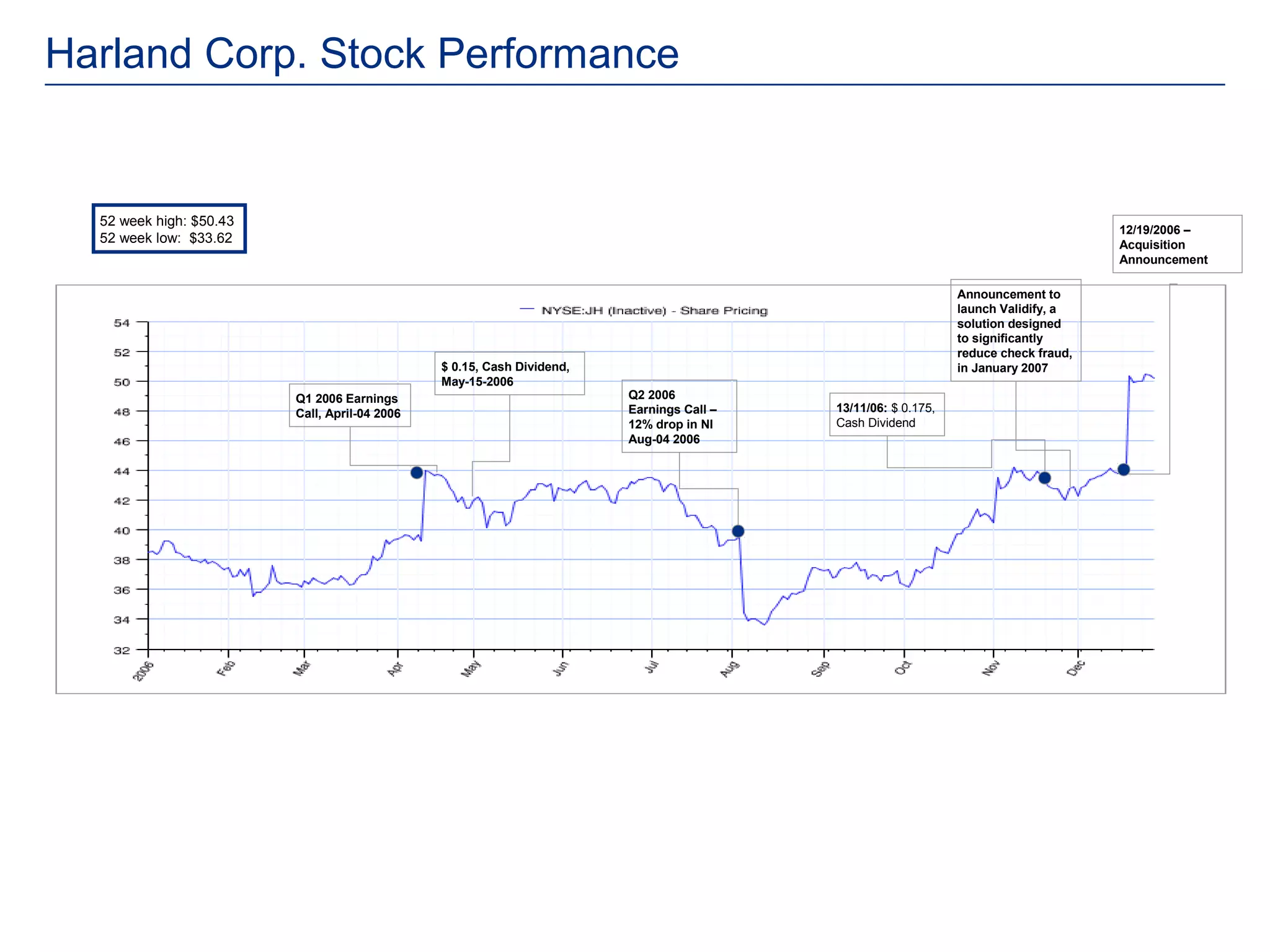

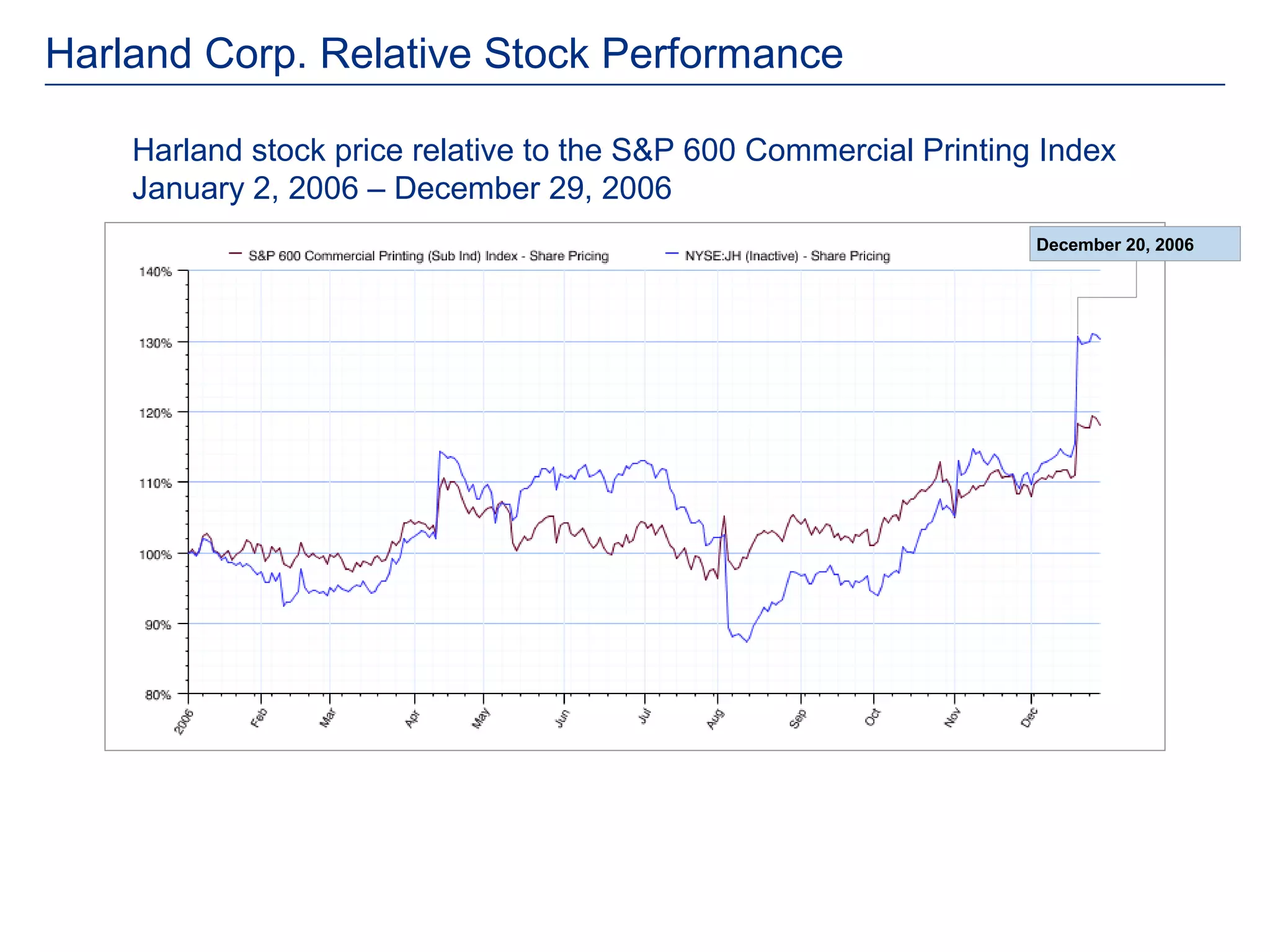

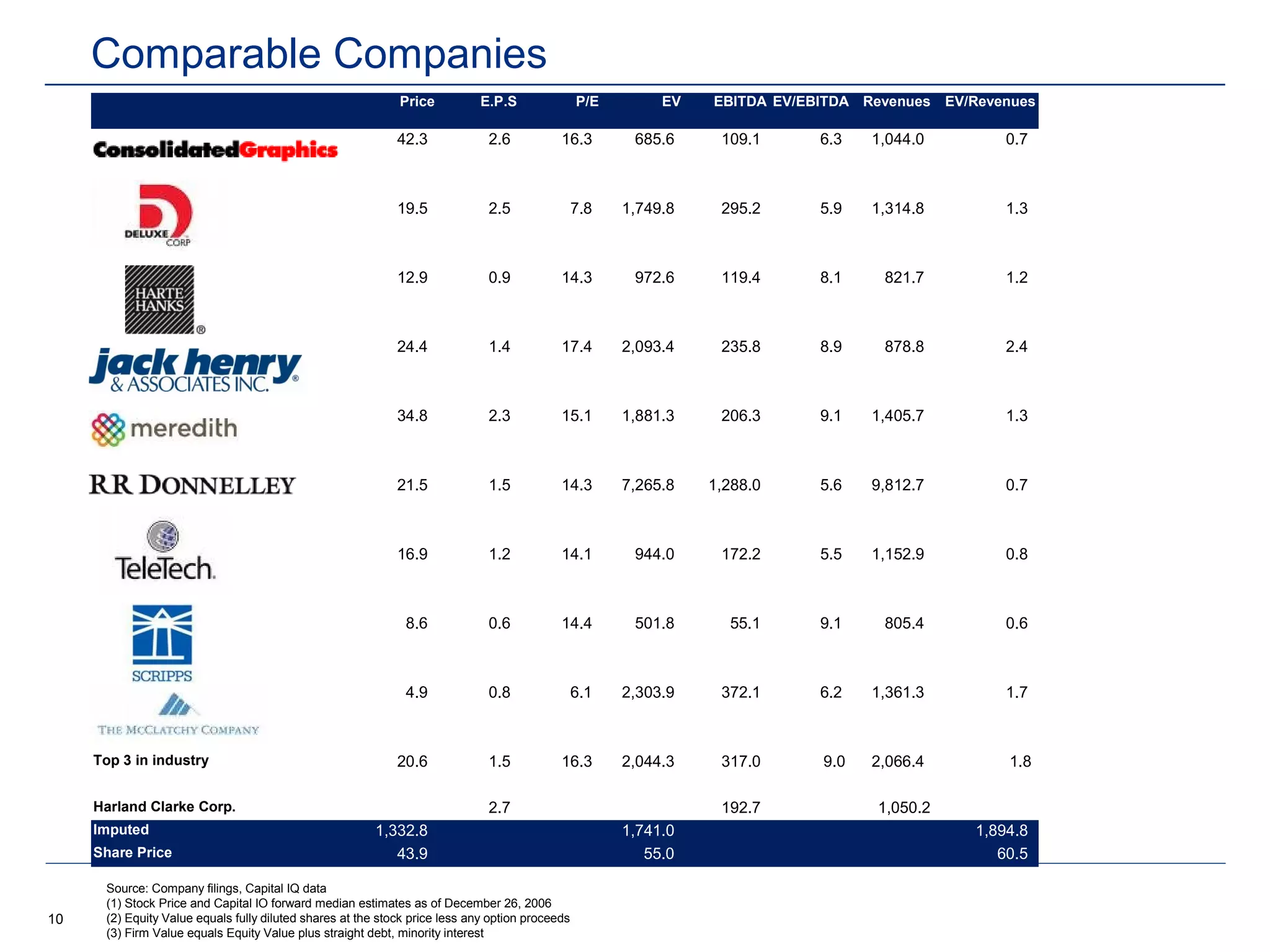

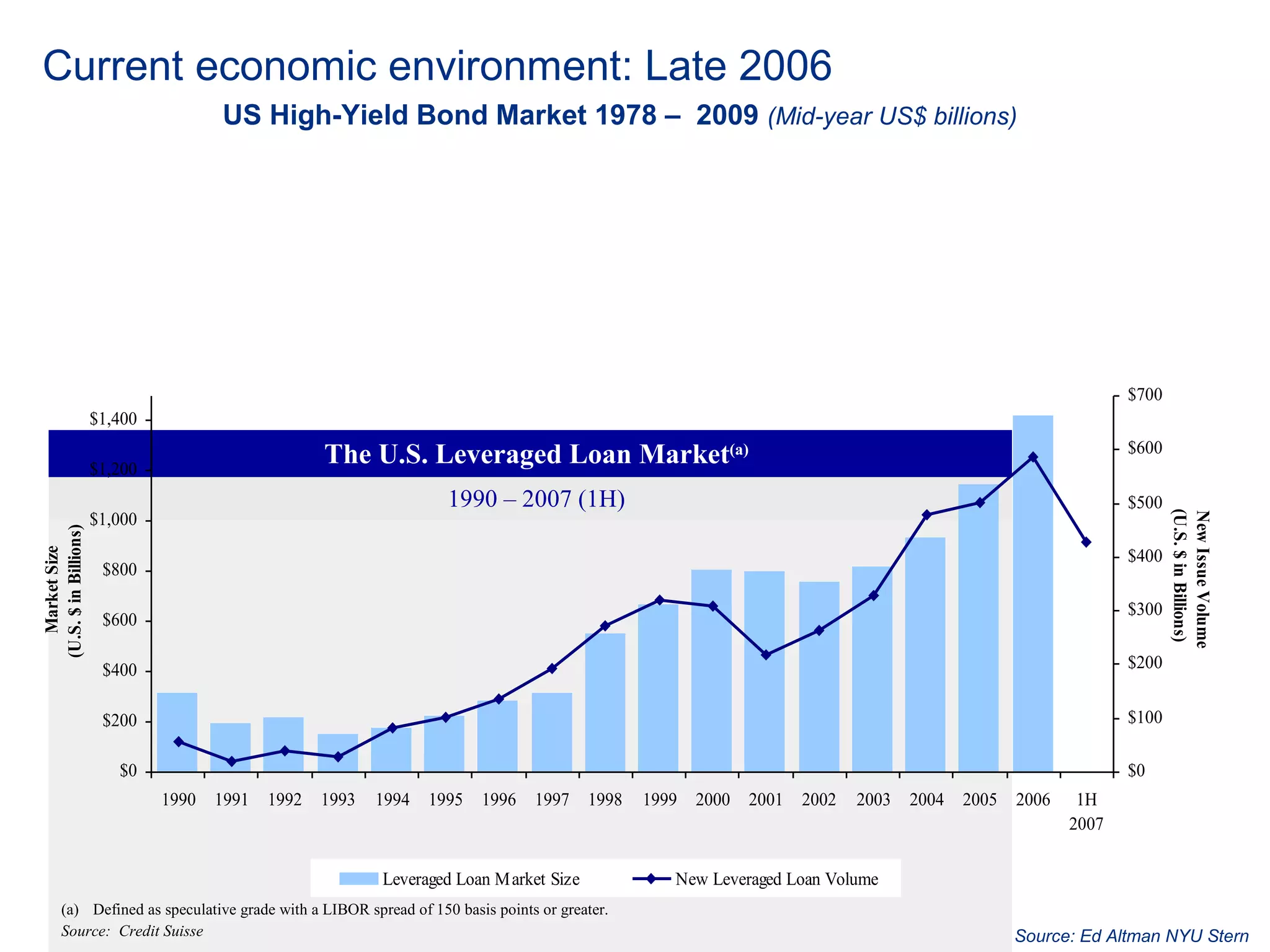

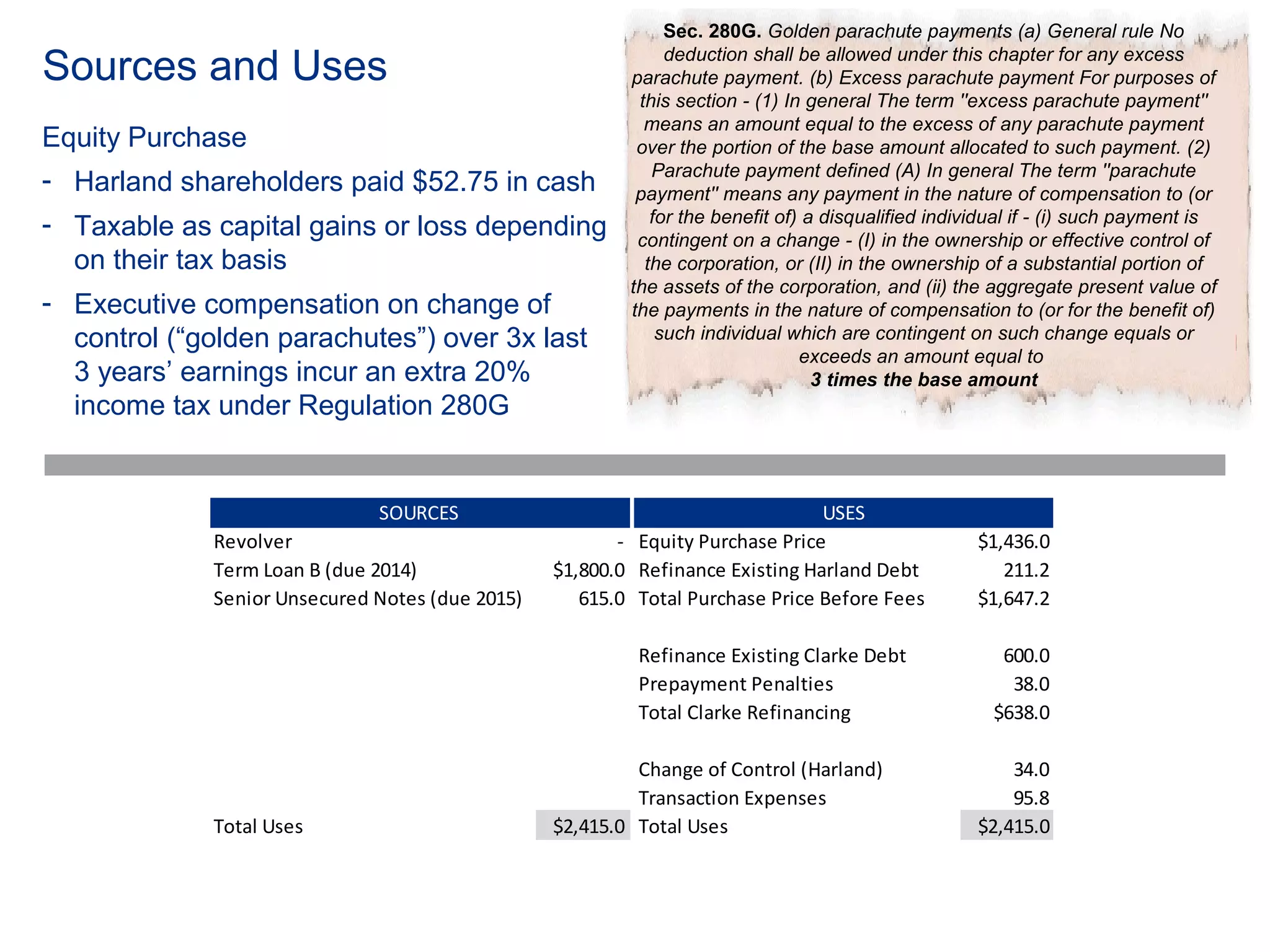

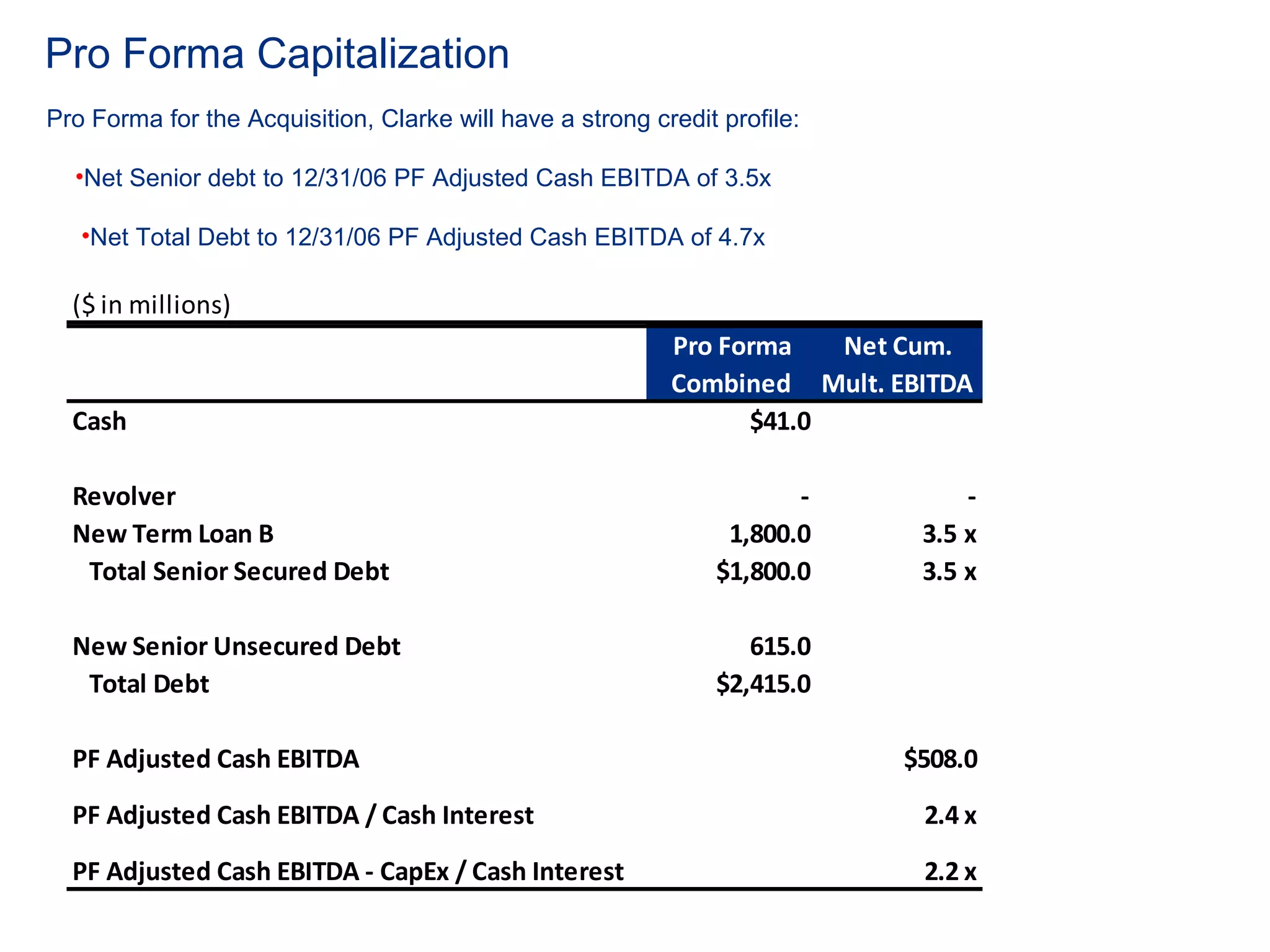

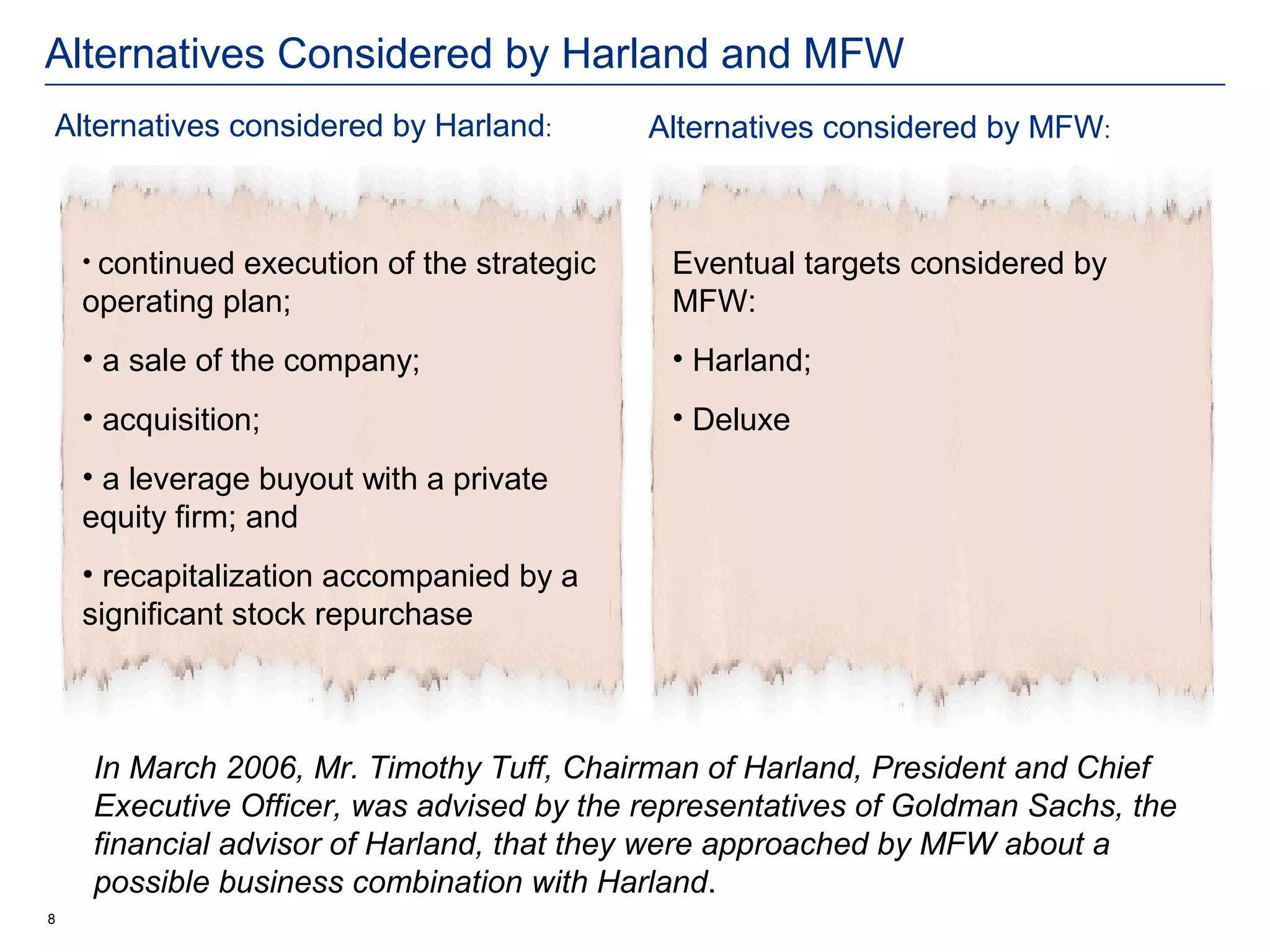

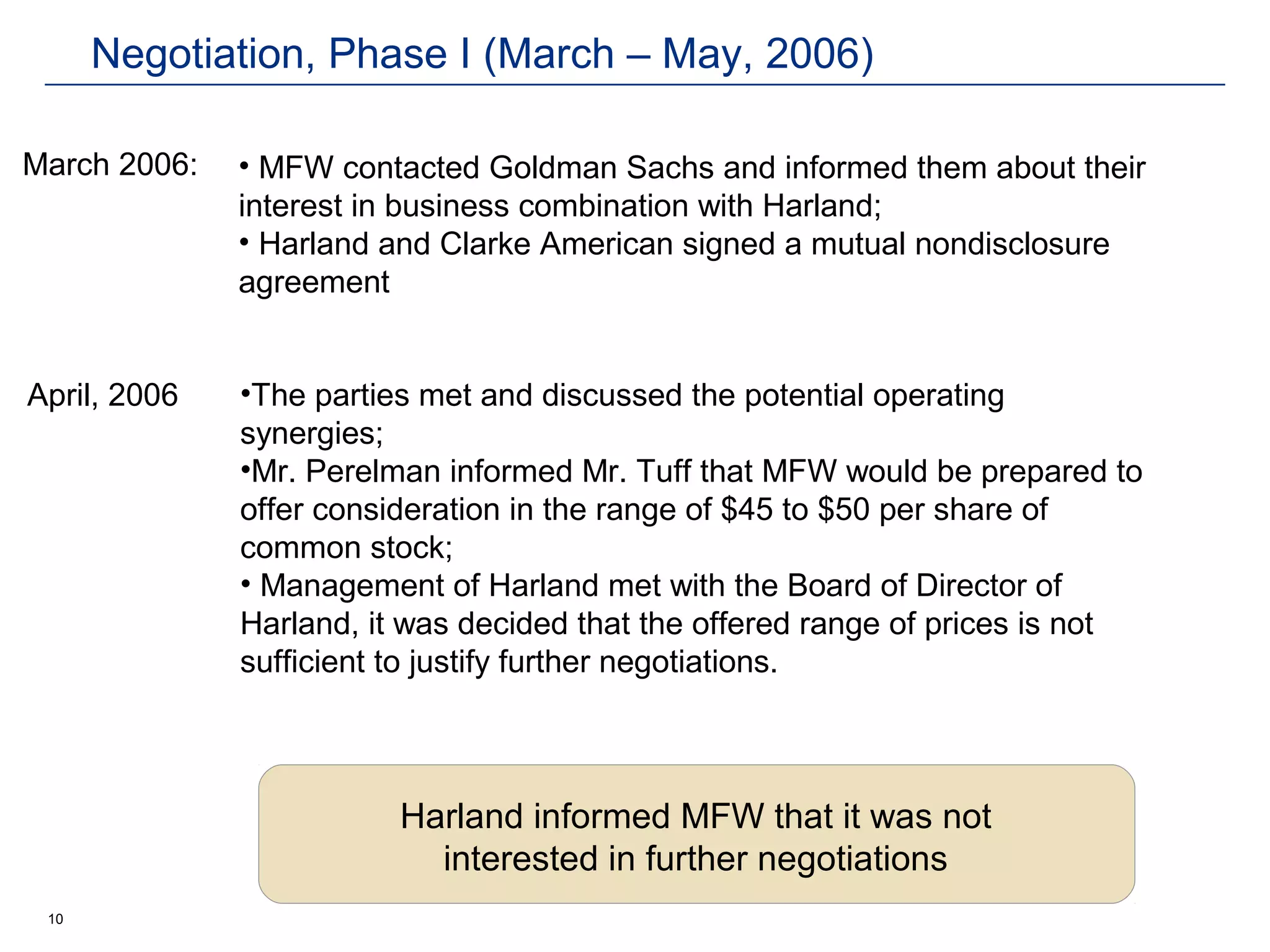

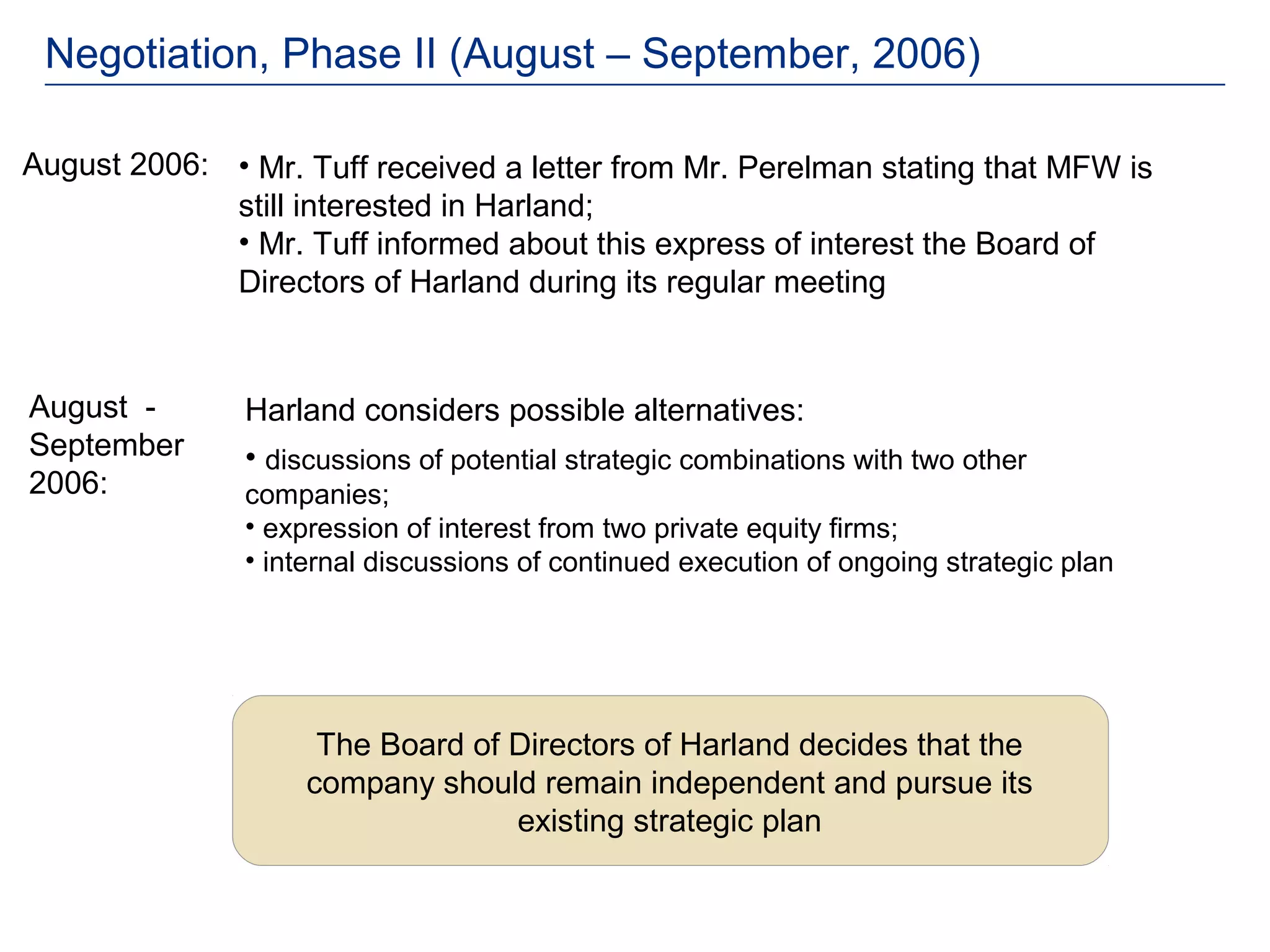

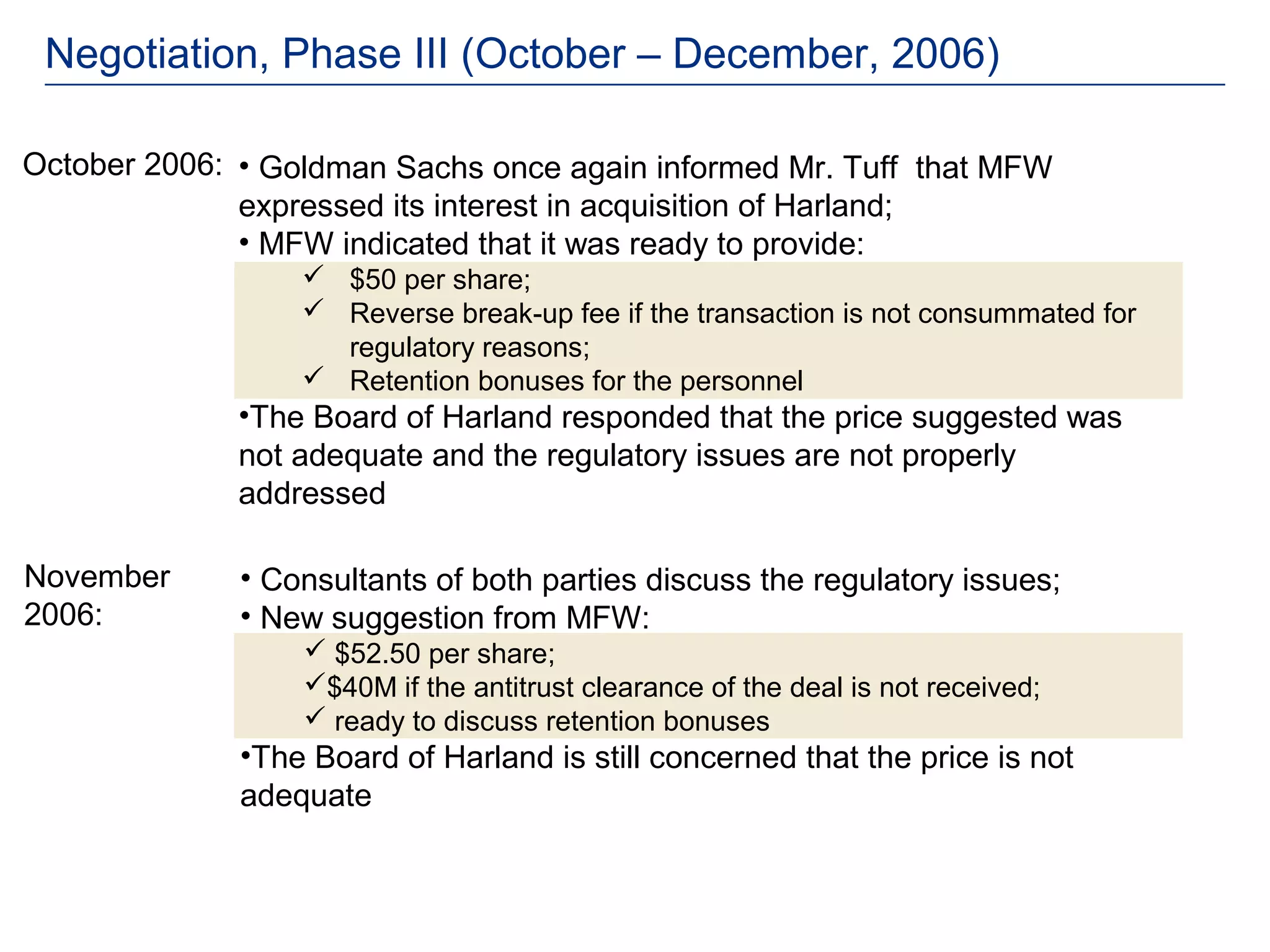

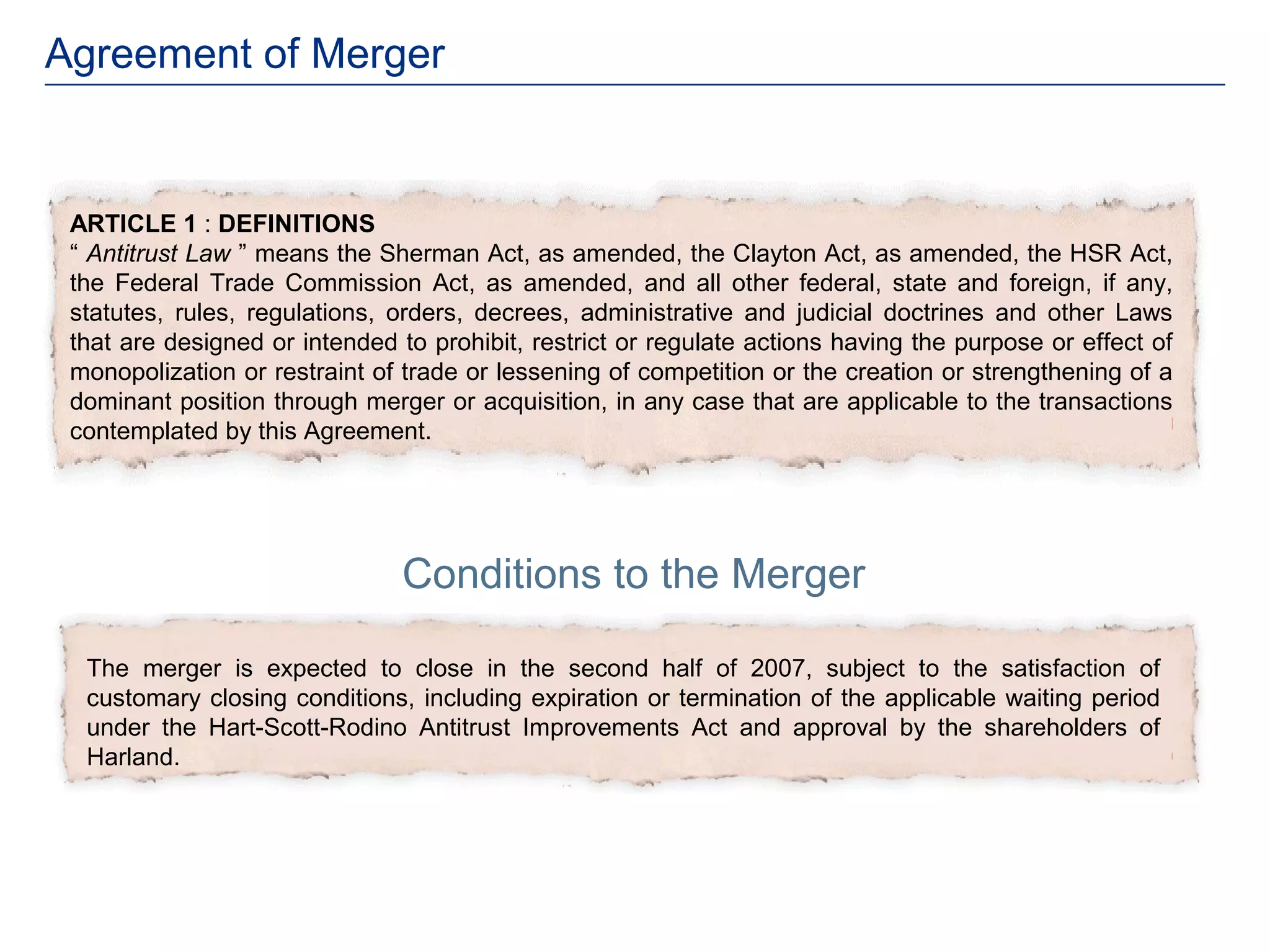

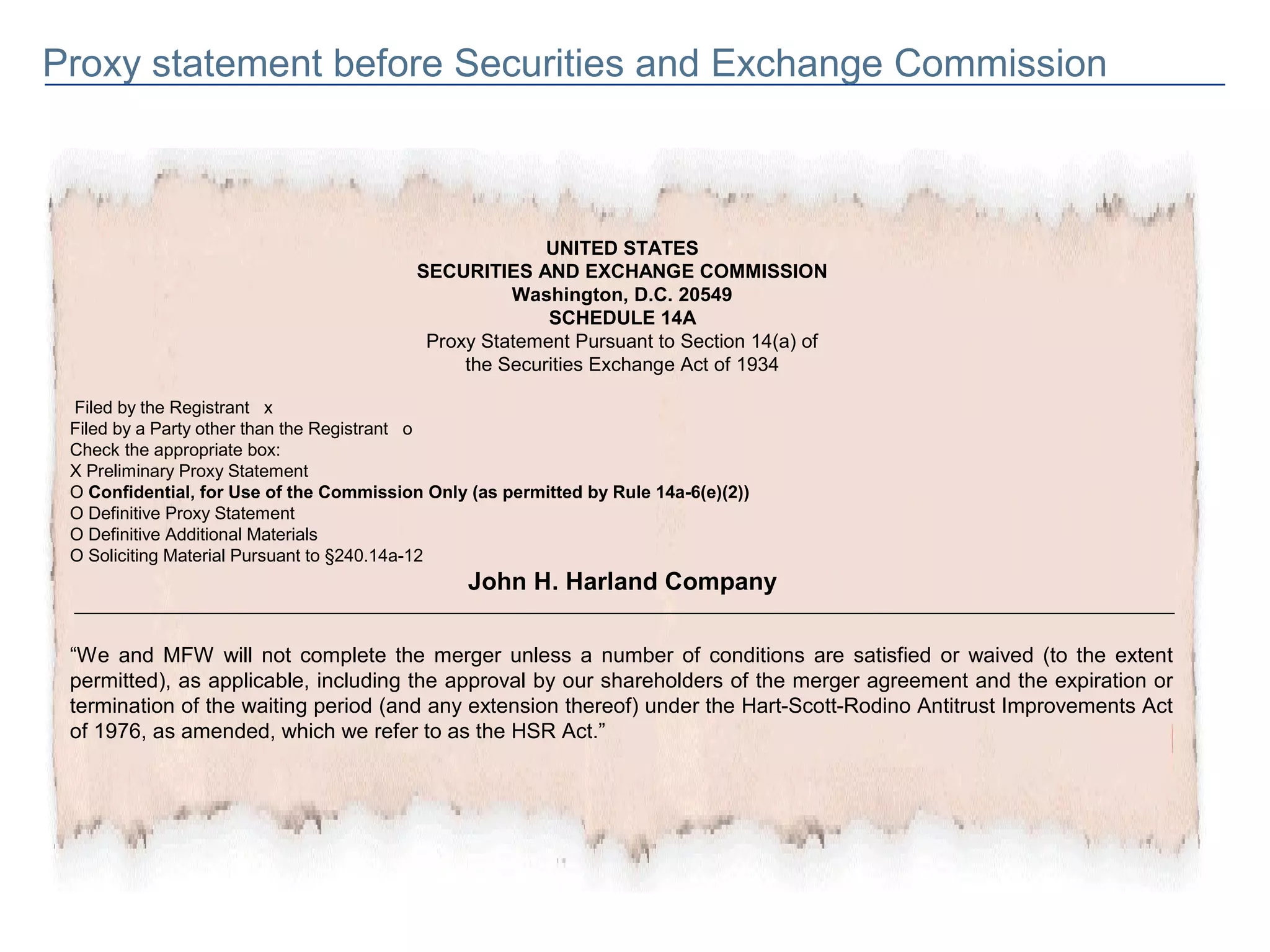

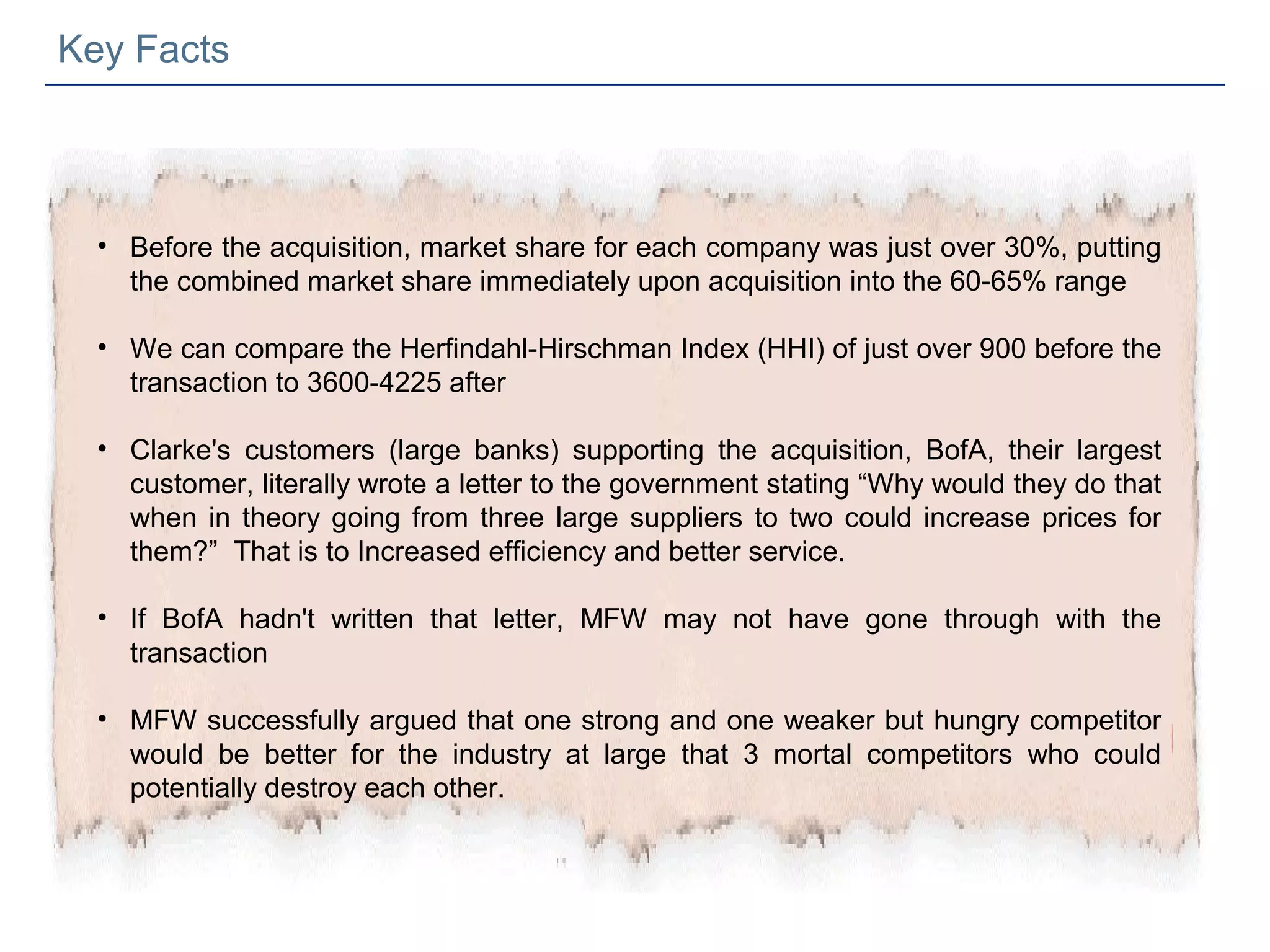

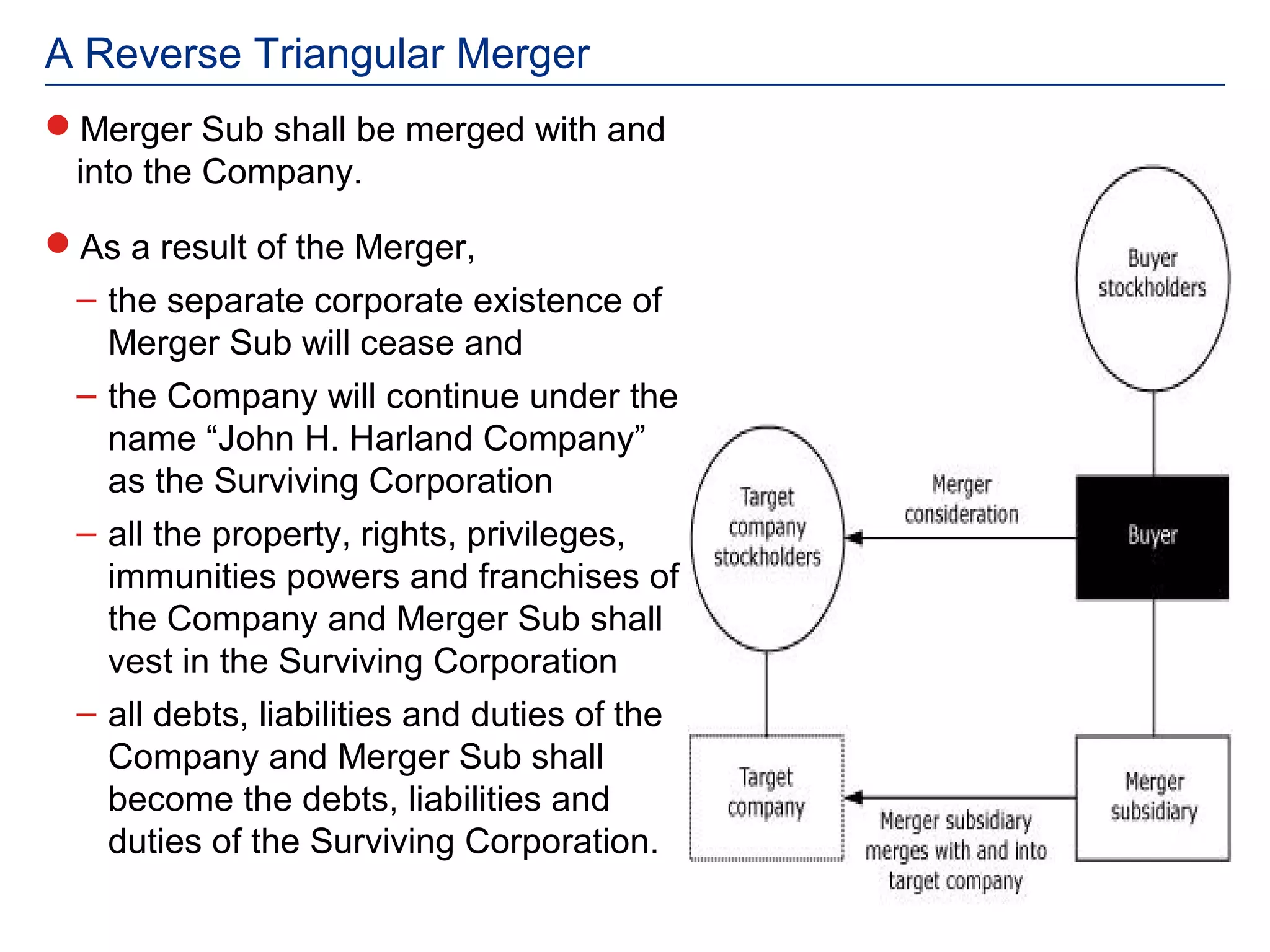

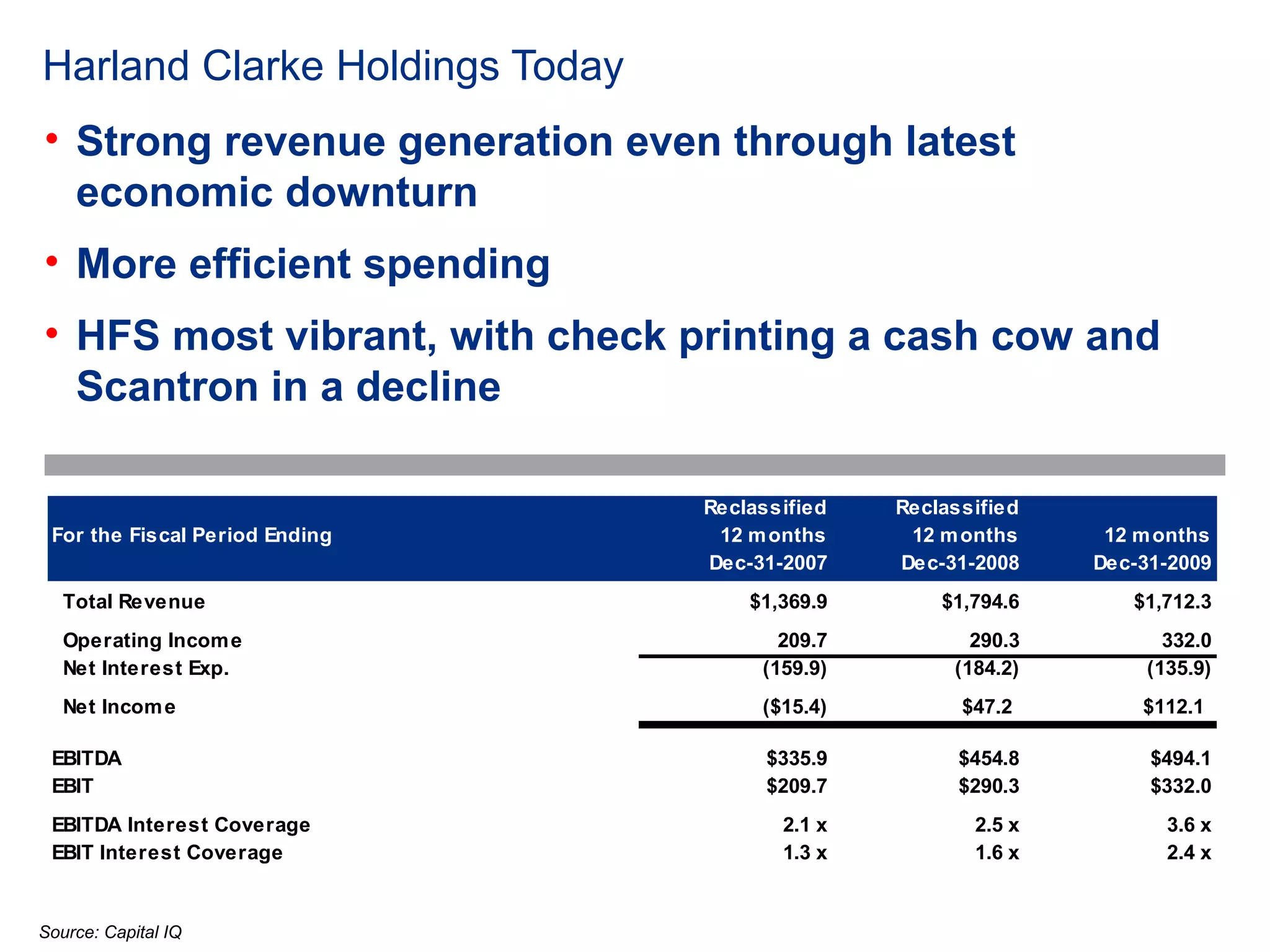

The document summarizes M&F Worldwide's proposed acquisition of Harland Corporation. Some key points:

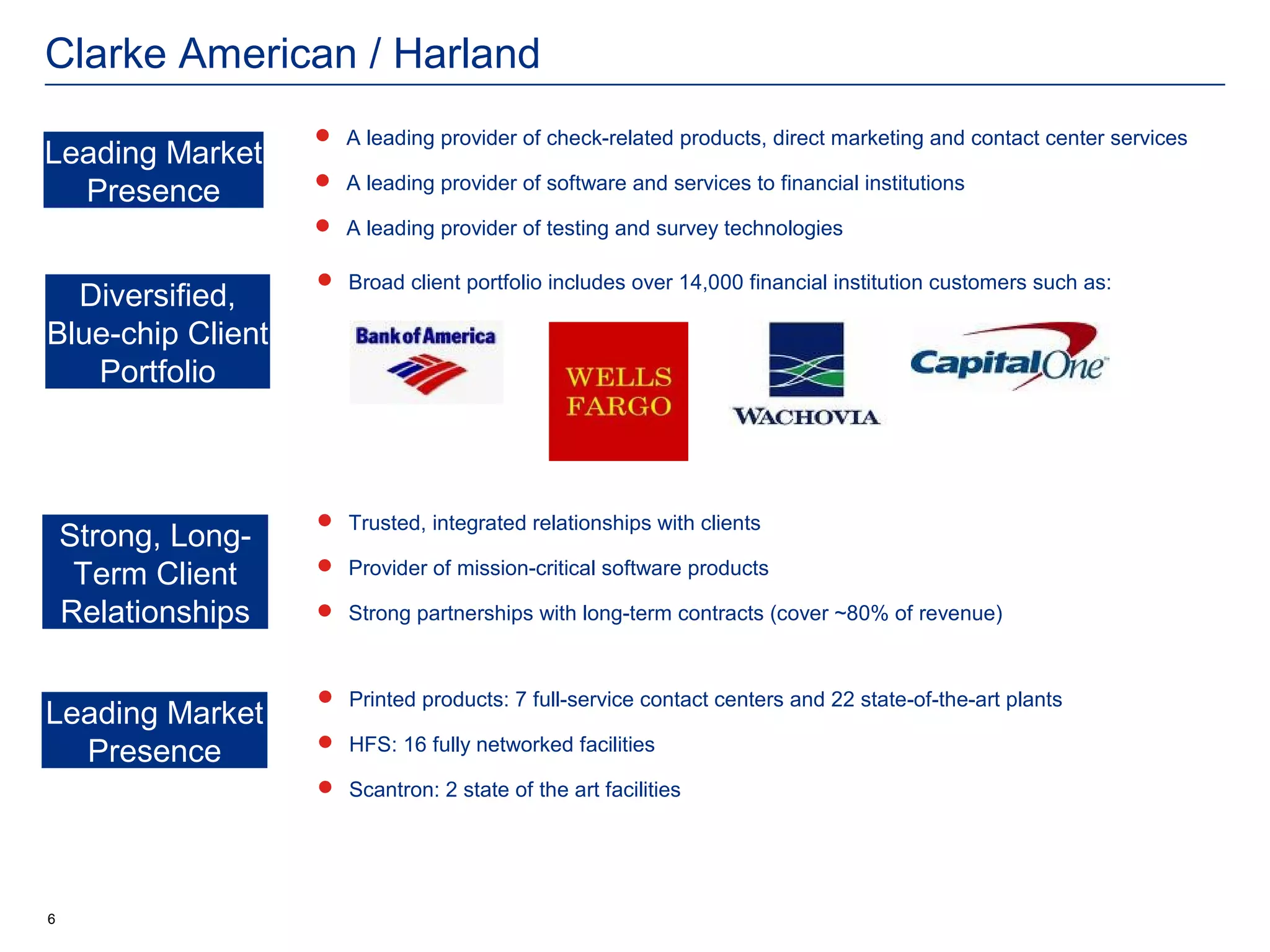

- M&F Worldwide is seeking an acquisition opportunity and Harland is one of the three major players in their industry.

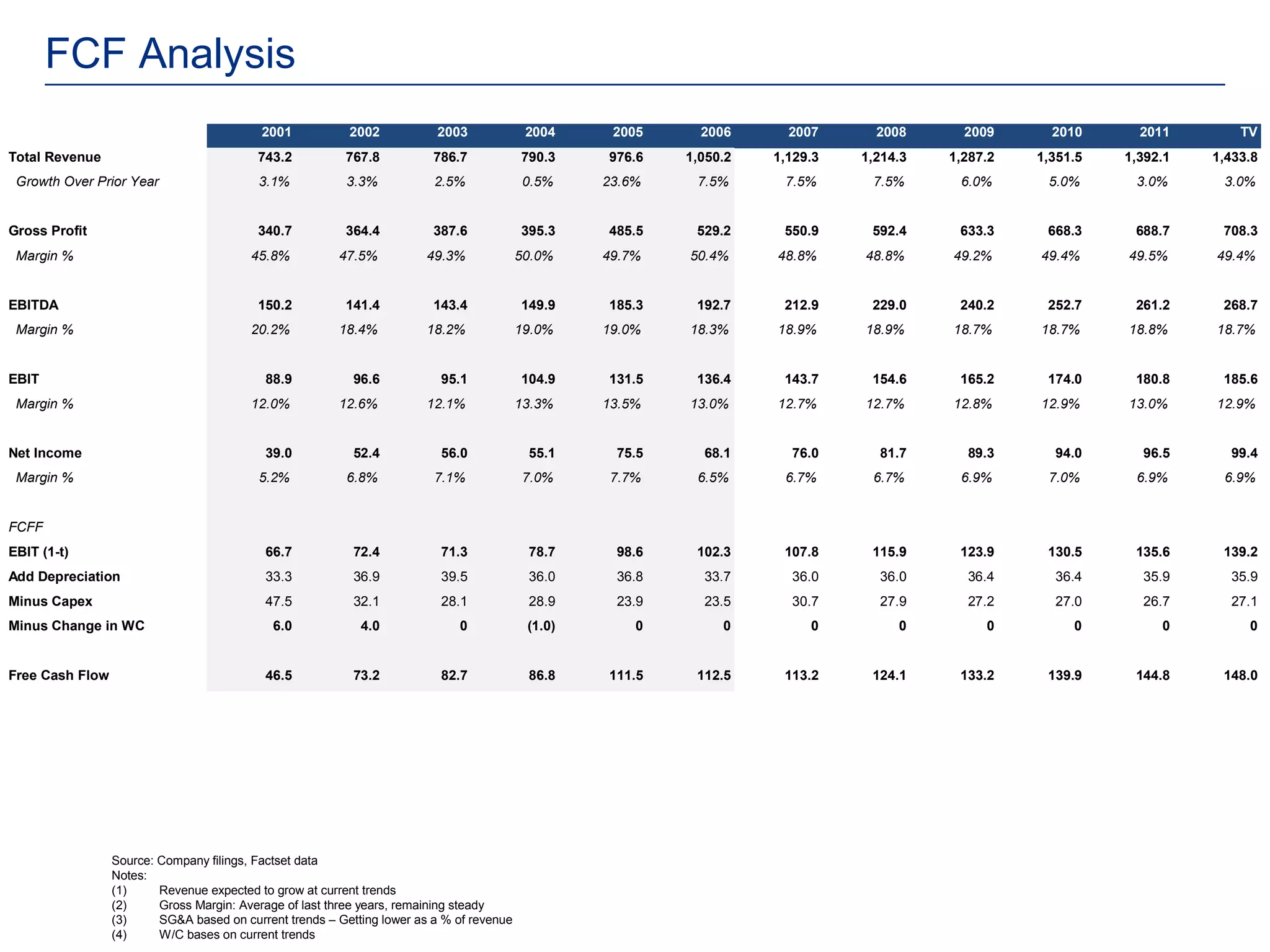

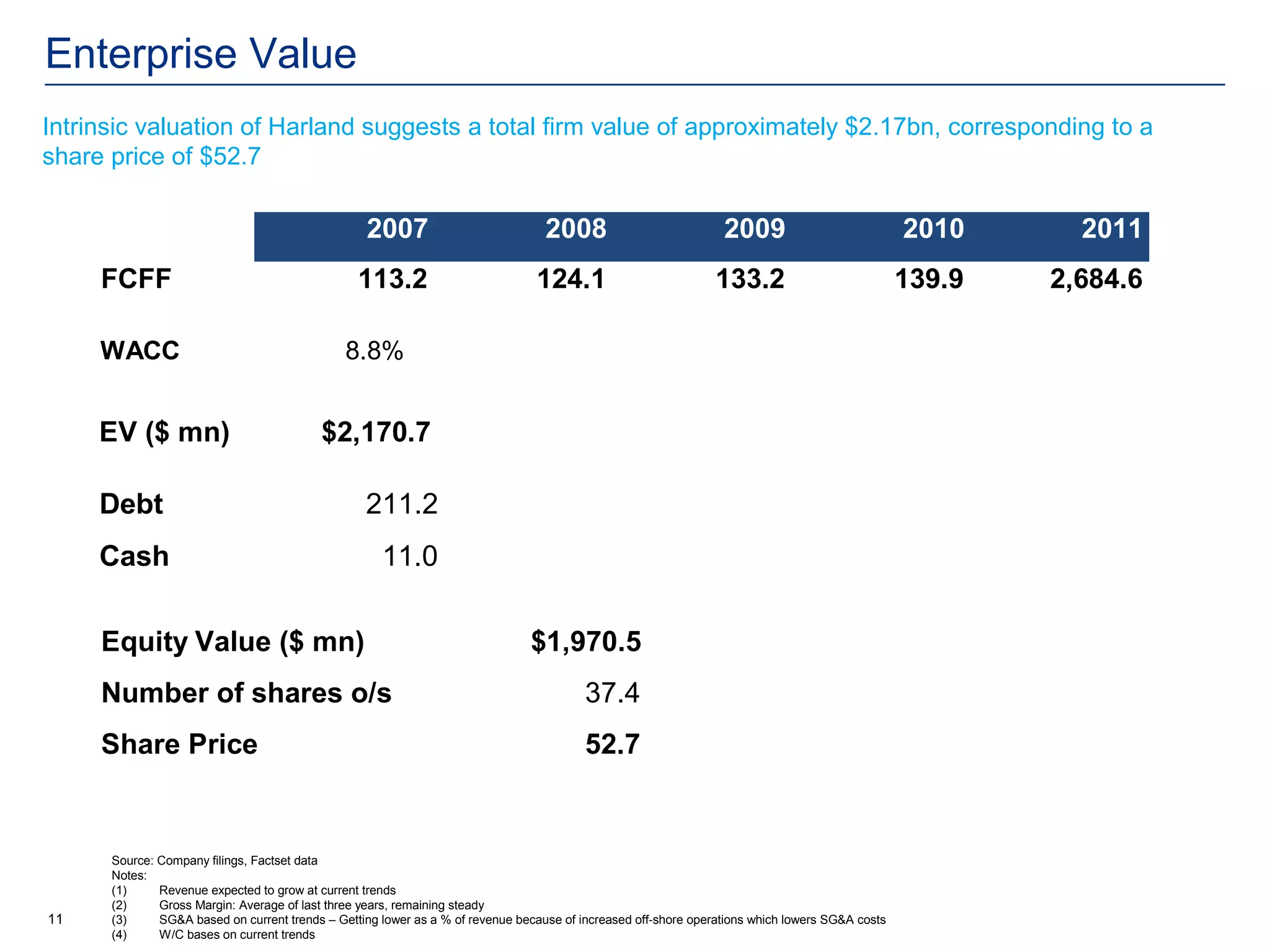

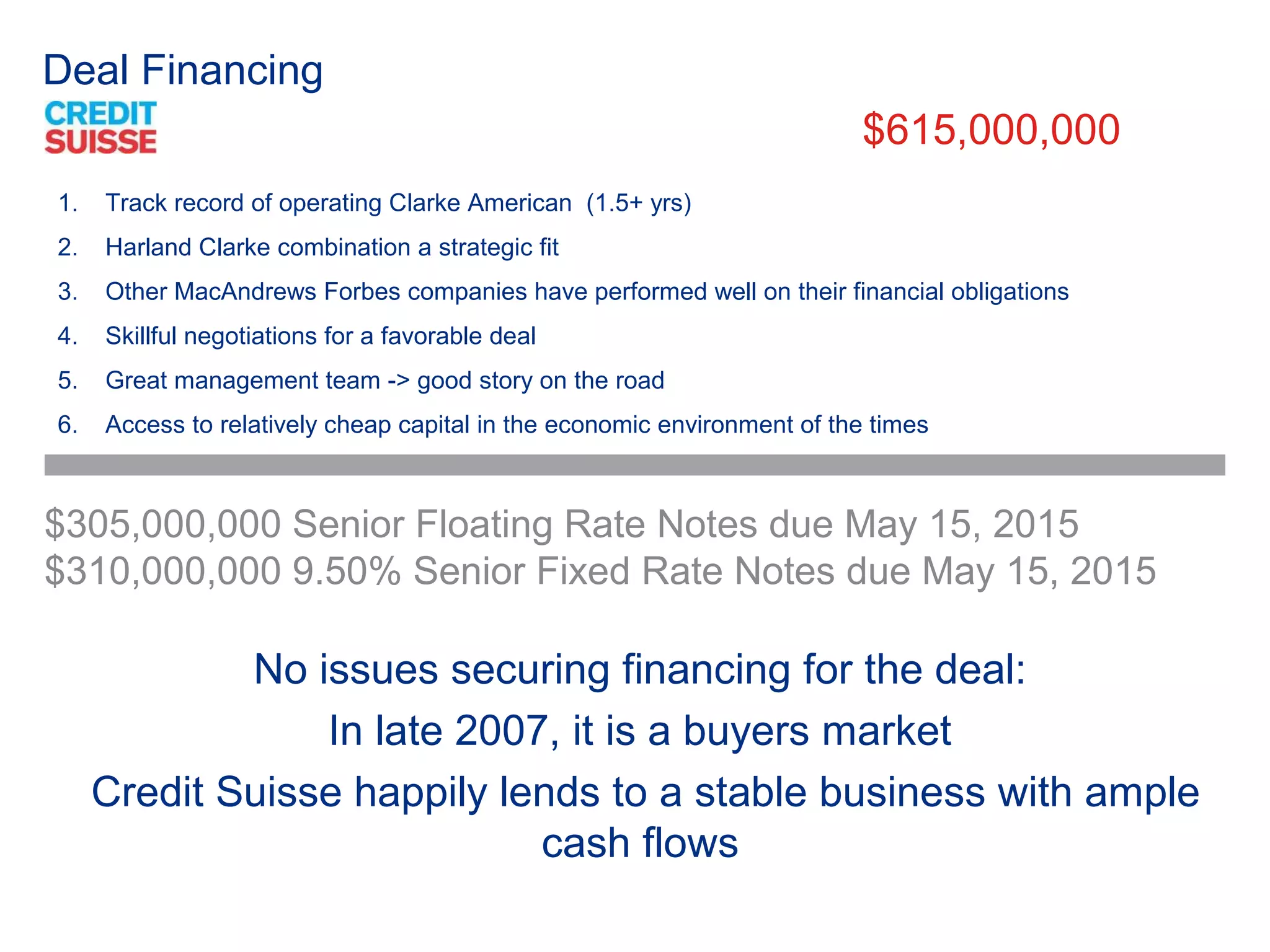

- The acquisition would create a new $1.7 billion revenue entity with $508 million in adjusted EBITDA and over $175 million in projected free cash flow.

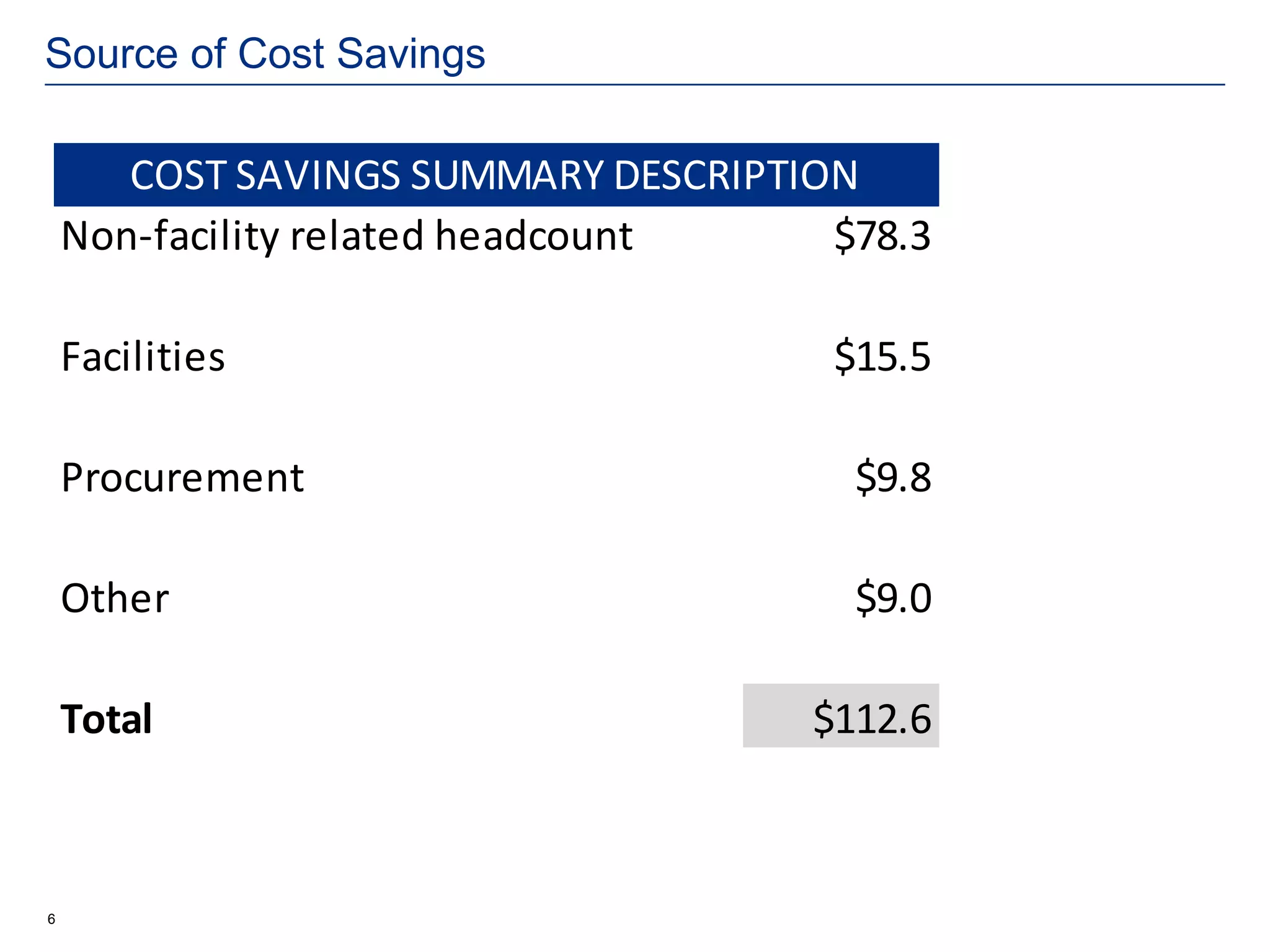

- Significant cost synergies of $112.6 million are projected from the acquisition through cost cutting, improved efficiency, and other measures.

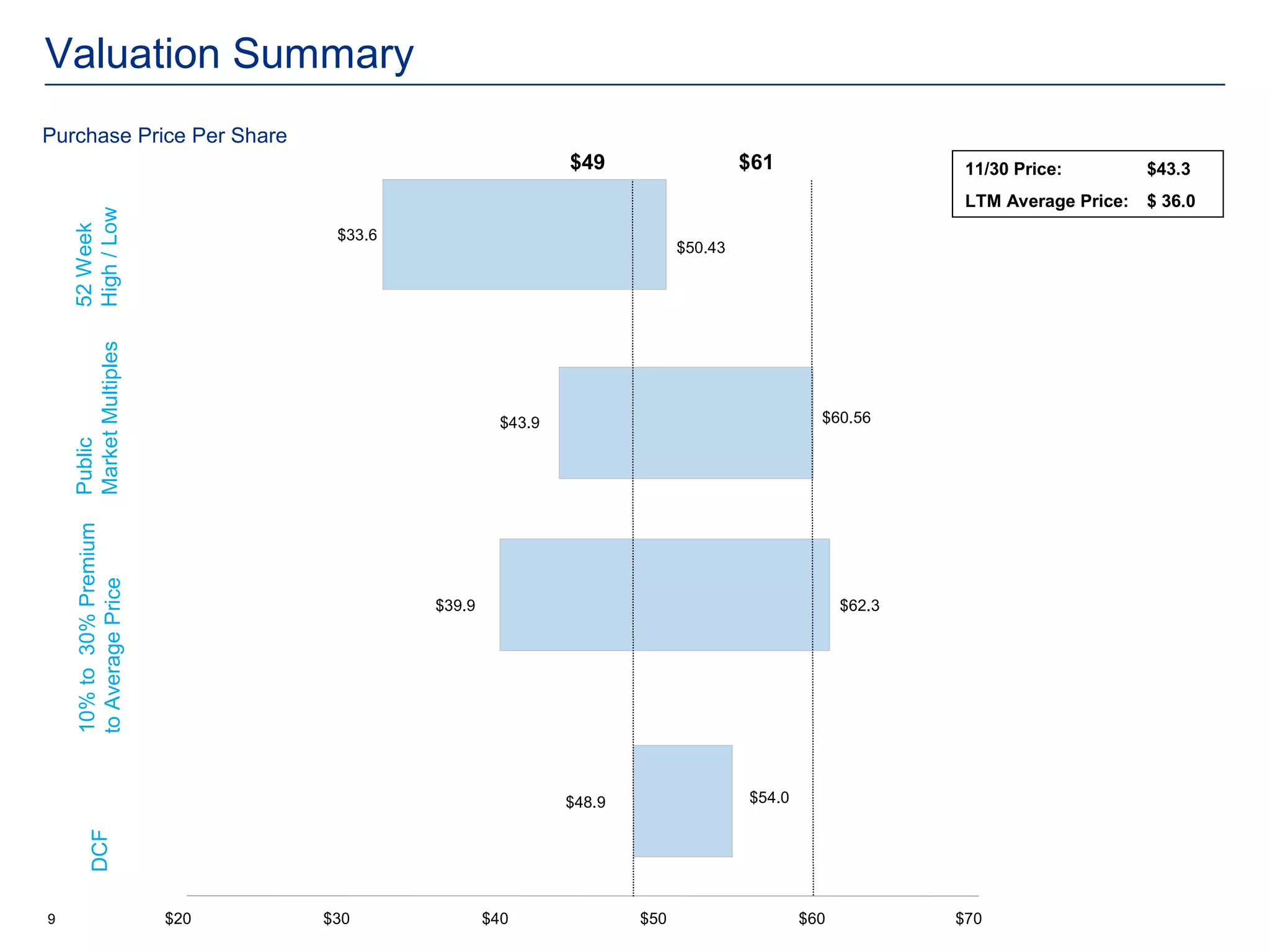

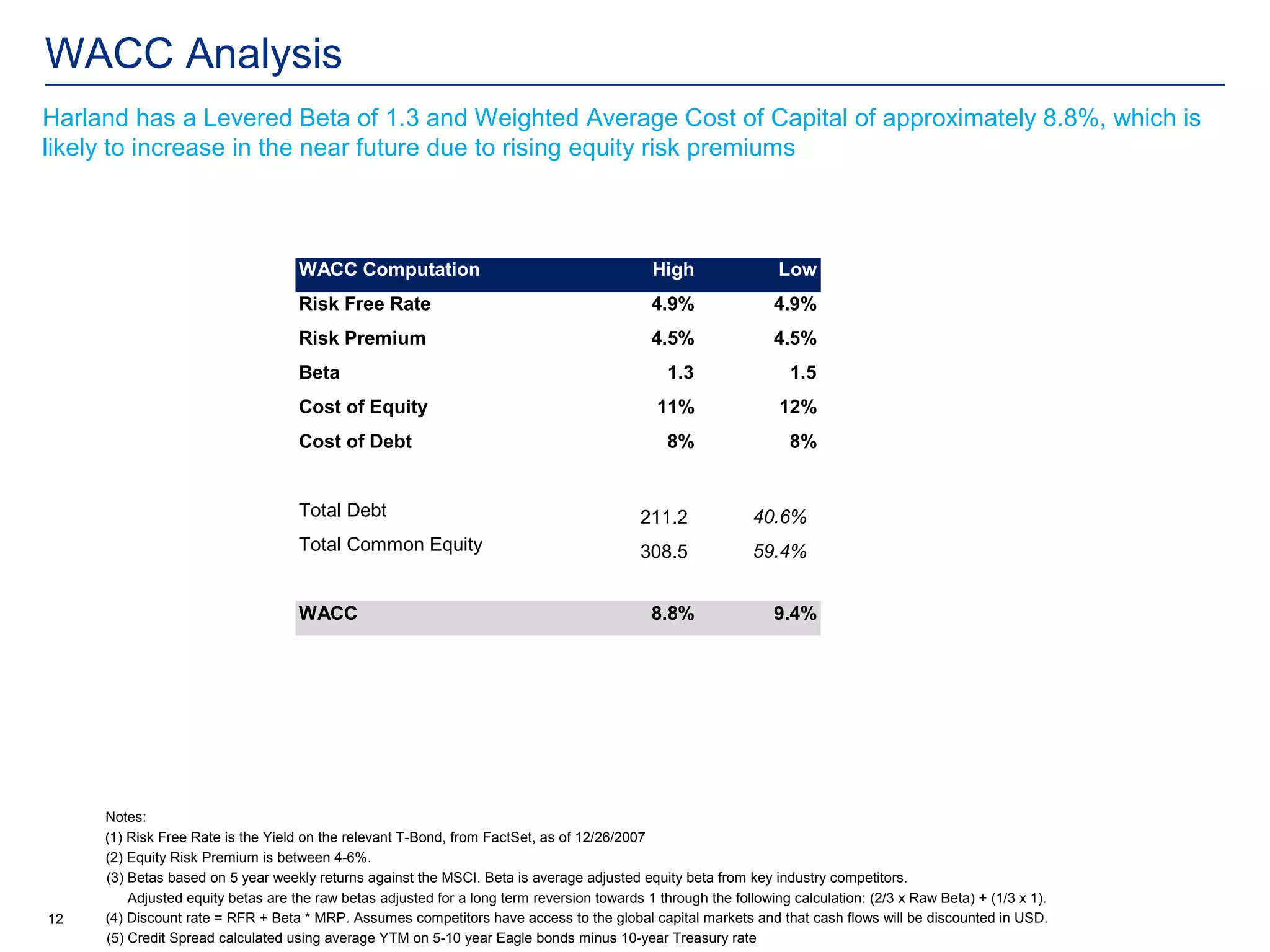

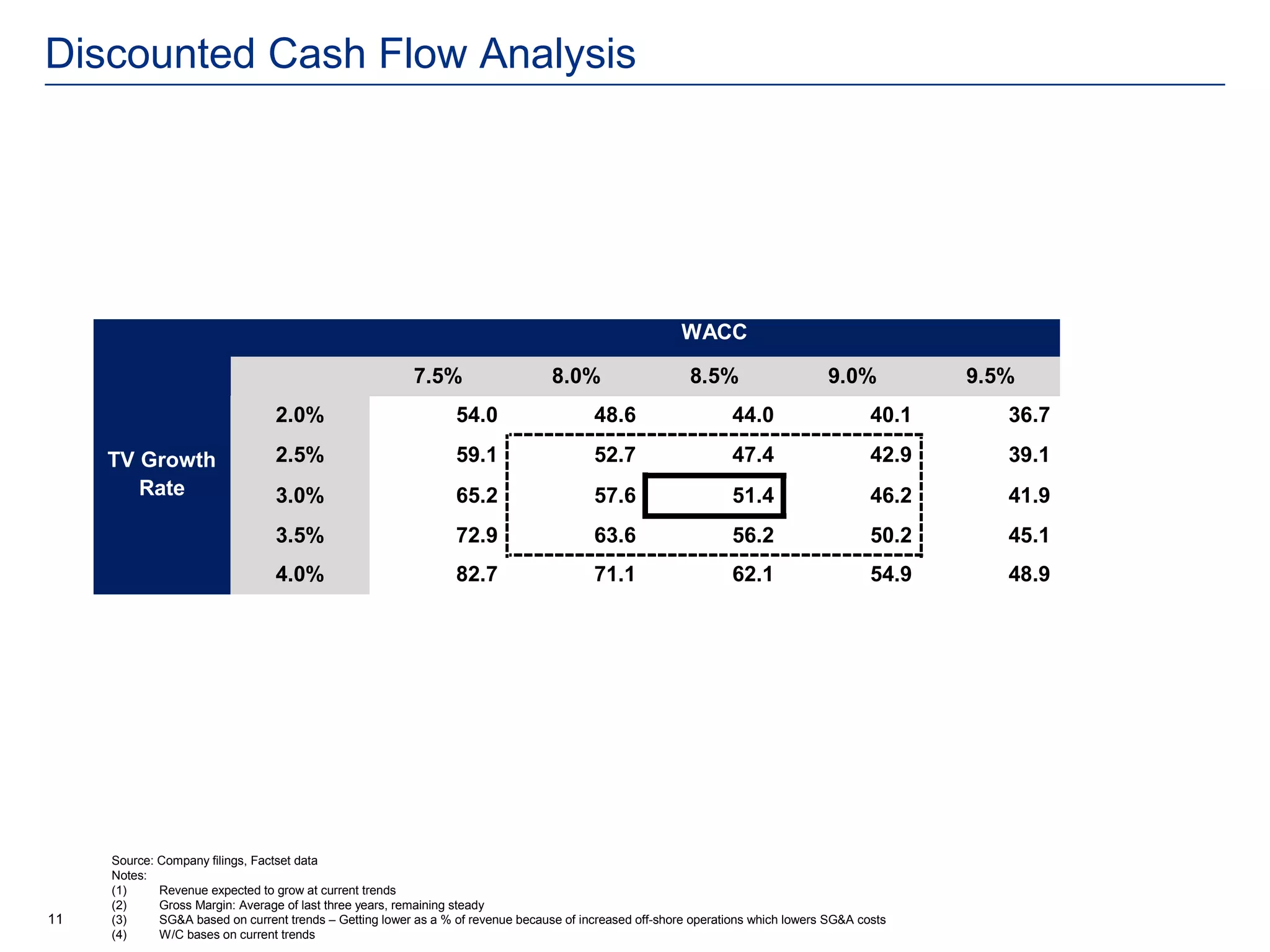

- A valuation of Harland Corporation is presented, with the proposed purchase price per share of $49 to $61 representing a premium to the market and supporting