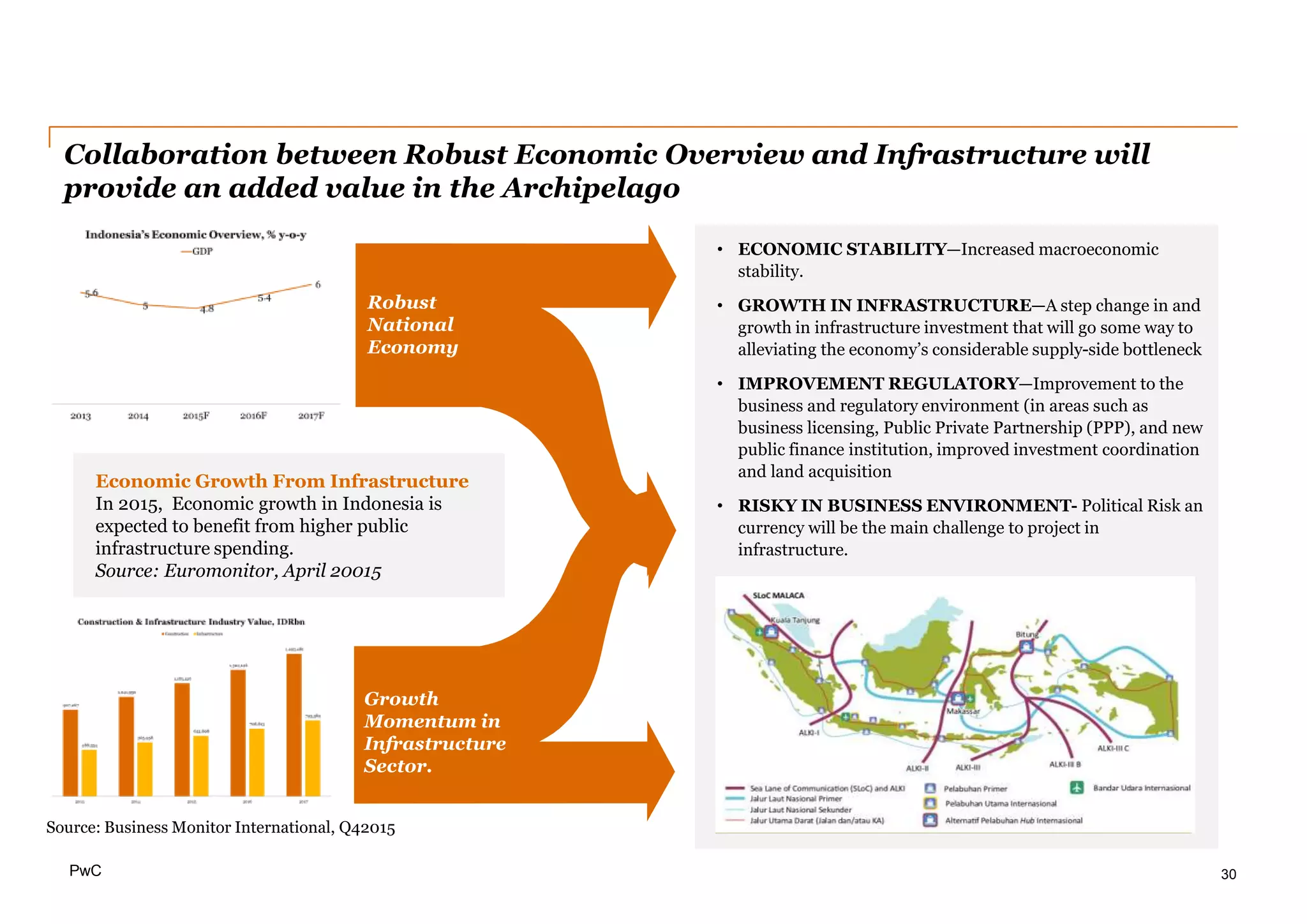

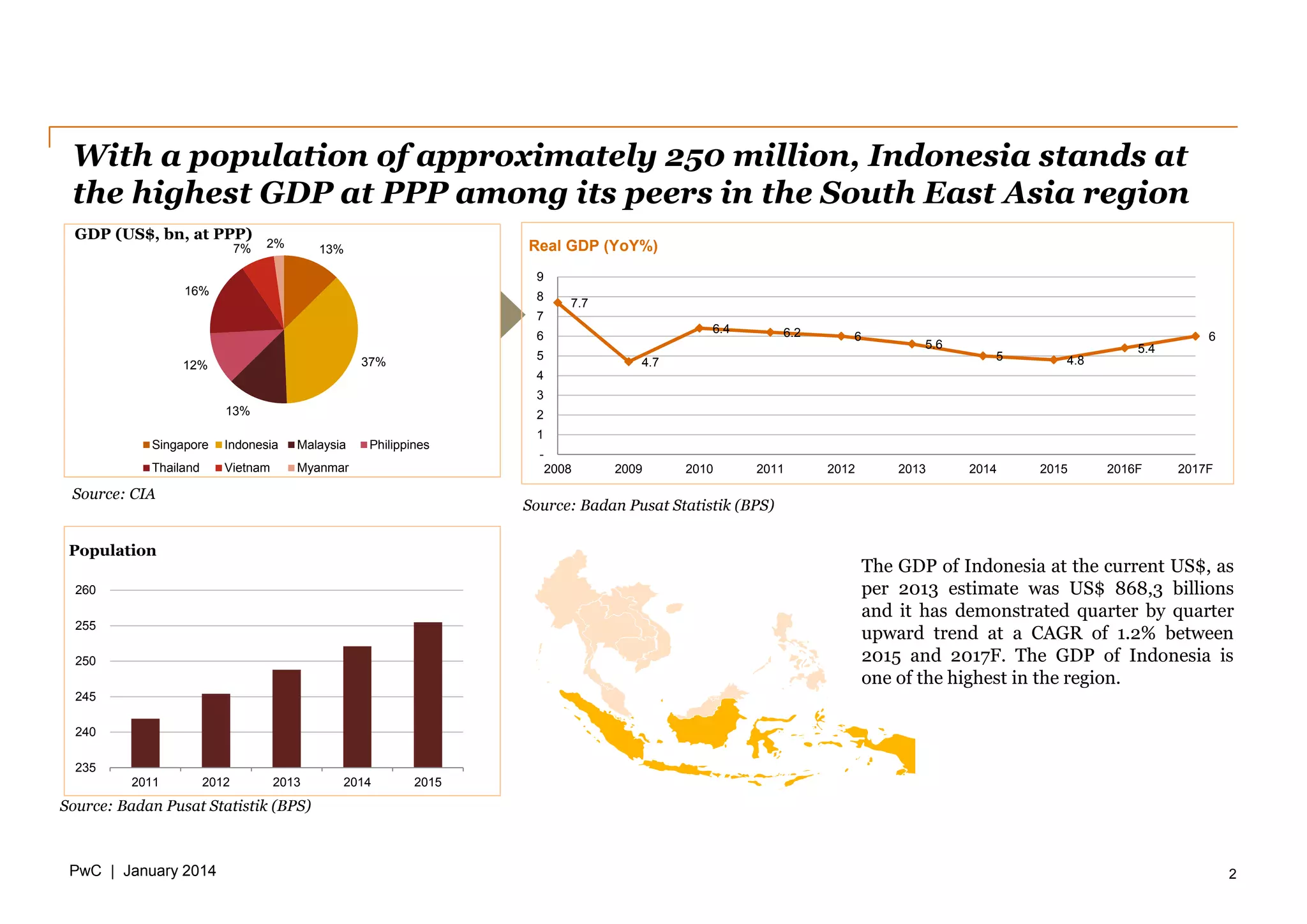

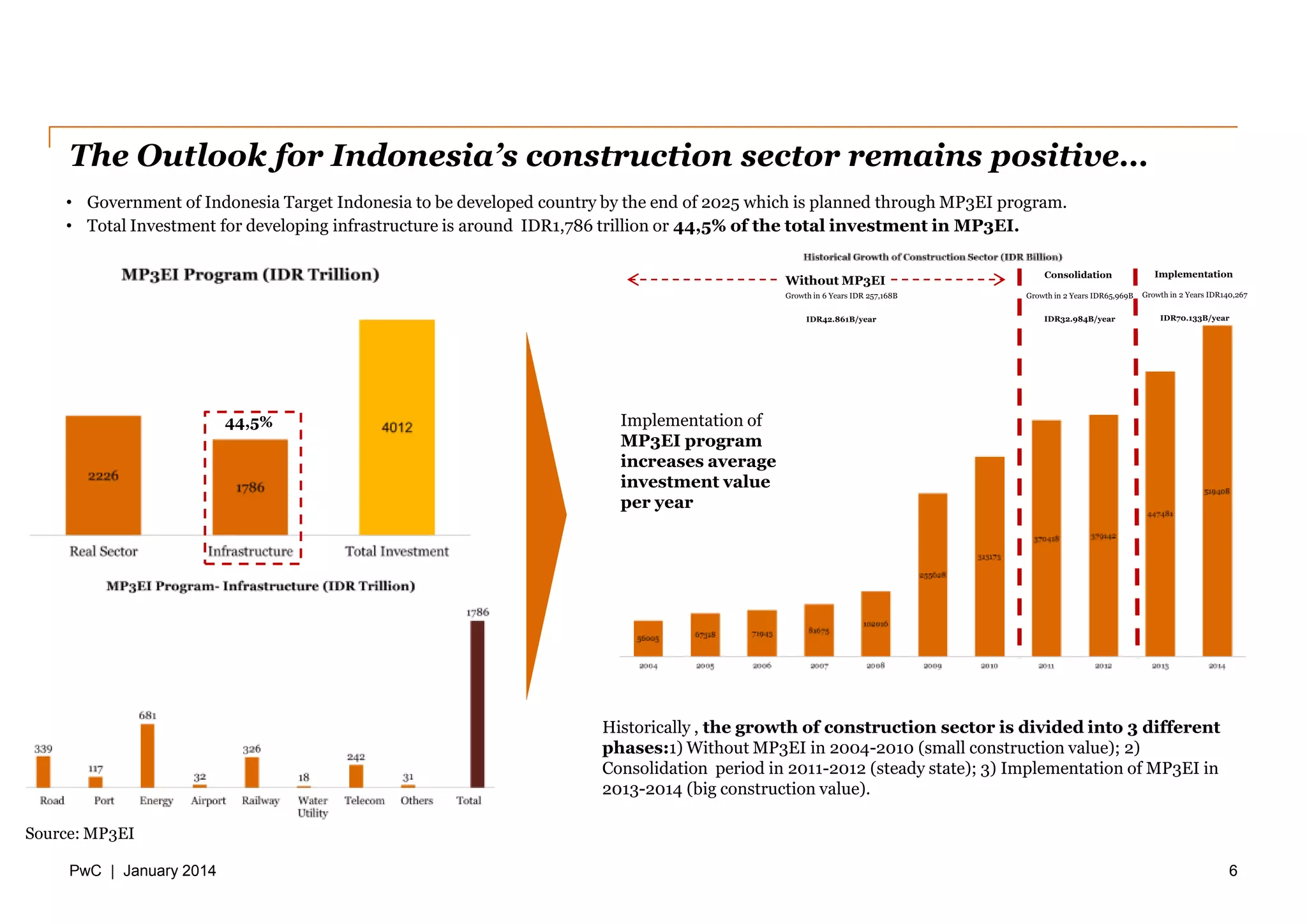

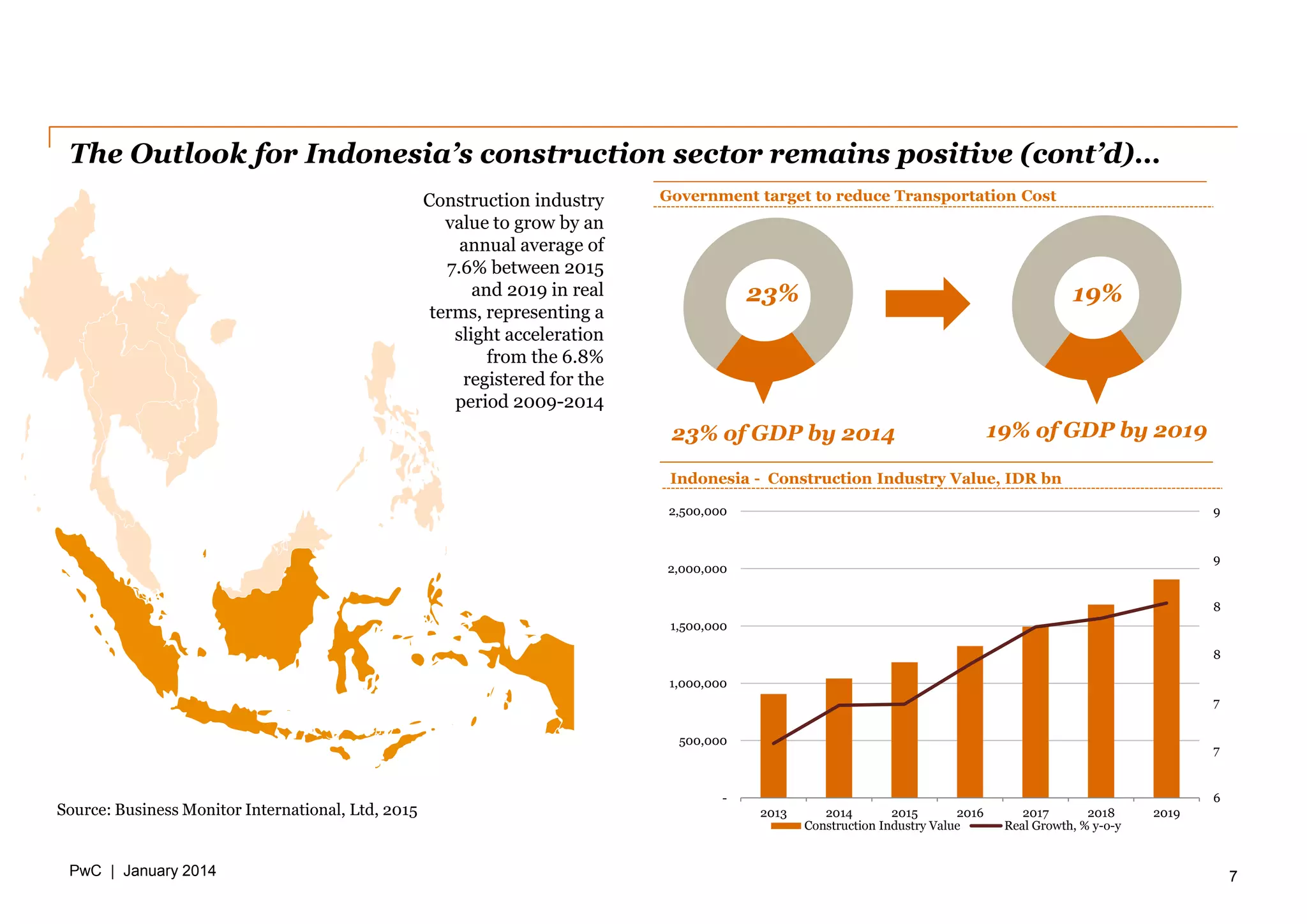

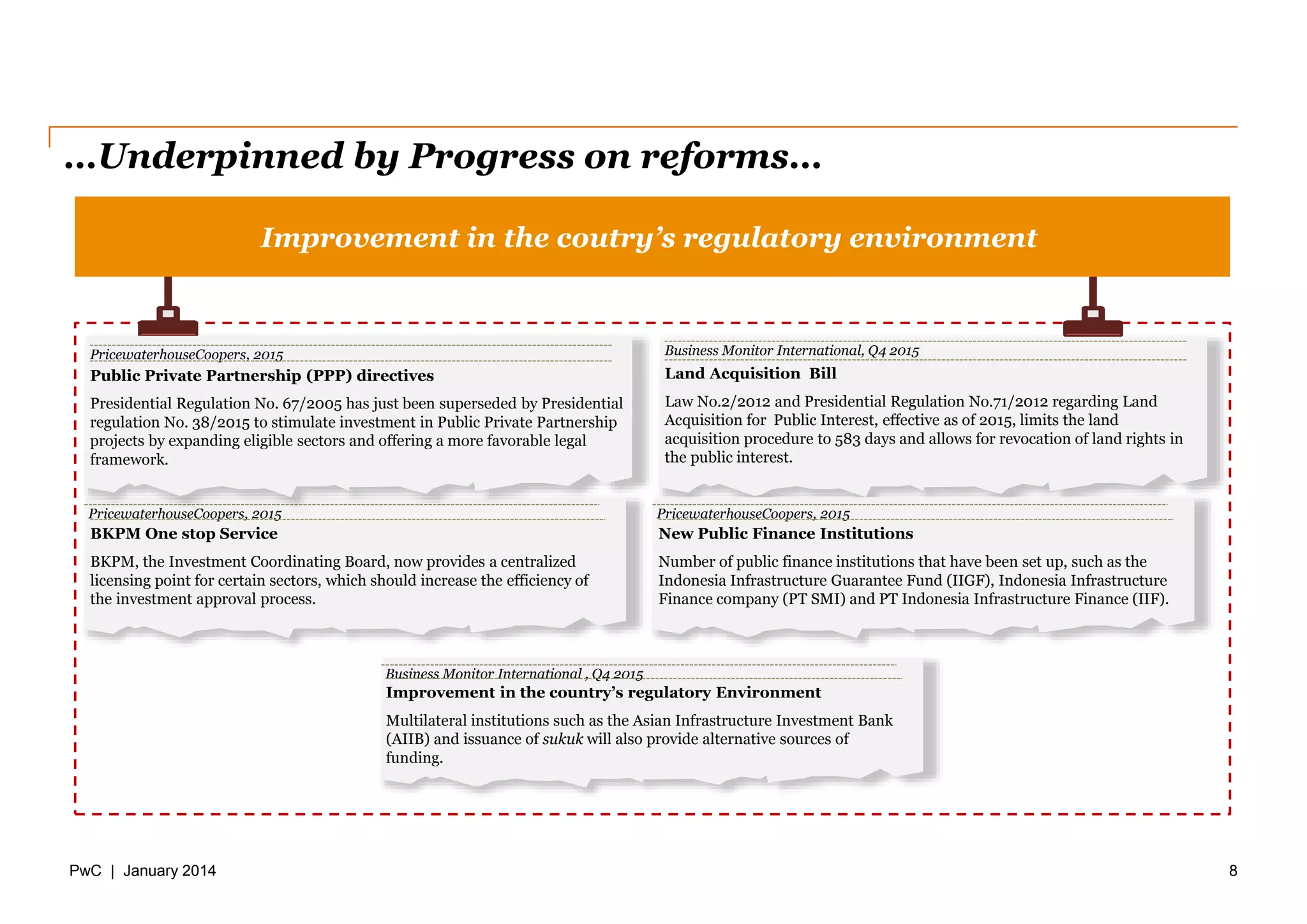

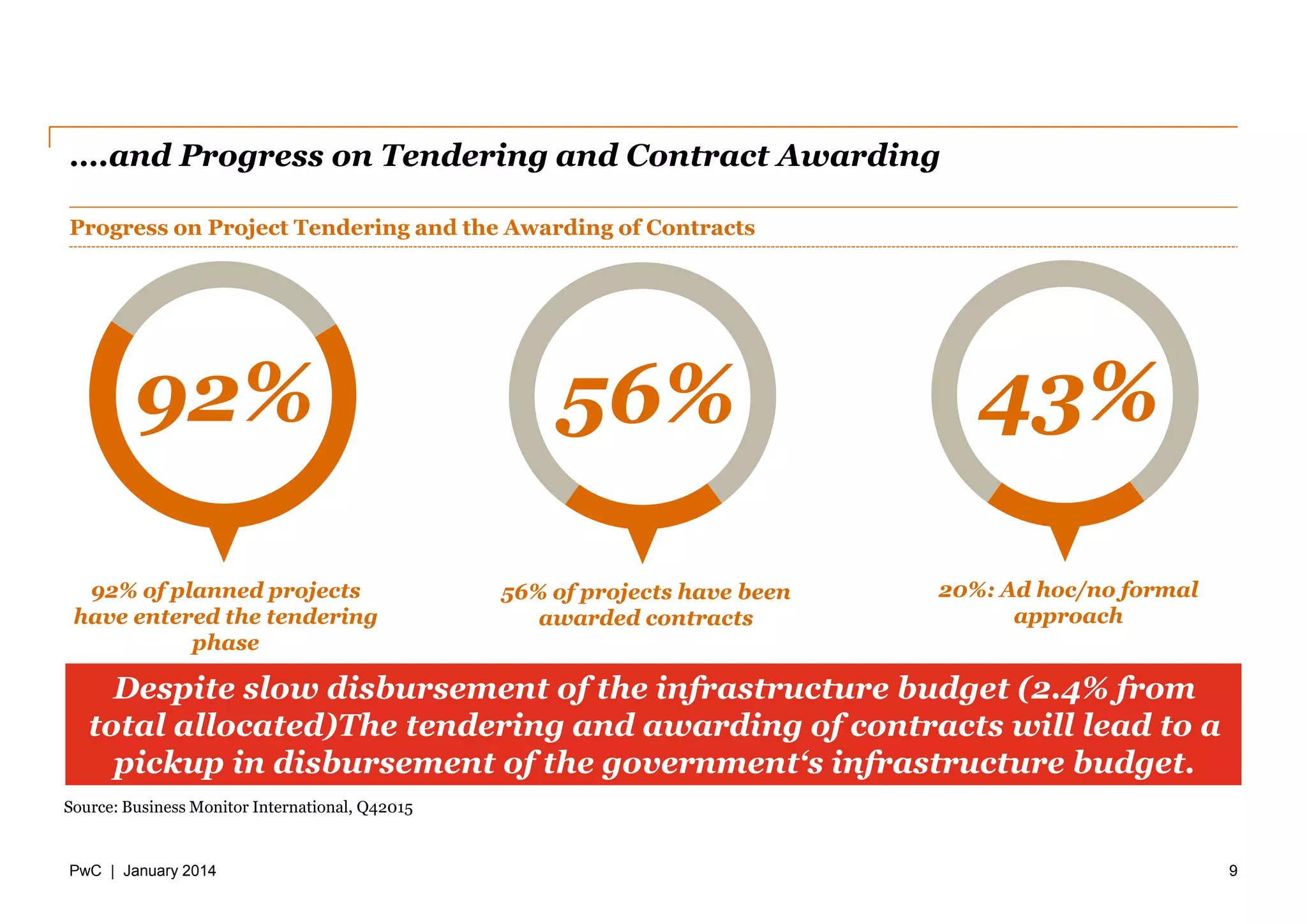

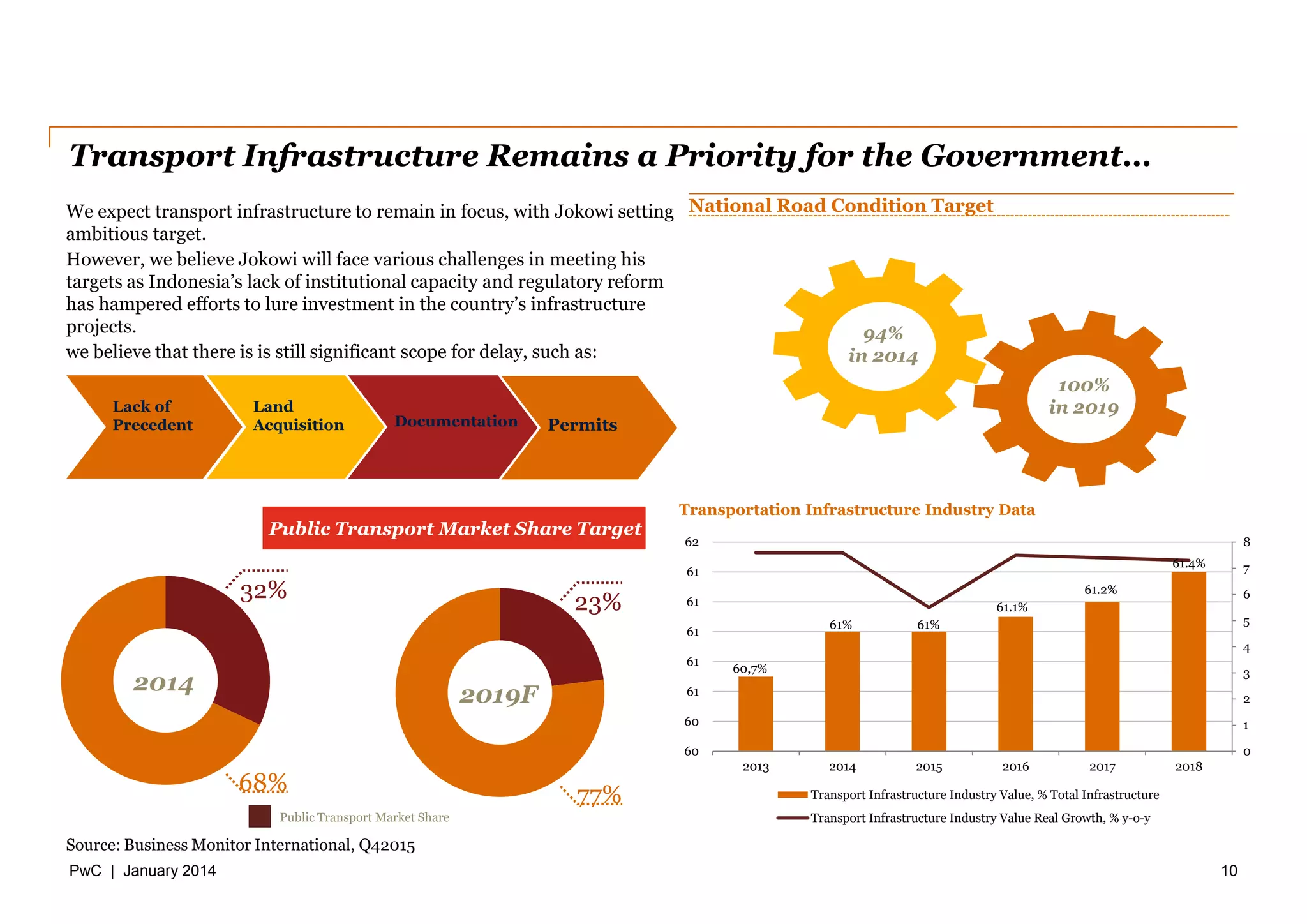

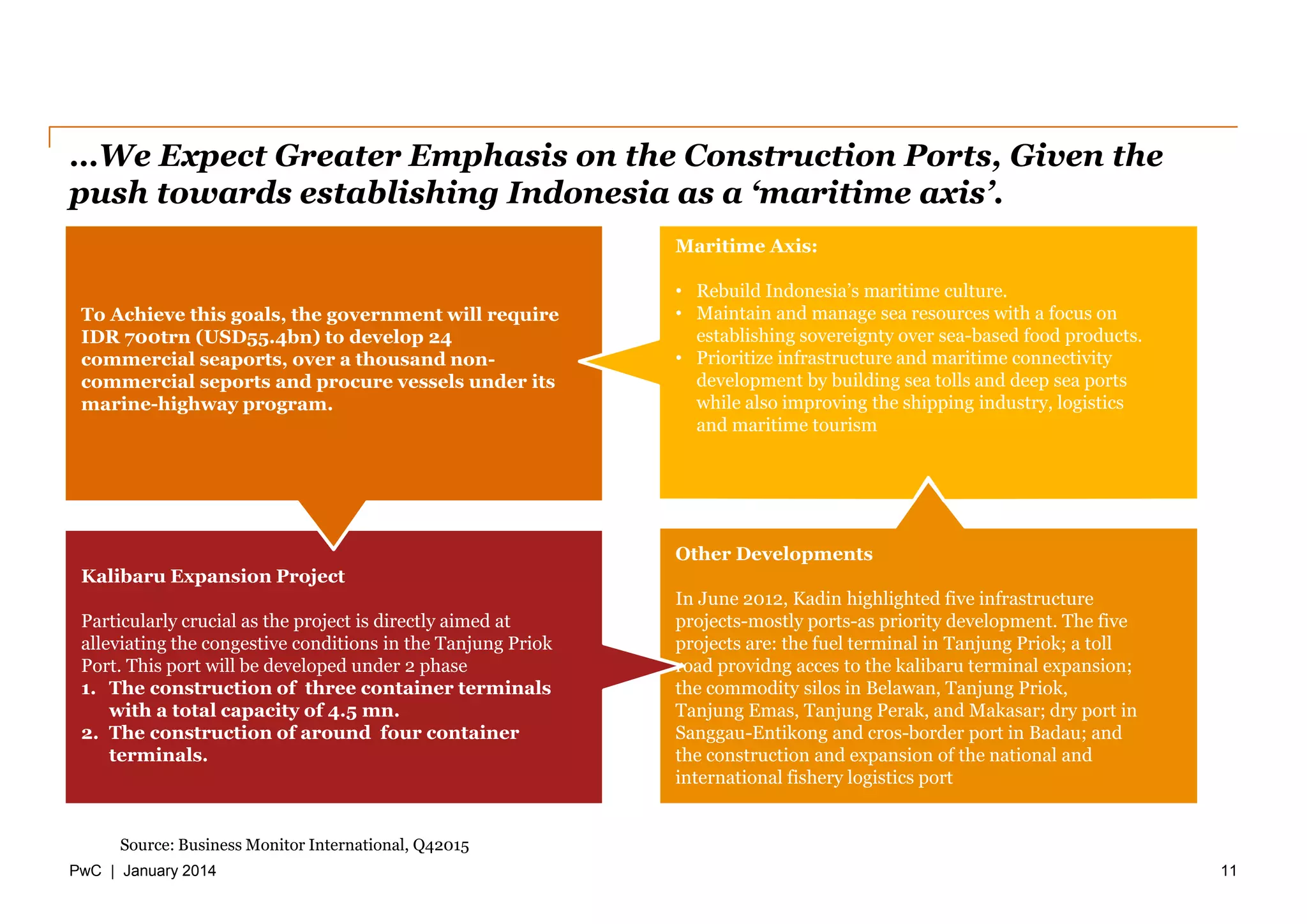

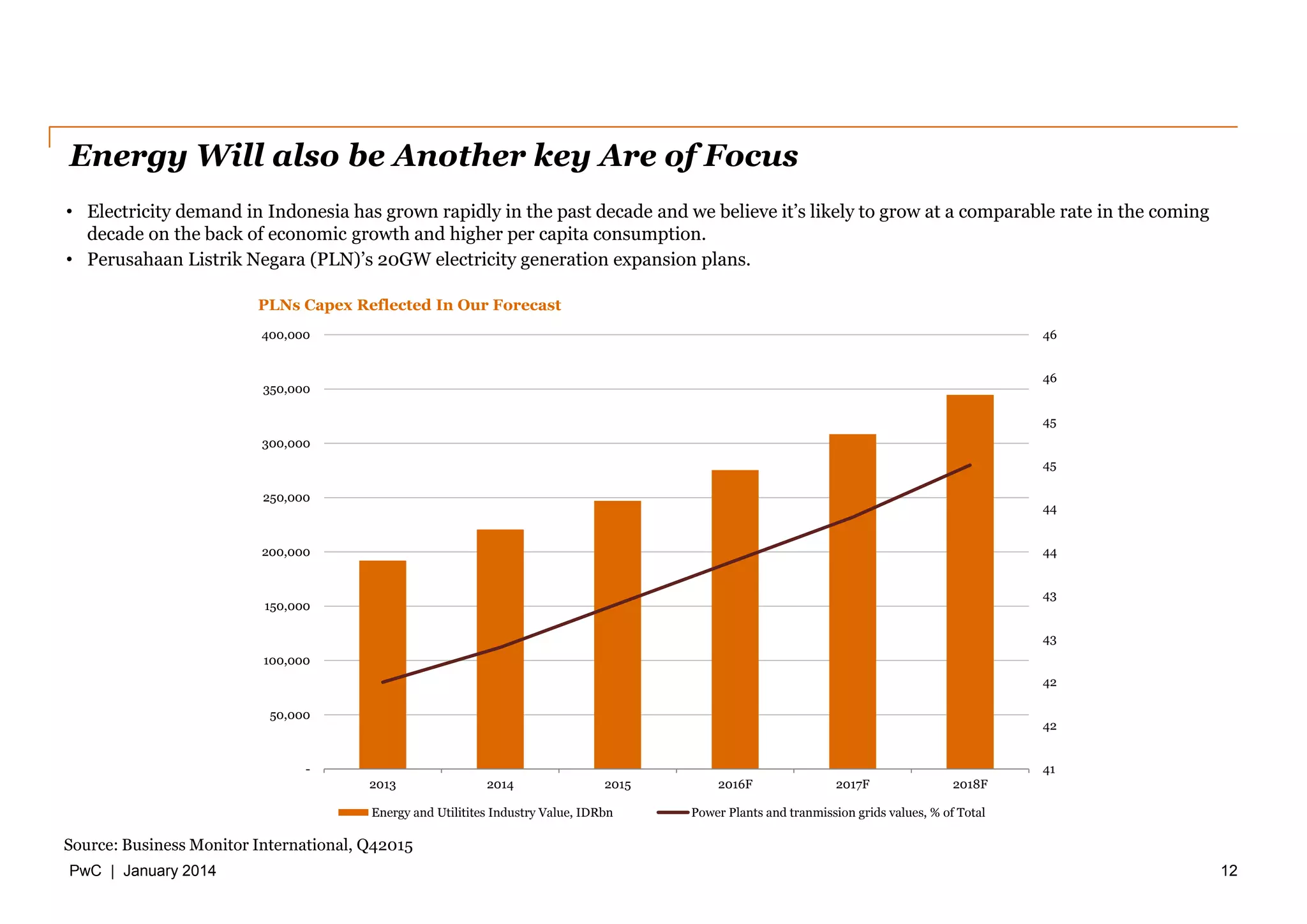

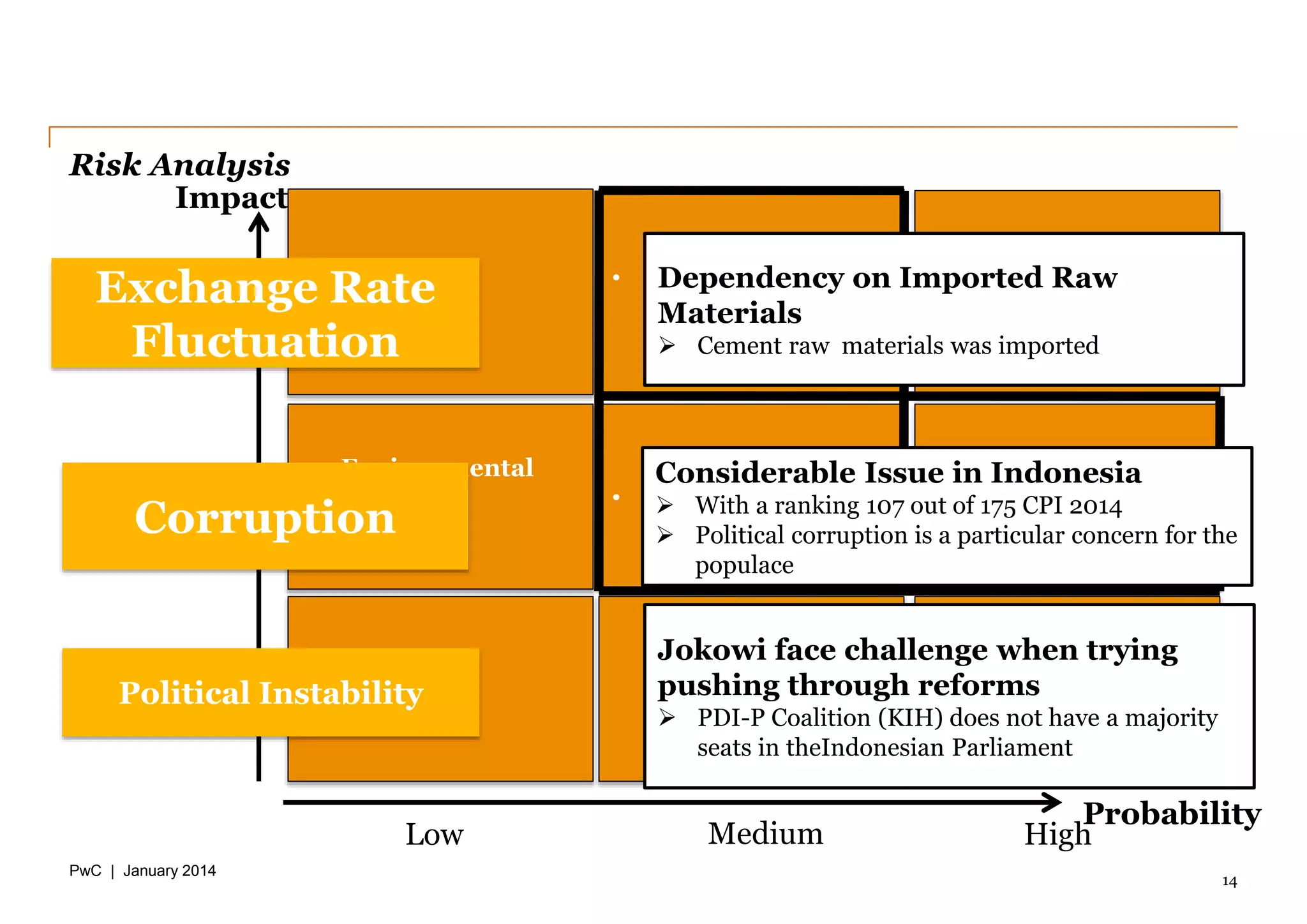

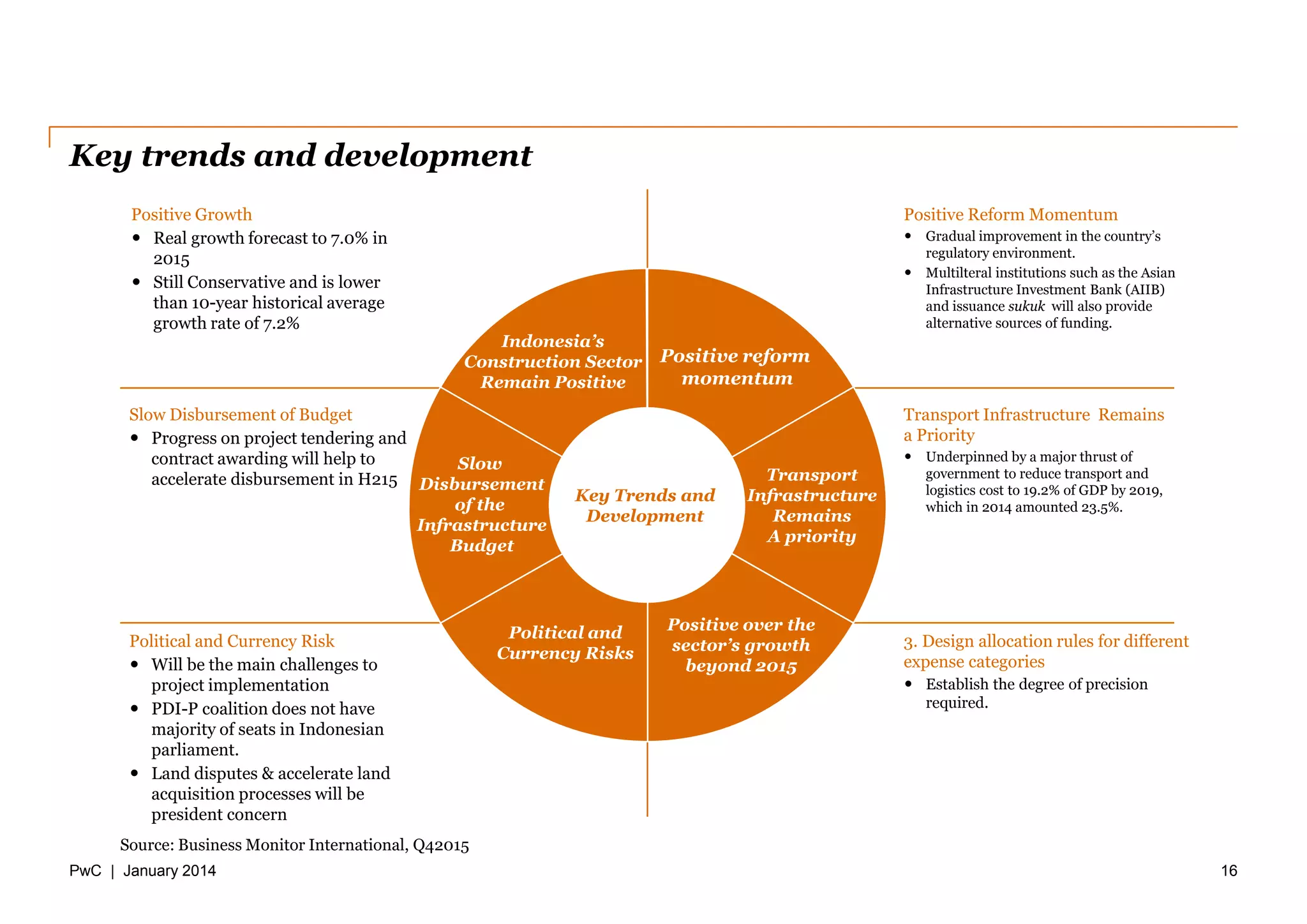

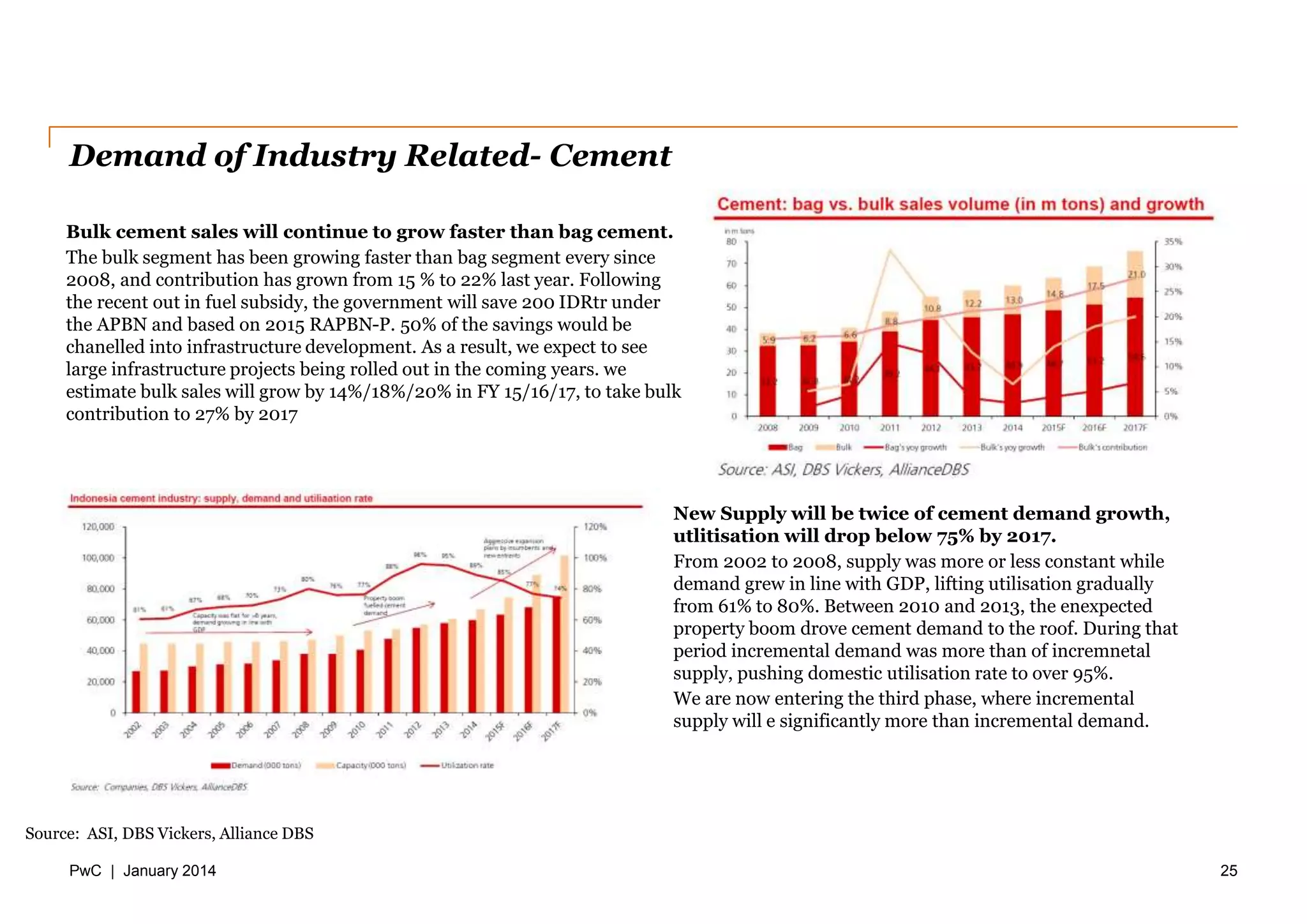

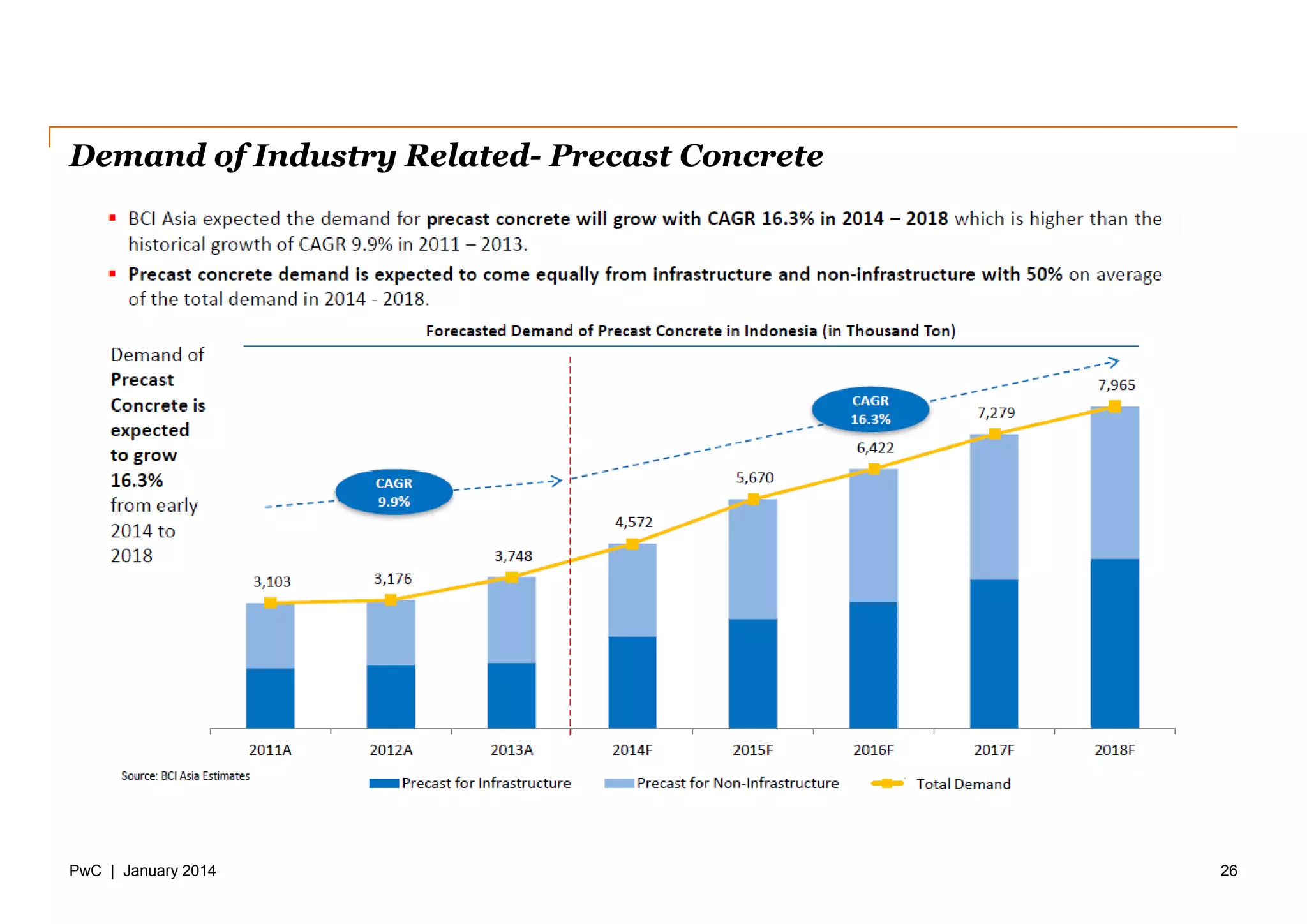

The document discusses infrastructure development in Indonesia. It notes that infrastructure investment is expected to boost Indonesia's economic growth in 2015. The government has made improving infrastructure a priority through its Master Plan for Acceleration and Expansion of Indonesian Economic Development. This includes investing over $400 billion in transportation, energy, and ports. While reforms and project tendering provide momentum, political and currency risks along with slow government budget disbursement remain challenges to infrastructure progress.