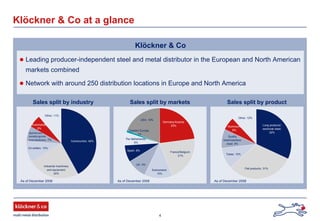

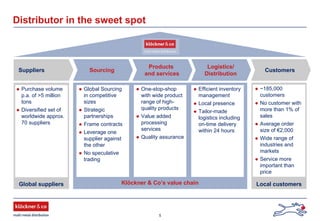

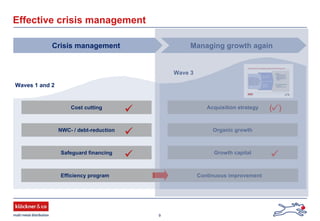

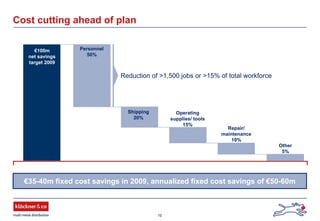

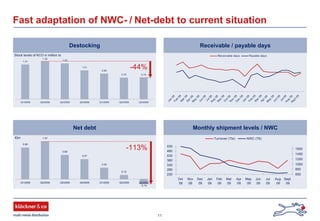

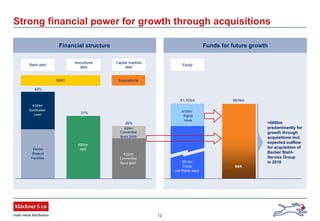

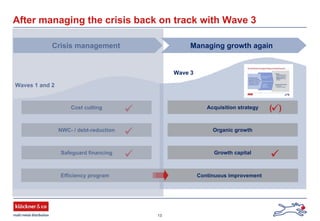

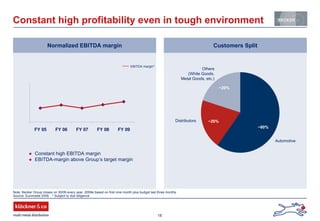

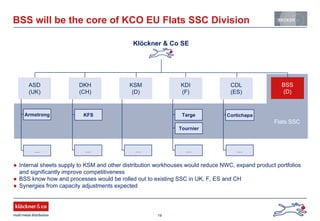

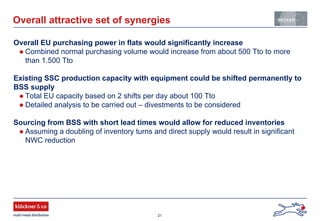

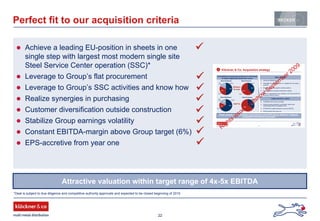

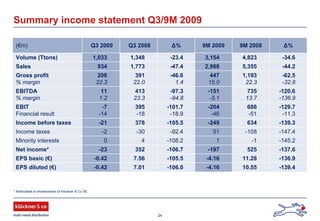

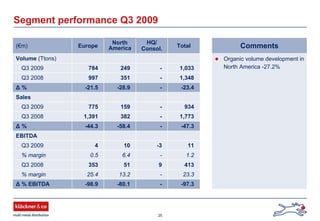

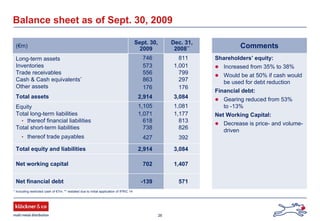

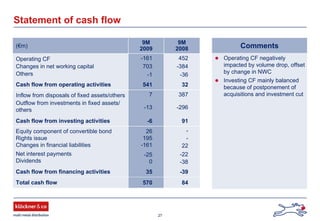

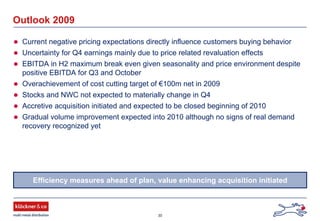

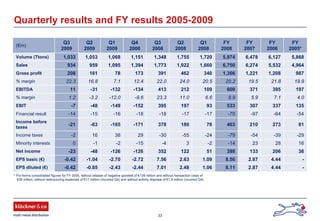

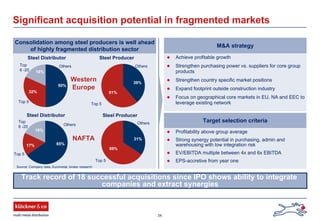

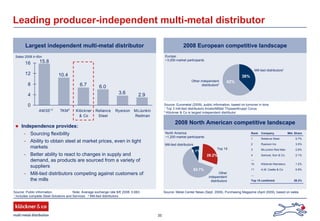

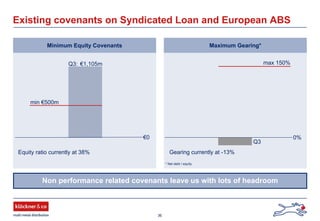

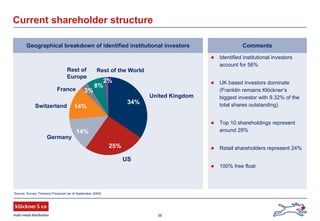

Klöckner & Co SE is a leading multi-metal distributor with a network of 250 locations in Europe and North America. In Q3 2009, Klöckner reported its first quarter of positive EBITDA since the beginning of the crisis. Cost cutting measures have achieved almost €100m in net cost savings for 2009. Klöckner placed a successful rights issue, converting its net debt position to net cash of €139m. Klöckner is pursuing an acquisition strategy and recently acquired Becker Stahl-Service Group, Germany's largest single-site steel service center.