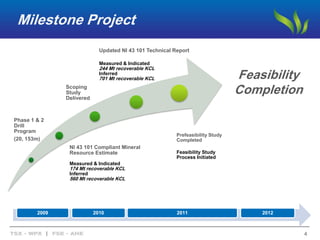

The document contains a presentation from Western Potash Corp. discussing their strengths, such as a world-class resource and positive economic assessments, alongside a disclaimer about the accuracy of the presented information. It outlines key milestones, including the recovery estimates and financial projections of the potash project, as well as details about the management team. The document concludes with investment highlights emphasizing the project's potential and capability for successful delivery.