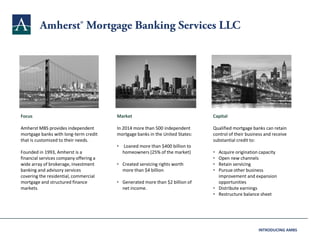

Introducing Amherst Mortgage Banking Services

- 1. Focus Amherst MBS provides independent mortgage banks with long-term credit that is customized to their needs. Founded in 1993, Amherst is a financial services company offering a wide array of brokerage, investment banking and advisory services covering the residential, commercial mortgage and structured finance markets. Market In 2014 more than 500 independent mortgage banks in the United States: • Loaned more than $400 billion to homeowners (25% of the market) • Created servicing rights worth more than $4 billion • Generated more than $2 billion of net income. Capital Qualified mortgage banks can retain control of their business and receive substantial credit to: • Acquire origination capacity • Open new channels • Retain servicing • Pursue other business improvement and expansion opportunities • Distribute earnings • Restructure balance sheet INTRODUCING AMBS

- 2. 2 Features Benefits Low Cost, Long Term Capital Without Giving Up Equity • Credit, not equity • Committed for up to five years • Secured by subordinated rights to your assets • Retain control • Retain ownership • Retain profits • Accelerate growth Cost • Much less than your expected return • Less than half the cost of preferred equity INTRODUCING AMBS $(3) $(2) $(1) $- $1 Today Year 1 Year 2 Year 3 Year 4 Year 5 Millions Cash Flow Preferred Equity AMBS

- 3. 3 About Us Founder & Chief Executive Officer Graham has provided executive level leadership, direction and insight to four large consumer finance companies. His experience in startups spans three companies where he was President or CEO and also the first employee hired. During his time as Senior Vice President and Director of Residential Lending at Bank of America in the 1990's, Graham recruited and led a team that improved the bank's national mortgage origination ranking to 5th from 100th in four years. He also developed credit policy, pricing models, capital markets and portfolio management tools. As CEO of a $4 billion federal savings bank during his tenure with ITT Financial Services, Graham managed regulated entities. While serving as Sr. Vice President of Risk Management at GE Capital, Graham provided leadership, direction and insight necessary to anticipate and monitor the risks associated with an evolving global customer base in a $250 billion portfolio of mortgage assets and insurance products. He also led GECC's prudent growth in mortgage originations, driving annual mortgage production from $5 billion to over $20 billion in just 18 months. Graham earned an MBA in Finance while attending the University of Southern California on a fellowship. At California Polytechnic University, he graduated cum laude in Finance, Insurance and Real Estate. Graham Williams Chief Operating Officer During his 15 years in the mortgage business, Paul has held several top management positions in sales, finance and operations. At First California Mortgage, a top 5 independent mortgage bank, Paul managed Internal Audit and Quality Control before moving into the CFO position. Paul spent another 2 years as the CFO of Homecomings Financial Network, the wholesale mortgage division of GMAC Mortgage, followed by 10 years as a Managing Director at Homecomings in charge of production and operations. Under Paul's leadership, a top notch management team was hired, a market leading on-line automated underwriting platform was implemented and a 65% improvement in operational efficiency was achieved....driving annual loan production from $2 billion to $28 billion in the process. Prior to joining the mortgage industry, Paul spent 10 years with KPMG in the financial services sector, leaving as a Senior Manager in the audit practice. Paul earned a Masters degree in Accounting while attending the University of Arizona. He graduated summa cum laude from Central Michigan University with a Bachelor's degree in Business Administration. Paul Breimayer Tim McAvenia SVP Business Development Tim has a 25 year background in mortgage sales, technology and process development. As a top performing wholesale and correspondent Account Executive at Flagstar Bank, Tim originated $1.2 billion in annual loan volume. Moving into an Area and then Regional Sales Manager position, Tim was instrumental in the development and implementation of Flagstar Bank's correspondent and warehouse lending programs. He was also a key contributor to Flagstar Bank’s online origination platform. He was an early adopter of technology to manage customer relationships and increase the effectiveness of his sales teams. Tim was also was heavily involved in new product development and automating compliance functionality. While the Western Region Manager at Nationstar Mortgage, Tim implemented a stronger sales structure, technology and metrics to grow production and profitability. As a Vice President at Torrey Pines Bank, Tim managed warehouse lending and specialty finance products related to residential mortgages. Tim graduated from the University of California, Santa Barbara, with a Bachelor's degree in Economics. INTRODUCING AMBS