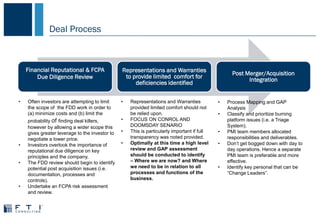

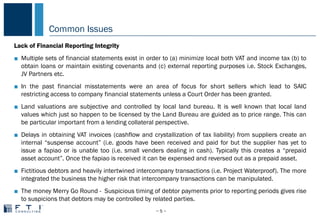

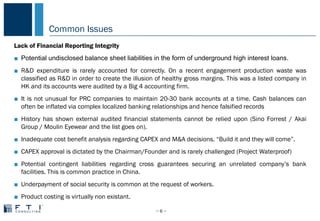

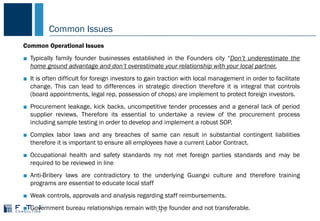

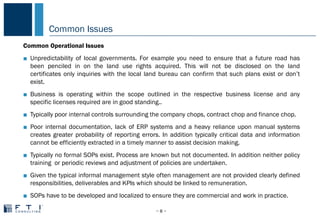

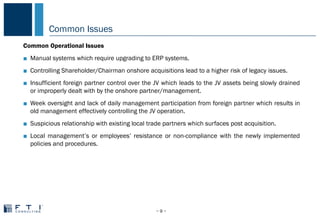

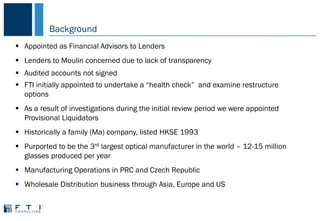

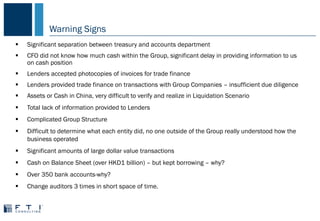

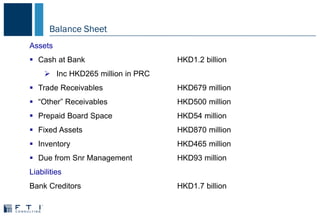

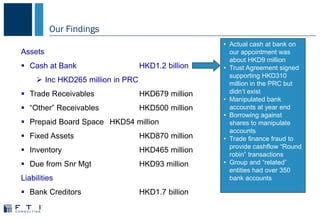

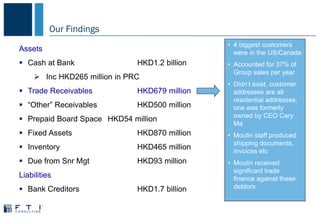

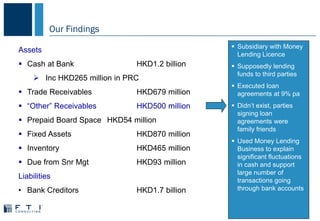

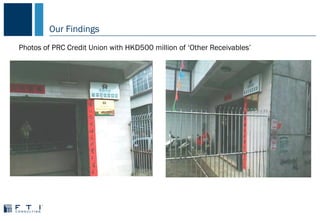

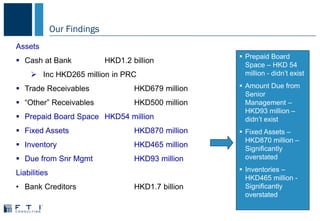

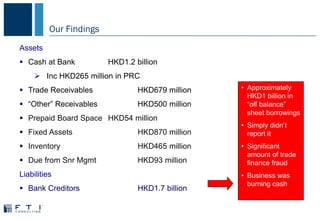

The document provides an overview of common issues that arise in conducting due diligence and transactions in China. It discusses typical deal processes and common financial, operational, and regulatory issues seen, such as lack of financial reporting integrity, complex ownership structures, weak internal controls, and non-compliance with labor laws. It also presents a case study on the liquidation of Moulin Global Eyecare, where warning signs of financial irregularities were overlooked, resulting in inability to verify assets and realize value for lenders.