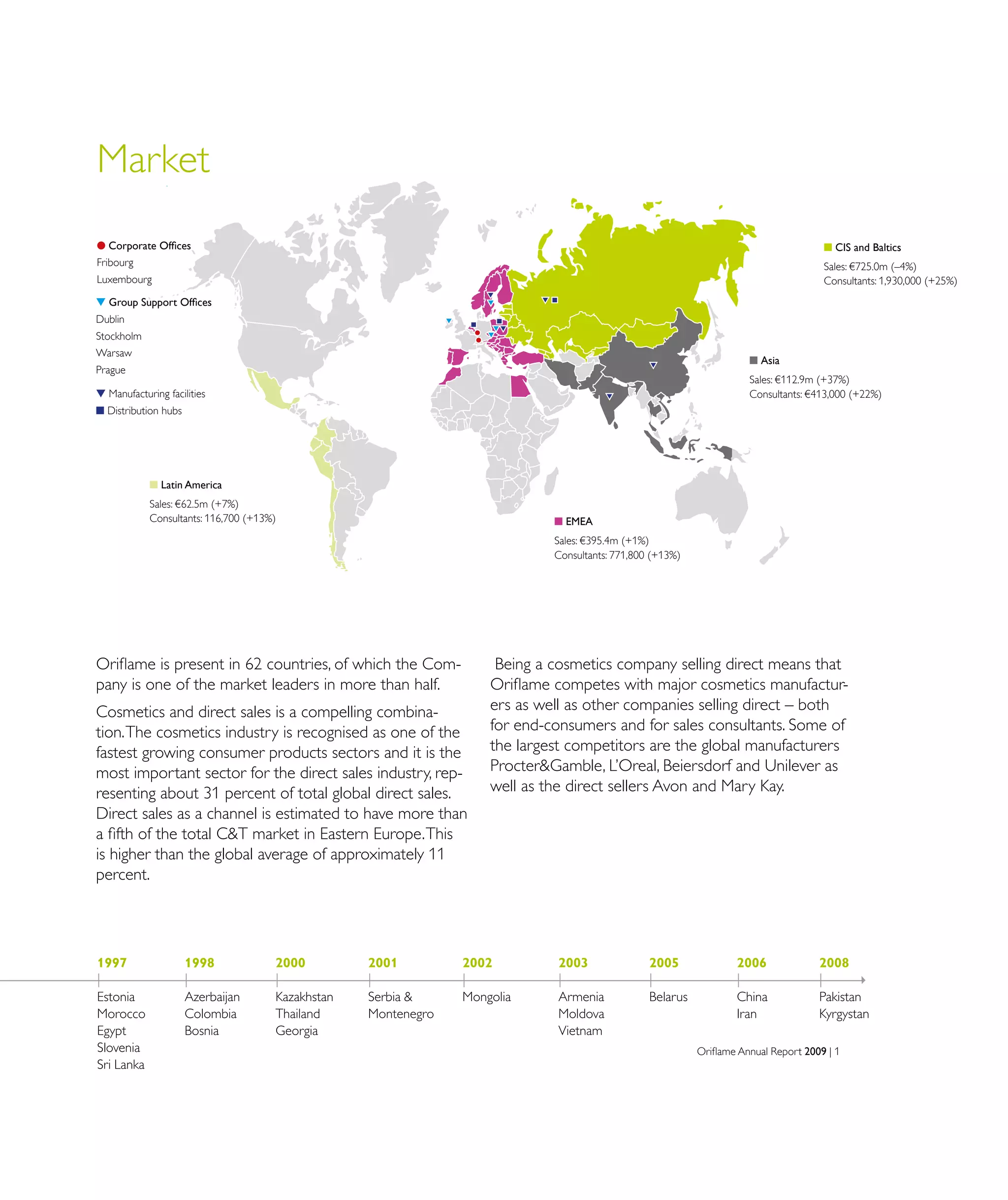

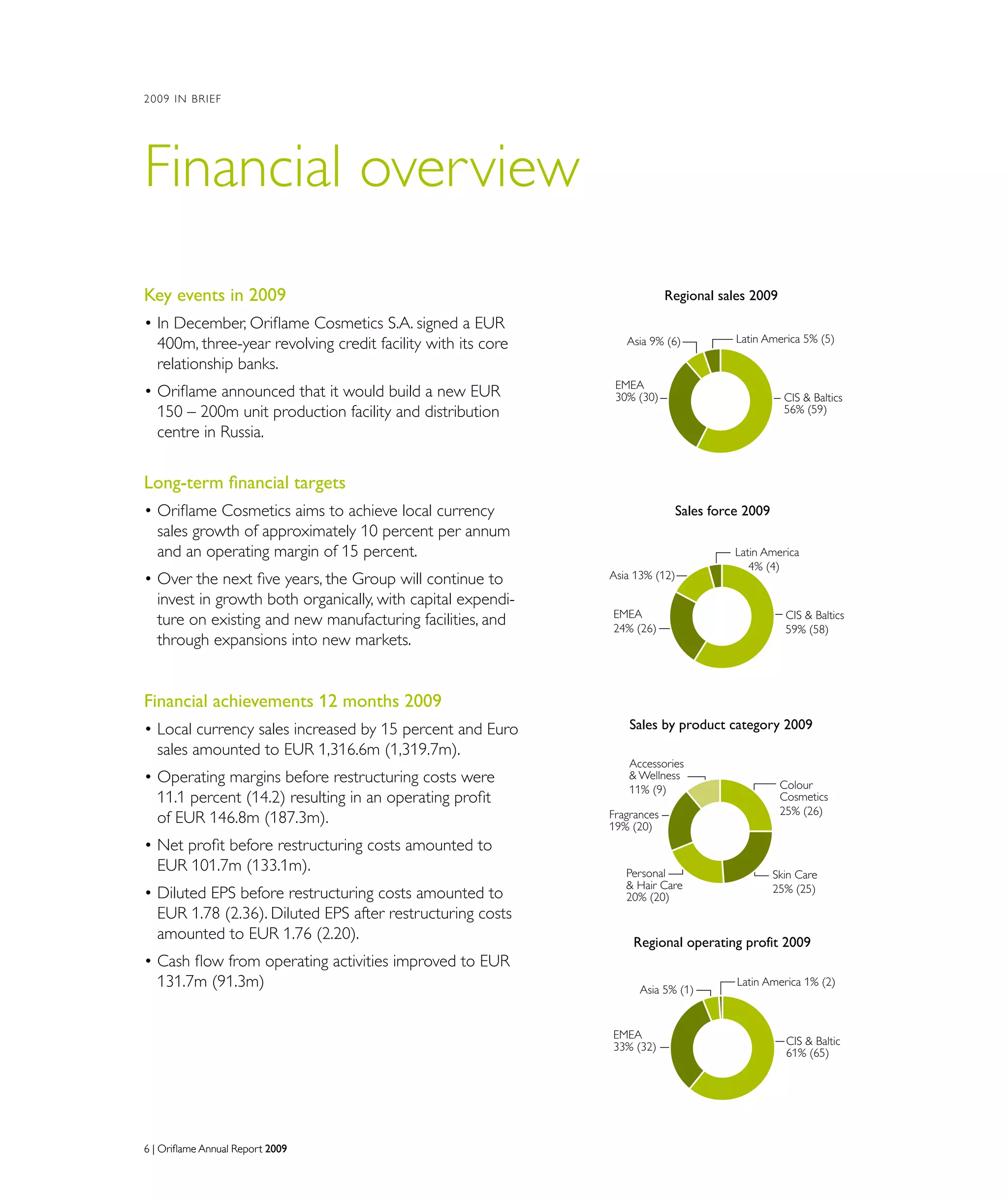

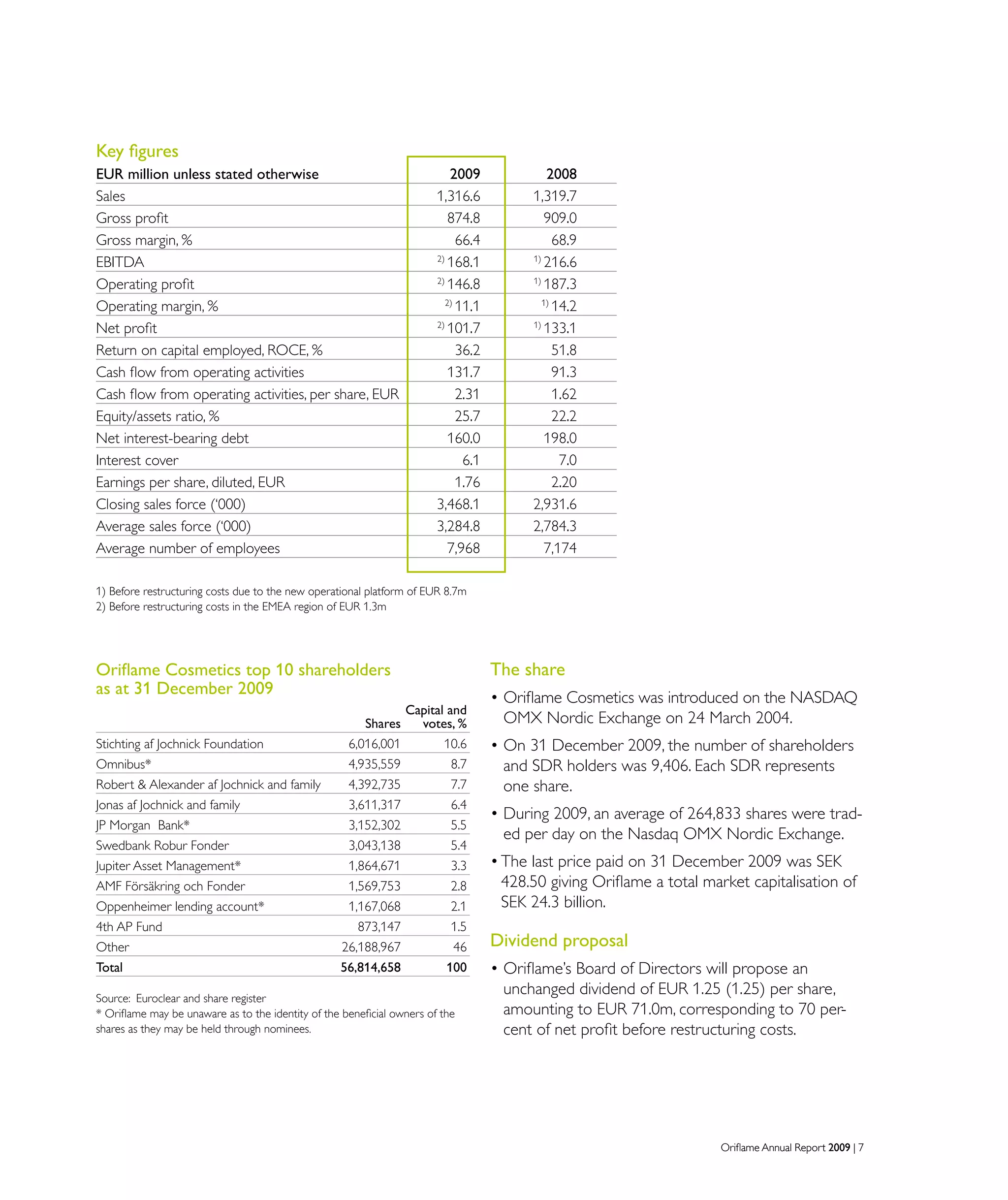

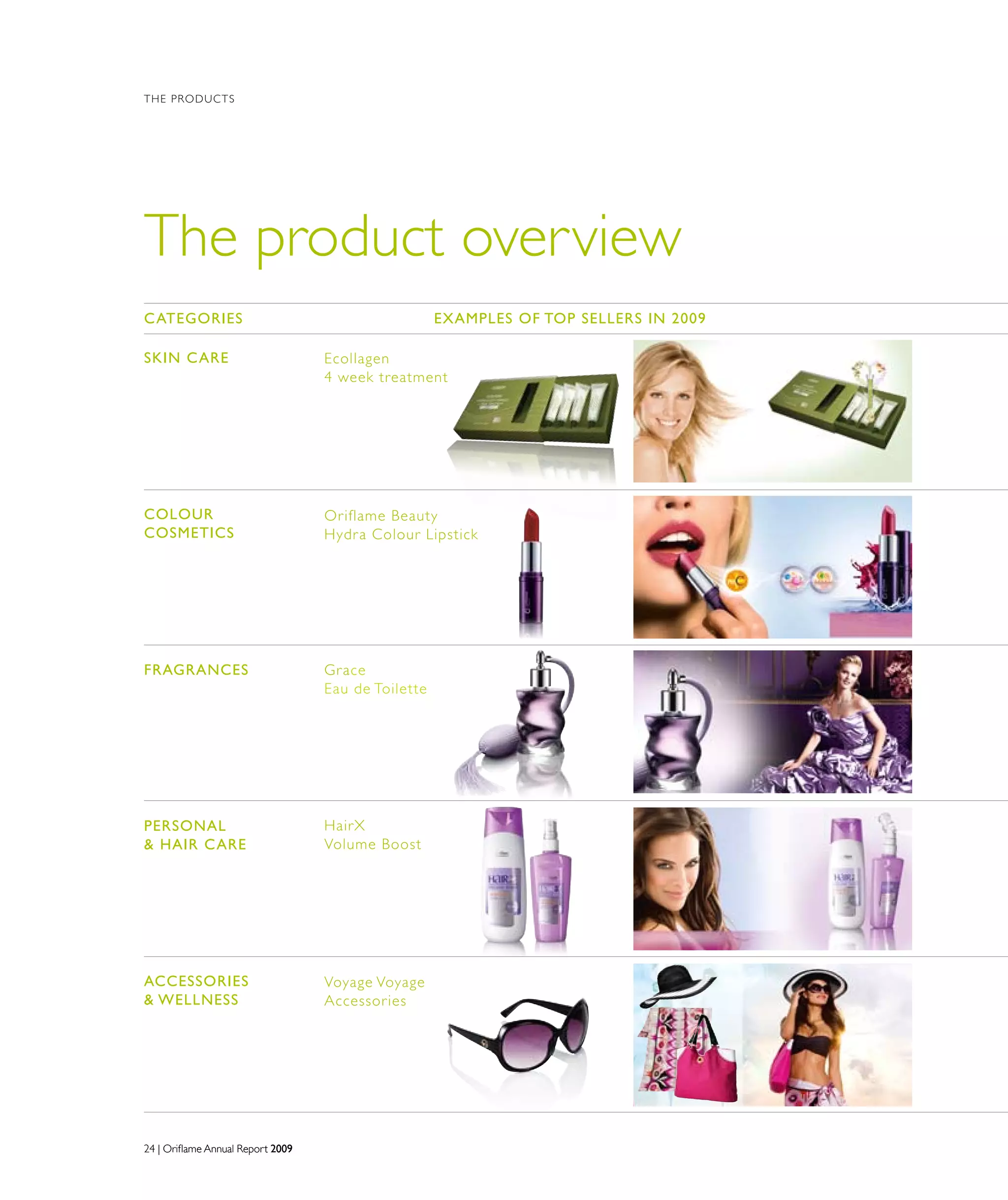

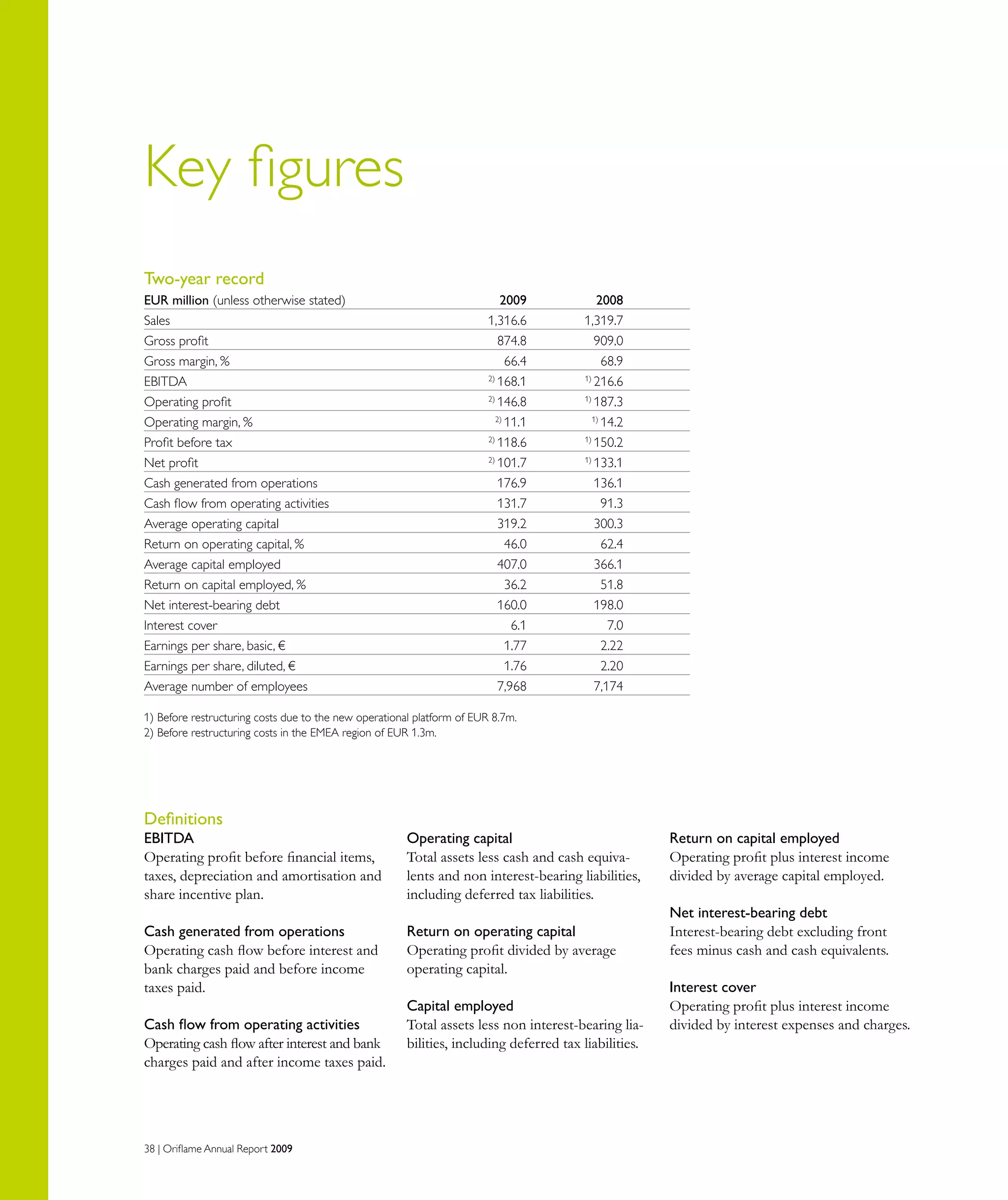

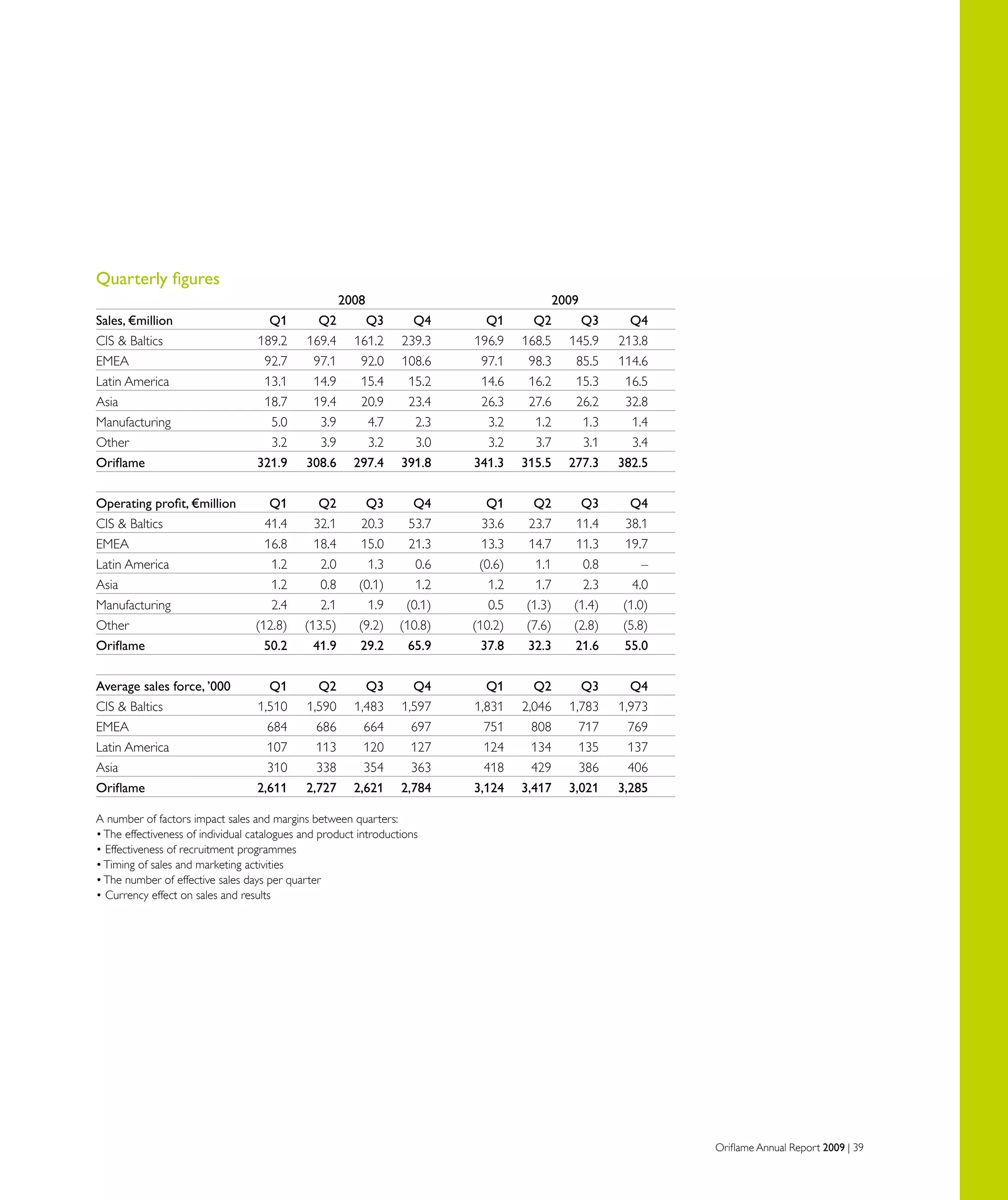

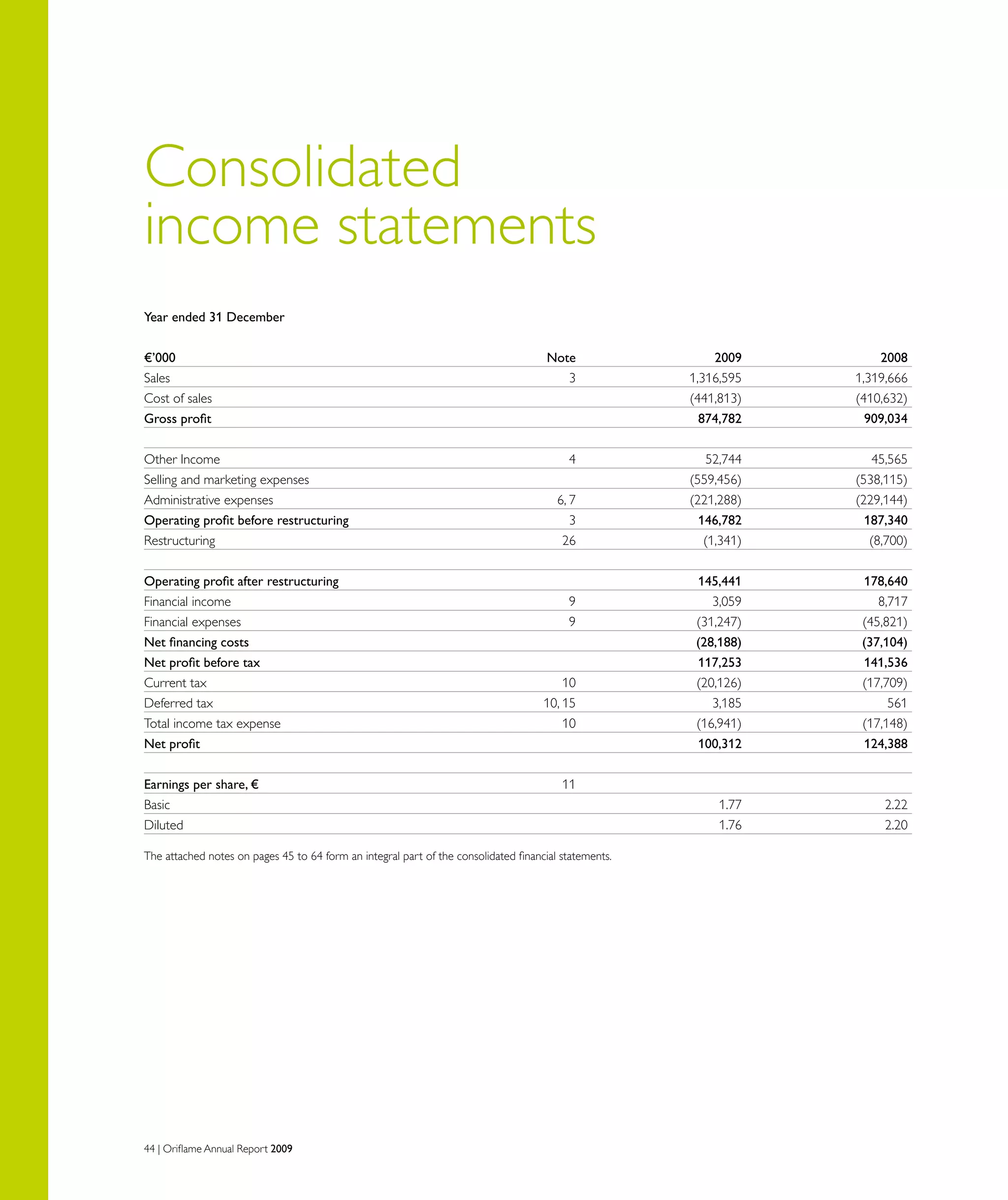

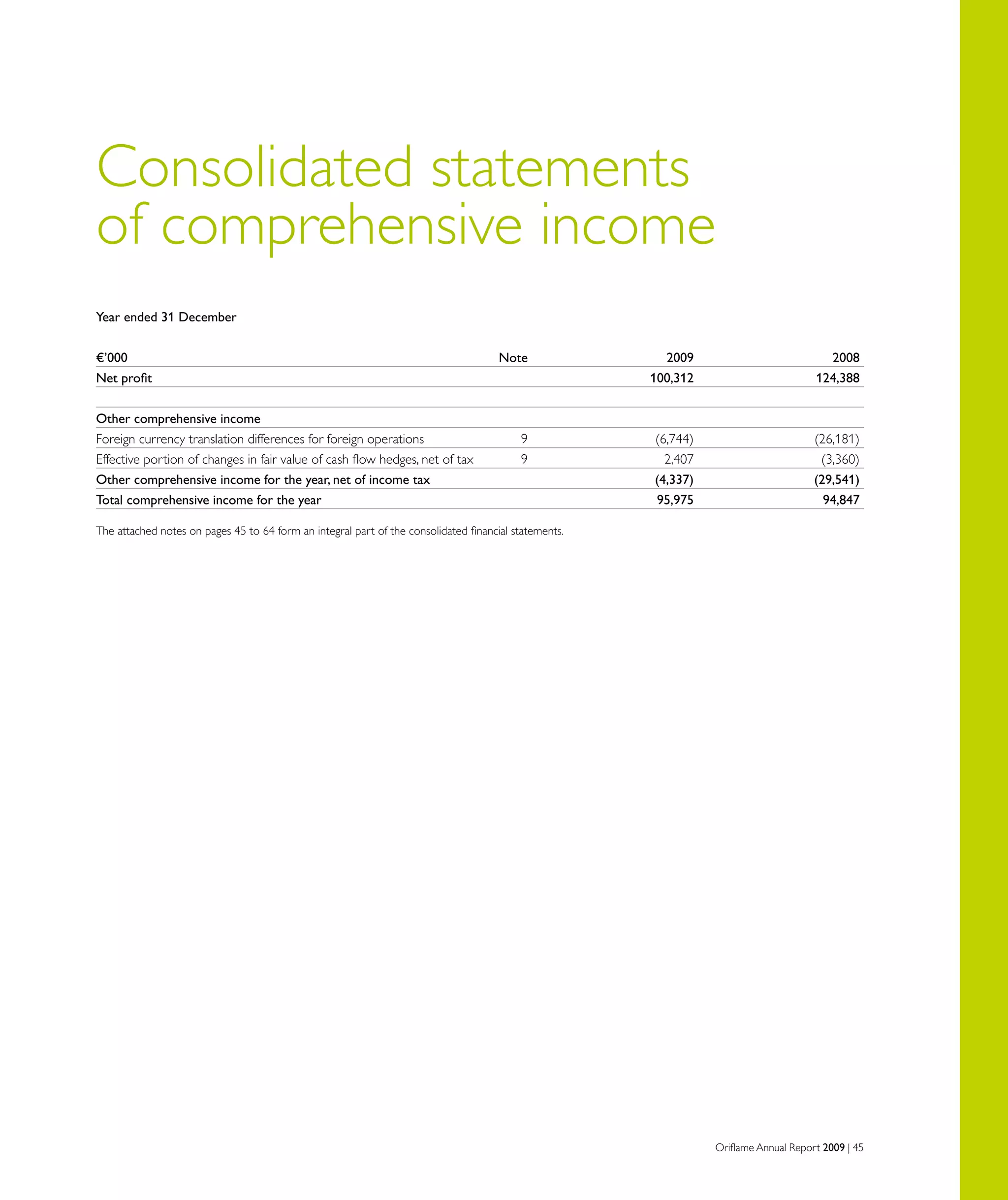

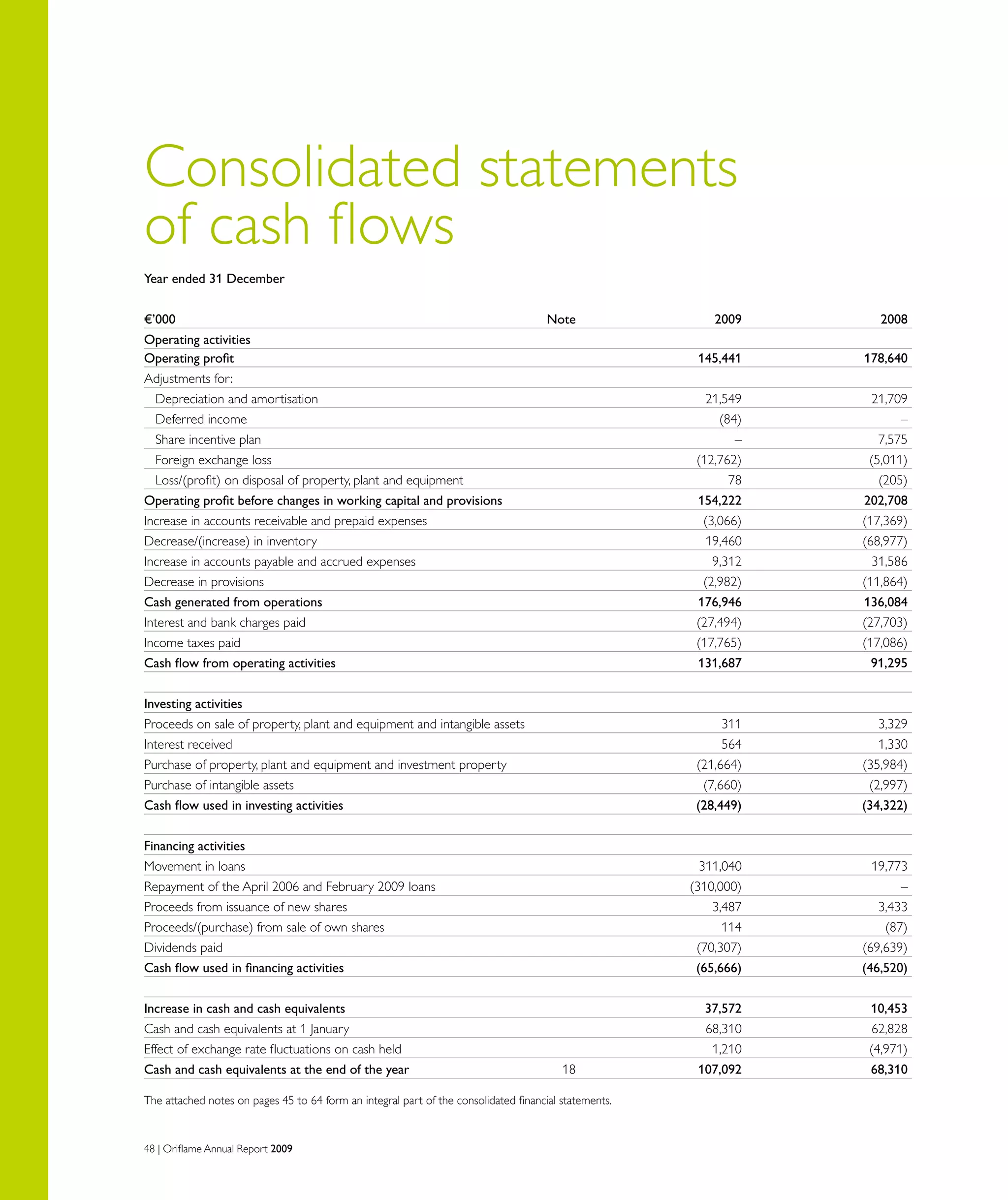

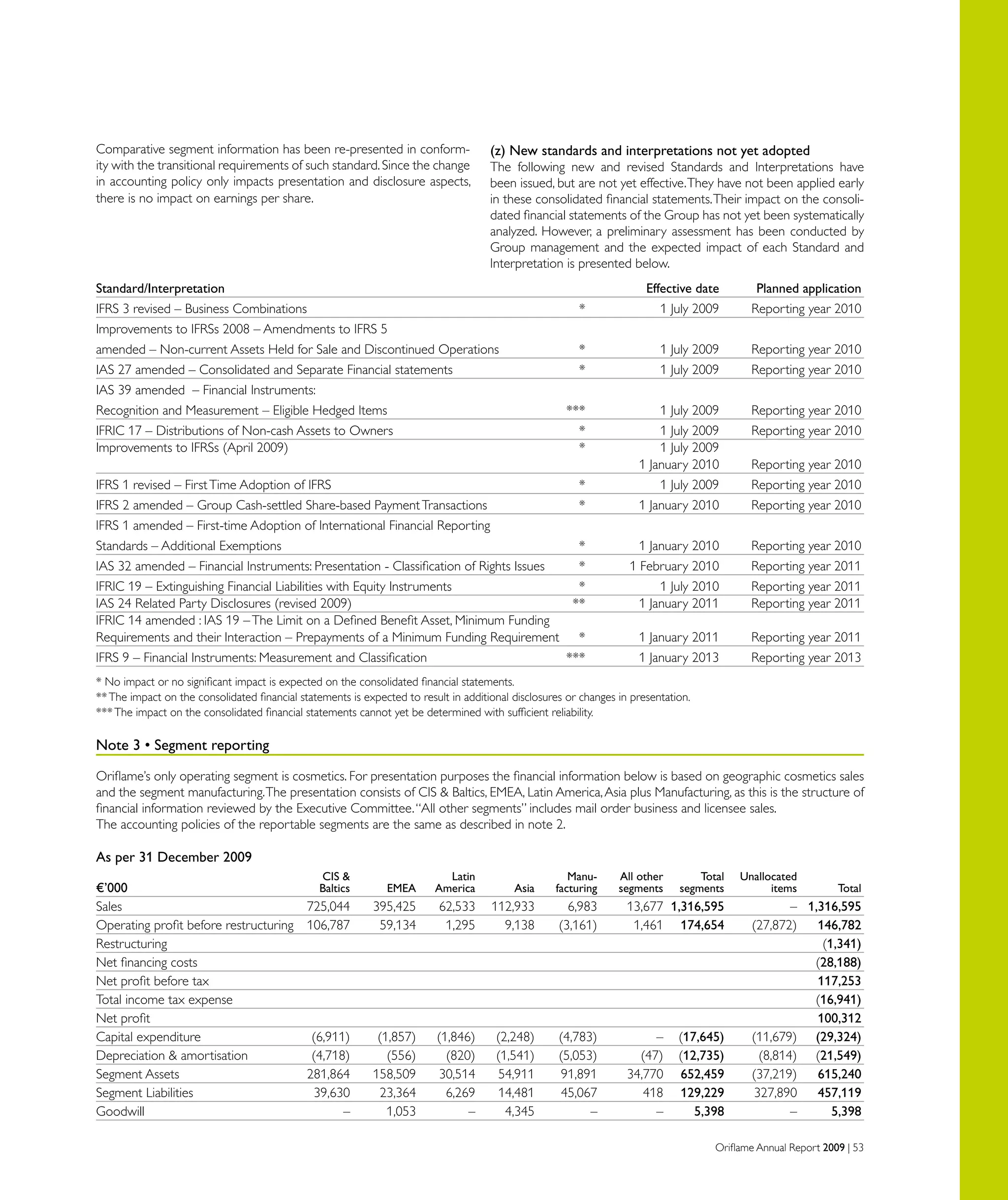

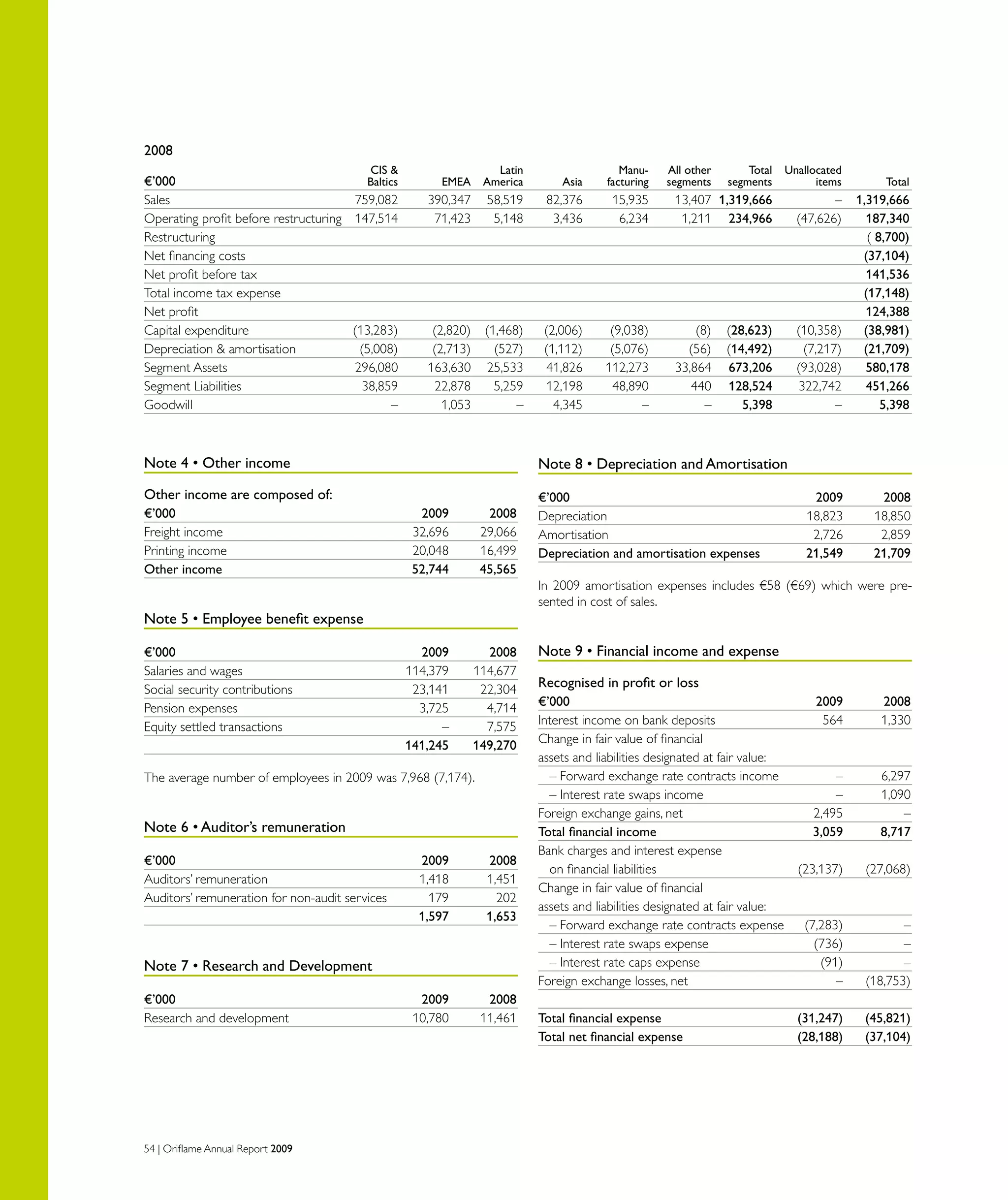

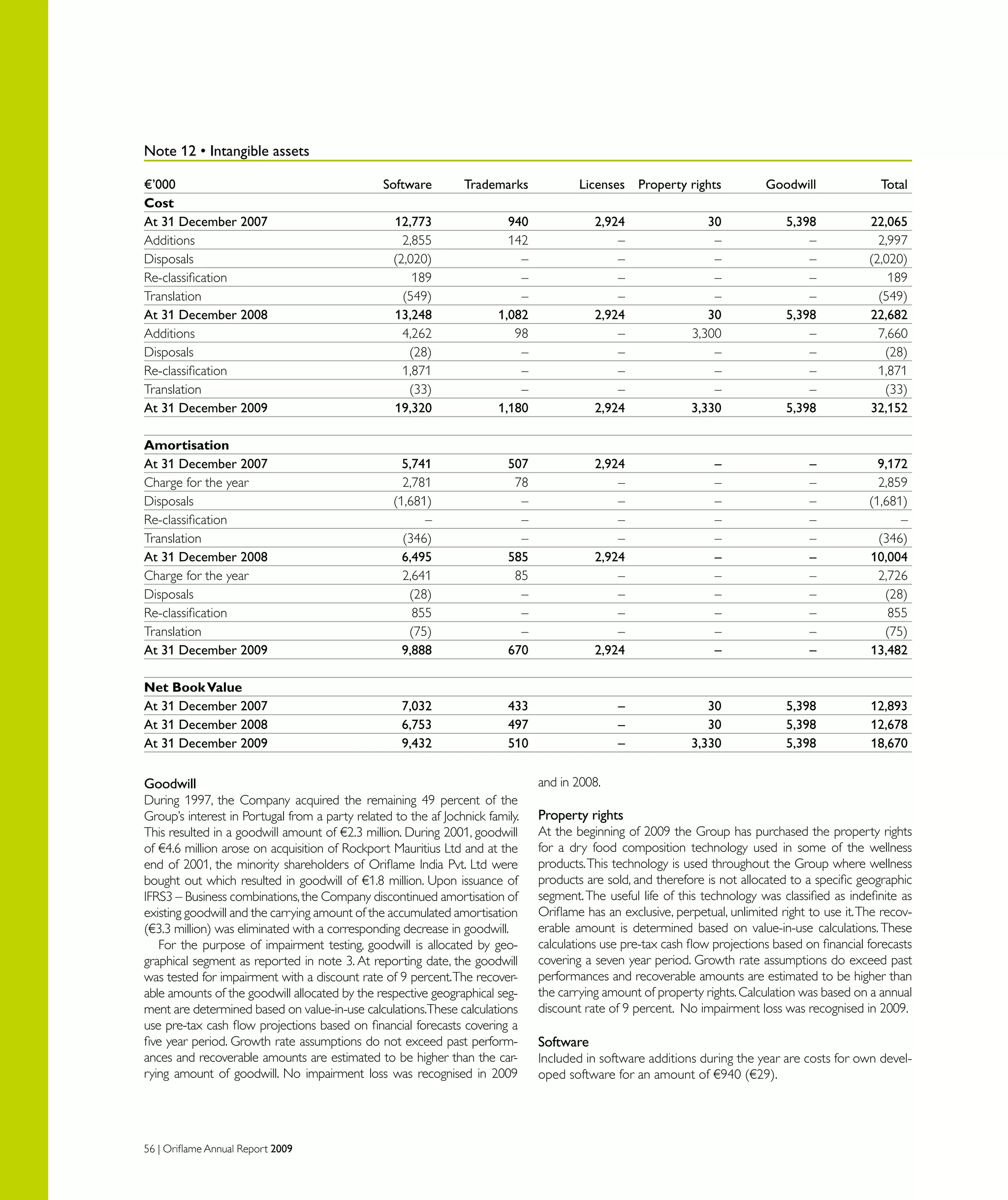

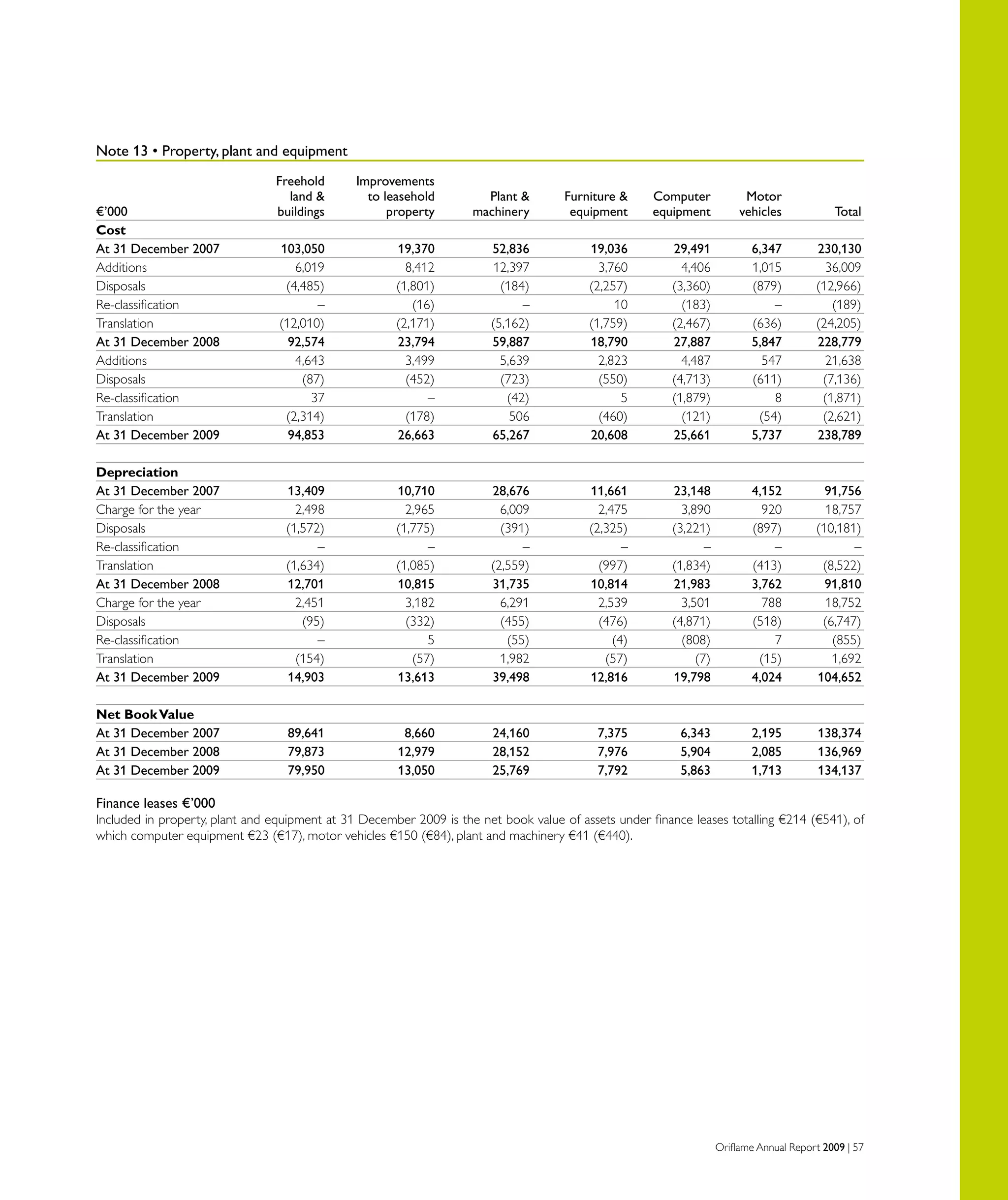

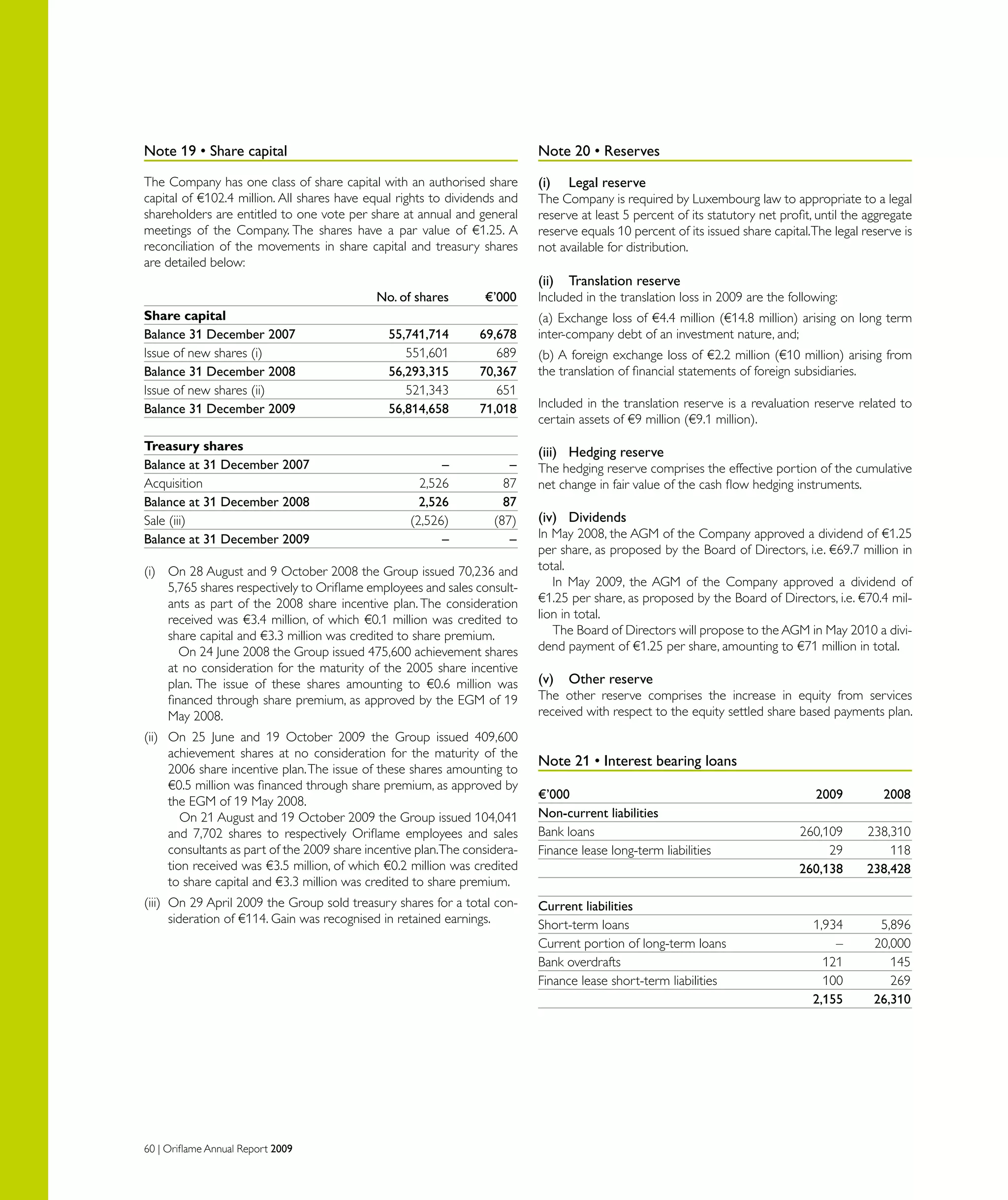

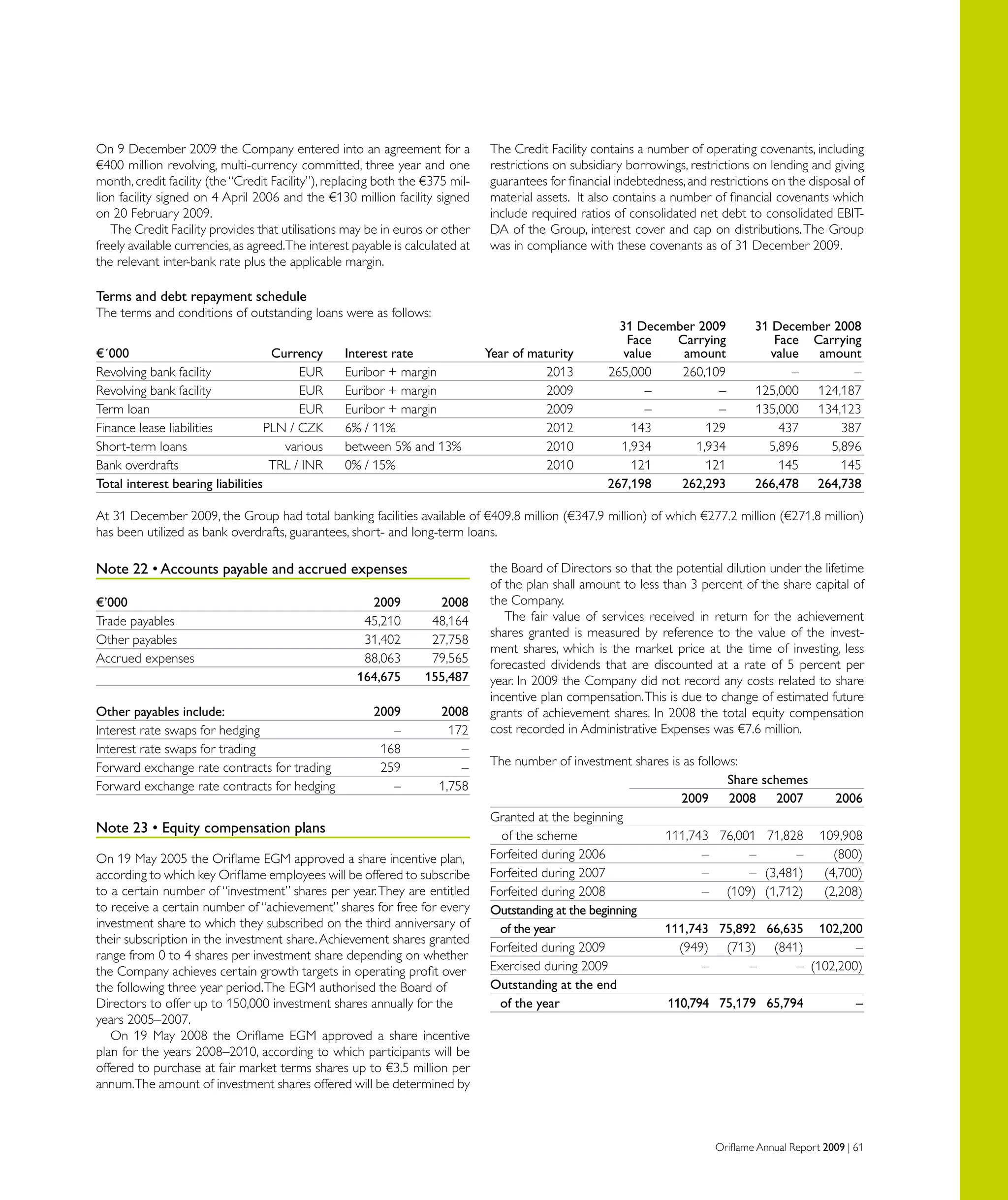

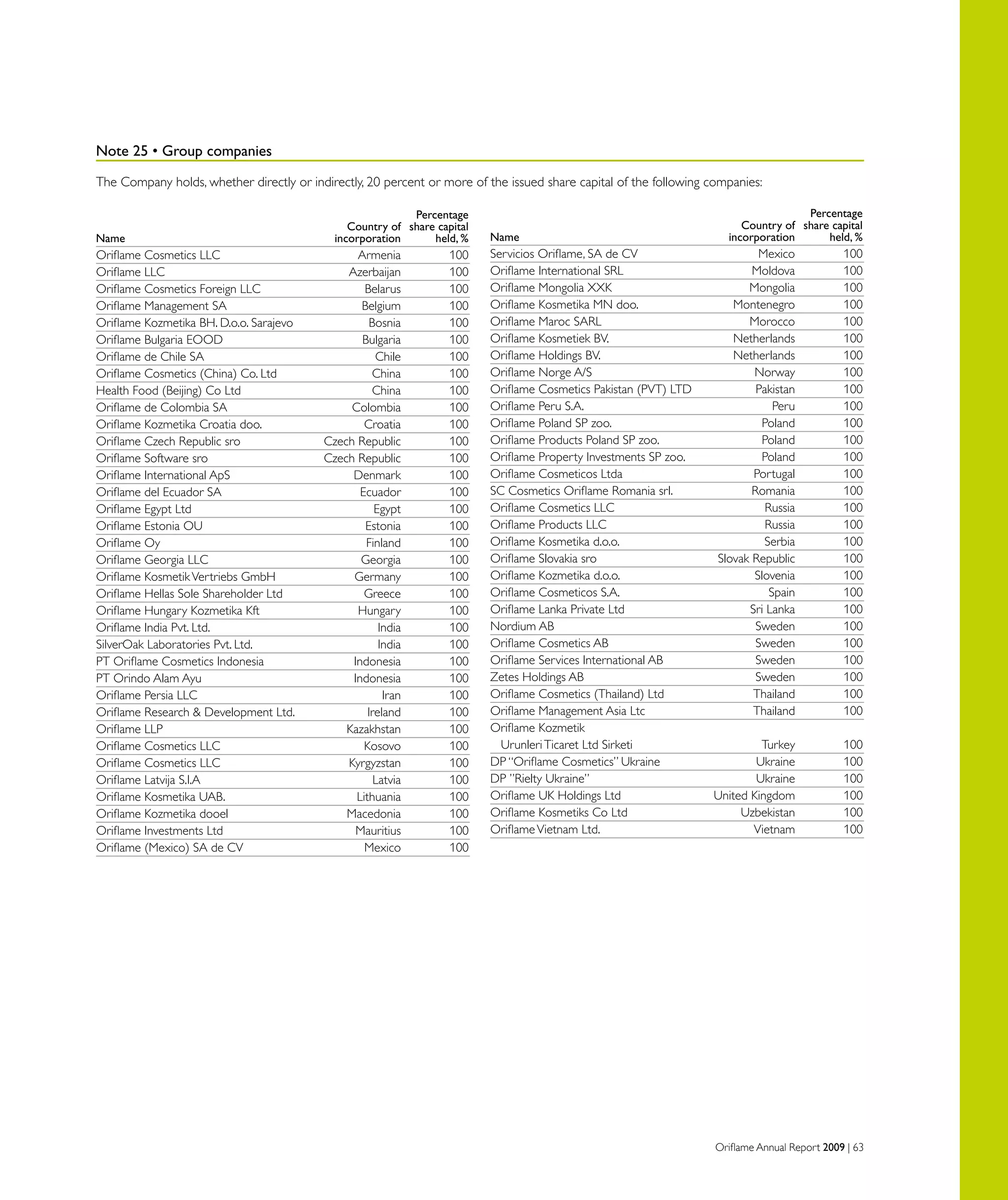

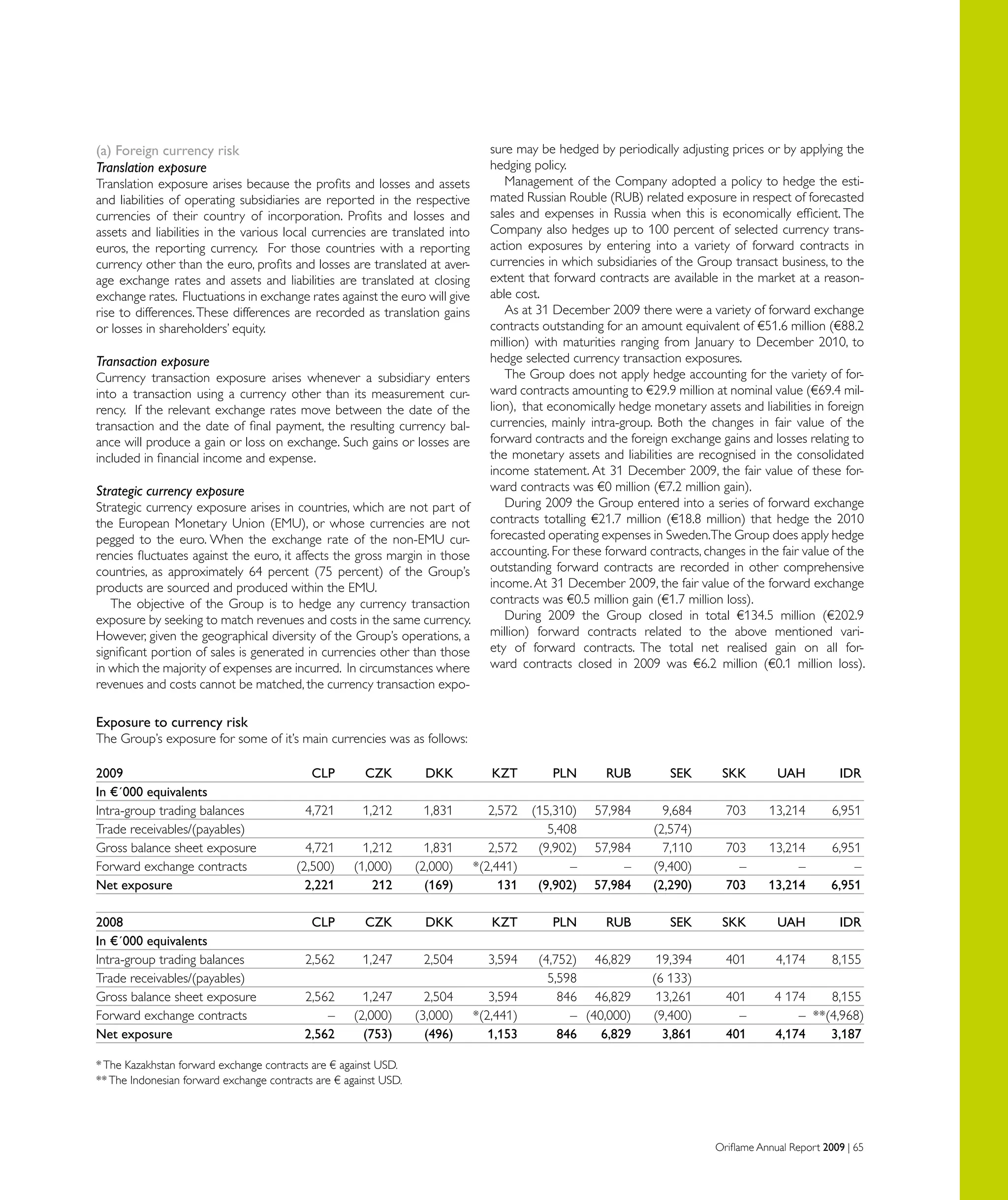

Oriflame is a global beauty company that sells cosmetics and wellness products through direct selling. In 2009, Oriflame achieved sales of €1.3 billion through a sales force of over 3.4 million consultants operating in 62 countries. Key events in 2009 included signing a €400 million credit facility. Oriflame aims for 10% annual local currency sales growth and 15% operating margins. Financial highlights for 2009 include 15% local currency sales growth, operating margins of 11.1% before restructuring costs, and net profit of €101.7 million before restructuring costs.