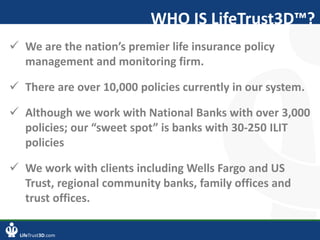

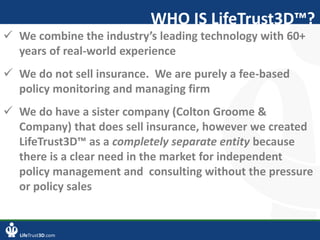

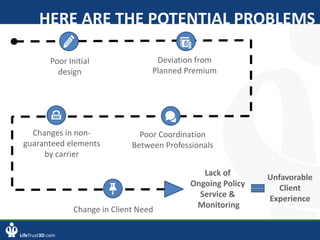

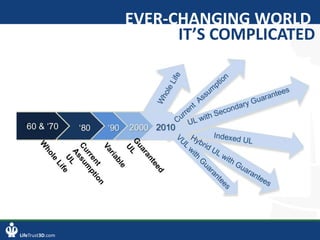

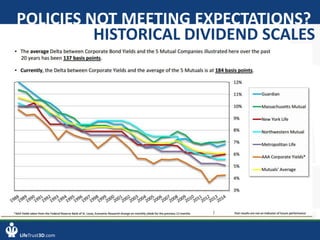

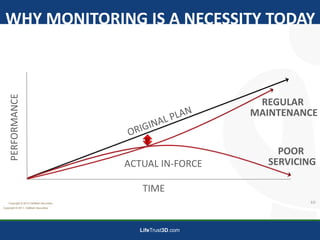

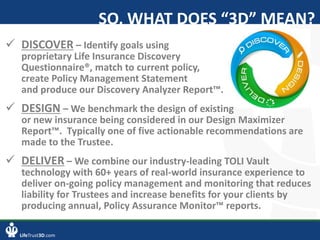

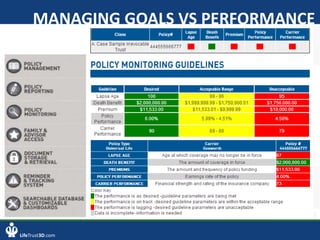

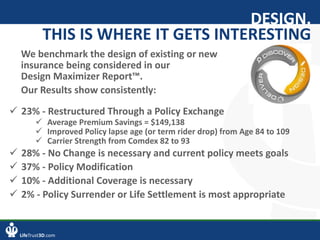

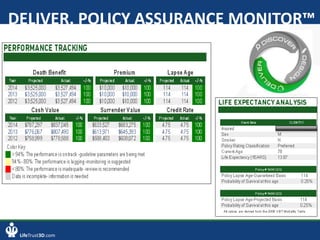

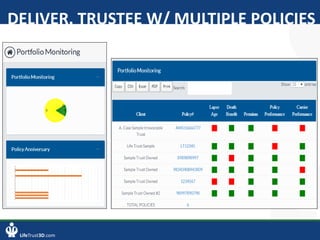

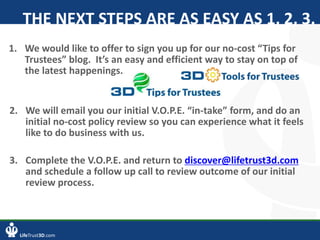

This document introduces LifeTrust3D, a life insurance policy management and monitoring firm. It explains that LifeTrust3D uses proprietary technology and expertise to discover clients' goals, design optimal policy solutions, and deliver ongoing policy monitoring and management. This helps ensure policies meet expectations and reduce risks and work for trustees. The document outlines LifeTrust3D's services and benefits to clients, provides client testimonials, and describes the next steps to work with LifeTrust3D.