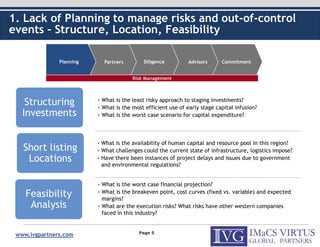

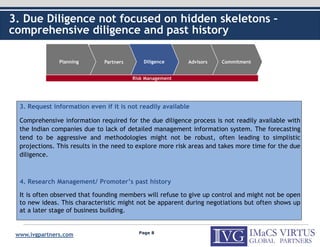

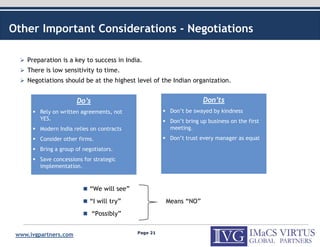

The document outlines common mistakes made by US companies in managing risks while entering the Indian market, focusing on inadequate planning, partner selection, and due diligence shortcomings. It emphasizes the importance of thorough risk management strategies that incorporate local insights, appropriate partnerships, and robust market assessments. Additionally, it highlights the need for companies to commit long-term to successfully navigate the complexities of the Indian business landscape.