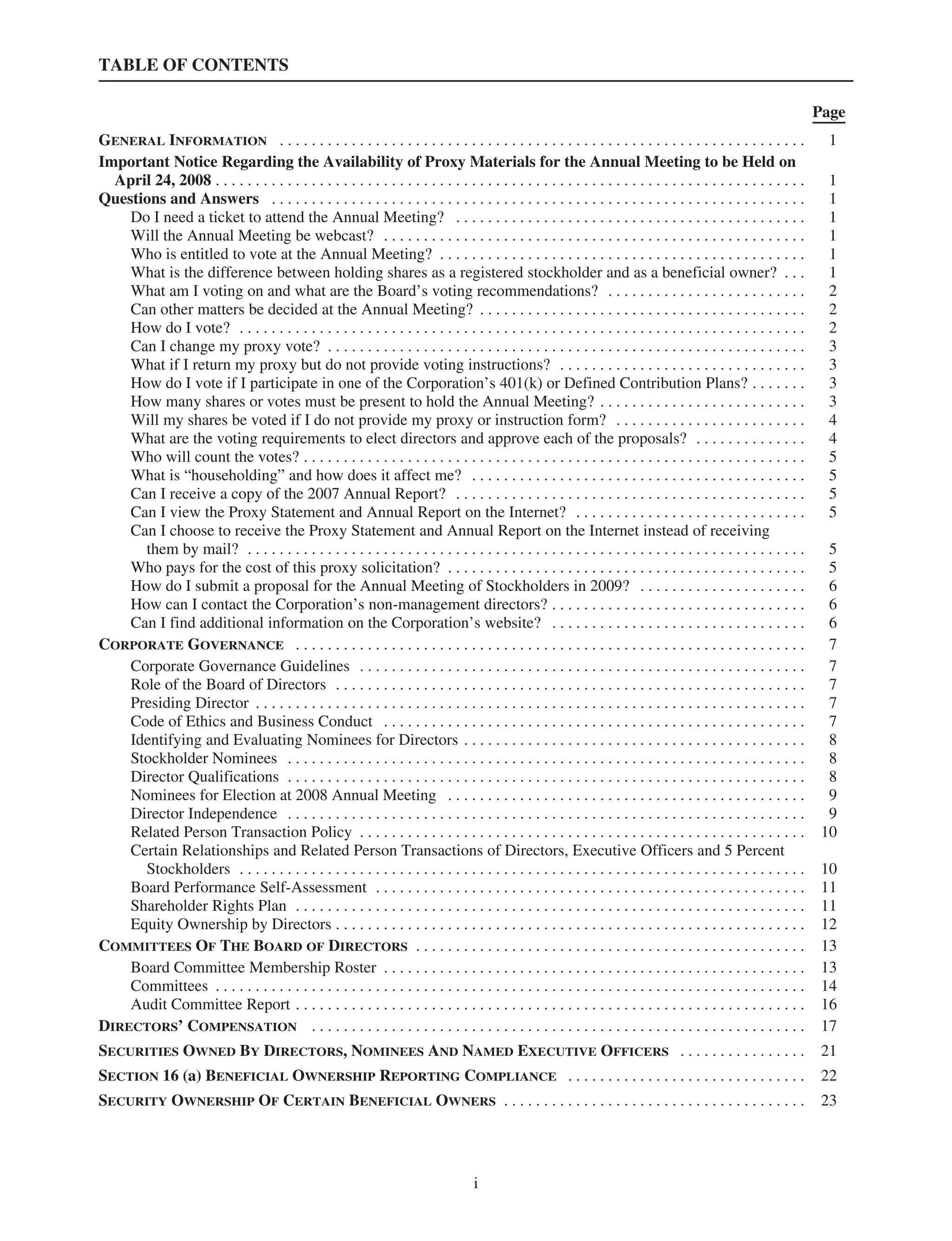

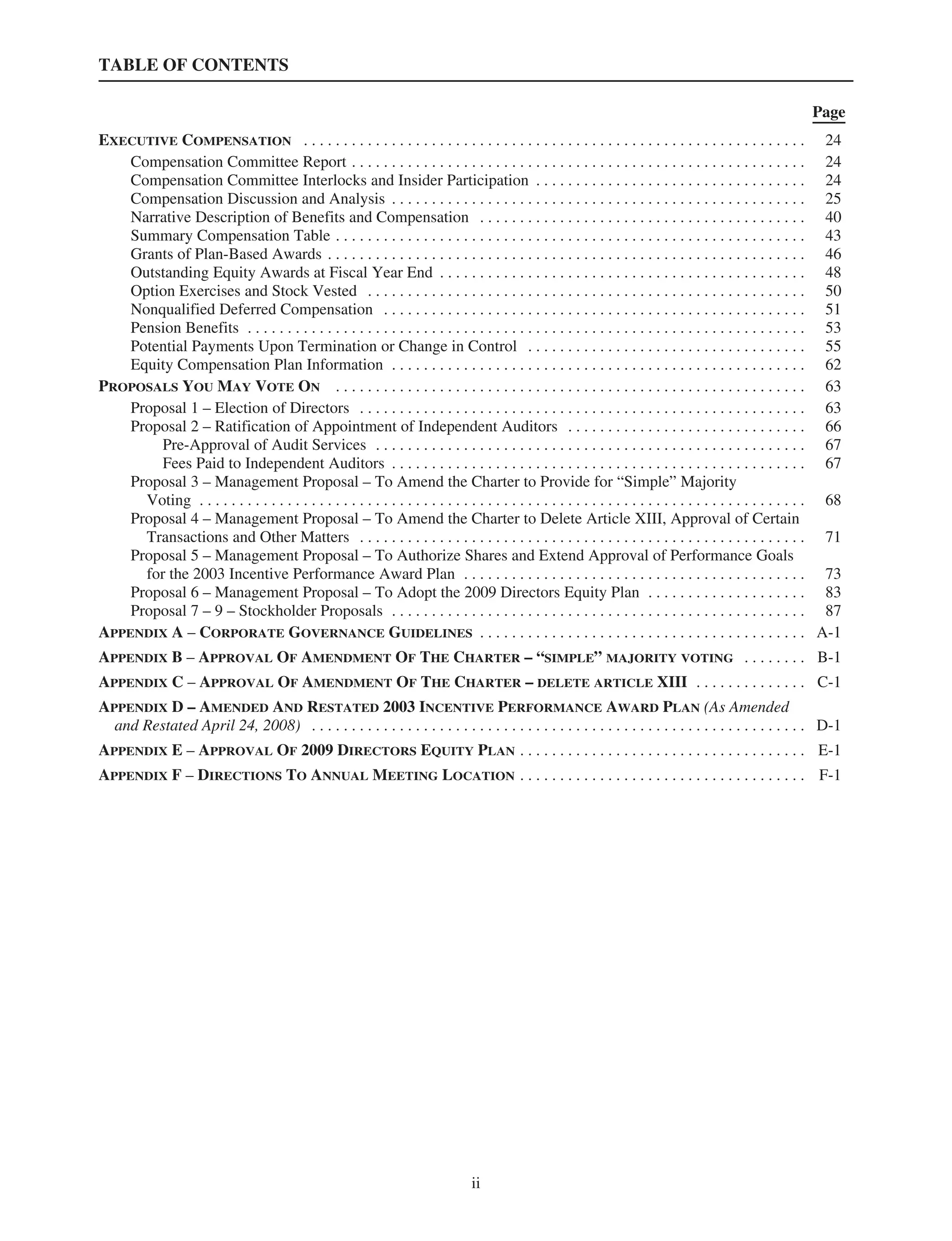

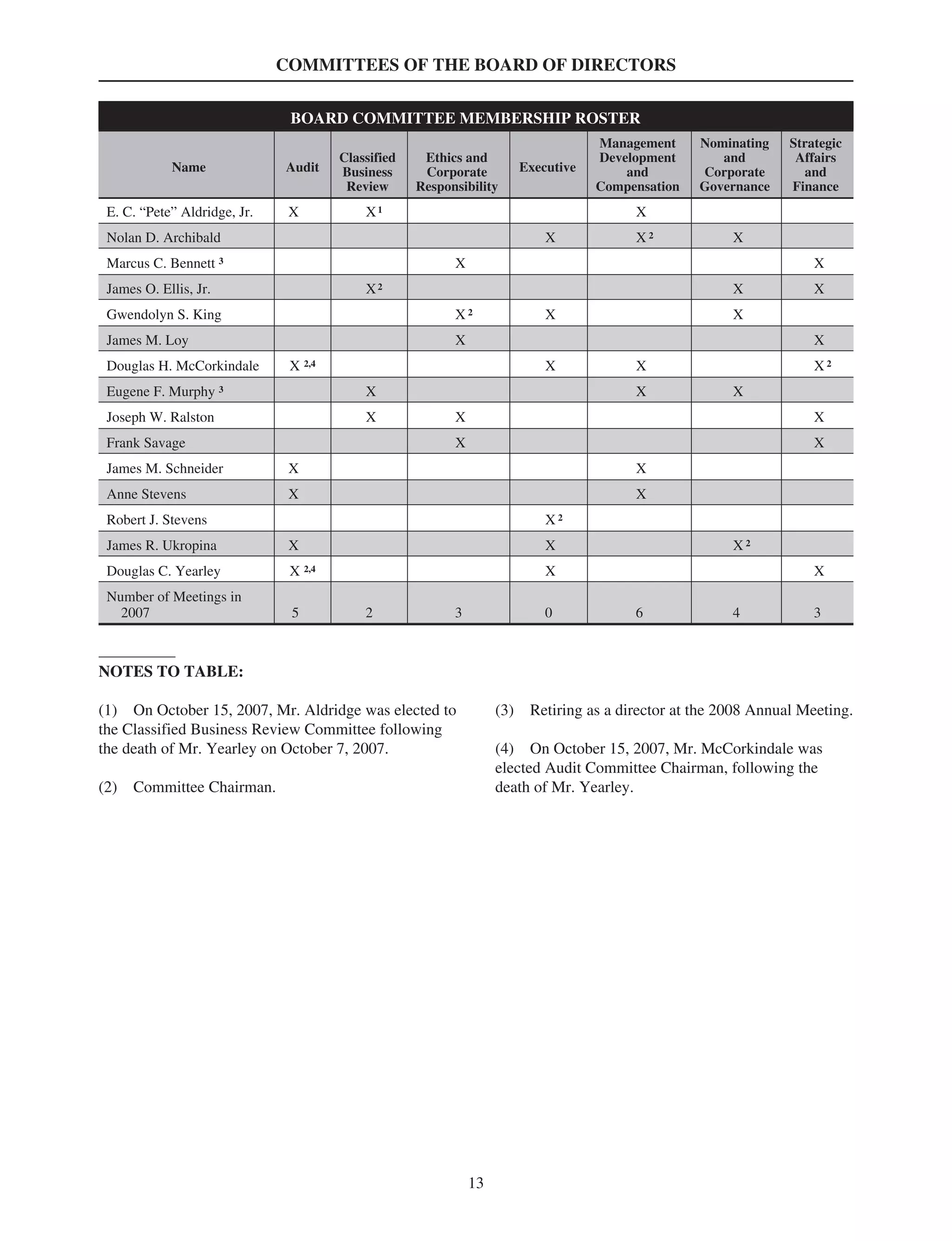

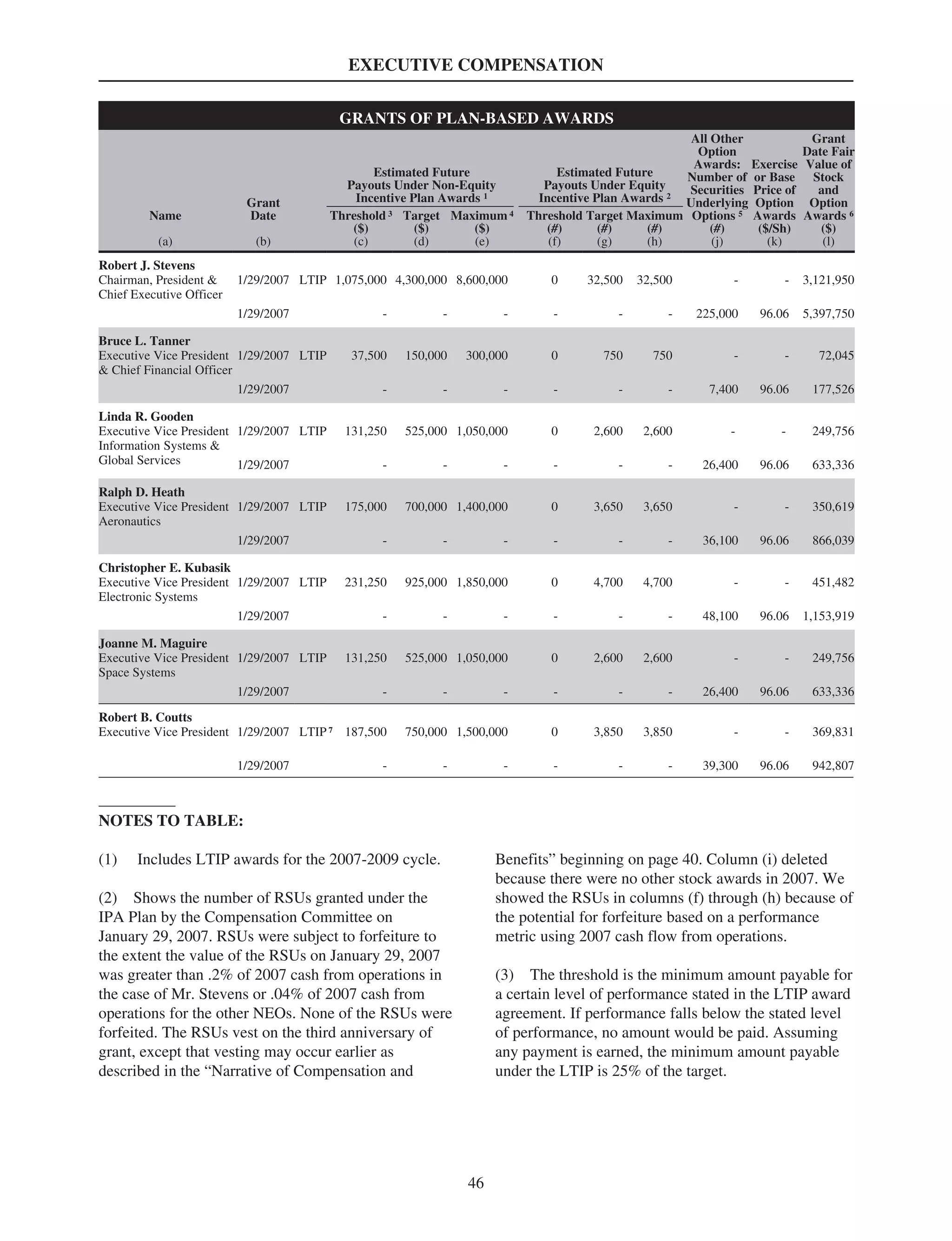

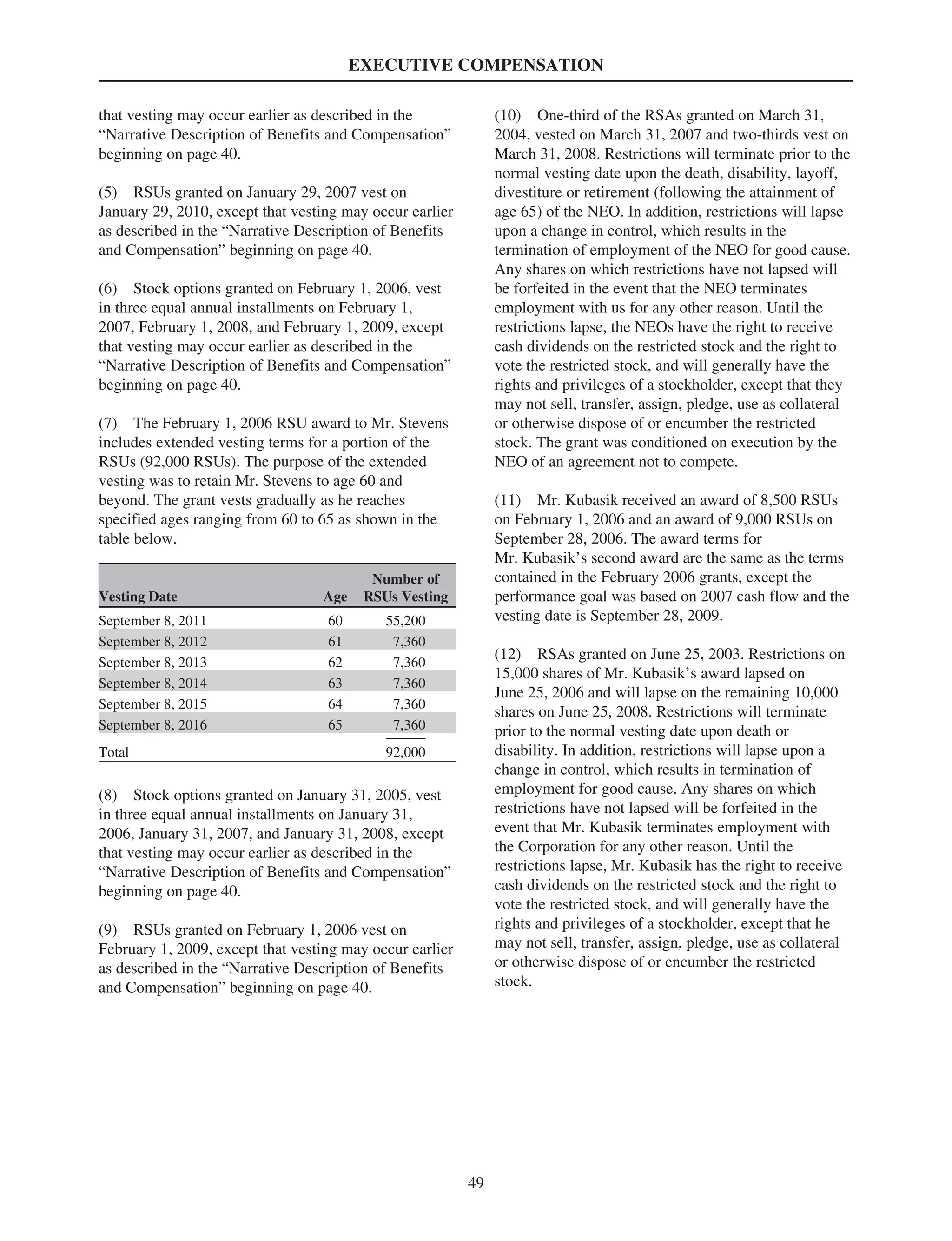

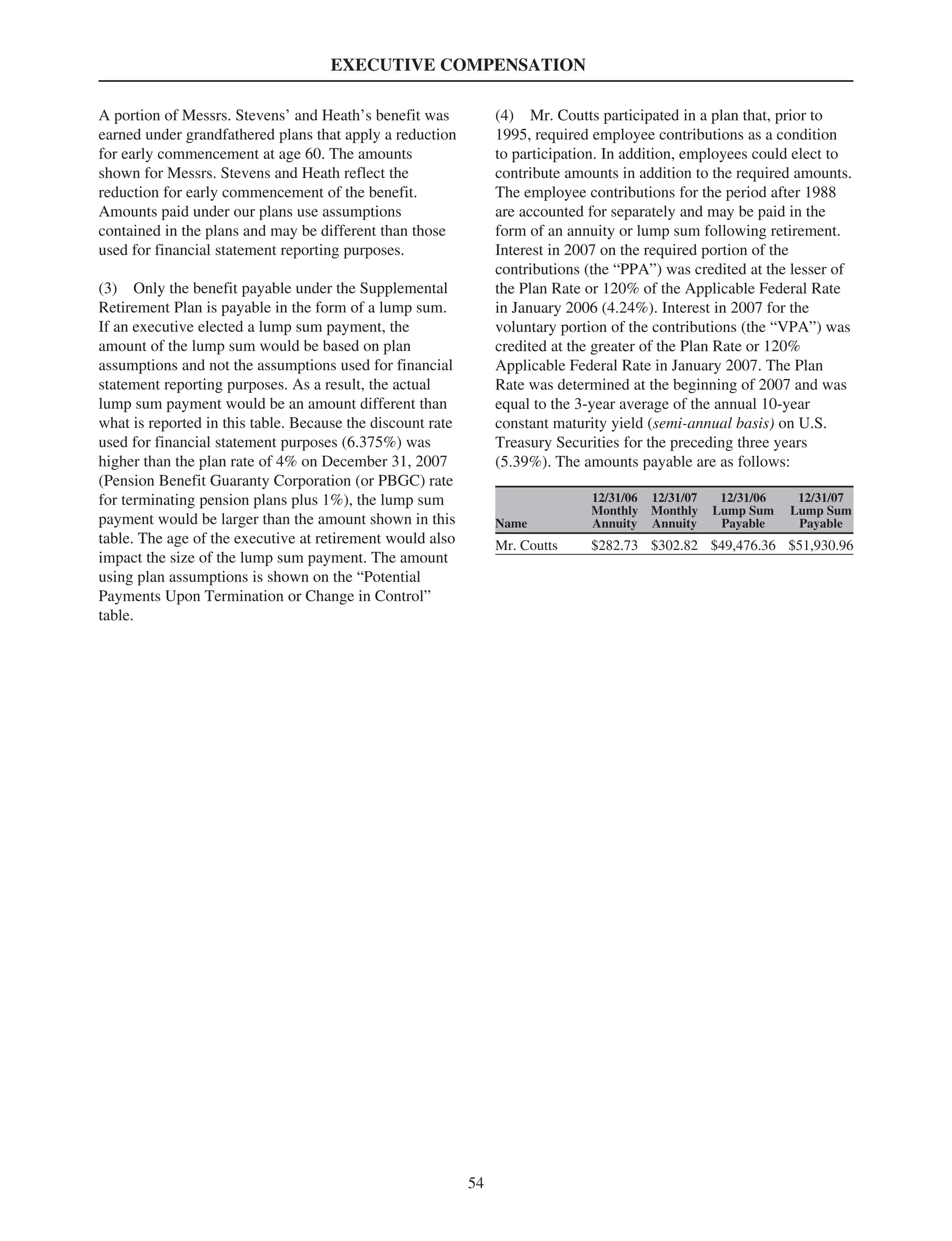

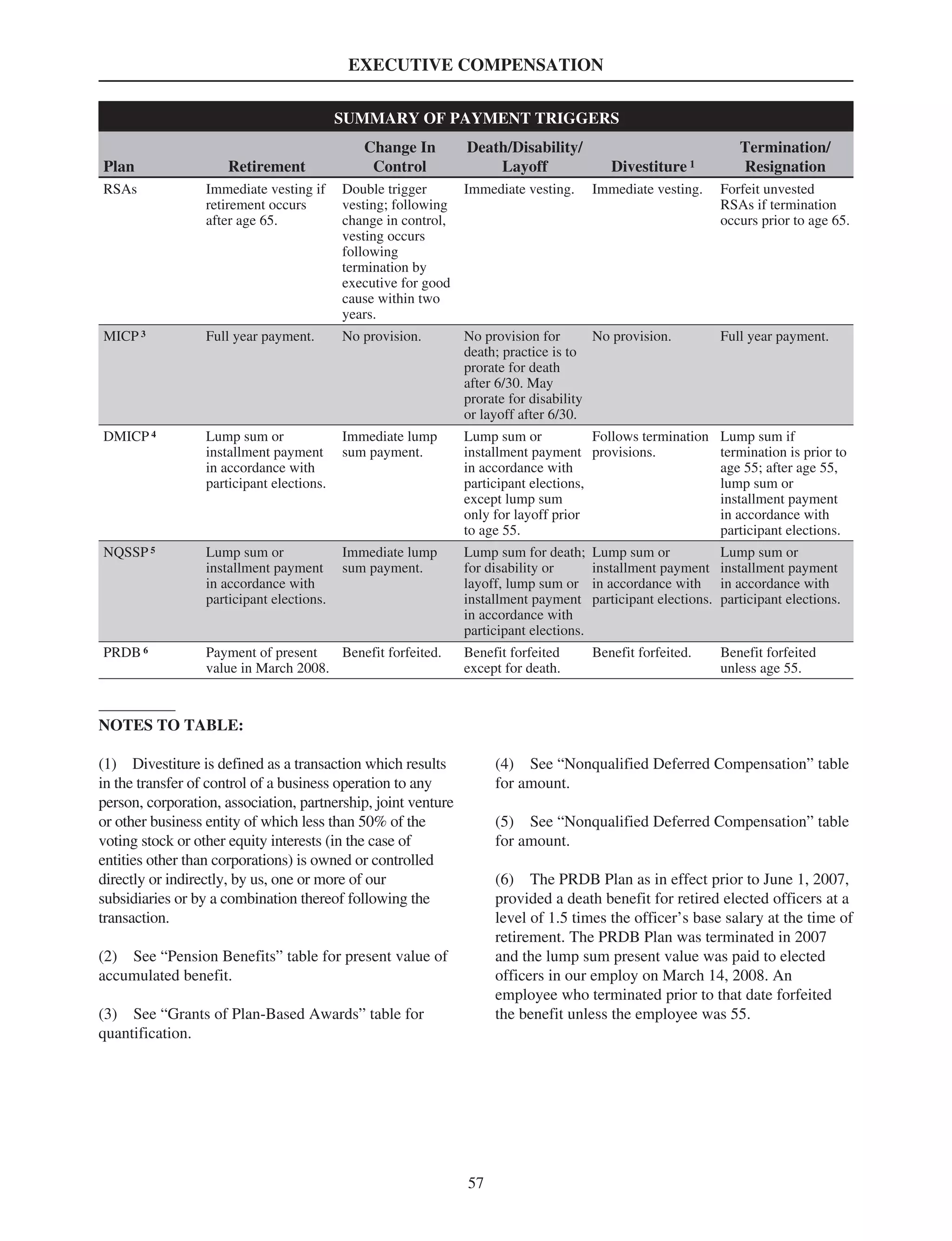

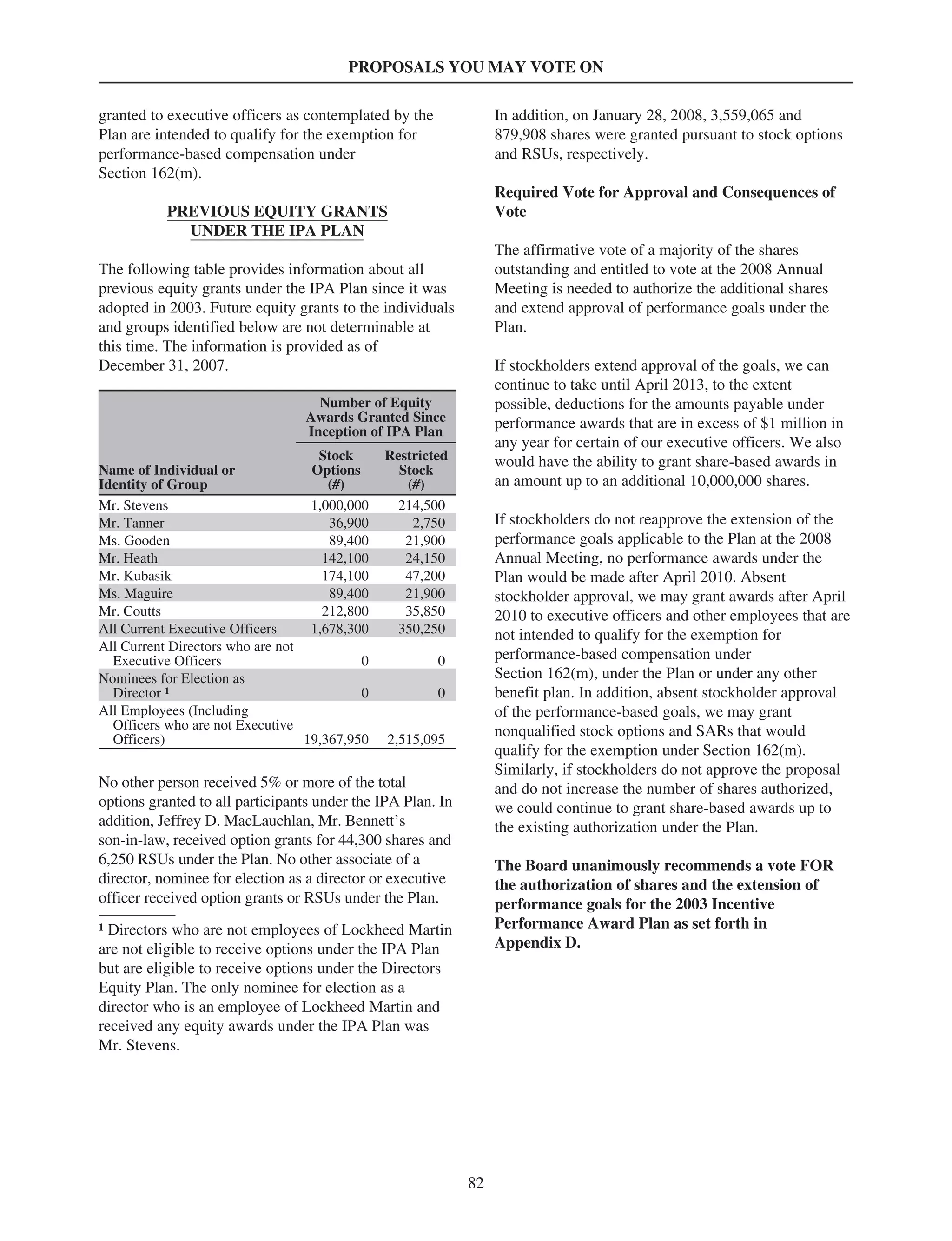

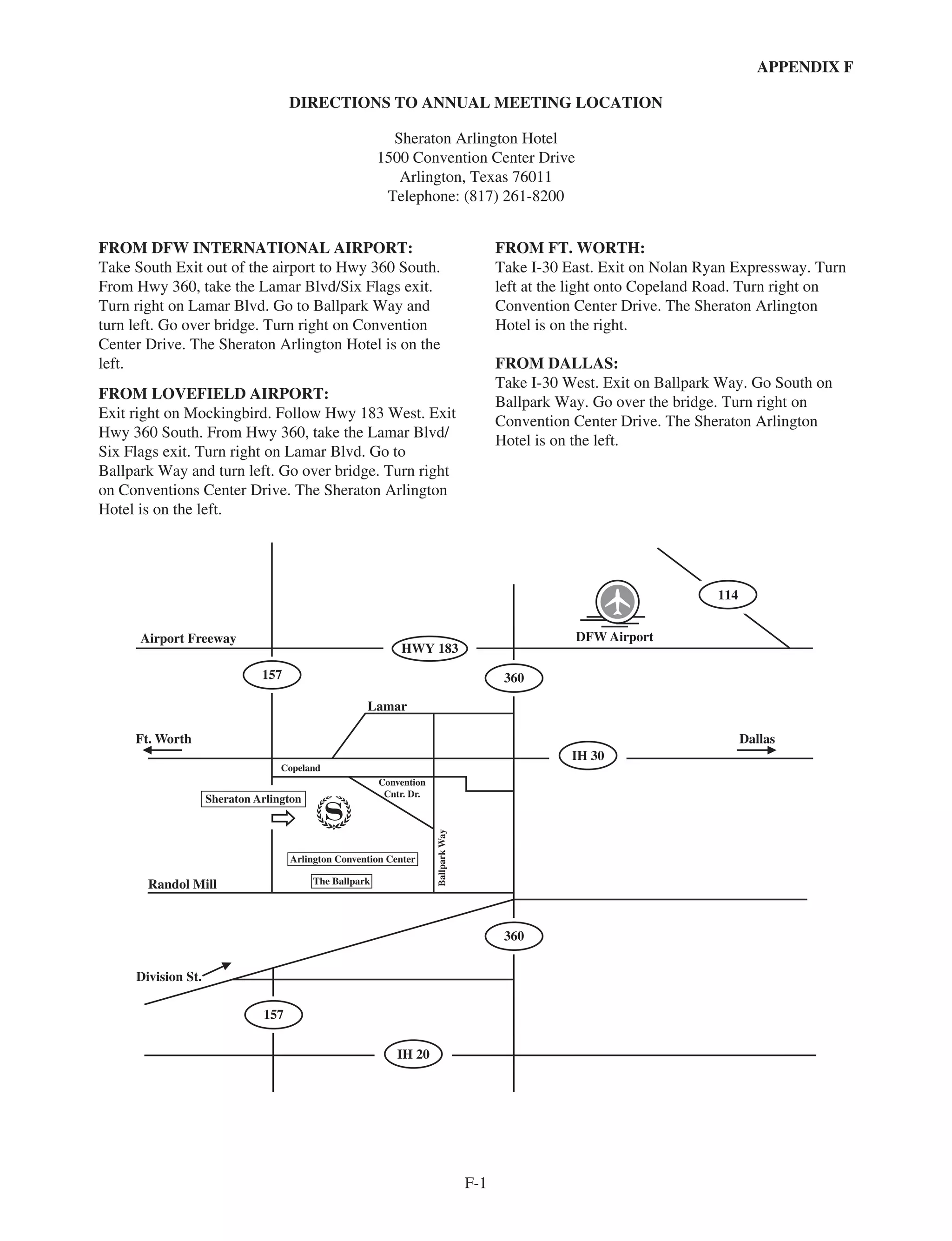

This document is Lockheed Martin Corporation's proxy statement for its 2008 annual meeting of stockholders. It provides notice of the meeting date, time, location, and items of business to be voted on, including the election of directors. It also includes questions and answers about voting procedures, corporate governance policies, director qualifications and independence, and proposals being submitted to a stockholder vote.