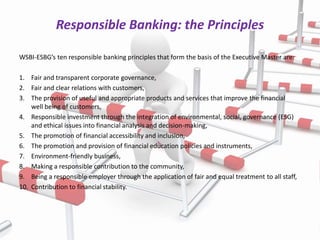

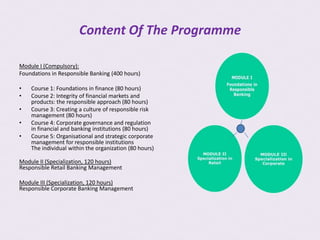

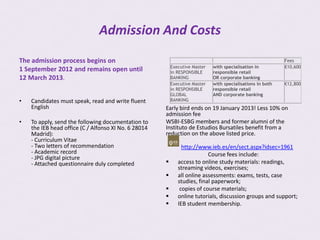

This document provides information about an online Executive Master's program in Responsible Banking offered through a partnership between the World Savings Banks Institute and European Savings Banks Group (WSBI-ESBG), the Instituto de Estudios Bursatiles (IEB), and the London School of Economics Executive Education. The one-year program aims to empower bankers to make positive change by promoting responsible banking principles. It includes modules on retail and corporate banking from a responsible management perspective, and provides certification in responsible banking upon completion. The program fees are €10,600-€12,800 depending on specializations chosen.