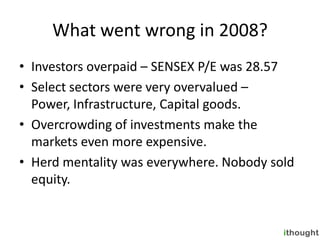

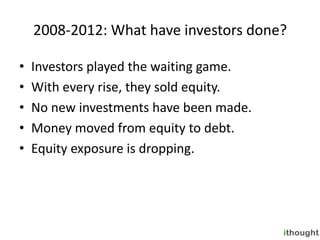

The document discusses the stock market crash of 2008 in India when the SENSEX fell from over 20,000 to under 17,000 in a month, and how investors since then have played the waiting game by selling on rises and moving money out of equity and into debt and gold. It argues the next bull market is coming as the economic cycle bottoms out, but many investors still wait for the perfect time to invest rather than starting now and that success depends more on mindset than trying to time the market perfectly.