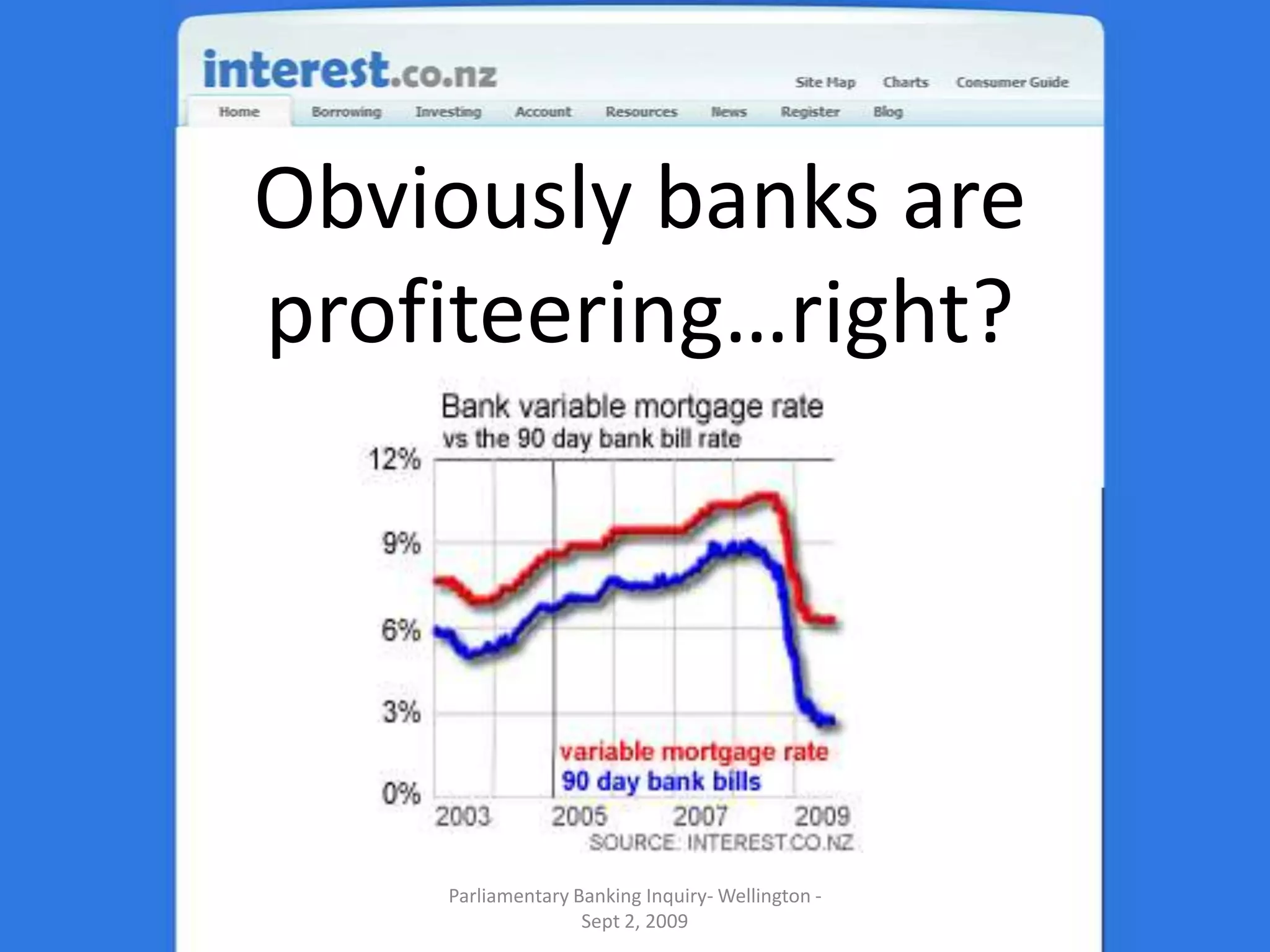

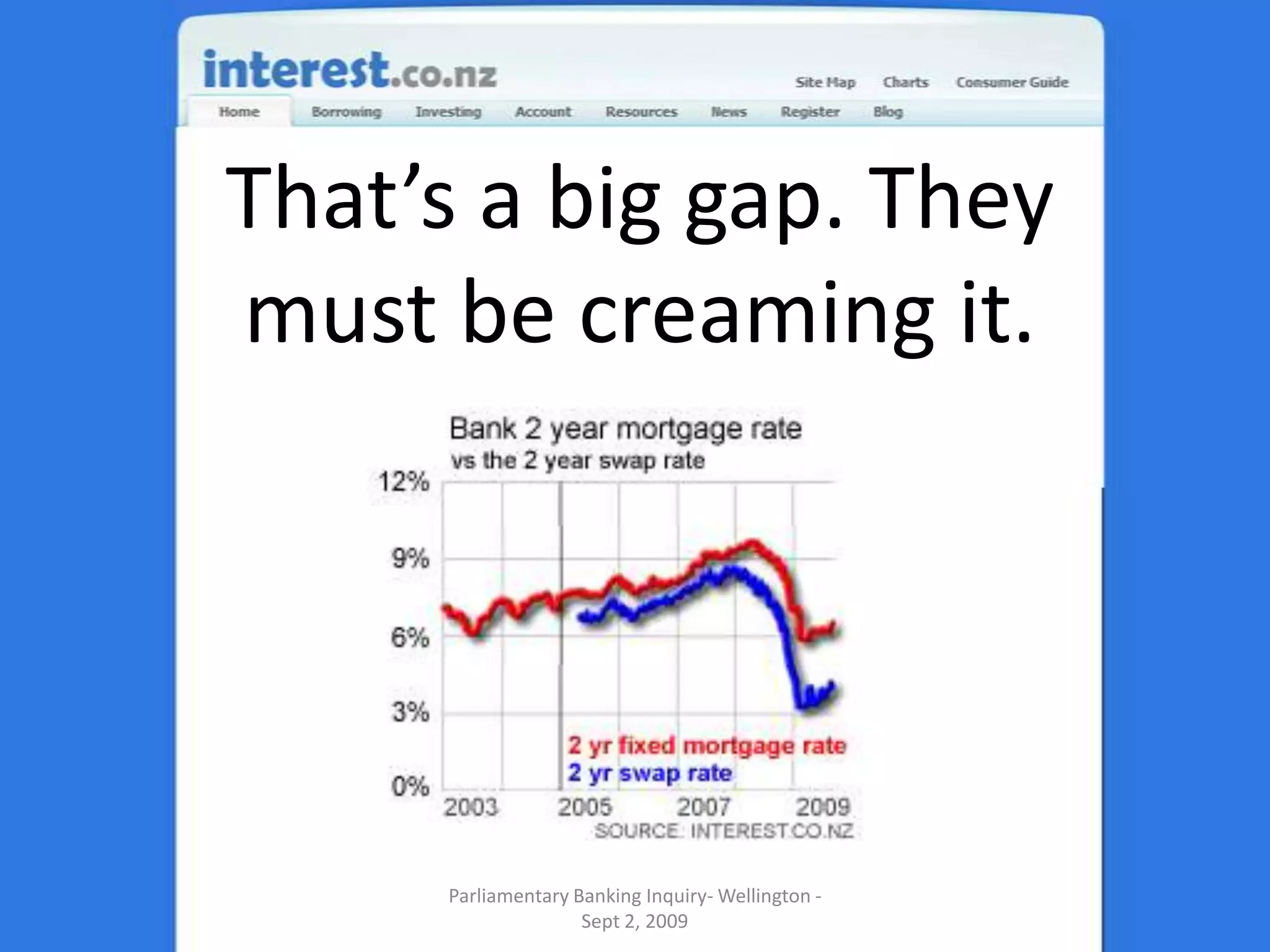

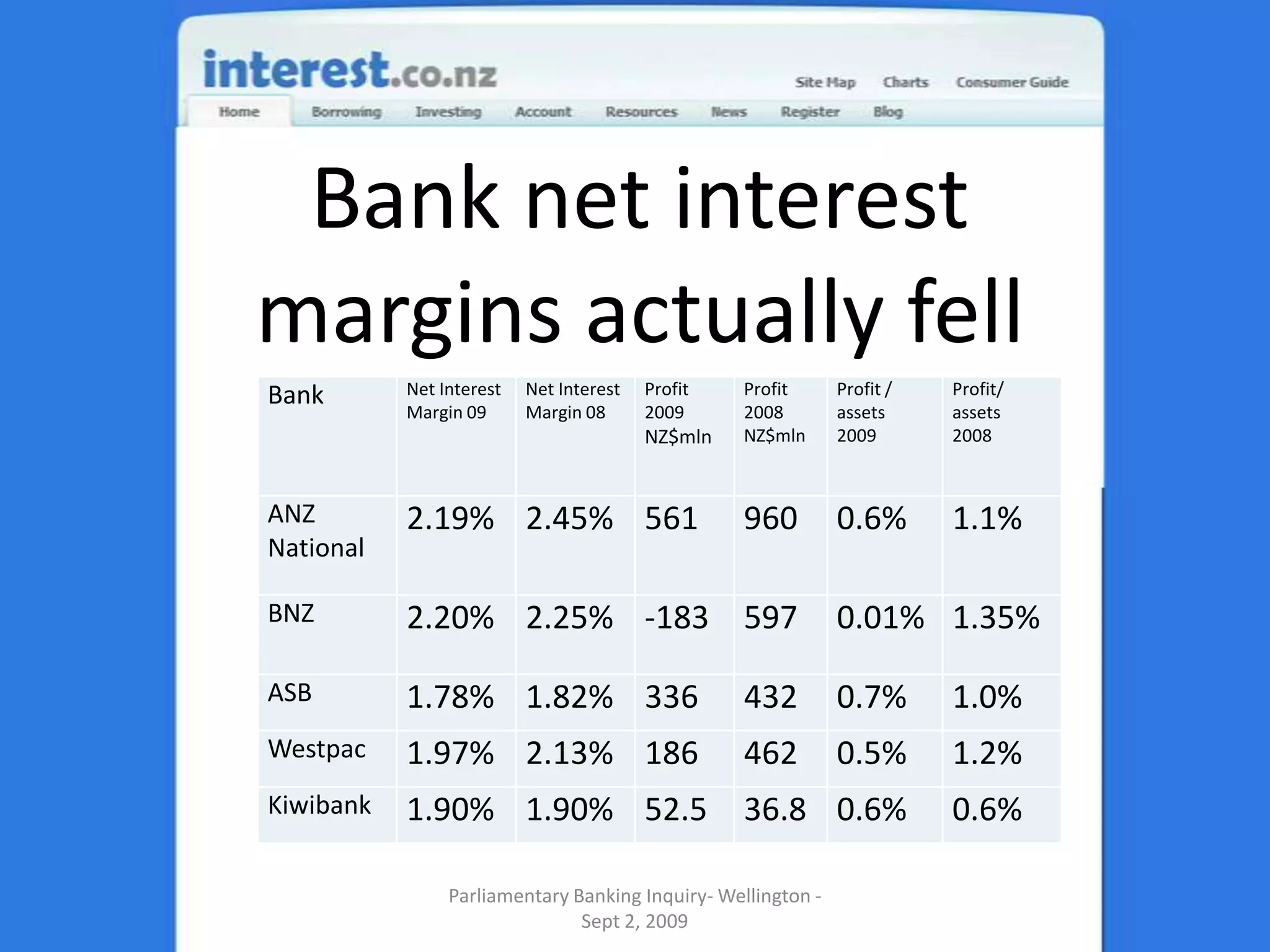

This document contains the text from a submission to a multi-party inquiry into banking in New Zealand. It addresses several issues, including arguing that the main problem is New Zealand's structural settings that favor housing investment rather than bank profiteering. It also notes that wholesale and local funding costs for banks have increased while bank net interest margins have actually fallen. The submission suggests solutions such as a flatter tax system, more productive investment, less property speculation, and changes to capital adequacy rules and requirements.