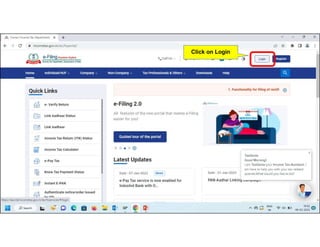

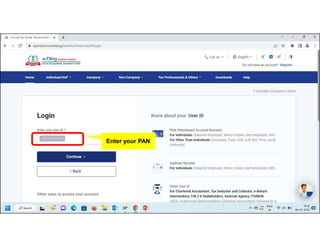

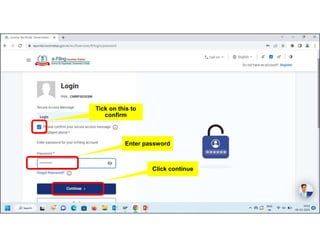

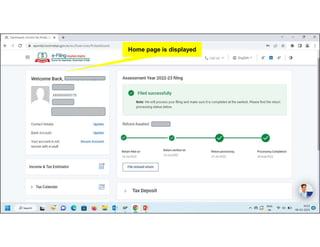

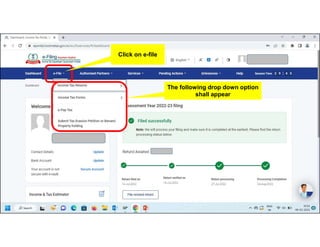

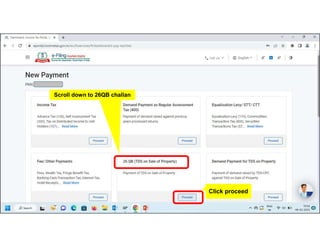

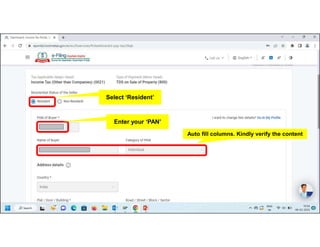

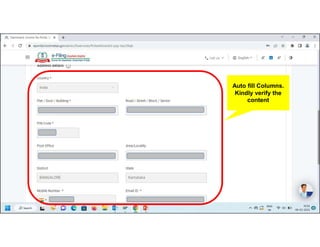

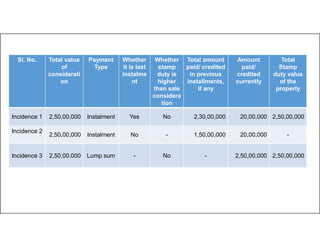

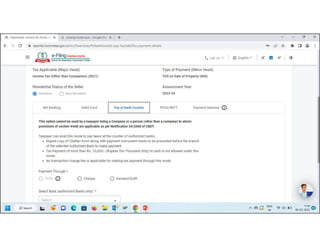

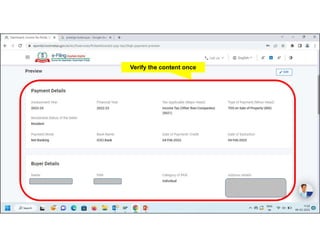

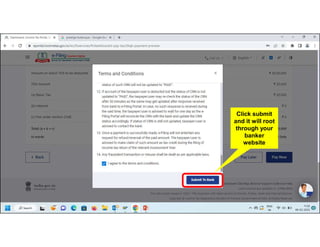

The document outlines a step-by-step process for making TDS payments related to the sale of property under the Income Tax Act, 1961. It includes instructions on logging into the income tax website, filling out necessary forms, and submitting payment details. Additionally, it provides guidance for addressing queries to the CRM team.