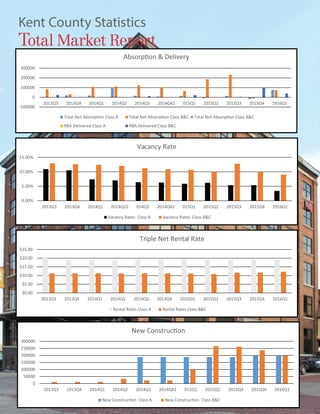

- Class A vacancy rates in the downtown and northeast submarkets of Grand Rapids decreased substantially in Q1 2016, reaching some of the lowest rates in the last 7 years.

- New construction projects are planned or underway in downtown Grand Rapids, including a 12-story office tower and several new residential buildings.

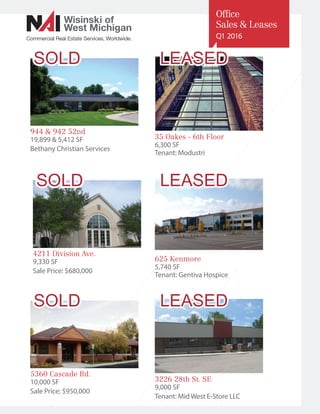

- Available industrial, office, and retail properties sold during Q1 2016, while several leases were signed, indicating continued strength in the West Michigan commercial real estate market.