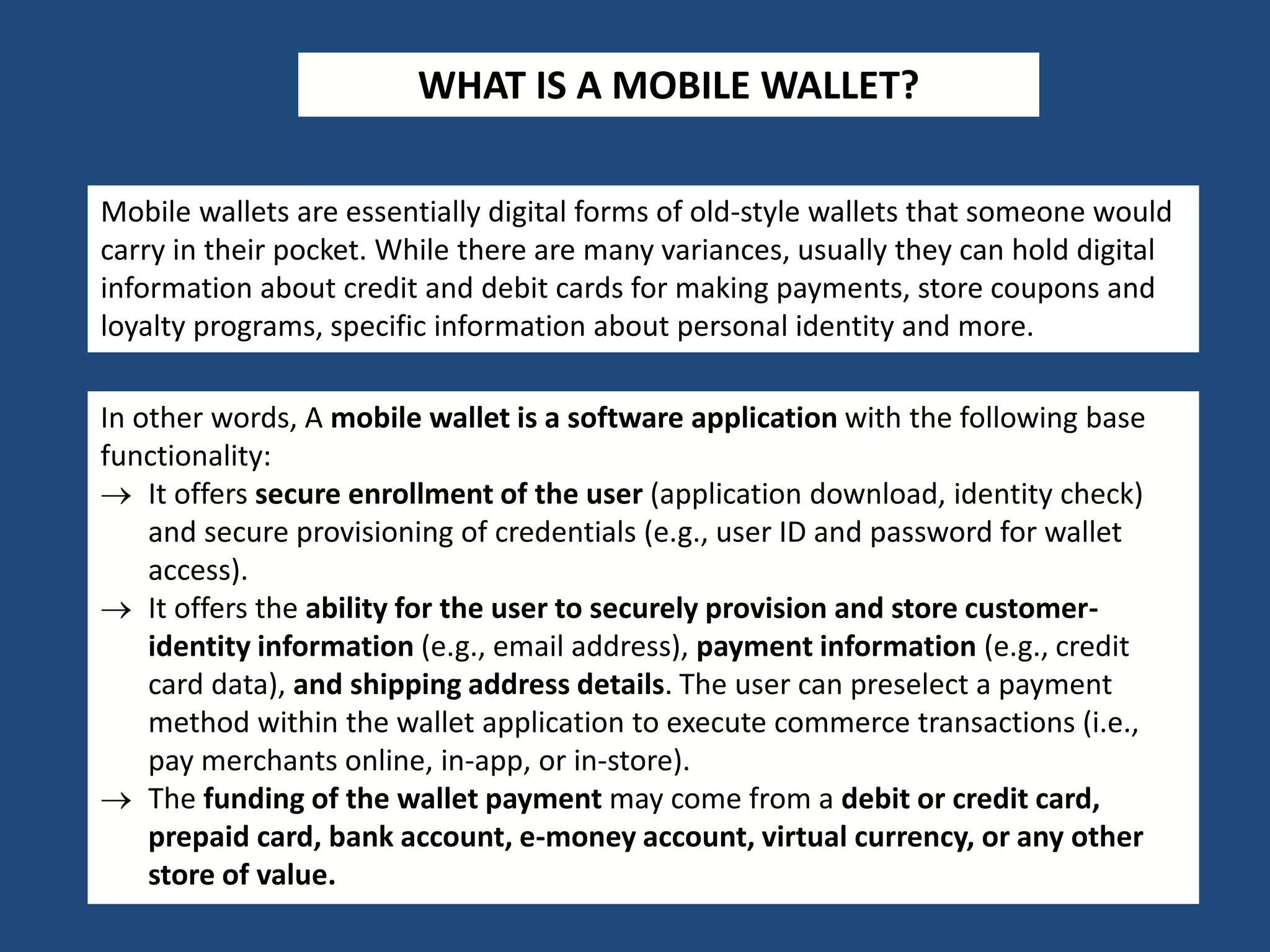

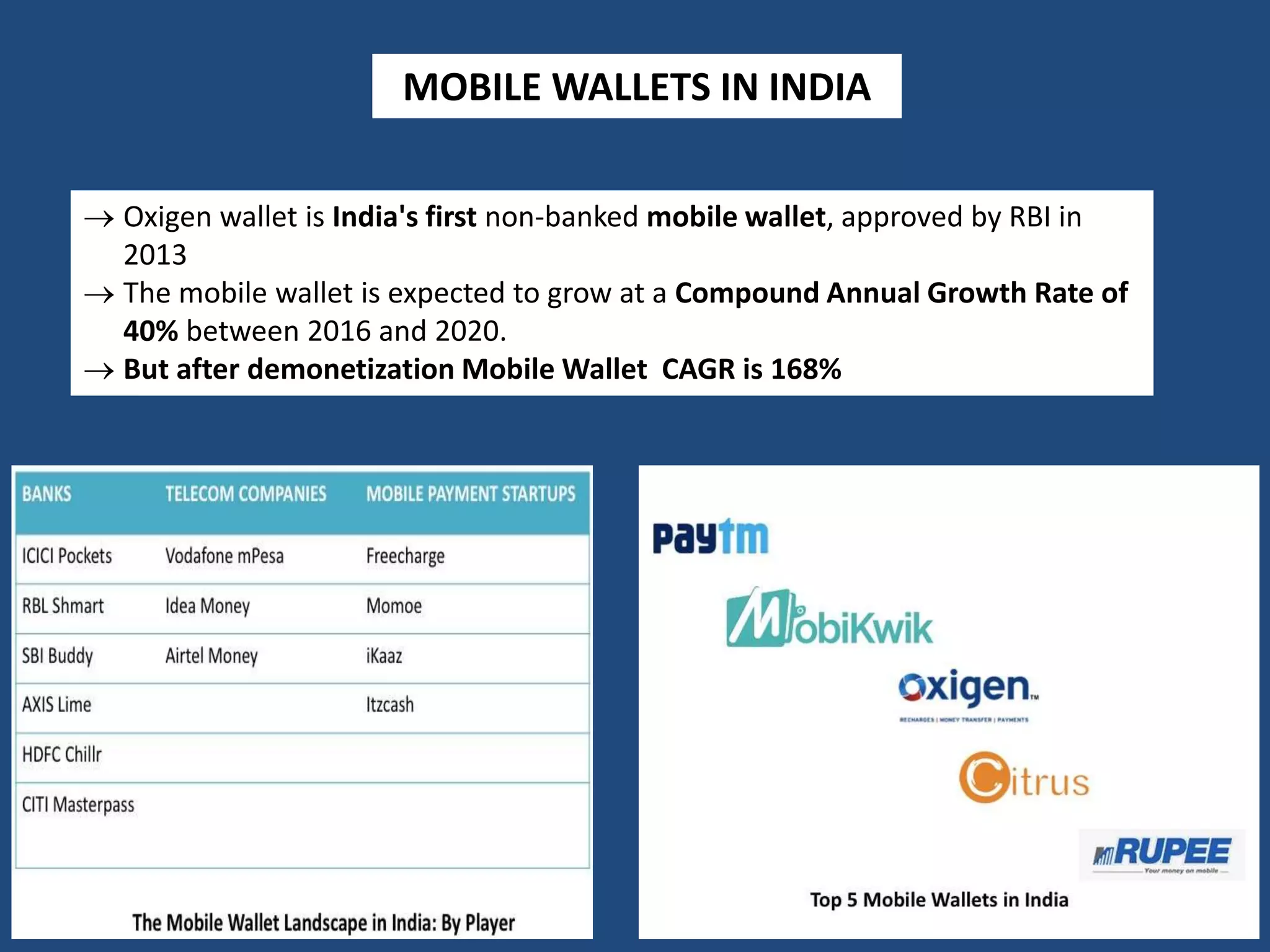

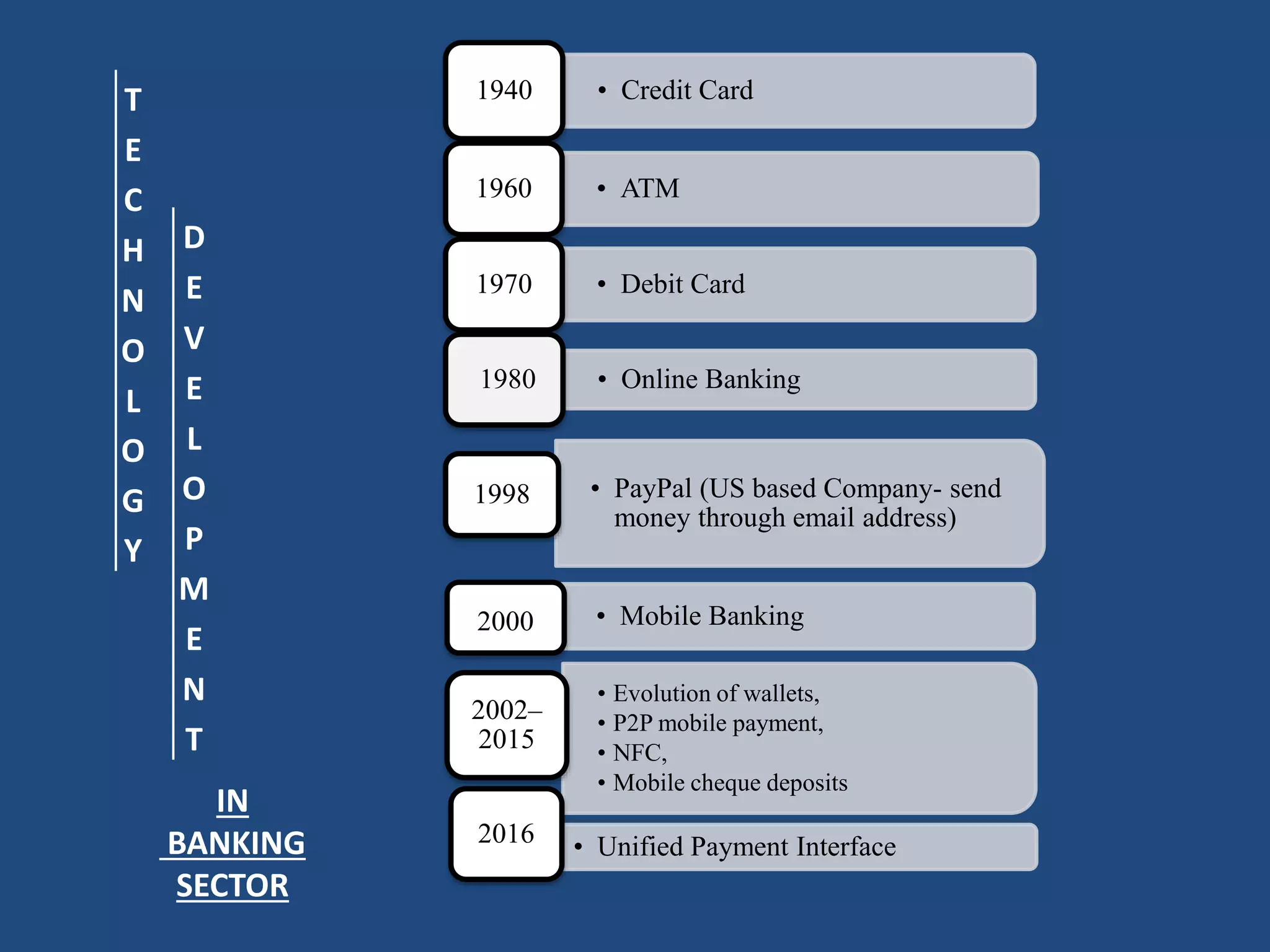

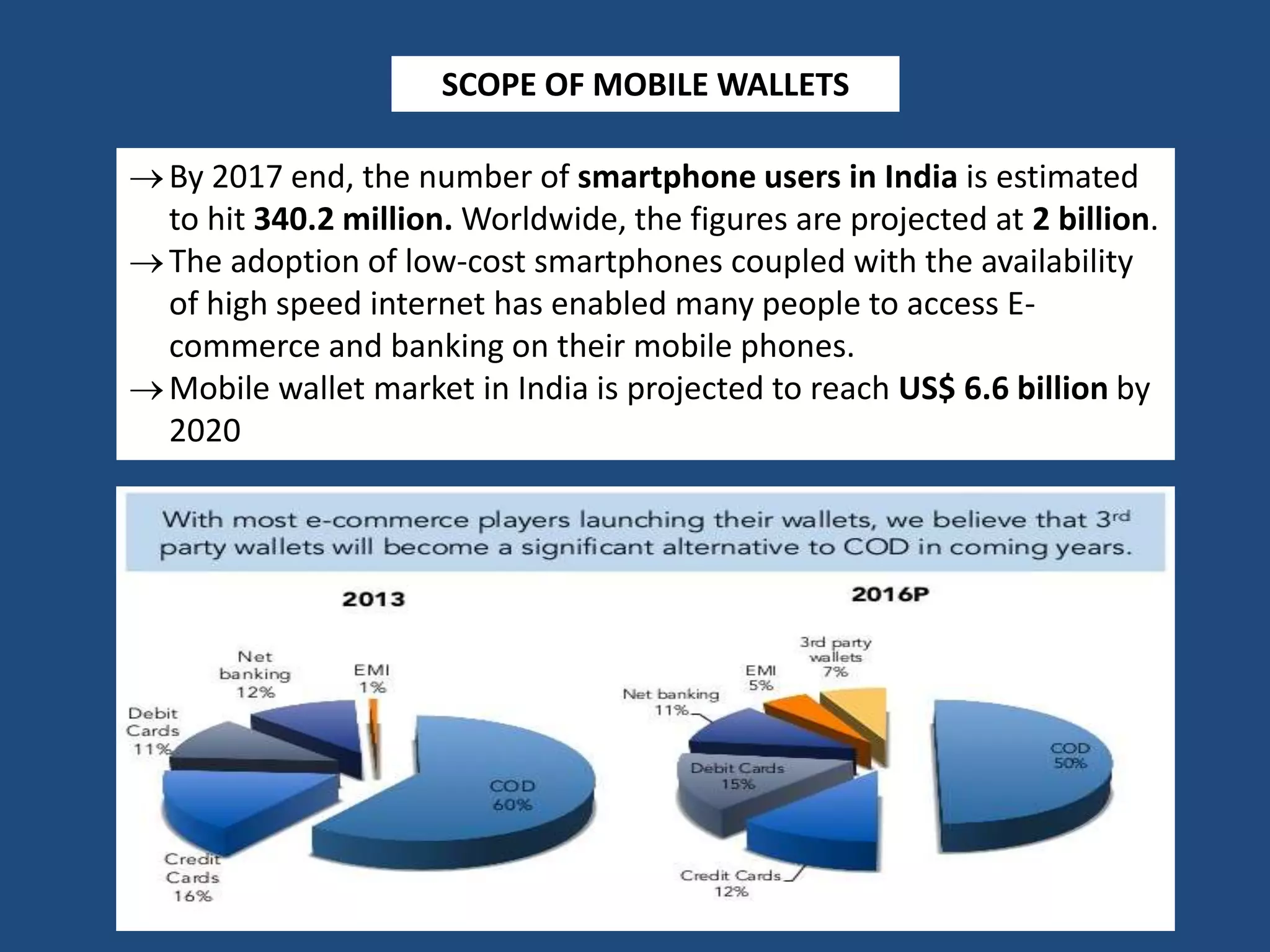

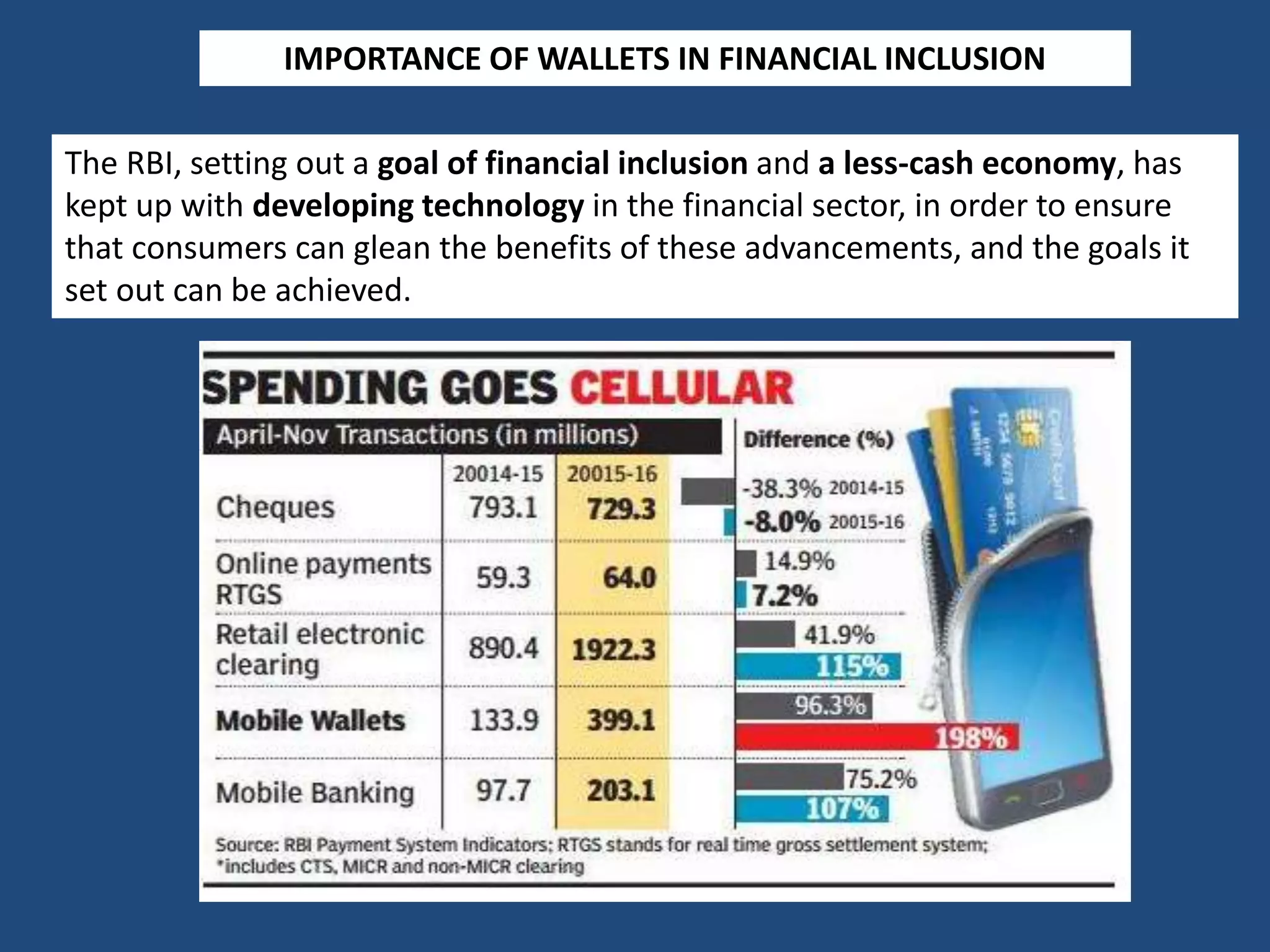

Mobile wallets are digital forms of traditional wallets that store payment and identity information on a mobile device. In India, mobile wallets grew rapidly after demonetization but now face threats from the Unified Payments Interface (UPI) and new Payment Banks licensed by the RBI. To remain competitive, mobile wallets will need to enhance their apps to be as easy to use as UPI and offer more discounts, offers, and loyalty programs to attract and retain customers.