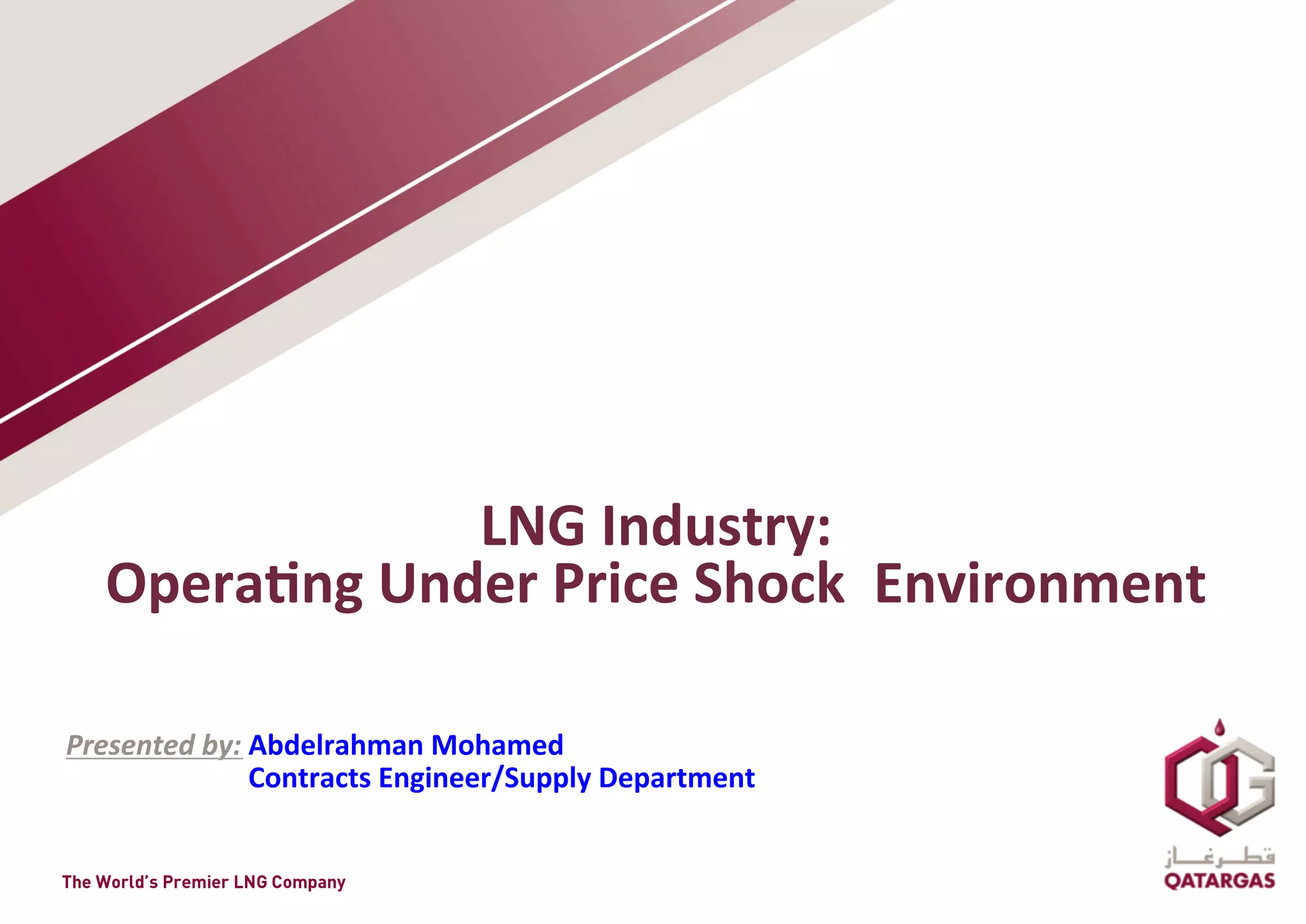

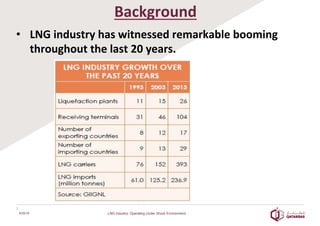

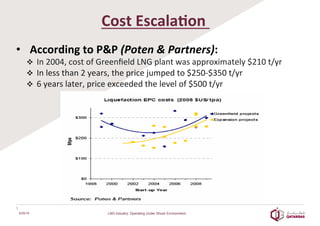

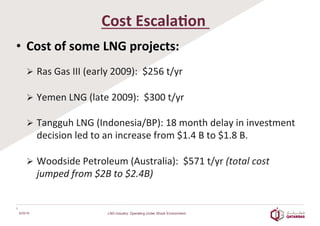

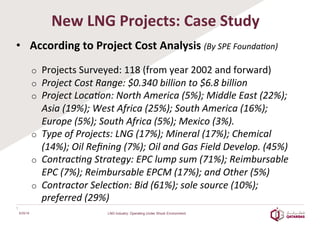

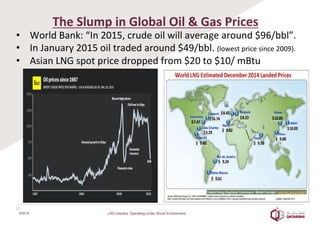

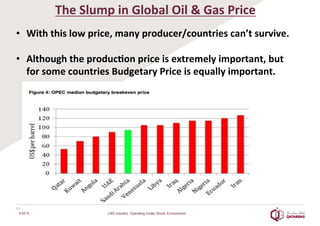

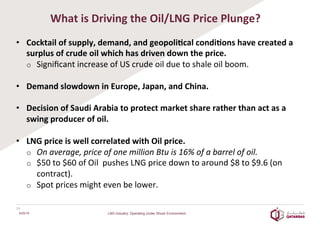

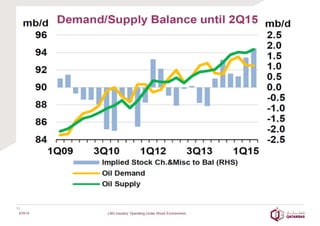

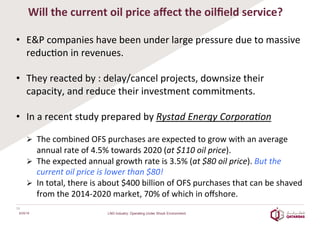

The document discusses the challenges facing the LNG industry due to rising costs and price volatility. It notes that LNG project costs escalated dramatically between 2004-2010 due to increased demand for contractors and materials. This was exacerbated by projects being awarded as lump-sum contracts, forcing contractors to add risk premiums to cover uncertainties. Additionally, contractors significantly increased profit margins during this period. The document outlines factors driving recent oil and LNG price declines, creating difficulties for many producer countries and companies.