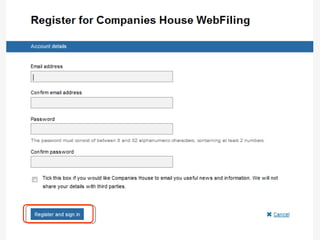

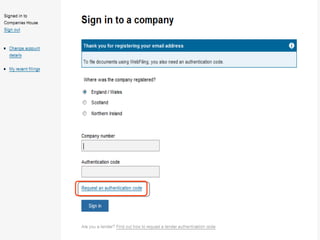

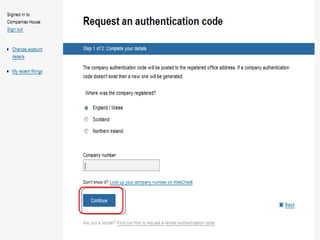

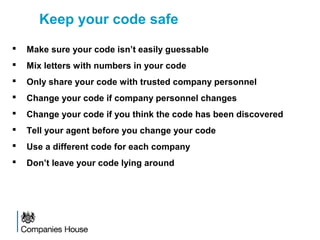

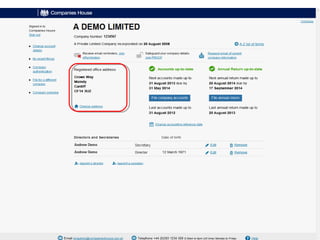

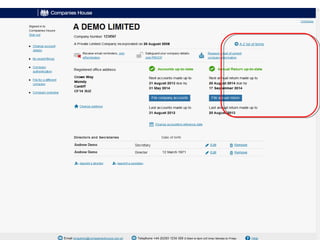

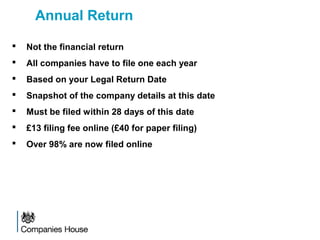

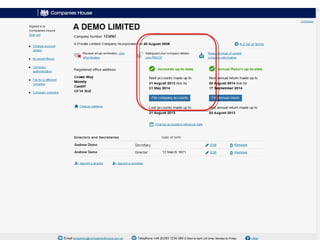

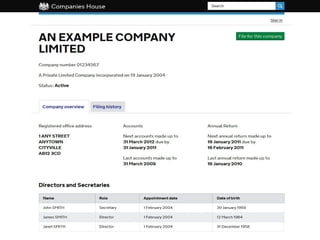

The document provides an agenda for a networking and information day hosted by Companies House. The agenda covers various topics related to Companies House including an introduction, the limited company, online filing, information services, intellectual property, and question time. A 30 minute comfort break is also included on the agenda.