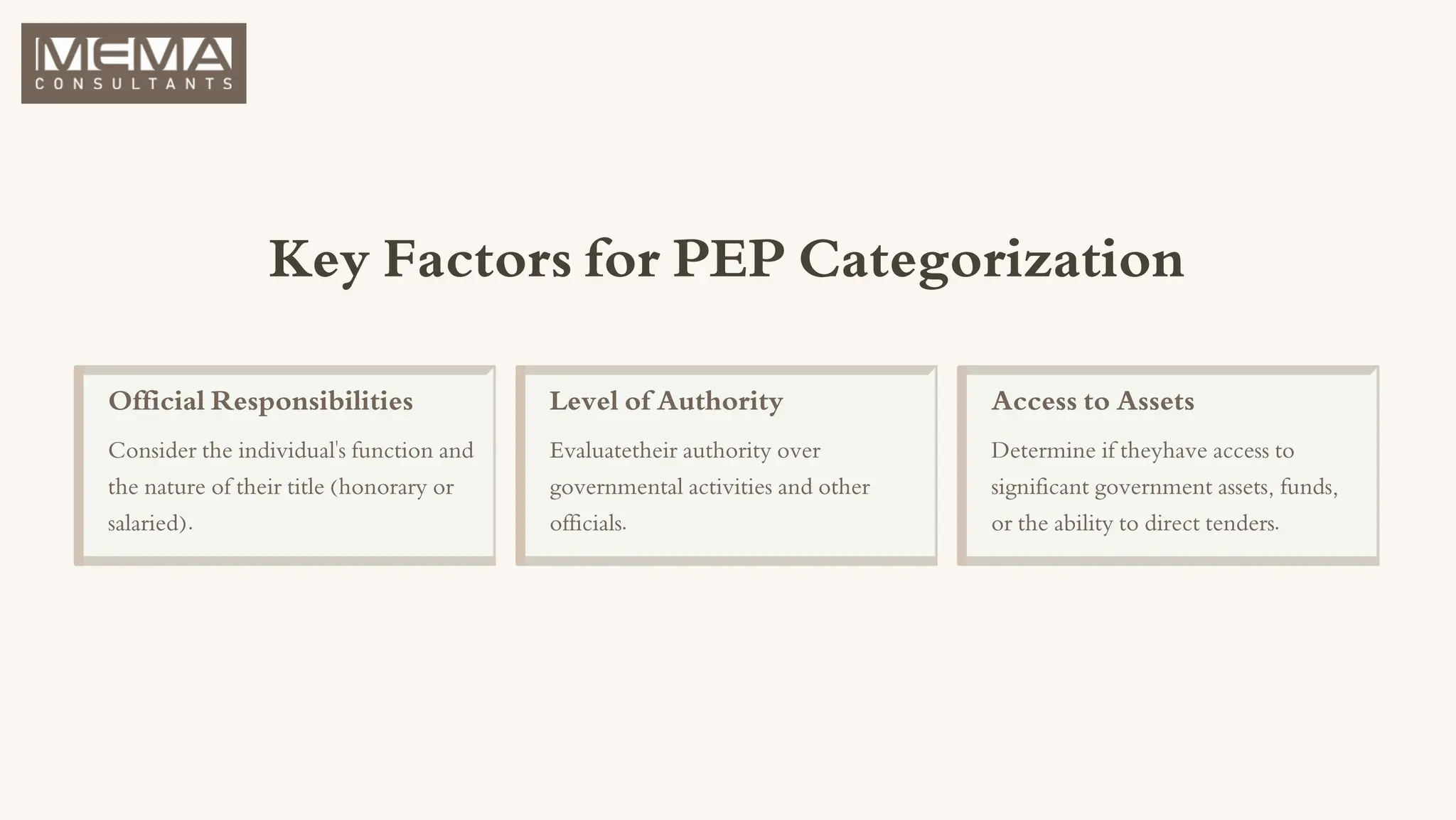

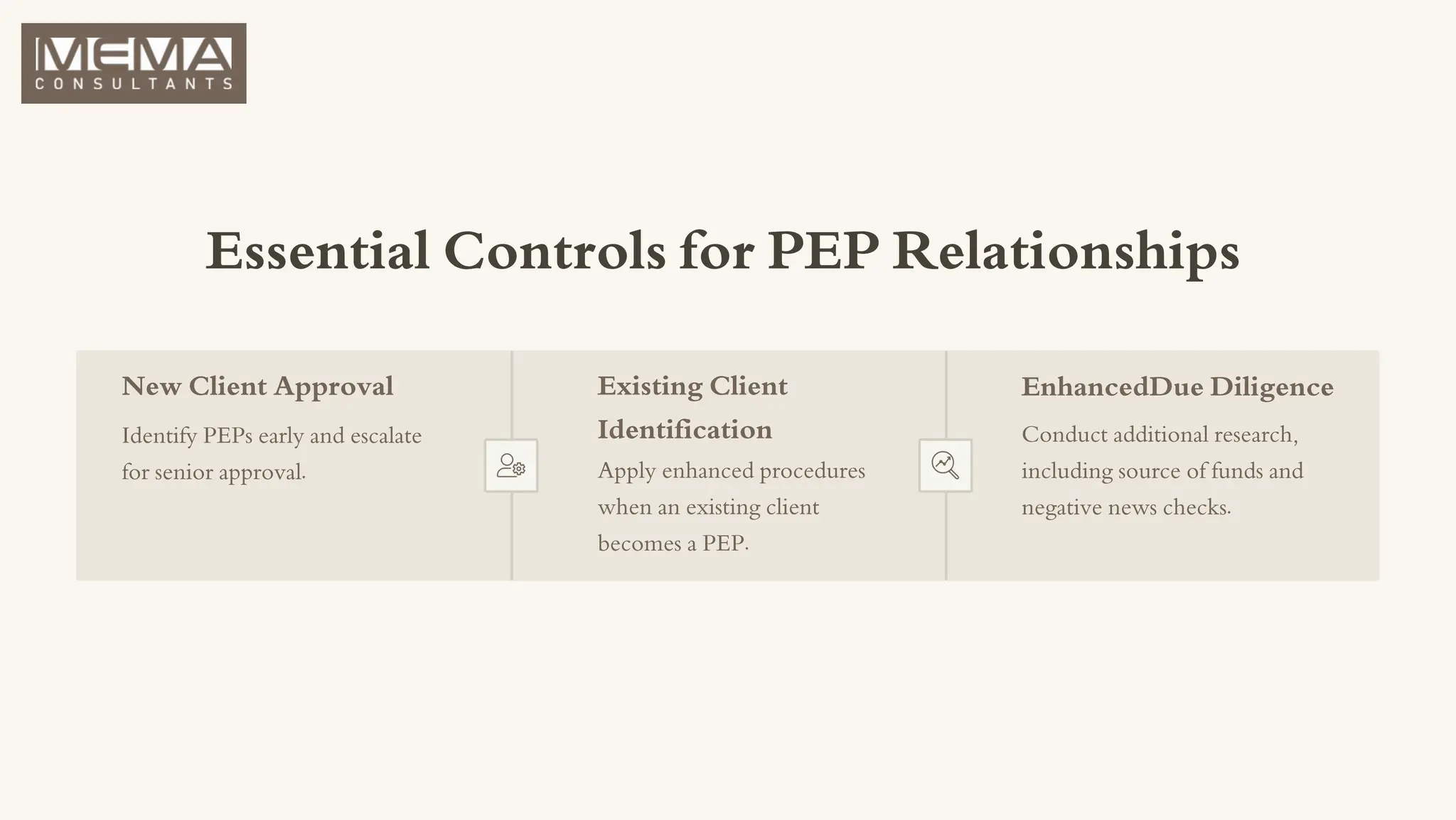

This presentation provides a comprehensive guide to understanding Politically Exposed Persons (PEPs) and their impact on compliance. It explains why PEPs are considered high-risk, outlines key factors for categorization, and details essential controls such as enhanced due diligence and customer due diligence procedures. Learn how MEMA Consultants helps organizations maintain regulatory integrity while managing PEP-related risks effectively.