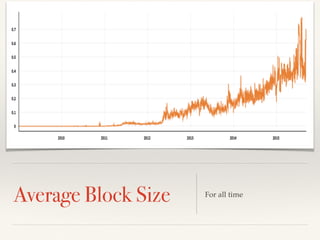

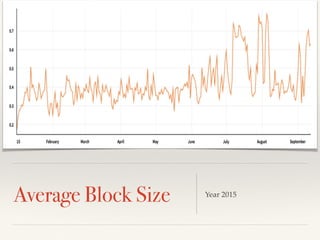

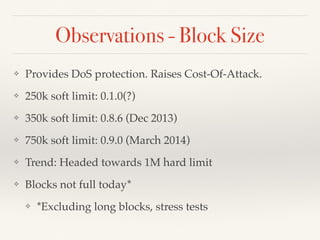

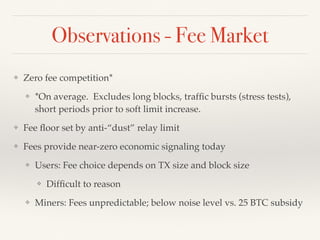

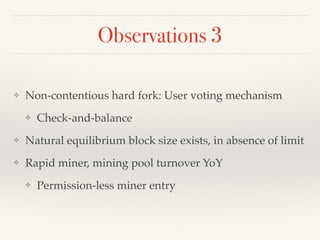

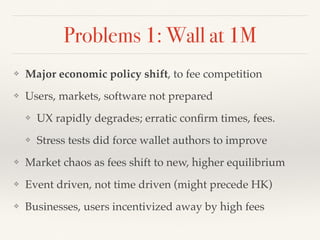

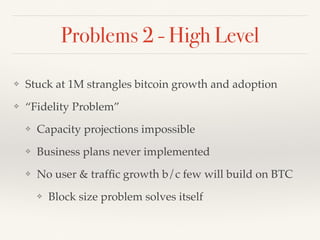

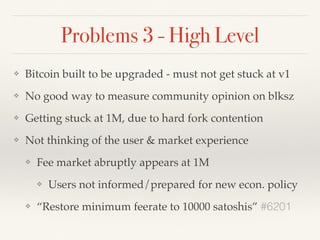

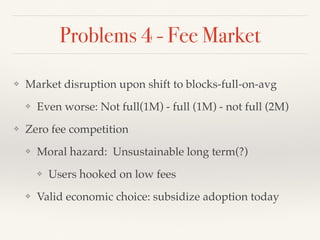

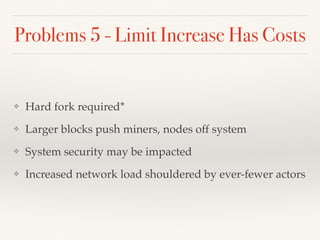

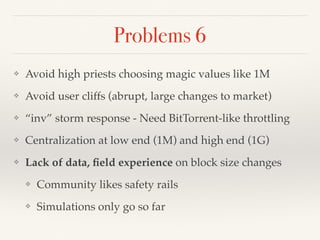

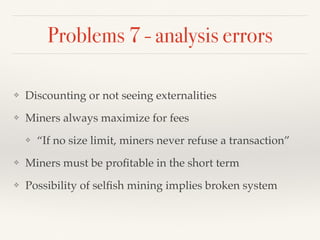

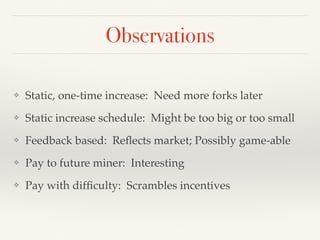

This document summarizes discussions from a 2015 Bitcoin scaling workshop regarding block size proposals. It notes that while the initial 1MB block size limit was intended to prevent spam, Bitcoin is now a settlement system and increasing the limit is needed to support user and transaction growth. However, issues could arise from abruptly shifting to a fee market or full blocks after hitting the hard limit. Various proposals are considered but all have costs and tradeoffs, so more experience is needed before determining the best approach.