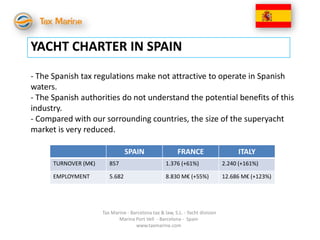

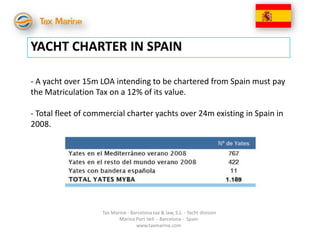

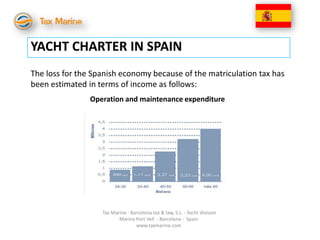

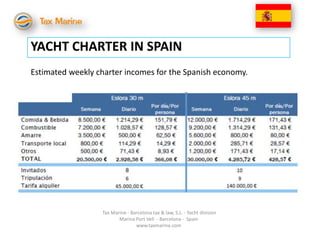

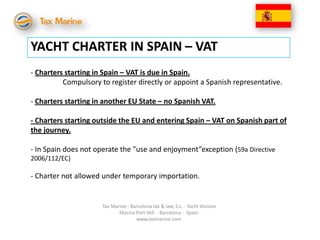

The document discusses yacht chartering in Spain. It notes that Spanish tax regulations make operating in Spanish waters unattractive. Compared to neighboring countries like France and Italy, the superyacht market in Spain is much smaller due to these tax policies. Specifically, yachts over 15 meters that are chartered commercially in Spain must pay a 12% matriculation tax on the yacht's value. Removing this tax could significantly boost the Spanish economy by bringing in over 100 million euros annually and increasing tax revenues.