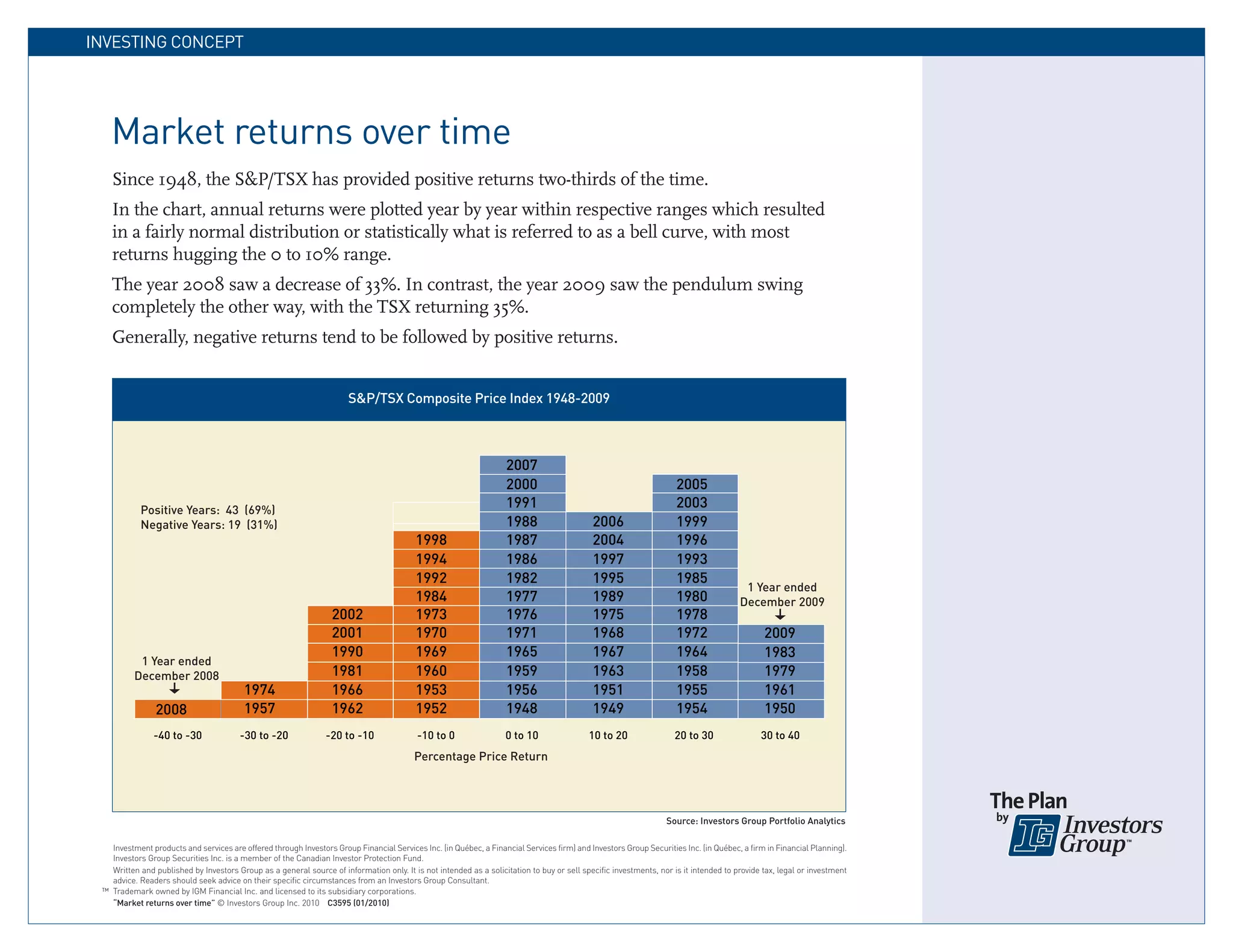

Over the period from 1948 to 2009:

- The S&P/TSX provided positive returns about two-thirds of the time, with most returns between 0-10%.

- The largest negative return was in 2008 with a 33% decrease, followed by a record 35% increase in 2009.

- Negative returns have generally been followed by positive returns in subsequent years.