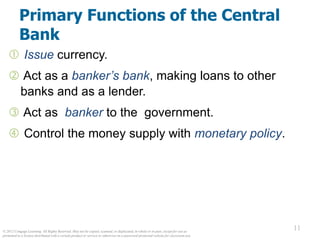

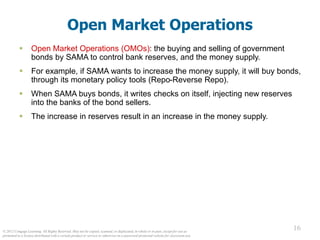

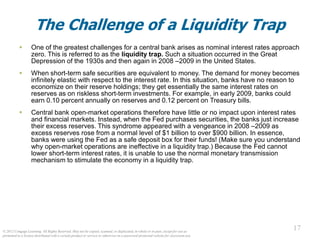

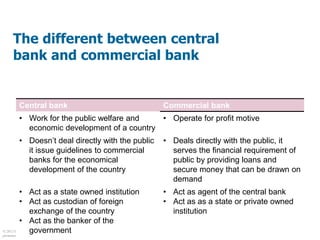

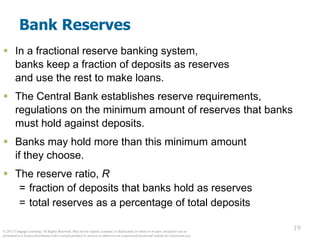

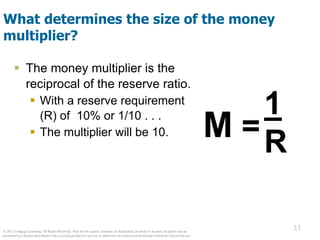

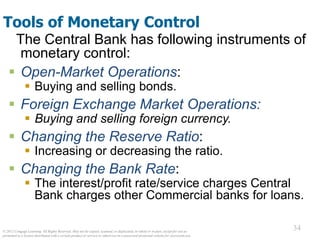

The document discusses the functions and operations of central banks. It focuses on the Saudi Arabian Monetary Agency (SAMA), which serves as the central bank of Saudi Arabia. SAMA's key responsibilities include issuing currency, acting as a bank for commercial banks and the government, controlling the money supply through monetary policy tools like reserve requirements and open market operations, and maintaining price stability and a fixed exchange rate. The ultimate goals of SAMA's monetary policy are economic growth and low, stable inflation.