The document provides an overview of the consulting firm Insigniam and discusses topics related to disruption and transformational leadership. Specifically, it introduces Insigniam as a firm that helps large organizations generate breakthroughs through innovation consulting. It also previews several articles in the issue that discuss how leaders at companies like Kaiser Permanente, DBS Bank, and BP have navigated disruption by embracing innovation and transforming their organizations. Additionally, it highlights Insigniam's services and solutions for strategic transformation and growth.

![4 INSIGNIAM QUARTERLY | Summer 2015

hen Democratic members of the U.S. House of

Representatives staged a sit-in in June on the House floor

in an attempt to force legislative action on gun control,

they not only made political history, they also made live-

streaming history. As House Republicans realized what the

group was up to, they called a recess, which automatically

cut the video feed broadcasting around the world via

C-SPAN. In response, legislators took to Periscope and

Facebook Live to live-stream the sit-in themselves.

“It was an unprecedented, milestone moment,” C-SPAN

Communications Director Howard Mortman told Mashable.

It was also a moment that exemplified the brave new world of news that

live-streaming is helping to create—one that challenges the dominance of

traditional media companies. Facebook’s more than 1.5 billion users are

effectively all citizen journalists. Former CNN President Jonathan Klein told

The New York Times, “[T]hey’re capable of doing things that a cable news

network could only dream of doing.”

Mr. Klein’s point was tragically epitomized in July when Diamond

Reynolds live-streamed the aftermath of the fatal shooting of her boyfriend

by a police officer in Minnesota. The video was viewed 5.7 million times from

her Facebook page, uploaded to YouTube and broadcast by television outlets

around the world.

Facebook is welcoming this new era with a key shift in its approach to

content. As USA Today reported, “In the beginning on Facebook, there was

text. Then images spread throughout the News Feed. Now Facebook says

video will soon consume the lion’s share of attention of its 1.7 billion users.

And it’s making aggressive moves to get people to make and view more

video, whether from friends and family or from professionals.”

Facebook has even indicated interest in jumping into the TV network

game by obtaining exclusive streaming rights from ABC and NBC for sporting

and political events. The goal is to tap into television advertising budgets,

which are larger than typical digital and social ad budgets.

It is a move that CEO Mark Zuckerberg sees happening across all channels:

“We see a world that is video first, with video at the heart of all of our apps

and services.”

W

THE

TICKER

LIVE-STREAMING’S

TIPPINGPOINT

“We see a

world that is

video first,

with video

at the heart

of all of our

apps and

services.”

— Mark Zuckerberg,

CEO, Facebook](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-6-320.jpg)

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 7

INDIA’S

POWERSURGE

When the World Health Organization released

its 2016 list of the world’s most polluted cities,

four of the top seven (and 22 of the top 50)

were in India. It was not all that surprising, but

India is now striving for a much cleaner future

by turning to solar power.

In 2015, Prime Minister Narendra Modi

announced the government’s goal of

upping India’s solar energy capacity from

the previous target of 20 gigawatts (GW) to

100GW by 2022. Since 2014, the country has

already made strides by more than doubling

its solar energy capacity and increasing its

renewable capacity target to 175GW with the

help of other renewable sources, according to

The Economic Times.

While there are still major challenges ahead

for India, including dealing with an outdated

power grid, the dropping cost of solar power

production will surely help the country pivot

away from energy sources like coal, which

contribute to air pollution. According to

the Bloomberg New Energy Outlook 2016, solar

and wind will become the cheapest ways of

producing electricity in many countries during

the 2020s and in most of the world by the

2030s. The report also estimates that the cost

of solar photovoltaic cells will fall 60 percent

globally by 2040, accounting for 29 percent of

India’s new power capacity.

In June, the nation’s efforts received a buoy

of more than $1 billion from the World Bank

Group. “India’s plans to virtually triple the

share of renewable energy by 2030 will both

transform the country’s energy supply and

have far-reaching global implications in the

fight against climate change,” World Bank

President Jim Yong Kim said in a release.

AUGMENTED REALITY TAKES OFF

Pokémon GO took the world by storm this

year—delighting and annoying millions. But

even if you are not a fan of the gaming app,

you should be paying attention. While the

game is just another reason for our tech-ad-

dicted world to be glued to smartphones, it

has also introduced the masses to aug-

mented reality (AR) and is a harbinger of an

industry on the rise.

Microsoft CEO Satya Nadella told CNBC

the craze could be good for his company

as it prepares to roll out the HoloLens AR

headset. “I think it’s fantastic to see these

augmented reality applications getting built,

because the best thing that can happen

when you’re creating a new category is for

applications that

are these killer

apps, whether it

be game or in the

industrial scenario,

to get invested in,”

he said.

Pokémon GO

is “creating a lust

for [augmented

reality] that hasn’t

existed outside some niches in the U.S.,”

Ryan Pamplin, vice president of sales and

partnerships at AR startup Meta Co., told

The Wall Street Journal. In the same article,

Mike Rothenberg of Rothenberg Ventures

compared it to the

large wave of virtual

reality investments af-

ter Facebook acquired

Oculus VR in 2014.

But even if the suc-

cess of Pokémon GO

did not signal the start

of something big for

AR, Apple’s surprise

recent announcement

surely did. During a quarterly earnings call,

CEO Tim Cook revealed the company is “high

on AR for the long run,” adding, “[W]e think

there’s great things for customers and a

great commercial opportunity.”

Since 2014,

India has

more than

doubled its

solar energy

capacity.](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-9-320.jpg)

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 13

“[C]ustomers

are expecting

things now,

which earlier they

did not expect.

It is for banks to

respond to those

customer needs

in the innovative,

disruptive

manner;

otherwise, they

are not going to

exist.”

—Chanda Kochhar,

CEO of ICICI Bank

Disrupted: My Misadventure in the Start-Up

Bubble by Dan Lyons. Hachette Books, 2016.

This nonfiction account made major waves

when—and even before—it was released in

April. If you have yet to read it, make the

time. Fifty-something author Dan Lyons

goes into often-painful detail about his year

as a marketing fellow at Massachusetts-

based startup HubSpot. In his author’s

note, Mr. Lyons says he wrote the book “to

provide a more realistic look at life inside a

‘unicorn’ startup and to puncture the popular

mythology about heroic entrepreneurs.” He

goes on to label HubSpot’s leadership “a pack

of sales and marketing charlatans who spun

a good story about magical transformational

technology and got rich by selling shares in a

company that still has never turned a profit.”

Mr. Lyons does not mince words. But while

Disrupted may sound like a scorned ex-employee

looking to air dirty laundry, Mr. Lyons also

delves into some deeper topics like corporate

surveillance, writing, “If your plumber or pool

installer or local appliance store uses HubSpot

software, HubSpot may be holding information

about you, without you even knowing it. We

figure we’re safe when we use online services.

We figure we can trust the people that run them

not to snoop on us. I used to believe that. I don’t

anymore.”

“We’re going

to disrupt

ourselves,

and we are

disrupting

ourselves, so

we’re not trying

to preserve

a model of

yesterday.”

—Mary T. Barra,

CEO of General

Motors

“[Disruptors]

are what

psychologists call

disagreeable—

they do not

require the

approval of their

peers in order

to do what they

think is correct.”

—Malcolm Gladwell,

author of The Tipping

Point and Blink

“Oracle has grown and

advanced because

we’ve been consistently

willing to cannibalize

ourselves. We will be

unrecognizable five or

10 years from now, just

like no one would have

believed when Oracle

went public in 1986

that it would be the

company it is today.”

—Safra Catz, CEO of Oracle](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-15-320.jpg)

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 19

“A manager manages for

the moment. But as a leader,

you’re leading from one place

to another. You can easily get

overwhelmed by managerial,

short-term necessities, but

if you get consumed by that,

you don’t invest enough time

in future viability.”

—Steven Parker

the procedures and then told their teams to

abide by them. “Then we would be scratching

our heads for years afterward wondering why

people were not fully adopting the change,”

he says. Instead, the supervisors solicited

their teams’ opinions on the existing system’s

strengths and weaknesses.

“You have to bring all the ideas to the table

and say, ‘Here’s a better way of working,’ and

then listen to people’s reactions so that they

buy into the change,” he says. “If you don’t

do that change management, you get passive

resistance.”

While such a project typically would

have taken only a couple of months, the

new permit-to-work system took almost

a full year to create. “During this process,

Mr. Parker and his leadership team listened

to input on and suggested modifications to

the permit system. Including the employees

in this process made the difference,” Mr.

Durand says.

Mr. Parker adds, “It might take longer to

deploy it the right way, but you get all that

back by not getting pushback for years to

come. People got behind the change—and

that’s been a common theme throughout the

[entire refinery].”

CONTINUOUS IMPROVEMENT

While driving Burnaby’s transformation,

Mr. Parker knew he also had to manage

expectations about how much could be

achieved—and how quickly. “If I went out and

said, ‘Here are the gap areas, and we’re going

to fix them in one or two years,’ everyone

would be disappointed,” he says. Instead, he

let his employees know that change would be

an evergreen, continuous process.

“Now people say things are getting better.

Is it perfect? No. But it’s on an upward trend,

rather than downward,” Mr. Parker says.

“That’s a critical change.”

It is a measurable change, too: From 2012

to 2015, Burnaby’s employee workplace

satisfaction shot up 31 points—from 57

percent to 88 percent.

And as Mr. Parker had predicted, improved

engagement led to improved performance.

Each year, Chevron refineries’ balanced

scorecards indicate performance in areas

such as safety, reliability, profitability and cost

management. A score of 1,000 indicates that a

plant has outperformed comparable Chevron

plants. Over the past decade, Burnaby’s

scorecard came in as low as 300. But in 2014, a

year into Mr. Parker’s tenure, Burnaby scored

just over 1,000. In 2015, the plant scored

1,210—its highest grade ever.

“For the first time in the history of the

plant, we have had two consecutive years of

winning performance,” he says. What makes

that feat even more impressive is that the

criteria get tougher as the facility gets better.

The higher a facility’s score, the harder it is

to maintain.

“People like to be on a winning team,” Mr.

Parker says, “but a true winning team doesn’t

just win once—it puts together back-to-back,

consecutive years of performance.” IQ](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-21-320.jpg)

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 21

“The tendency

of good

management is

to explain away

events that

are occurring.

Boards can be

an effective

counterweight to

that. ”

—Ray Gilmartin,

member of the board,

National Association of

Corporate Directors

Borders’ story is not unique. Many in-

cumbents fail to realize that change is taking

place, according to Ray Gilmartin, former

chair, CEO and president of Merck & Co.

and a former director for both Microsoft and

General Mills. He argues the board, however,

is uniquely positioned to spot those unfore-

seen and slow-growing threats and act in the

face of that change. “Boards have no real

emotional commitment to the current direc-

tion of the firm. They are in a position to be

more objective about what is happening. The

tendency of good management is to explain

away events that are occurring. Boards can be

an effective counterweight to that. Through

their objectivity they can explore [disruptive

innovation] a little differently.”

BEYOND ‘REVIEW AND CONCUR’

In the five years since Borders went under,

the boardroom has changed. Disruption

is now a ubiquitous term, and boards are

putting more time and focus on strategy.

According to KPMG’s September 2015 Global

Boardroom Insights, 53 percent of directors say

their board’s involvement in the formulation

and consideration of strategic alternatives has

increased in the past two to three years. And

24 percent say boards are spending more time

testing the ongoing validity of the fundamen-

tal assumptions that help to form strategy.

Mr. Gilmartin, who is now a member of

the board for the National Association of

Corporate Directors, adds that most boards

are moving away from a “review and concur”

approach, toward one in which strategy dis-

cussions are a continual process throughout

the year. This provides more opportunity

for boards to discuss and advise on potential

threats.

But first directors must be able to recog-

nize disruption—and that means understand-

ing what it is, and what it is not. It is tempting

to label any business variable or unforeseen

market upset as a disruption, which is why

Mr. Gilmartin recommends boards create a

framework from which to view challenges.

Being on the same page in identifying these

forces is the first step to being in sync when

the board and management team address

them, he says.

The biggest disruptions can stem from](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-23-320.jpg)

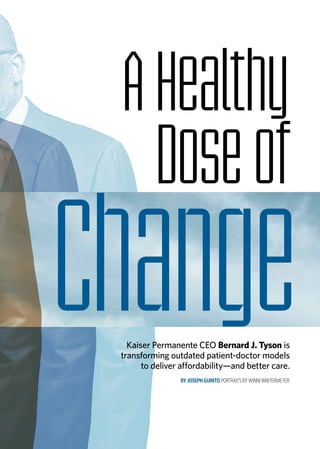

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 27

zation to meet the needs of millions of people

in the future.”

For Kaiser Permanente, that means noth-

ing short of a revolution in traditional doctor-

patient dynamic.

“The entire health care industry was built

on the idea of people coming to our space for

care,” he says. “Whether that’s a medical of-

fice, a hospital or a pharmacy, we’ve designed

the health system for people to come in to us

for their health needs. For the future, what

we have to do is push care out to where the

patient or member is. That’s our reimagined

idea—care anywhere. What we’re trying to do

now—what we will do—is turn this industry

upside down.”

Affordability Above All

No matter how forward-thinking the vision,

Mr. Tyson will not get very far without mak-

ing cost control priority No. 1. Nearly 58 per-

cent of U.S. consumers surveyed said rising

health insurance rates add financial strain to

them or their family, according to a May 2016

TransUnion survey. And three in four are ex-

tremely or somewhat concerned about in-

creased costs from health insurers’ 2017 rate

proposals.

“Affordability is the single biggest issue

in the industry today,” Mr. Tyson says. “The

work we have in front of us in the industry is

to build a more affordable system that covers

and cares for the American people.”

Kaiser Permanente’s integrated system—

which includes a network of providers, hos-

pitals and insurers—gives it a jump-start

on controlling costs, Mr. Tyson says. Most

of the industry works off an input model,

where money flows to health care compa-

nies when patients do things like visit the

doctor, take tests or buy prescription drugs.

Providers in that case are incentivized to

maximize those inputs so as to maximize

revenue. Meanwhile, insurers, which typical-

ly hold the “first dollars” from patients, are

incentivized to limit inputs to limit expenses.

But because Kaiser Permanente is respon-

sible for the entire health care dollar and has

a say in where it goes, Mr. Tyson and his lead-

ership team are free to do things differently.

For instance, they can reward doctors and

nurses and other caregivers through year-end

bonuses tied to improving clinical outcomes

for patients.

“[Trying new things] is part of who we are,”

he says. “It goes back to the day when [found-

ers] Henry Kaiser and Sidney Garfield didn’t

want to build this organization with the mind-

set of a sick care system when what people re-

ally want to do is live healthy, happy, productive

lives. Today the question is, how do we build

that kind of system while serving as a model for

the entire health care industry by dealing with

the issue of affordability?”

Mr. Tyson fires off a one-word answer:

“Innovation.”

“We have an internal saying here,” he says.

“We say, ‘We want to be the best at getting

better.’ That calls for a disciplined approach of

improvement that is continuous. It’s not about

looking for a silver bullet. It’s not about look-

ing for a big bang.”

Tech as a Tool

Much of Kaiser’s continuous improvement in

health care affordability ties back to its strate-

gic use of technology. The organization em-

ploys nearly 200,000 people, with about 6,000

in IT, and focuses each year either on tech

upgrades or entirely new systems. (It spent

a whopping $4 billion alone to implement

“Kaiser Permanente HealthConnect,” a com-

prehensive health information system that

gives doctors and patients access to electronic

“What we’re

trying to do

now—what we

will do—is turn

this industry

upside down.”

—Bernard J. Tyson,

chairman and CEO,

Kaiser Permanente

AnnualhealthspendingintheUnitedStatesisprojected

tojumpanaverageof5.8 percentthrough2025.](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-29-320.jpg)

![quarterly.insigniam.com | INSIGNIAM QUARTERLY 51

experience was Intel. I had the great privi-

lege of serving on the board of Intel Corp.

under the chairmanship of Gordon Moore

when Andy Grove was the CEO. That com-

pany moved from memory into micropro-

cessors when leadership saw a disruption

coming, and it got there before anybody

else. It was absolutely amazing. It is one of

the great examples of realizing what was

happening in the marketplace and creating

the disruption for the future.

IQ: Are there any companies that you think

are great examples of doing it wrong?

JB: No, I’ve never met anybody who does it to-

tally wrong. The major disruptions at the mo-

ment are based in both the sharing economy

and the virtual economy. Those disruptors are

reaping both the reward and the consequenc-

es of it. The reward is growth; people want

to have that flexibility. The consequences are

a great rumbling of the regulators, like we’ve

seen with Uber (see “When a Disruptor Meets

Regulators,” at left).

It’s important for the companies to tend to

all these things because you never know. If you

bury a volcano, it may just blow up one day.

So while these organizations are certainly dis-

rupting and doing it pretty well, there’s a lot

of unattended business. Of course, as they’re

disrupting, every disruptor creates an opportu-

nity to be disrupted themselves.

IQ: What advice do you have for CEOs

about identifying and dealing with

disruptions that are on the horizon?

JB: I would say that the most important thing

is to recognize that every single industry is dis-

rupted at one time in its life. The best thing

is to surround yourself with people who don’t

think like you, and get out of the bubble that

inevitably is created around you. IQ

ple. That’s unstoppable. In my whole business

career going back to the ’60s, that’s been an

impact. It just gets faster and faster and faster.

We have to think through, “Where does the

disruption take us, and what do we want to

do? What are we building today to meet that

need? Can we maintain flexibility?” Flexibility

costs money, but it actually costs less than to-

tally restructuring after you build something

that is wrong for the future.

In the case of oil and gas, for example, I

think people do have to think about the fol-

lowing: If we are to burn oil and gas, we need

to do something to limit the amount of car-

bon dioxide that goes into the atmosphere.

Can we capture it? Can we use it? Can we

store it? It’s the same with methane, natural

gas. You can’t let natural gas go into the at-

mosphere. It’s much more damaging in terms

of impact on climate change than CO2. You’ve

got to keep it tightly stored even in transporta-

tion. Do we have the right technology? Do we

have the right monitoring?

Third, what else do we do with all these

[disruptors and skills]? What other business

should we be in? For example, if you’re in oil

and gas, should you create a business strategy

to produce electricity from renewables?

Finally, specifically for oil and gas, you real-

ly have to think very carefully about how to at-

tract great people into an industry that many

young people view as substandard. That, I

think, is a very important challenge. Young

people want to go to startups. They want to

go to a bunch of other places in Silicon Valley

or Silicon Roundabout in London and create a

startup, create an app, do something different

for the future.

IQ: Can you give an example of a company

that handles disruption well?

JB: The very best example in my personal

Sometimes quintessential

disruptors find

themselves on the

defensive. Take Uber,

which is seeing regulators

ban or partially ban

its service in countries

around the world. While it

is unlikely the company’s

rapid growth can be

easily slowed, it has

undoubtedly hit a few

speed bumps. Lord John

Browne says Uber needs

to tread carefully.

“It is this real question

about how to engage

with regulators,” he says.

“When do you actually

reject what they say and

contest it? When do you

cooperate? When do

you concede? When do

you work with them to

change regulation in a

transparent way?”

“I’m not trying to

buy the regulator

cooperative,” he

continues. “I think

it’s a very important

consideration that all

industries should think

about. Every industry

has regulations that

ensure fair play between

the people who are

competing or has set

standards for the safety

of the general public. I

think those choices by

CEOs are very critical.”

When a

Disruptor

Meets

Regulators](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-53-320.jpg)

![54 INSIGNIAM QUARTERLY | Fall 2016

seeks out entrepreneurial employees who

are not afraid to constantly suggest what

they could do better—and then to do it. “It’s

all about empowerment,” Ms. Tans says.

Booking.com has a relatively flat hierarchy

of self-steering teams expected to make their

own decisions. “We try to put decision-mak-

ing as low as possible in the organization so

we can move quickly,” she says. “If you have

to go all the way to the top to approve every

decision, it slows everything down.”

This decentralized approach can lead to

failures, but Ms. Tans sees that as essential to

what Booking.com does as a tech company.

“The quickest way to innovate successfully is

to make lots of little mistakes on your way

to getting it right,” she says. “If you’re afraid

of failure or getting it wrong, you’ll never

truly innovate or disrupt the market. You’ll

never test out those crazy, off-the-wall ideas

that may actually be genius and make your

product better for your customers. We cel-

ebrate failure at Booking.com because it’s a

moment for us all to learn.”

This empowered culture also helps recruit

tech professionals, who can be notoriously

difficult to attract in the current war for IT

talent. “It helps that we aren’t based in Sili-

con Valley, where everyone is fighting for the

same people,” Ms. Tans says. The compa-

ny’s chief technology officer says he spends

roughly 30 percent of his time on recruiting

efforts to be sure the company can find and

keep the best people.

Booking.com’s global recruiting efforts

have resulted in a workplace with more than

85 nationalities at the Amsterdam headquar-

ters alone. “Our diverse and international

workforce is representative of our business,”

Ms. Tans says. The company has also invested

in having local talent on the ground to build

partnerships with accommodation providers.

Booking.com began in the Netherlands in

1996, offering online accommodation booking

to Dutch travelers. When CEO Gillian Tans

joined the company as COO in 2002, it had

just a handful of employees—mostly software

engineers—and about 300 customers, mostly

in Holland. But from the start, Booking.com

took a different approach than most of the

booking websites of the day (or even of

today) by adopting an agency (pay at the

property) model of service instead of the

merchant (pay upon booking) model.

According to travel news and information

site Skift, “Using a Booking.com extranet,

hotels could set their own rates and room

allocations, and collect payment from guests

at the property. Commissions to Booking.com

started at 12 percent instead of the 25 per-

cent to 30 percent margins given to the other

[online travel agencies] and having to wait

months to collect on prepaid bookings.”

This helped the company skip cumber-

some negotiations between properties,

which, according to Skift, often led to

disagreements and lengthy discussions over

issues such as brand standards, rate parity,

search results display and room allocations.

“We’ve always been disruptive,” says Ms.

Tans, pointing to the fact that Booking.com

began online in 1996 when everyone else

was still brick and mortar. This approach

is what ultimately made it an attractive

acquisition for the Priceline Group. In 2005,

the company was acquired for $135 million by

the U.S.-based organization. Today, Booking.

com is the largest accommodation booking

site in the world and Priceline’s biggest brand

by far. In fact, the acquisition of Booking.

com is largely credited for Priceline’s current

success—its profits grew from $10 million

in 2003 to $9.2 billion by 2015. Boasting

relationships with more than 970,000

properties, Booking.com books almost twice

as many rooms per night as its next biggest

competitor, Expedia.

A History of

Disruption

“We try to

put decision-

making as low

as possible in

the organization

so we can move

quickly. If you

have to go all

the way to the

top to approve

every decision,

it slows

everything

down.”

—Gillian Tans](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-56-320.jpg)

![60 INSIGNIAM QUARTERLY | Fall 2016

It is a transformation Mr. Gupta sees as too

big to fail. “You have to have the consummate

belief that if you don’t do something, you’re

going to die.”

Spreading the Joy

DBS’ current mission is to make banking joyful.

At the heart of the seemingly Disney-esque

goal is a stat Mr. Gupta often references: Nearly

three-fourths of millennials would rather go to

the dentist than listen to what banks are saying.

“That’s a terrible place to start,” he says. “But

if we can figure out a way to make banking

joyful and DBS a joy to be with, then we can

competitively position ourselves in a very

different way from anybody else.”

Living up to that mission means changing

the DBS culture into one that makes every

decision based on what is best for the customer.

“When people compare us to the startups

or even the Googles or Apples, it really boils

down to, ‘You’re conservative, you’re fuddy-

duddies, you’re old-fashioned and you’re

inward-looking.’ So how do you change the

culture to be more like Google and Facebook?”

DBS started by implementing a process-

improvement agenda, its own version of the

five-day GE Work-Out framework through

which groups gather to discuss specific

process improvements. In doing so, DBS

landed on the notion of customer journeys.

By mapping customer needs, desires

and context, DBS would create a better

experience. Mr. Gupta says the approach

“galvanized” the company.

“Our people found a very easy rubric for

[when to innovate and suggest change]. It was

simple: If it made sense for the customer, it’s

probably okay to try and do it,” he says.

Today, DBS has an executive director

who heads all customer journey design

and development. All managing directors

DBS Balance Sheet

Headquarters: Singapore

Total Assets (2015): SGD$458 billion

Annual Income: SGD$10.8 billion

Branches: 280+

Institutional Banking Customers: 200,000+

Customers: 6 million+

Key Markets: Singapore, Hong Kong, China,

Taiwan, India, Indonesia

Source: DBS Annual Report 2015

“Disruption assumes that some of

to come and eliminate you,

young star tup can](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-62-320.jpg)

![66 INSIGNIAM QUARTERLY | Fall 2016

proactively respond to the looming threat of cyberattacks. According

to a 2016 report by Barclays and the United Kingdom’s Institute of

Directors, 91 percent of business leaders believe cybersecurity is crucial,

but only 57 percent say they have a formal strategic framework in place

to protect their organization.

“Our report shows that cyber must stop being treated as the domain

of the IT department and should be a boardroom priority,” Richard

Benham, author of the report and CEO of the United Kingdom’s

National Cyber Management Centre, said in a statement.

In fact, support and awareness from both the C-suite and the

boardroom are crucial factors when it comes to successfully impeding

security breaches. Growth of cyberattacks and breaches was reduced by

more than 50 percent in companies that had a security strategy backed

by a fully engaged C-suite and board of directors, according to a 2016

report by The Economist Intelligence Unit.

“It’s difficult to obtain funding for essential systems and training

if you don’t have the support and buy-in of the C-suite and the board

of directors,” Mr. Goldfarb says. Adds Mr. Samani: “It’s impossible to

There is no panacea for all cyber-

security threats—and that means

companies must be willing to try

innovative approaches to battle

unseen digital foes. One such

approach on the rise is bug bounty

programs, in which organizations

pay white-hat hackers to identify

weaknesses in their cybersecurity

systems.

Standard-fare tech companies

such as Yahoo, Google, Facebook,

Mozilla/Firefox and Microsoft have

well-established bug bounty pro-

grams. Collectively they have paid

out more than $13 million in fees to

hackers for finding vulnerabilities.

Over the past couple of years,

however, new players and non-

tech giants—including Deutsche

Telekom, Samsung, Tesla, Star-

bucks, General Motors, the U.S.

Department of Defense and Spo-

tify—have been getting into the

game. According to crowdsource

cybersecurity agency Bugcrowd’s

State of Bug Bounty 2016

report, “Overall, organizations

from more ‘traditional’ indus-

tries have seen year-over-year

growth [in bounty programs]

of over 217 percent on average,

including financial services and

banking, automotive, health care,

education, telecommunications,

hospitality, real estate, utilities

and consumer goods.”

In August, Apple said it would

pay rewards of up to $200,000

to researchers who find critical

security bugs in its products.

And earlier this year, Uber

announced it was launching a

bounty program, offering fees of

as much as $10,000 for critical

issues. The ride-sharing company

also provides the hackers with a

“treasure map” that clues them

in to some of the more vulnerable

components of the system.

“Uber’s in 70 countries around

the world now, so a one-size-fits-

all model is definitely never going

to work for us,” Samantha Davison,

manager of security awareness at

the company, said at this year’s

Infosecurity Europe conference.

Yet despite the apparent surge

in bug bounty interest, Bugworld’s

report found that 94 percent of

companies on the Forbes 2000

have yet to launch a vulnerability

disclosure or bug bounty program.

Cyber Pest Control](https://image.slidesharecdn.com/insigniamquarterlydisruption-160921181321/85/Insigniam-Quarterly-Fall-2016-Disruption-68-320.jpg)