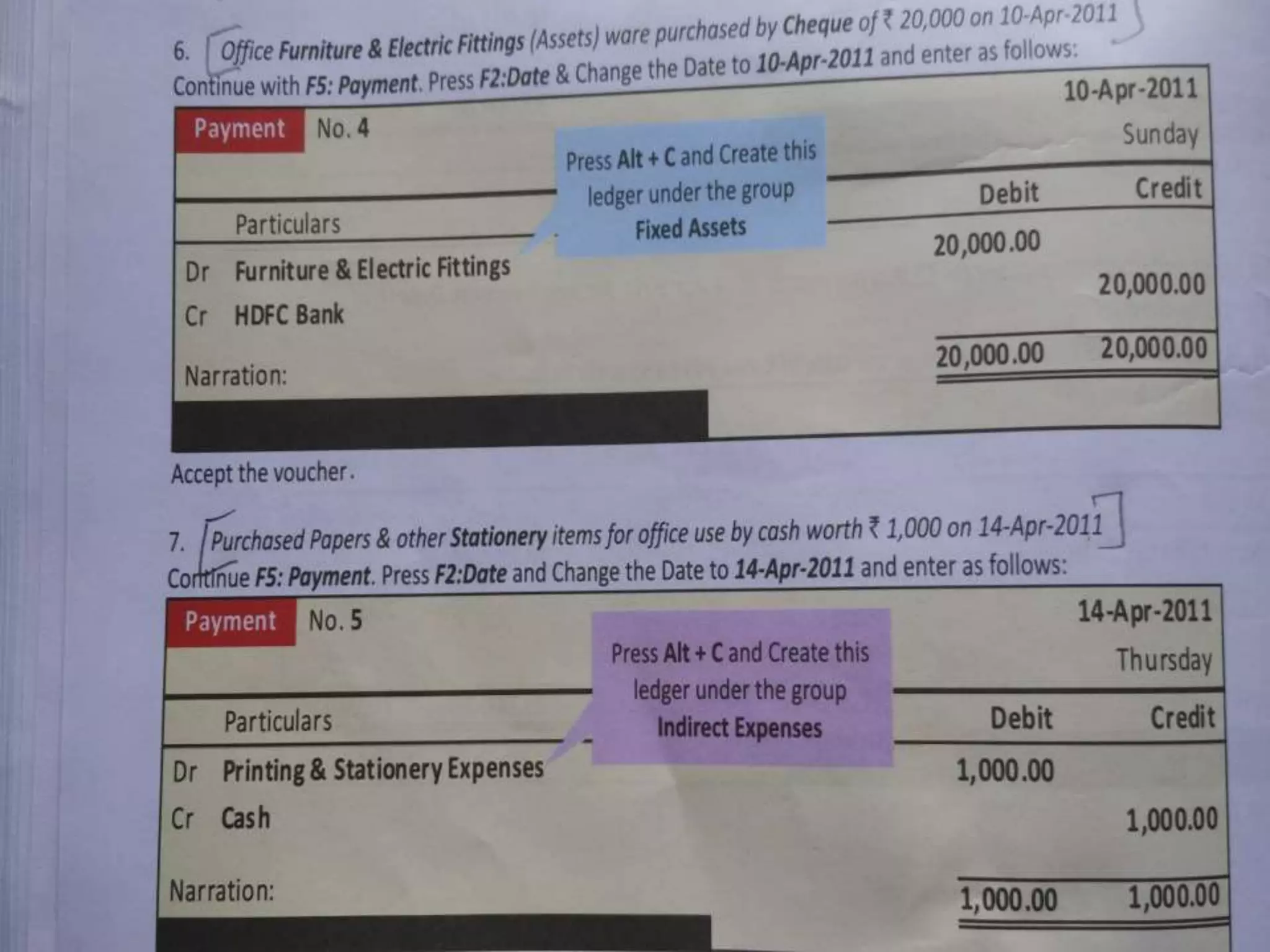

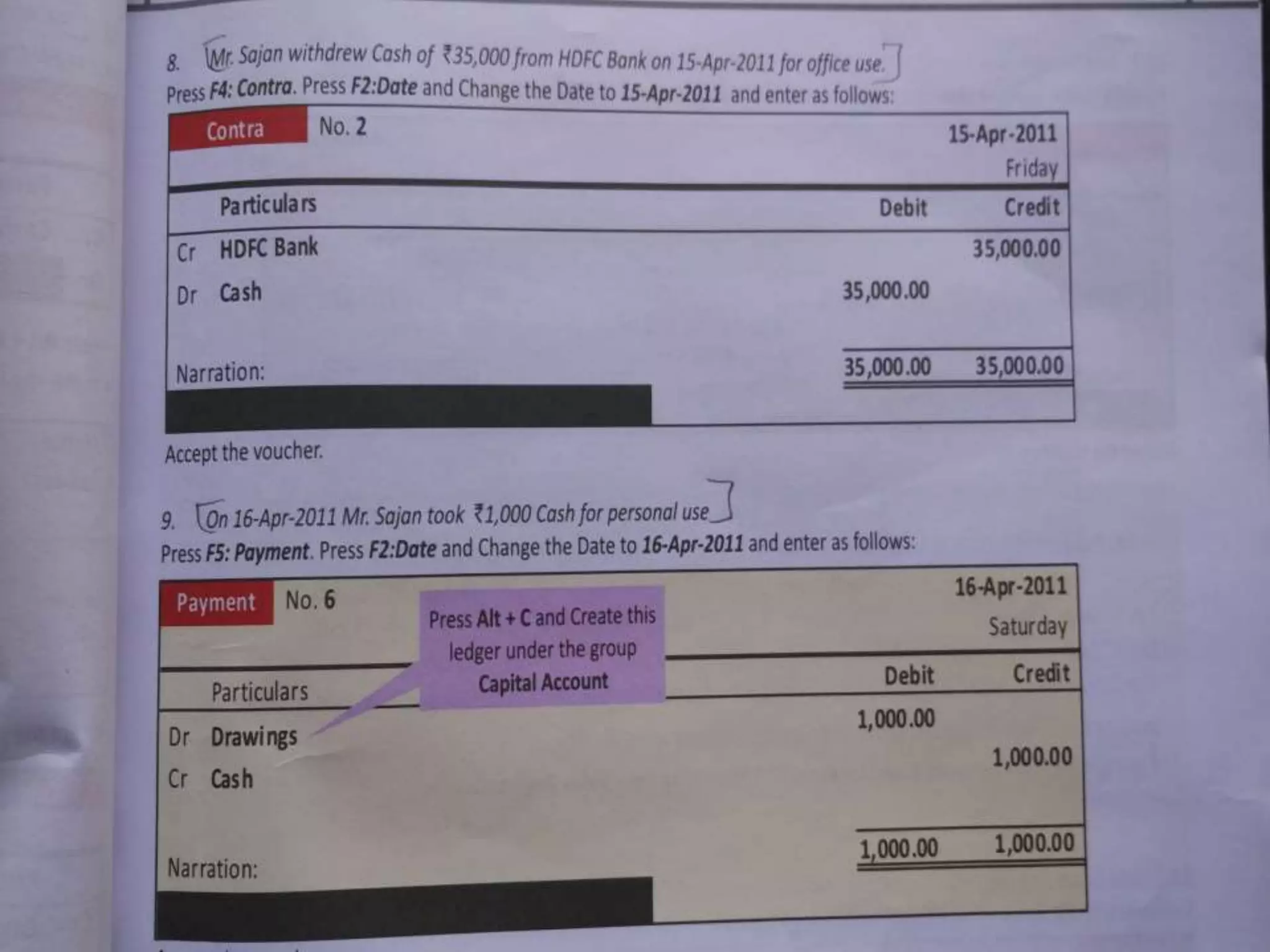

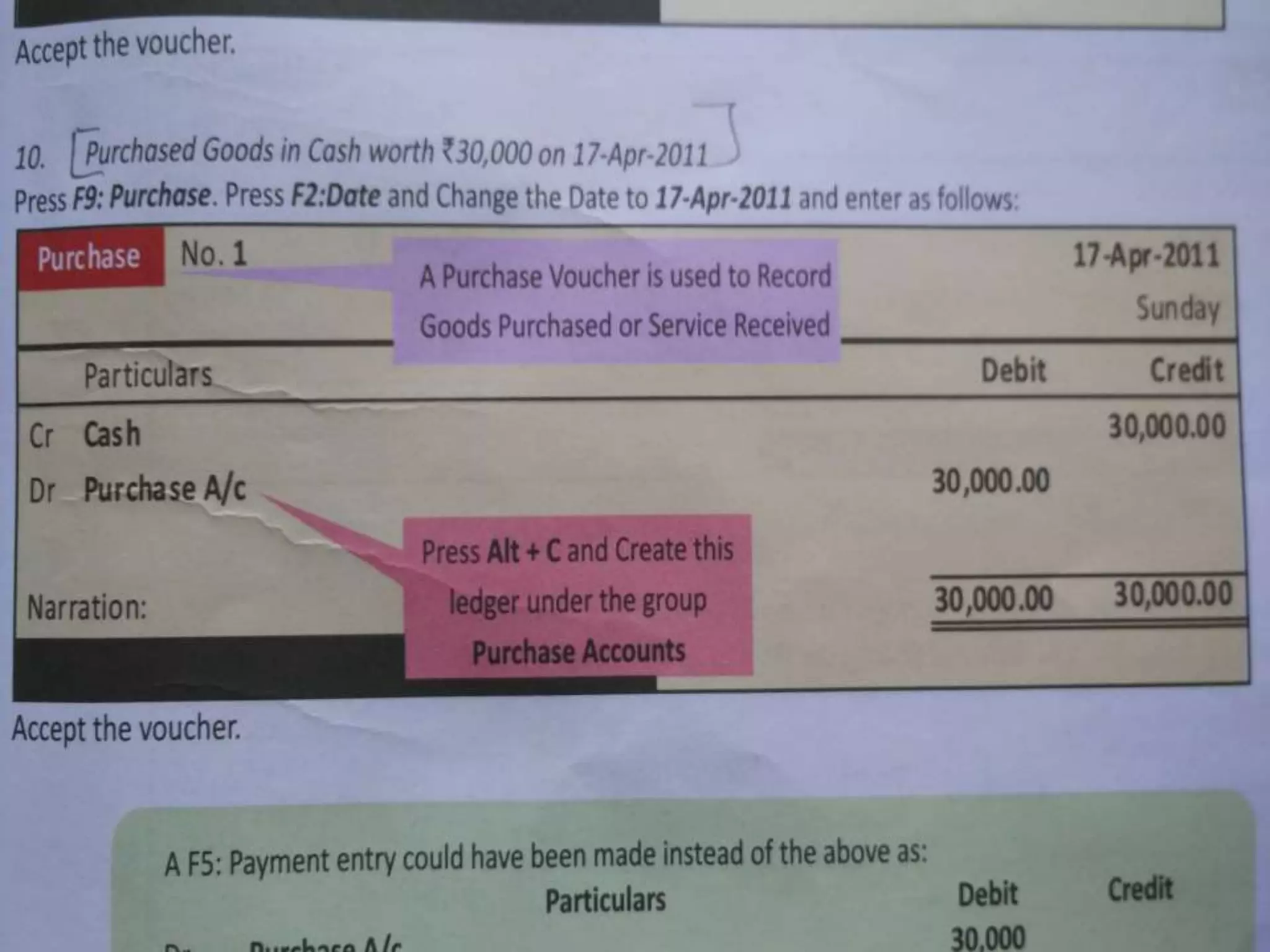

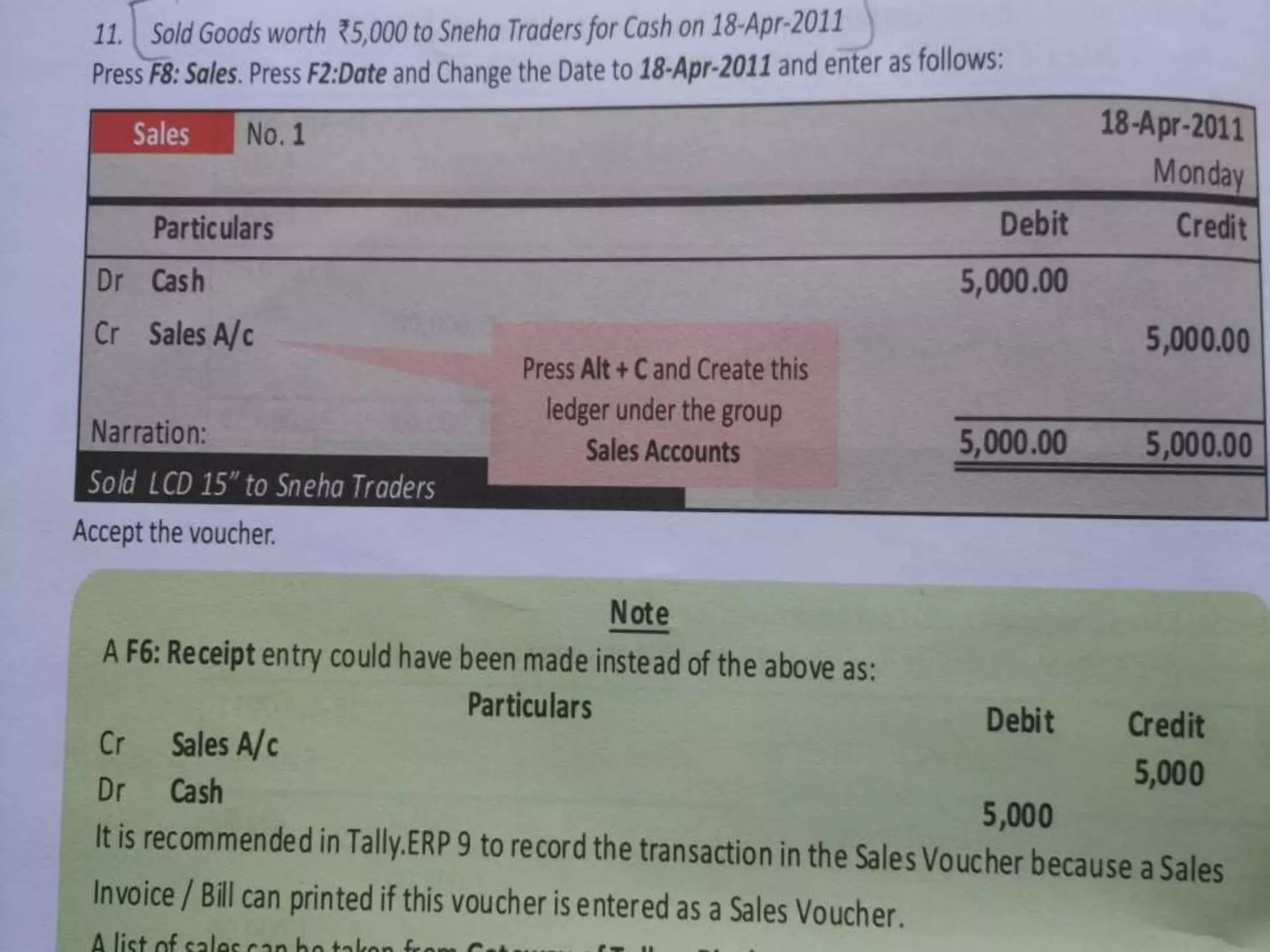

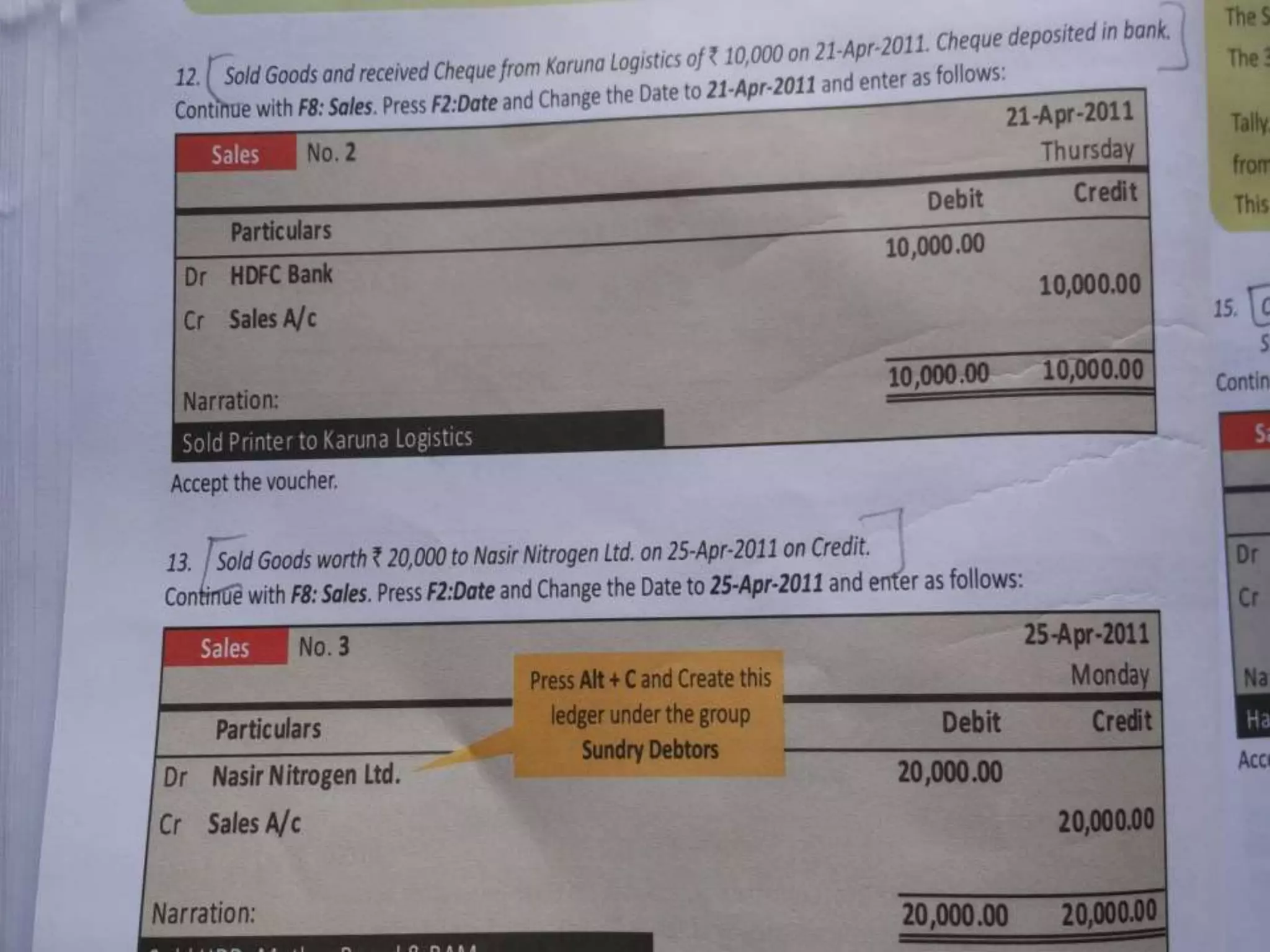

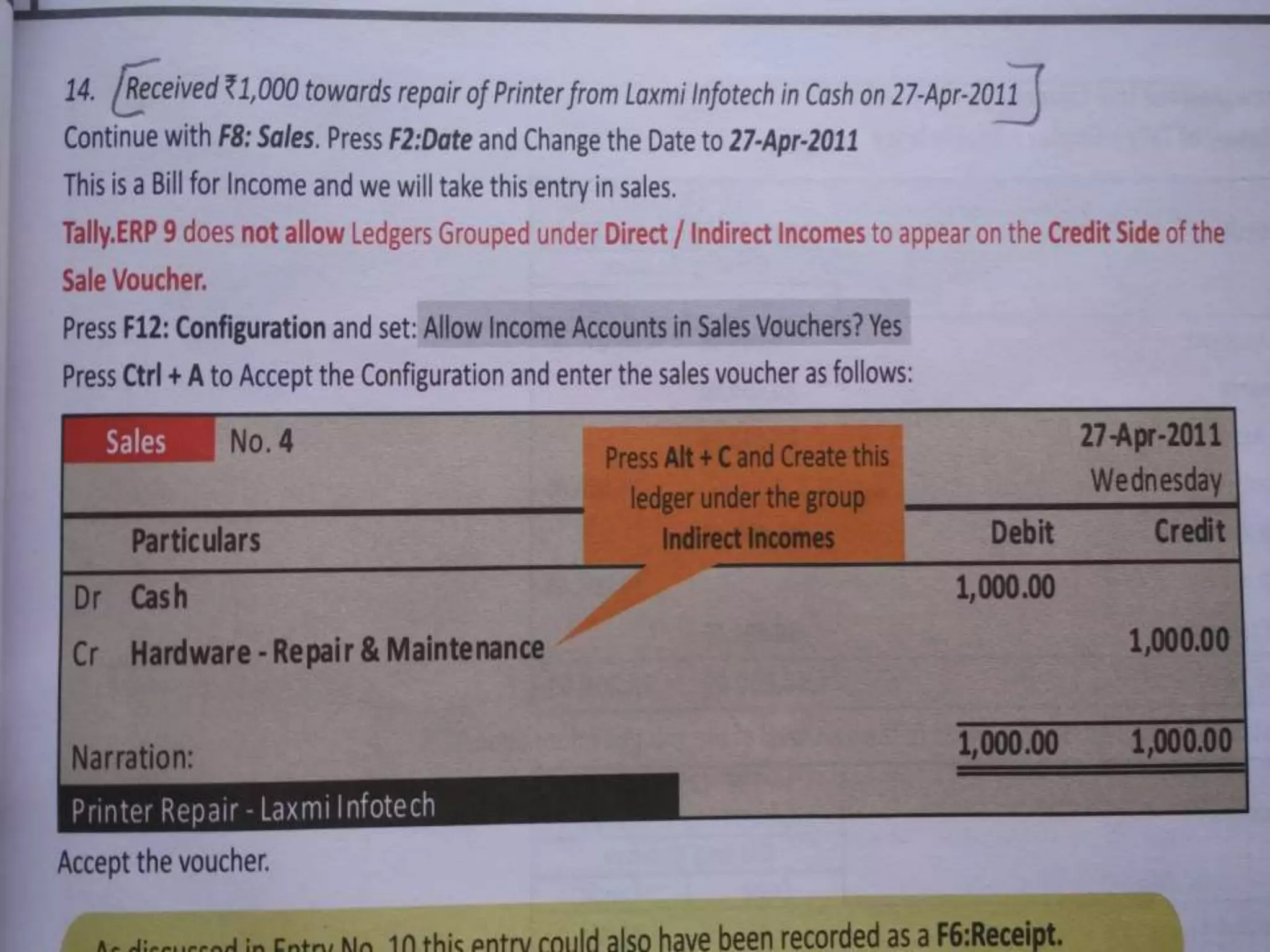

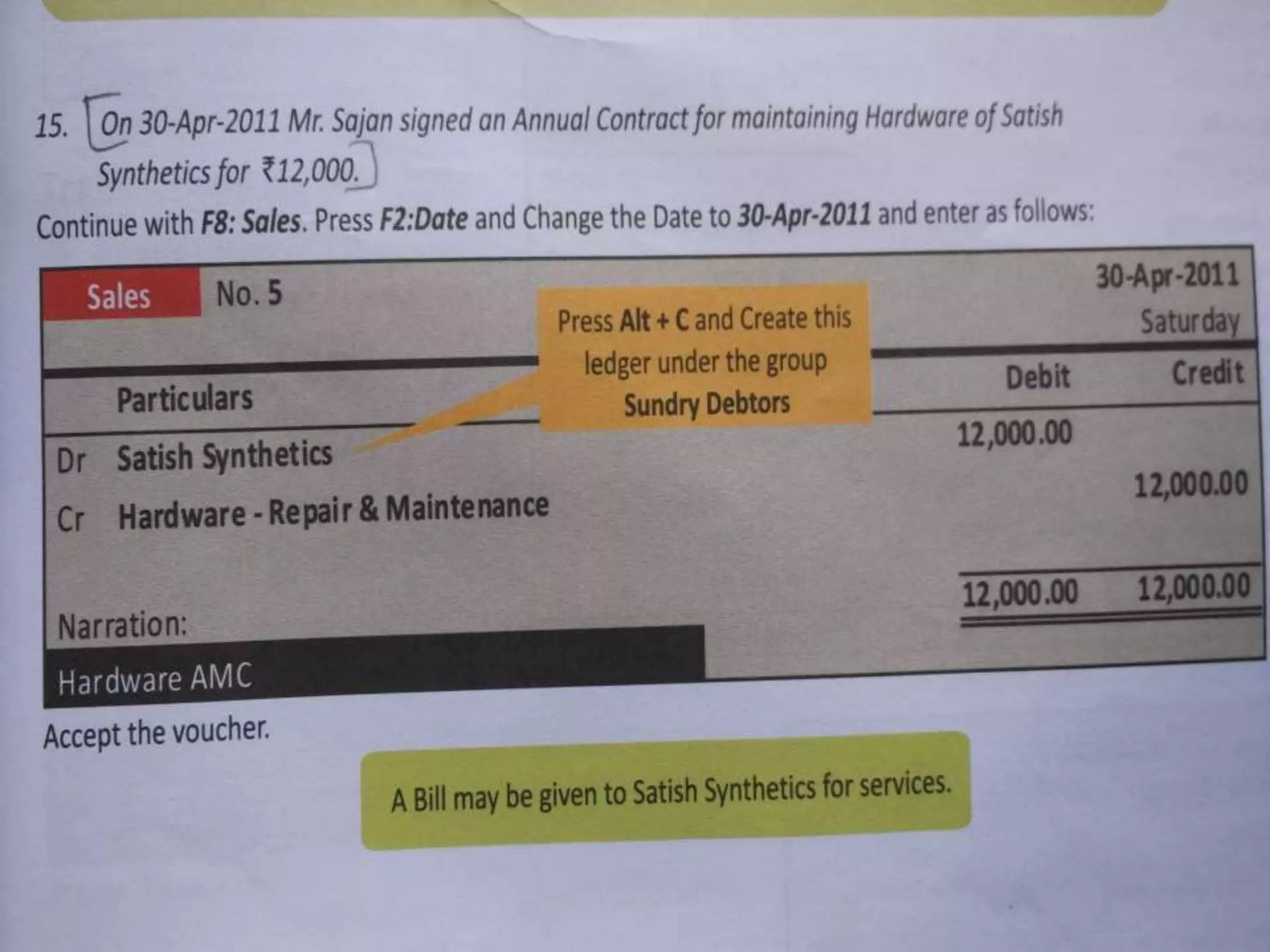

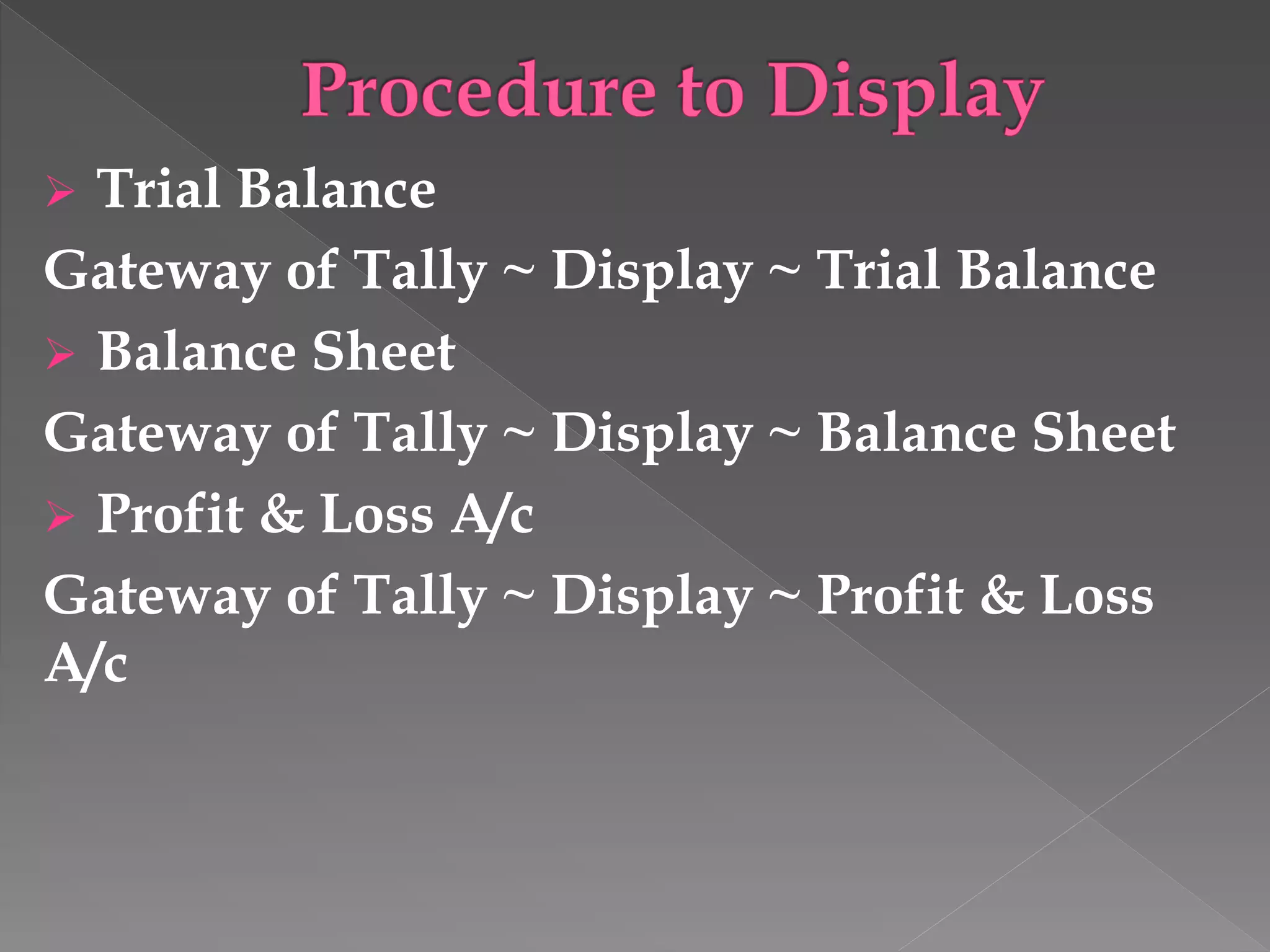

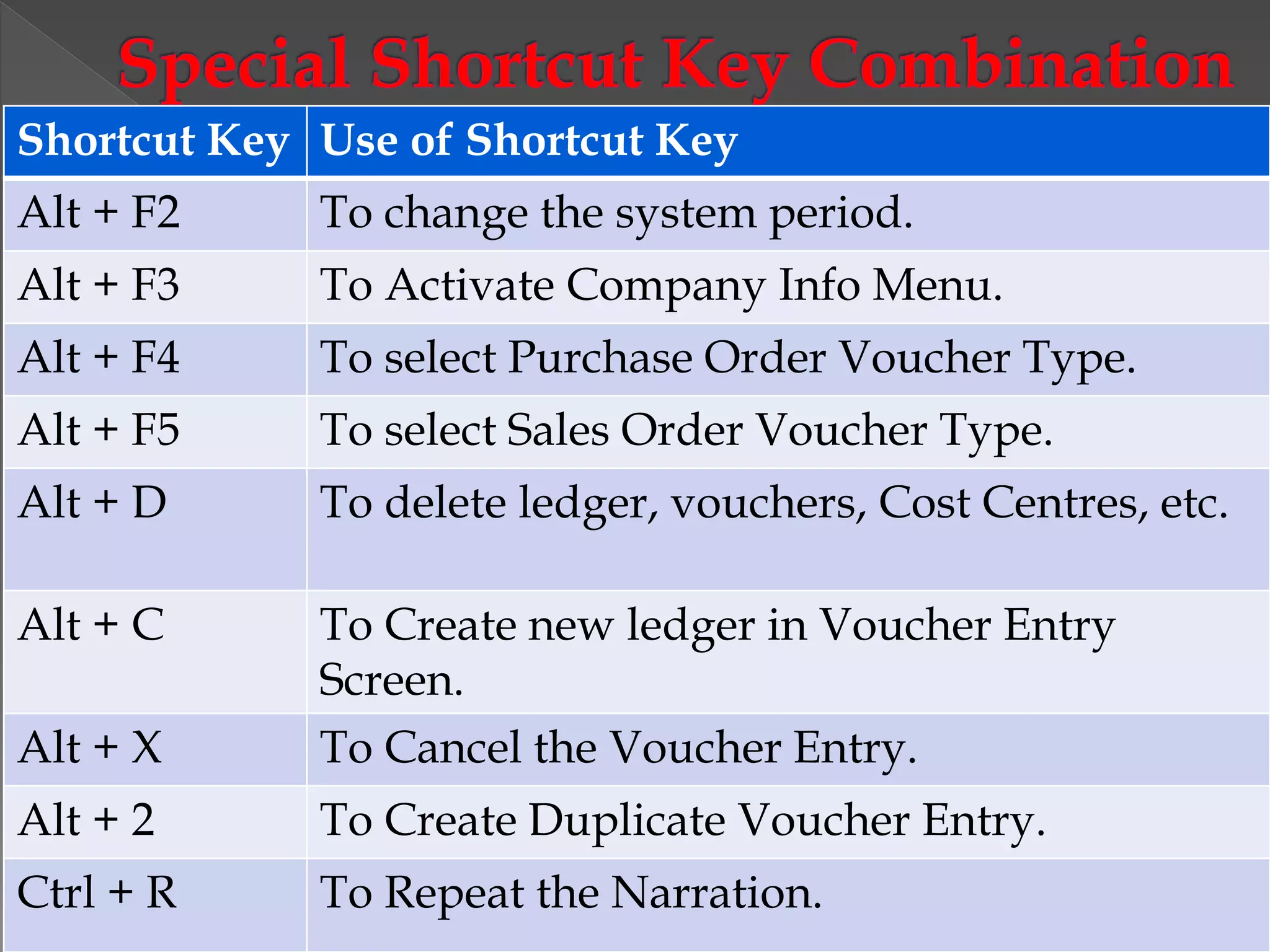

The document is a comprehensive guide to Tally, an accounting software that offers features for bookkeeping, including company creation, group and ledger management, and various types of vouchers for recording transactions. It covers the procedural steps for generating trial balances, profit and loss accounts, and balance sheets, as well as inventory control and reports. Tally is designed to be user-friendly, secure, and supports multiple languages, with interactive help available for users.