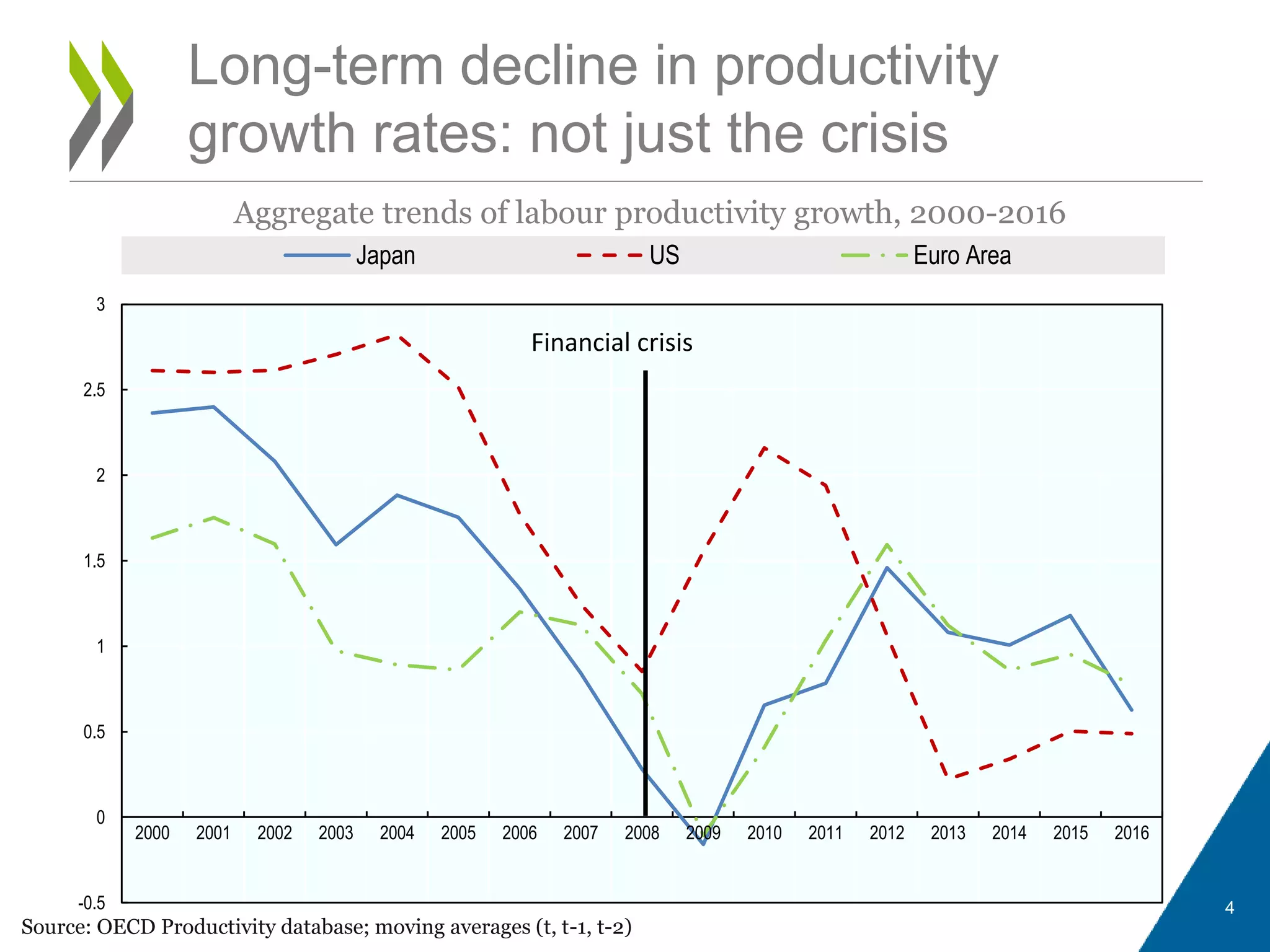

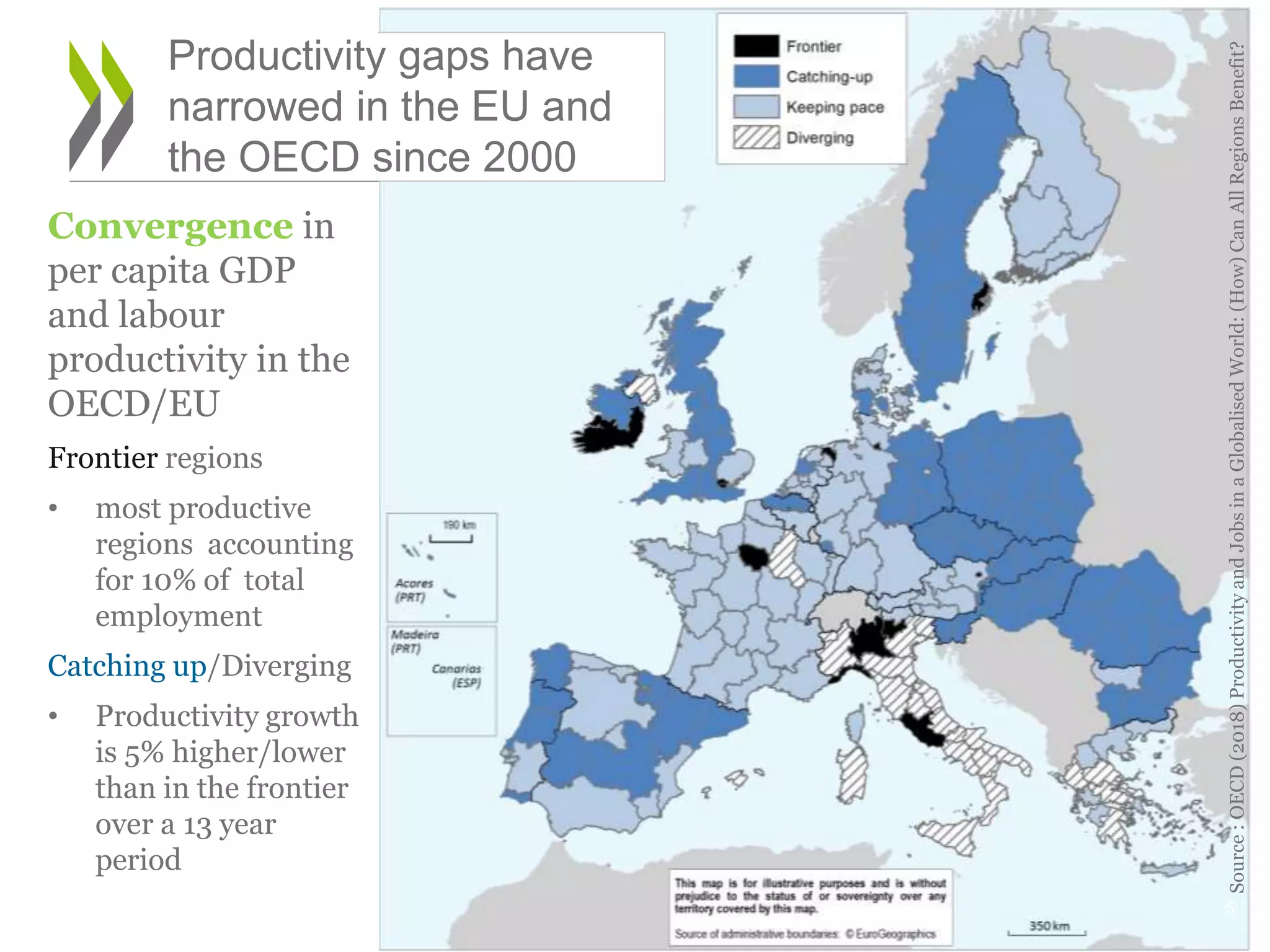

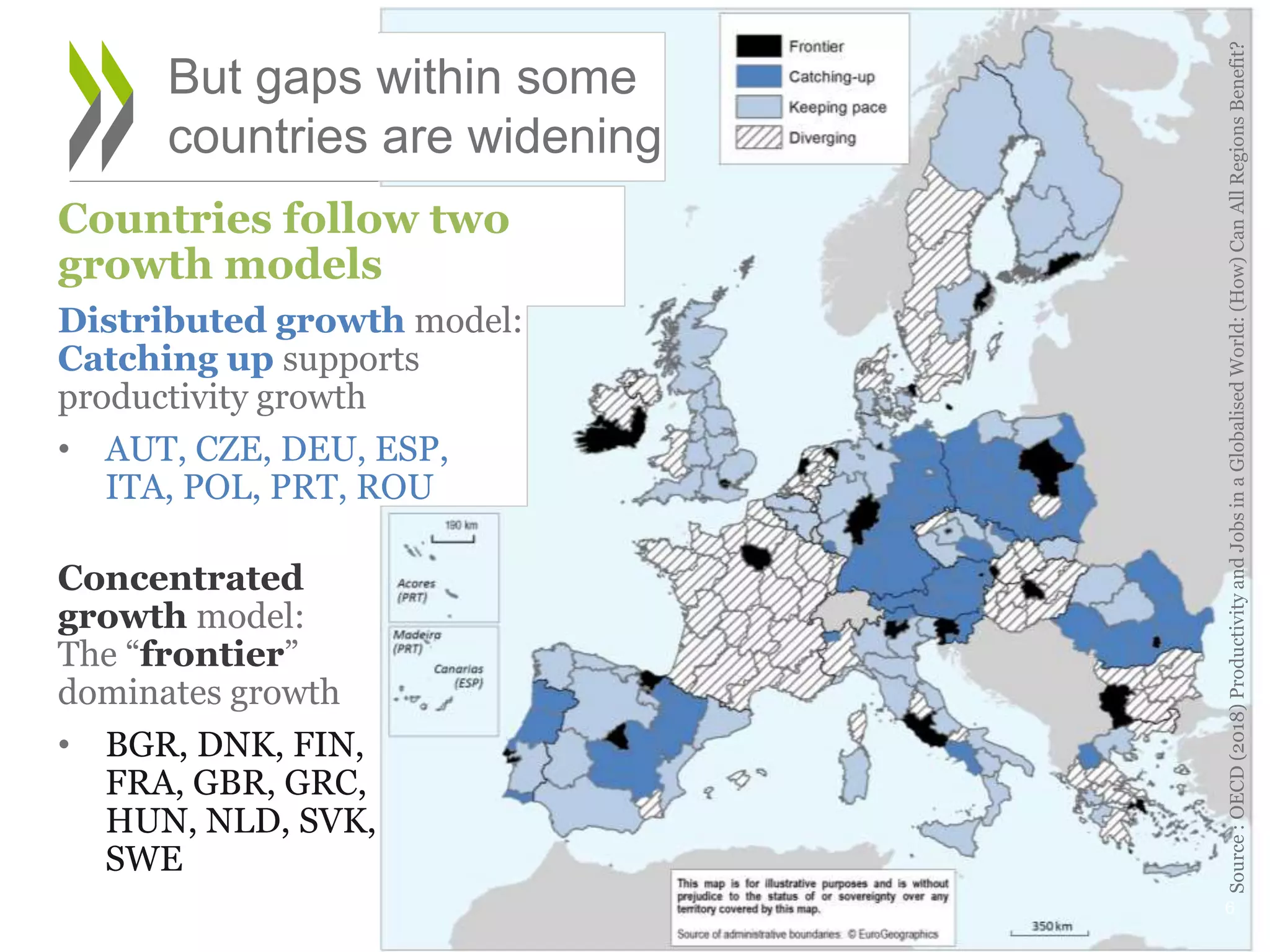

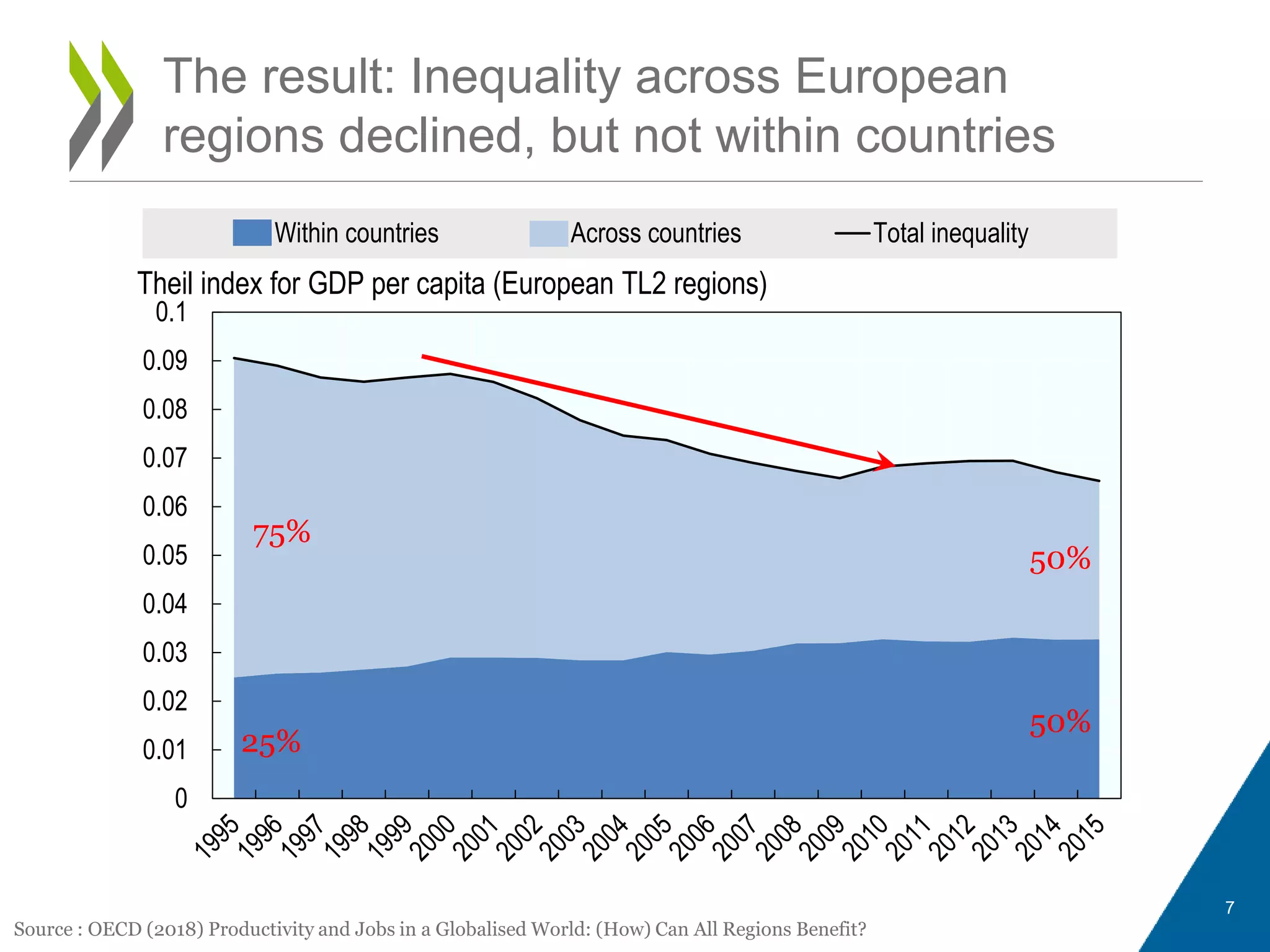

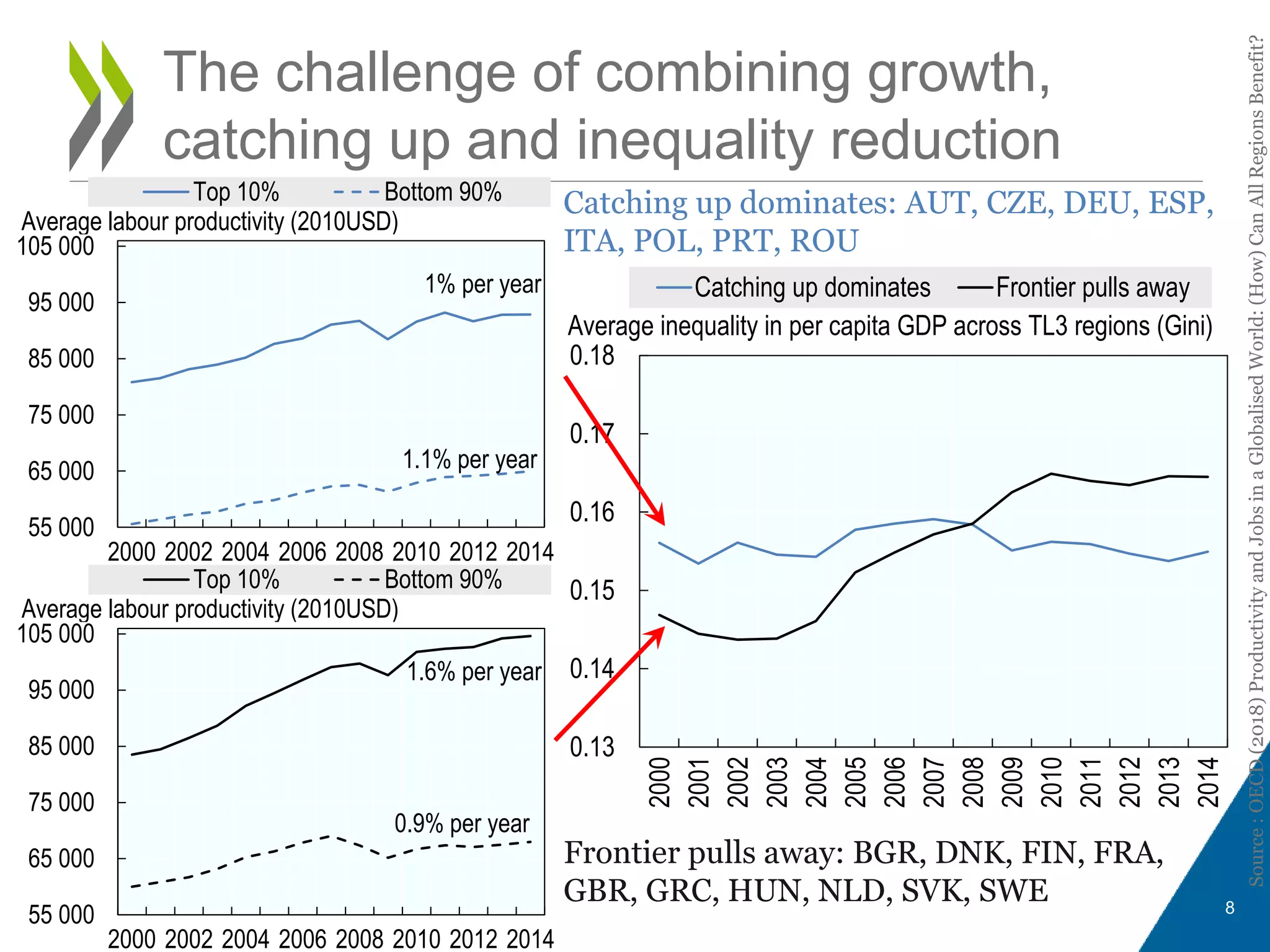

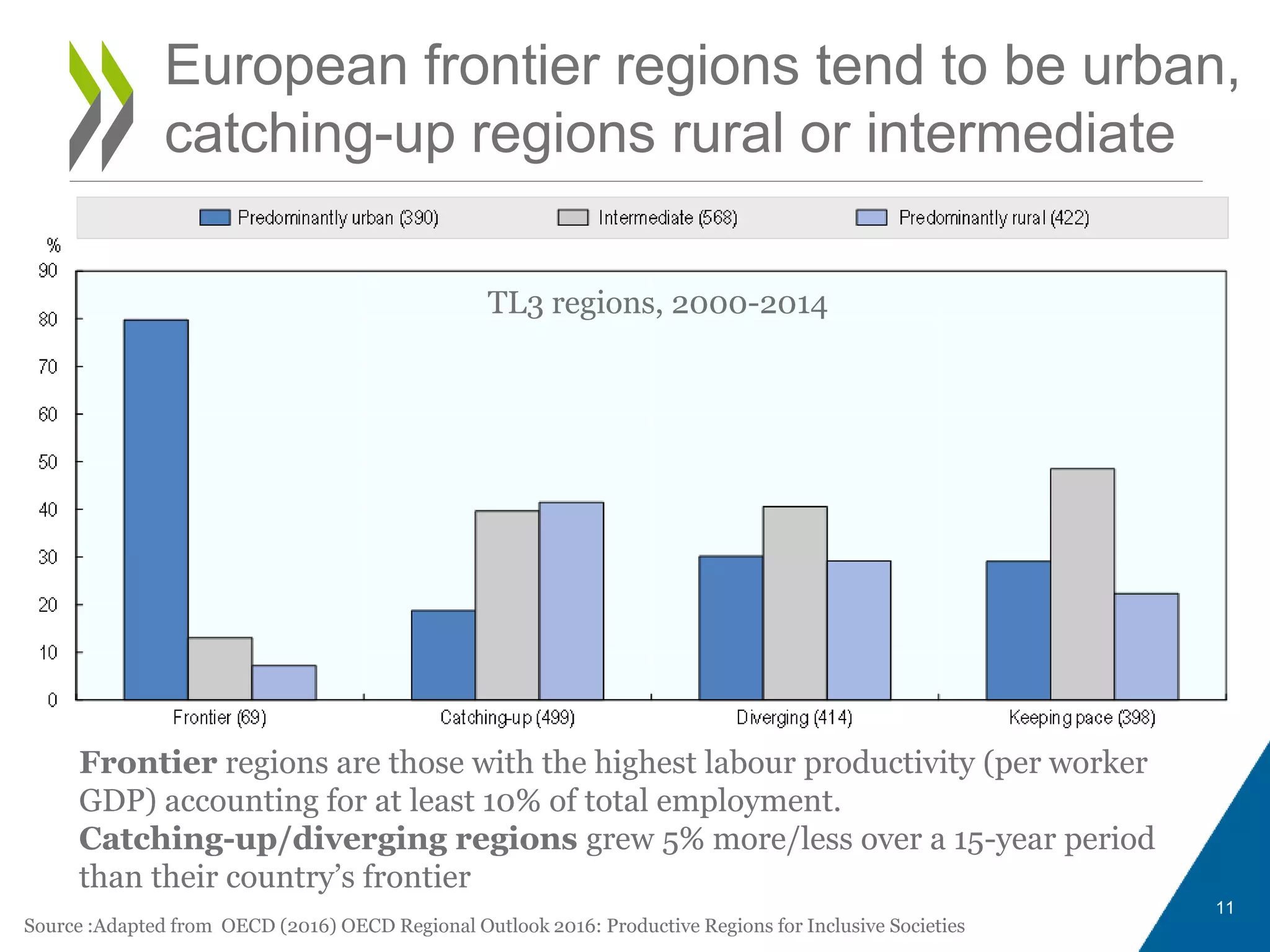

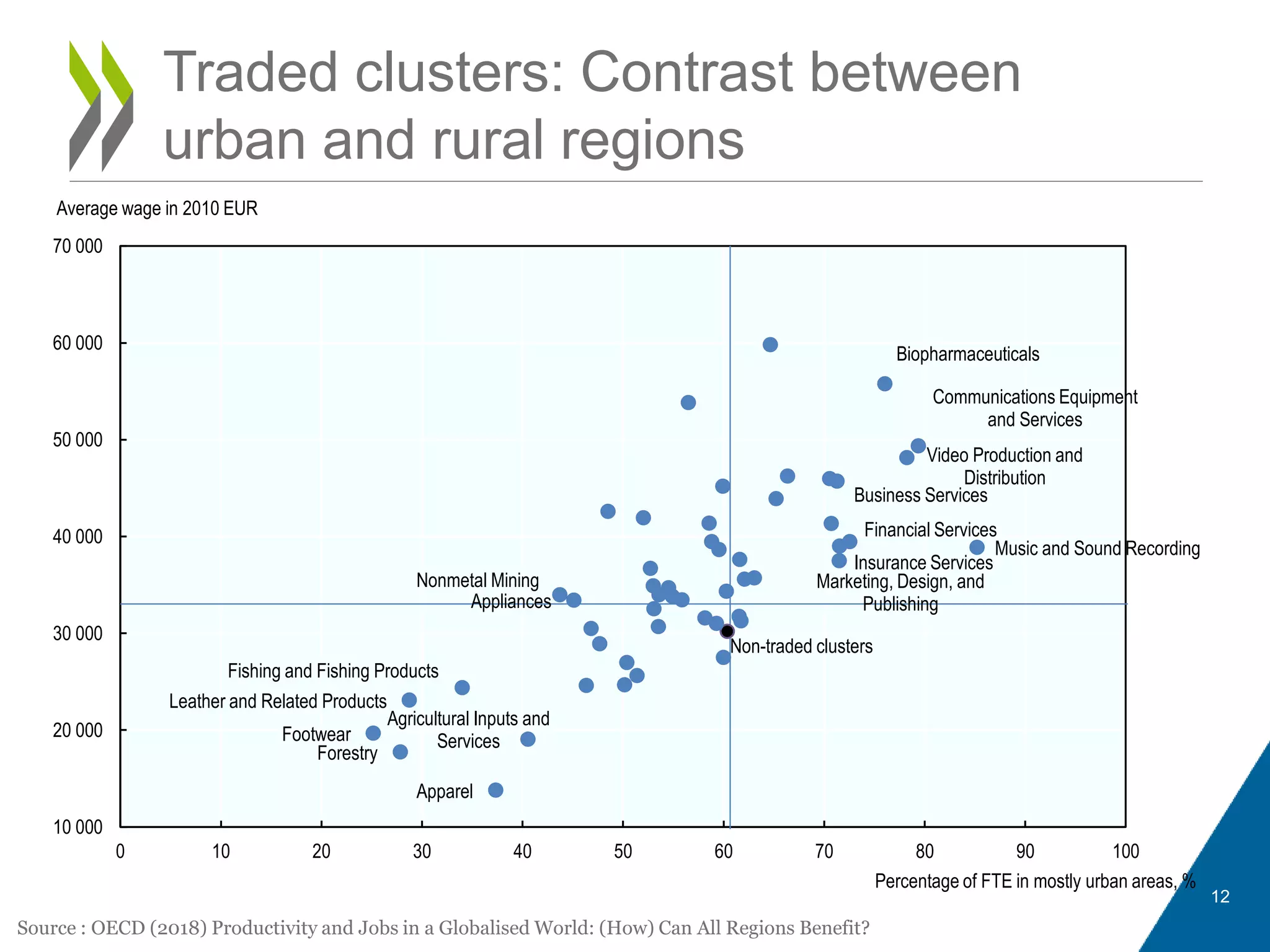

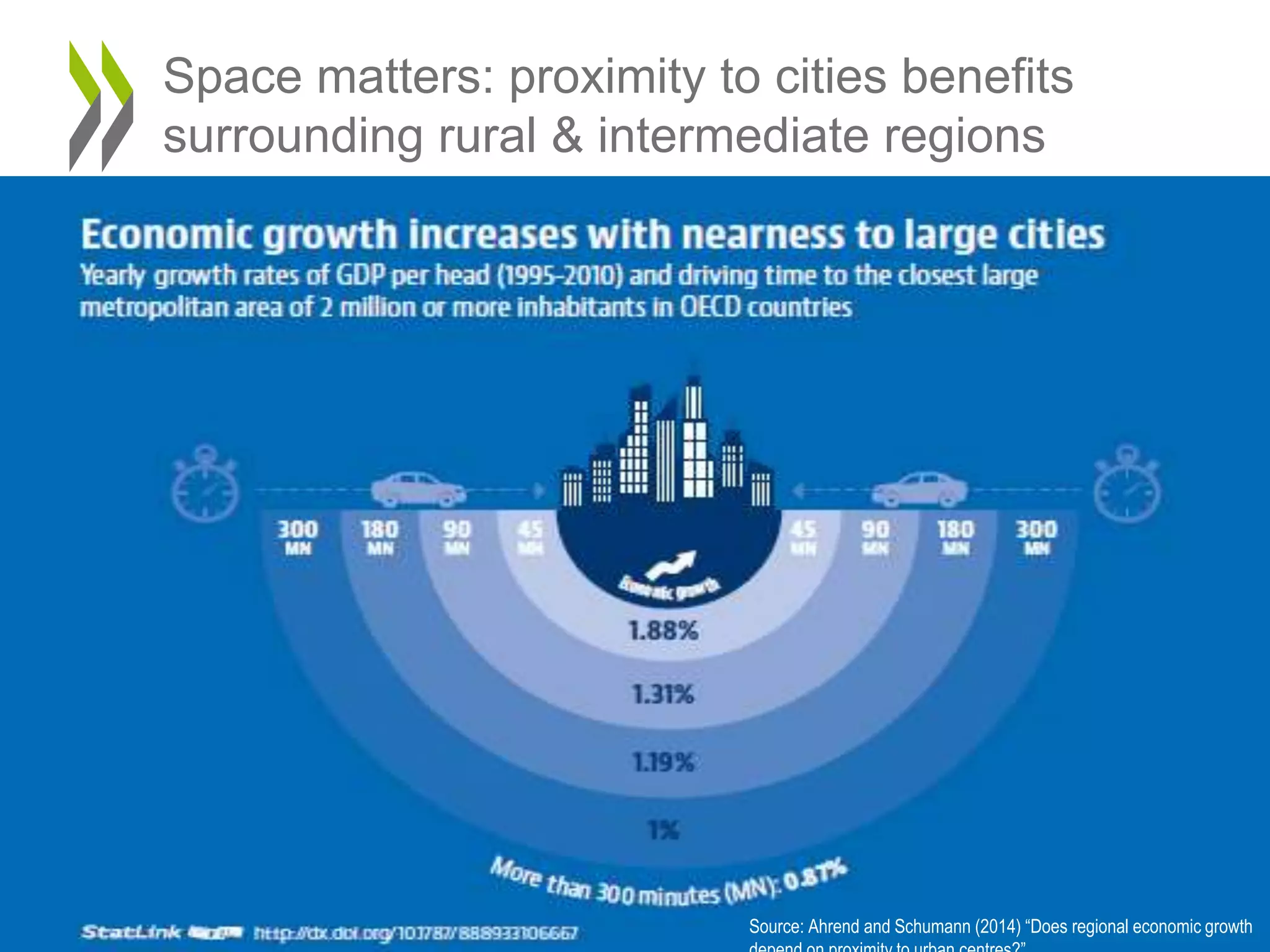

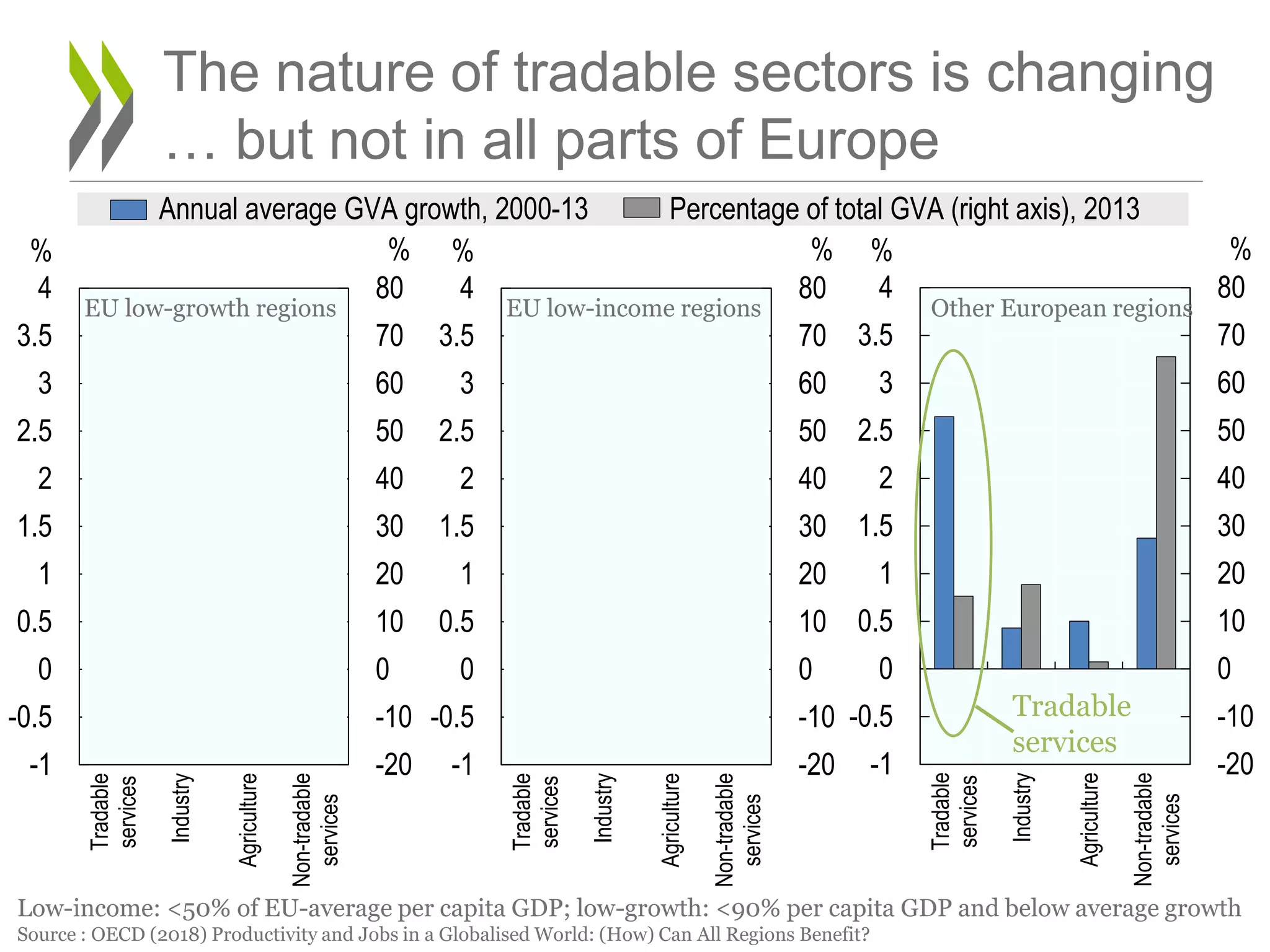

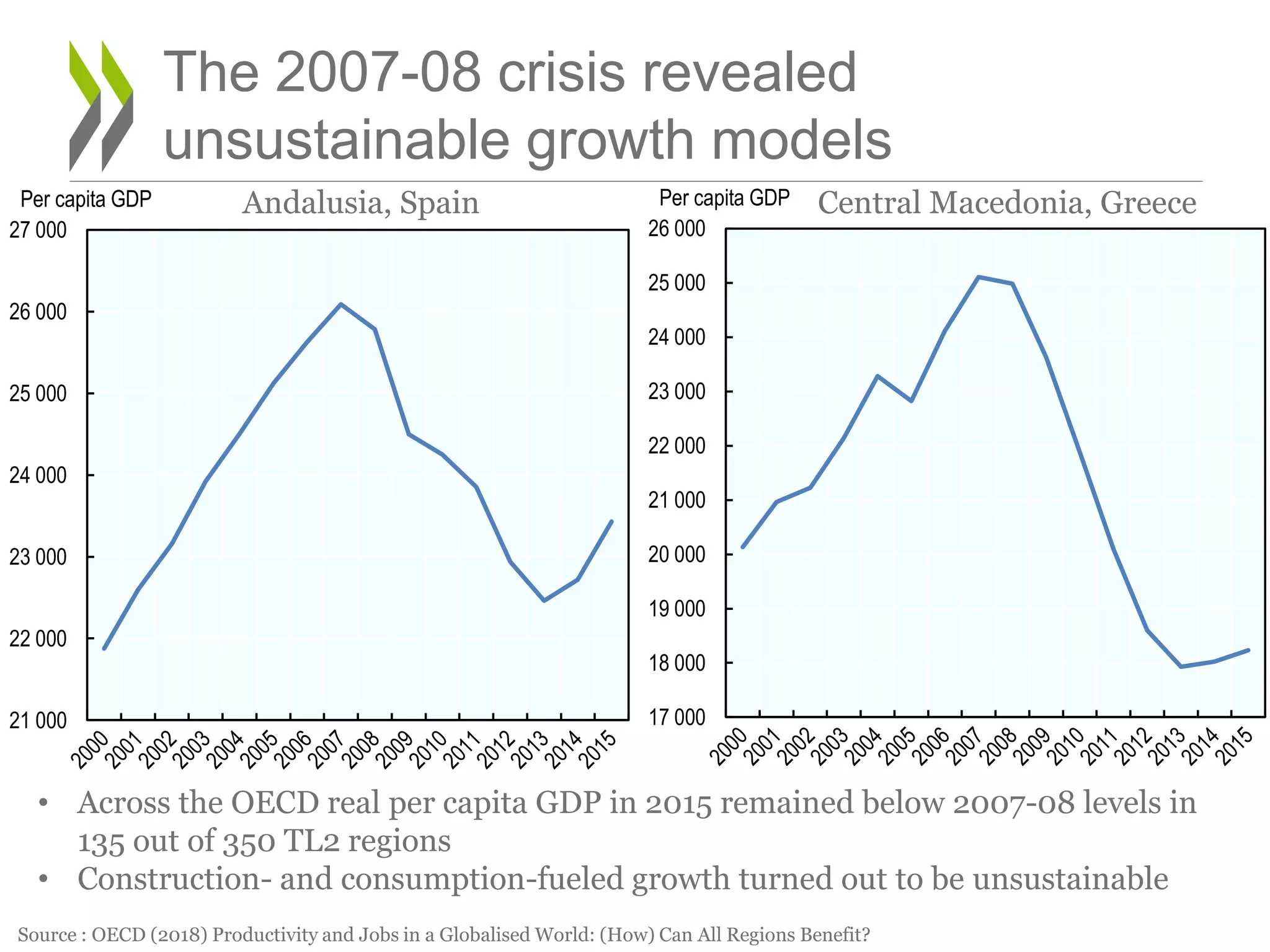

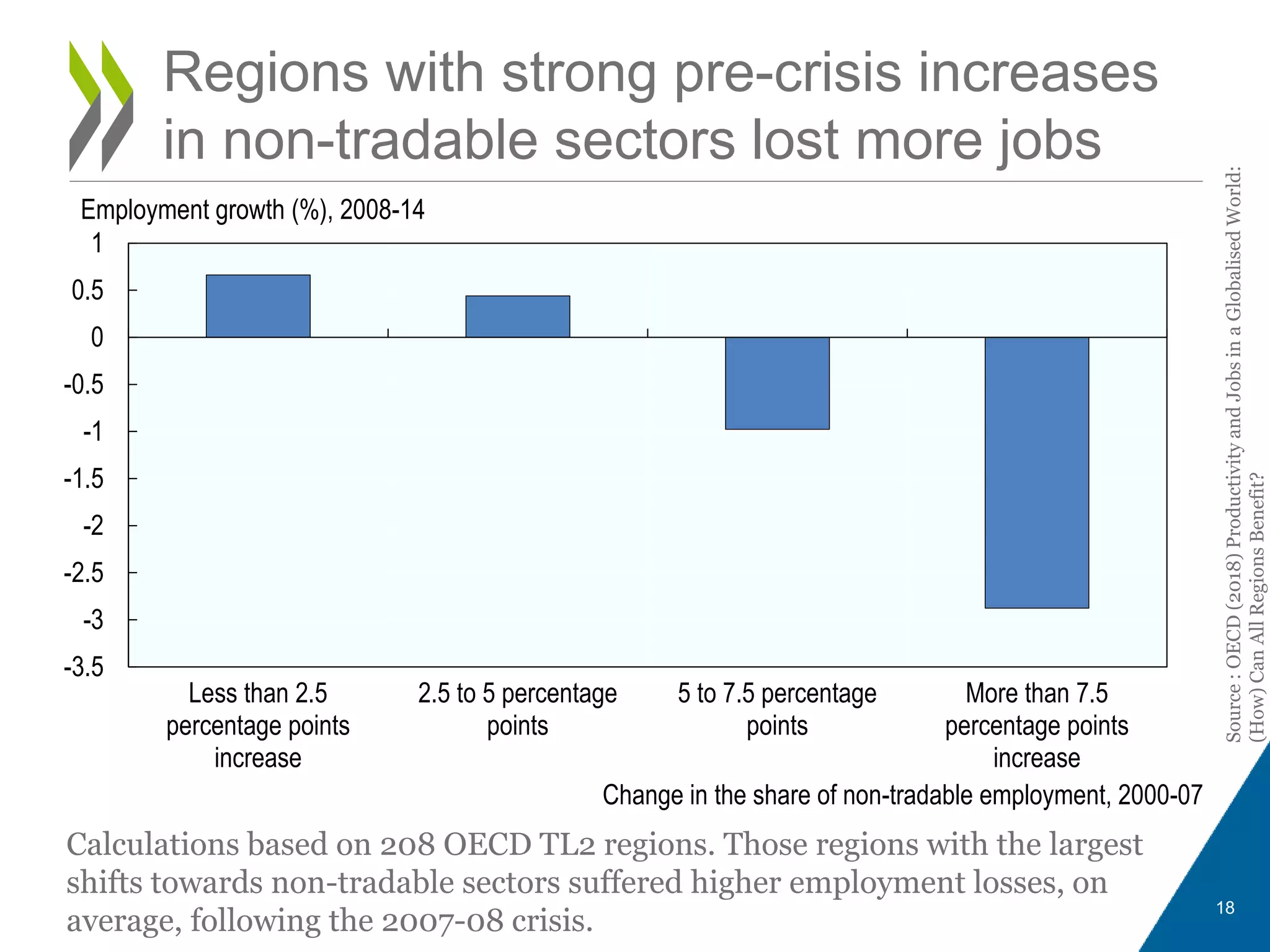

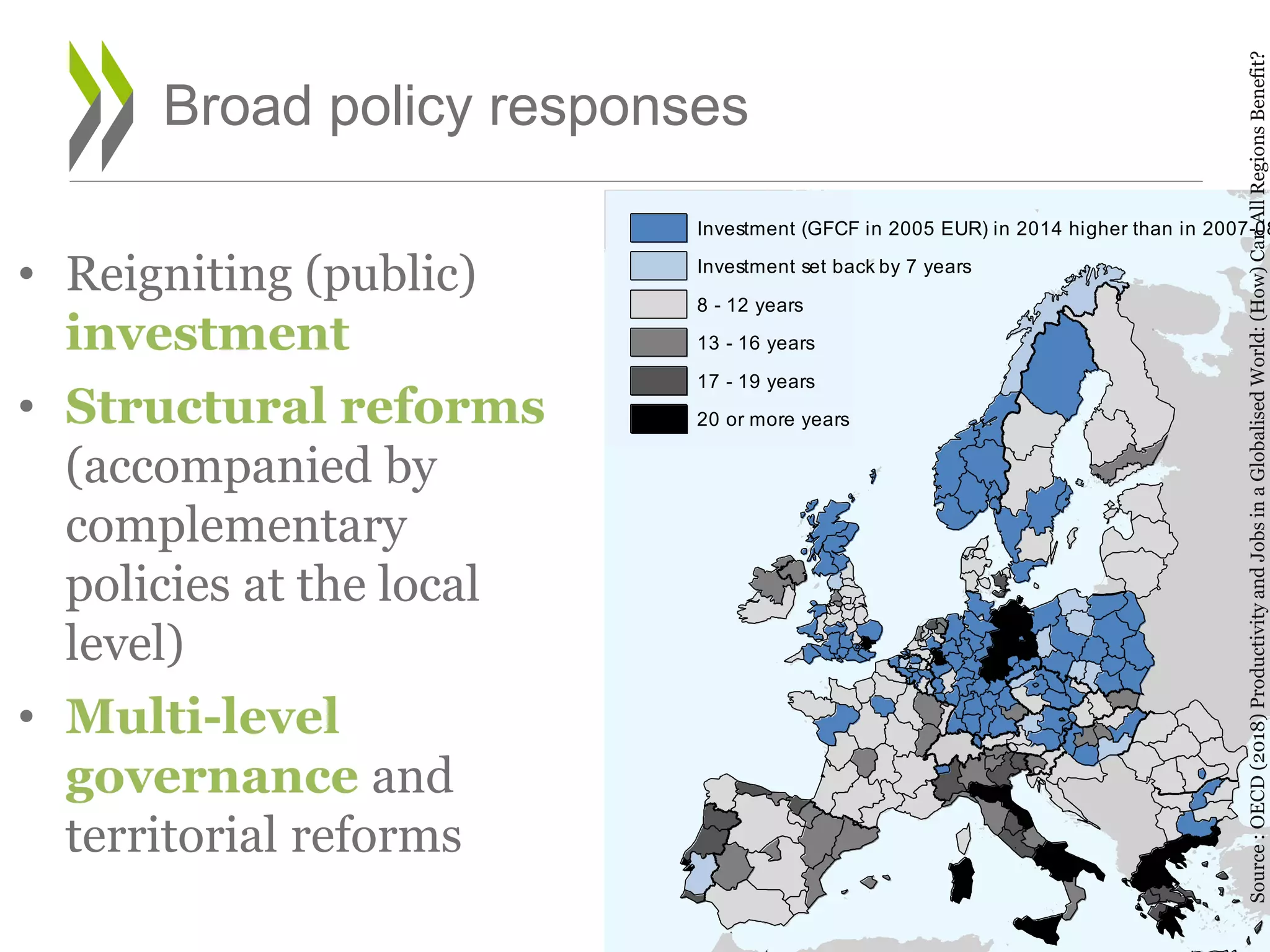

The document discusses the challenges and opportunities for productivity and job growth in a globalized world, particularly in regions that are catching up versus those that are leading in productivity. It highlights the importance of well-functioning cities, tradable sectors, and effective policy interventions to support regional economic development. Key strategies include investment in skills, structural reforms, and integrating local strengths to achieve inclusive growth across all regions.