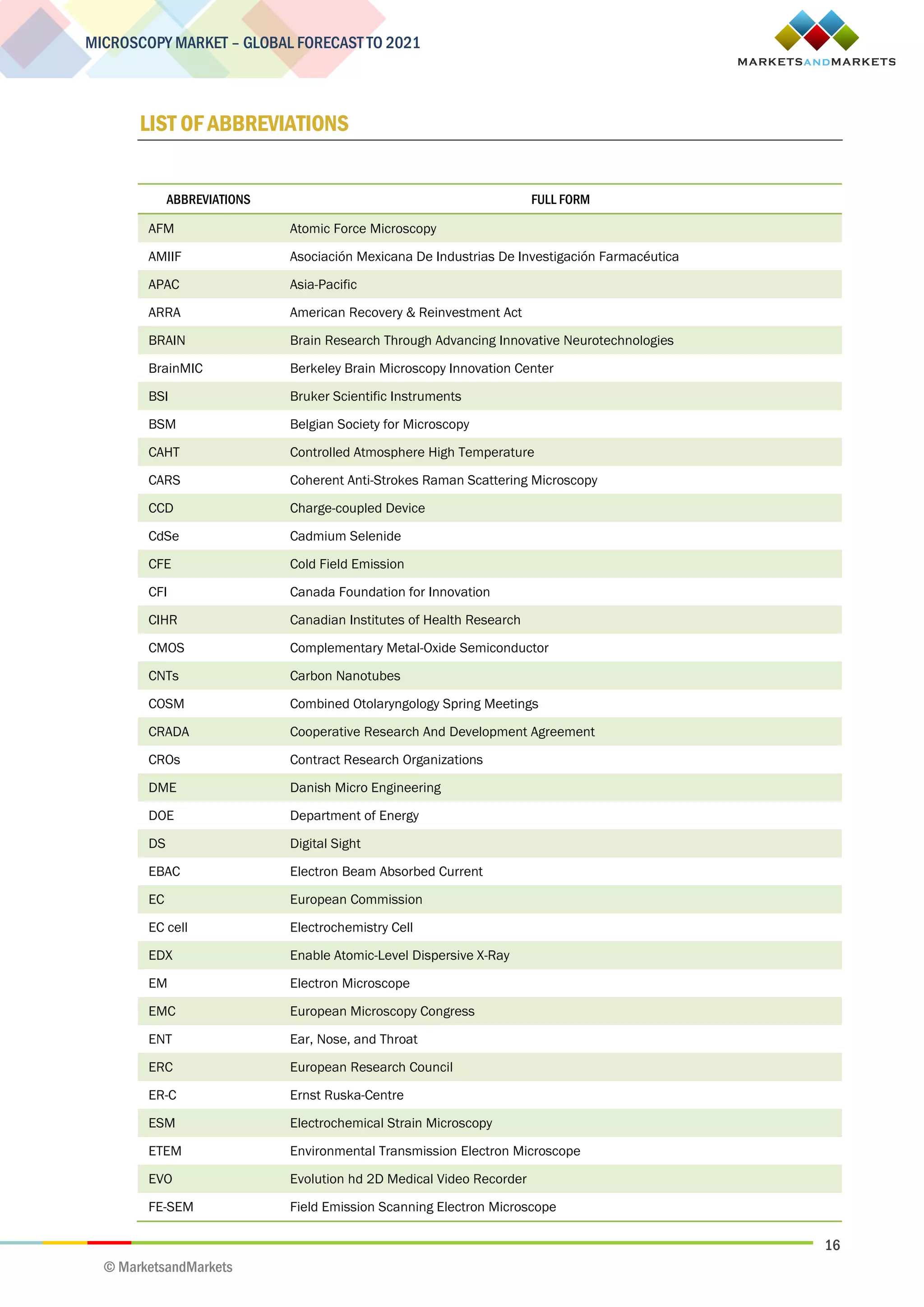

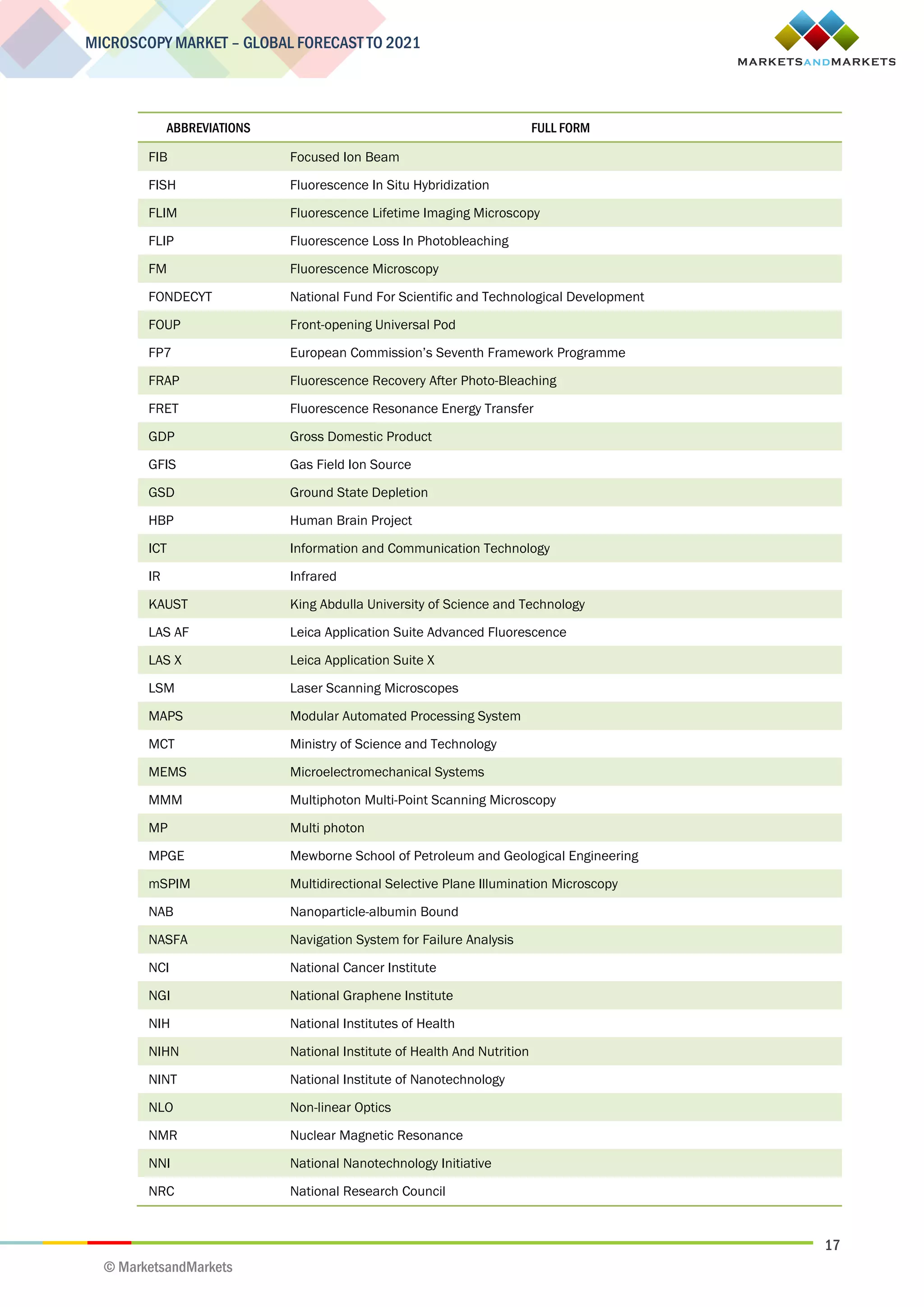

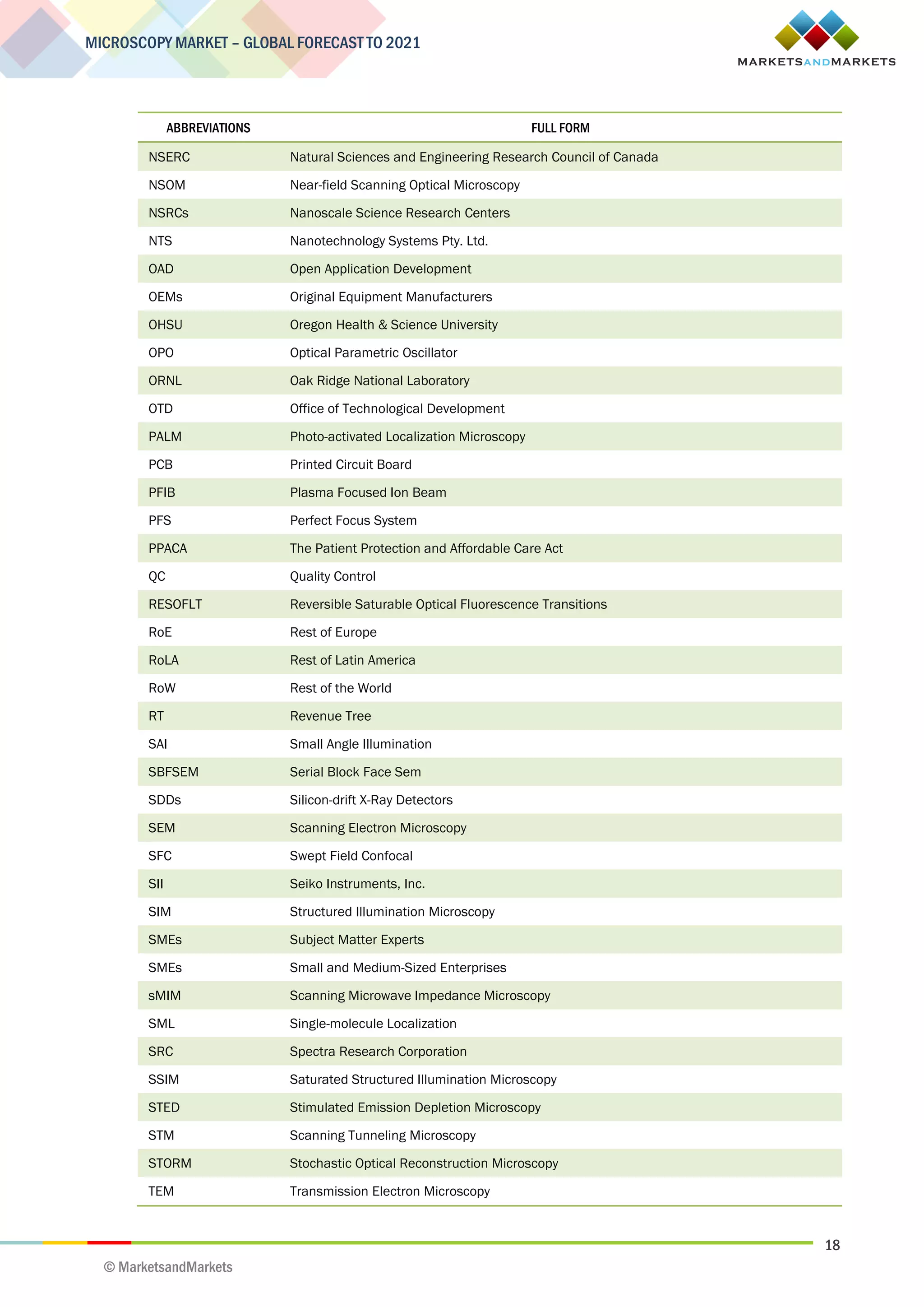

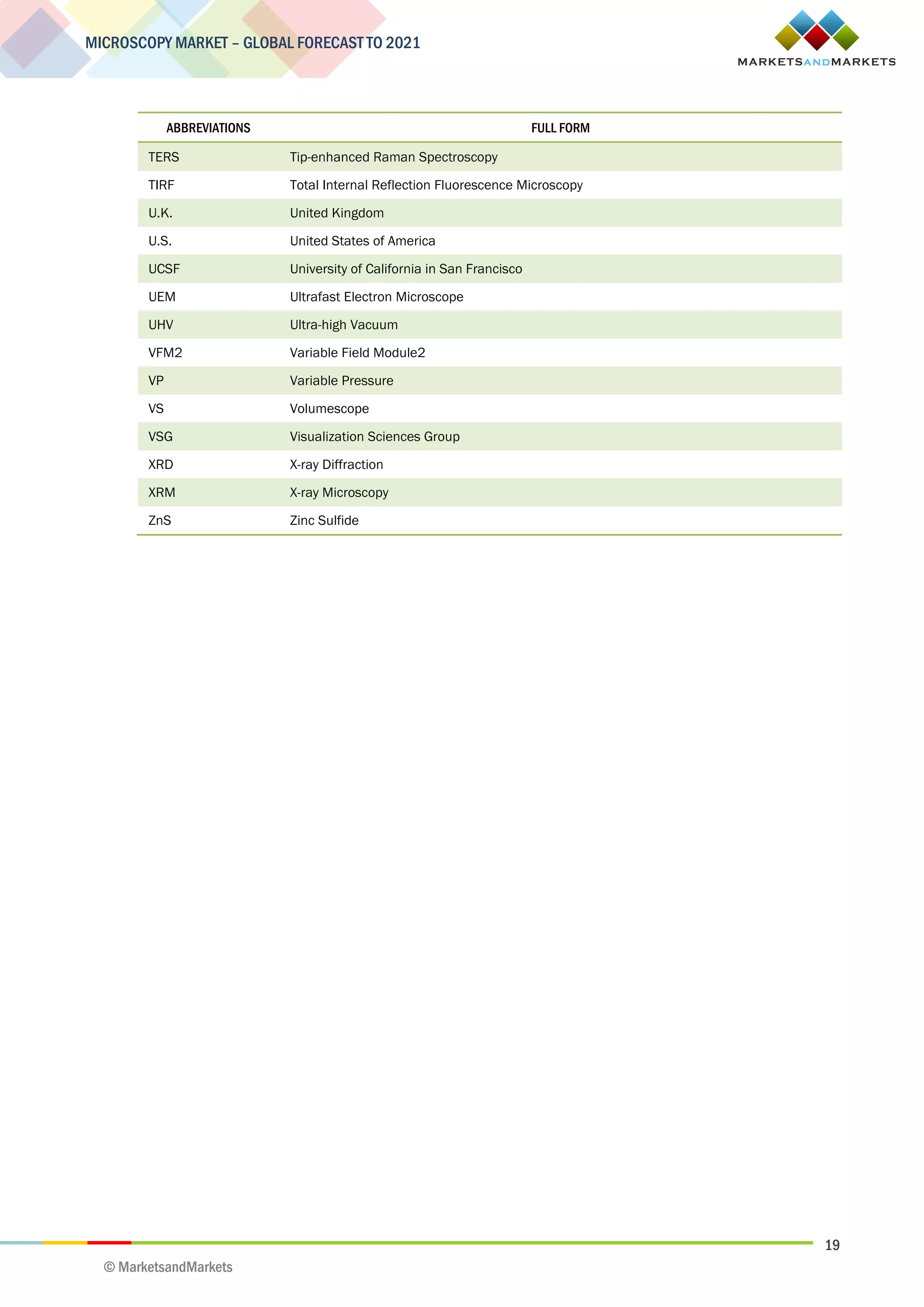

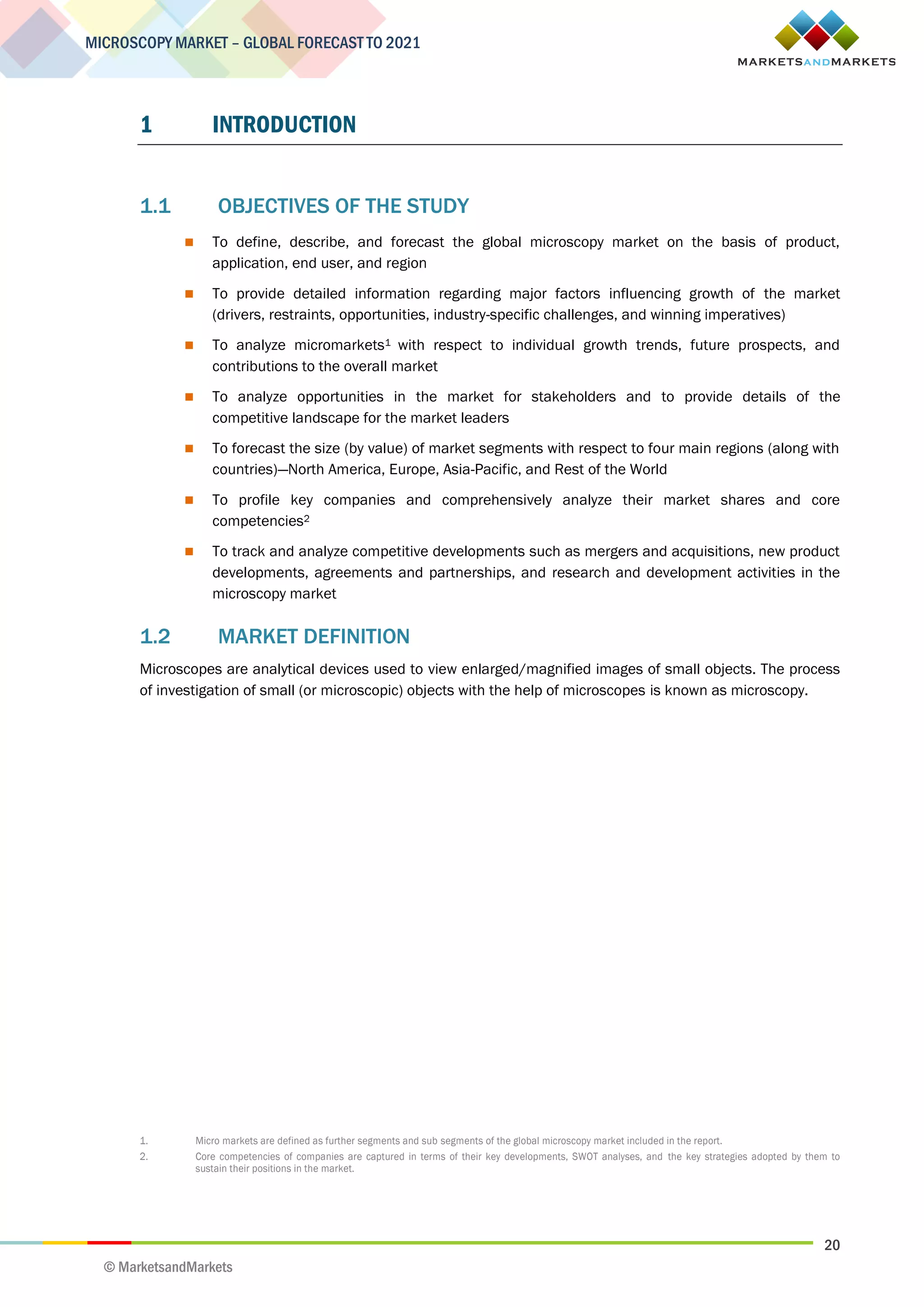

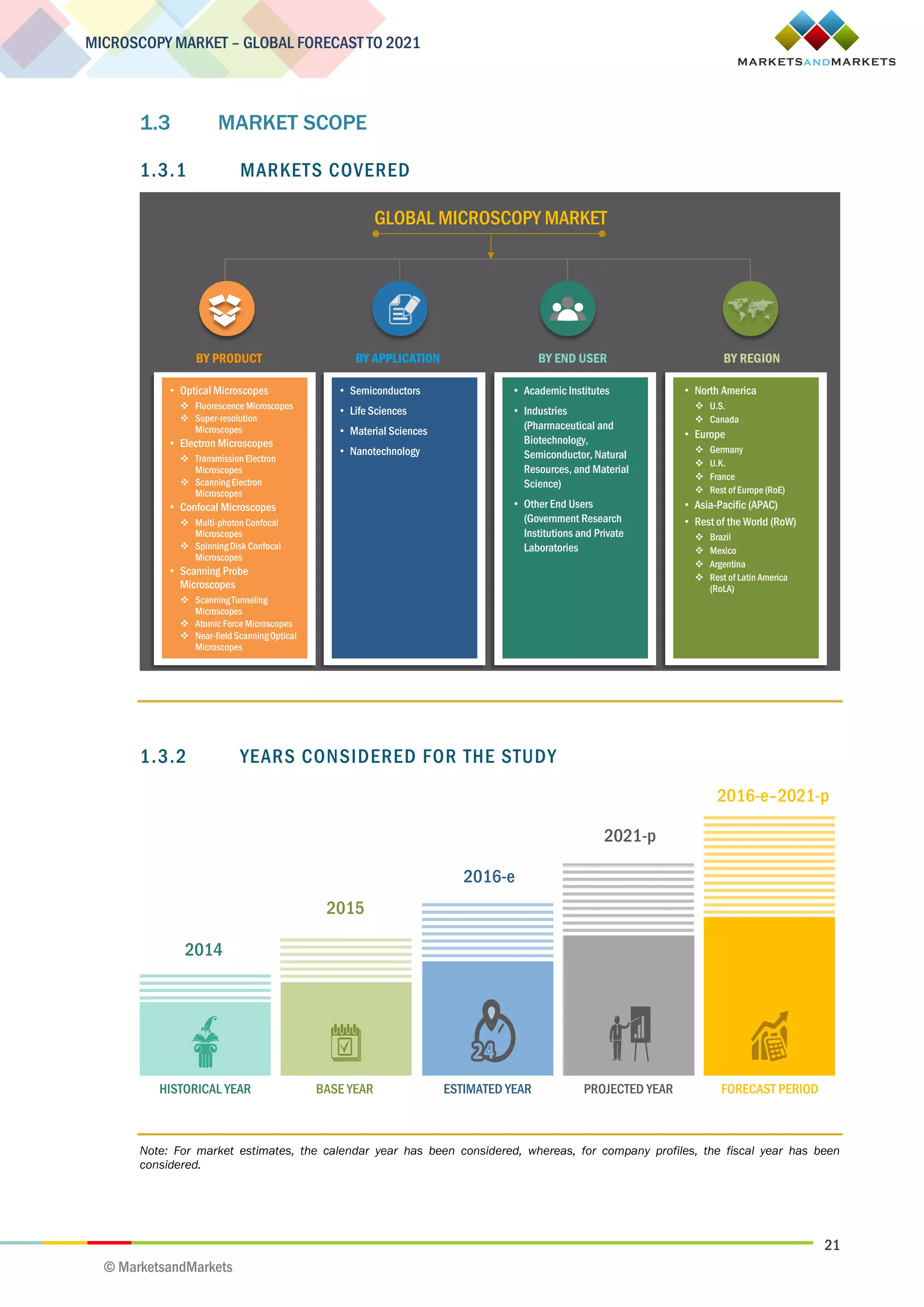

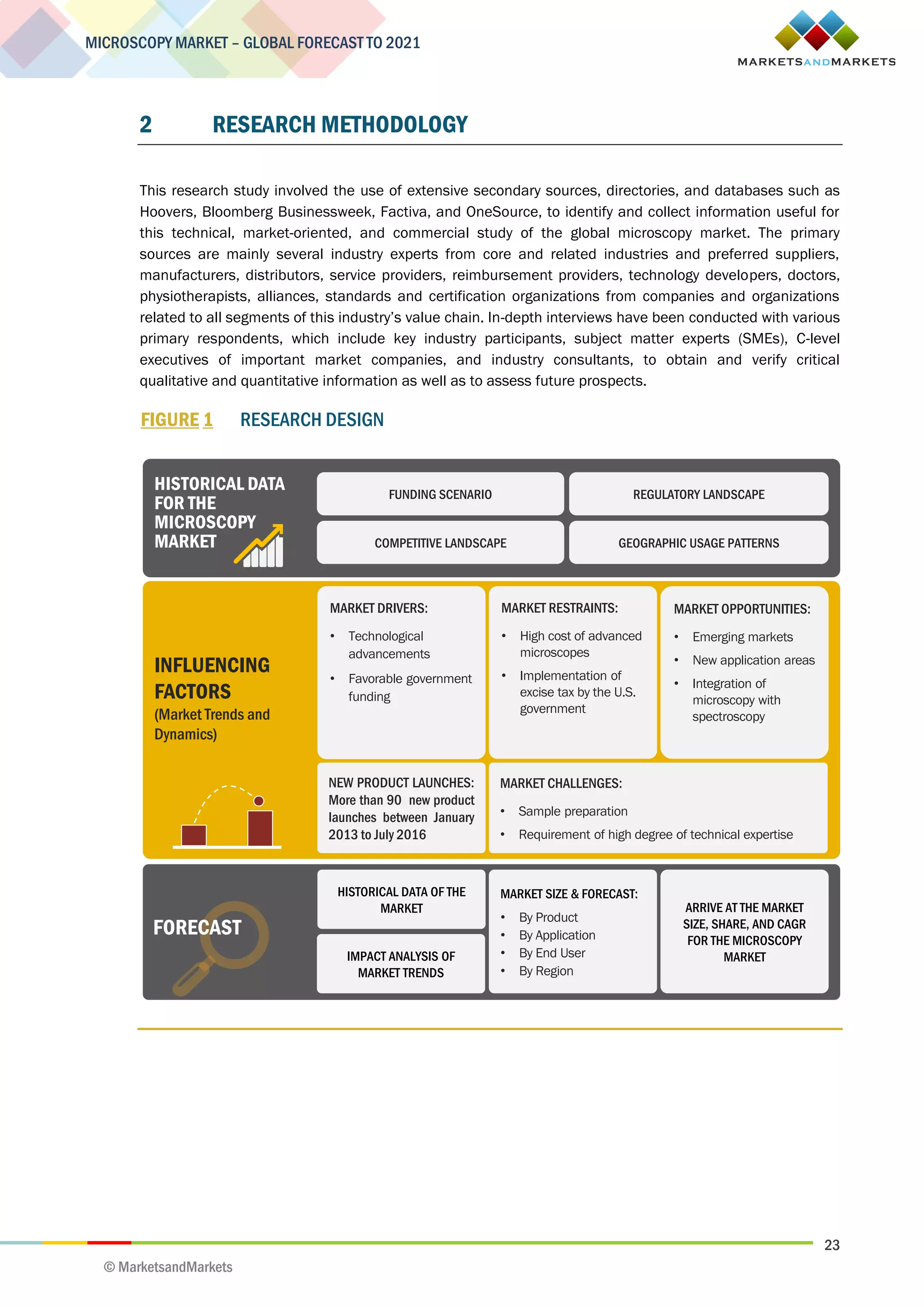

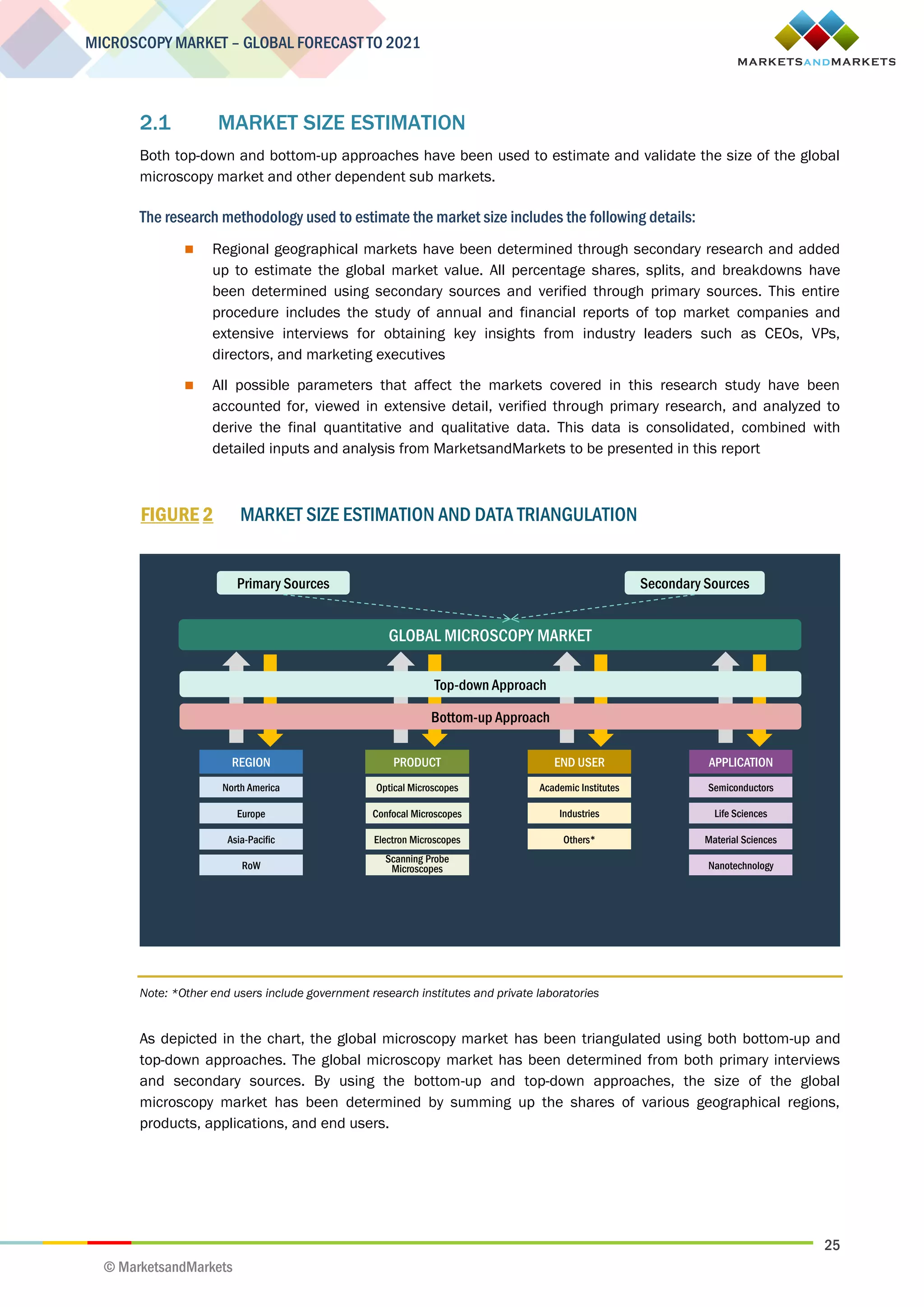

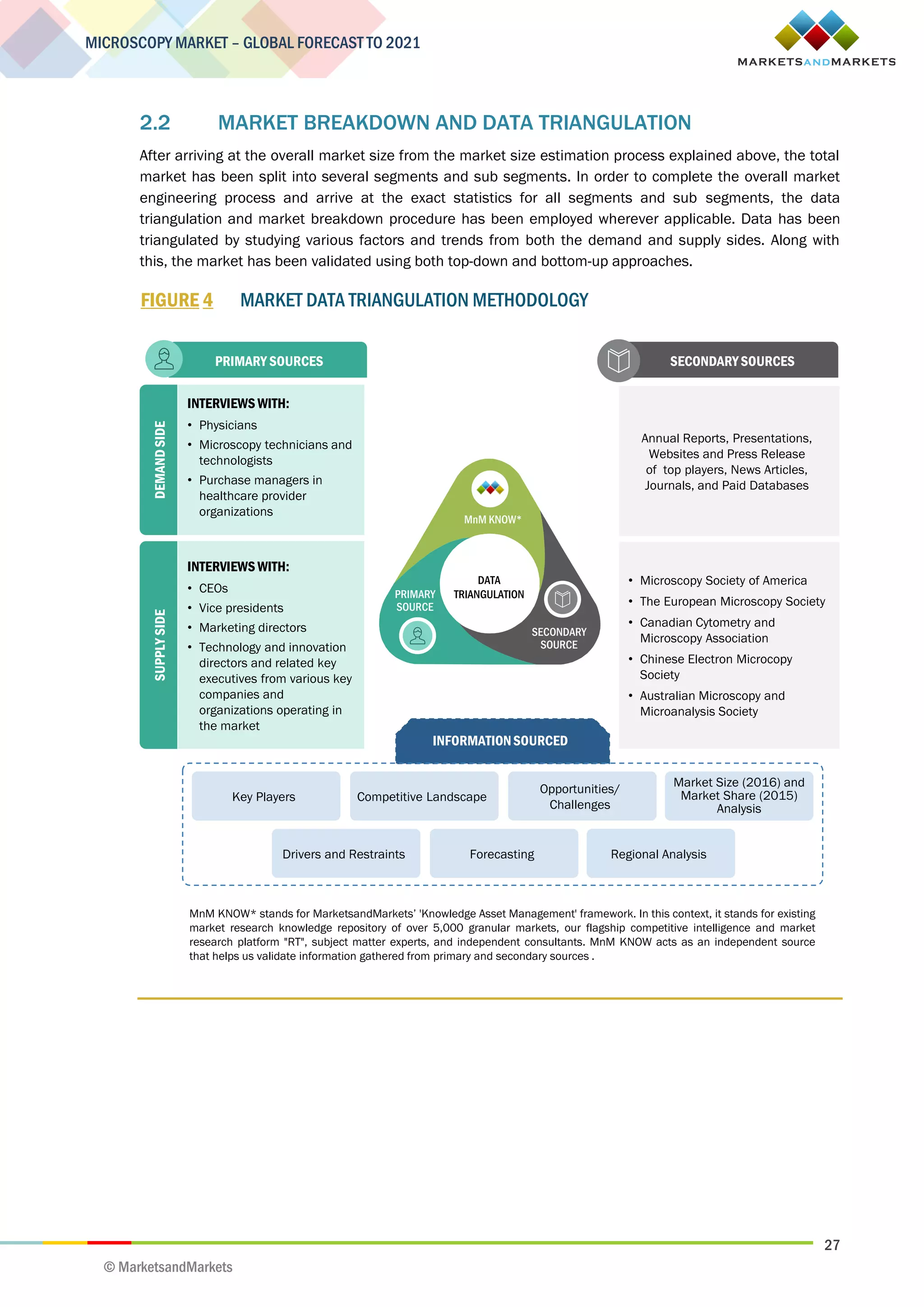

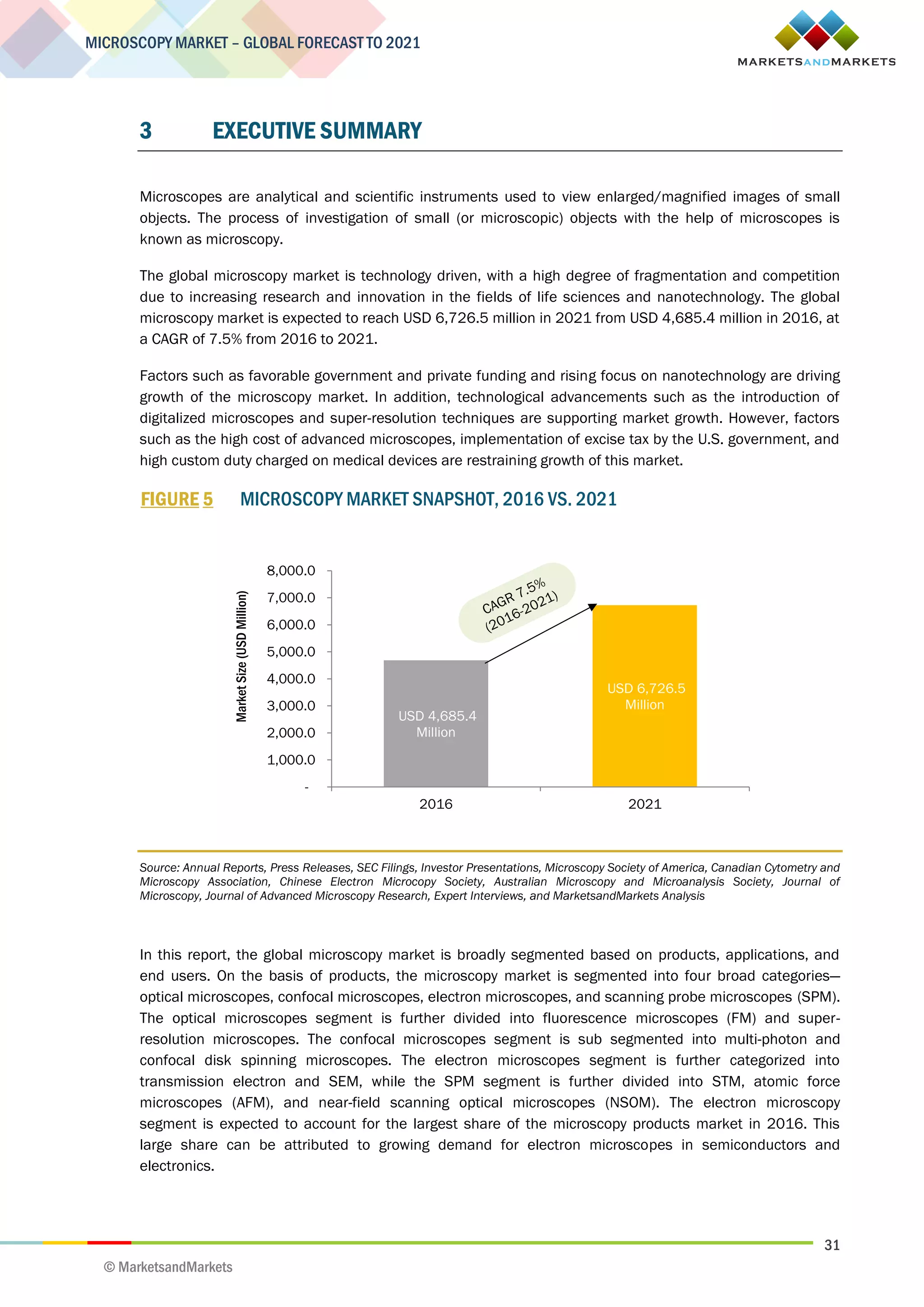

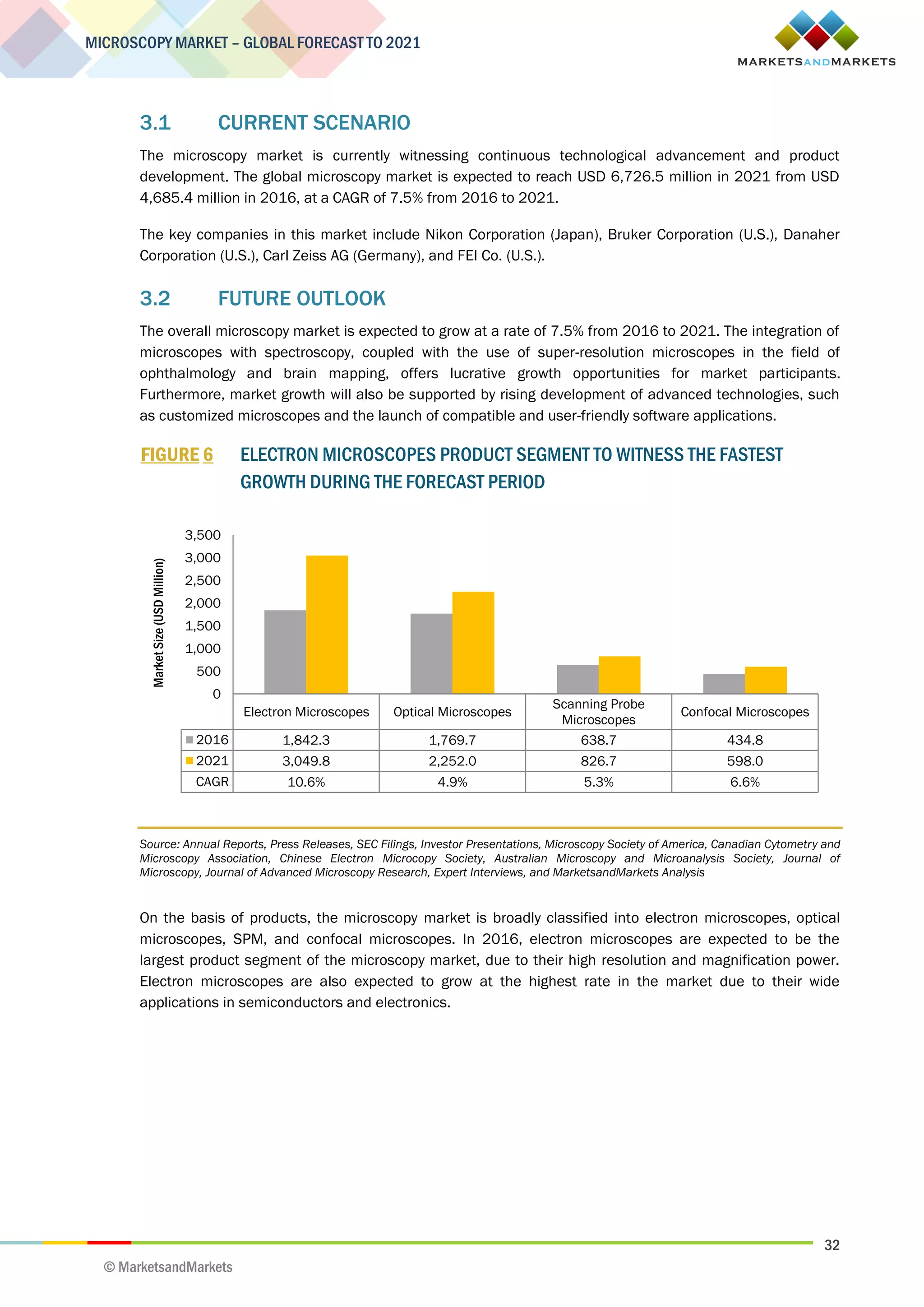

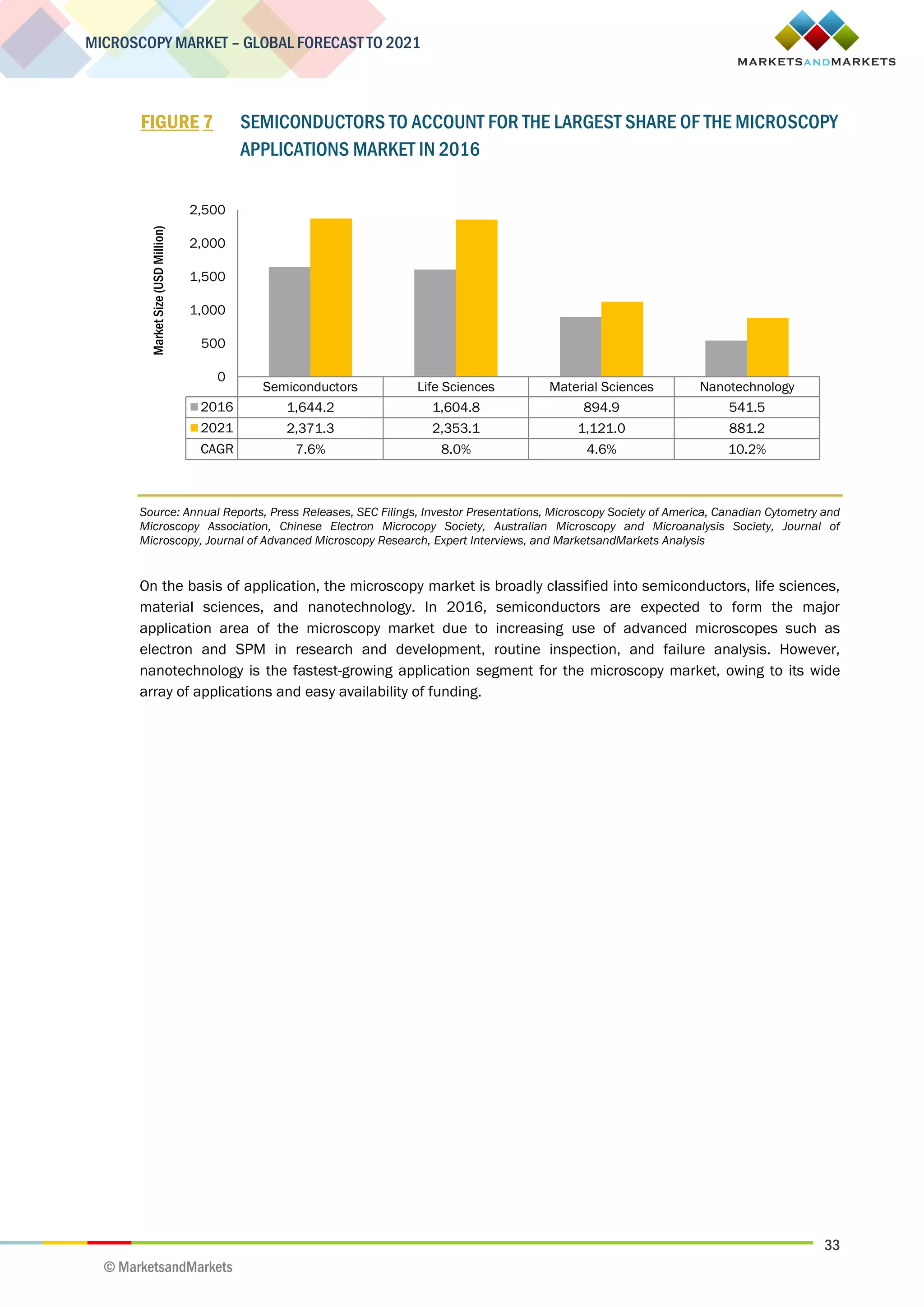

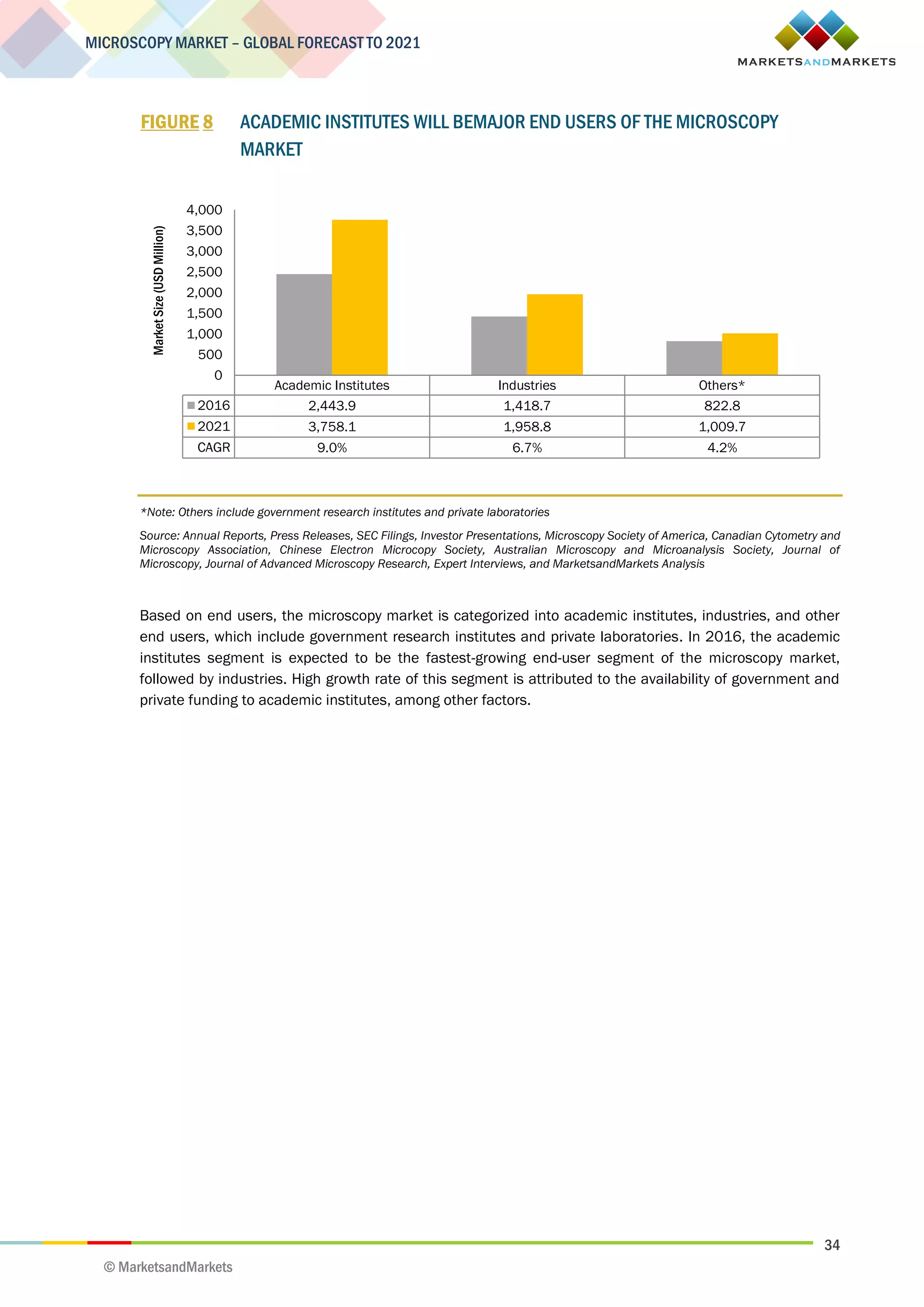

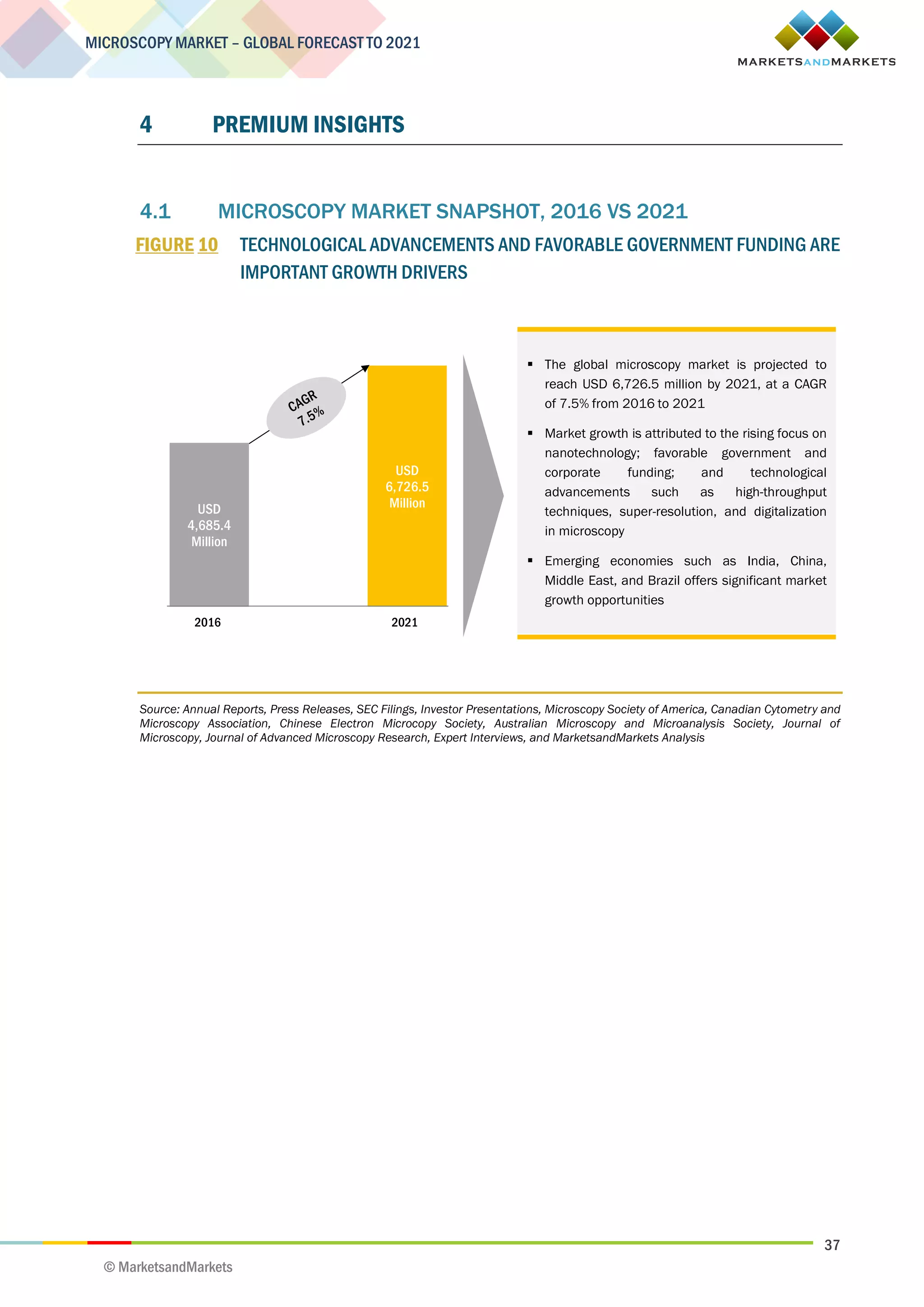

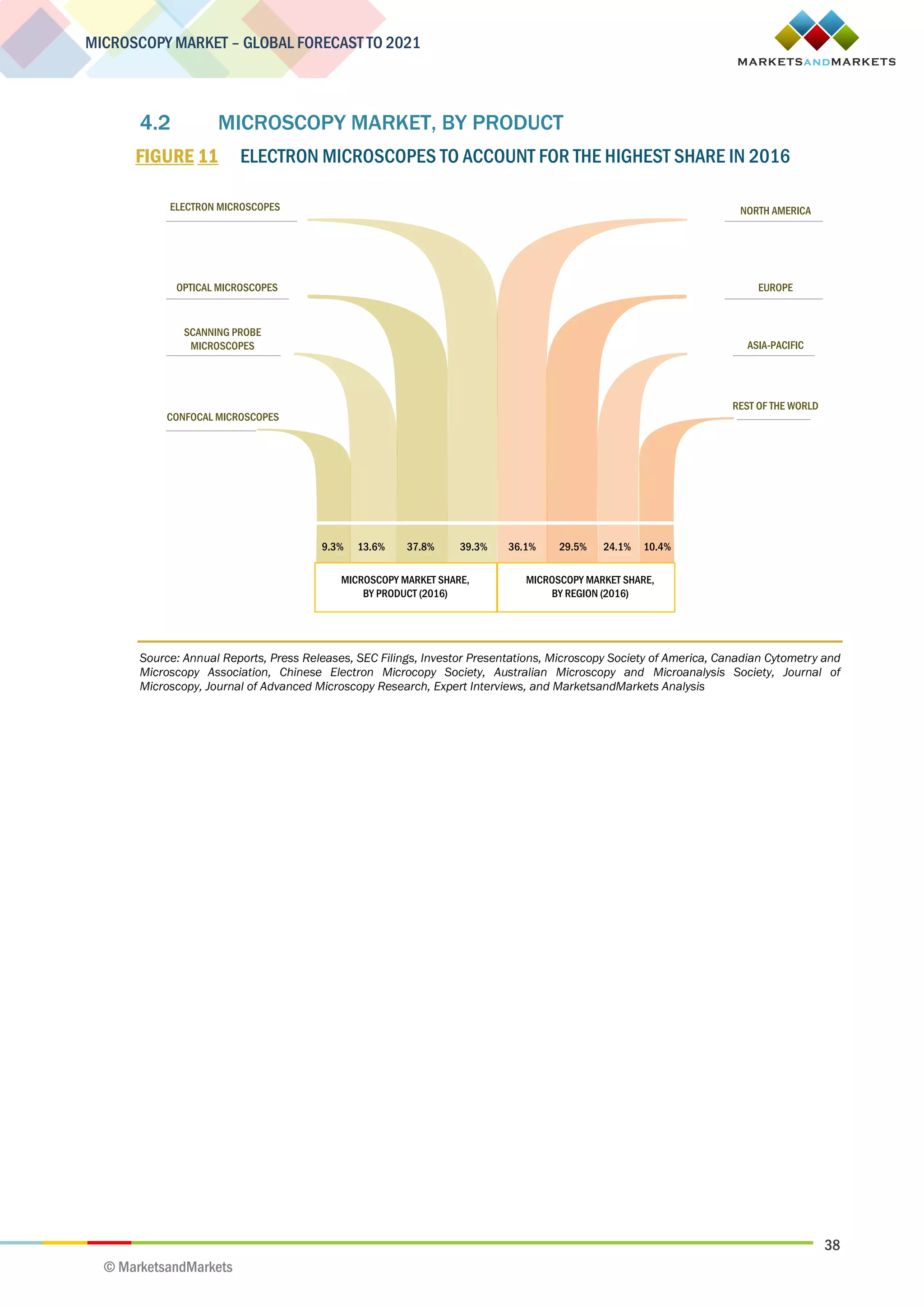

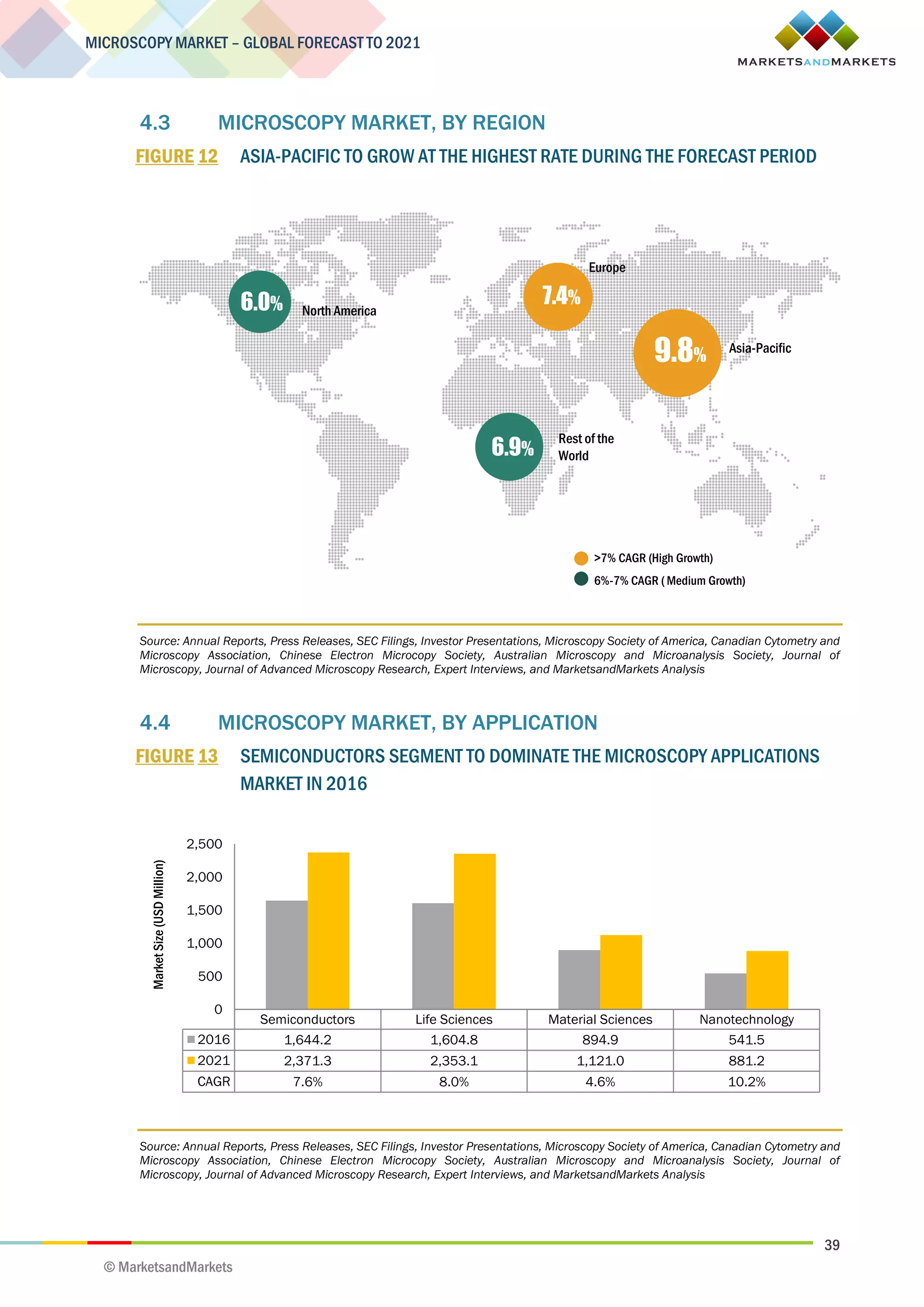

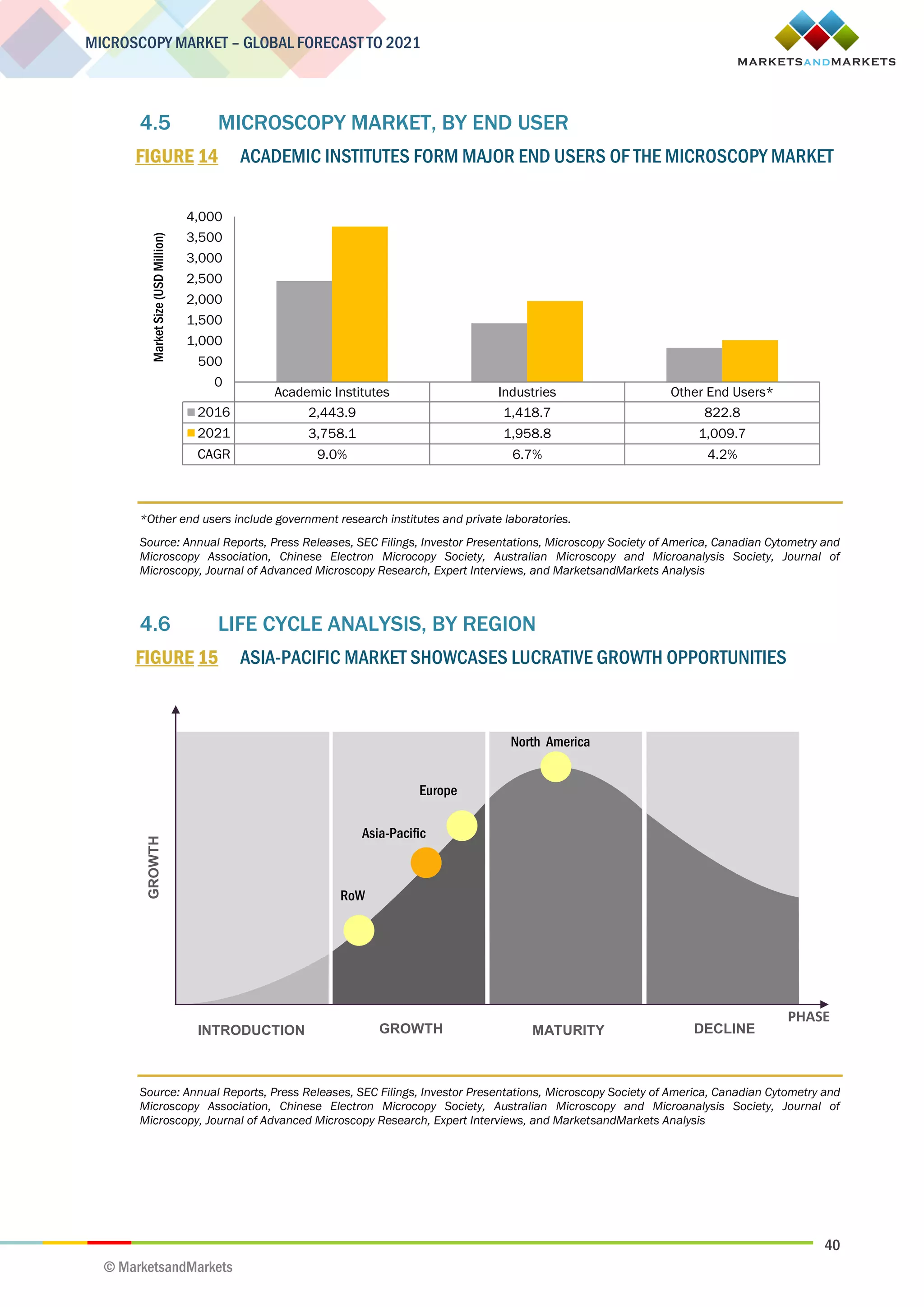

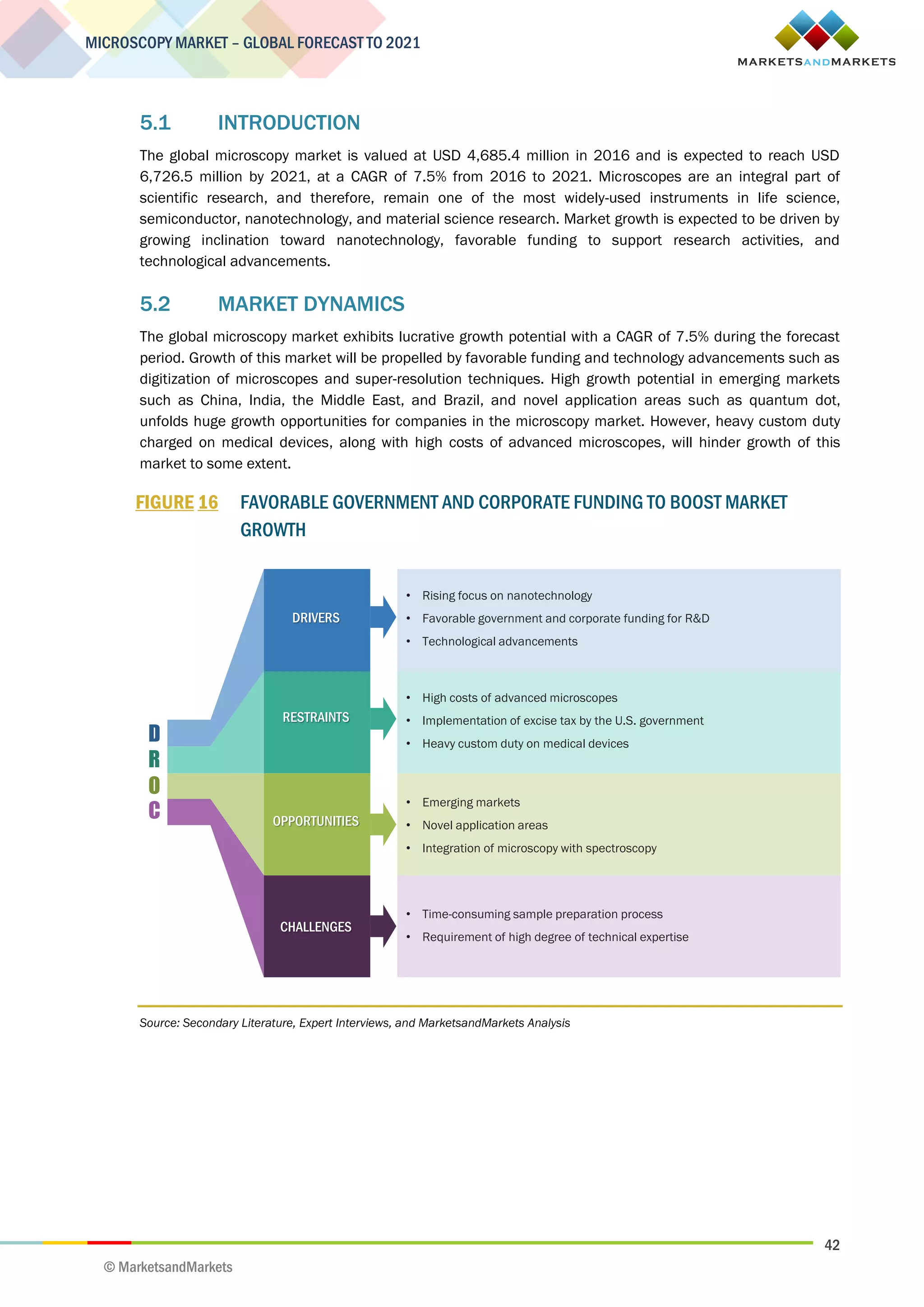

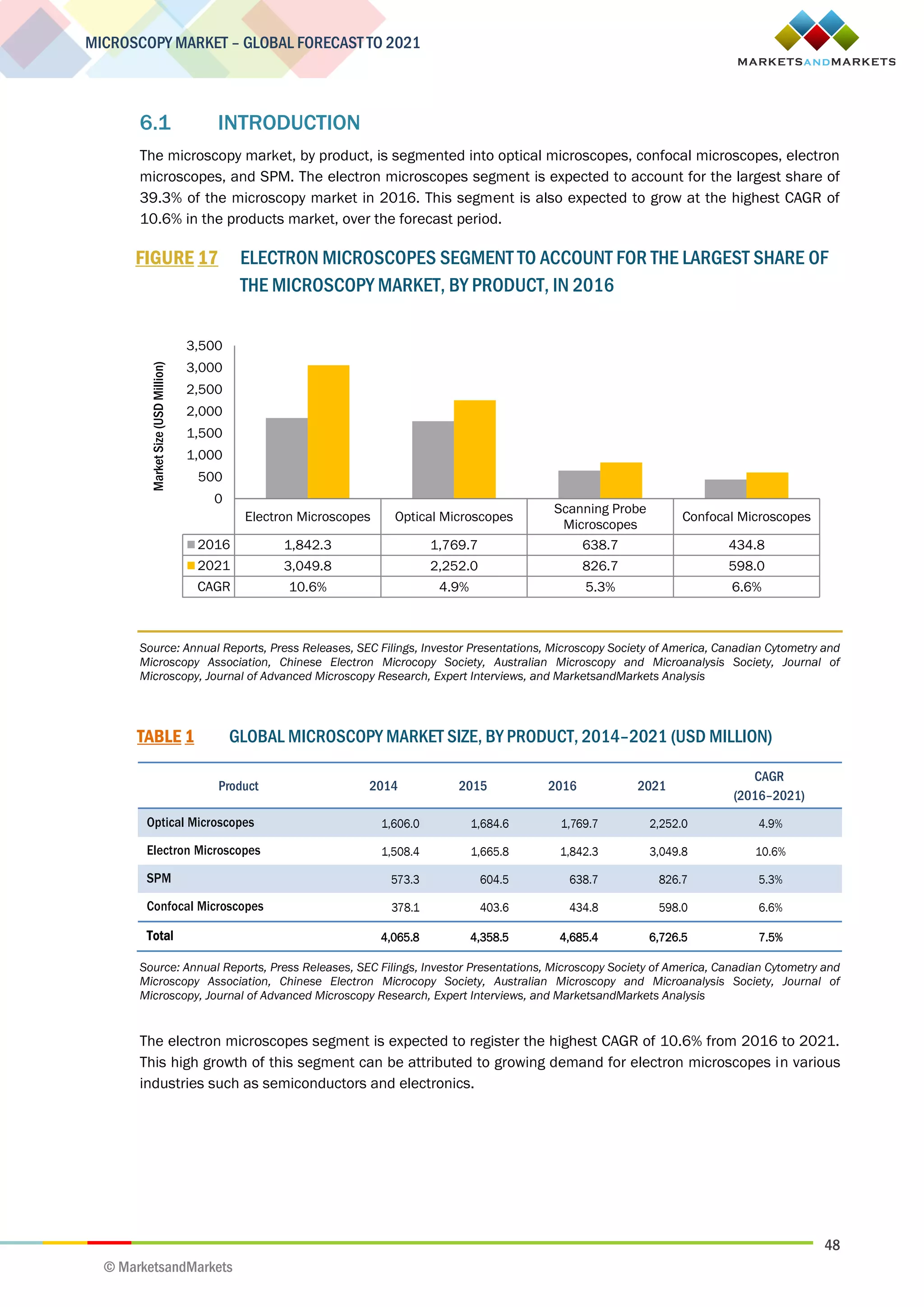

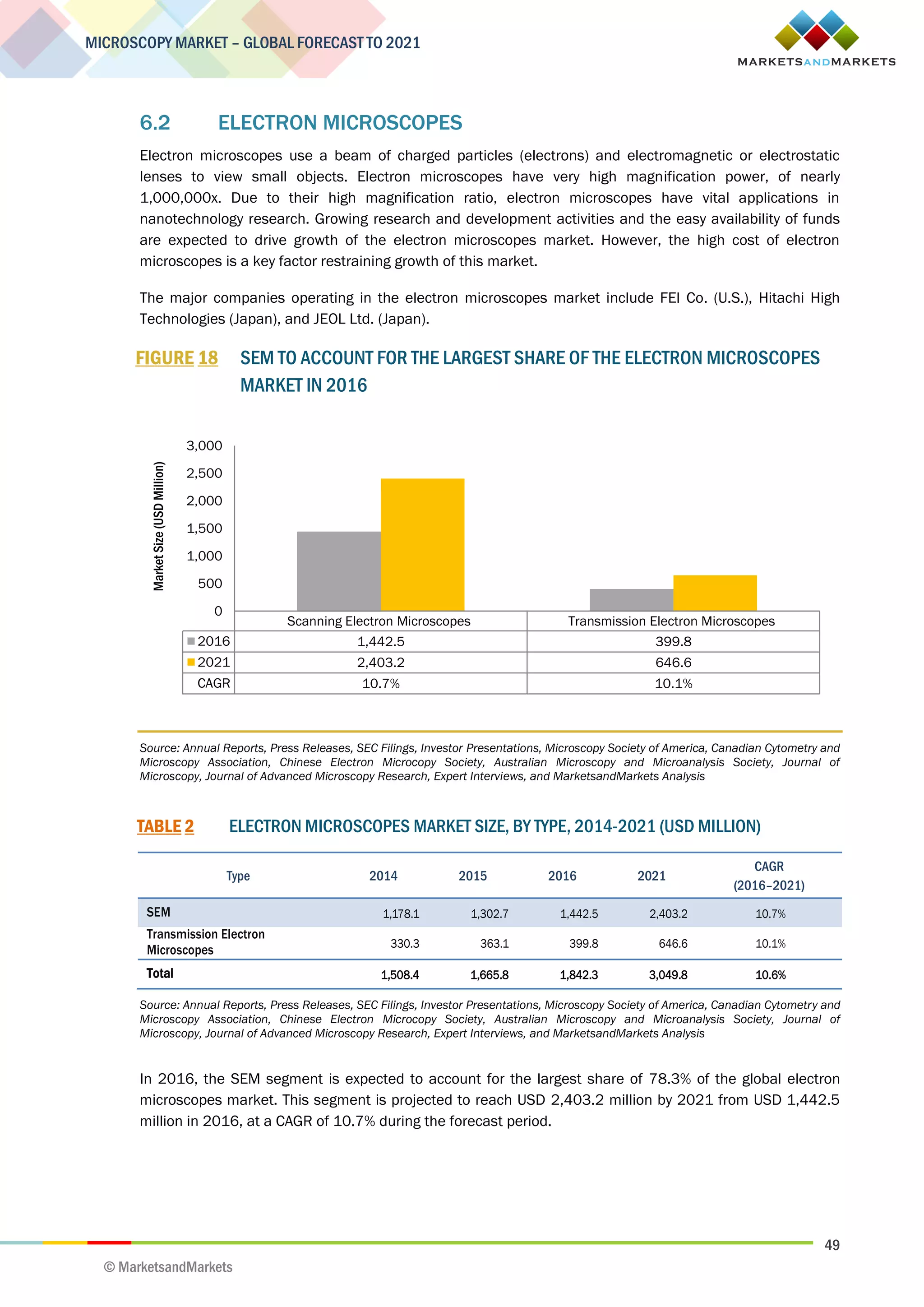

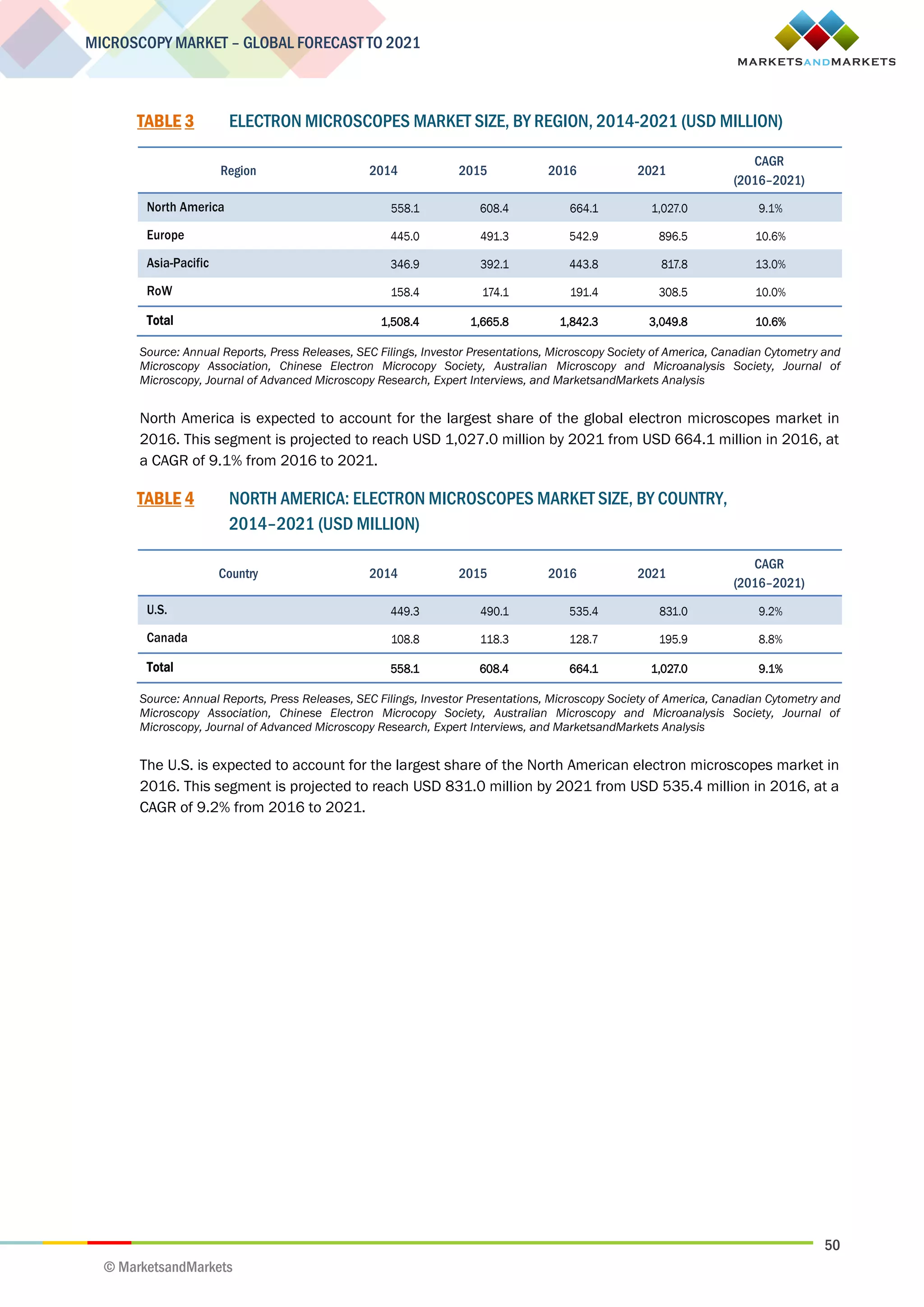

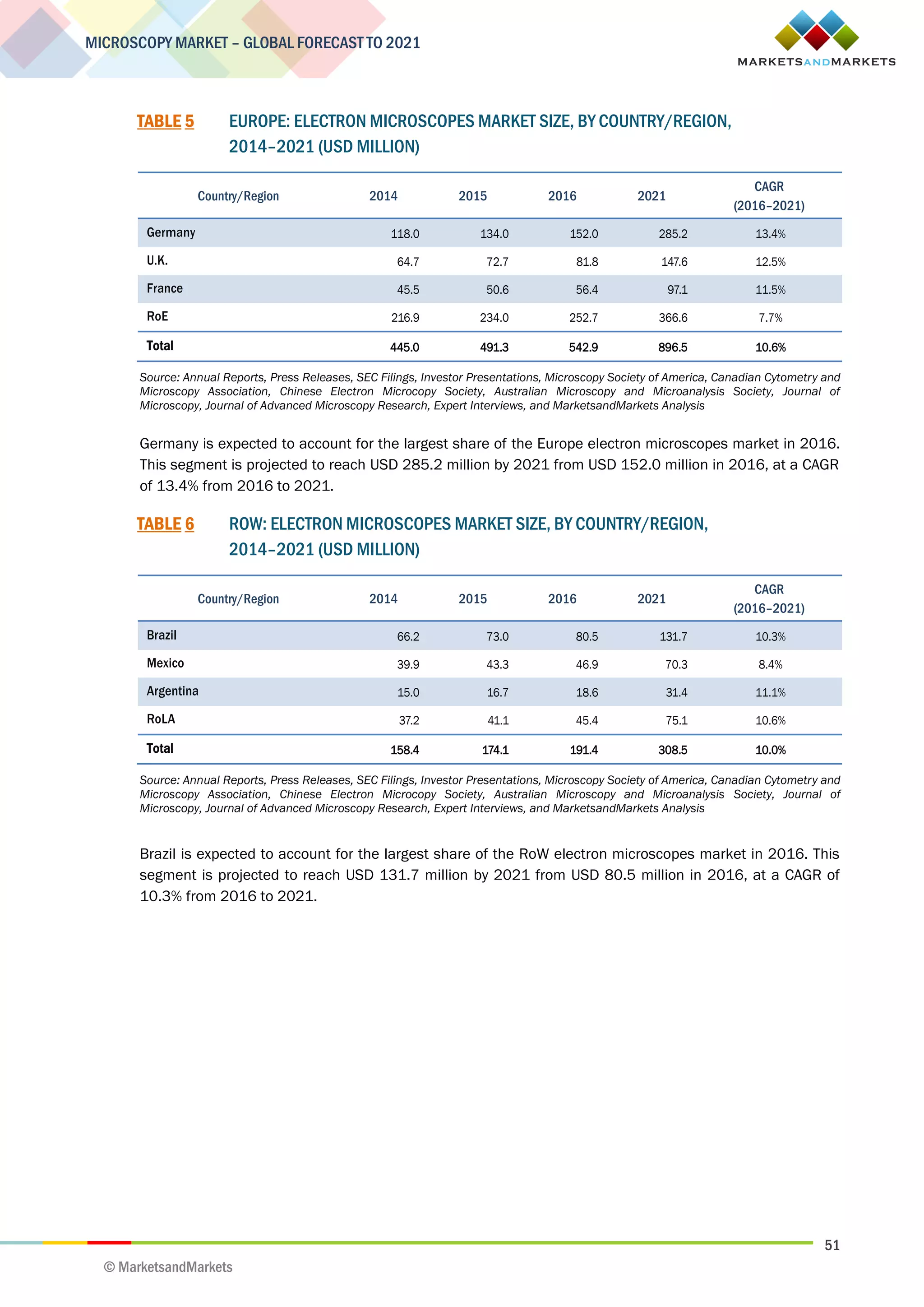

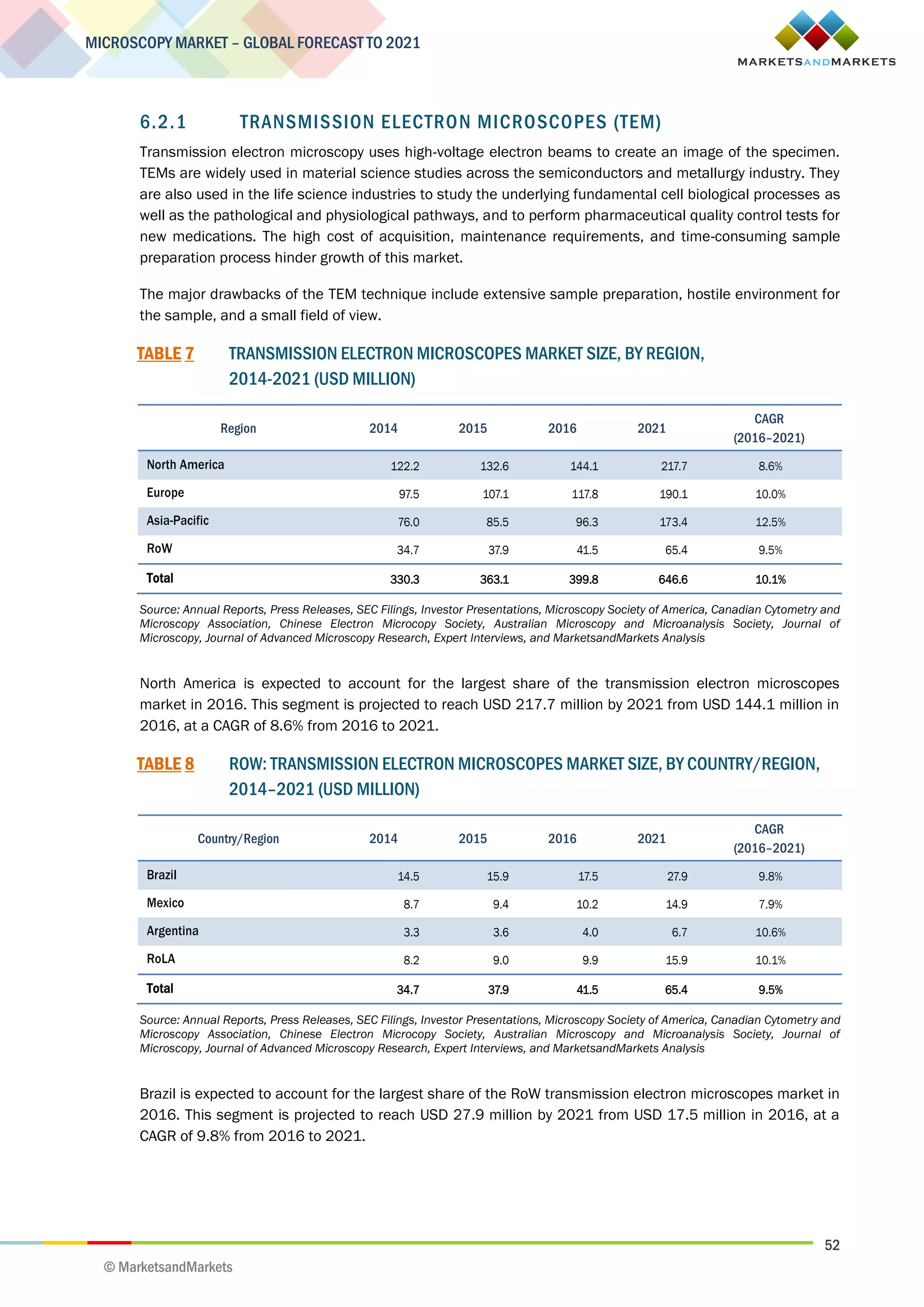

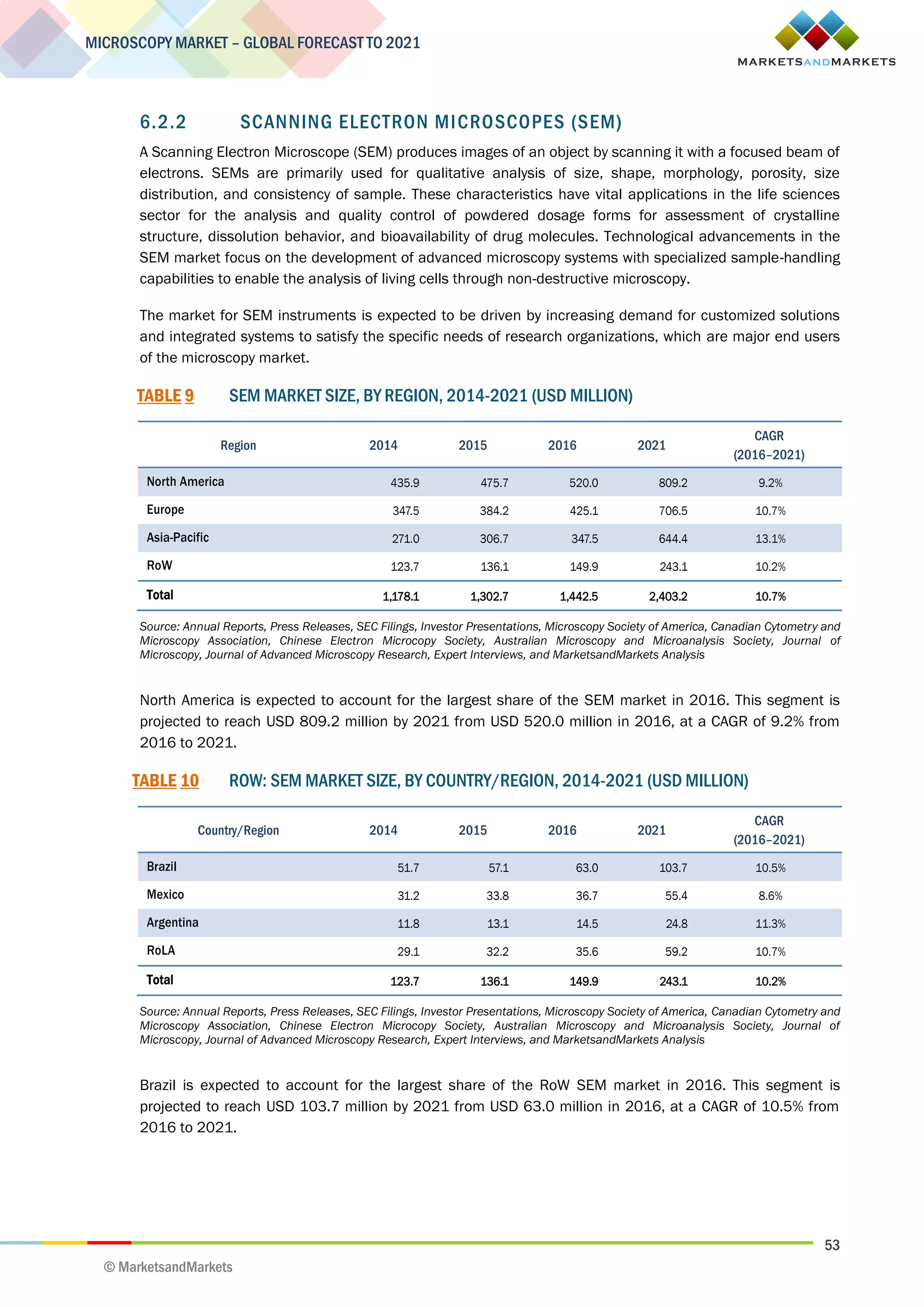

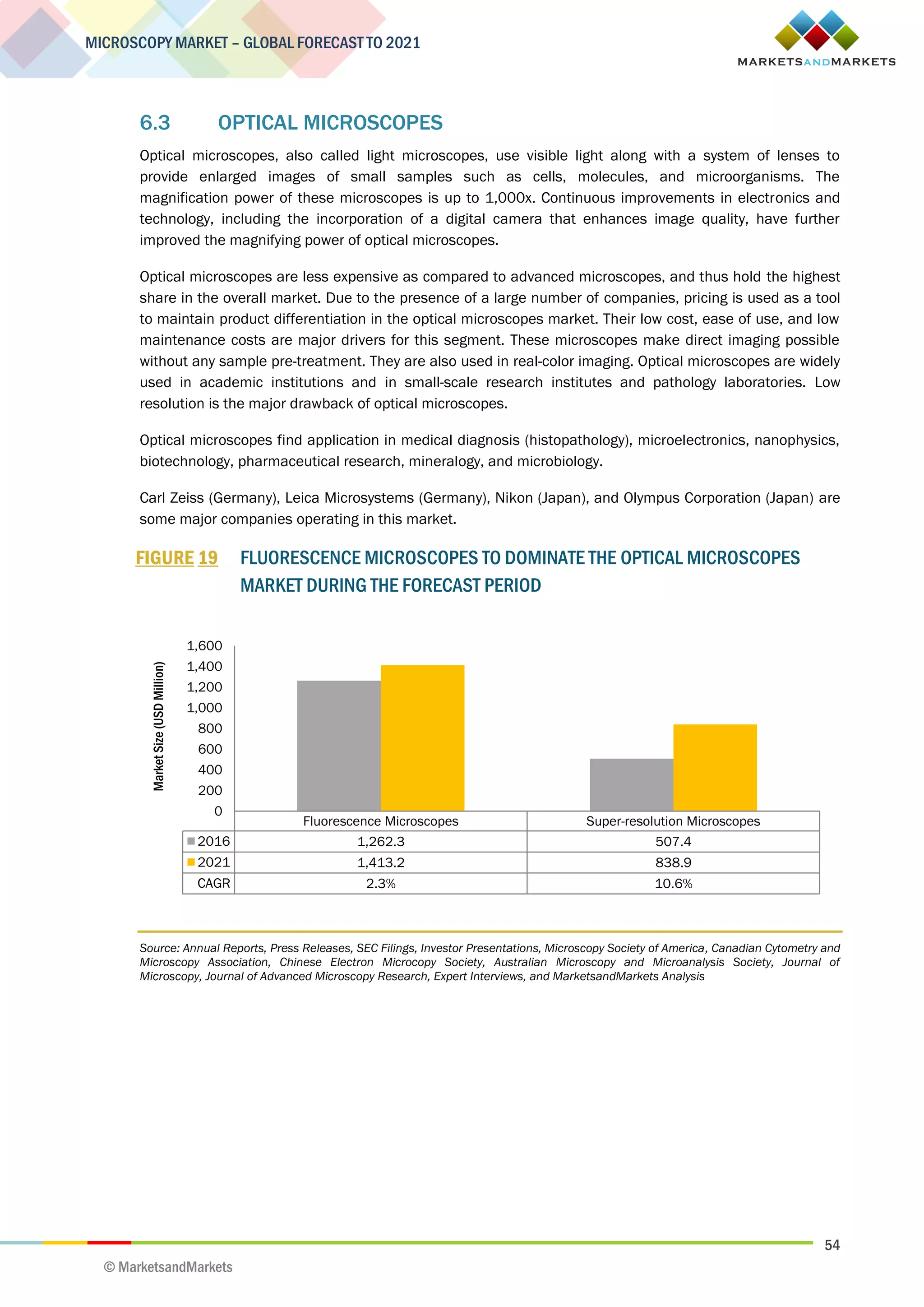

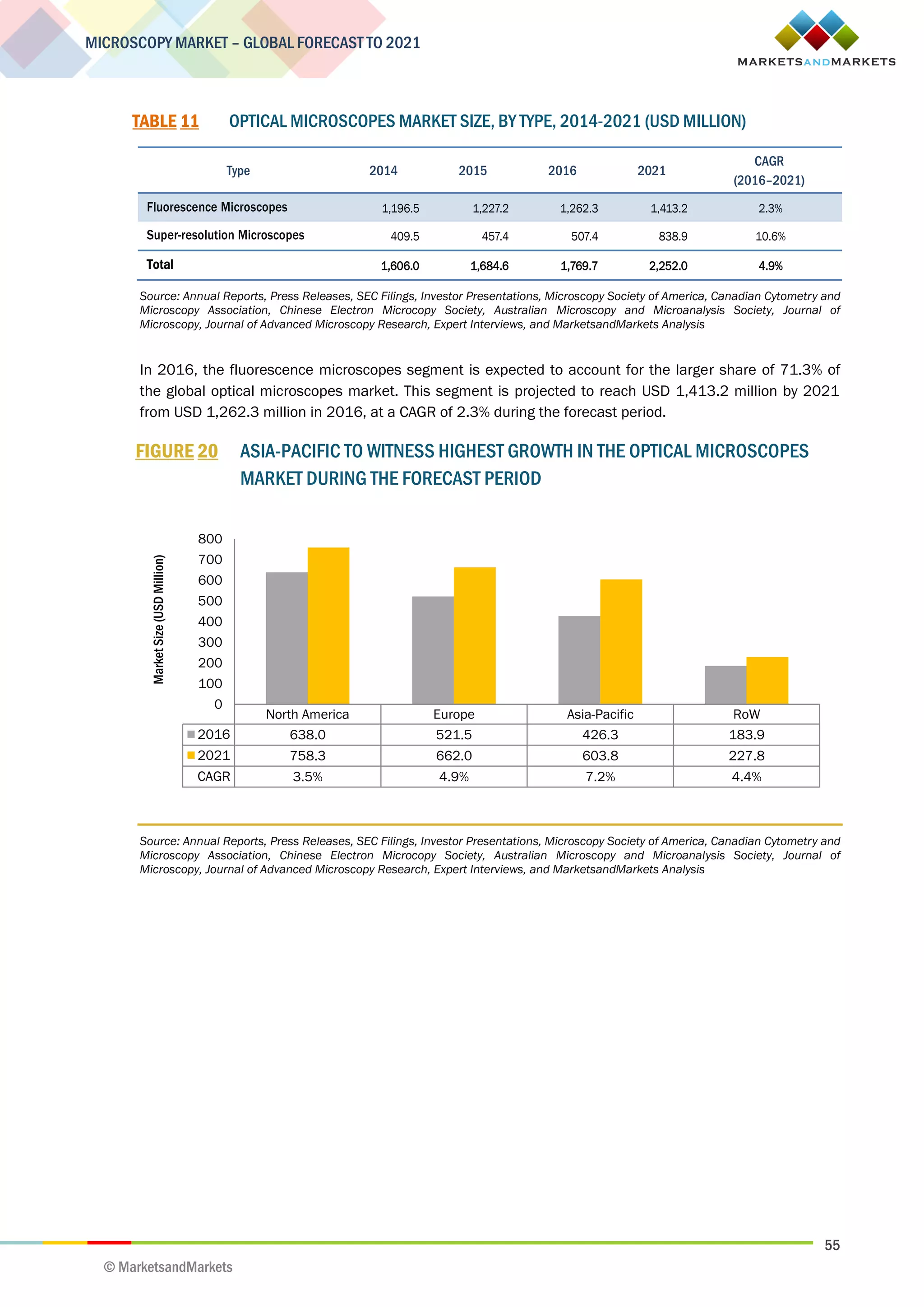

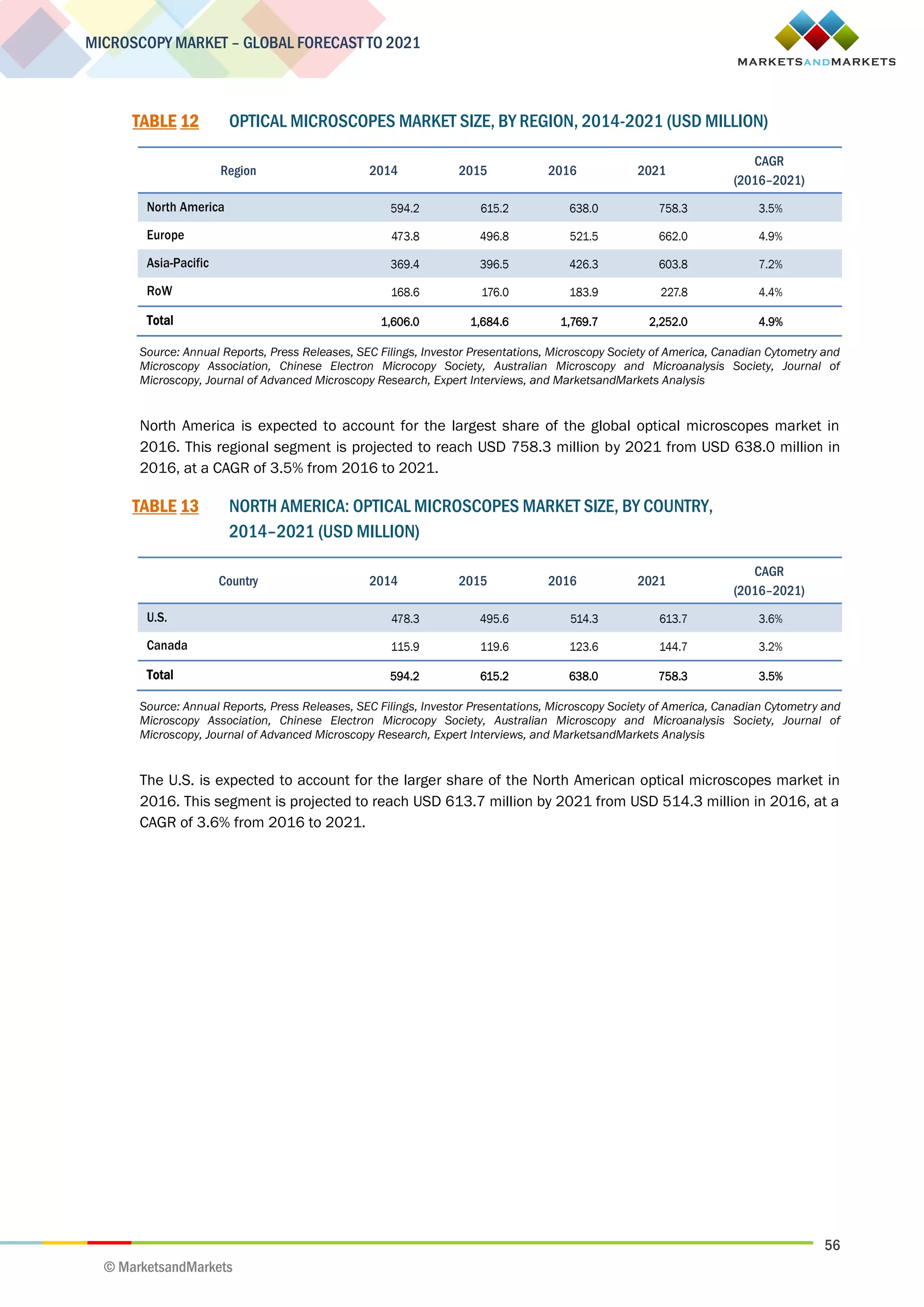

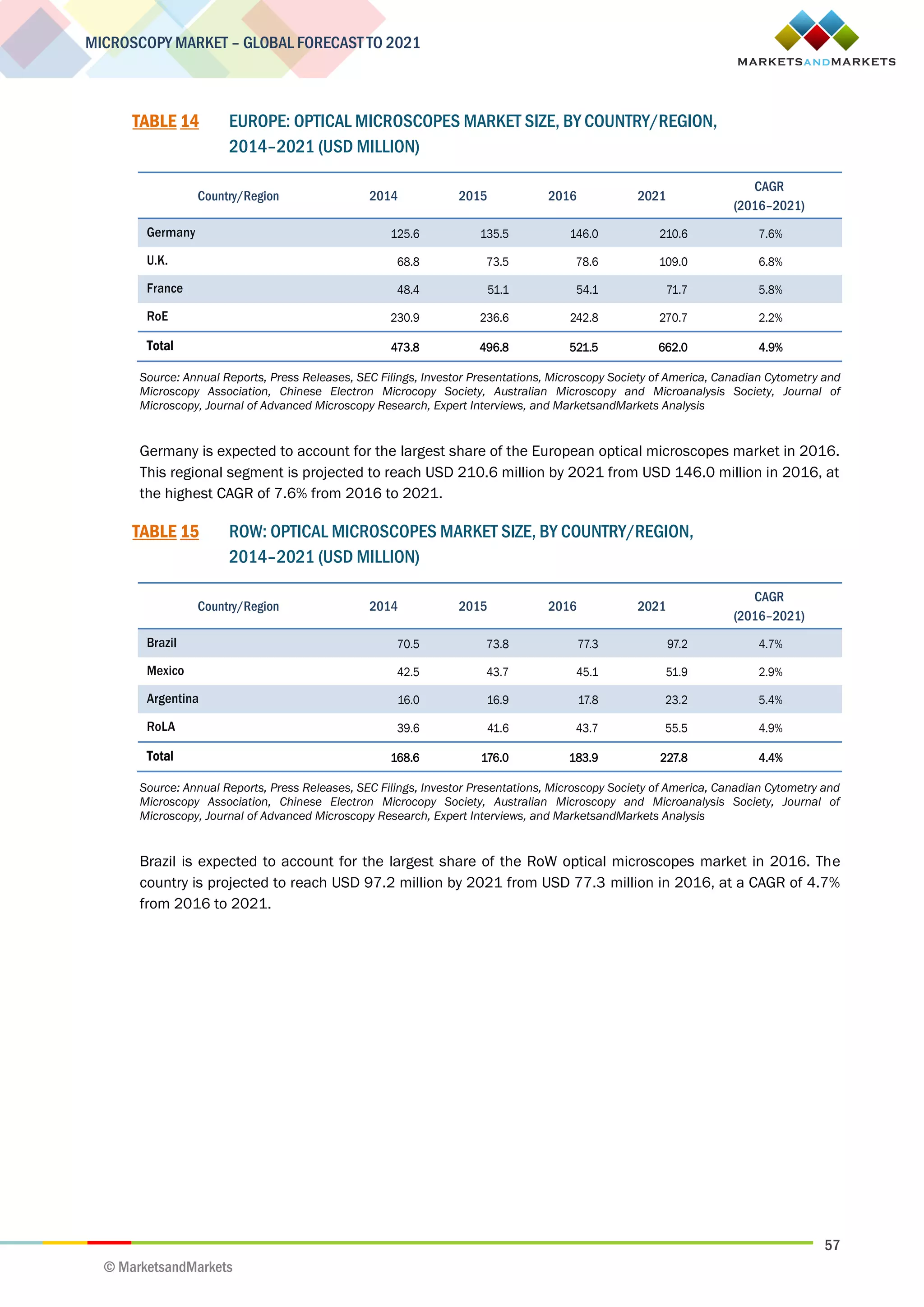

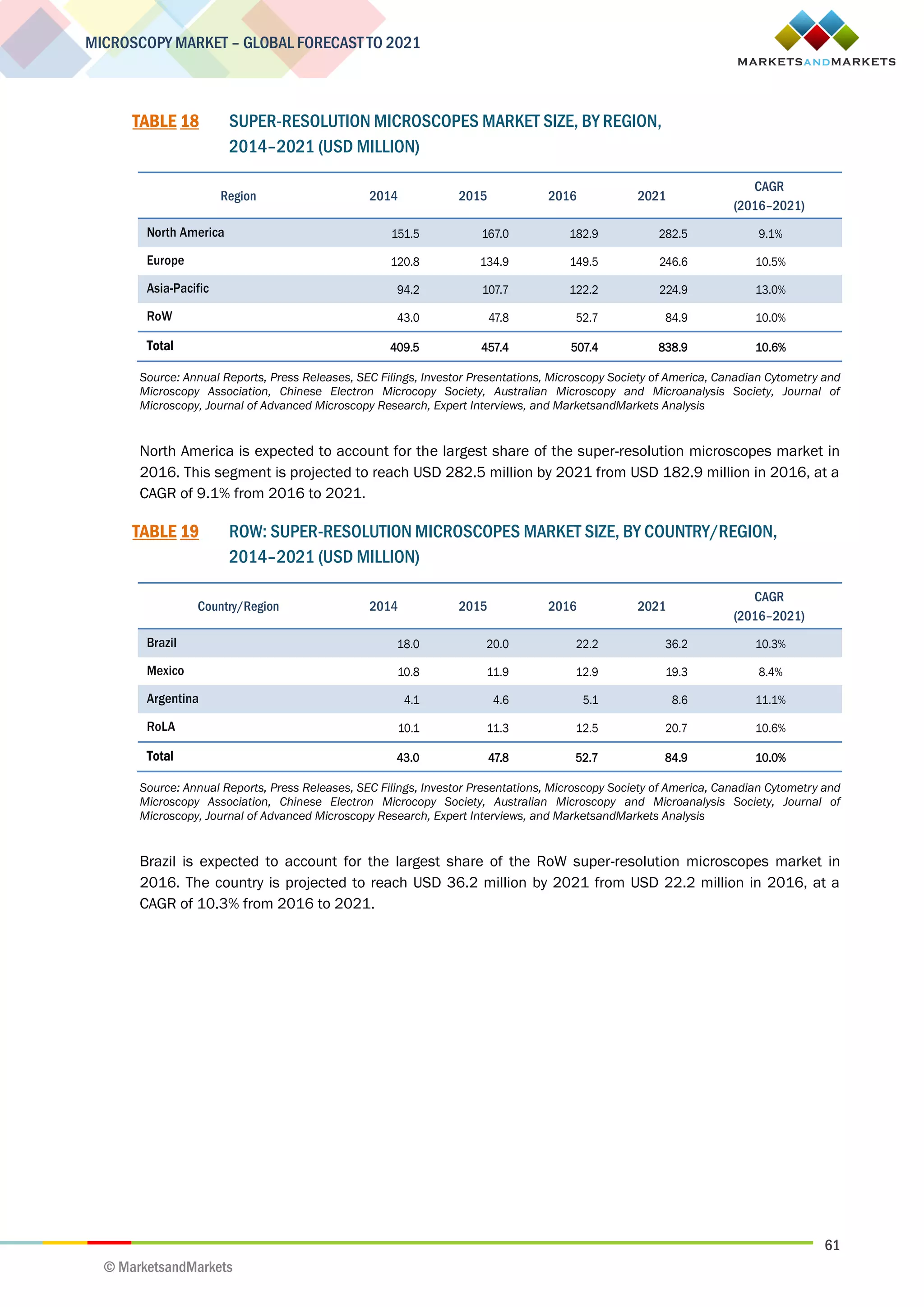

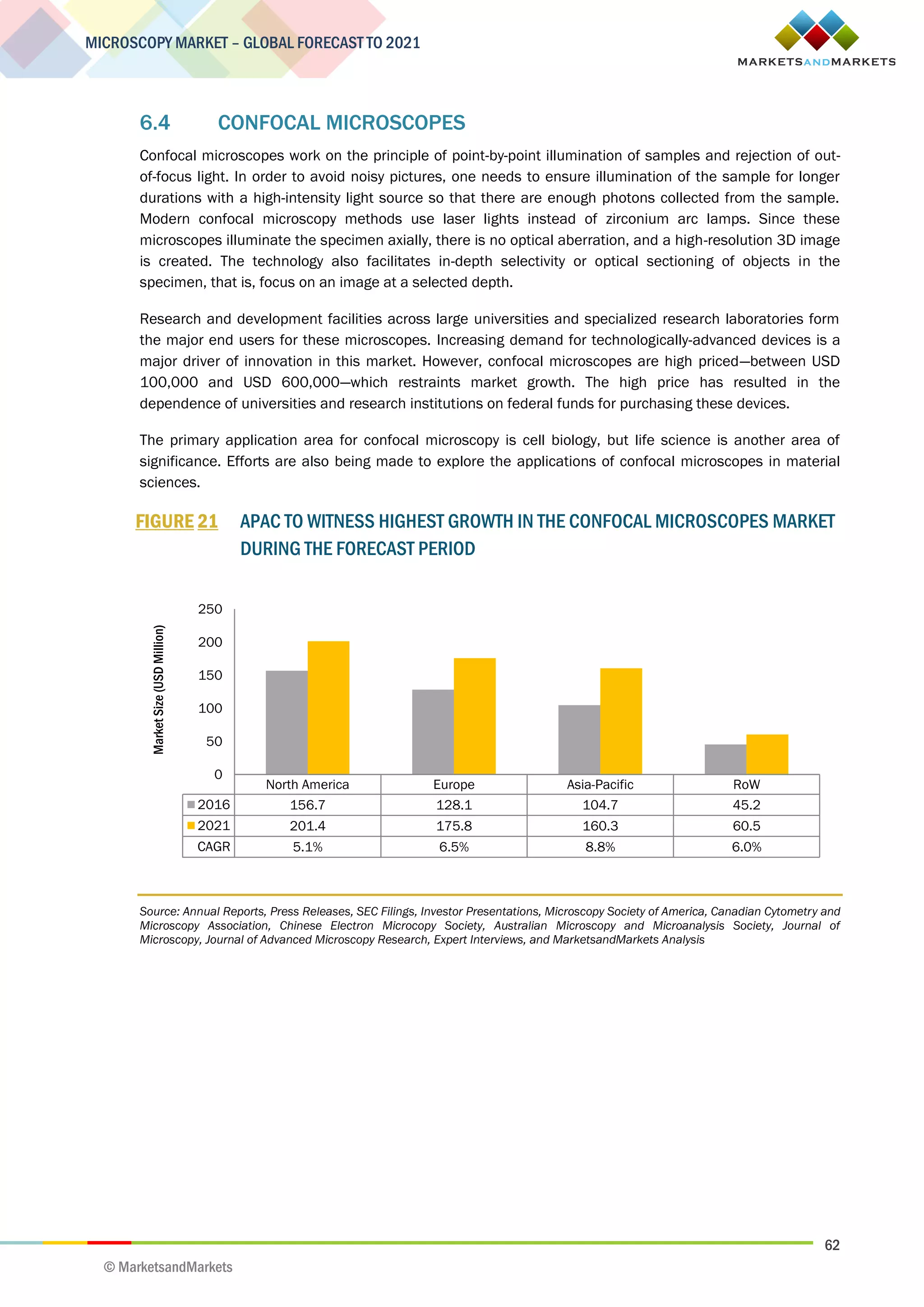

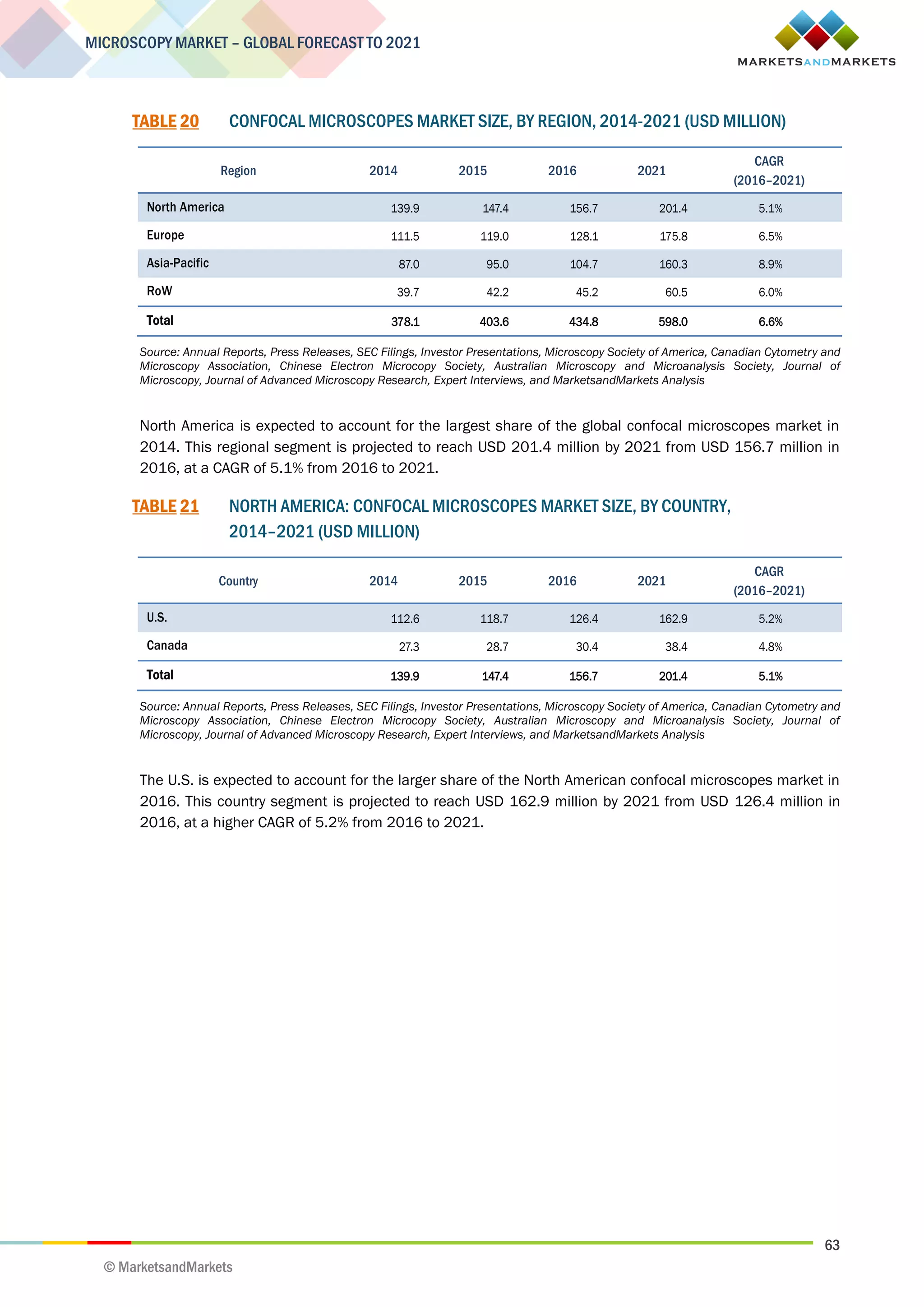

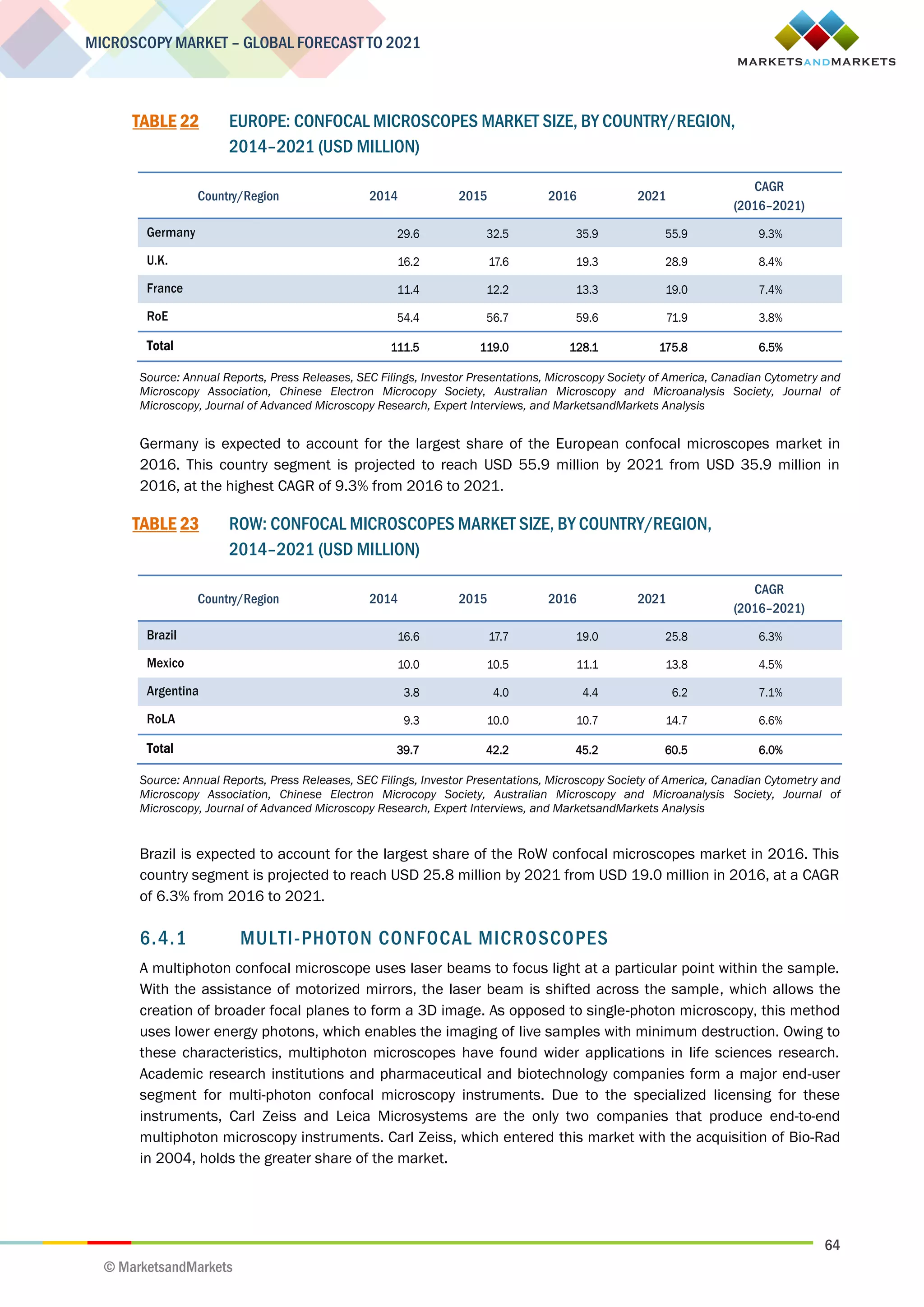

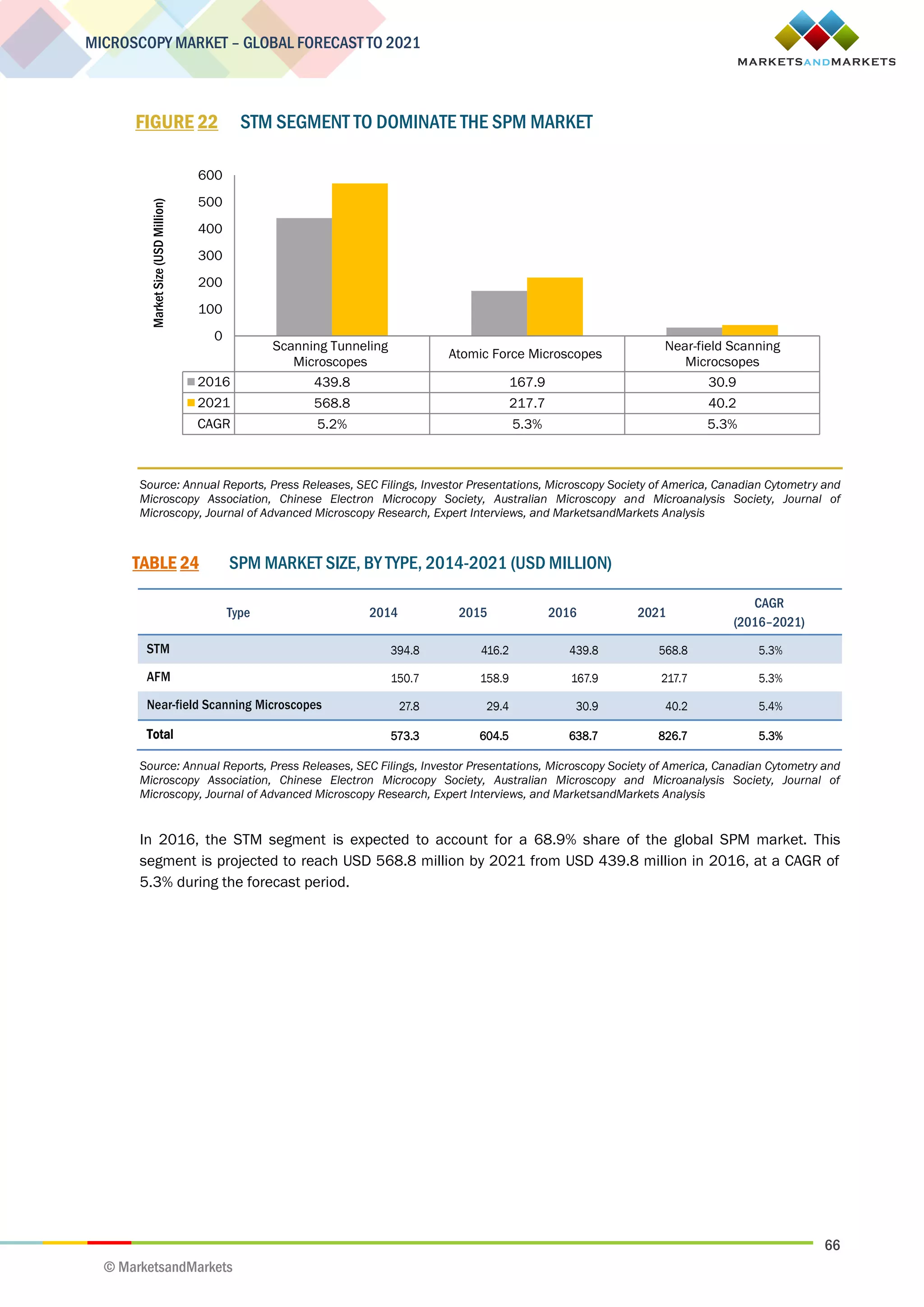

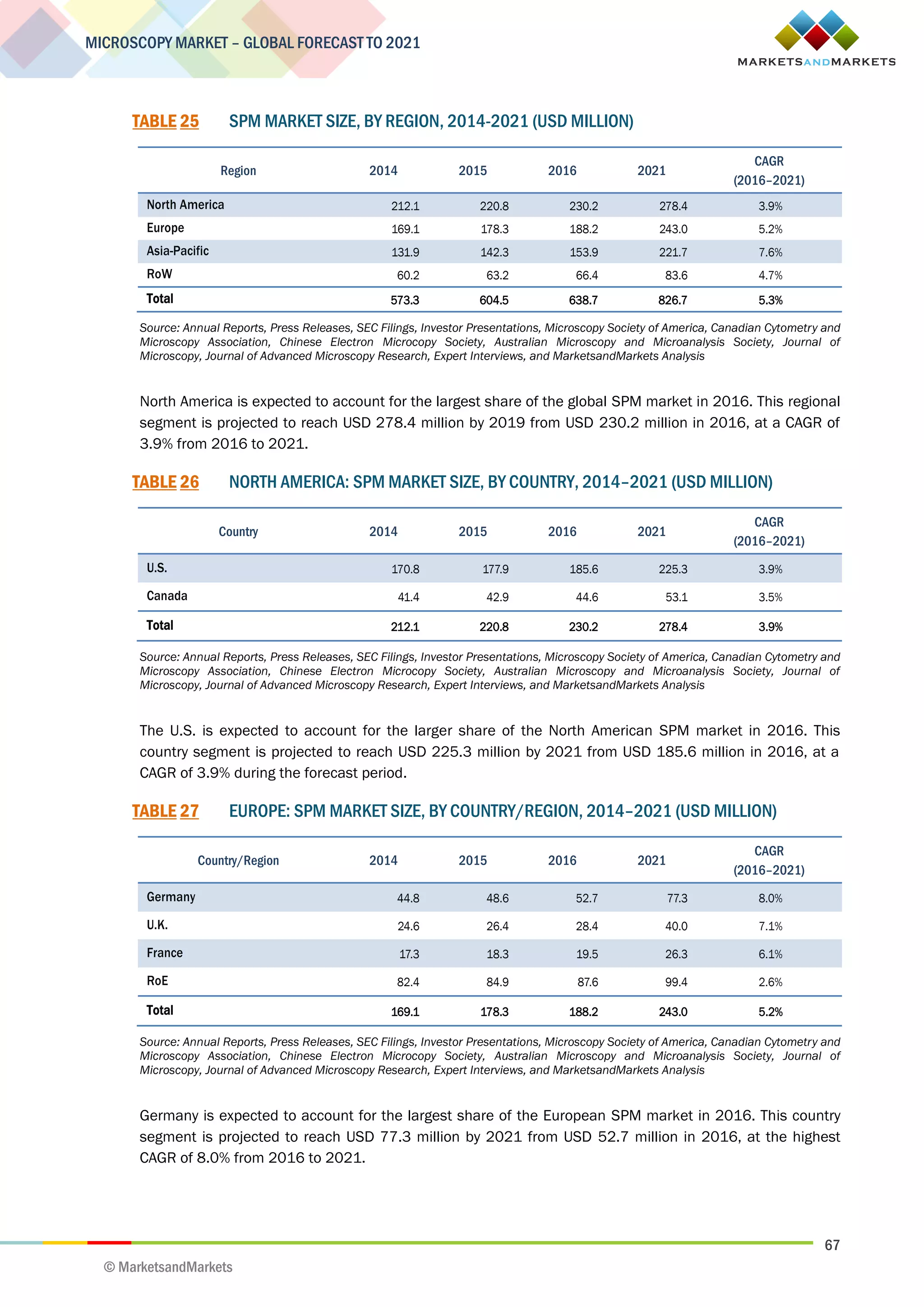

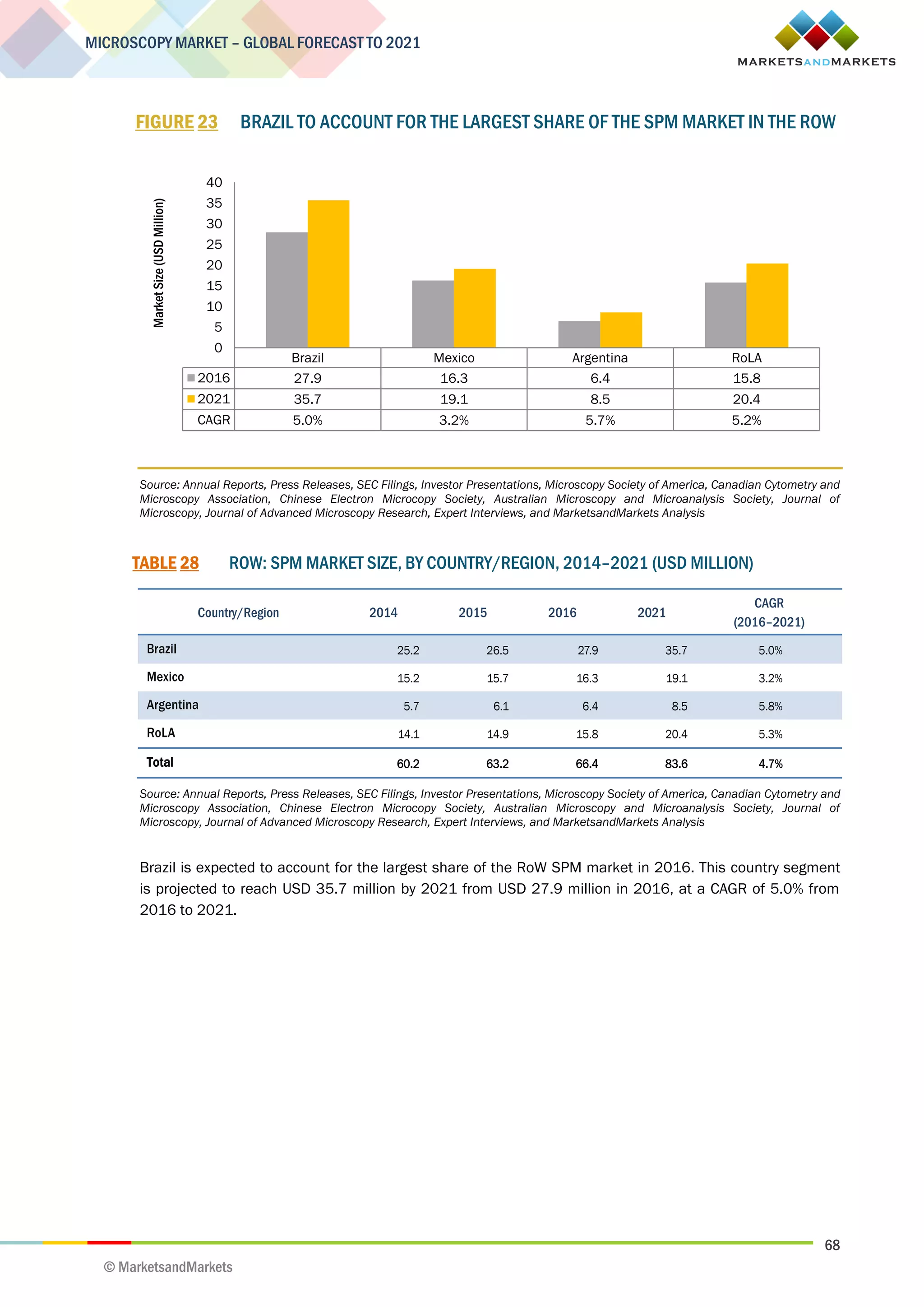

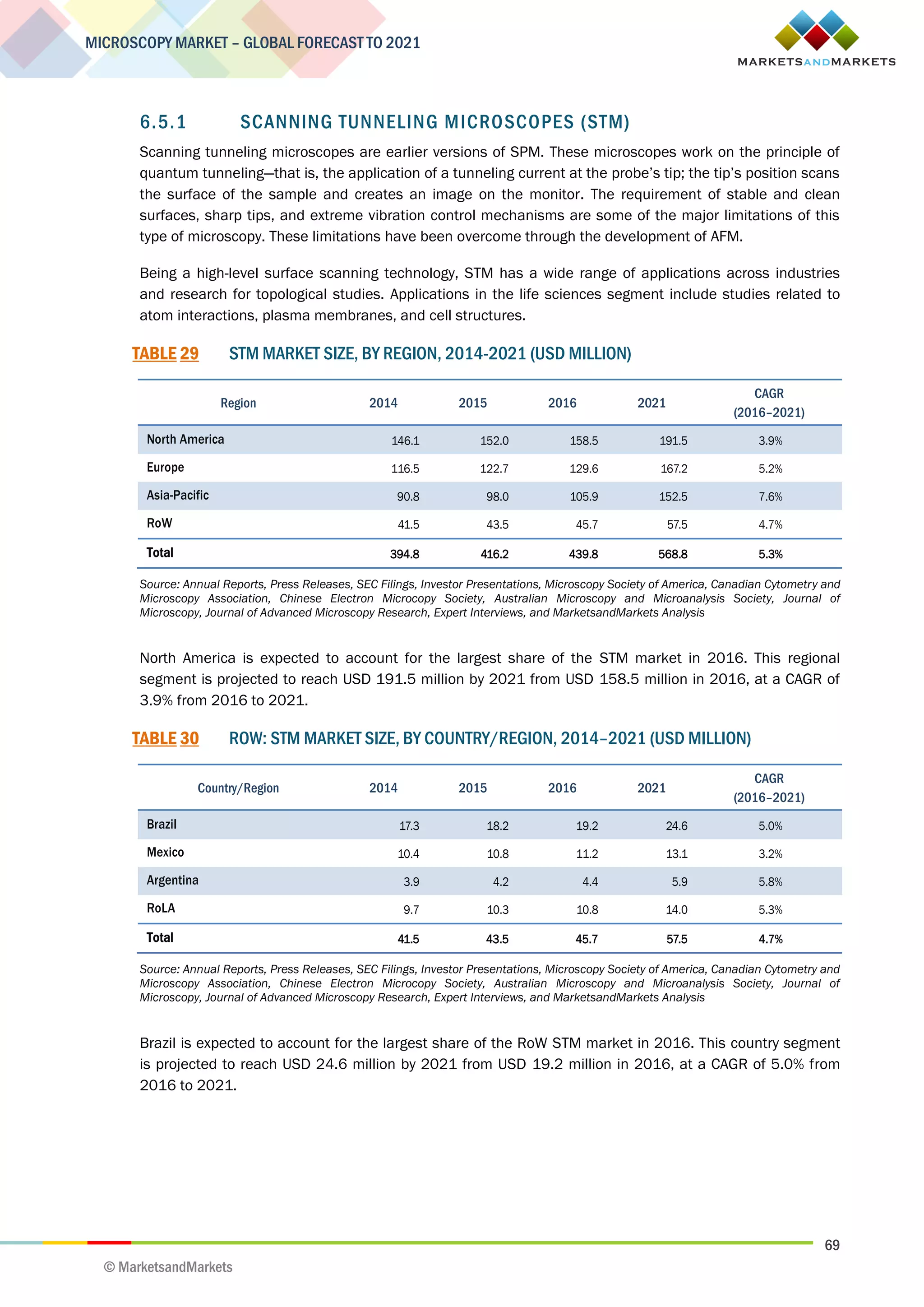

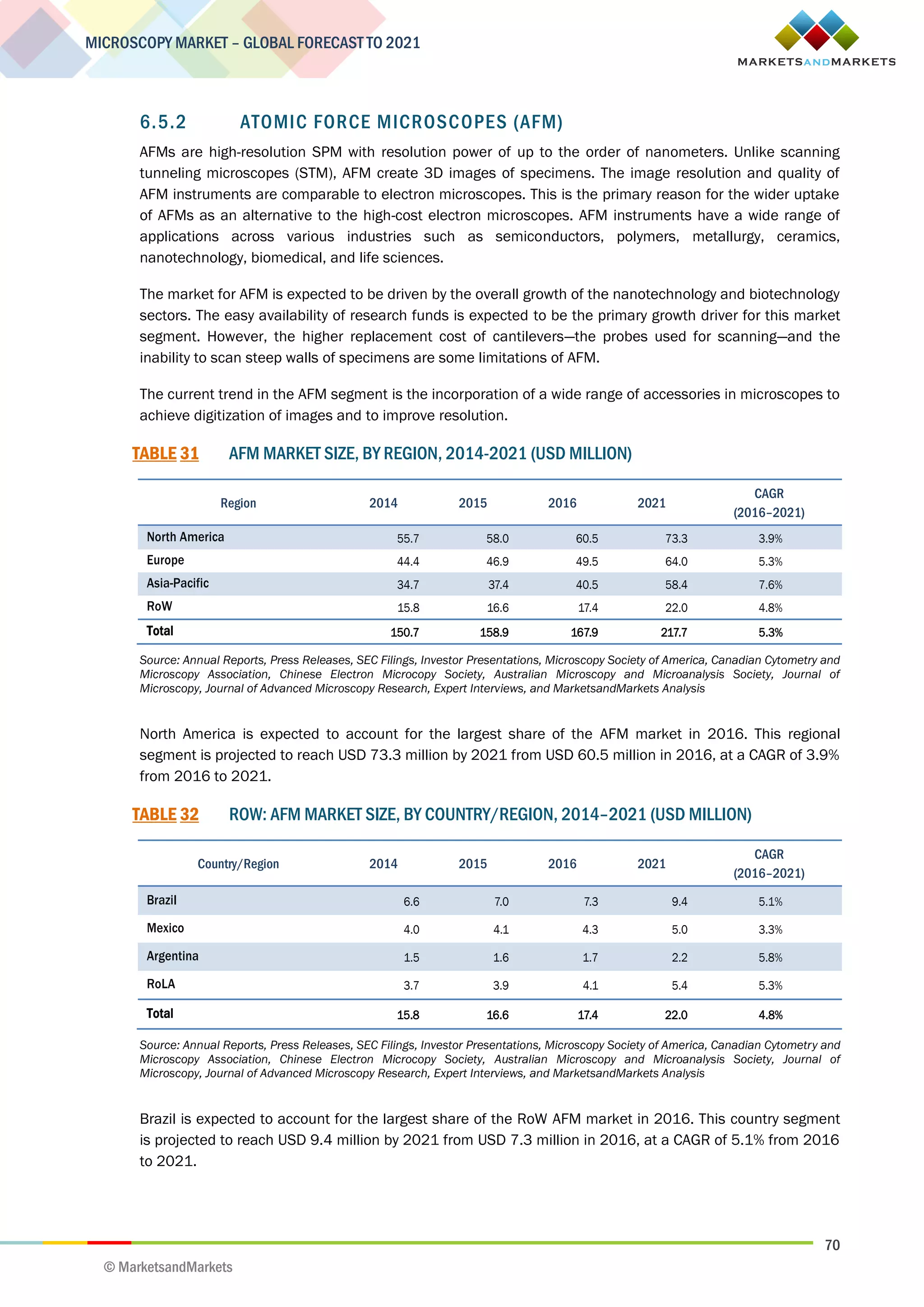

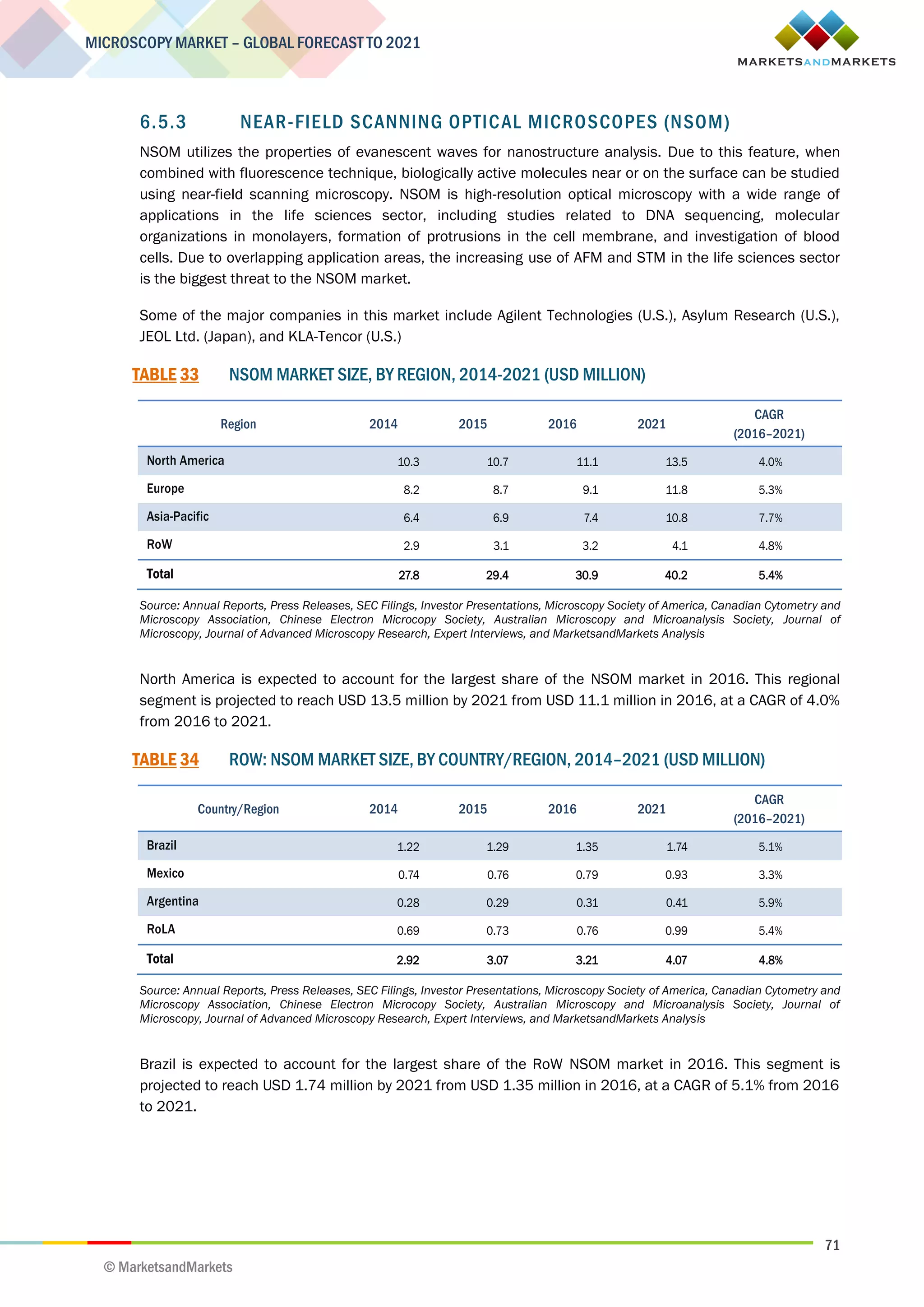

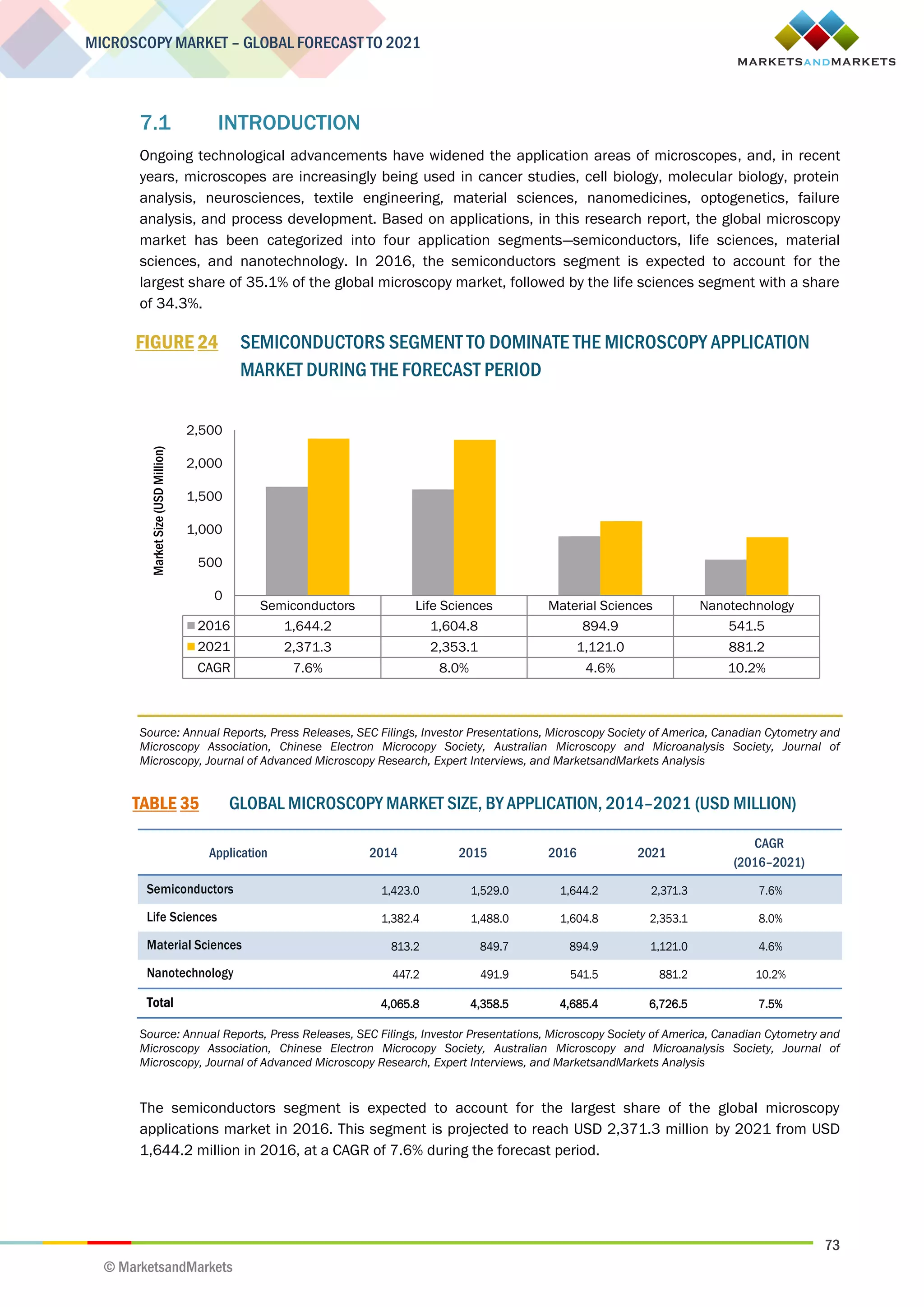

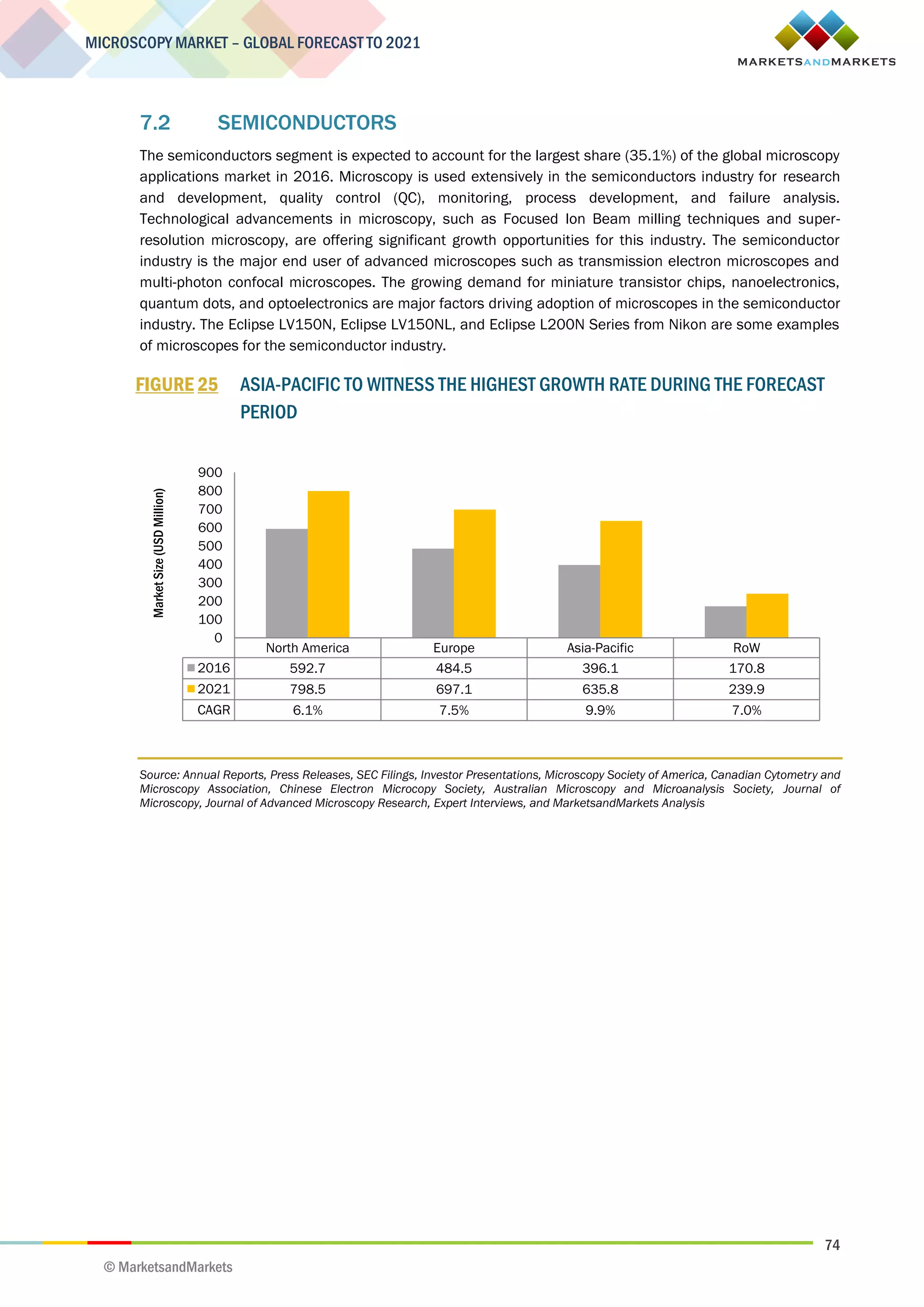

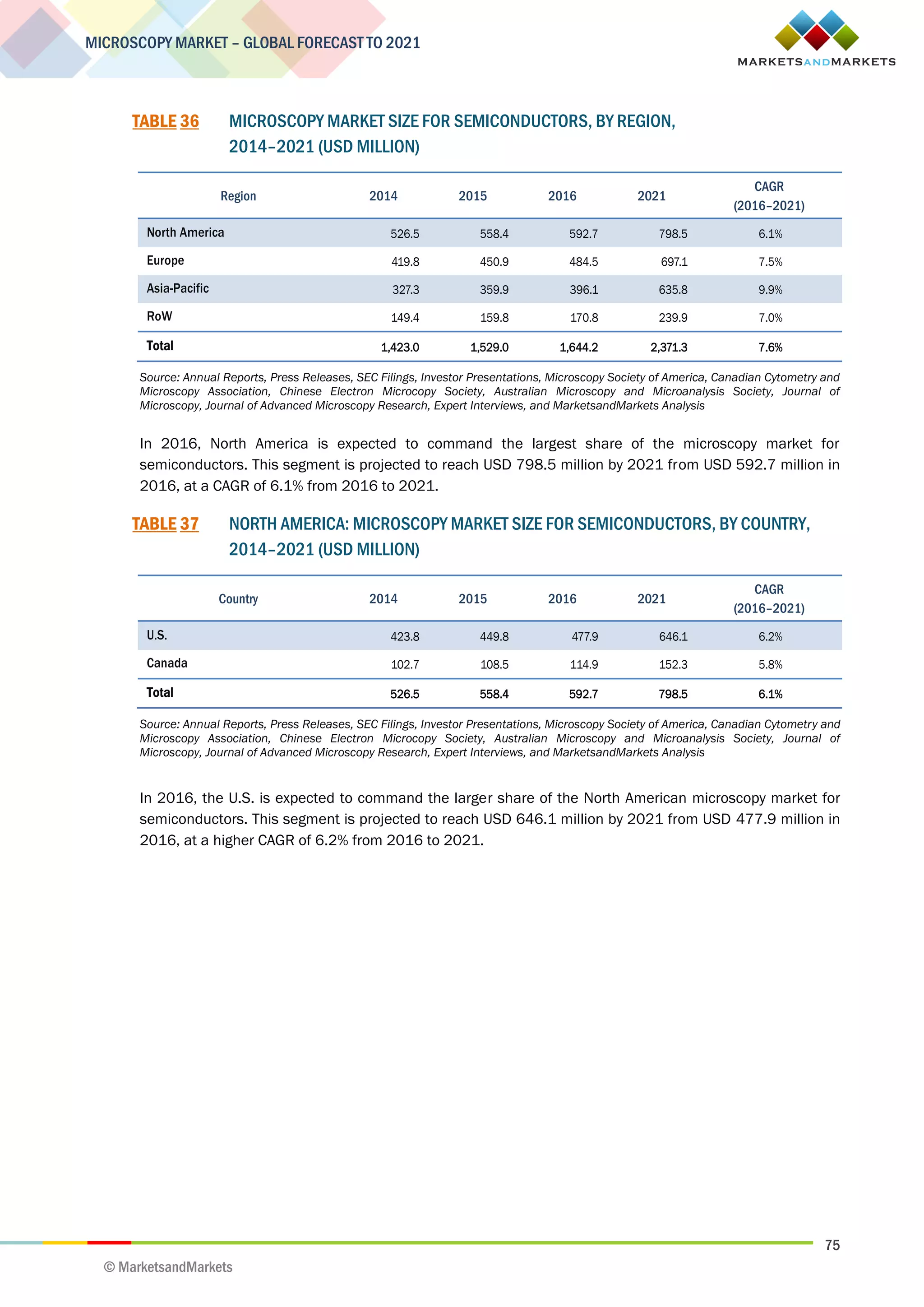

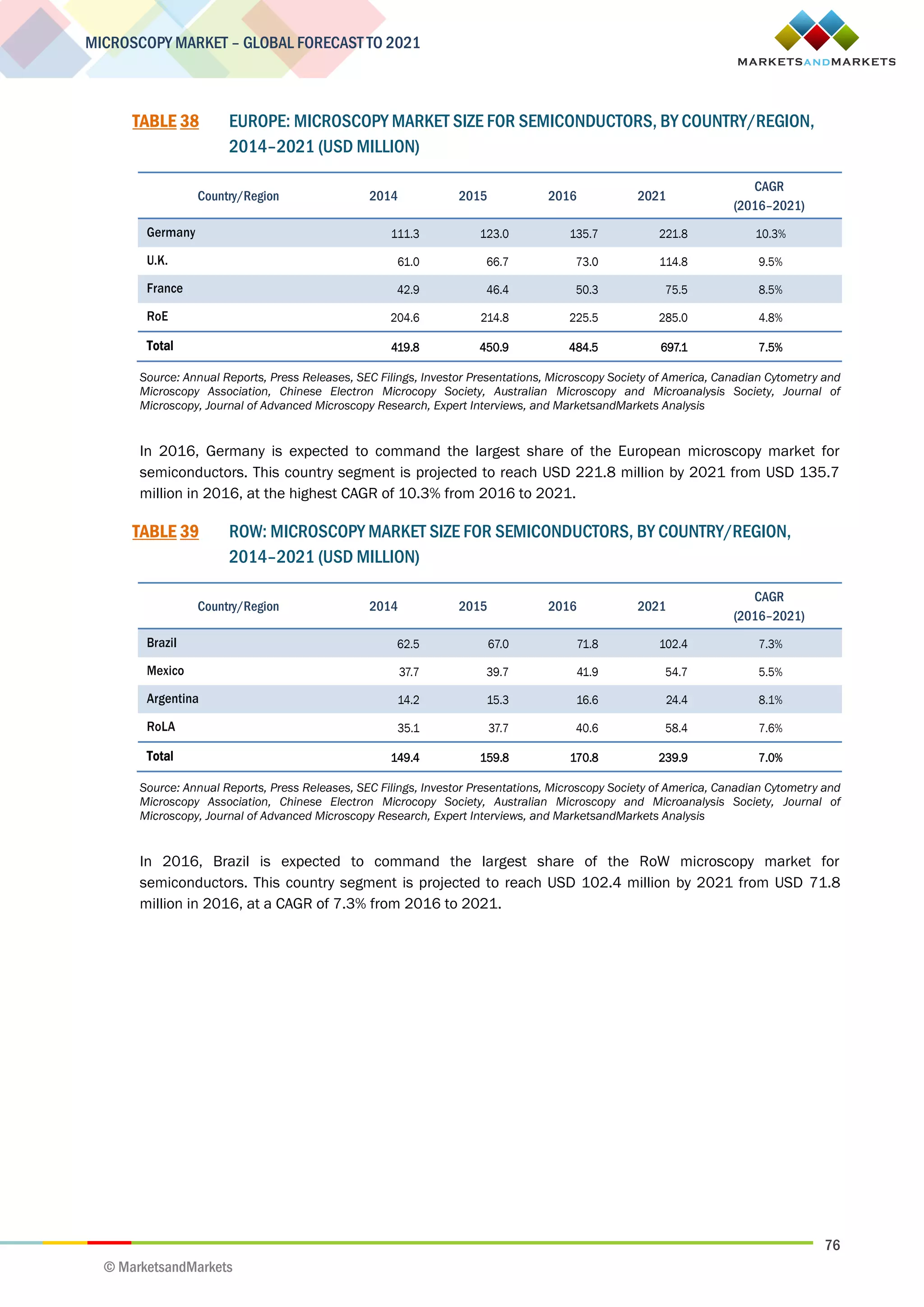

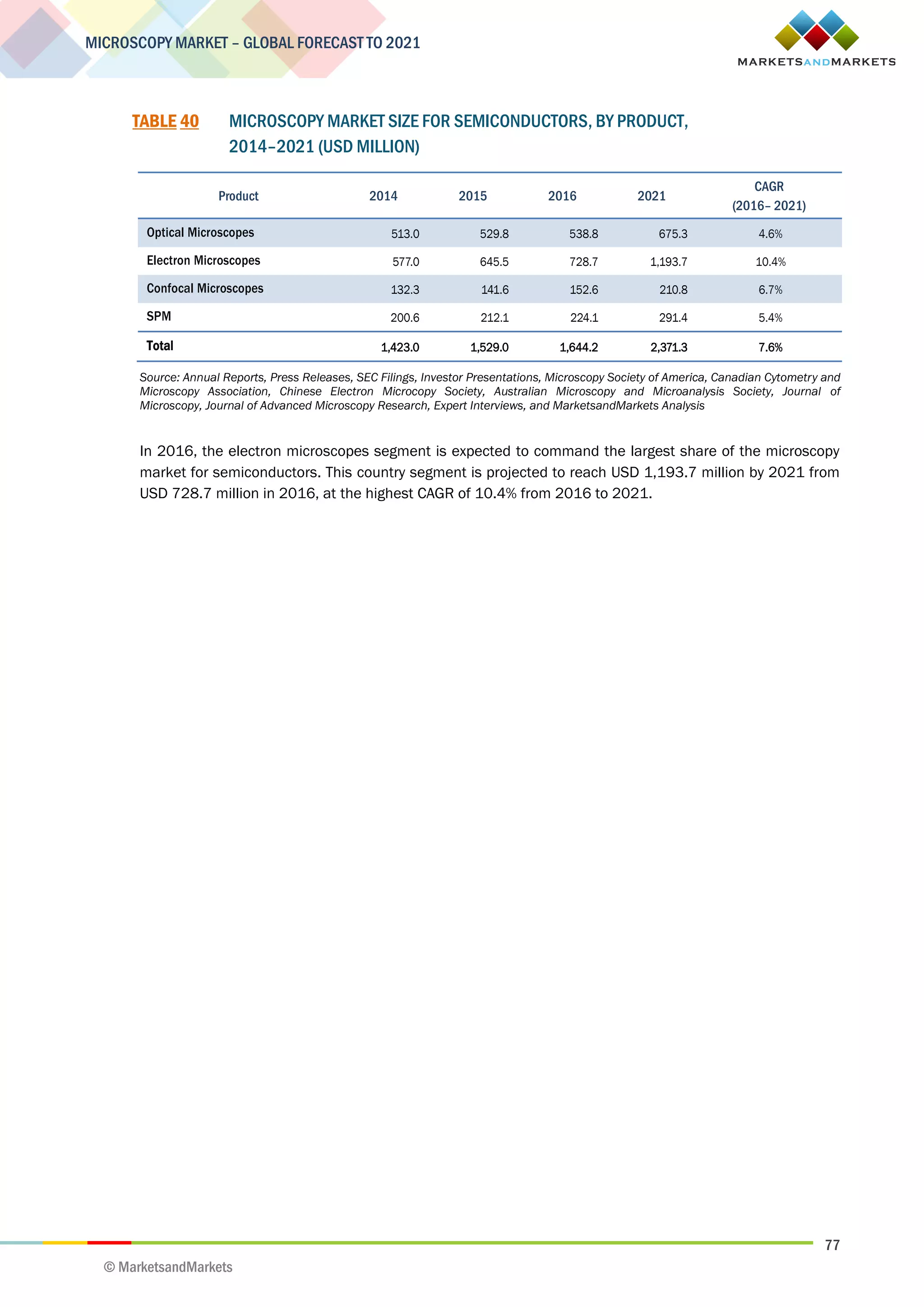

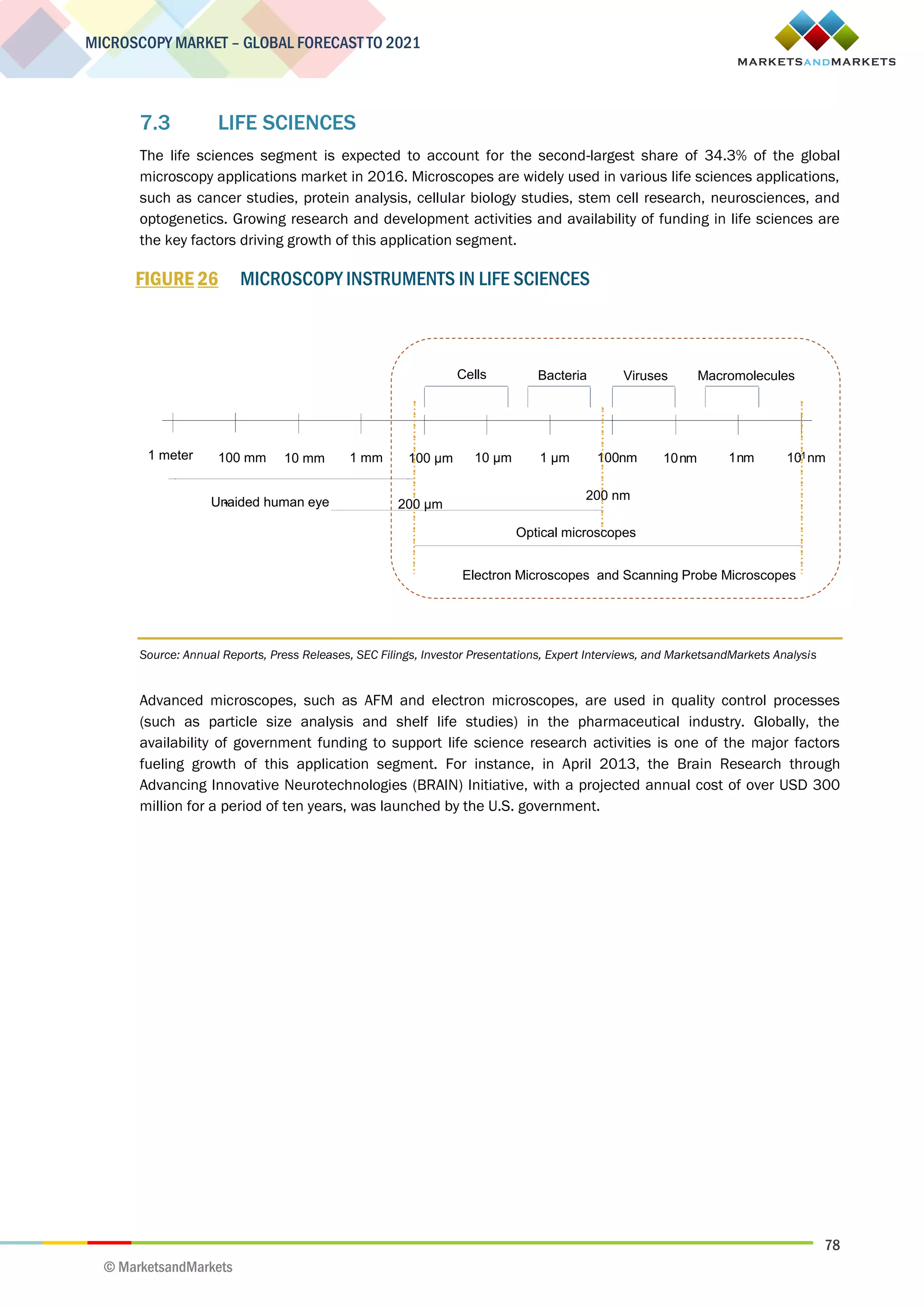

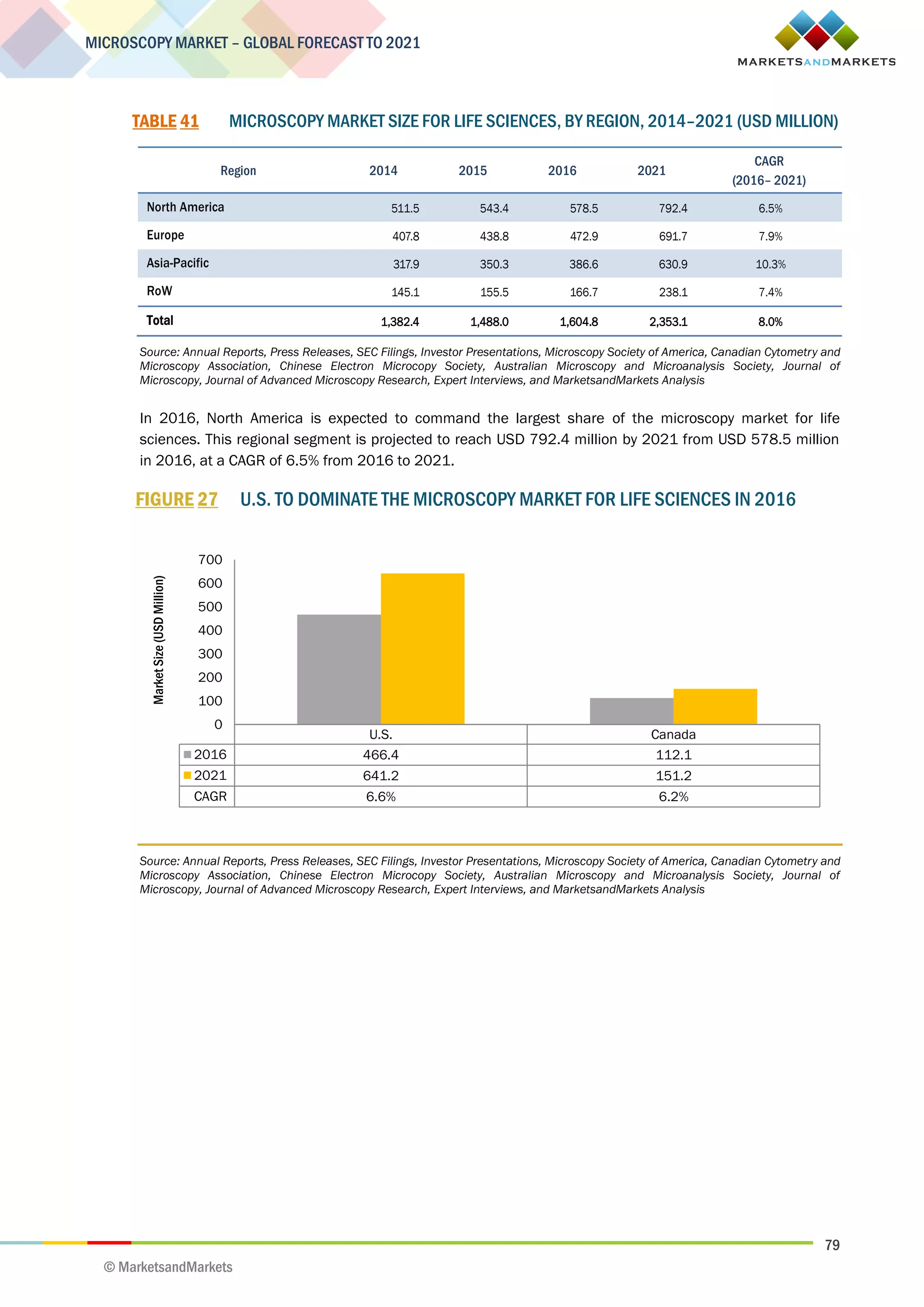

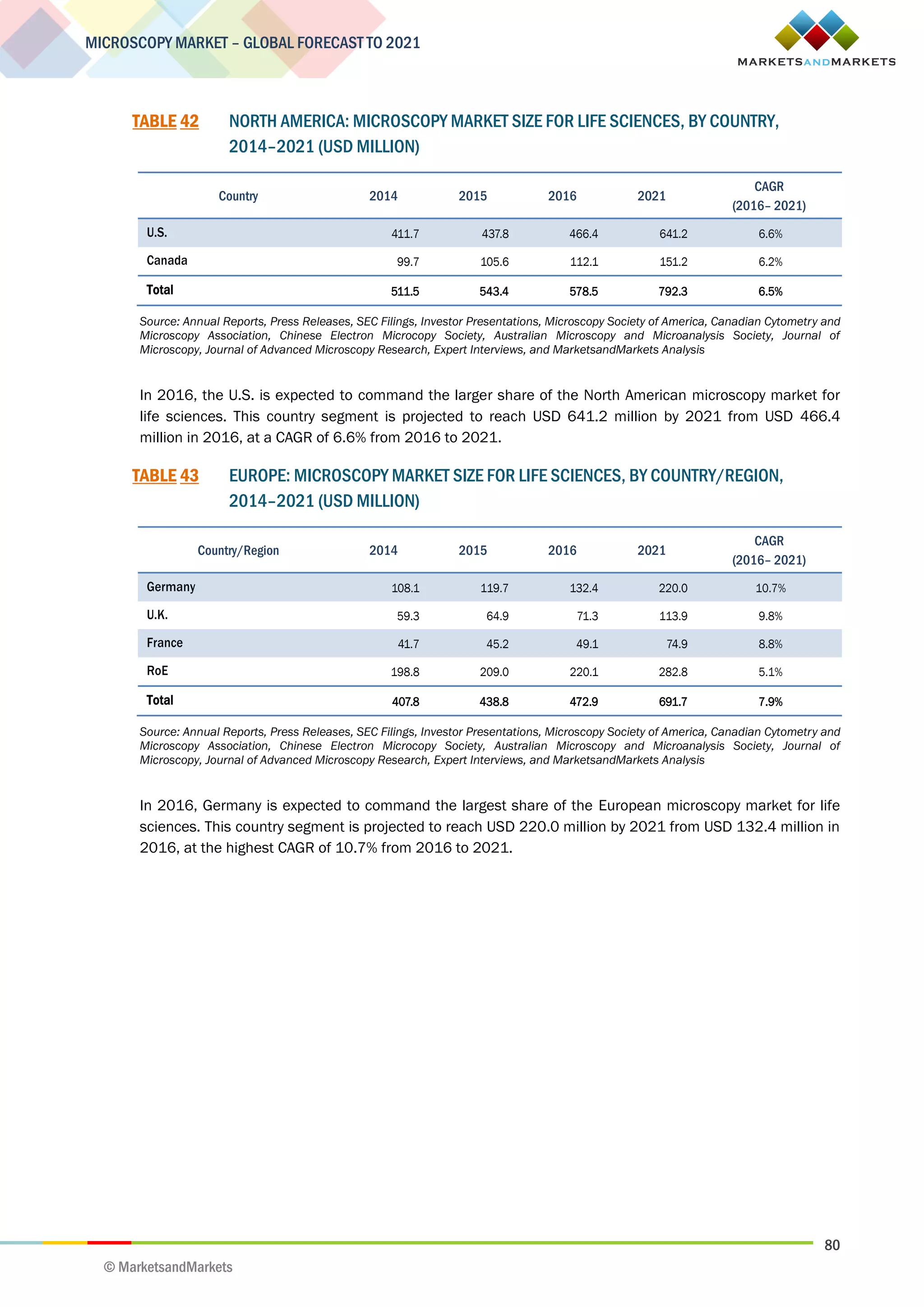

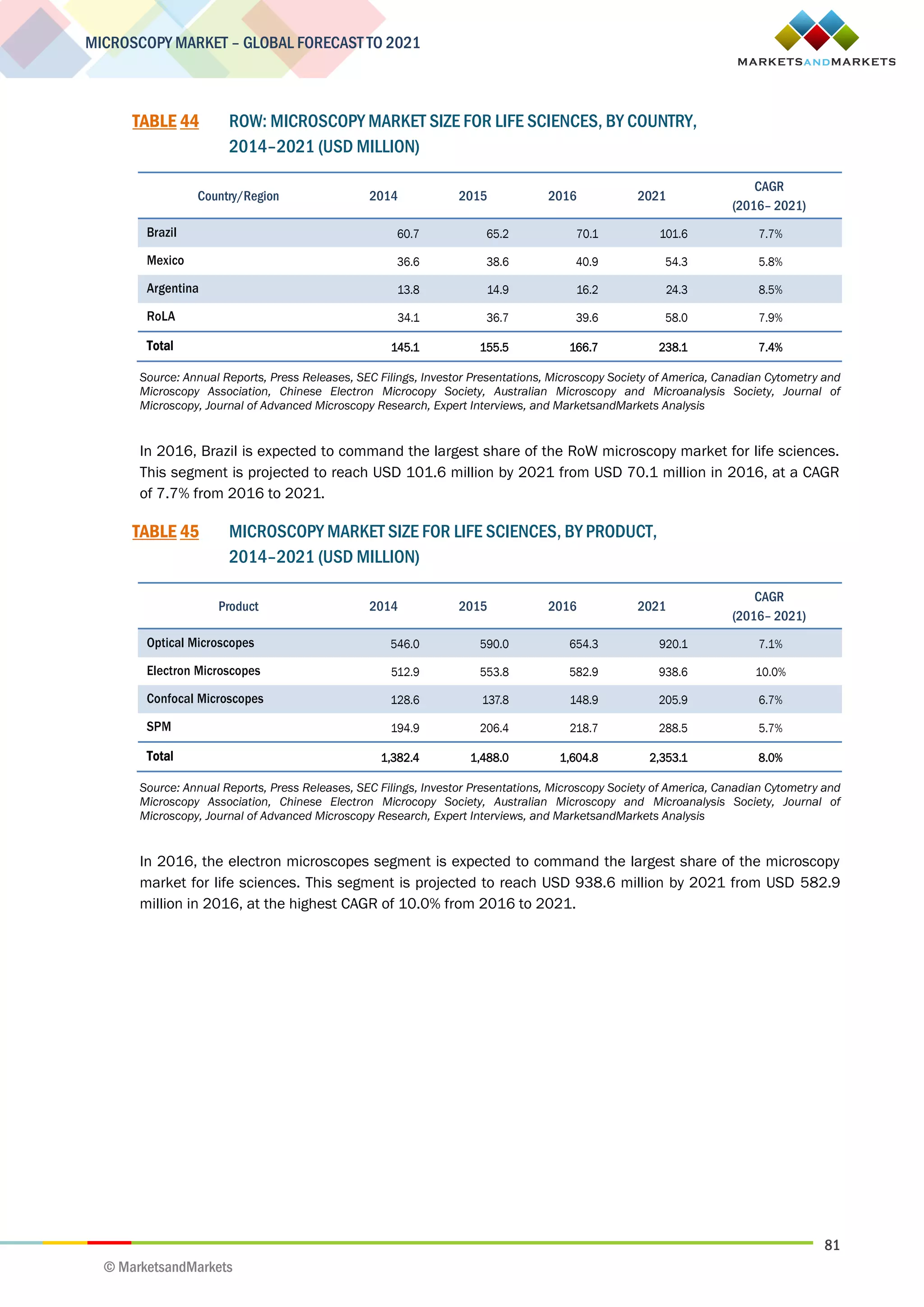

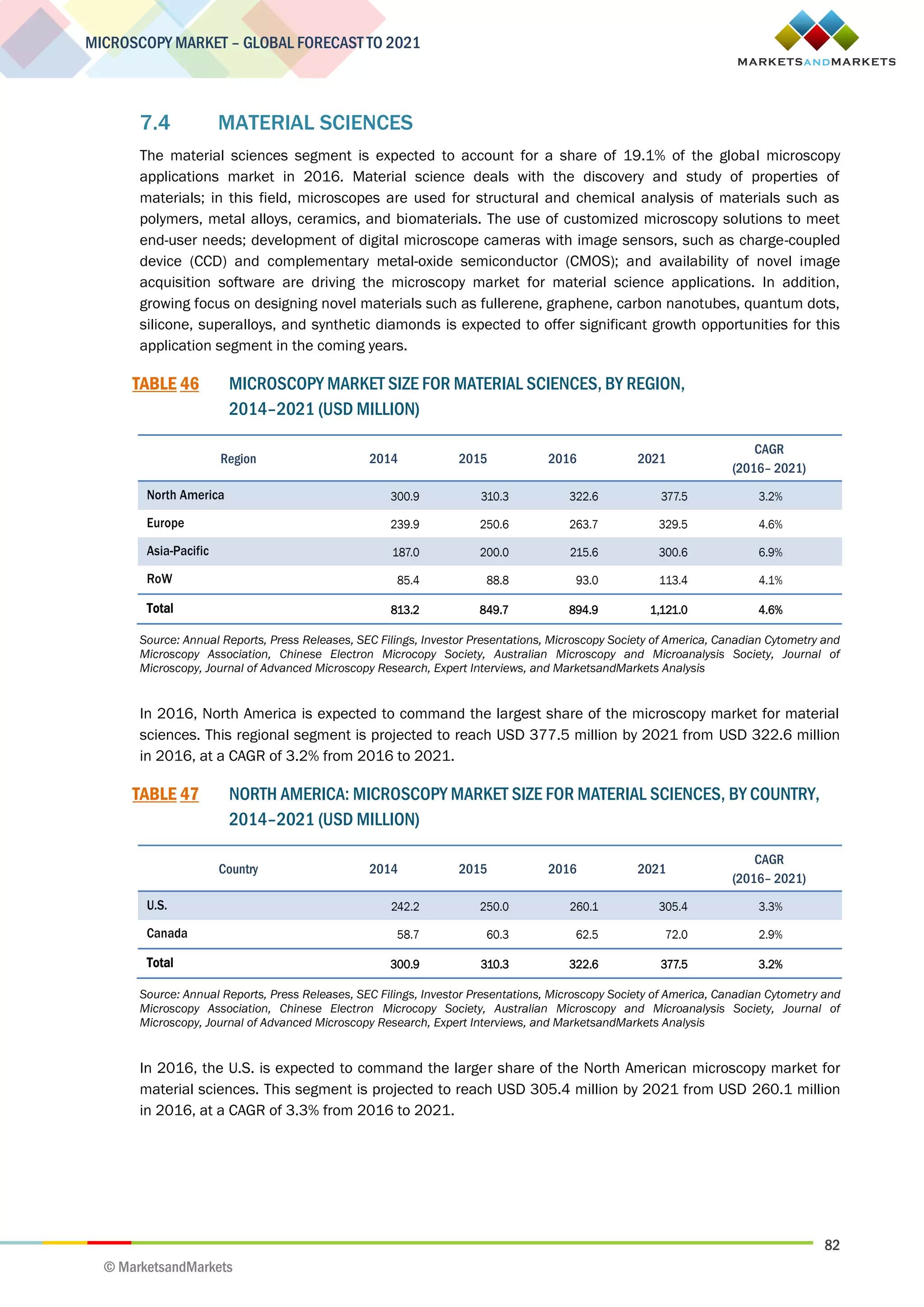

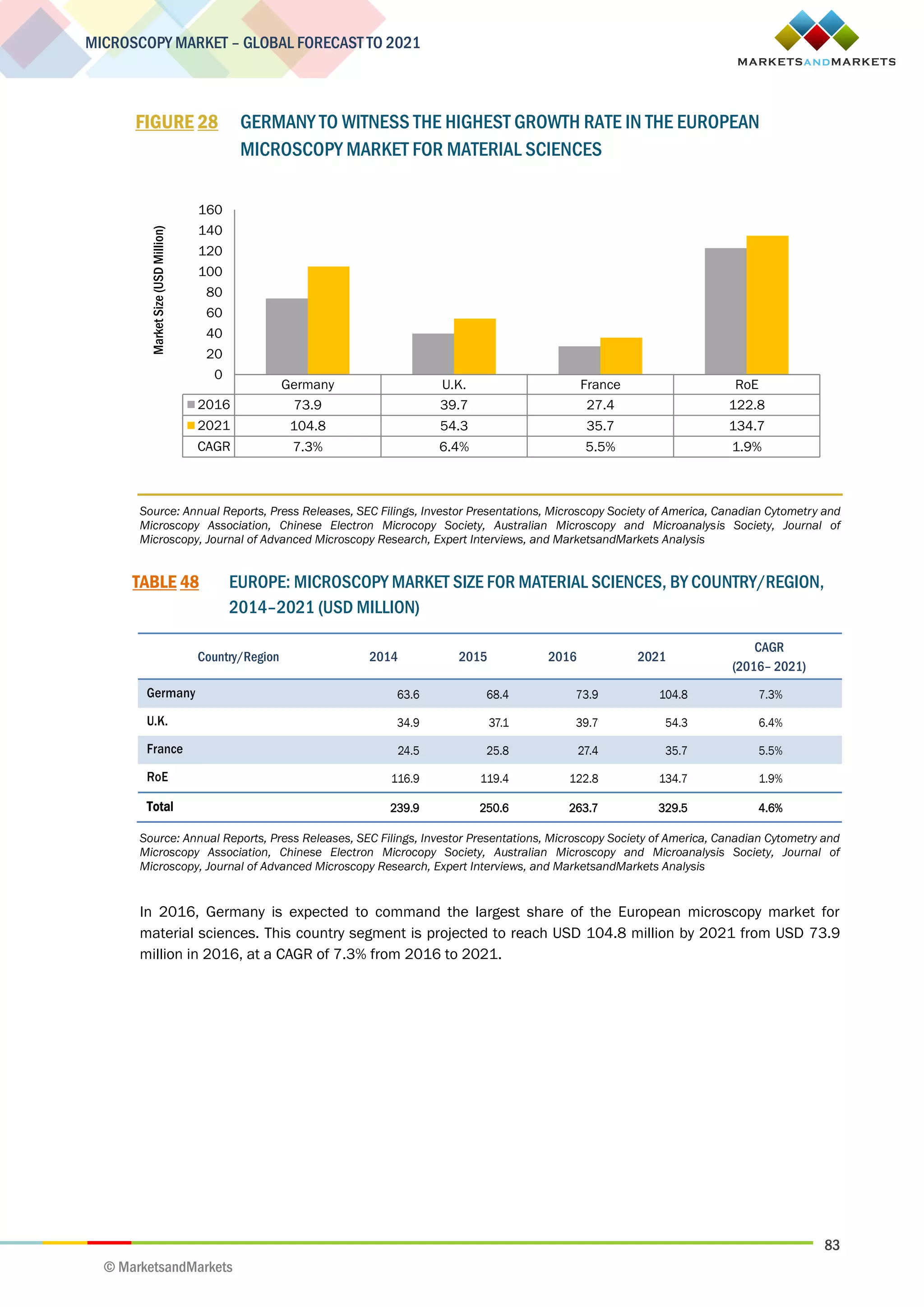

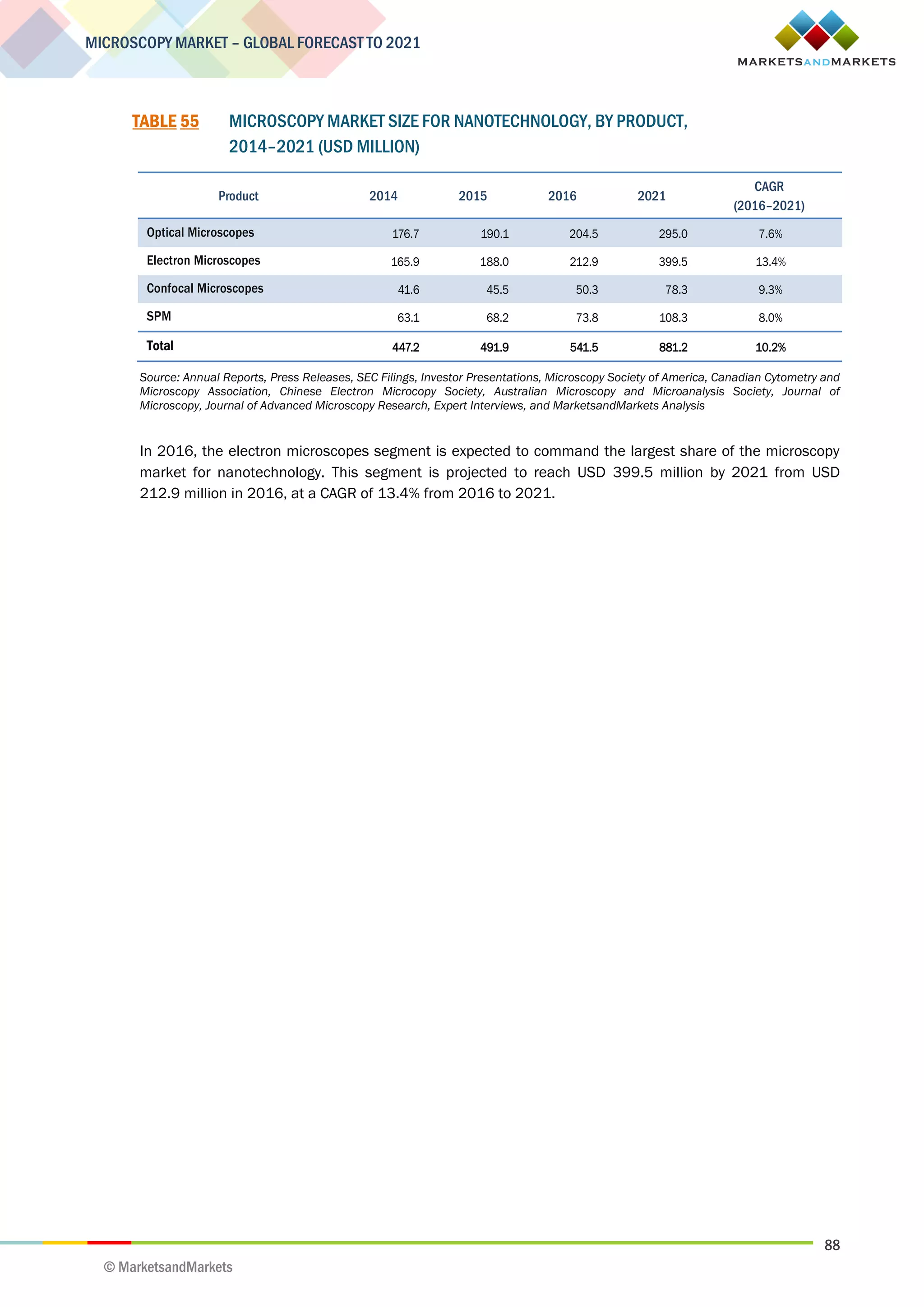

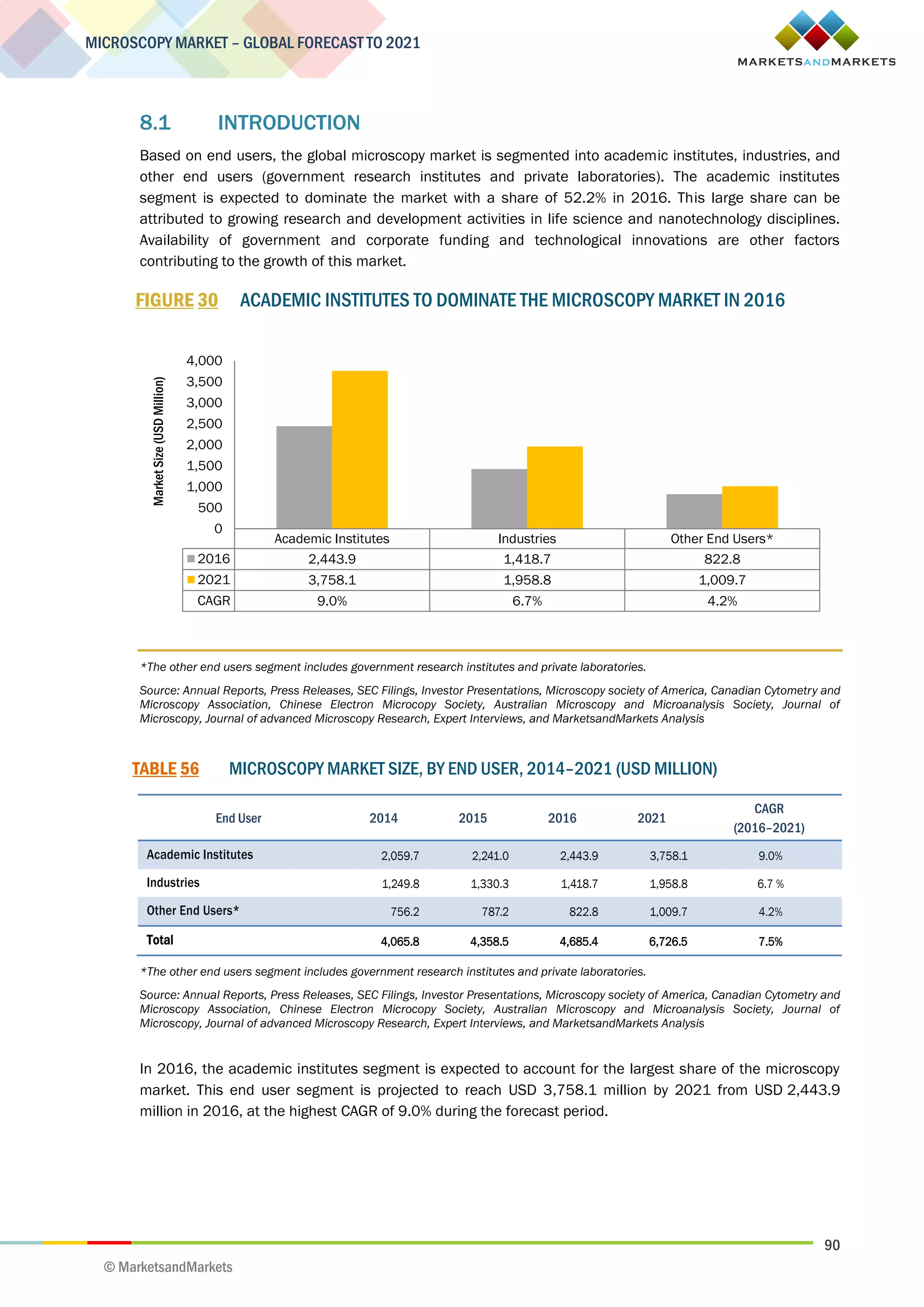

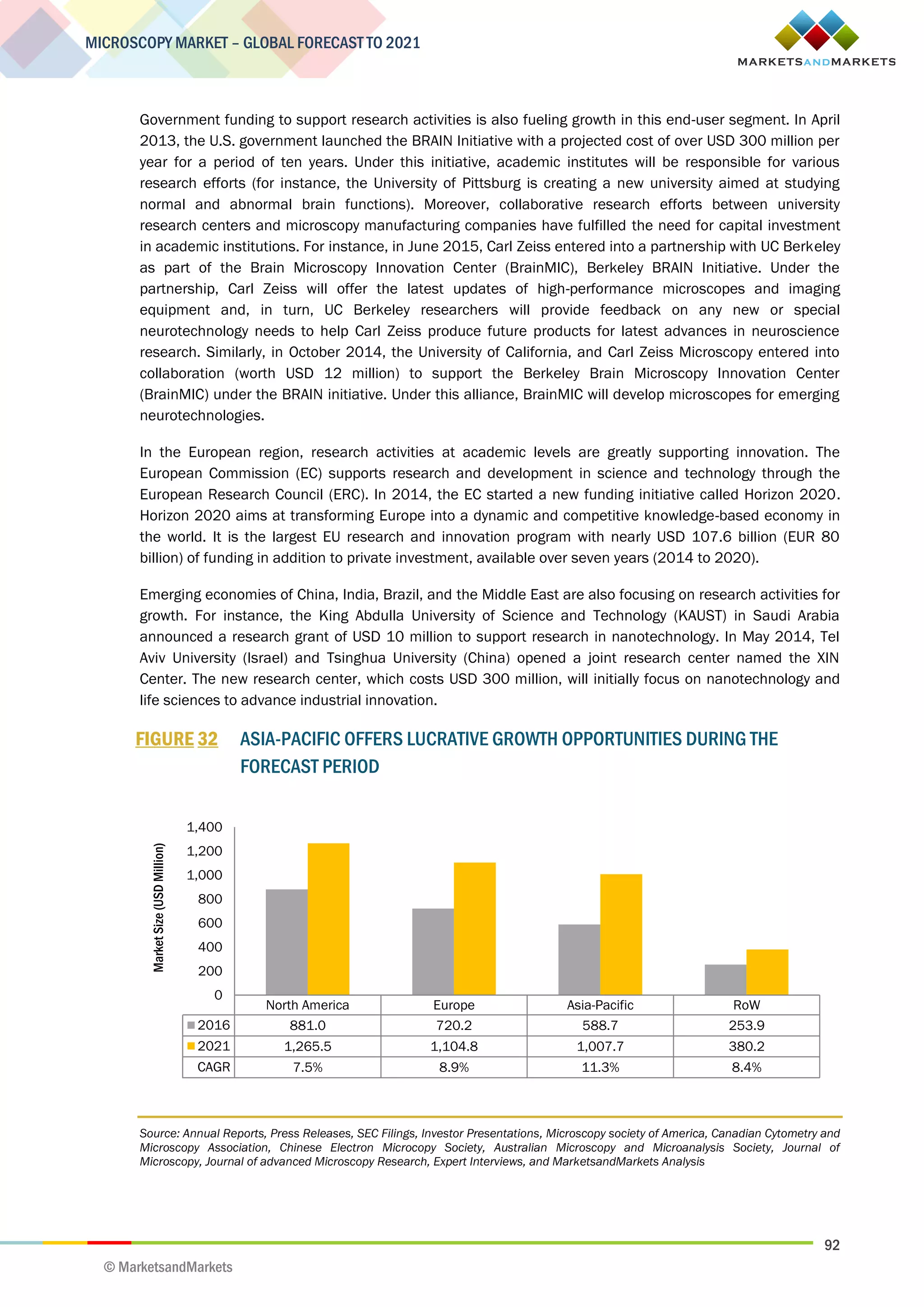

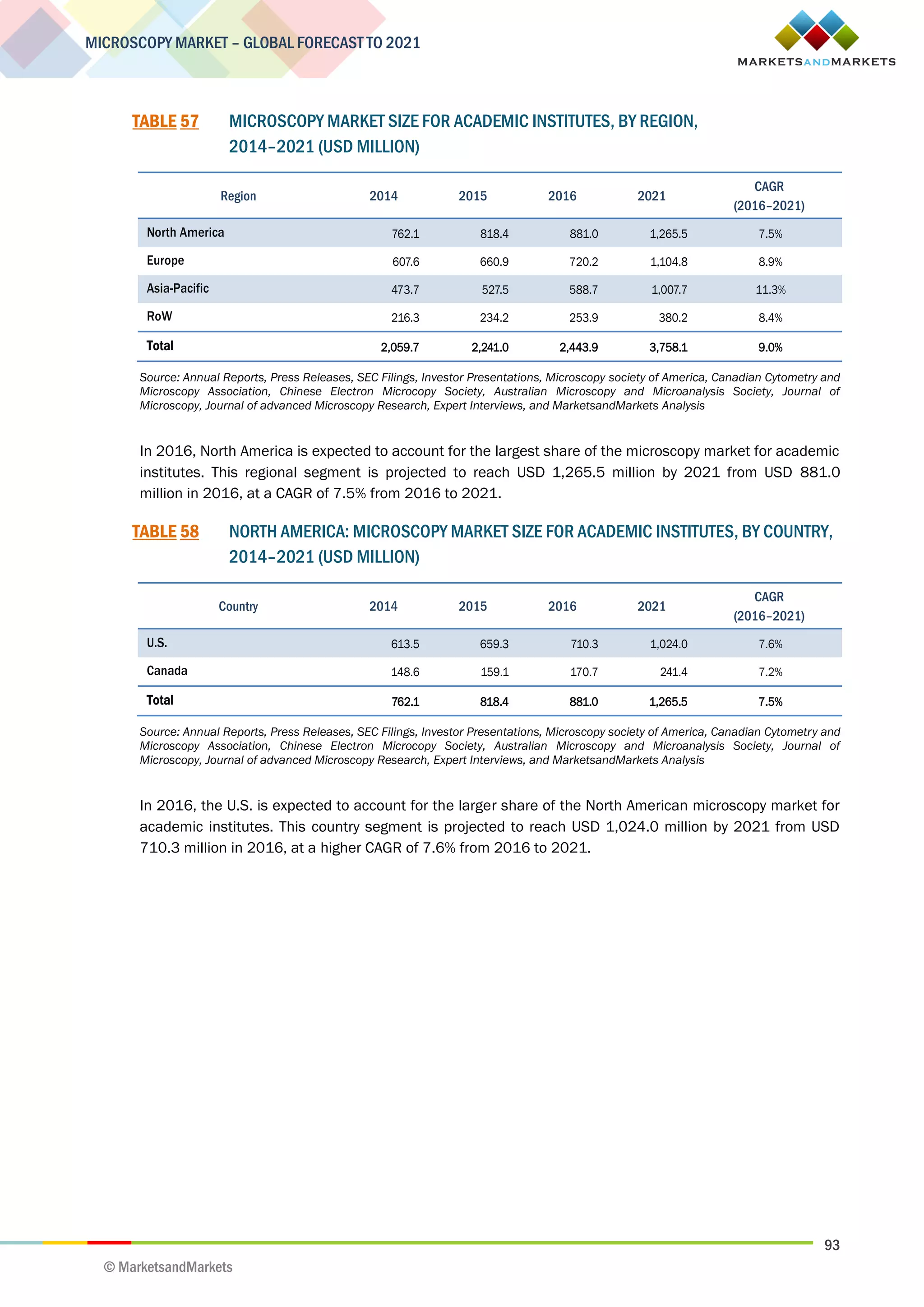

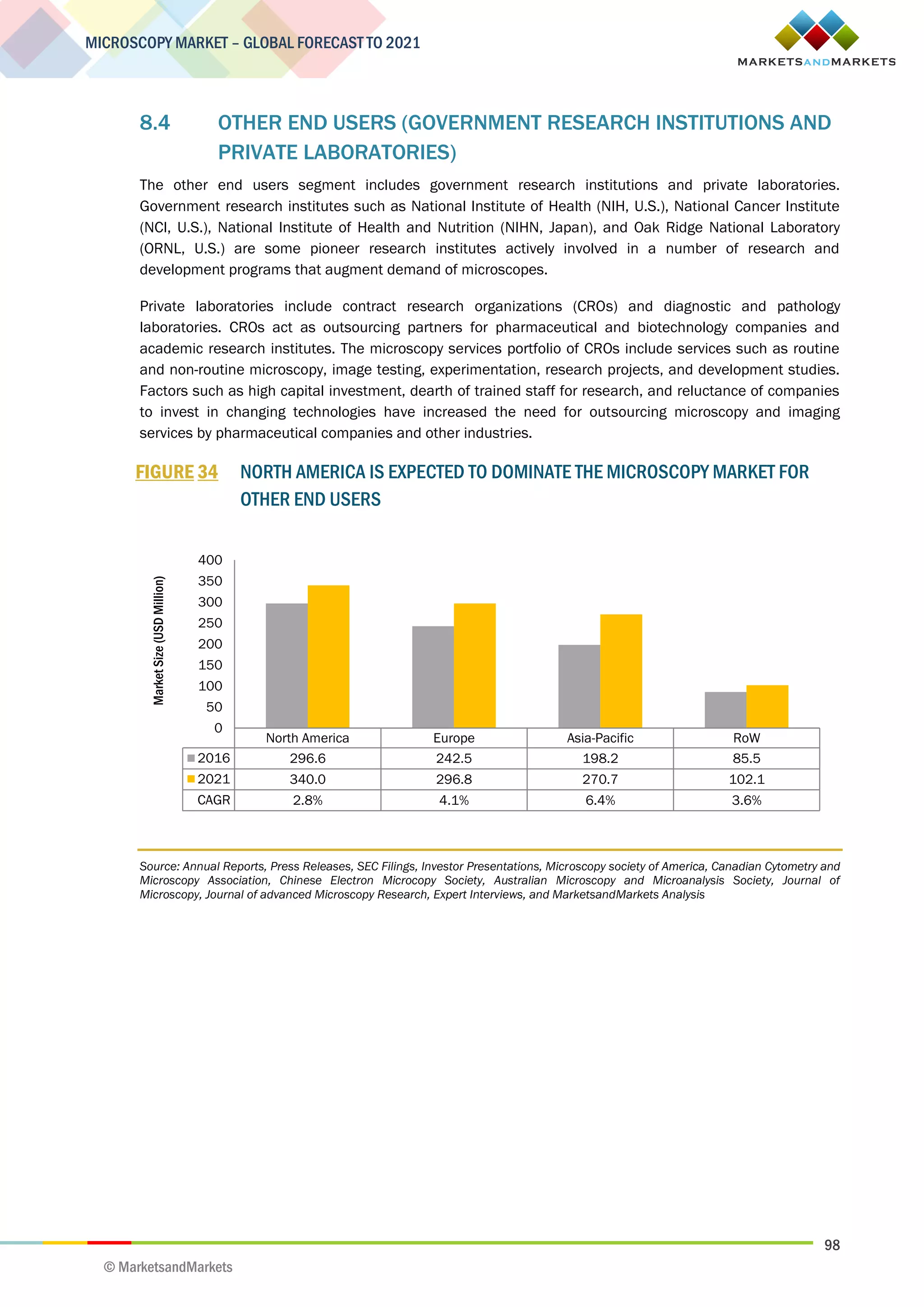

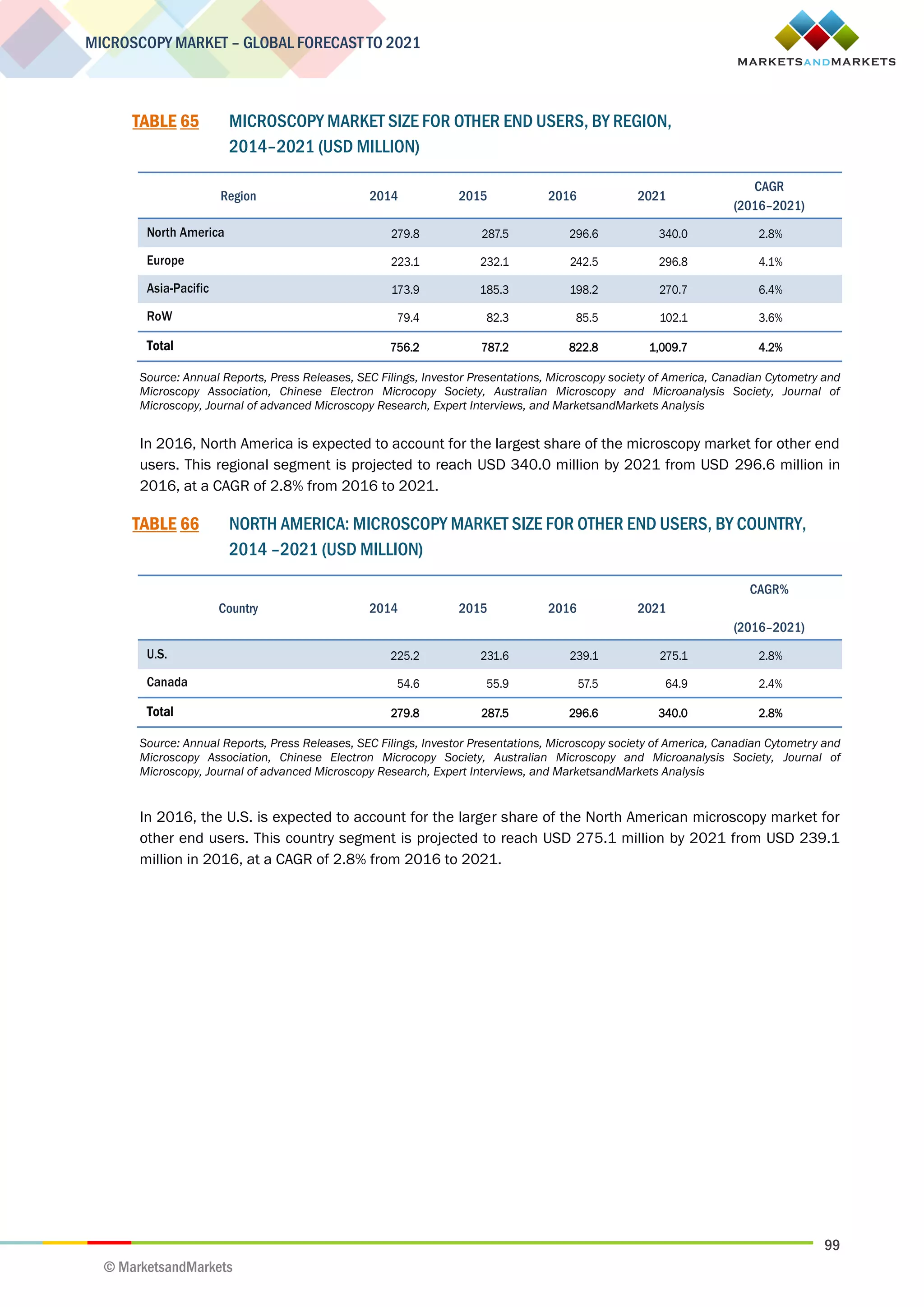

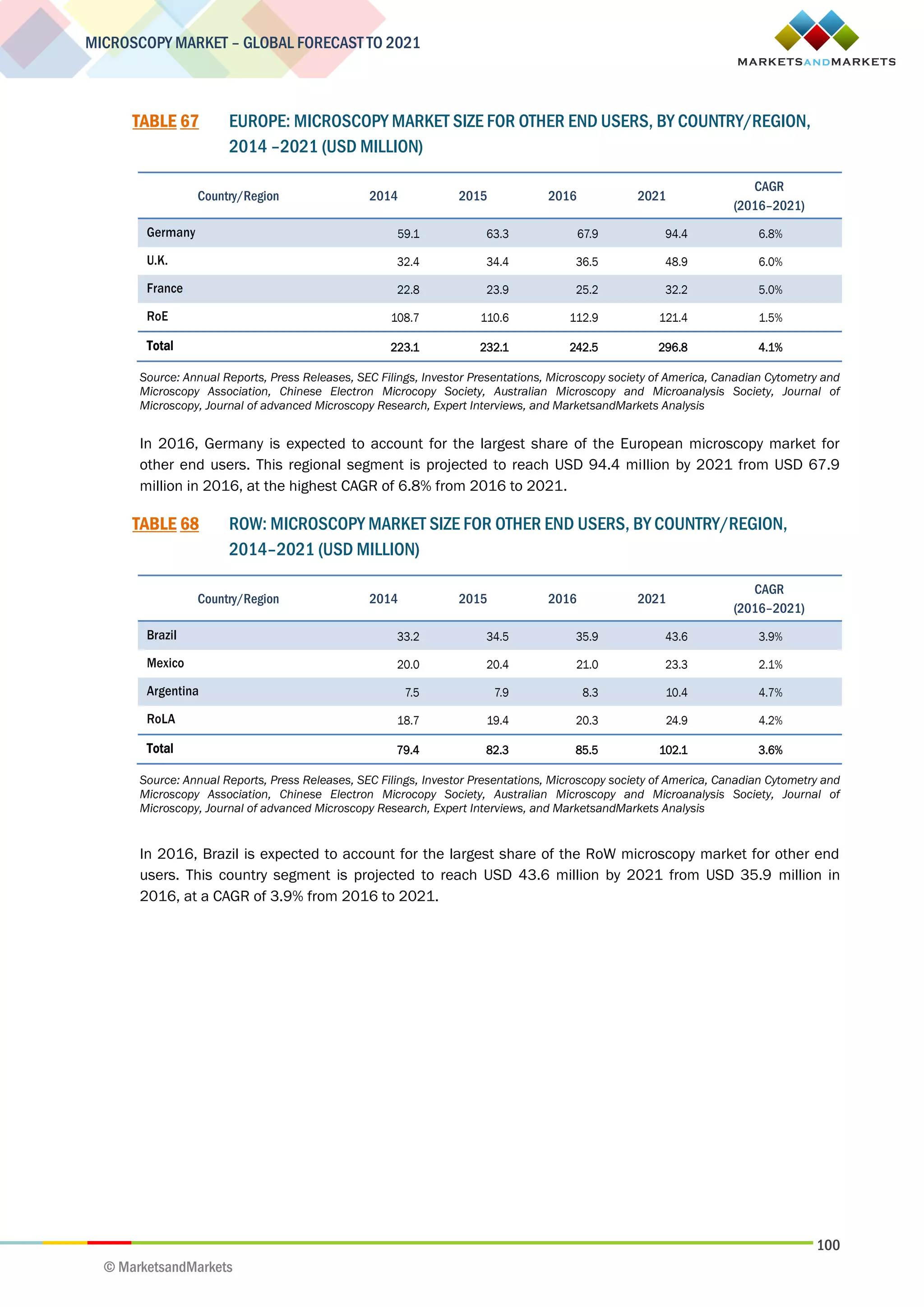

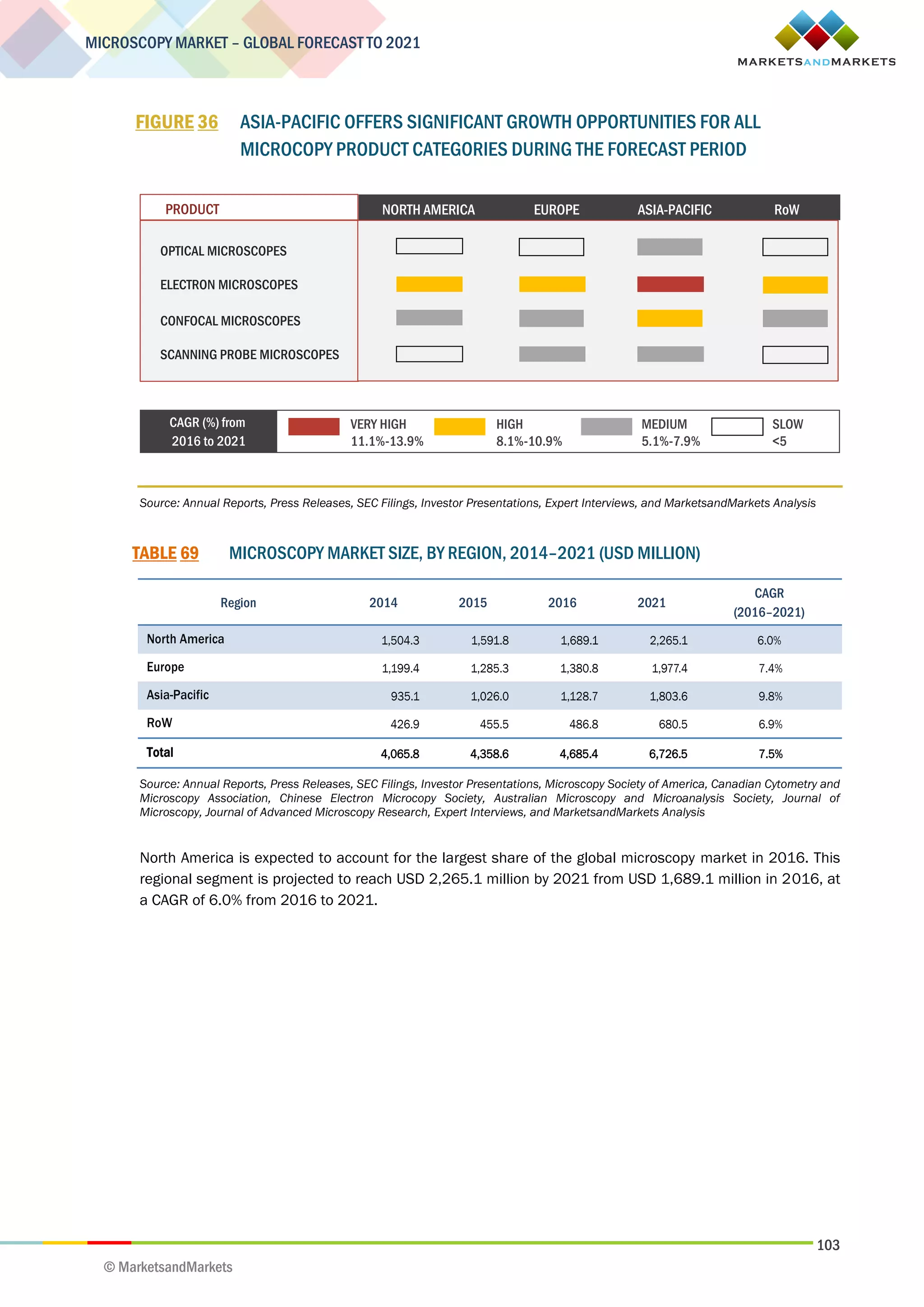

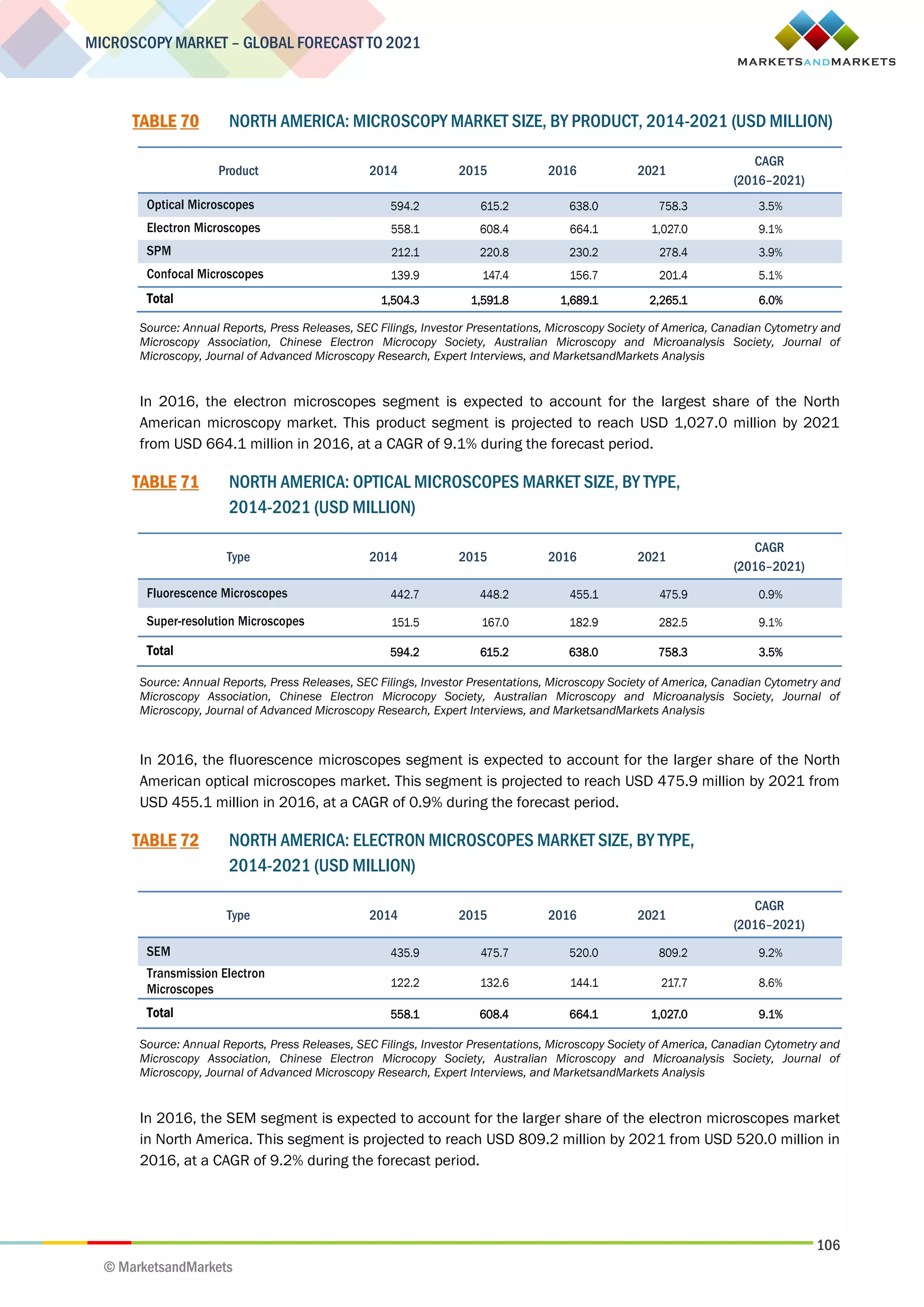

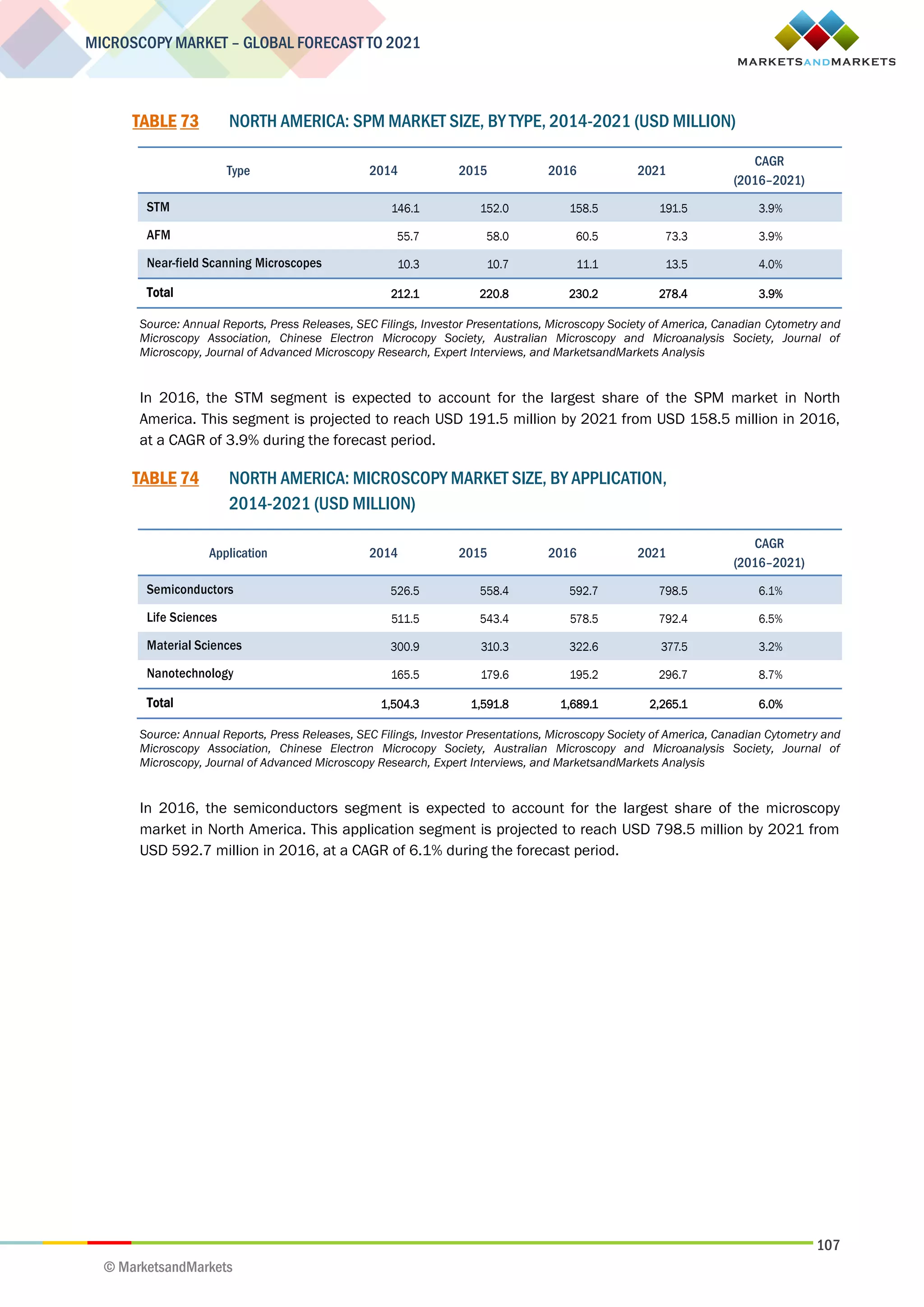

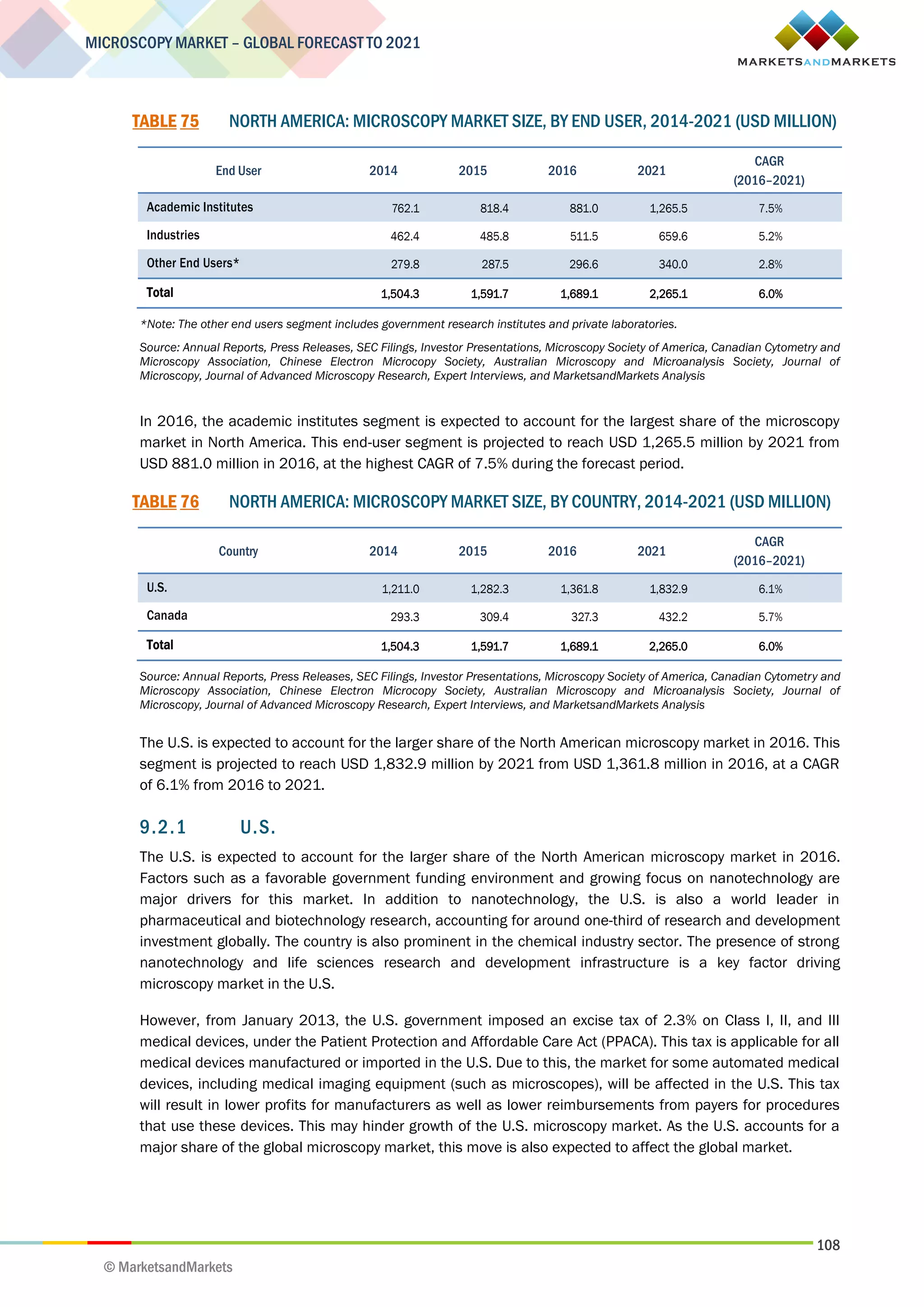

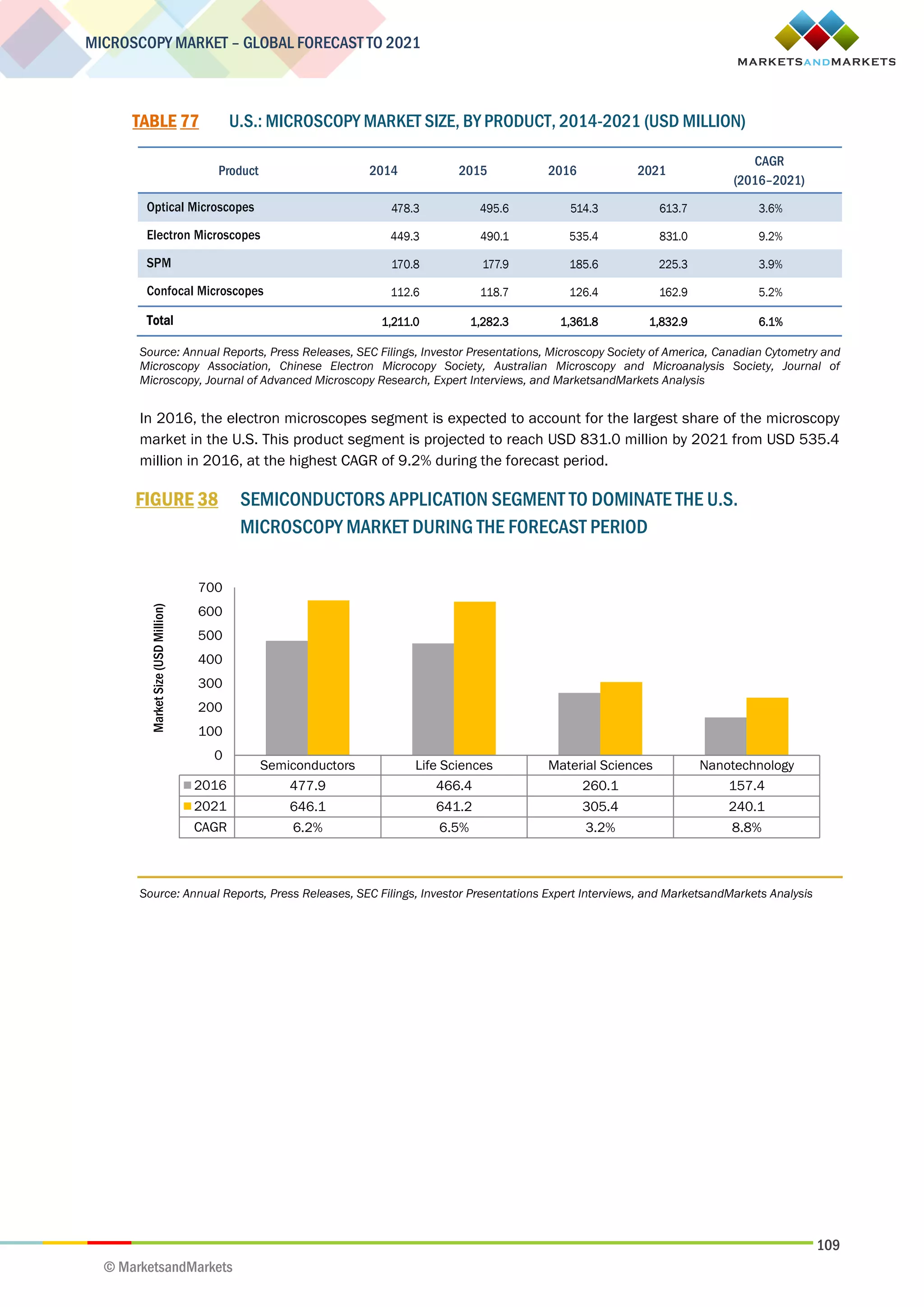

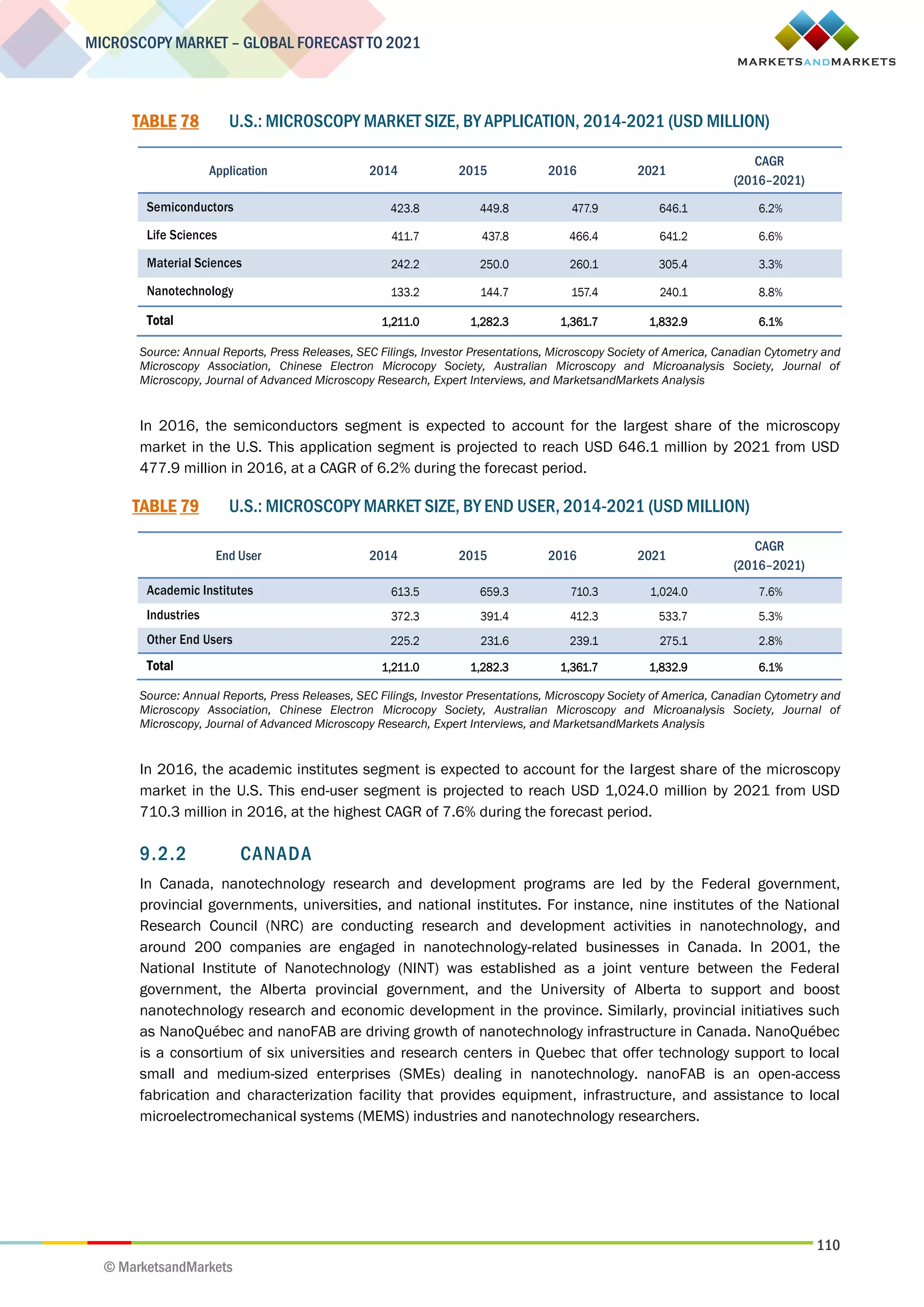

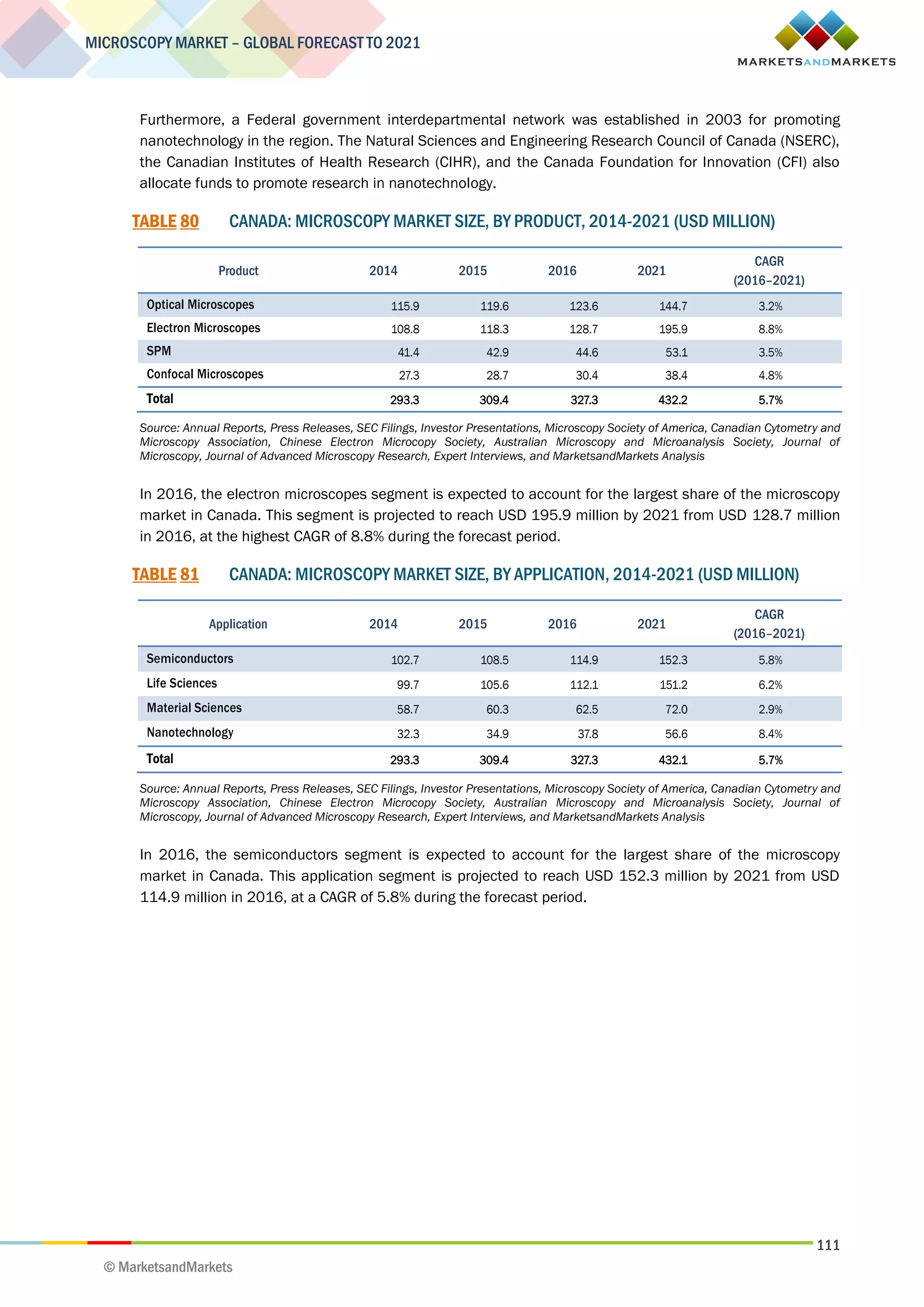

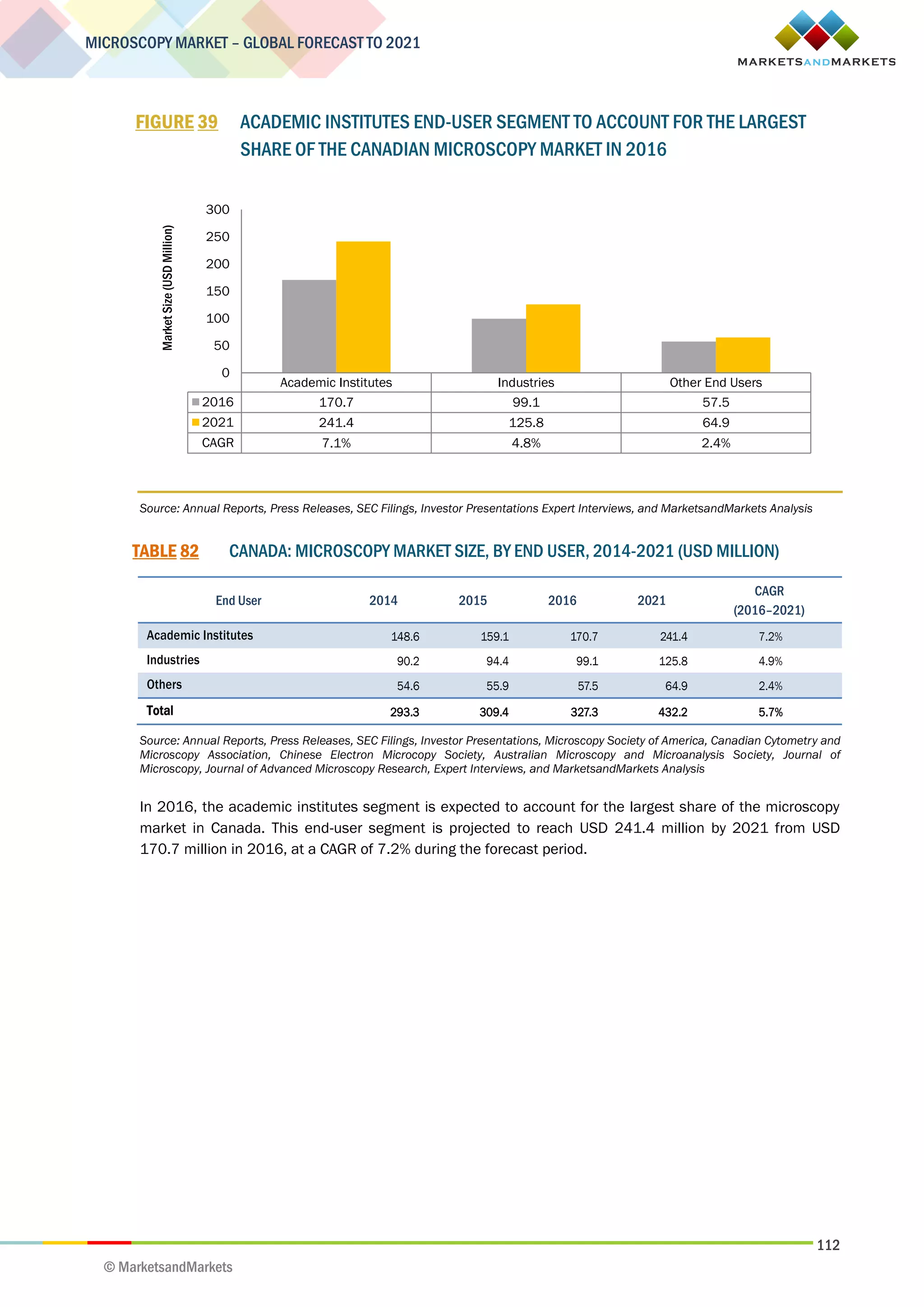

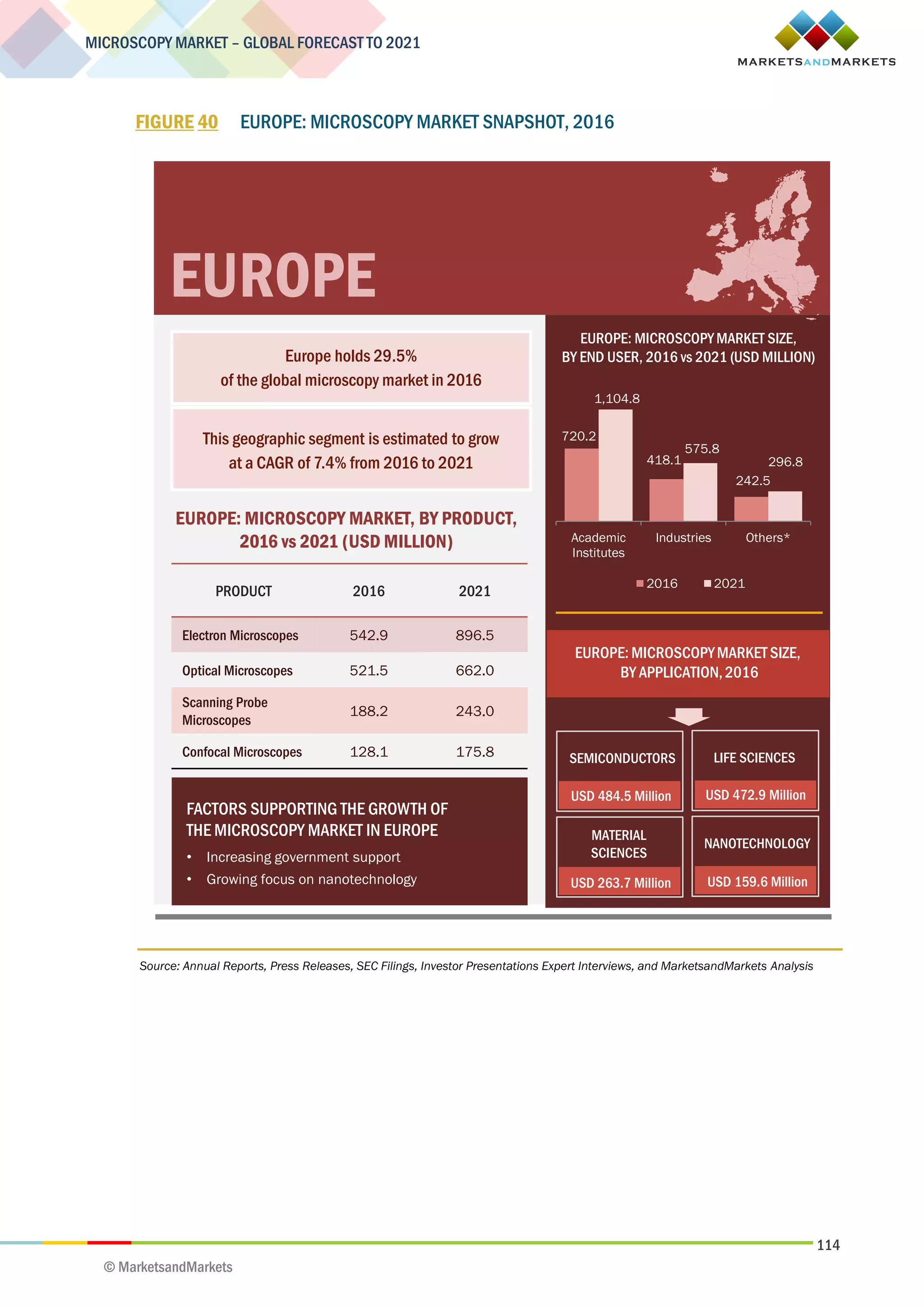

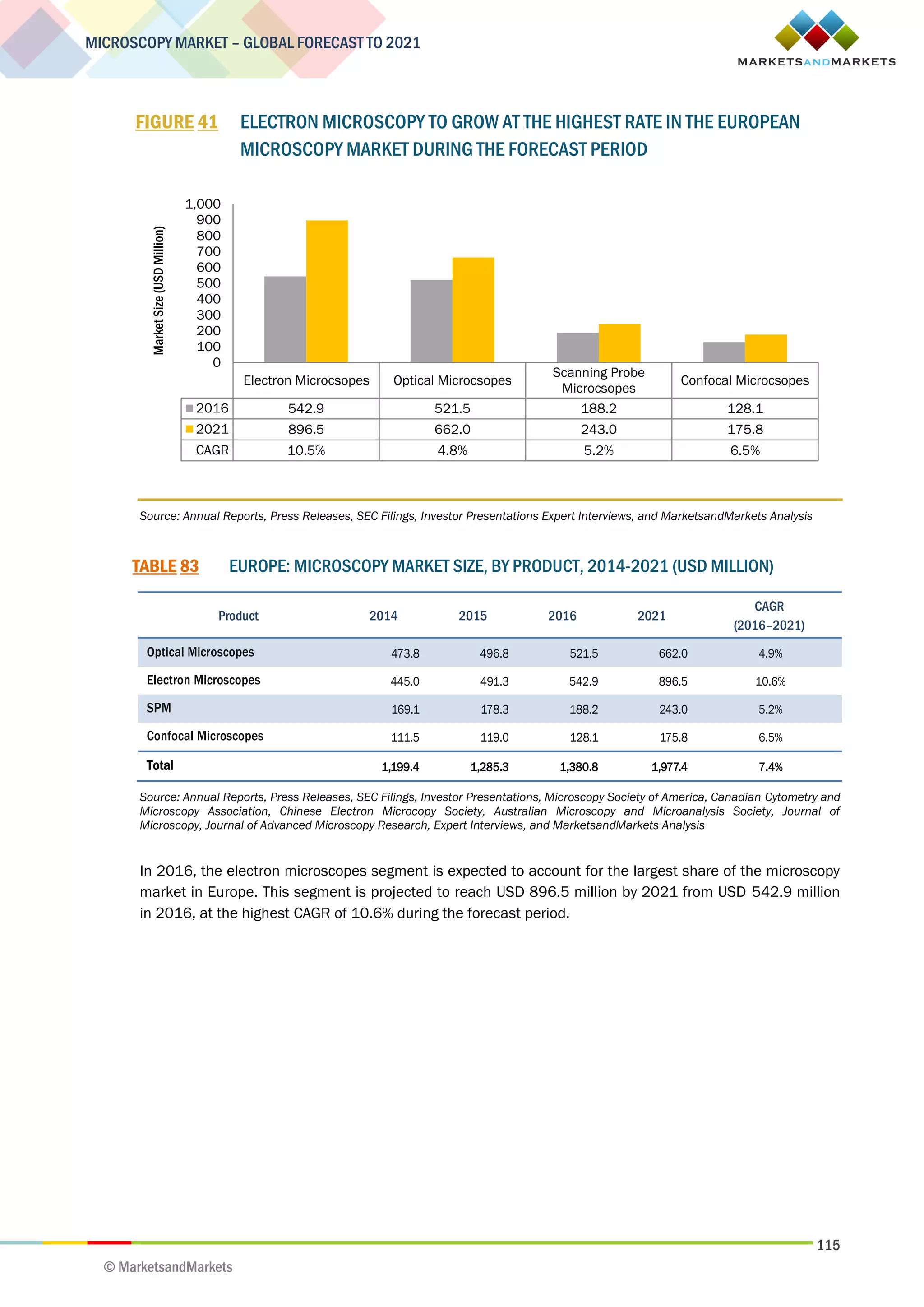

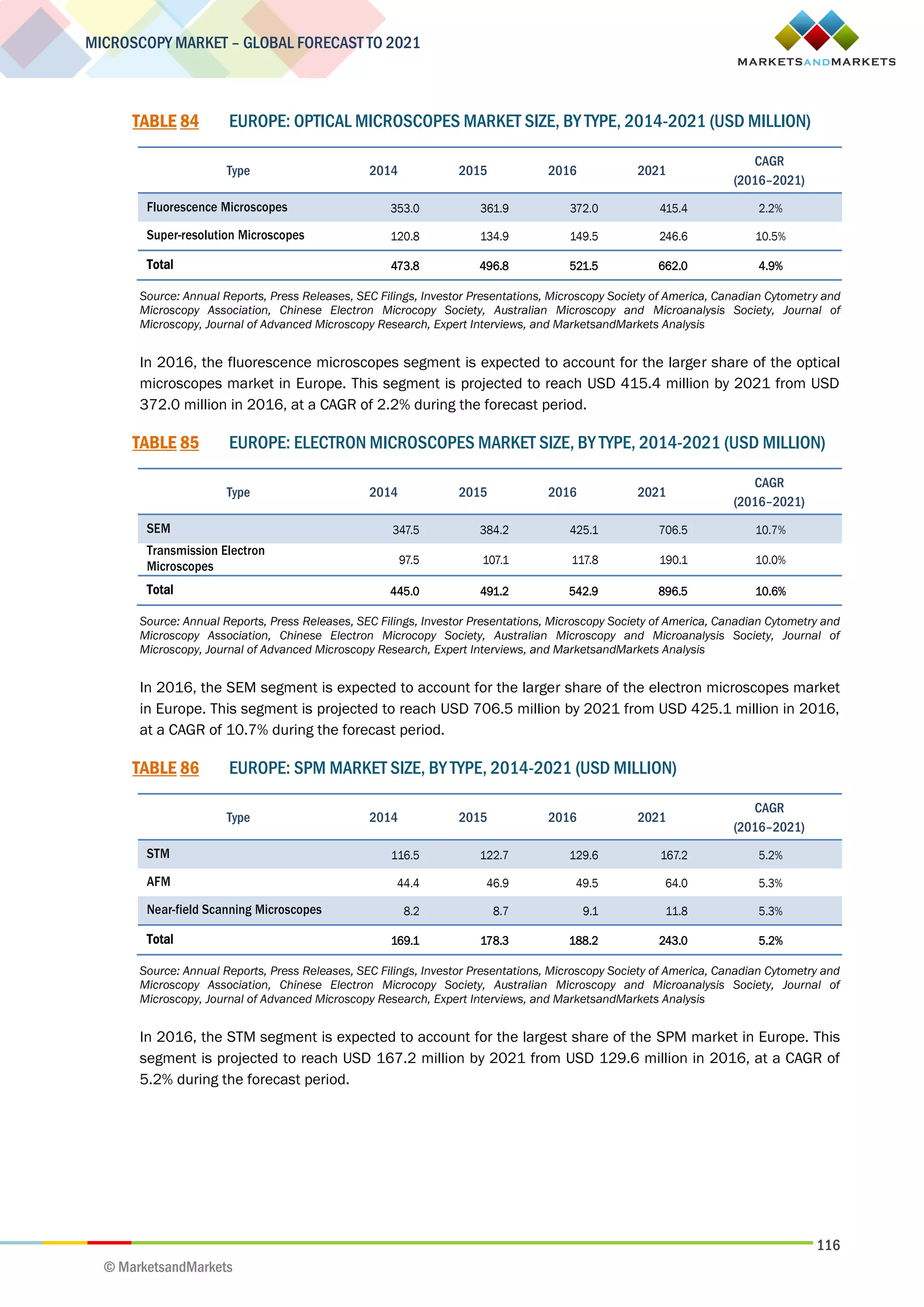

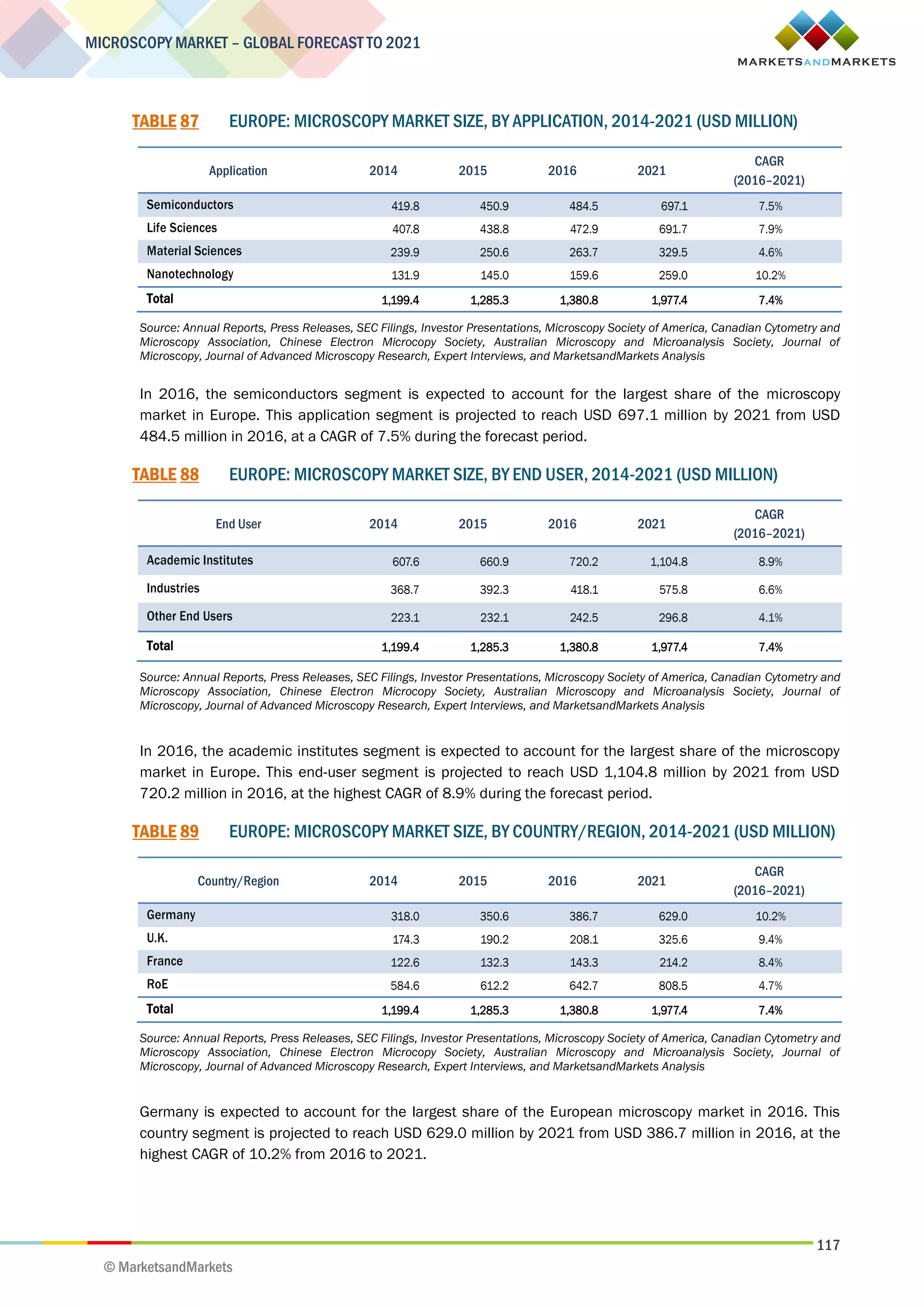

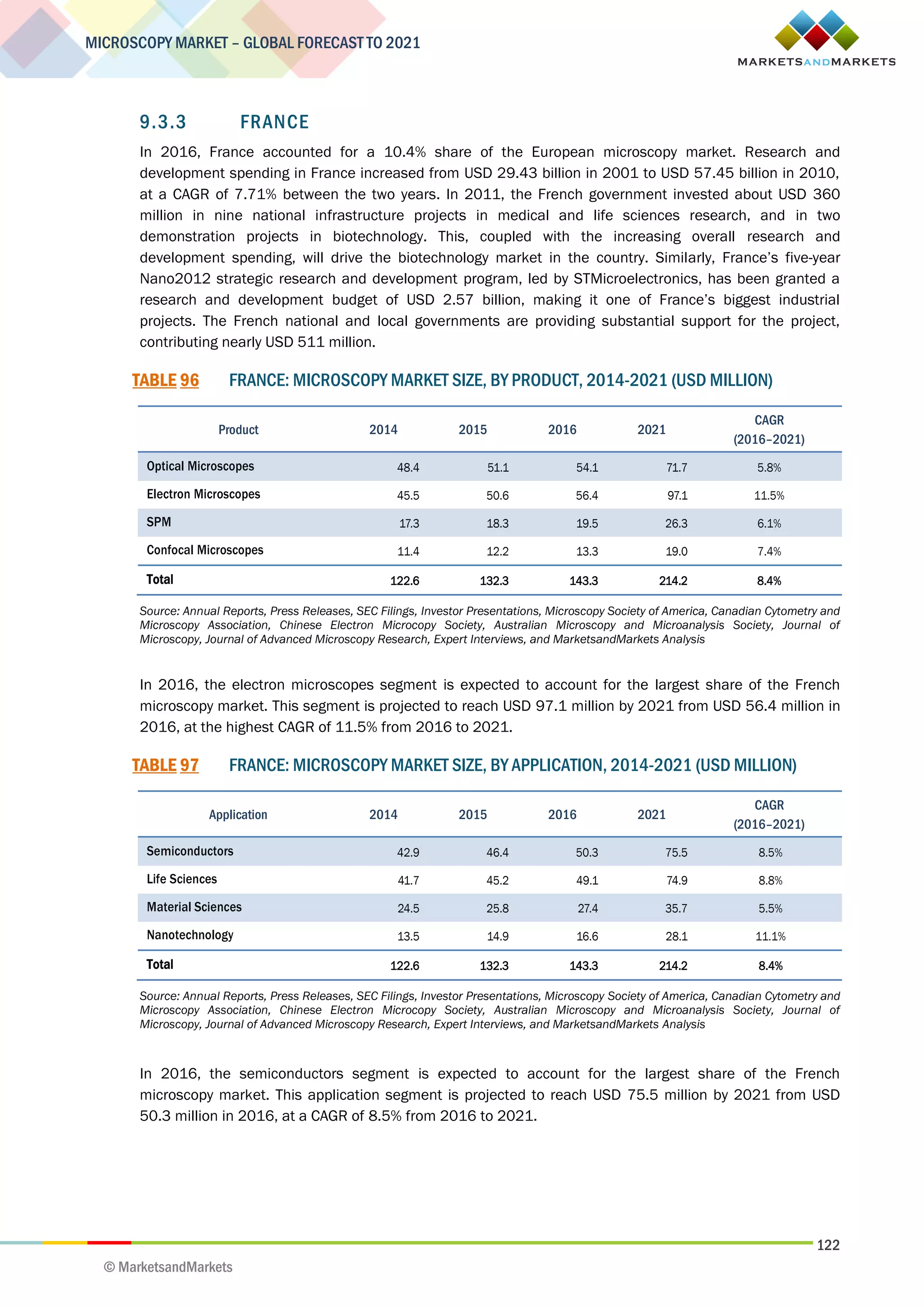

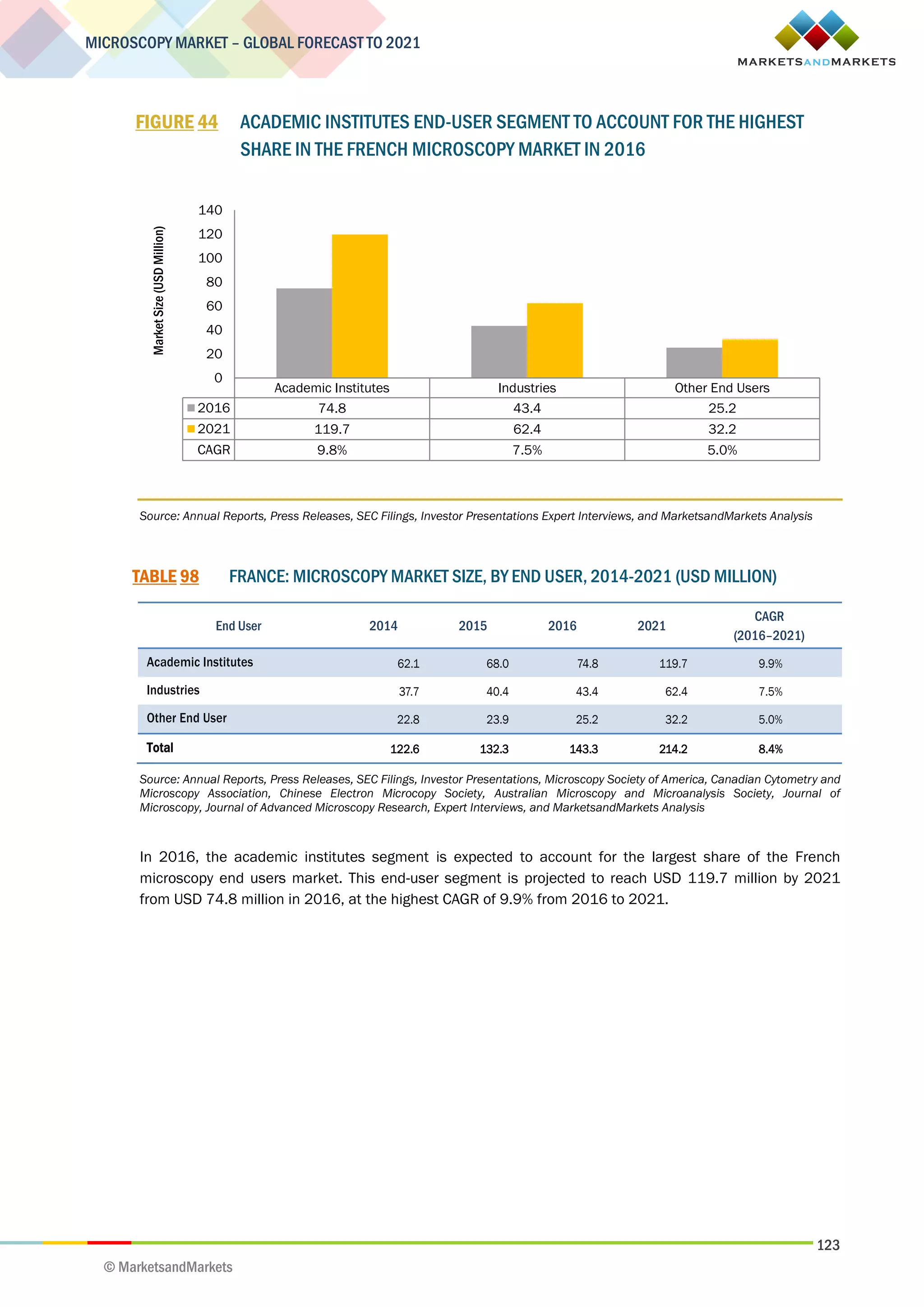

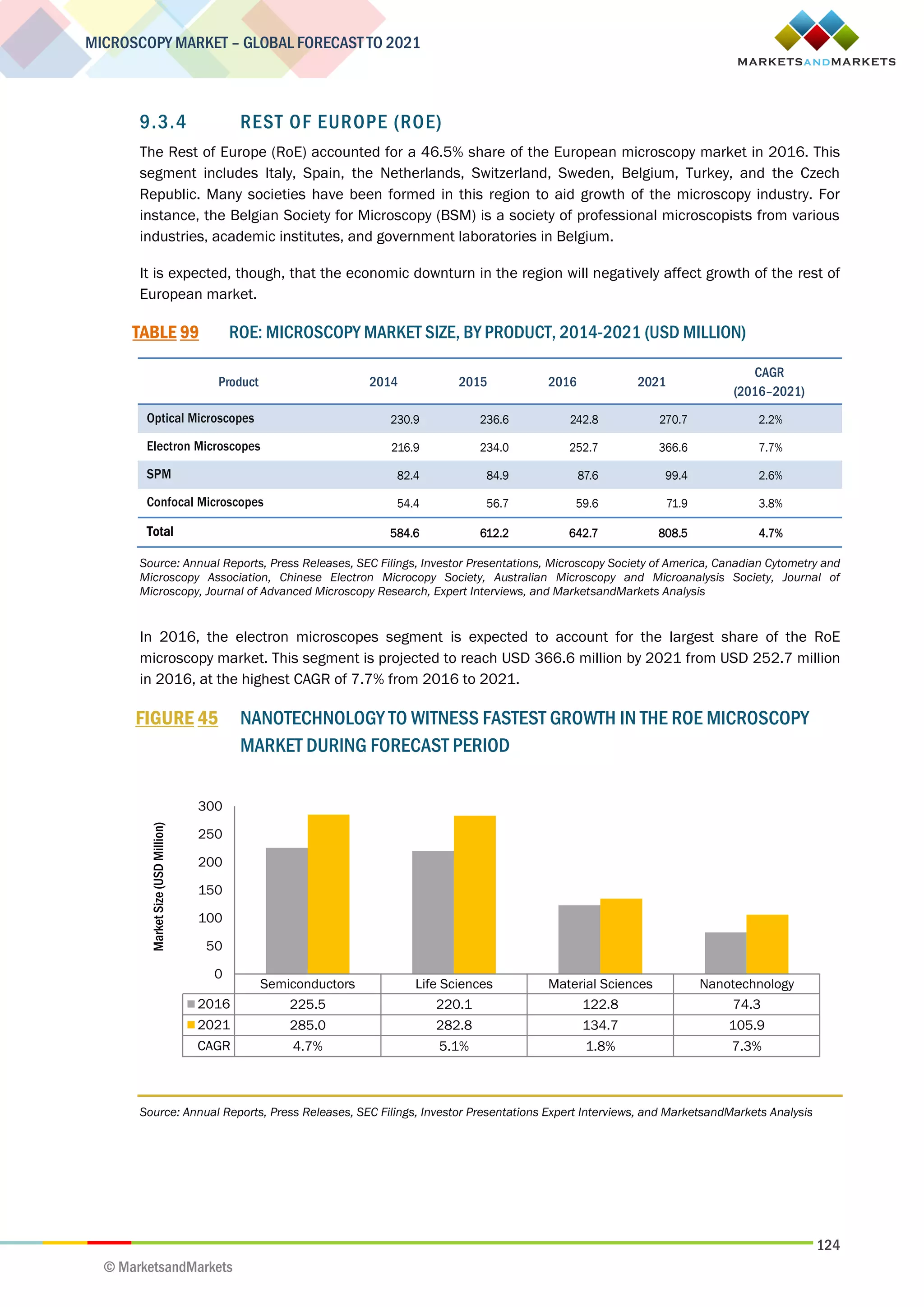

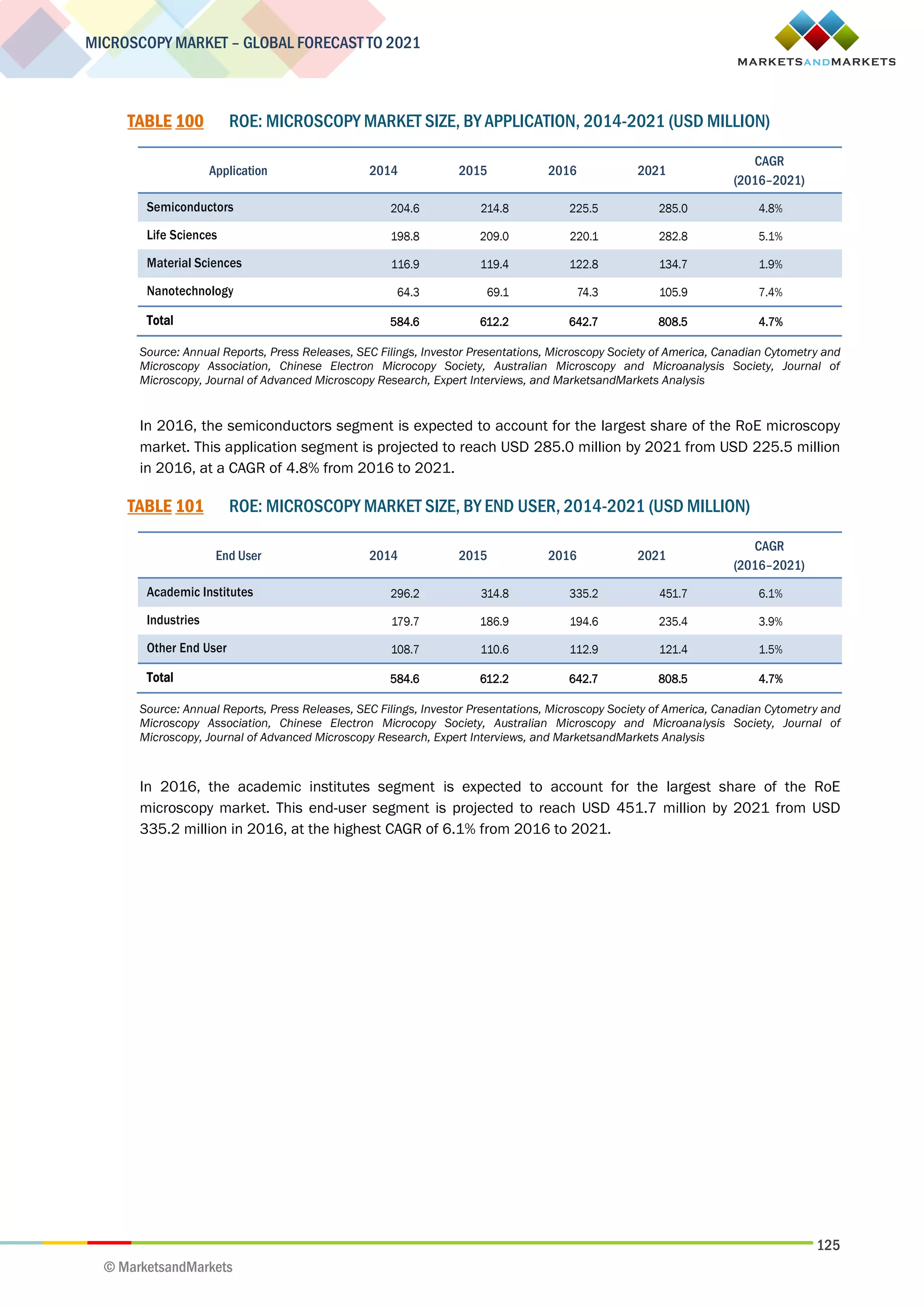

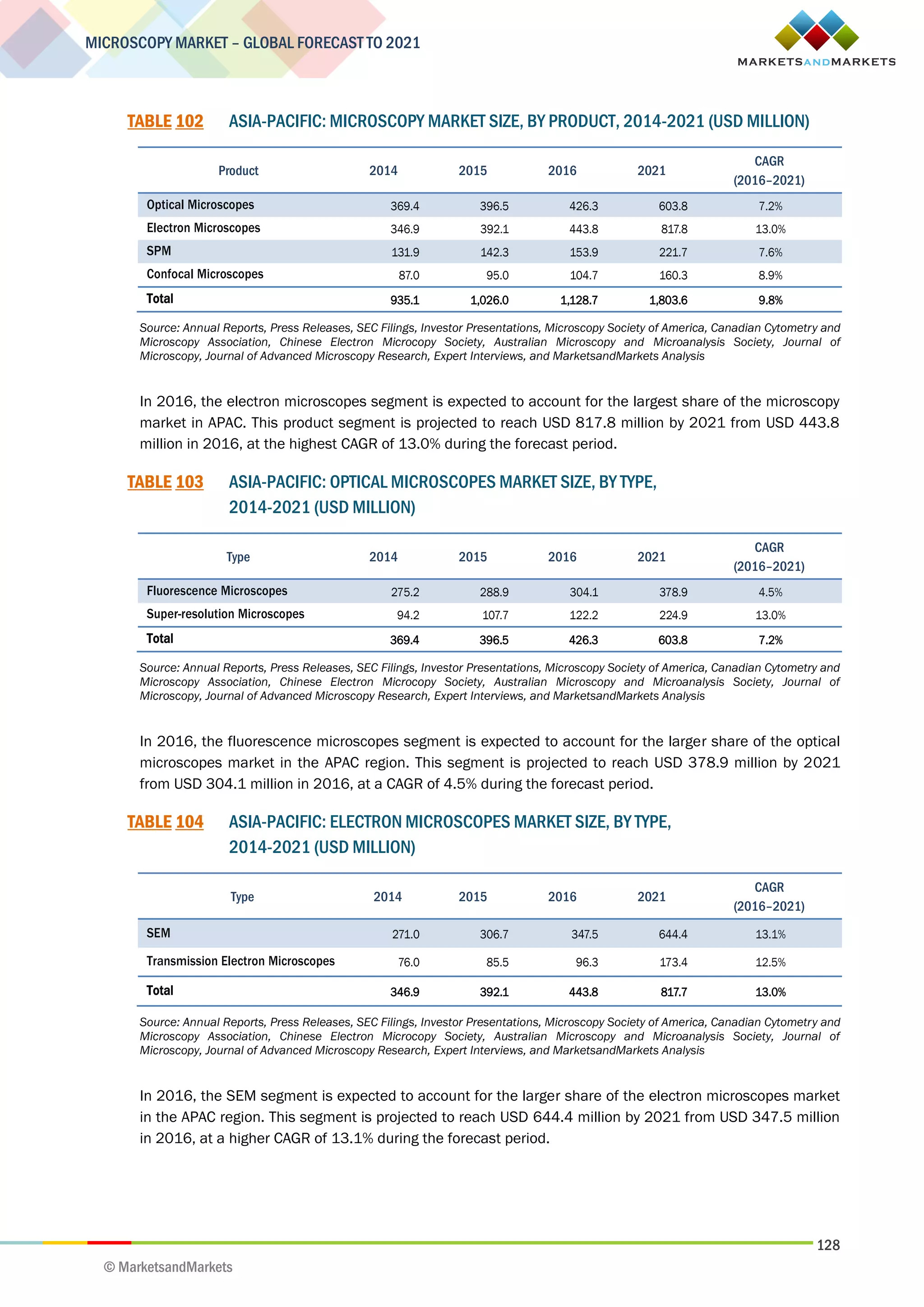

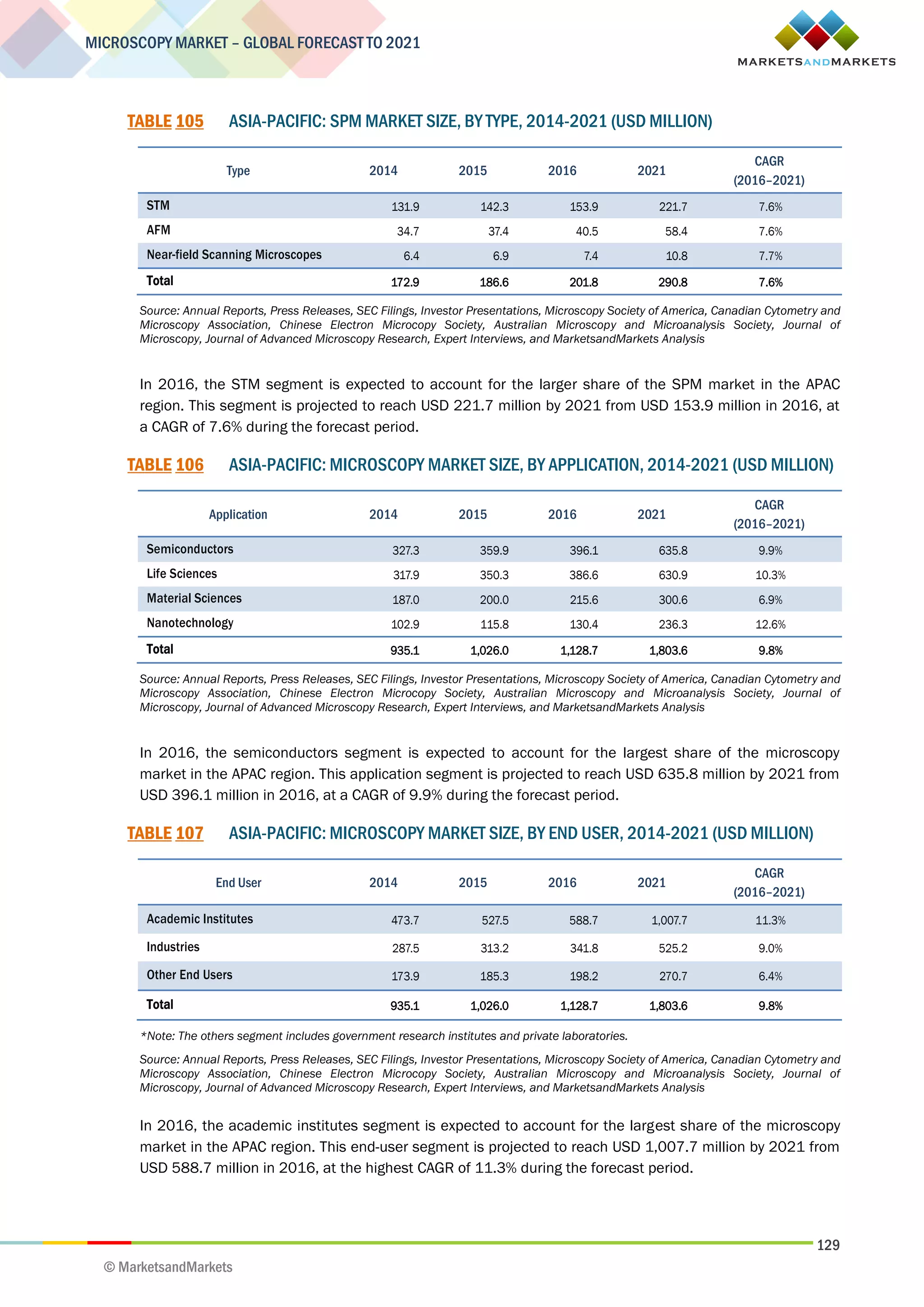

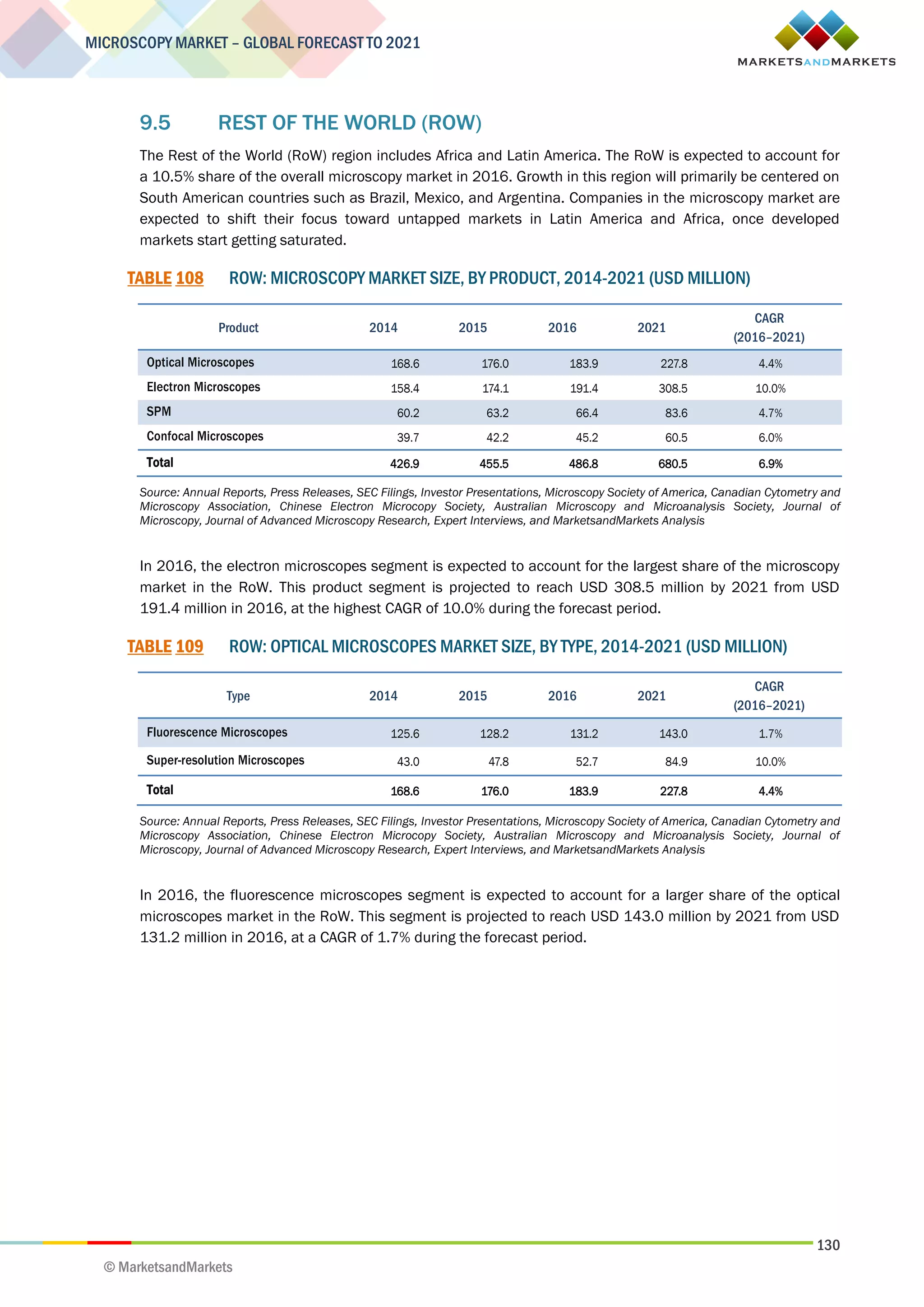

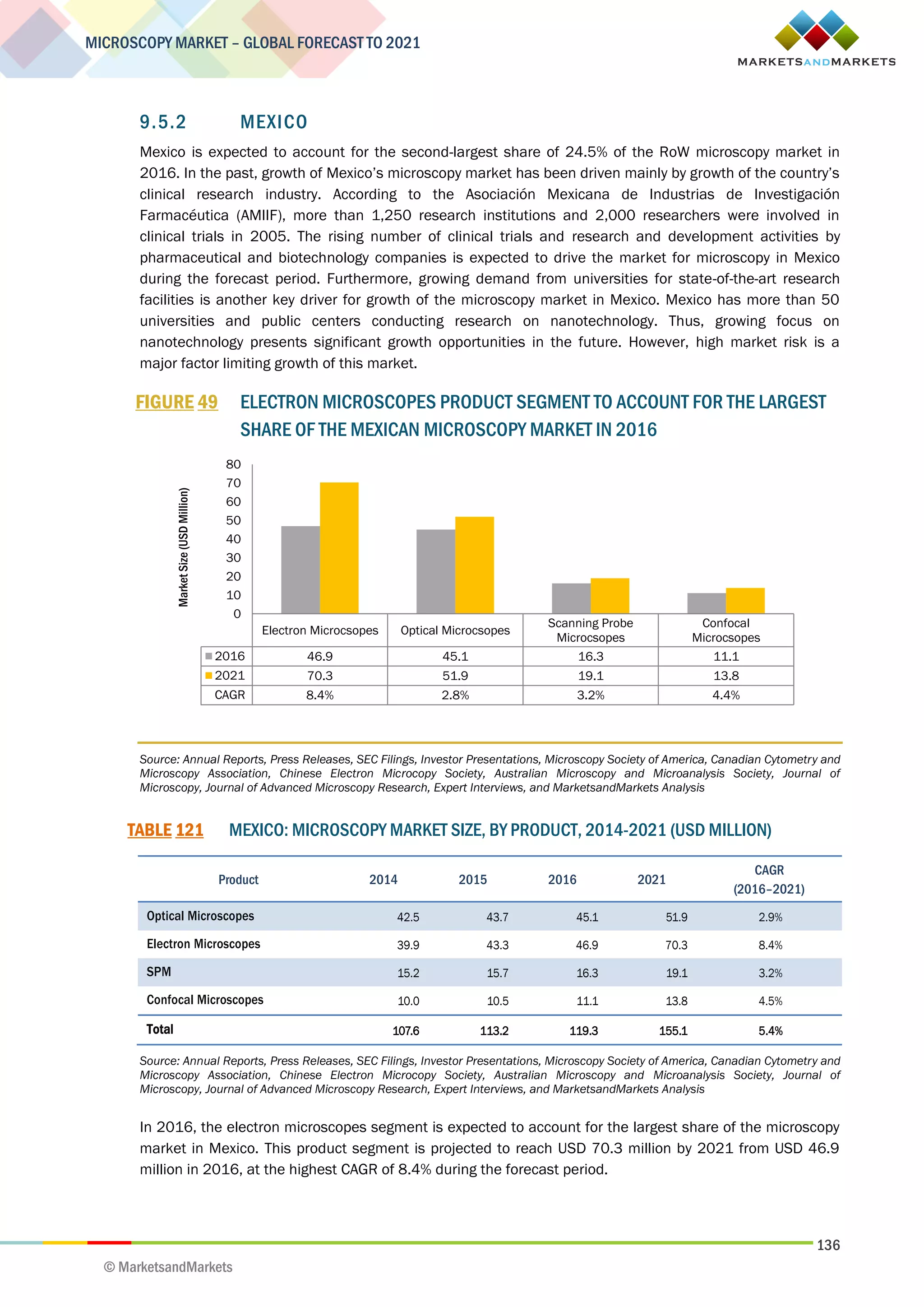

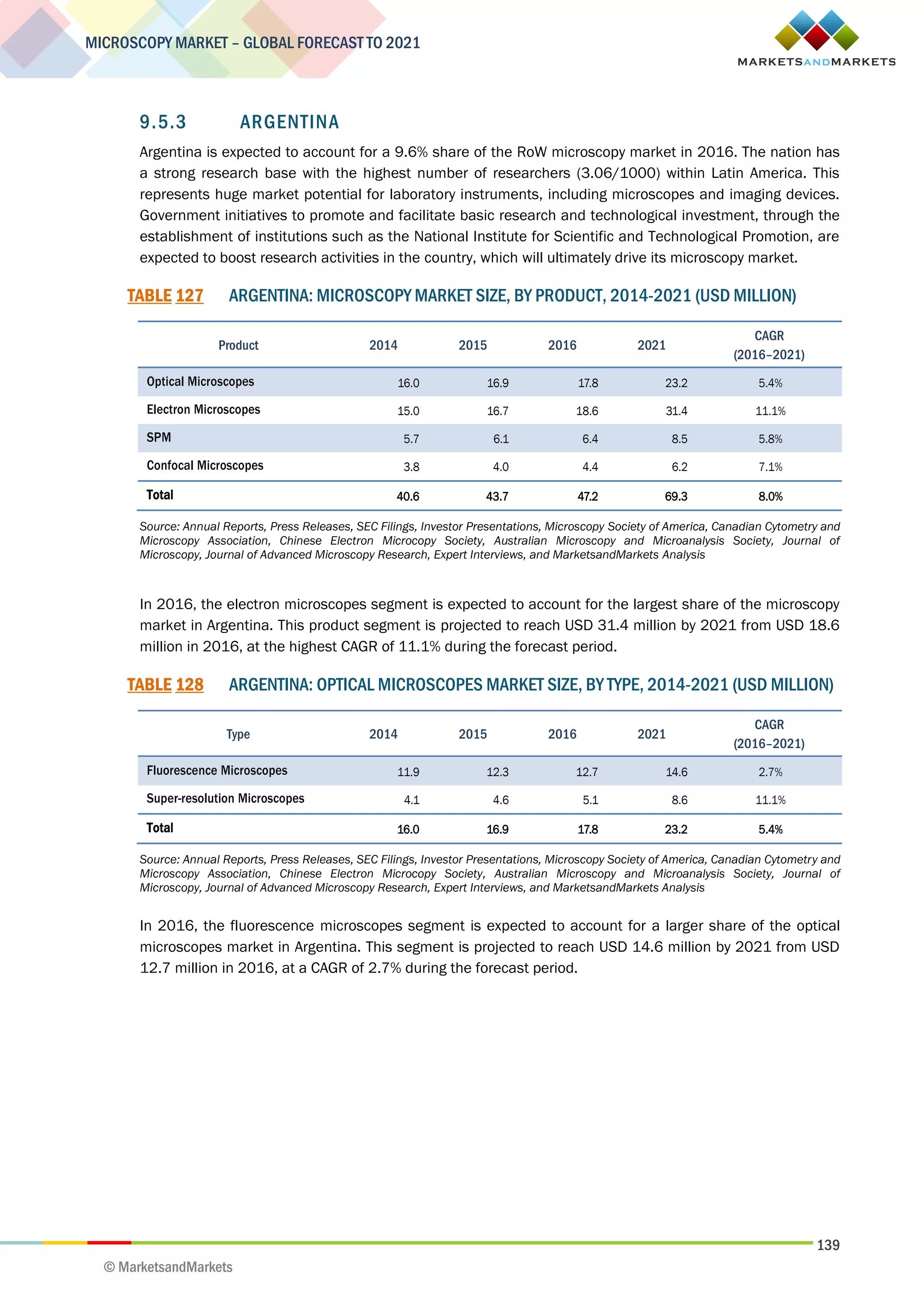

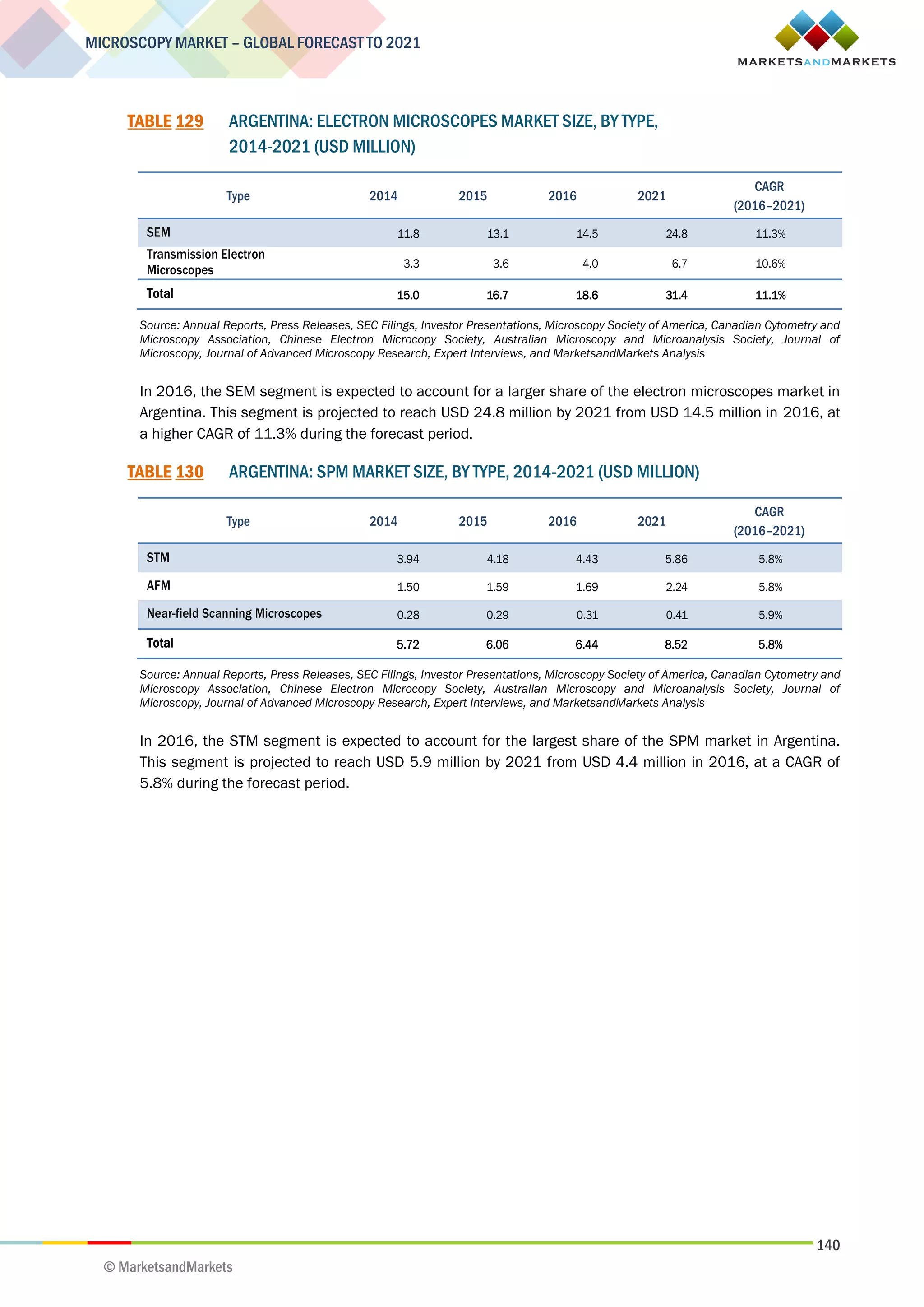

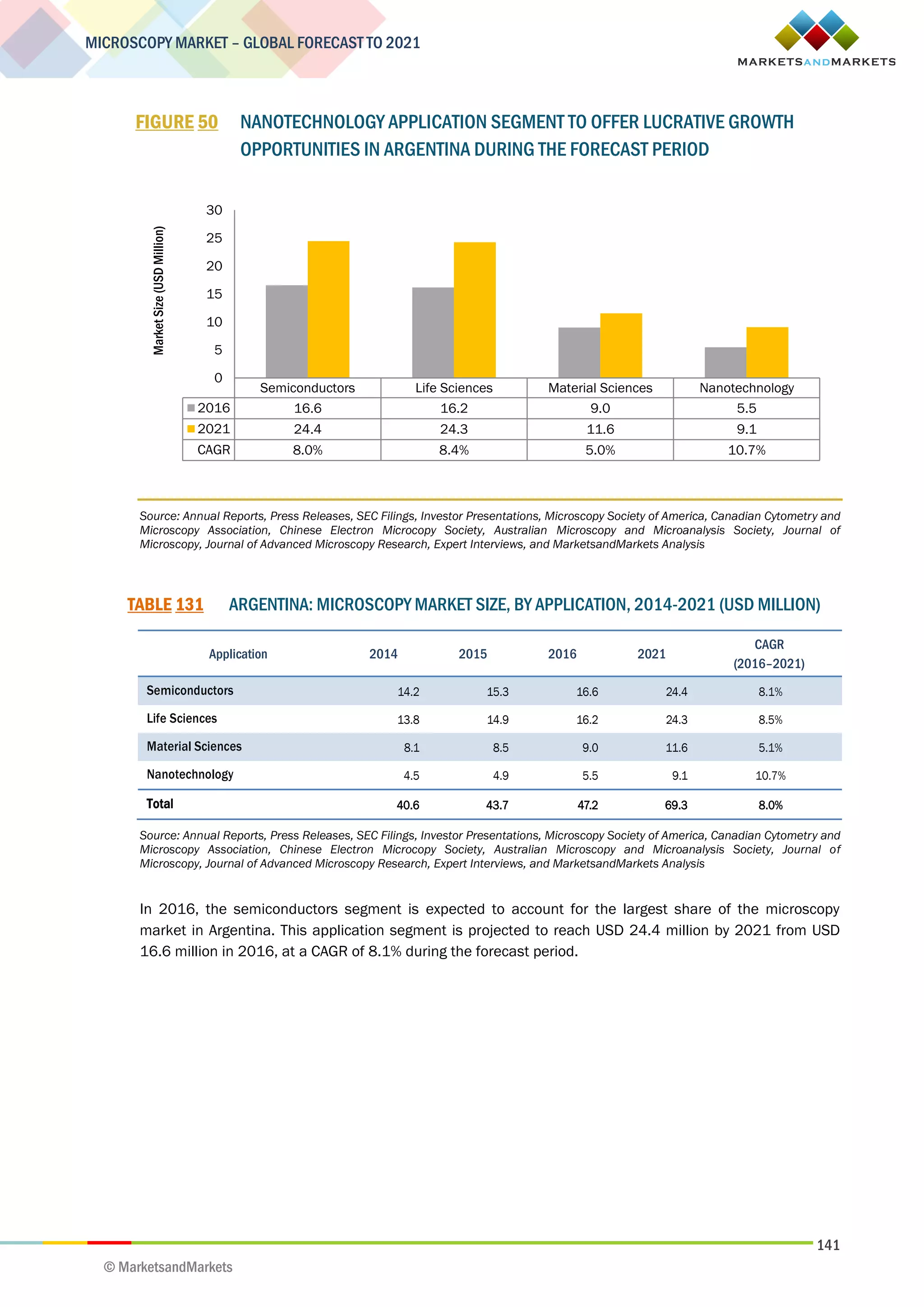

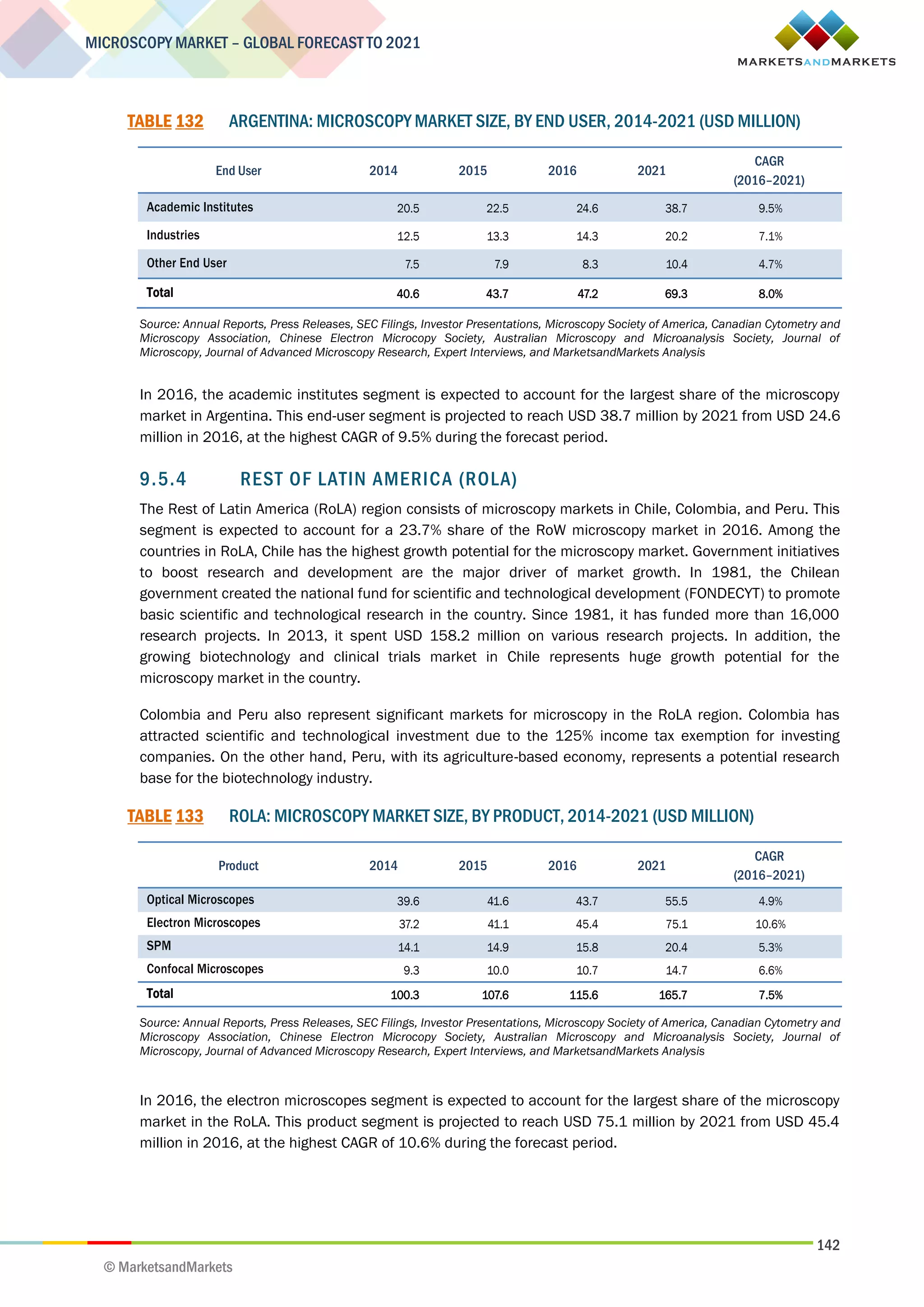

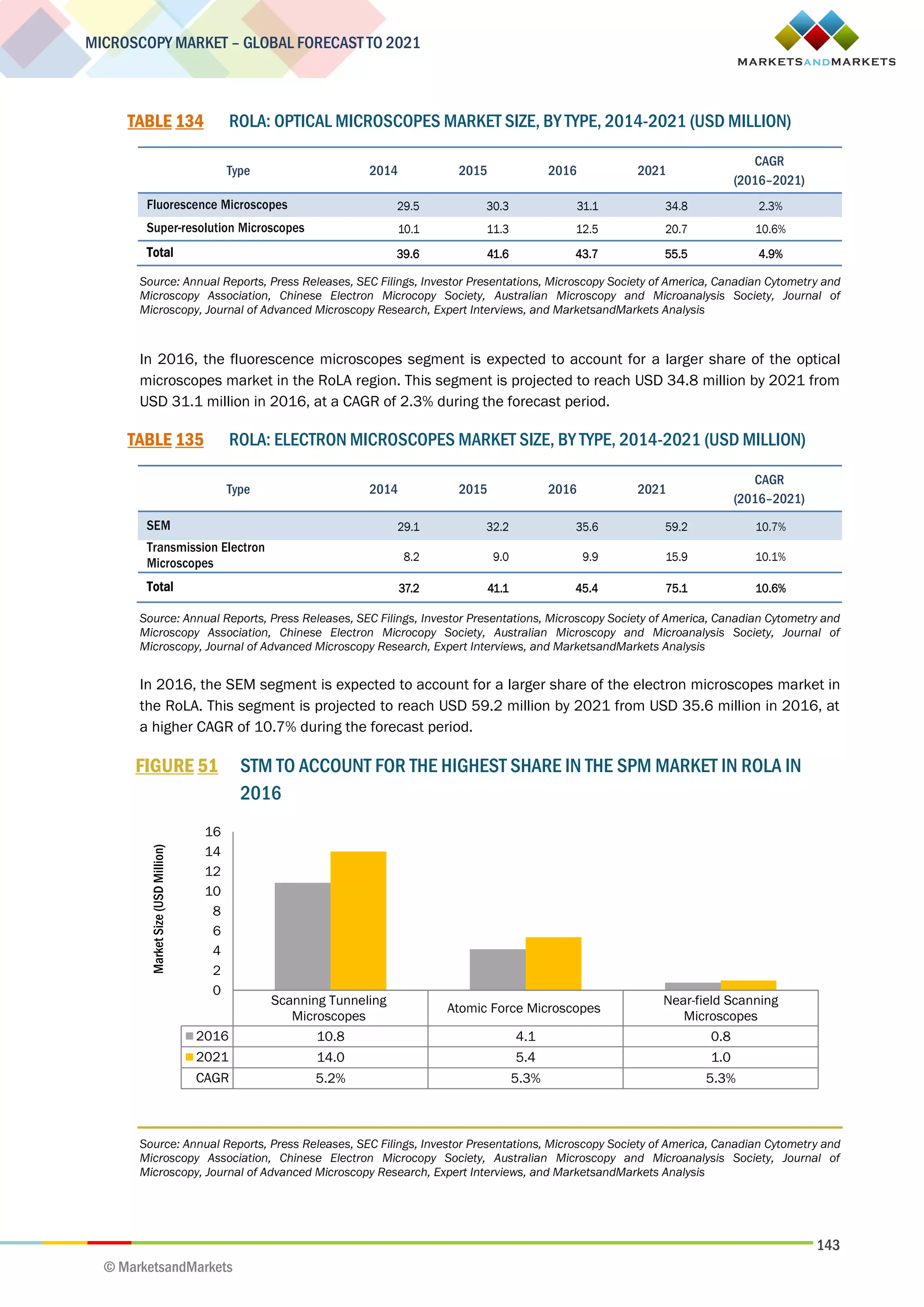

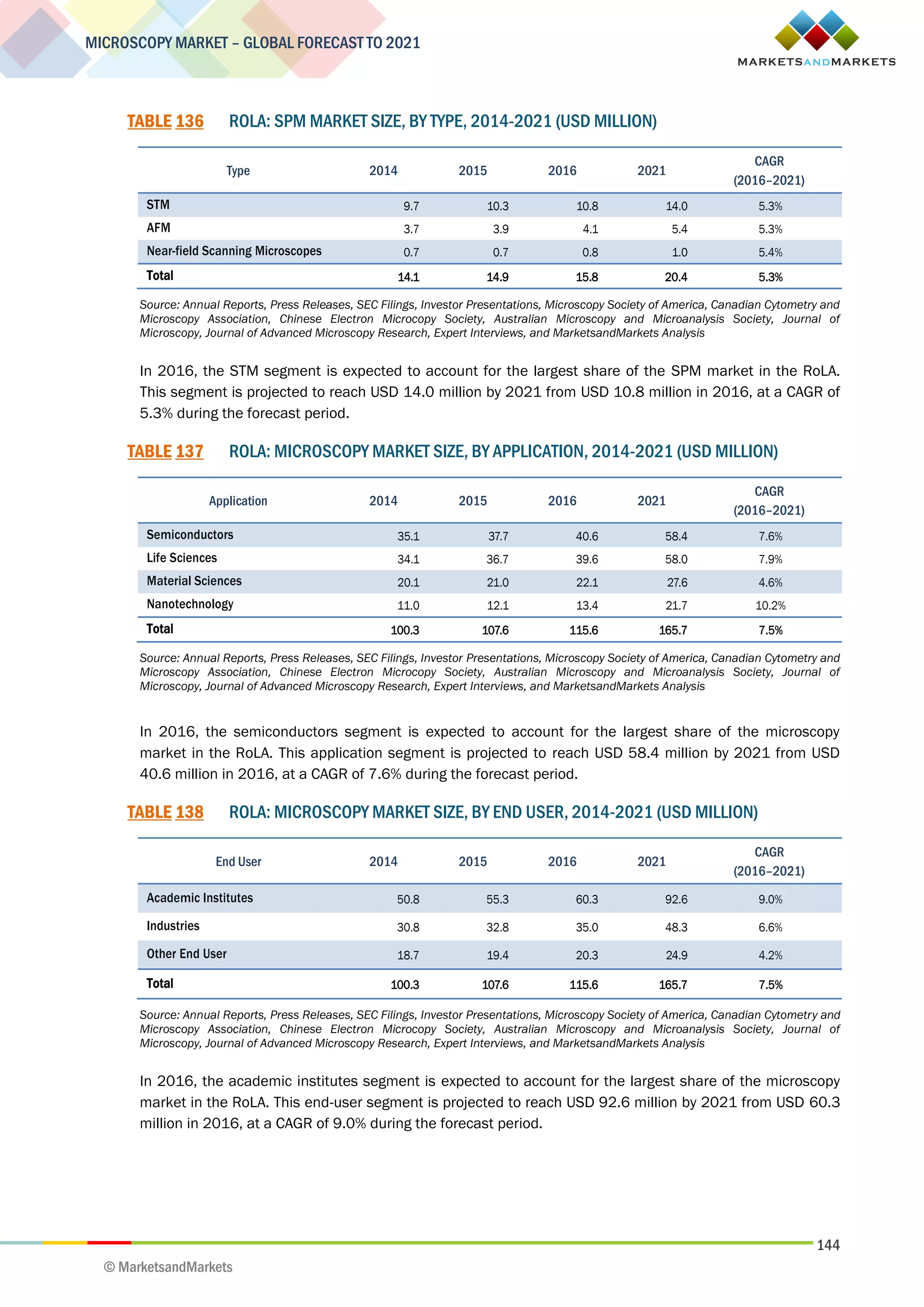

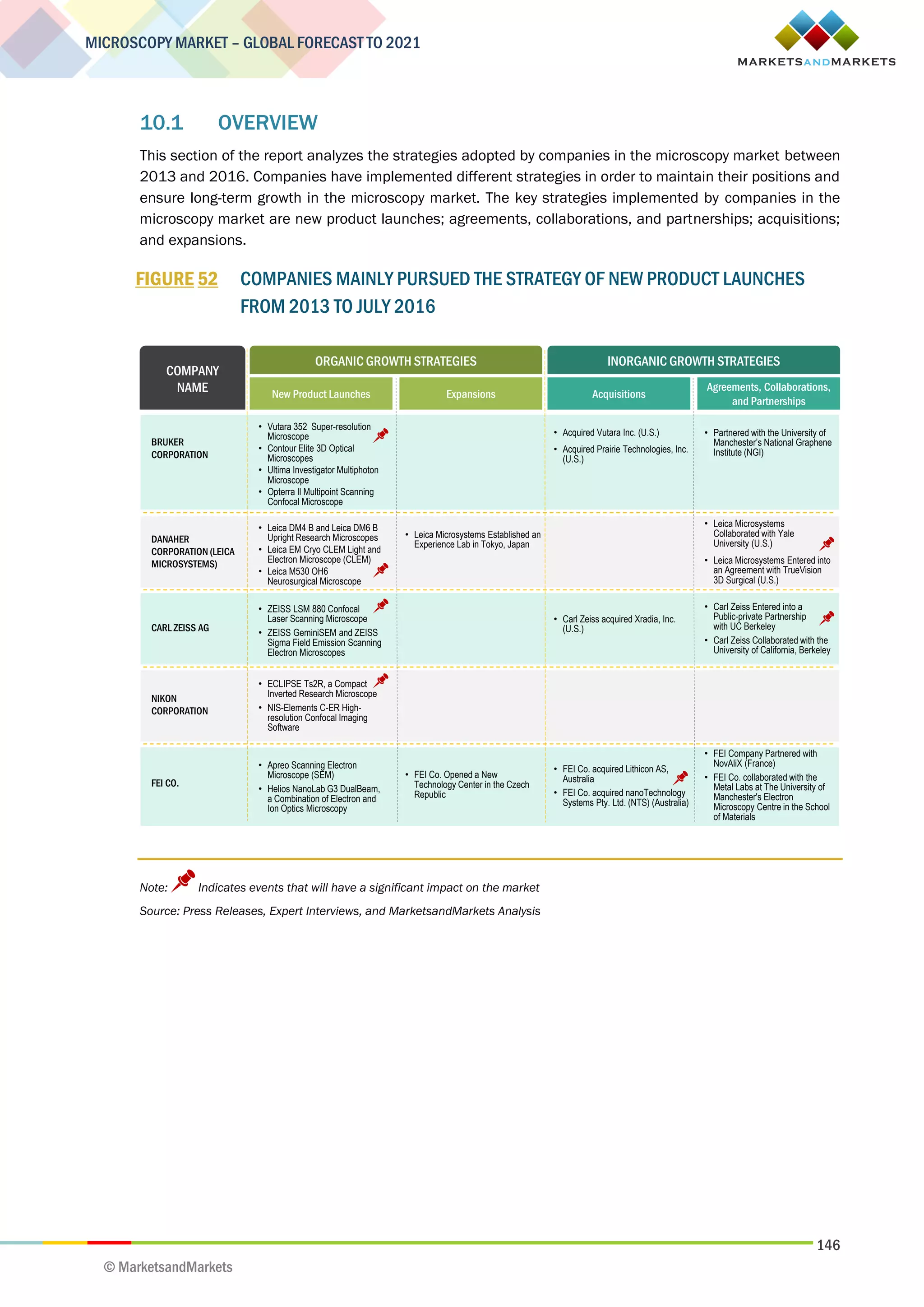

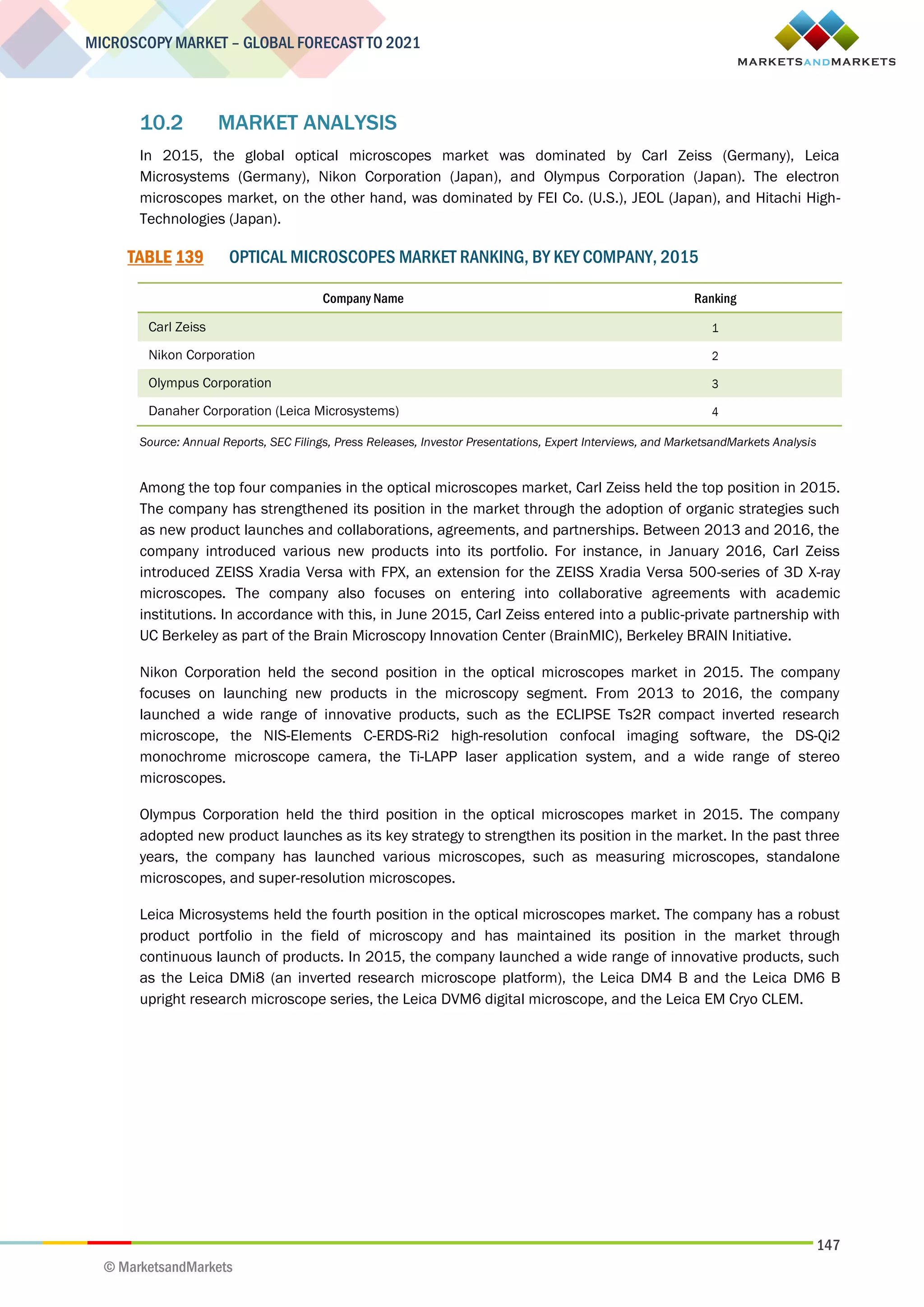

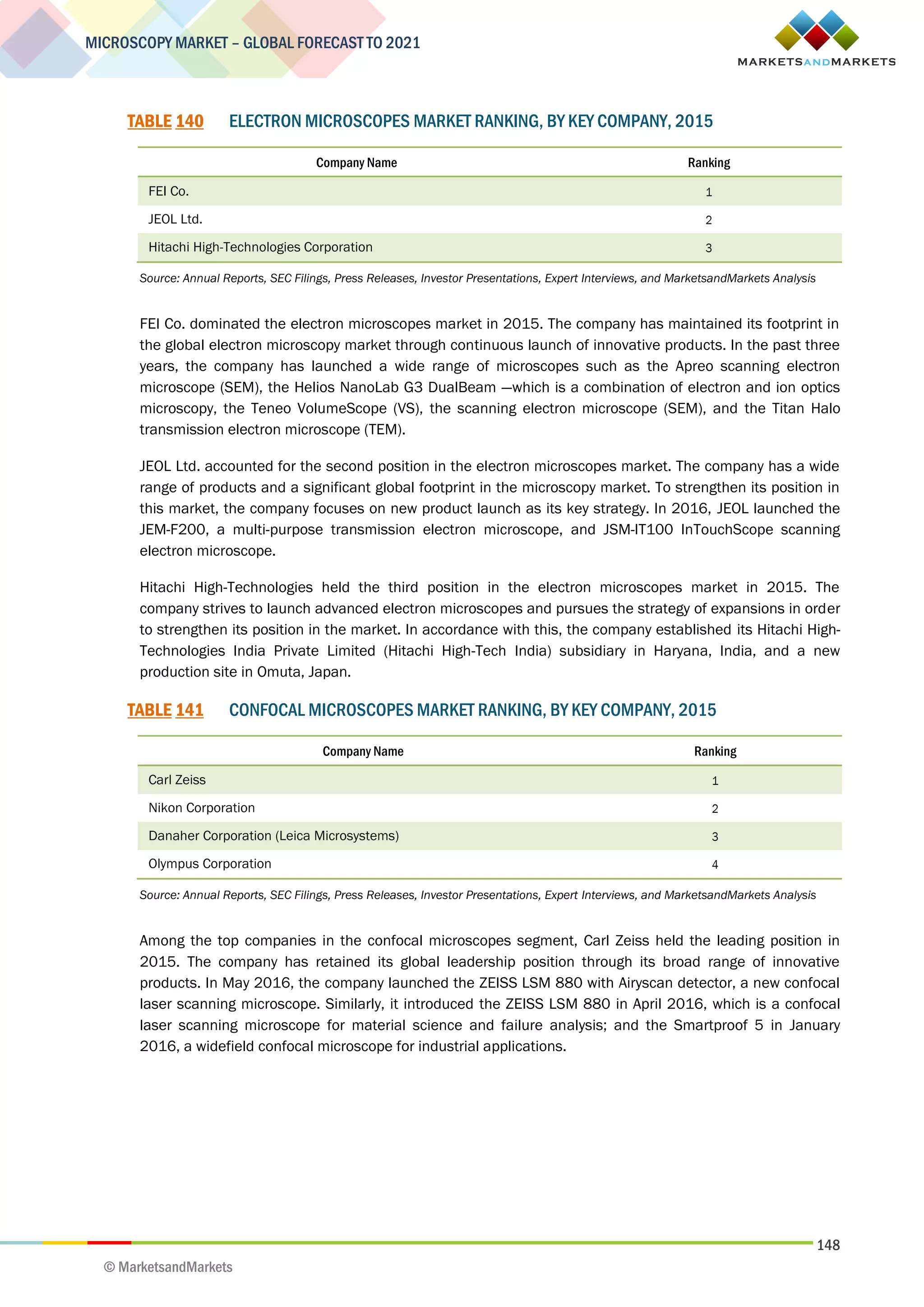

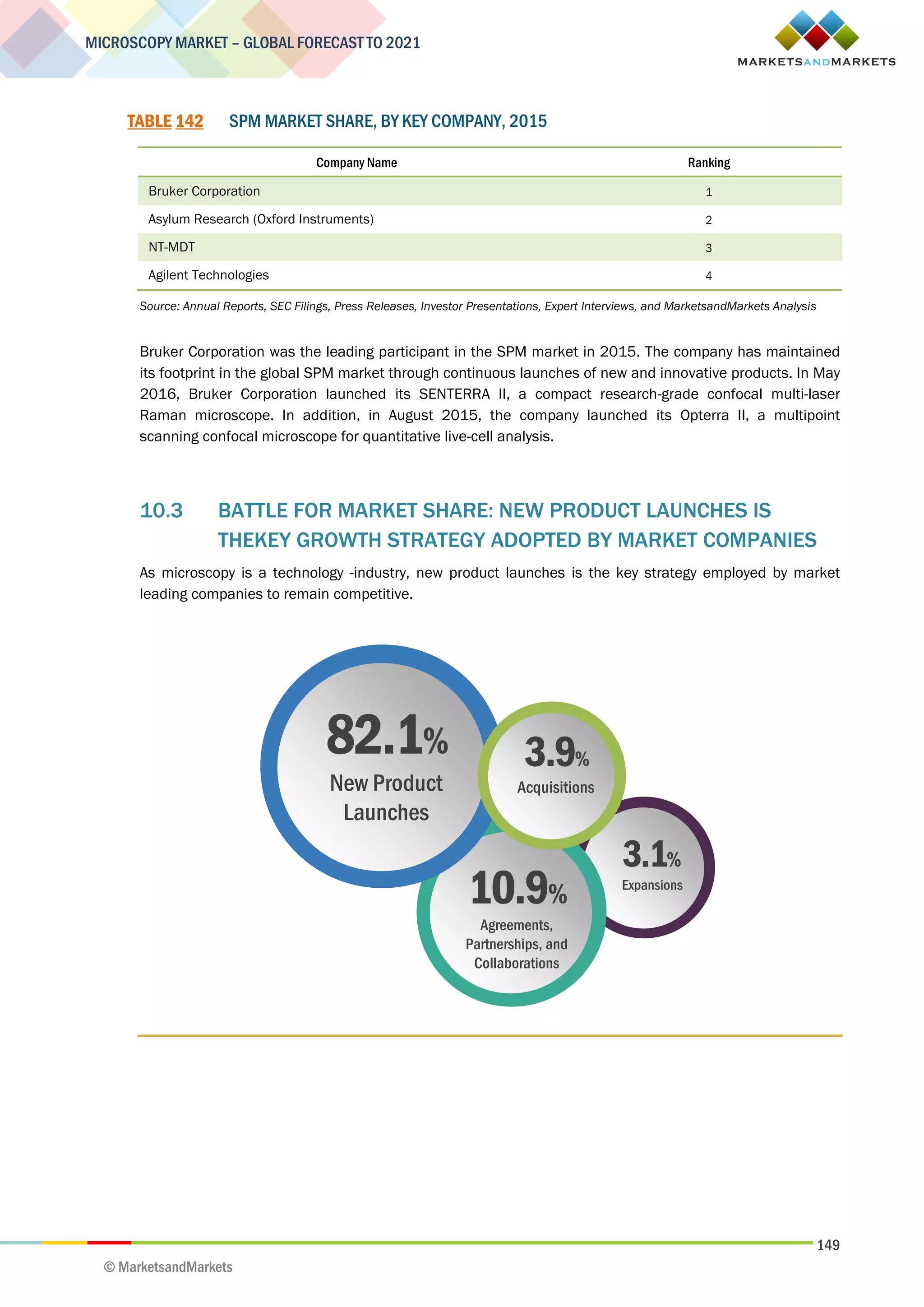

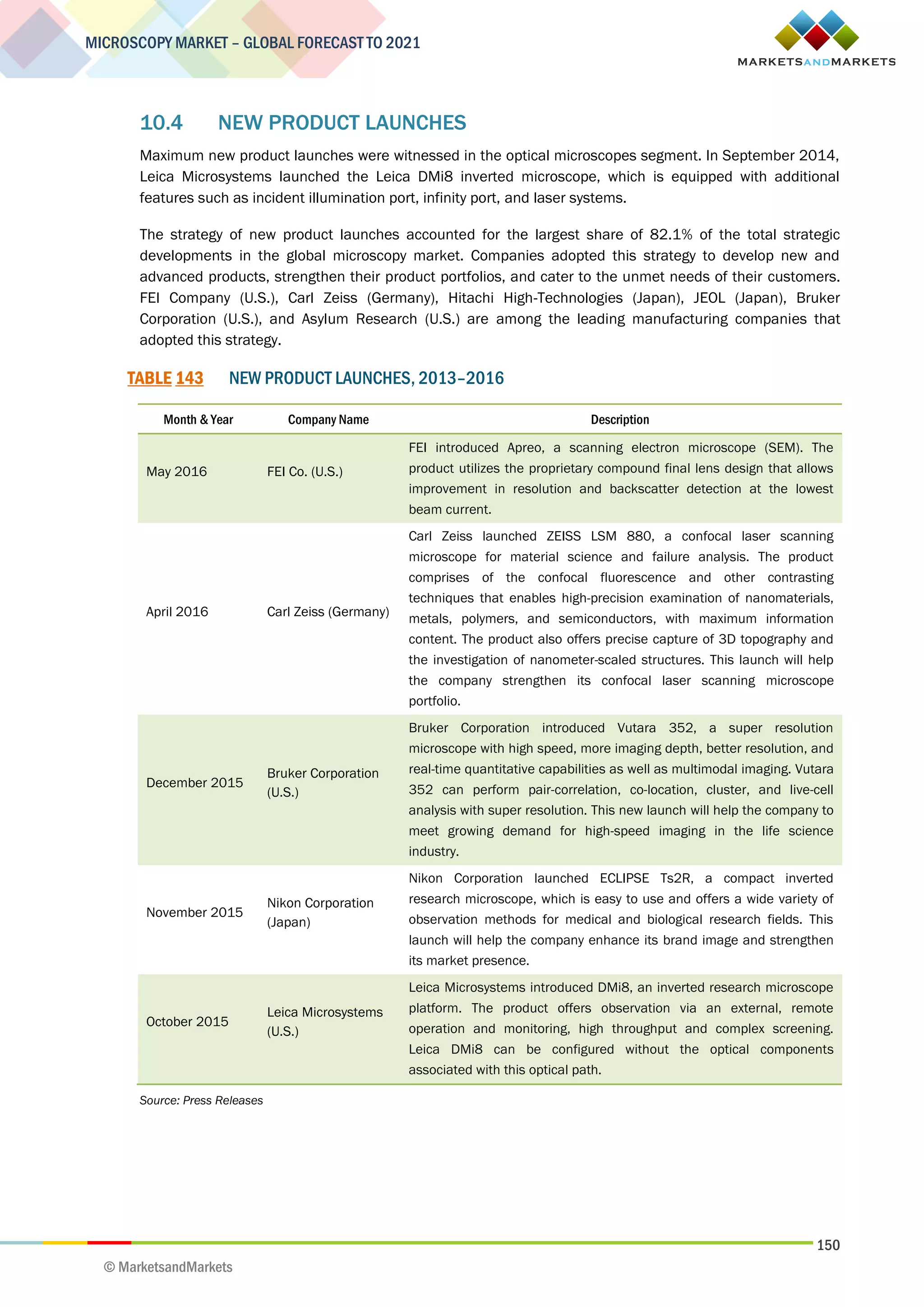

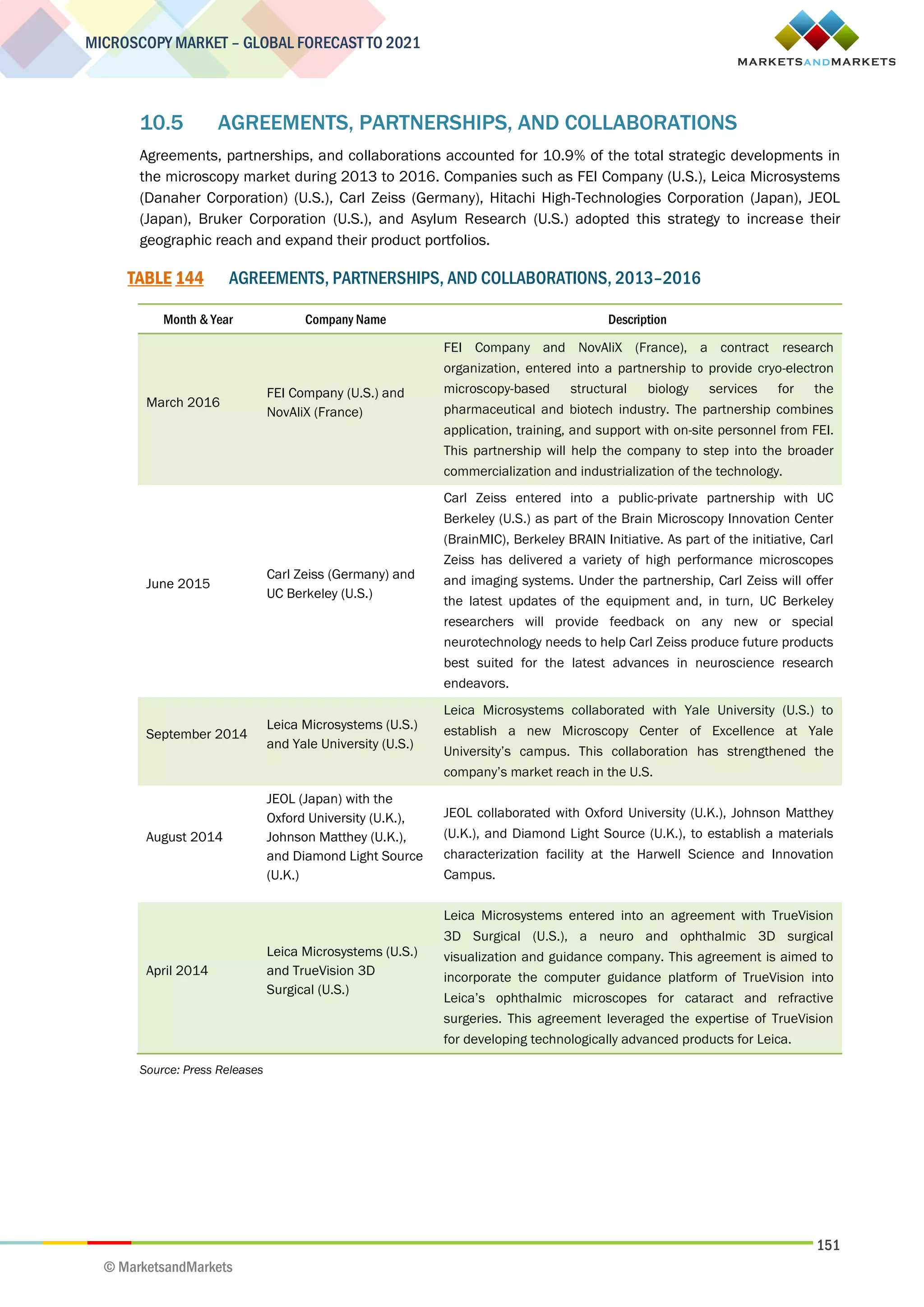

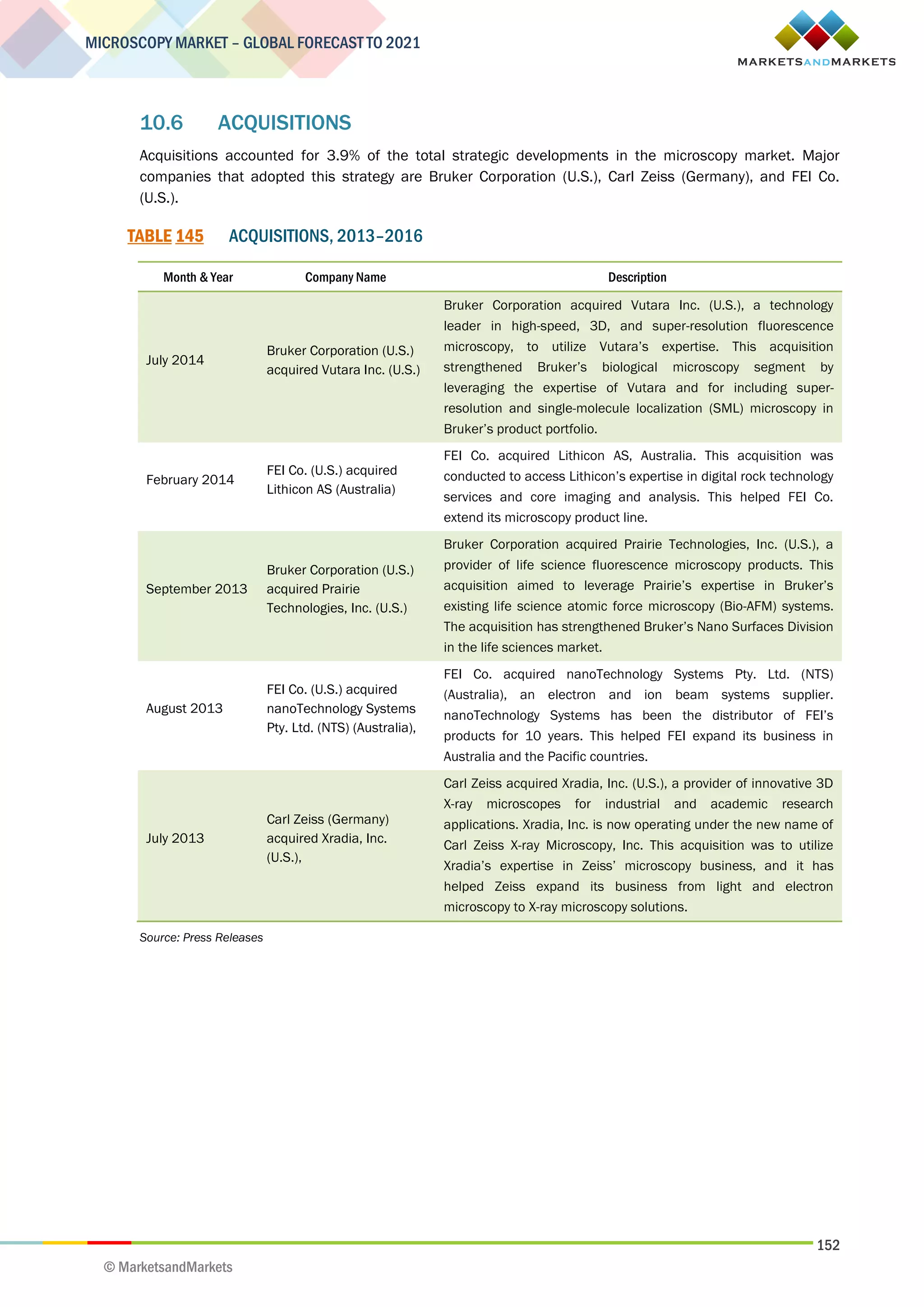

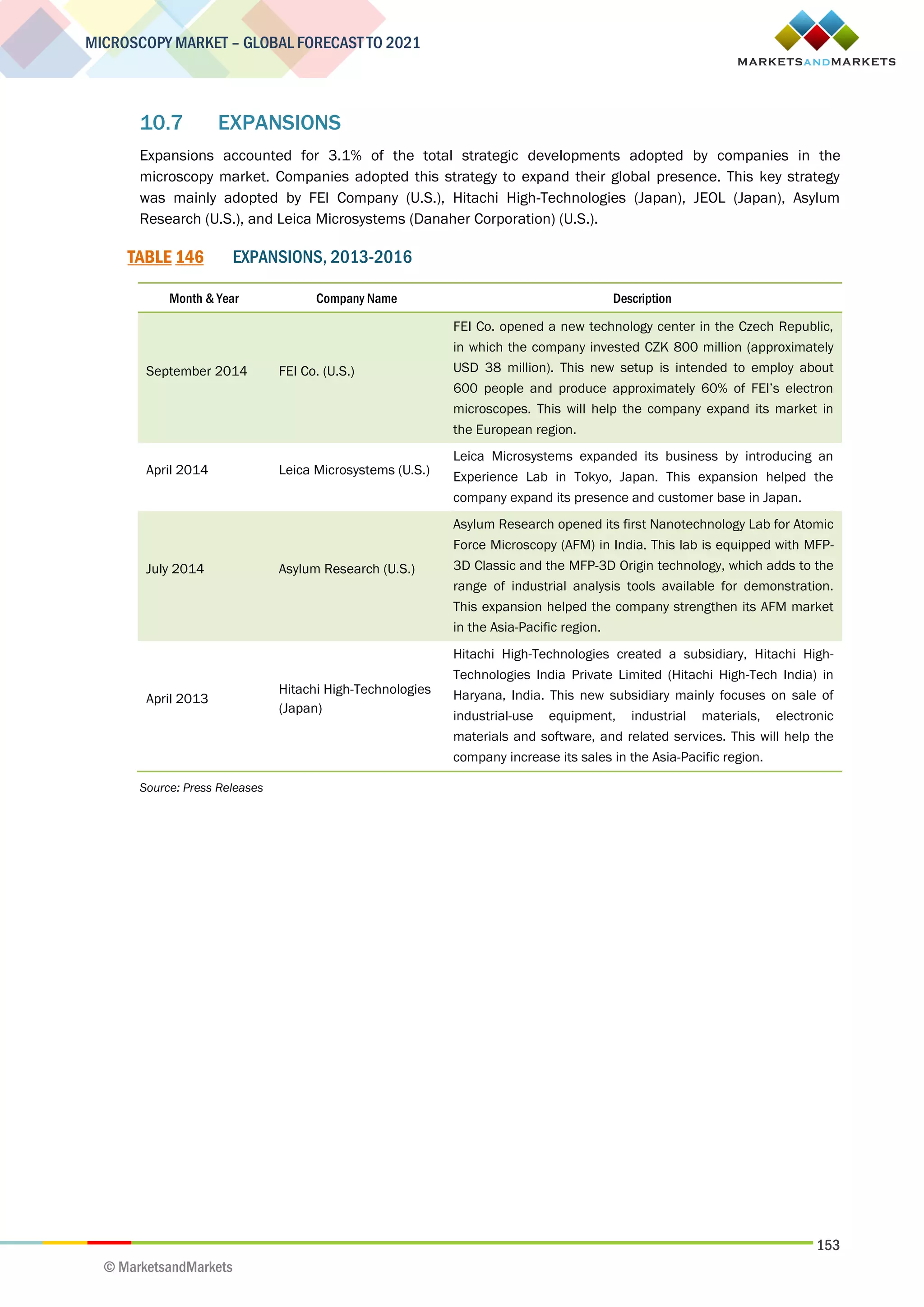

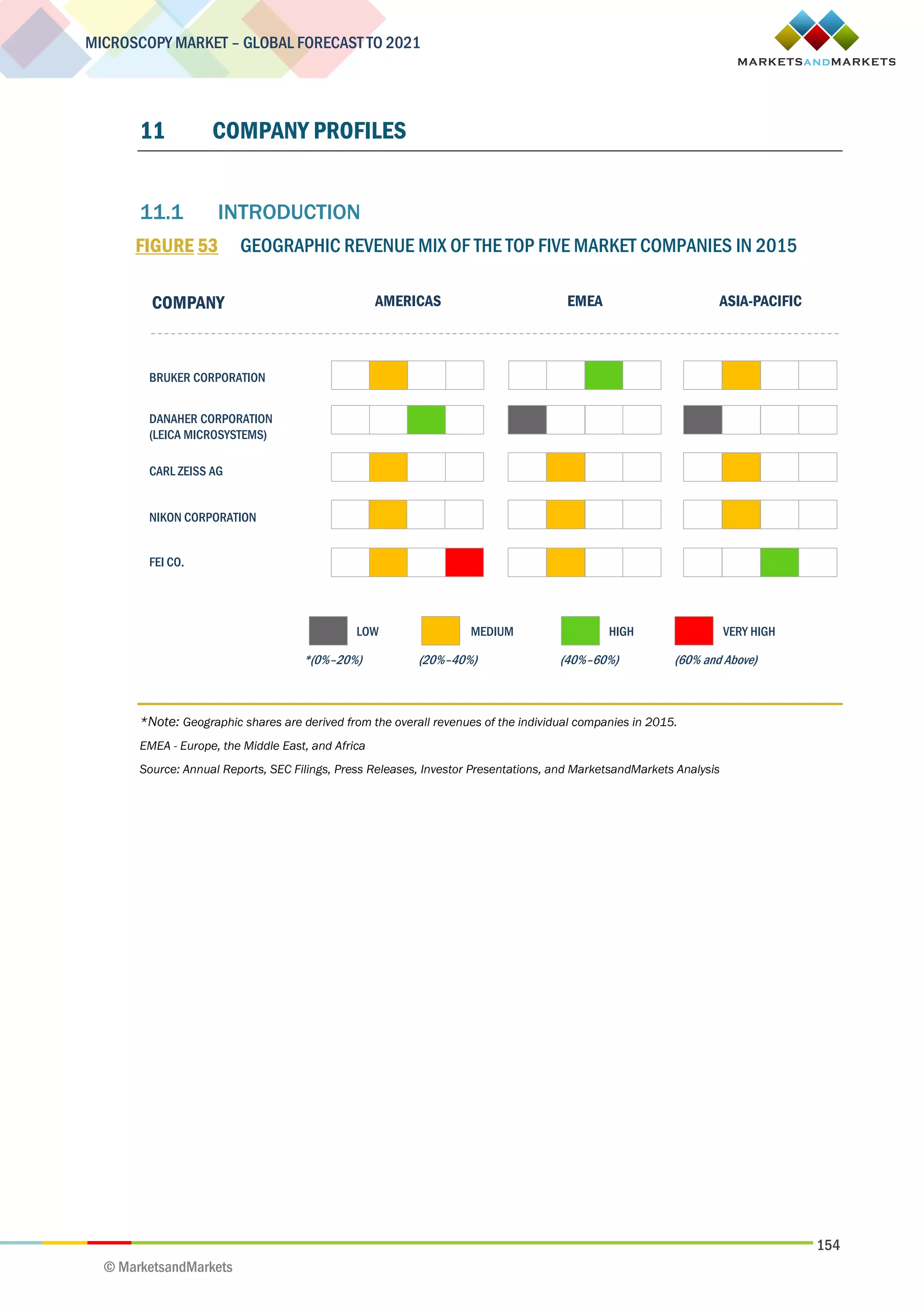

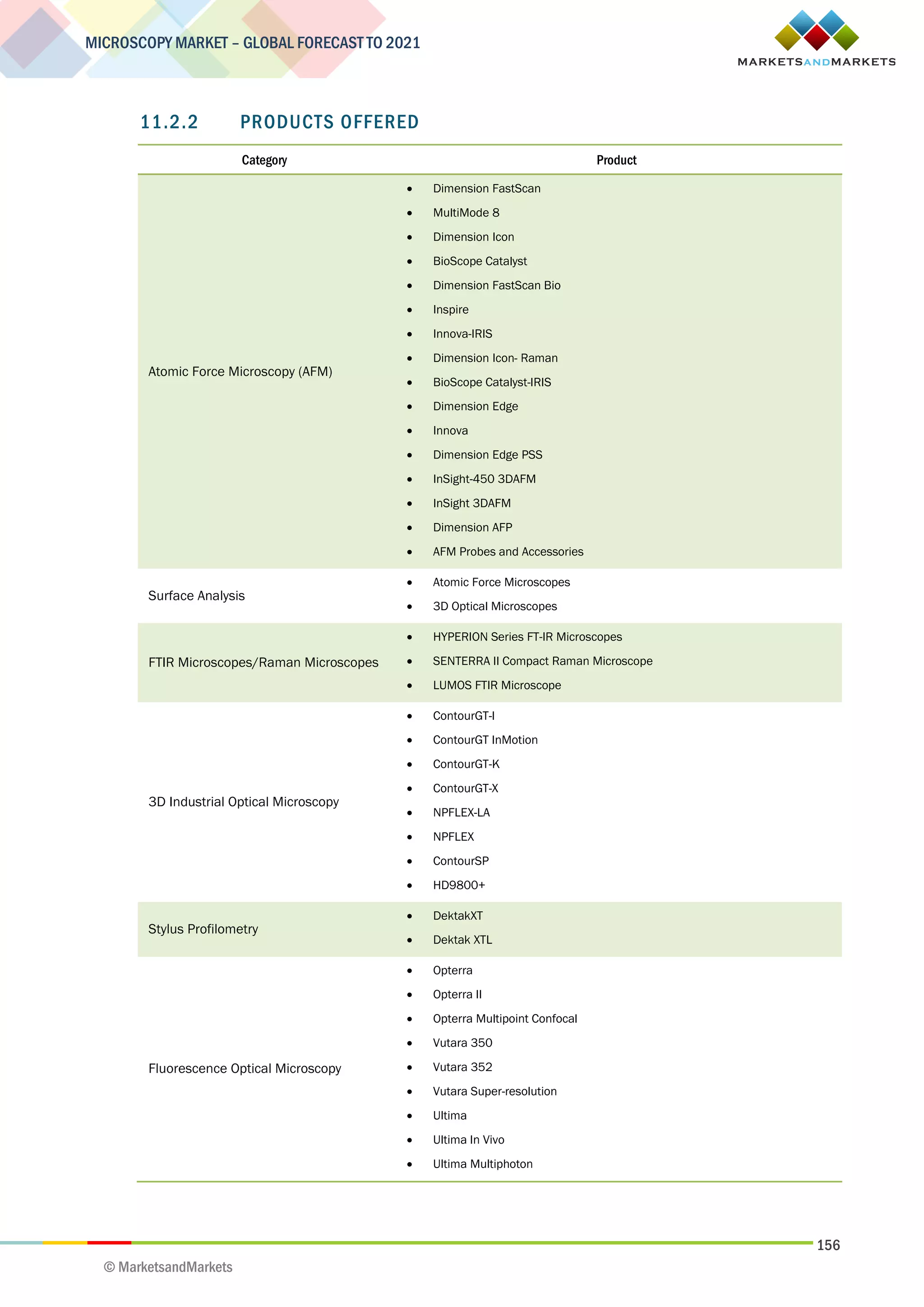

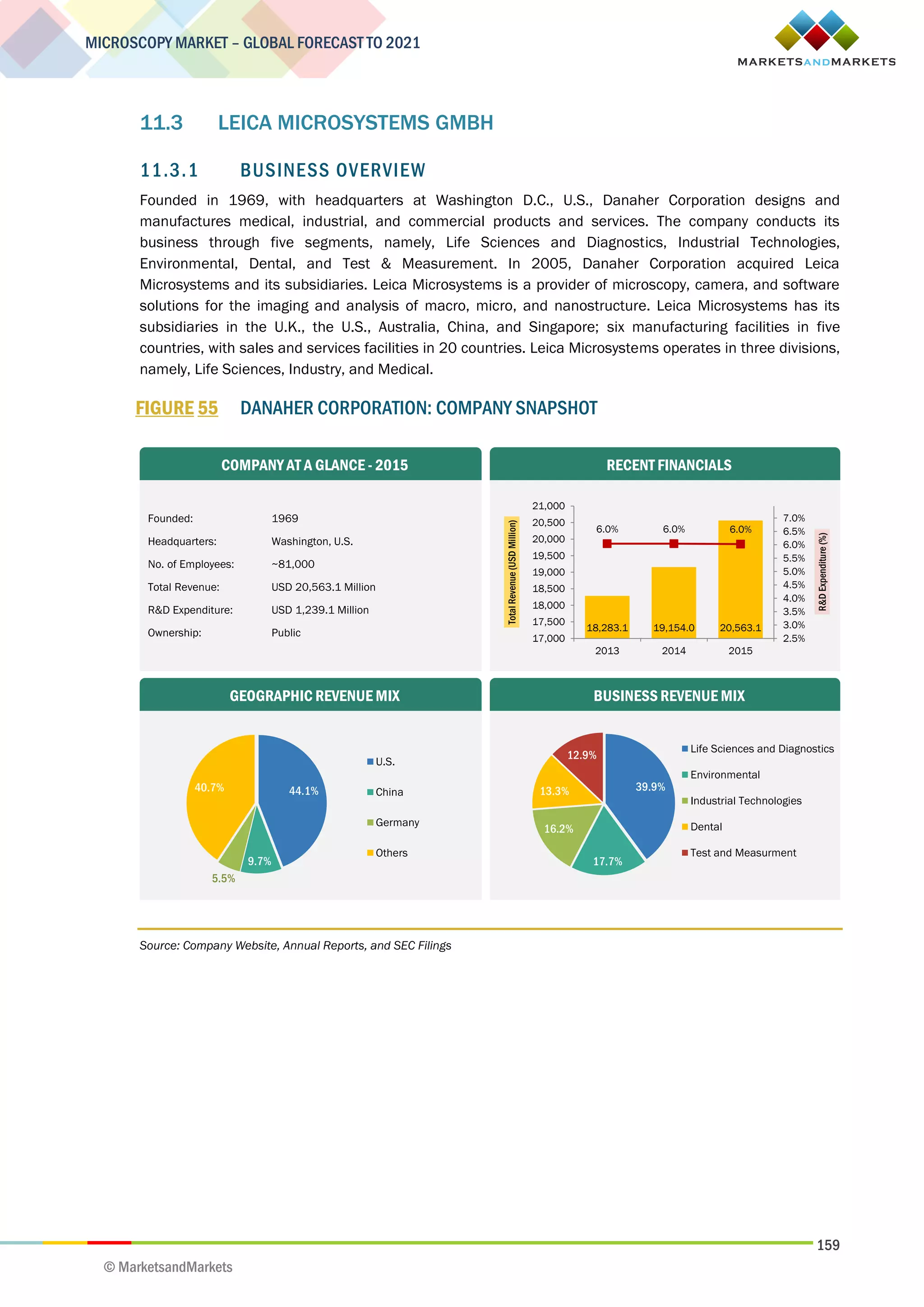

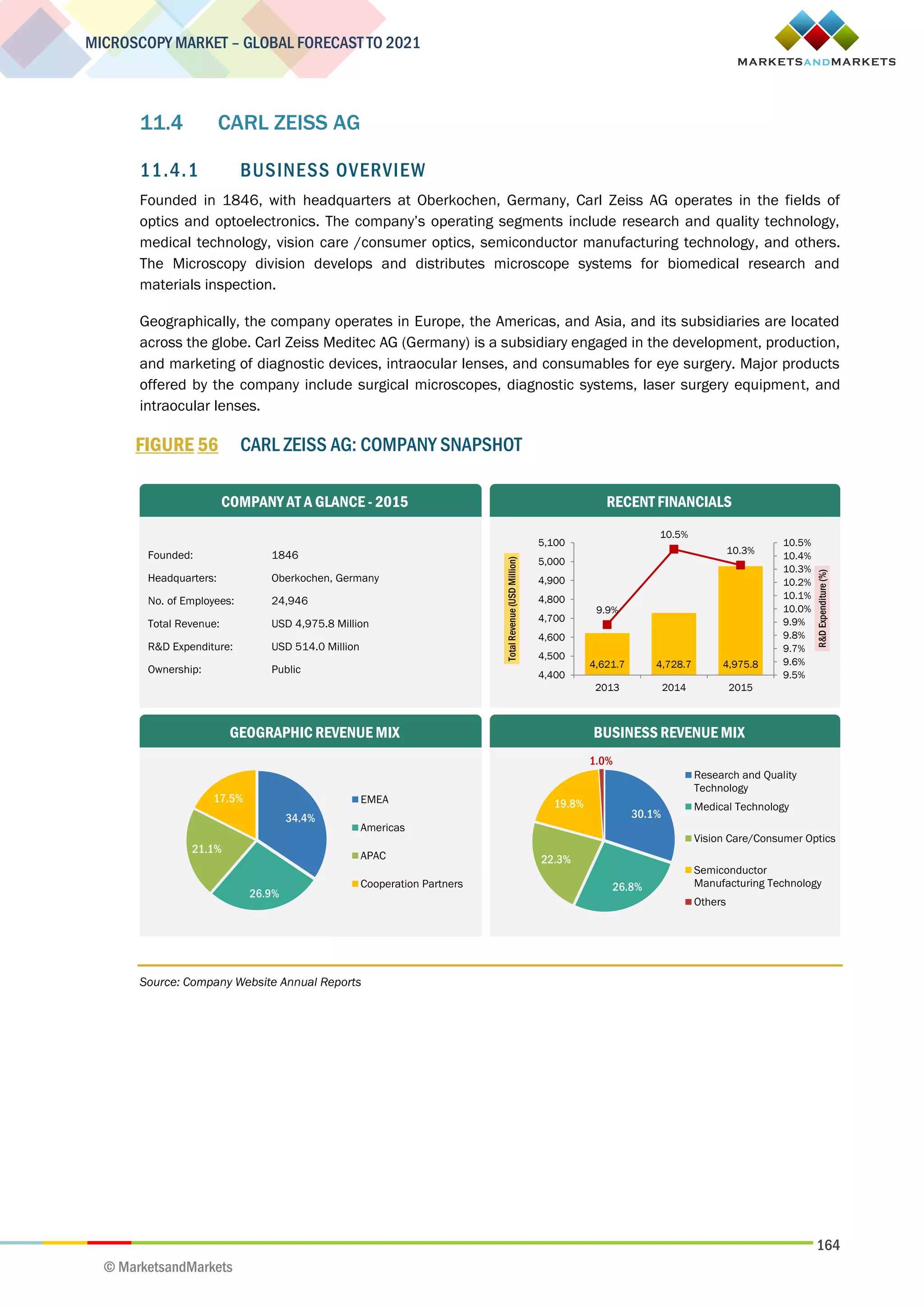

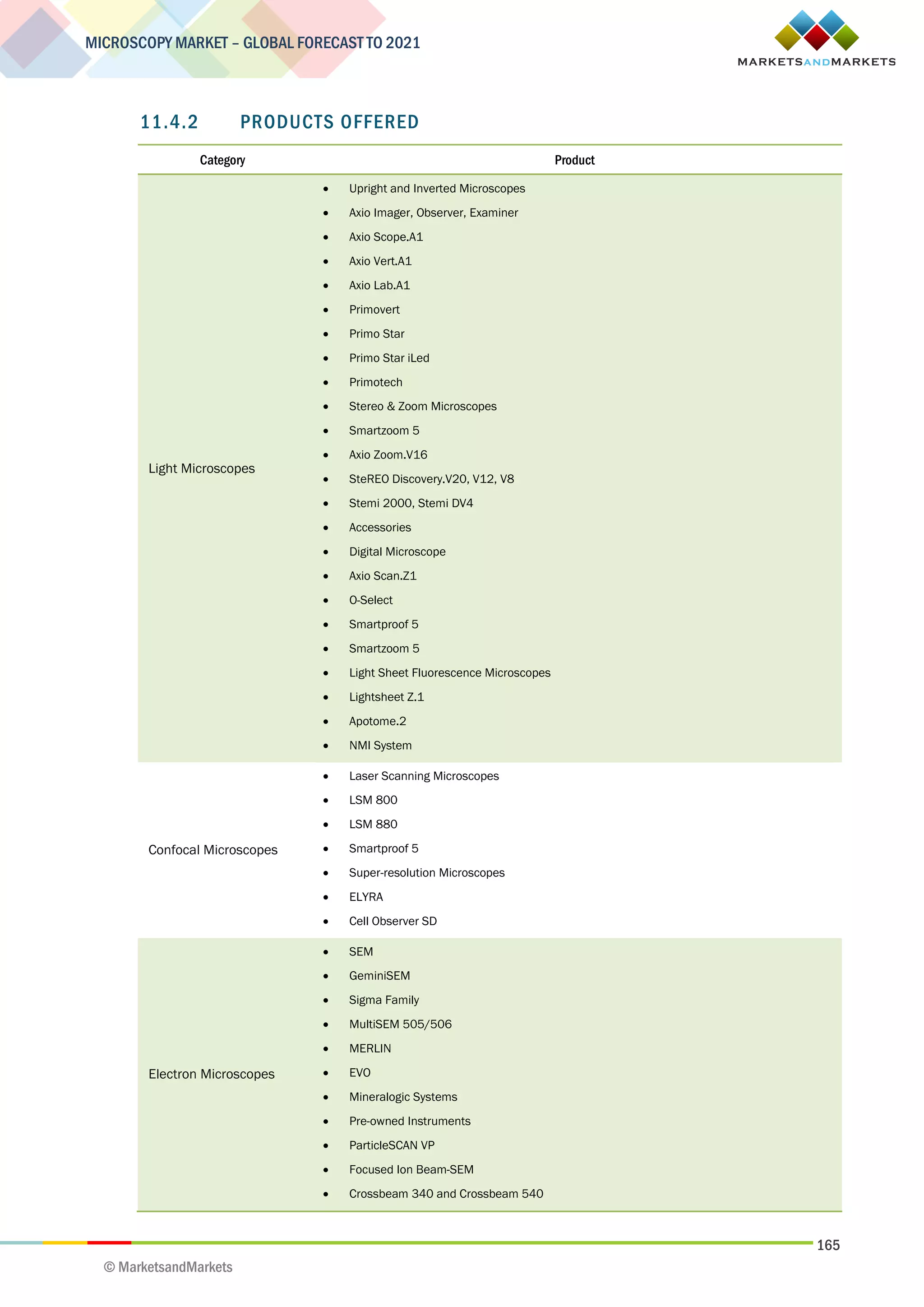

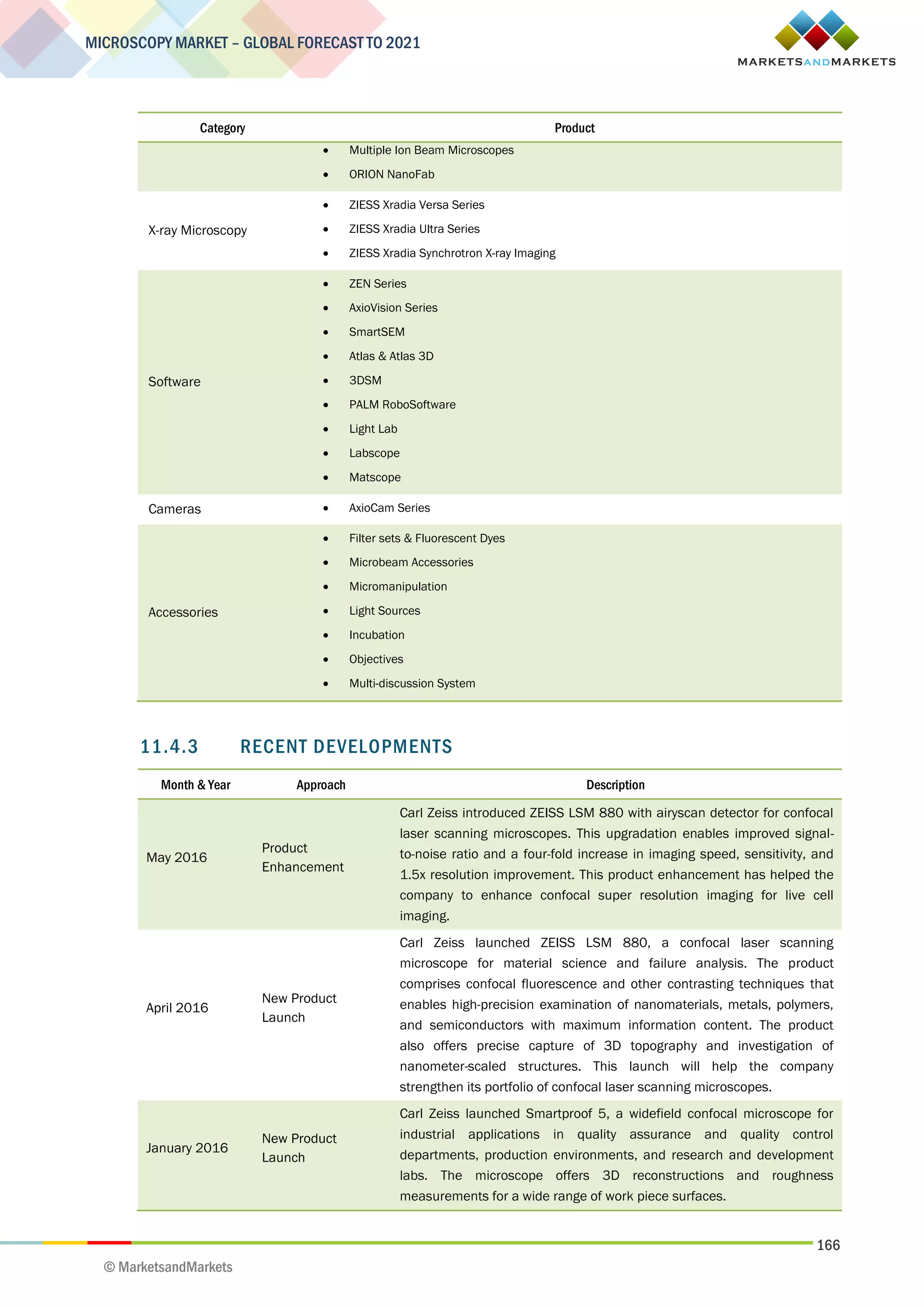

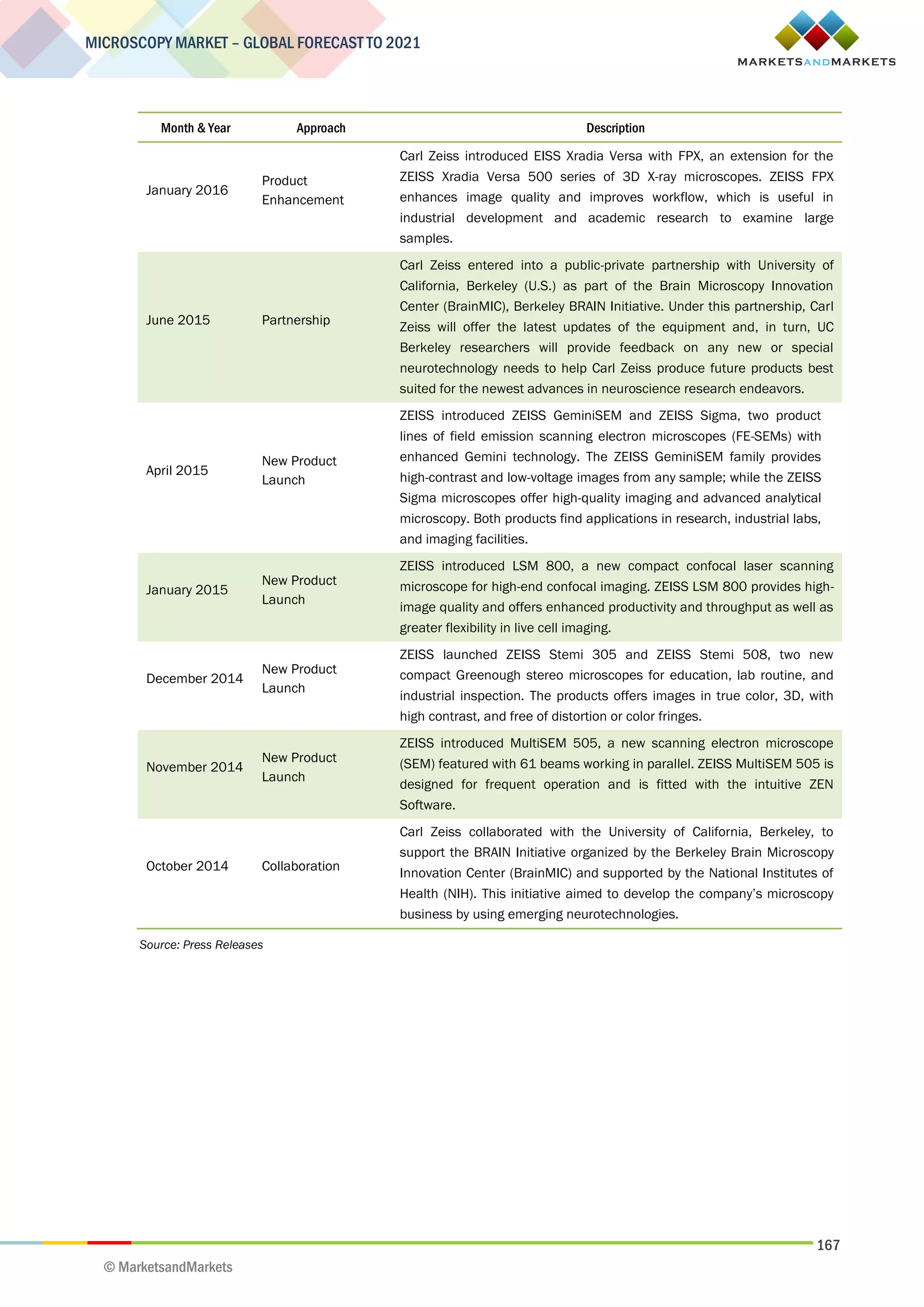

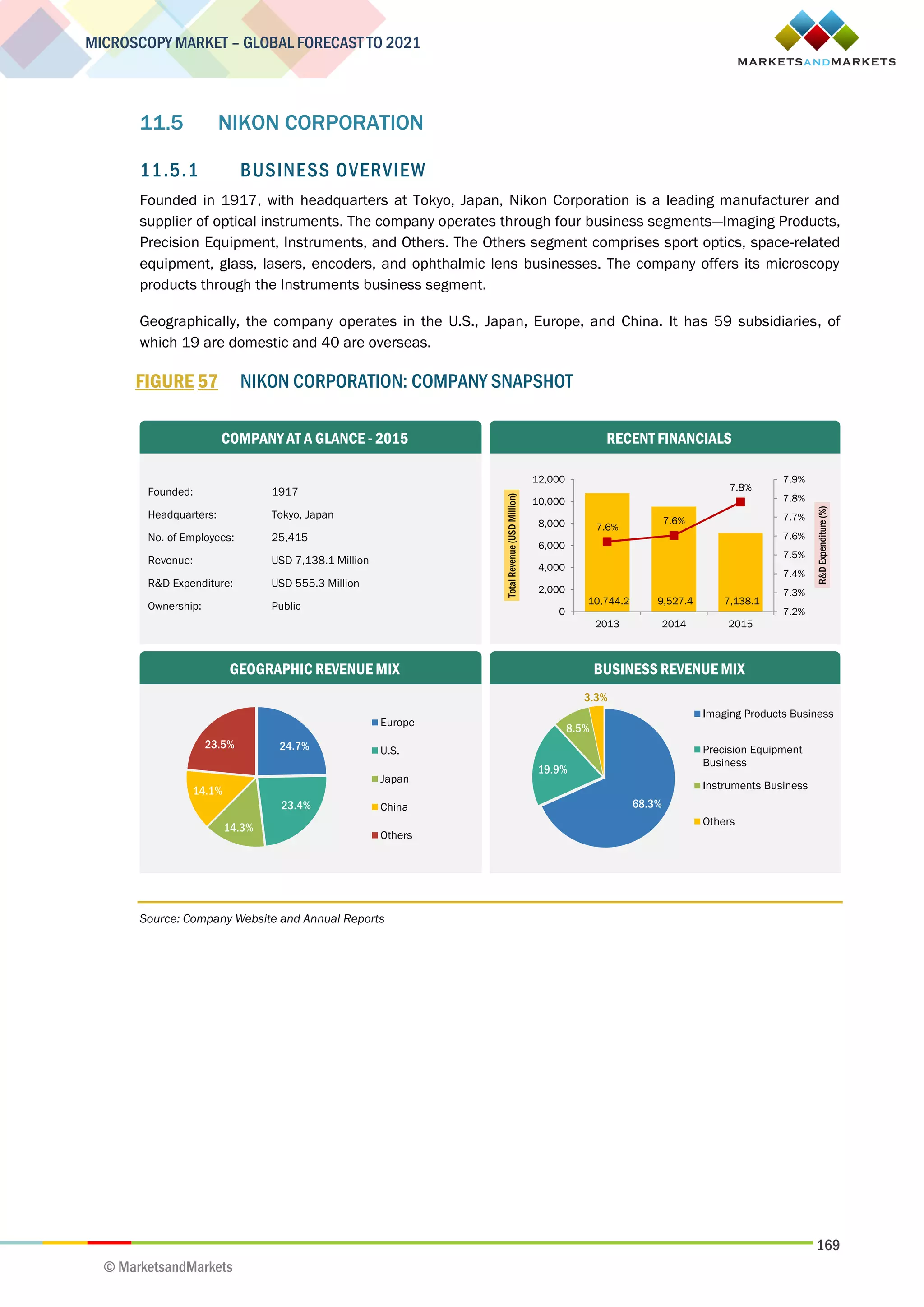

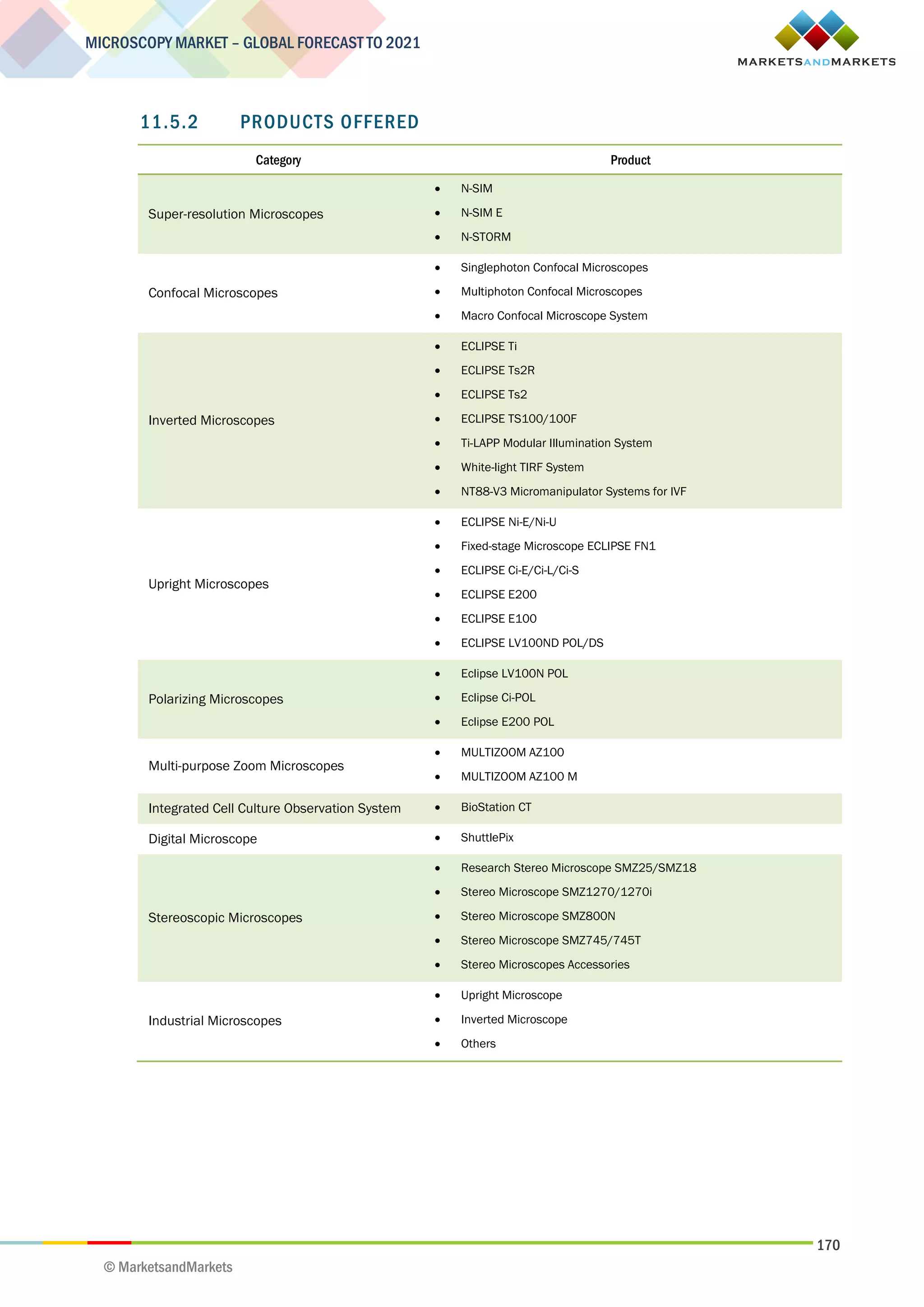

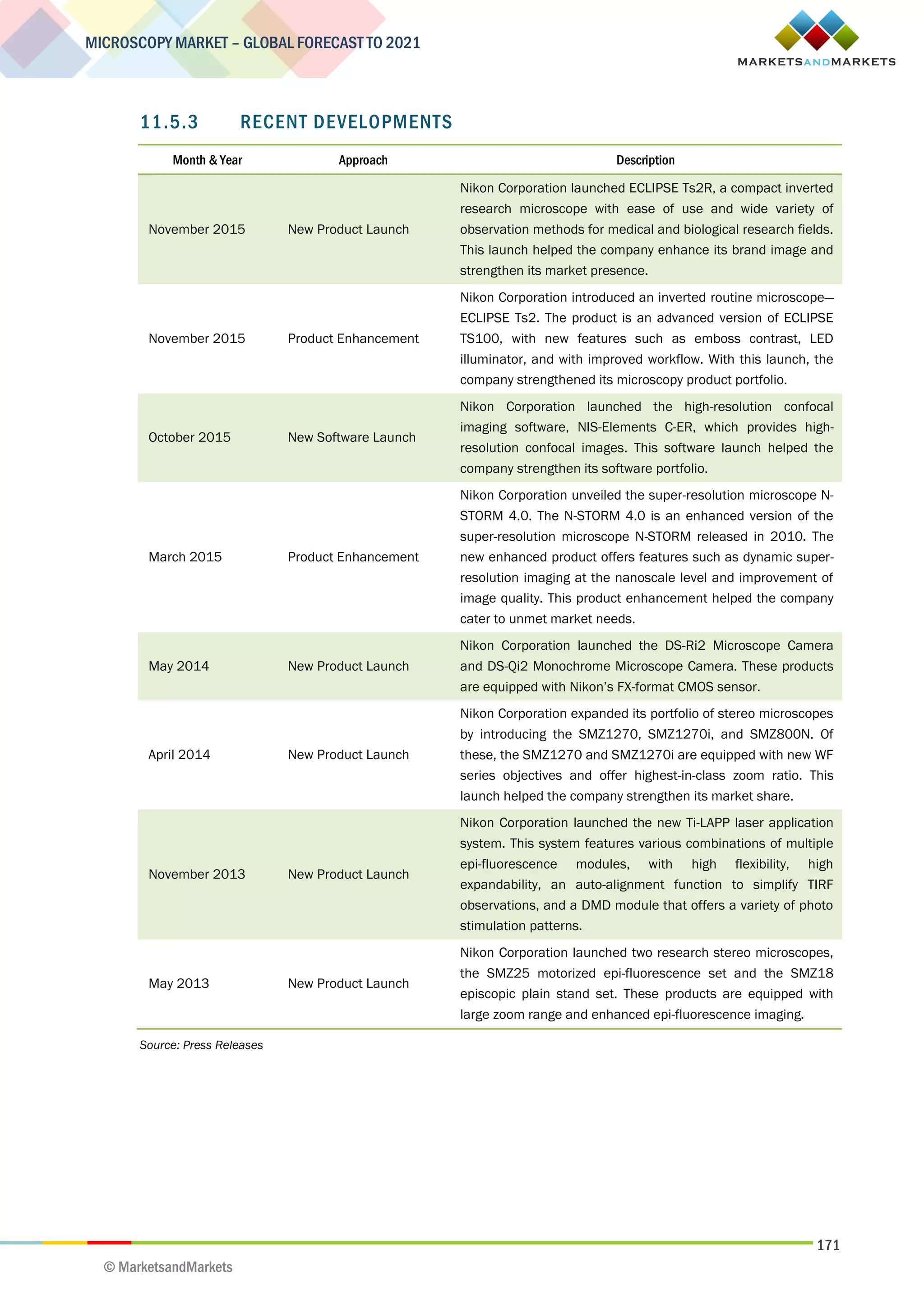

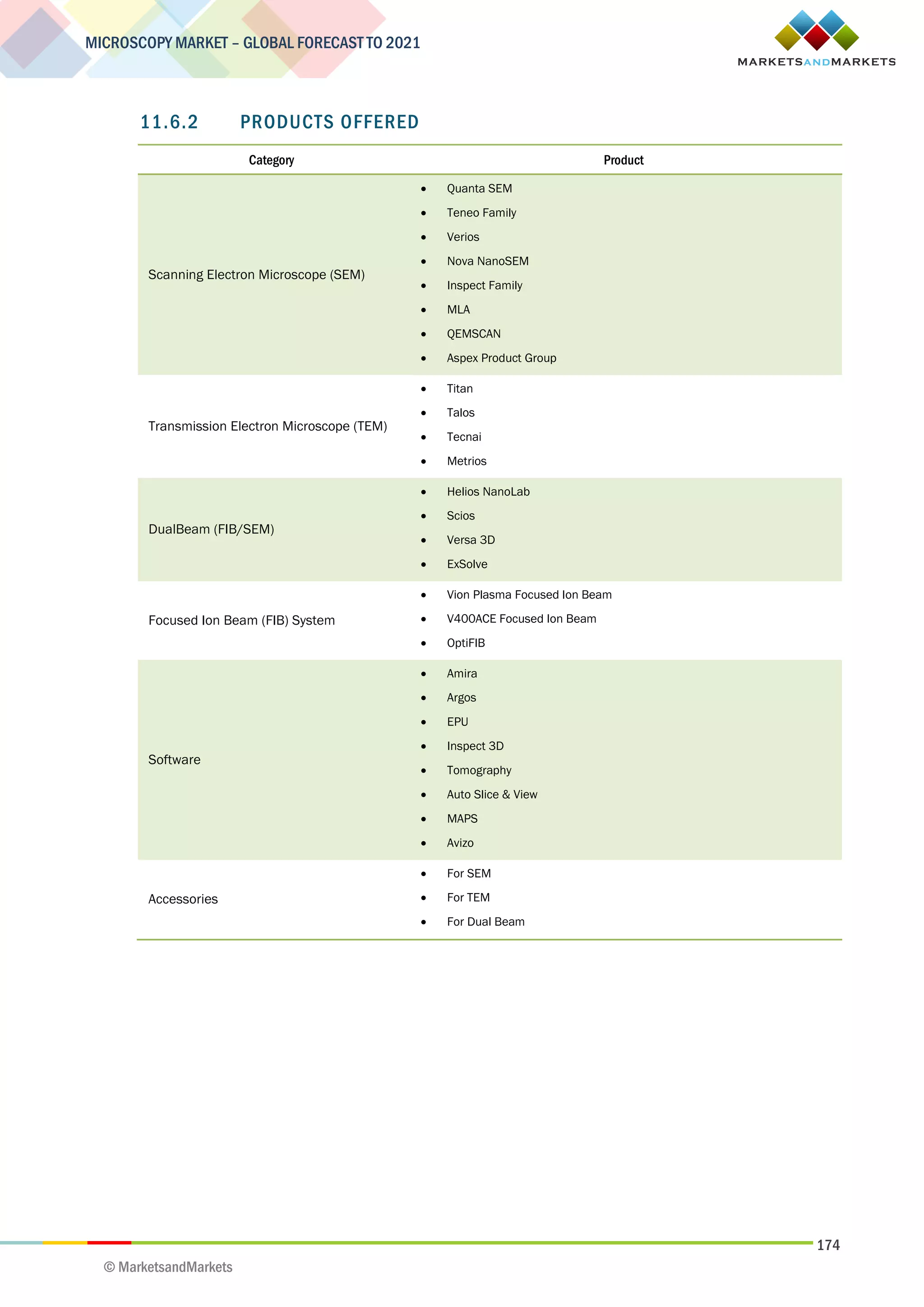

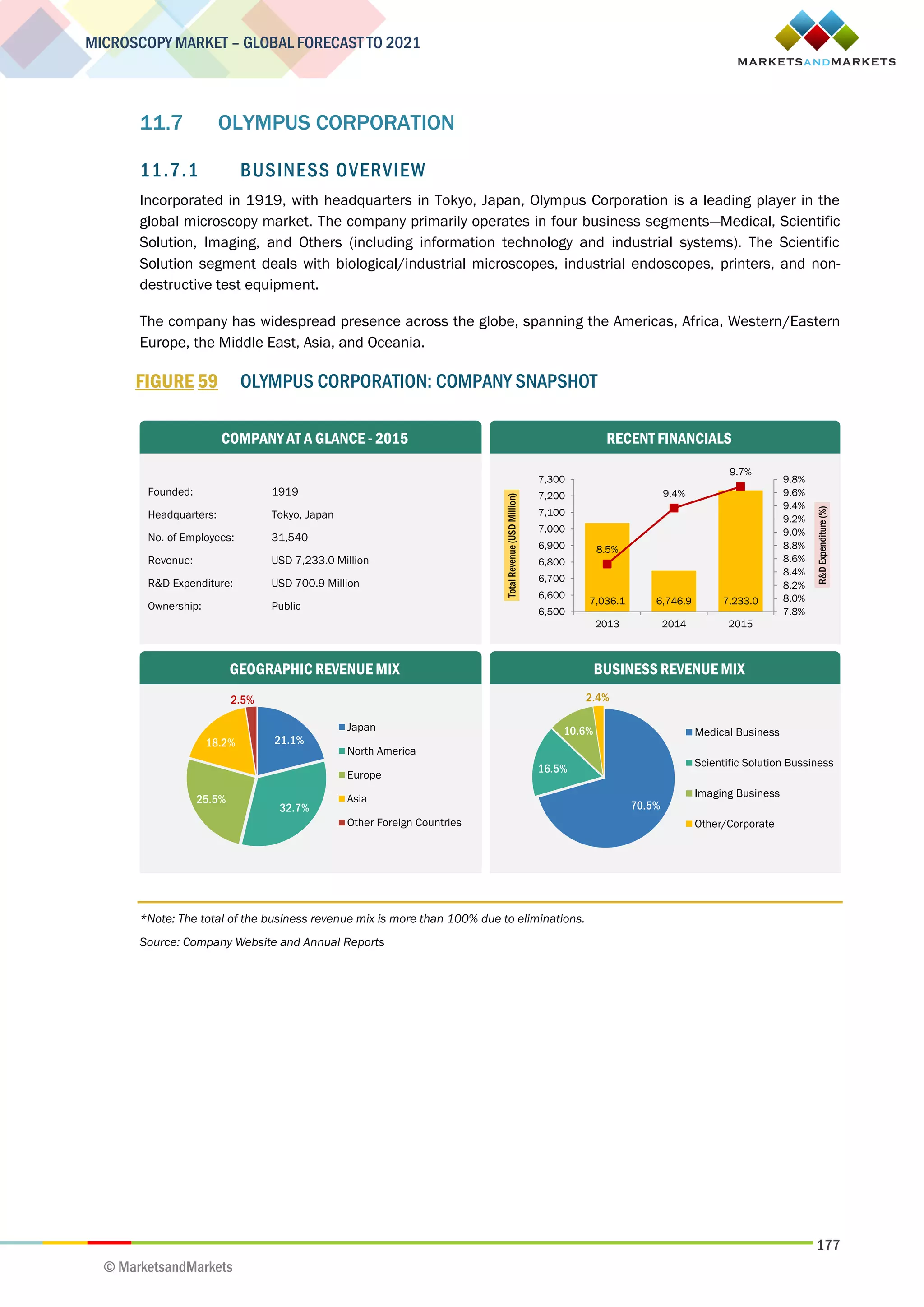

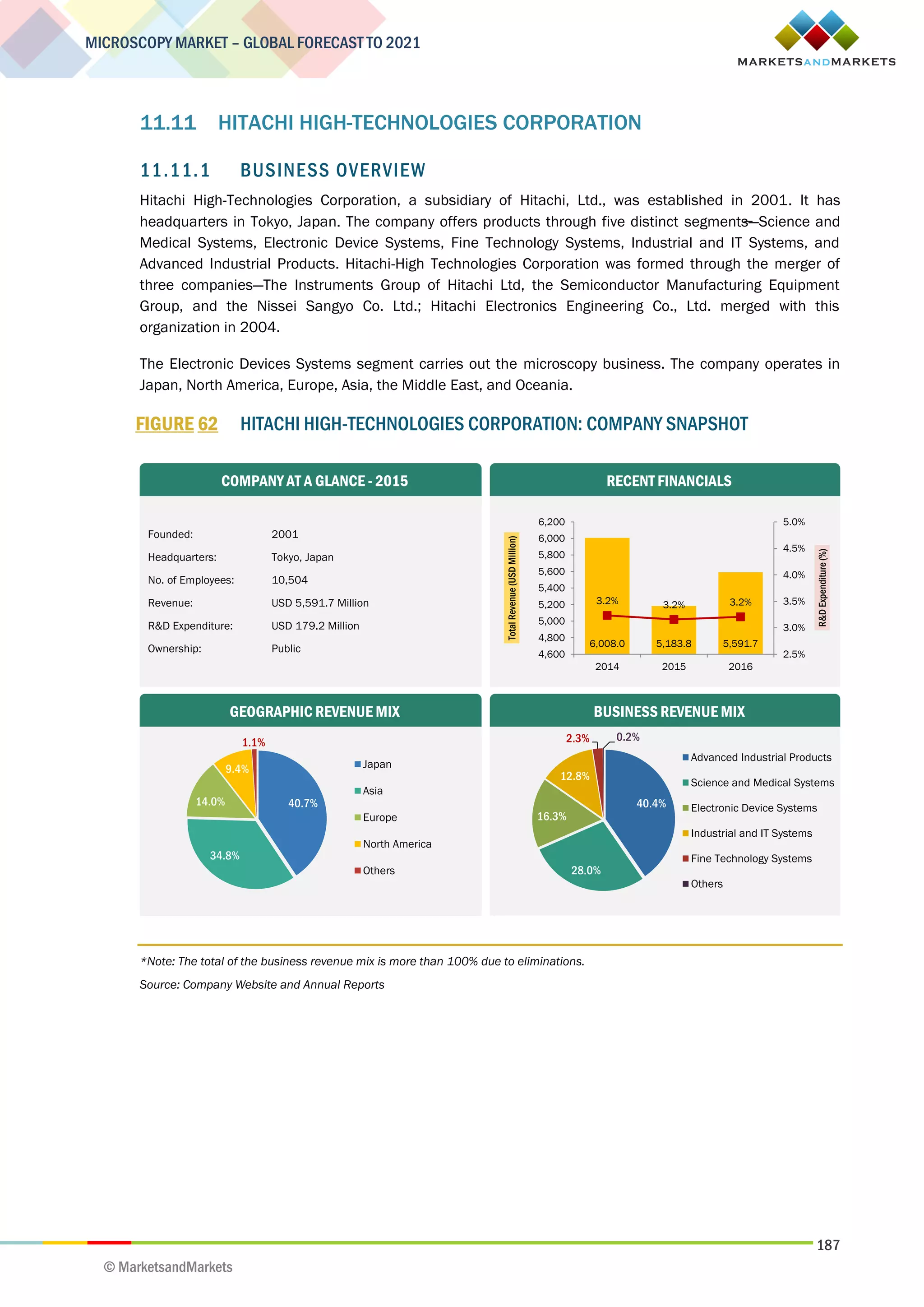

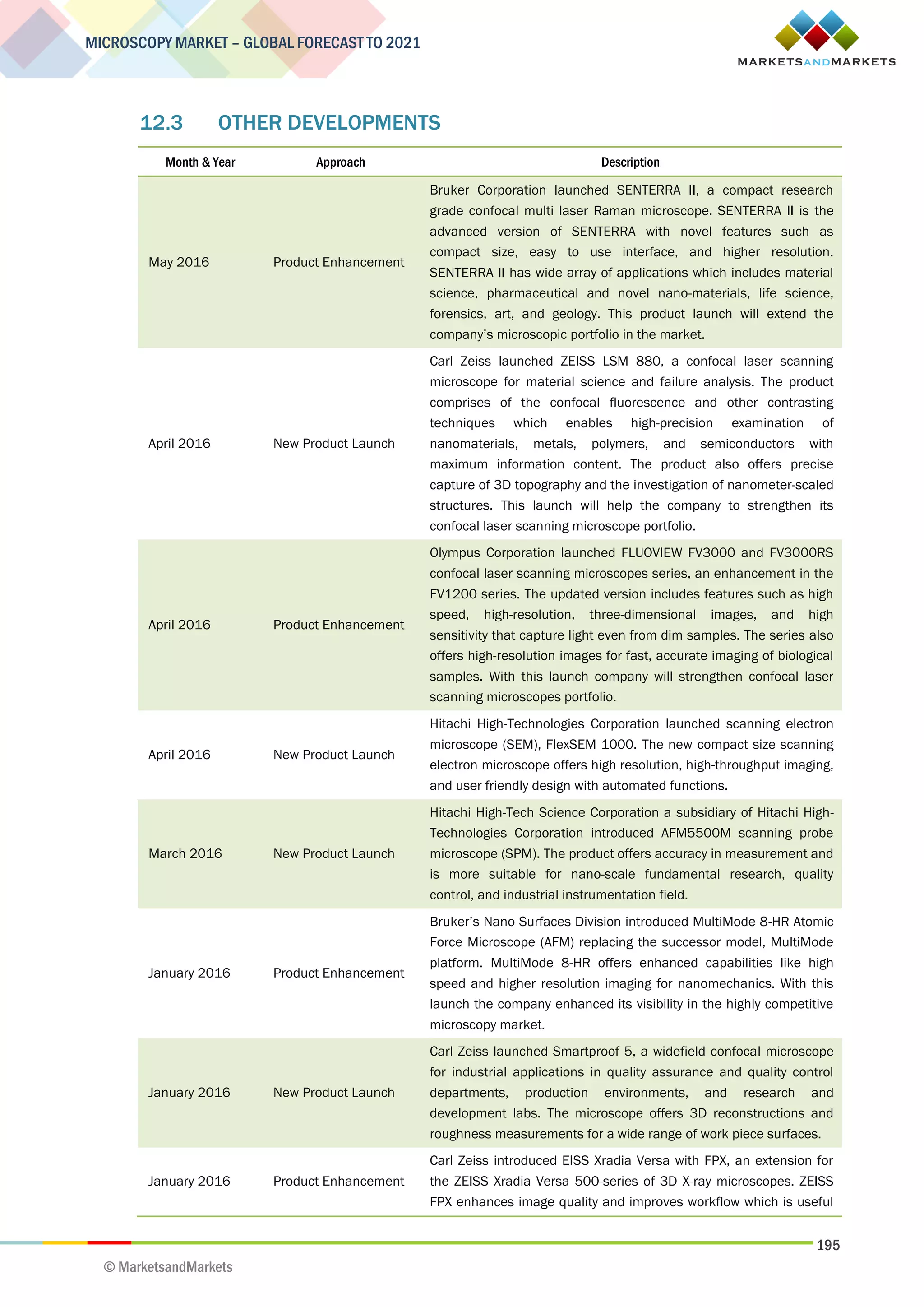

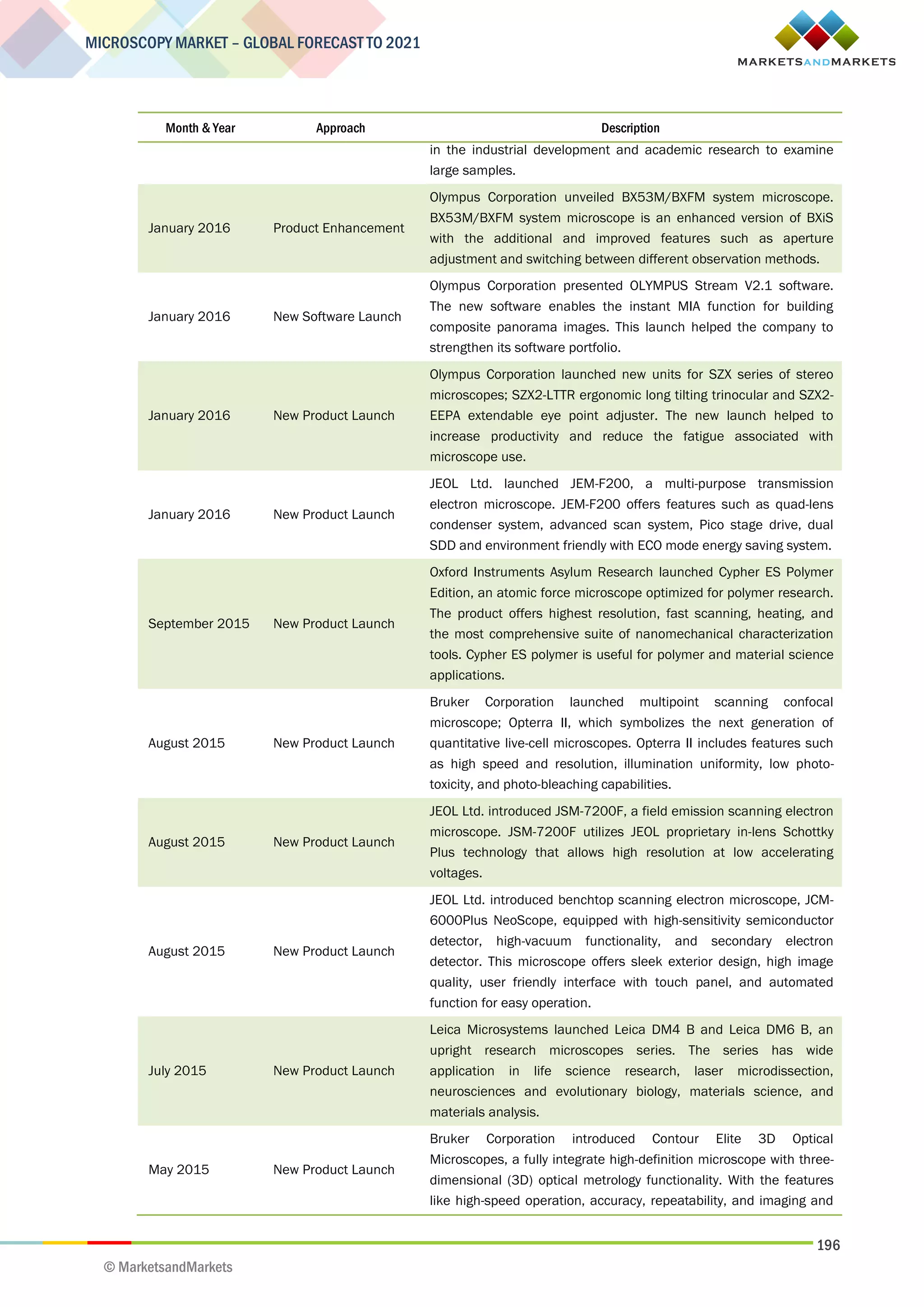

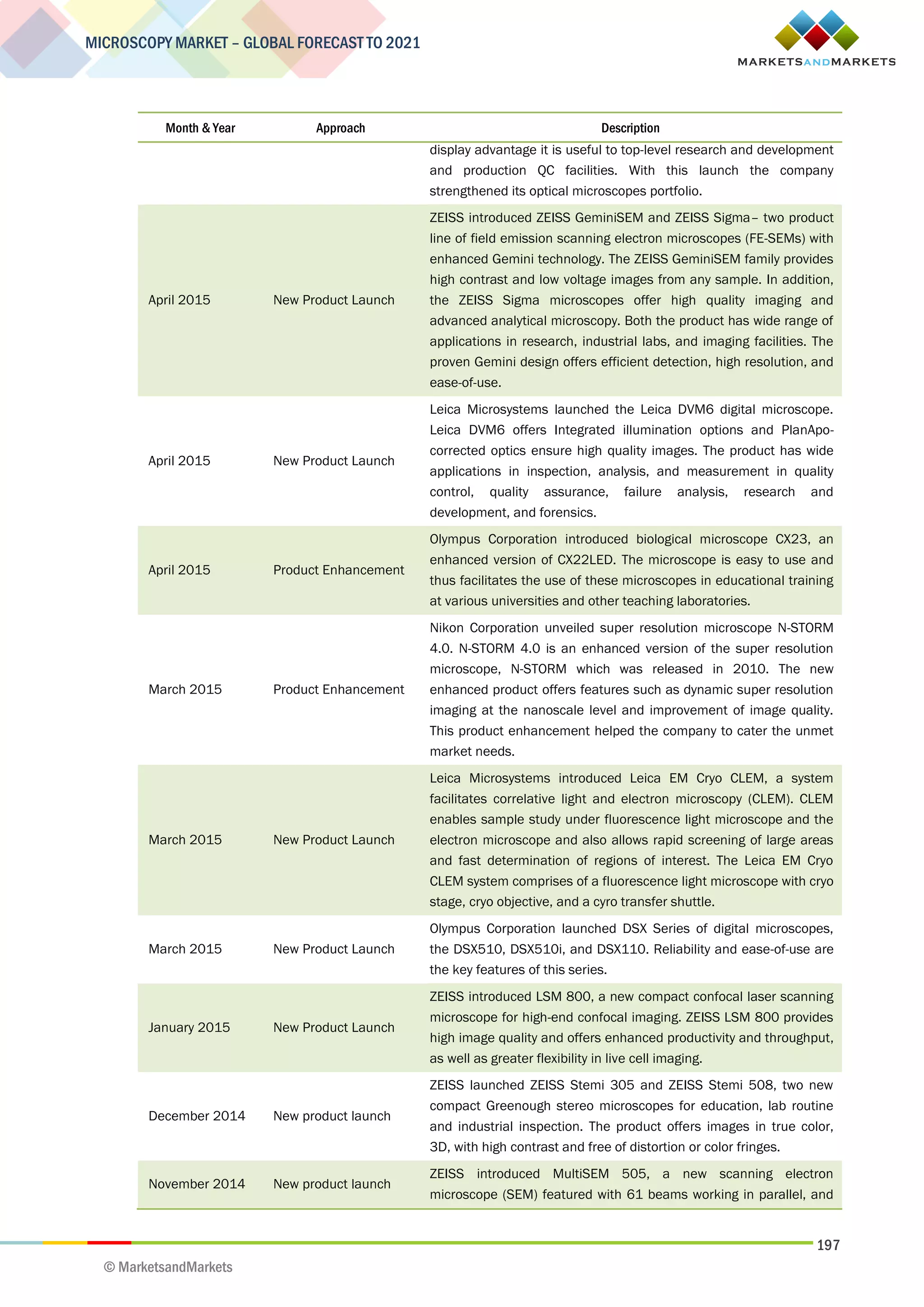

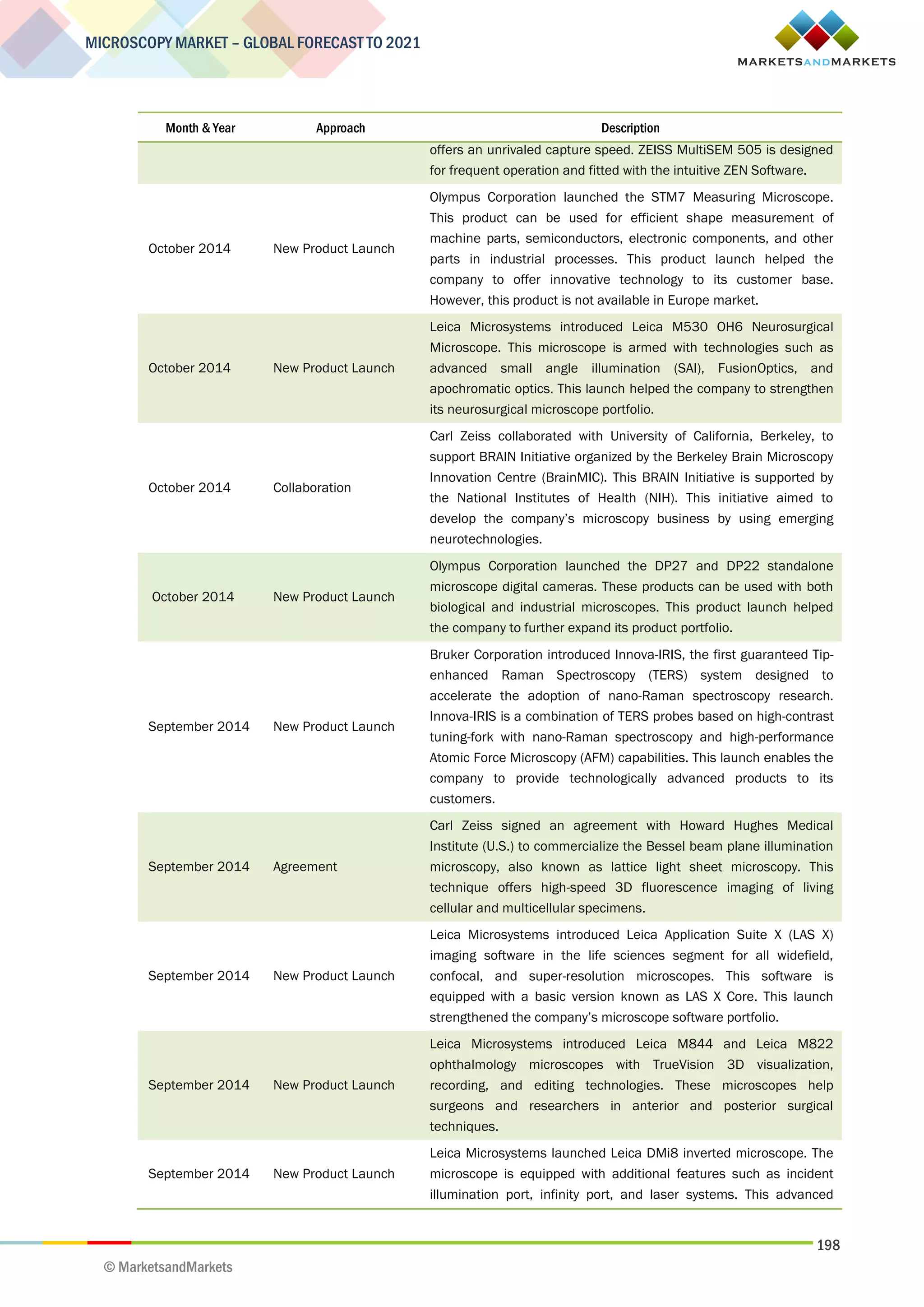

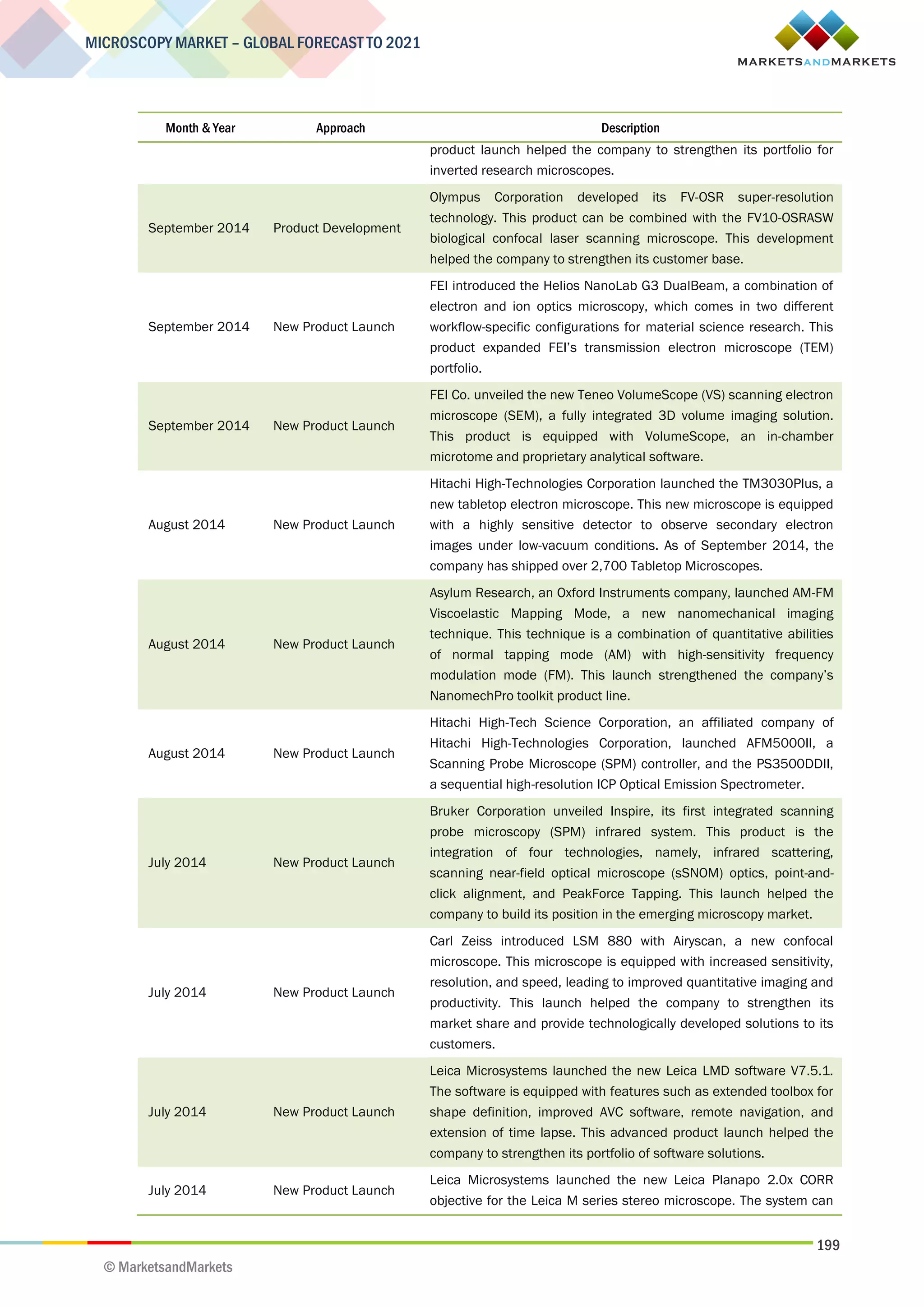

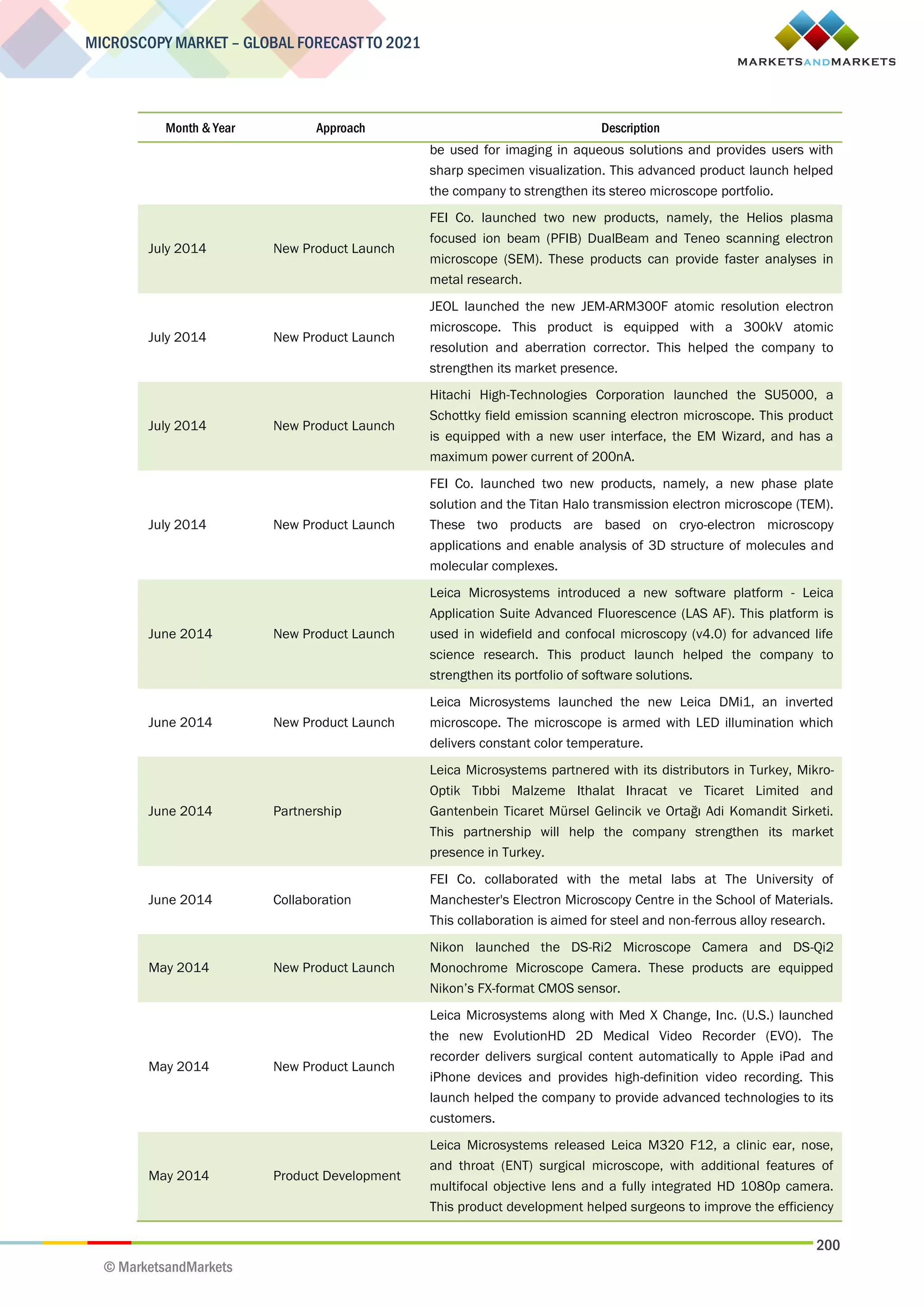

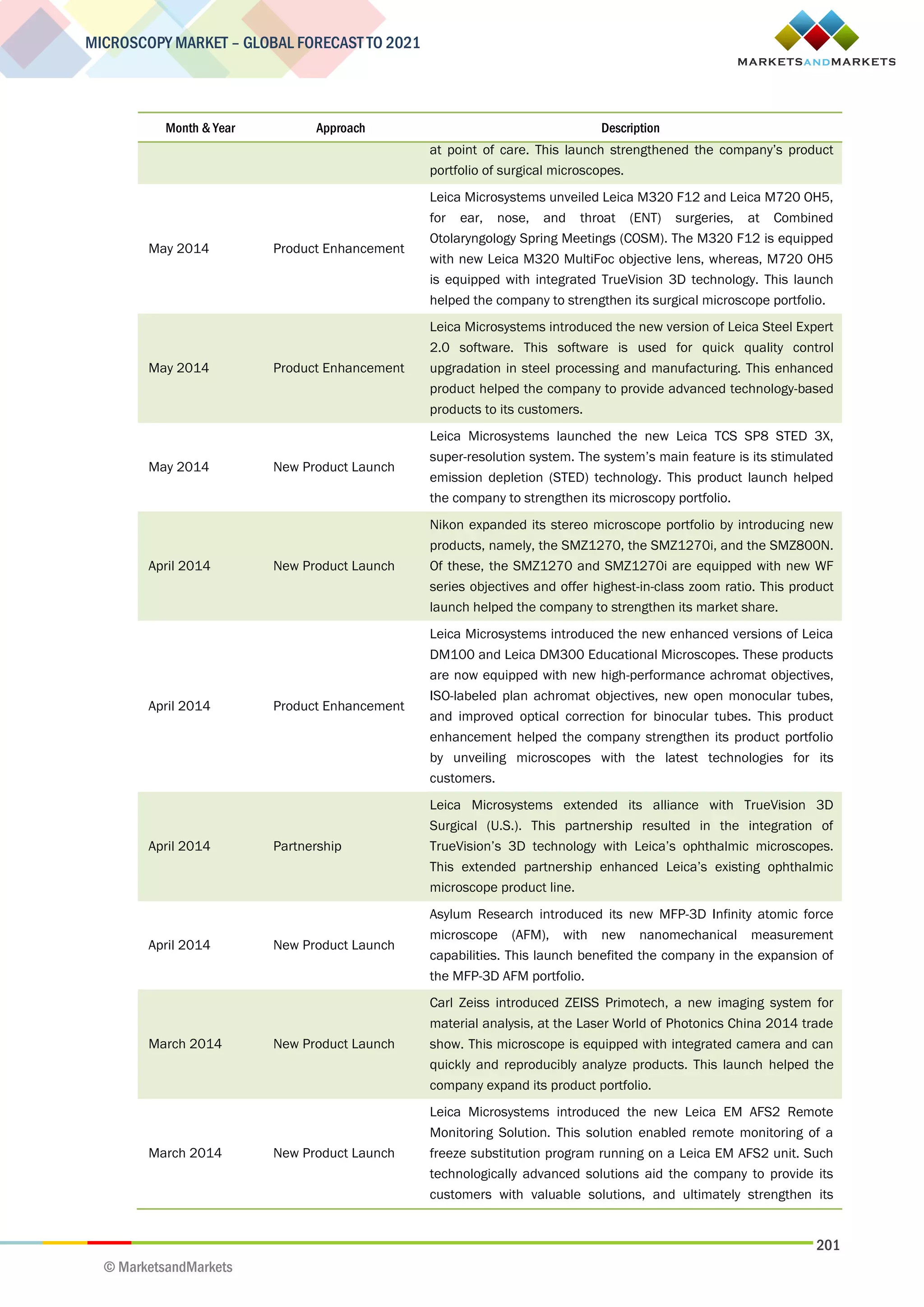

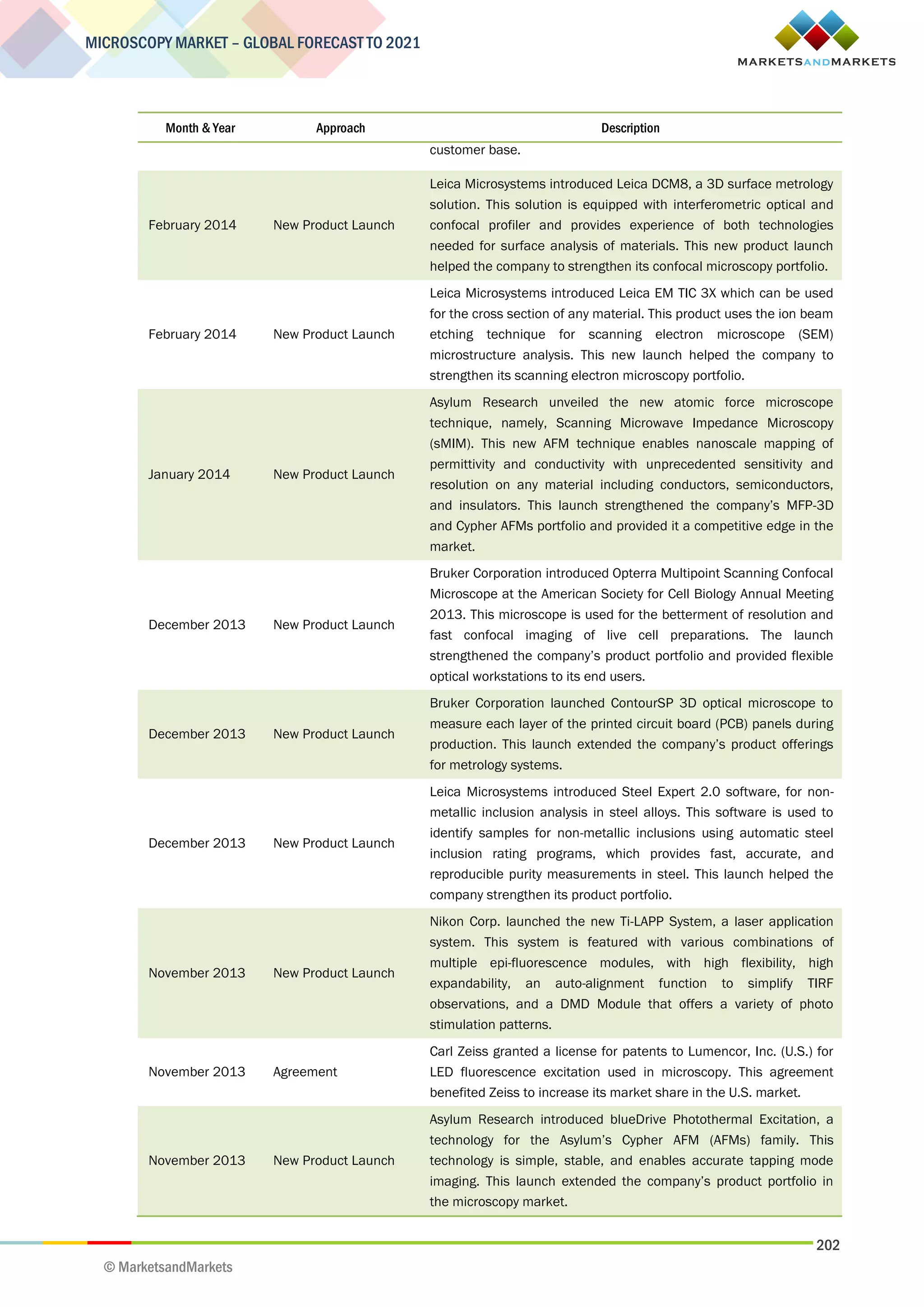

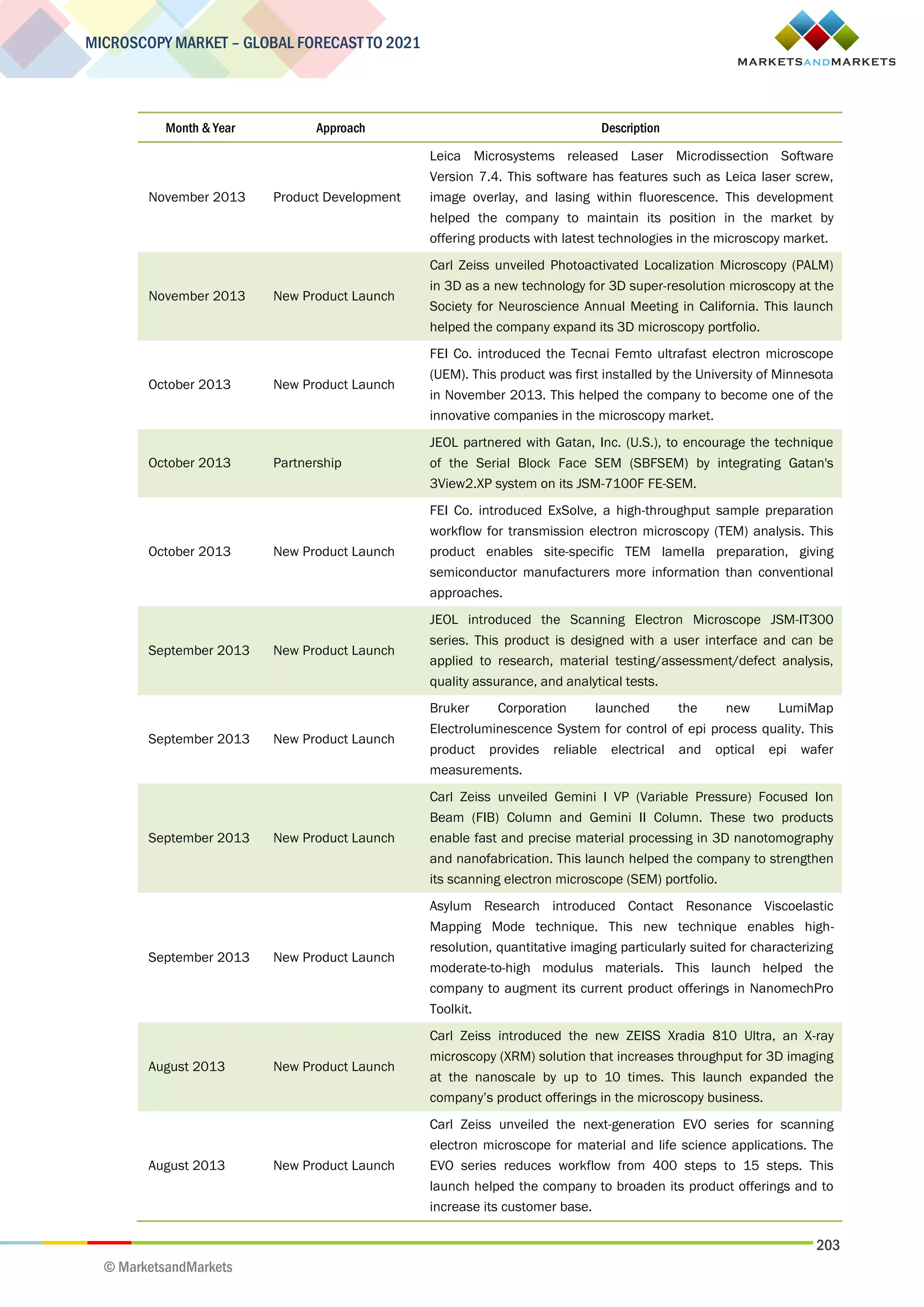

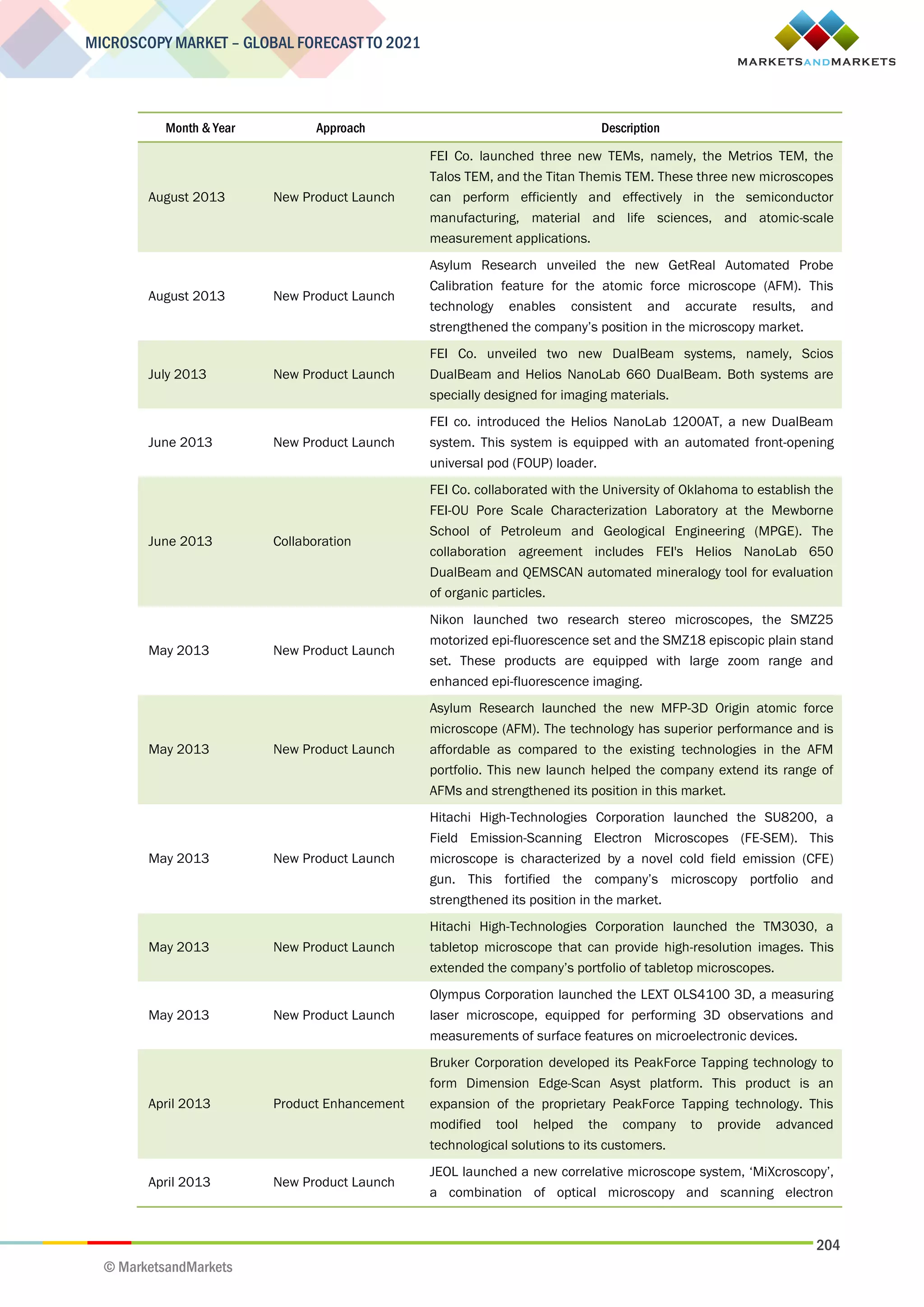

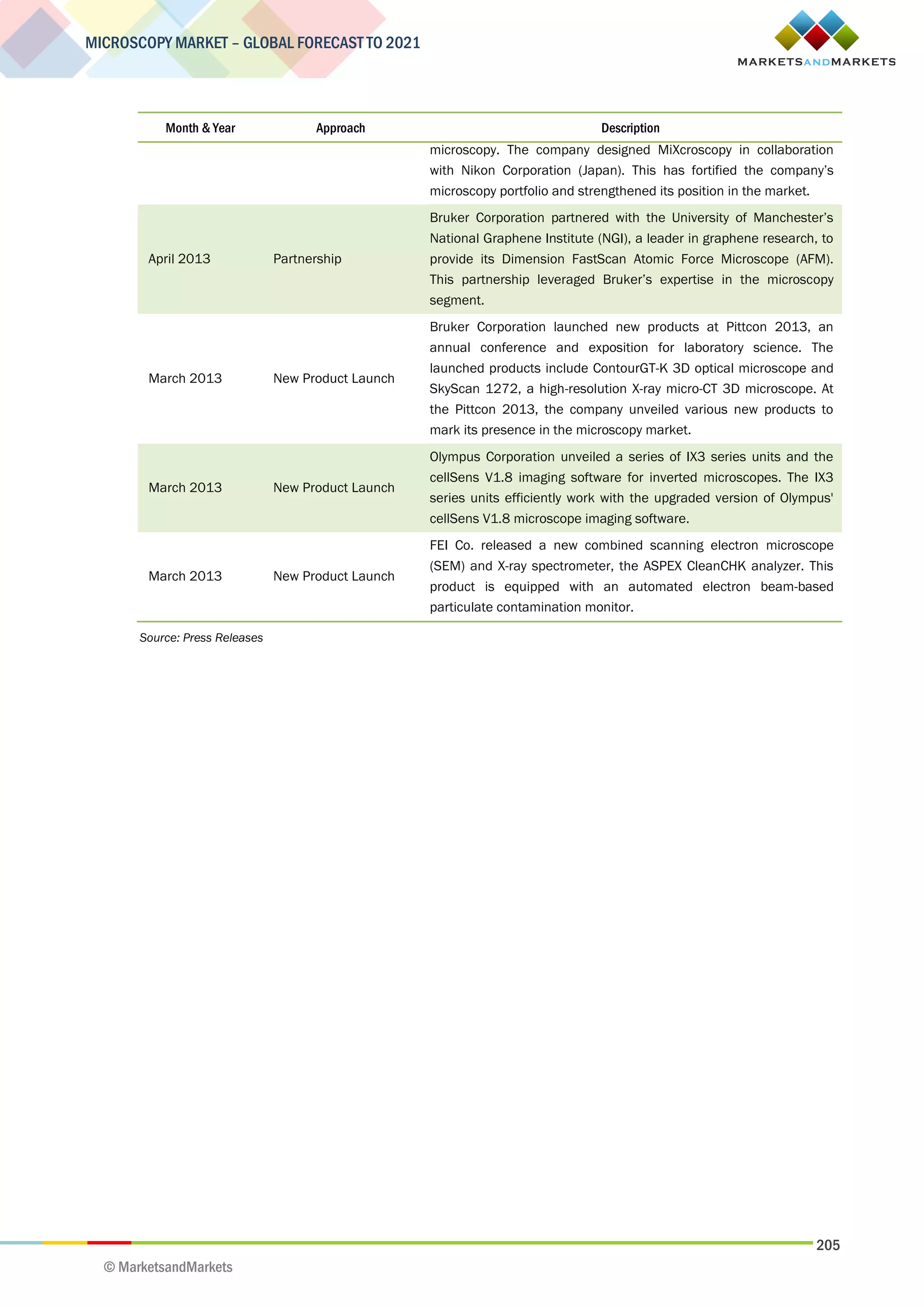

This document provides an overview of the microscopy market and its segmentation by product, application, end user, and region. It is a market research report published by MarketsandMarkets, which is a global market research firm. The report analyzes the microscopy market between 2014-2021 and provides market forecasts for annual revenues. It includes detailed information on key market players, market drivers and restraints, opportunities and challenges, and competitive analysis.