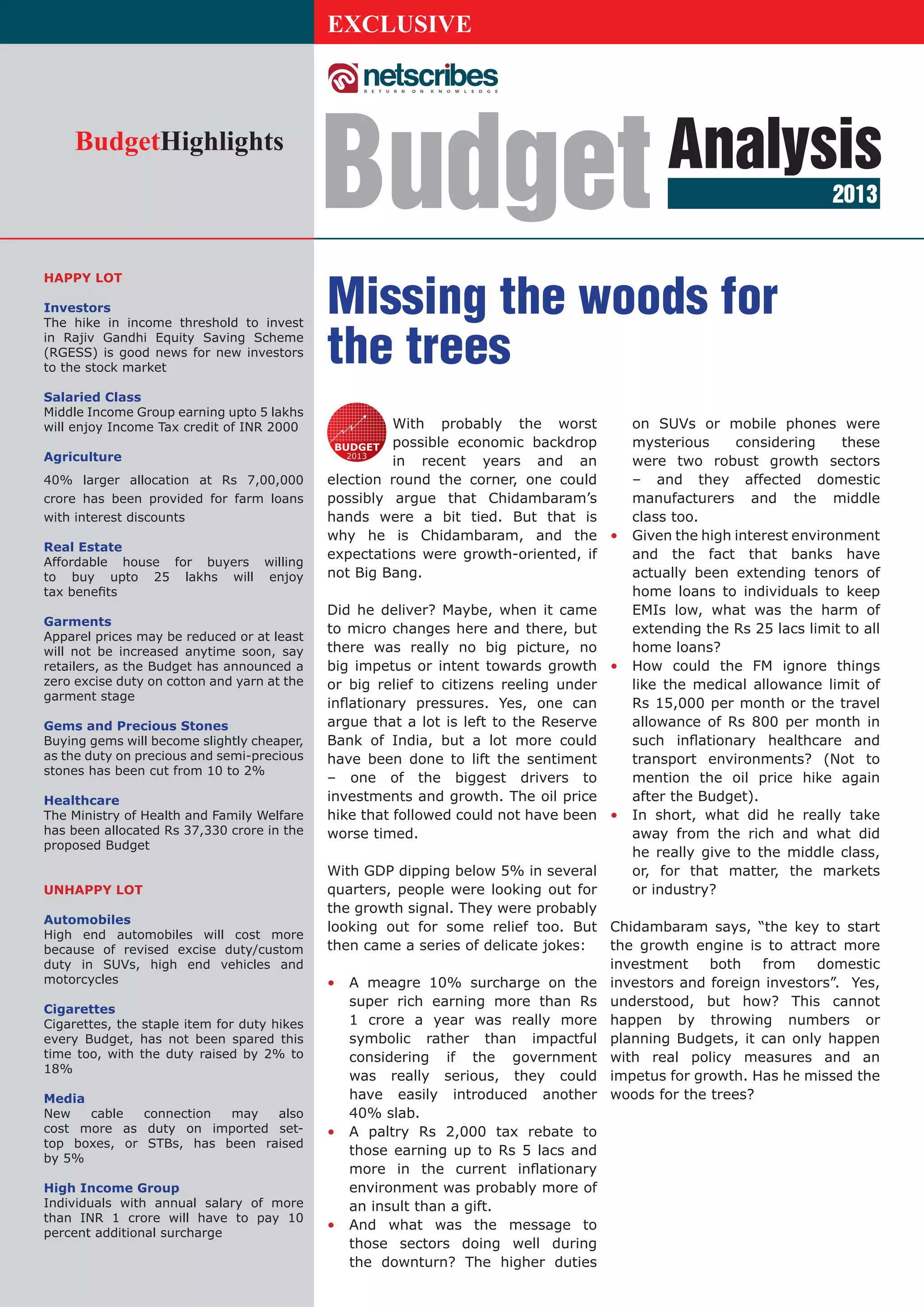

The budget analysis document provides a summary of key aspects of the 2013 Indian budget. It highlights that while the budget aimed to address certain sectors, it lacked a clear growth strategy and big reforms. It notes some positive steps like increased farm lending and fiscal deficit targets, but argues more could have been done to boost growth, investment and relieve inflation pressures. The summary critiques the budget for failing to meaningfully tax the rich or benefit the middle class.