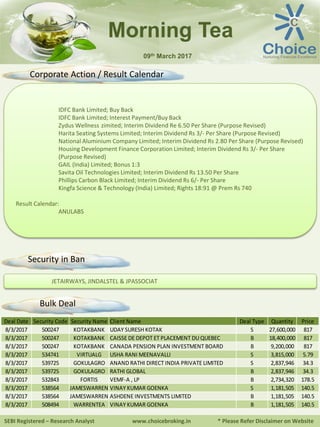

The document provides a morning market summary and analysis on March 9th, 2017. It discusses movements in global markets, with US markets dipping as energy stocks declined over 5% on rising inventories. Asian markets were mixed as China inflation data was released. The Indian market is expected to open lower tracking Asian indices. Two stocks, Aegischem and Marksans, are recommended as buy trades. The document also provides corporate actions, result calendar, and disclaimer.