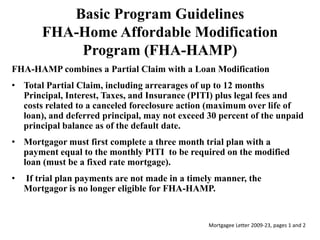

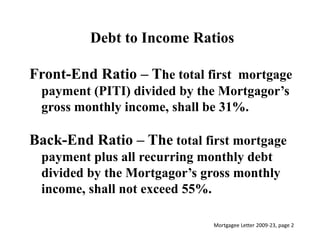

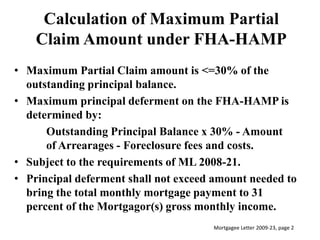

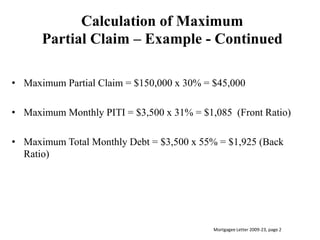

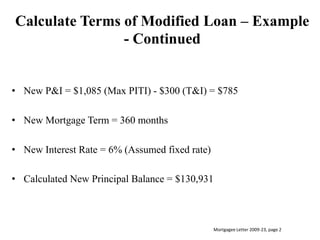

The FHA-HAMP program combines a partial claim with a loan modification to help struggling homeowners in default. It allows for up to 30% of the unpaid principal balance to go towards arrearages and fees, with the remainder deferred until payoff. Homeowners must complete a 3 month trial plan first. The modified loan amount is calculated to keep the front-end ratio below 31% and back-end ratio below 55% of gross monthly income. If successful, the partial claim is subordinated to the modified loan and documents are sent to HUD for processing.

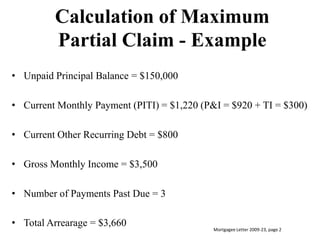

![Principal Reduction and Total Partial ClaimPrincipal Reduction = $150,000 - $130,931= $19,069Total Partial Claim = $19,069 principal deferment + $3,660 arrearage = $22,729Total Partial Claim < $45,000 Calculated Maximum Partial ClaimMortgagor’s New Back End Ratio is 53.9% [Sum of PITI + Other Recurring Monthly Debt ($1,085 + $800) divided by $3,500 Gross Monthly Income] which satisfies the 55% Back End Ratio limitation.Mortgagee Letter 2009-23, page 2](https://image.slidesharecdn.com/makinghomeaffordable-parrilla-091006113245-phpapp01/85/Making-Home-Affordable-Parrilla-8-320.jpg)