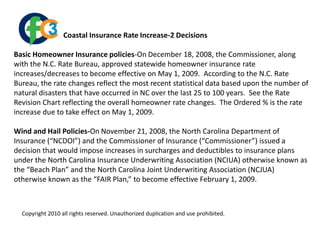

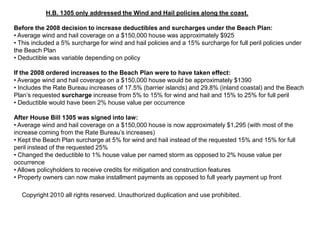

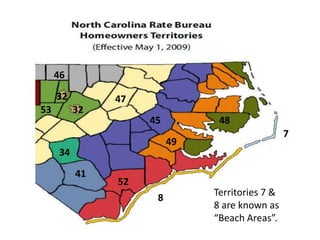

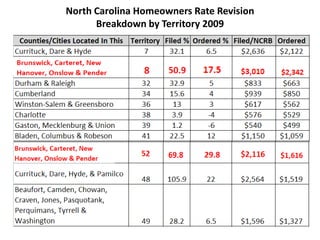

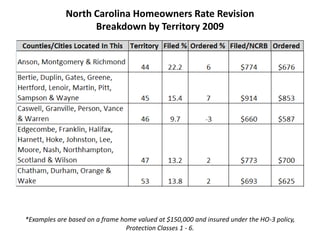

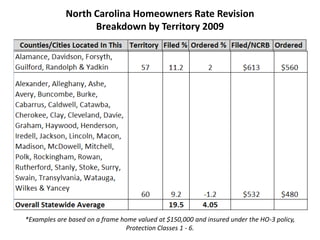

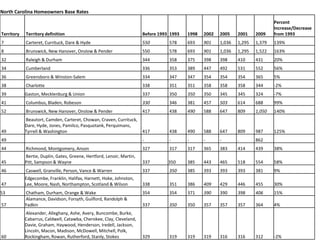

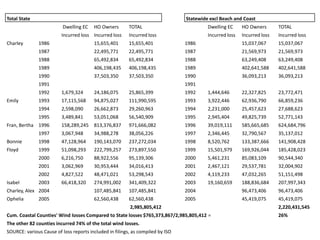

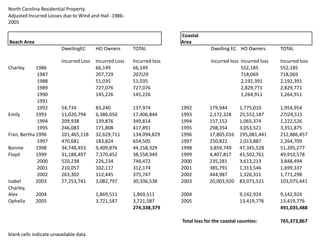

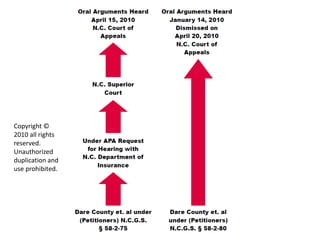

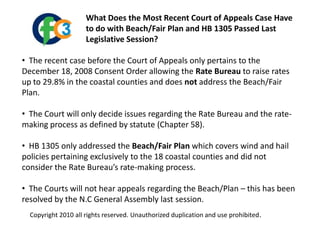

The document discusses two decisions related to coastal insurance rate increases in North Carolina. The first decision approved statewide homeowner insurance rate increases of up to 29.8% for coastal counties. The second decision imposed increases to wind and hail insurance plans, but a new law (HB 1305) reduced some of those increases and changes. The document also addresses related court cases and provides recommendations for achieving fairness in the state's rate-making process.