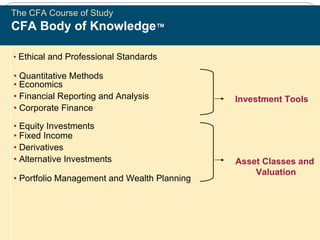

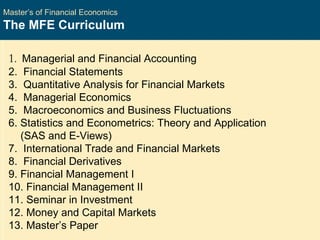

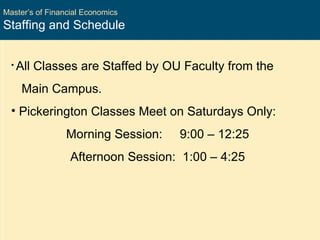

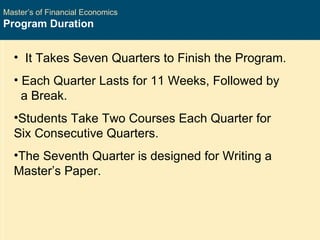

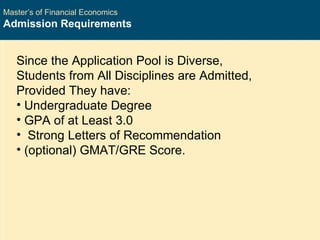

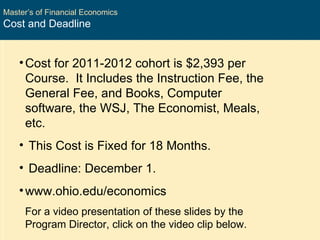

The document summarizes a Master of Financial Economics program at Ohio University that is based on the CFA curriculum. The MFE program aims to train students for careers in the financial sector by teaching CFA topics at the graduate level. The curriculum covers areas like economics, financial reporting, portfolio management, and investment tools. Students take two courses per quarter over six quarters while attending classes only on Saturdays. The program cost is fixed for 18 months and admission requires an undergraduate degree and GPA of at least 3.0.