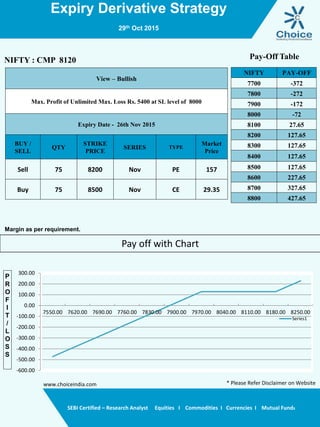

The document outlines an expiry derivative strategy that is bullish on the Nifty. It involves selling 75 put options at a strike price of 8200 and buying 75 call options at a strike price of 8500. This strategy has unlimited profit potential above 8500 and a maximum loss of Rs. 5400 if the Nifty closes below 8000 on the expiry date of November 26th, 2015. A pay-off table is included to illustrate potential profits and losses at different index closing levels.