Embed presentation

Download to read offline

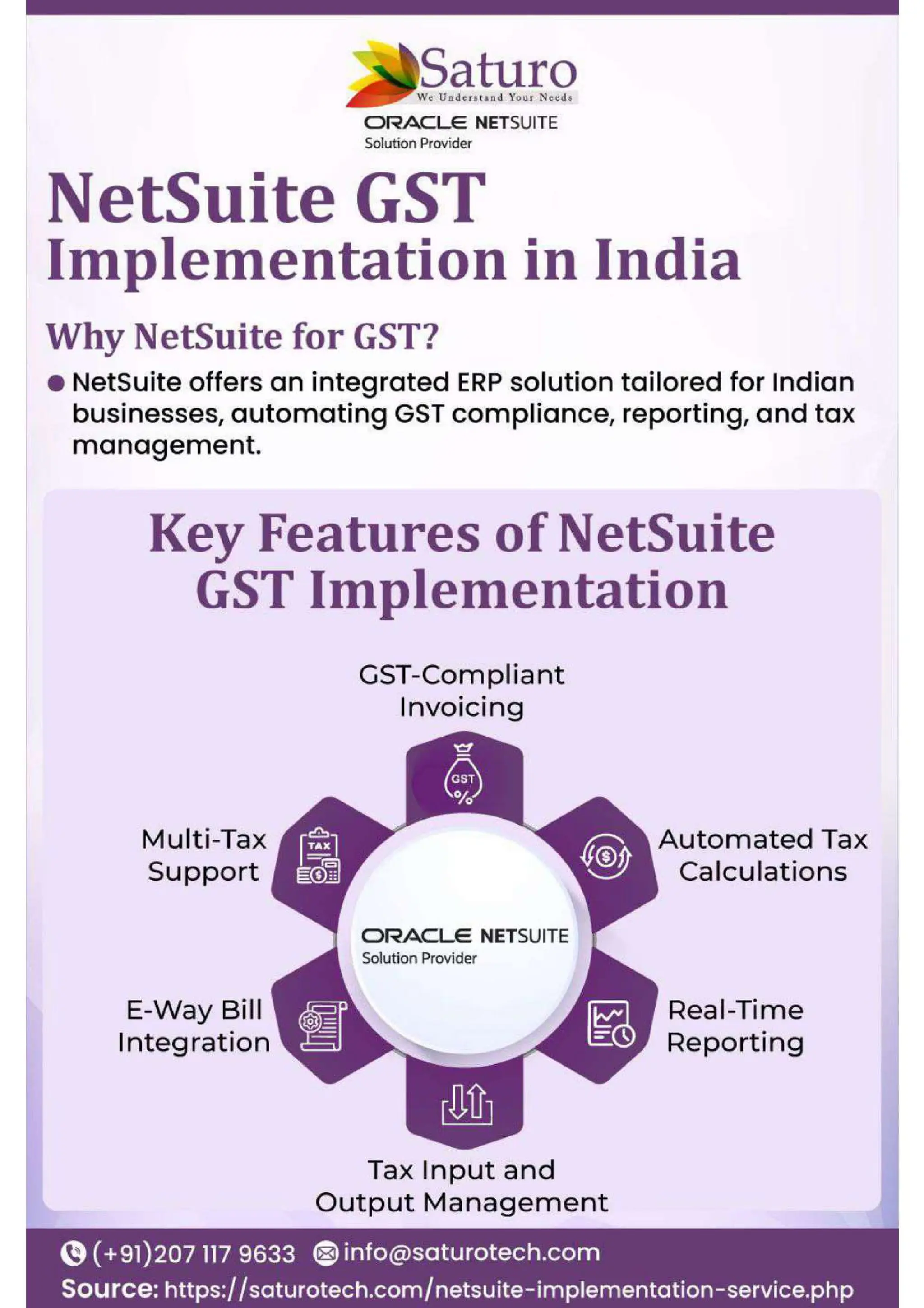

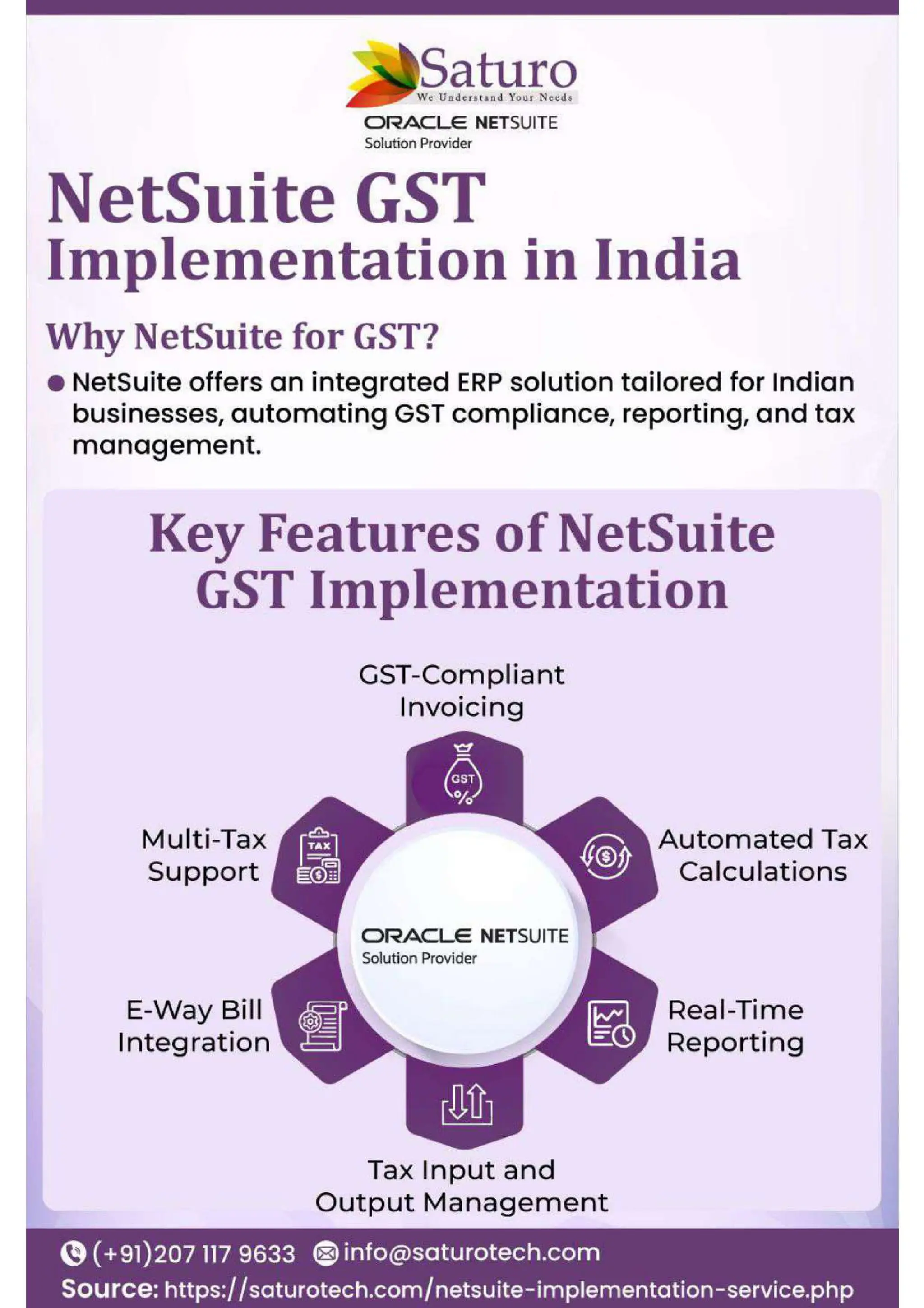

Saturo is an authorized solution provider for Oracle NetSuite and have delivered projects for various clients successfully. Saturo has developed GST and TDS Customization which is 100% compatible with NetSuite and developed on NetSuite platform itself. This GST and TDS Customization is very flexible and can be modified very easily even if there is sudden change in tax norms. We offer you professional off shore NetSuite Indian GST and TDS Custom Solution and Support. We are a cloud technology company and offer a cloud-based solution to our customers. We have customers from the USA, UK, Middle East, APAC, and Australia. Saturo’s Offerings of Indian GST and TDS/TCS Reports in NetSuite: GST Tax Reporting (GSTR1): The Goods and Services Tax Return 1 is a document that each registered tax payer needs to file every month/quarter. It must contain the details of all sales and supply of goods and services made by the tax payer during the tax period. Below are the few reports which we have provided in GSTR1: B2B Report Taxable outward supplies made to registered persons (including UIN-holders) Under this we can provide all the invoice detail for register customer. HSN-Code Report By creating the HSN/ SAC code as per the item and services provides by client system can generate the report. B2CL Taxable outward inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh. B2CS All invoices which have less than 2.5 lakhs amount will be including in this report with unregister person. Exempt and non GST outward supplies On the basis on nil and exempted item all detail of invoice will populate in this report section. CDNR Customer credit note and debit note for register person, can we generate by setting all information on the record. CDNUR Customer credit note and debit note for unregister person can we generate by setting all information on the record. Export On the basis of tax code and place of supply setting system can generate the zero rated report. GSTR1 Summary Report This will provide the summary of all invoices by each section as per government rule. Tax Reporting (GSTR-3B): GSTR-3B is a simplified summary return and the purpose of the return is for taxpayers to declare their summary GST liabilities for a particular tax period and discharge these liabilities. A normal taxpayer is required to file Form GSTR-3B returns for every tax period. Below are the few Reports which we have provided in GSTR-3B: Outward taxable supplies (other than zero rated, nil rated and exempted): All the invoice detail except zero, nil and exempted we track under this report. Outward taxable supplies (zero rated): This report can we be generated for zero rated tax code selected on invoice. Other outward supplies, (Nil rated, exempted): This report can we generated for nil rated and exempted tax code selection on invoice. Inward supplies (liable to reverse charge):