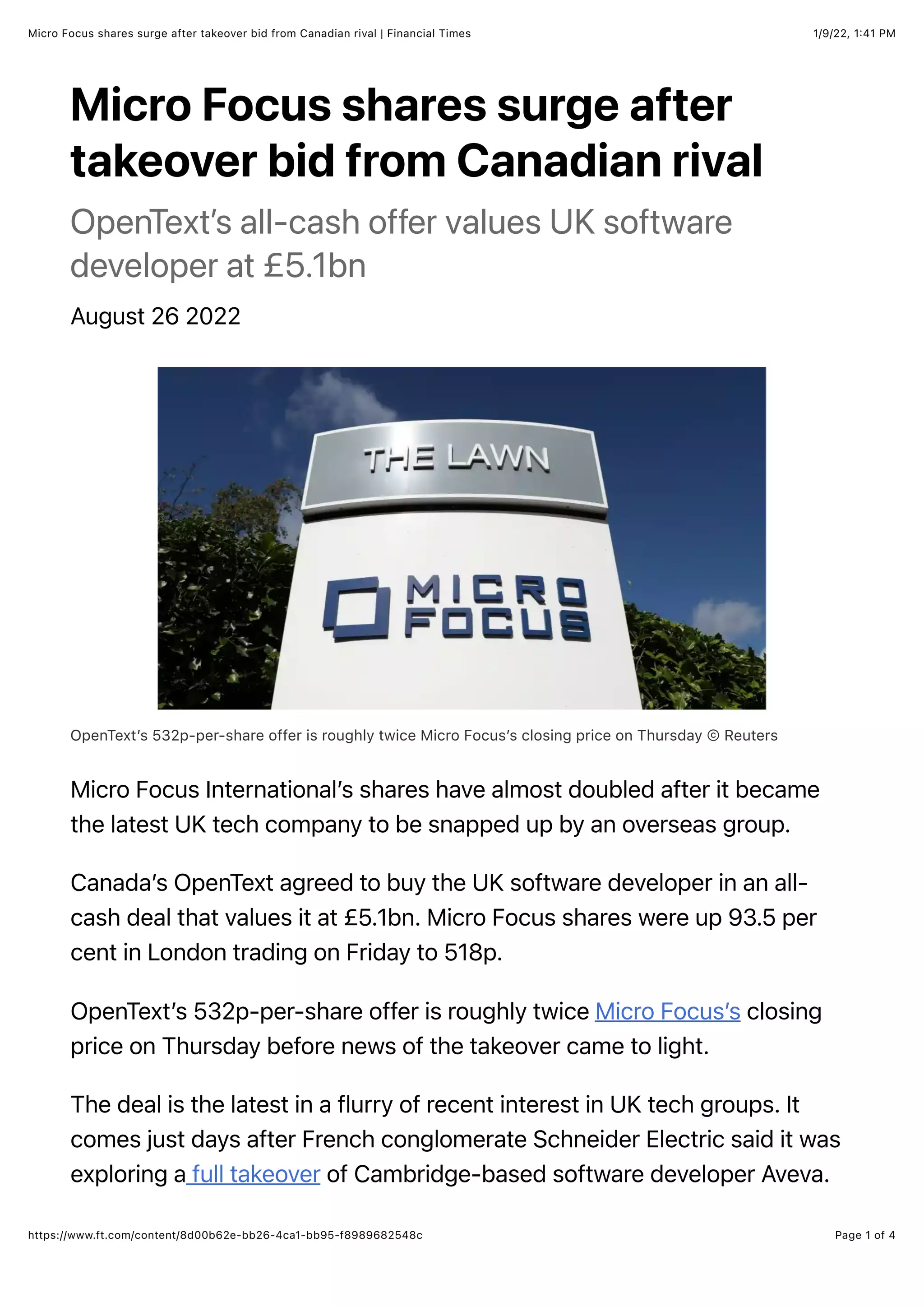

Micro Focus International's shares surged nearly 93.5% following OpenText's all-cash takeover bid valuing the UK software developer at £5.1 billion. OpenText's 532p-per-share offer is essentially double Micro Focus's price prior to the announcement, highlighting recent trends of overseas interest in UK tech firms. The acquisition is expected to generate $400 million in cost savings and enhance growth opportunities for OpenText, amid a broader consolidation trend in the IT sector.