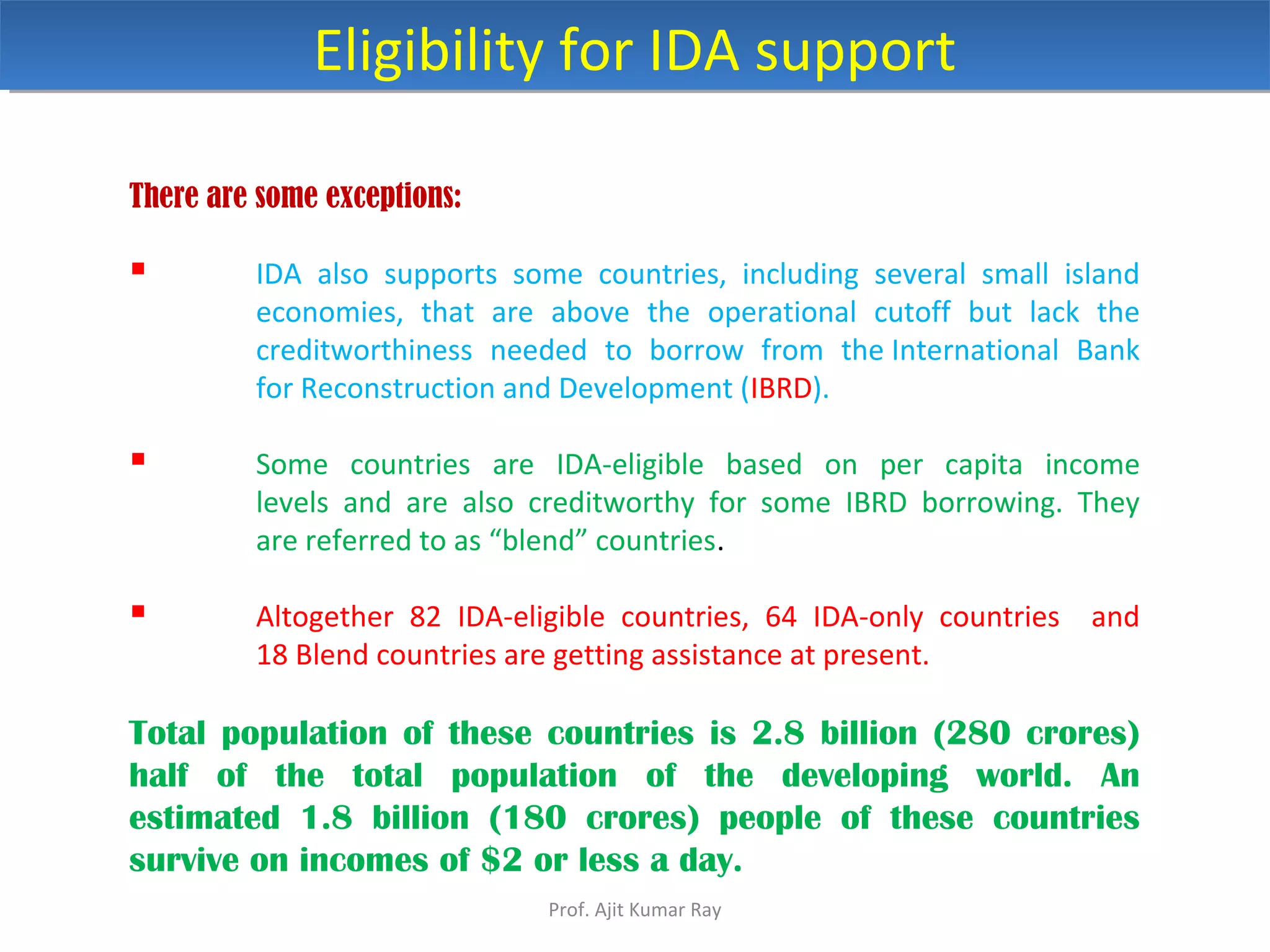

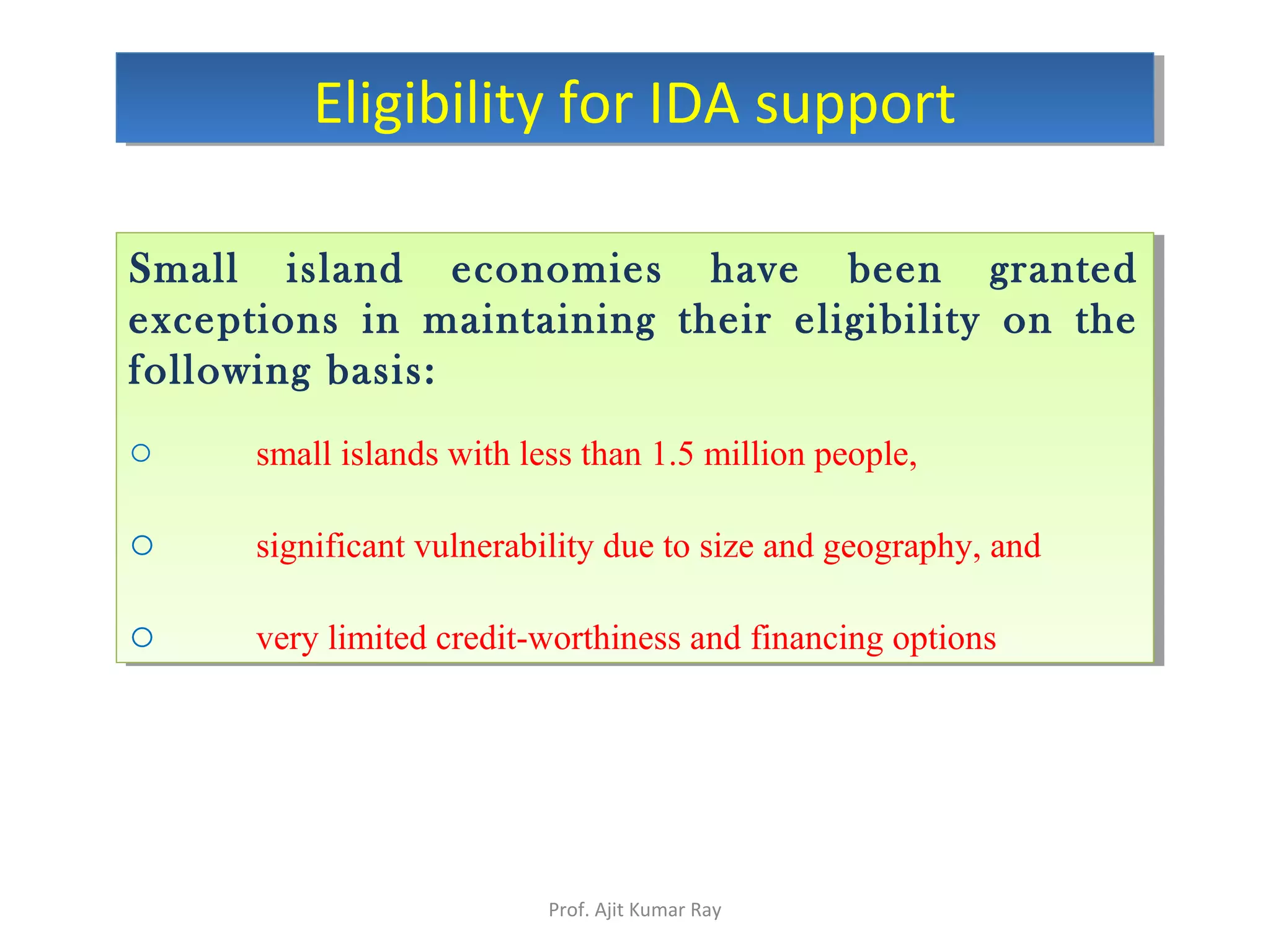

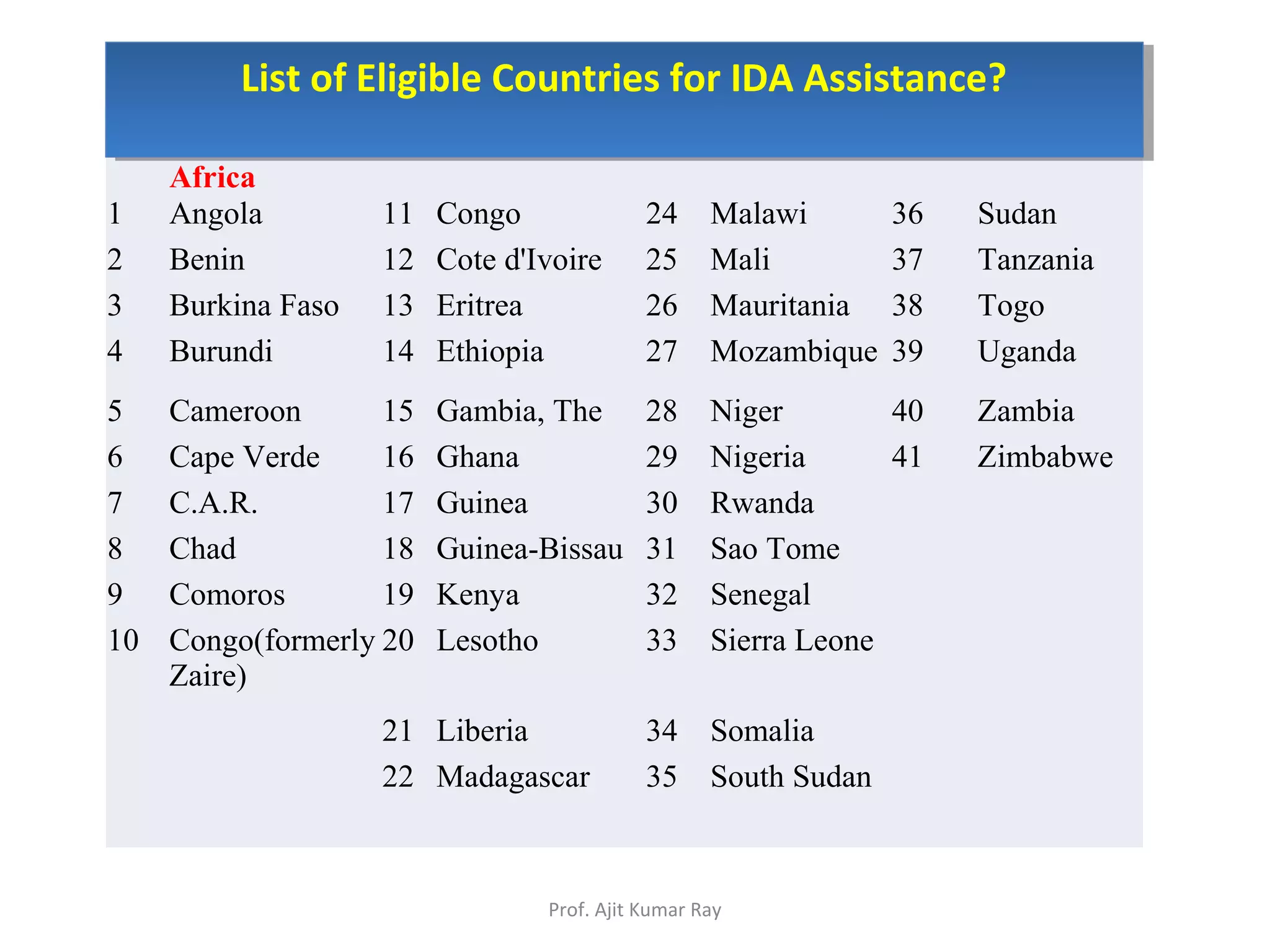

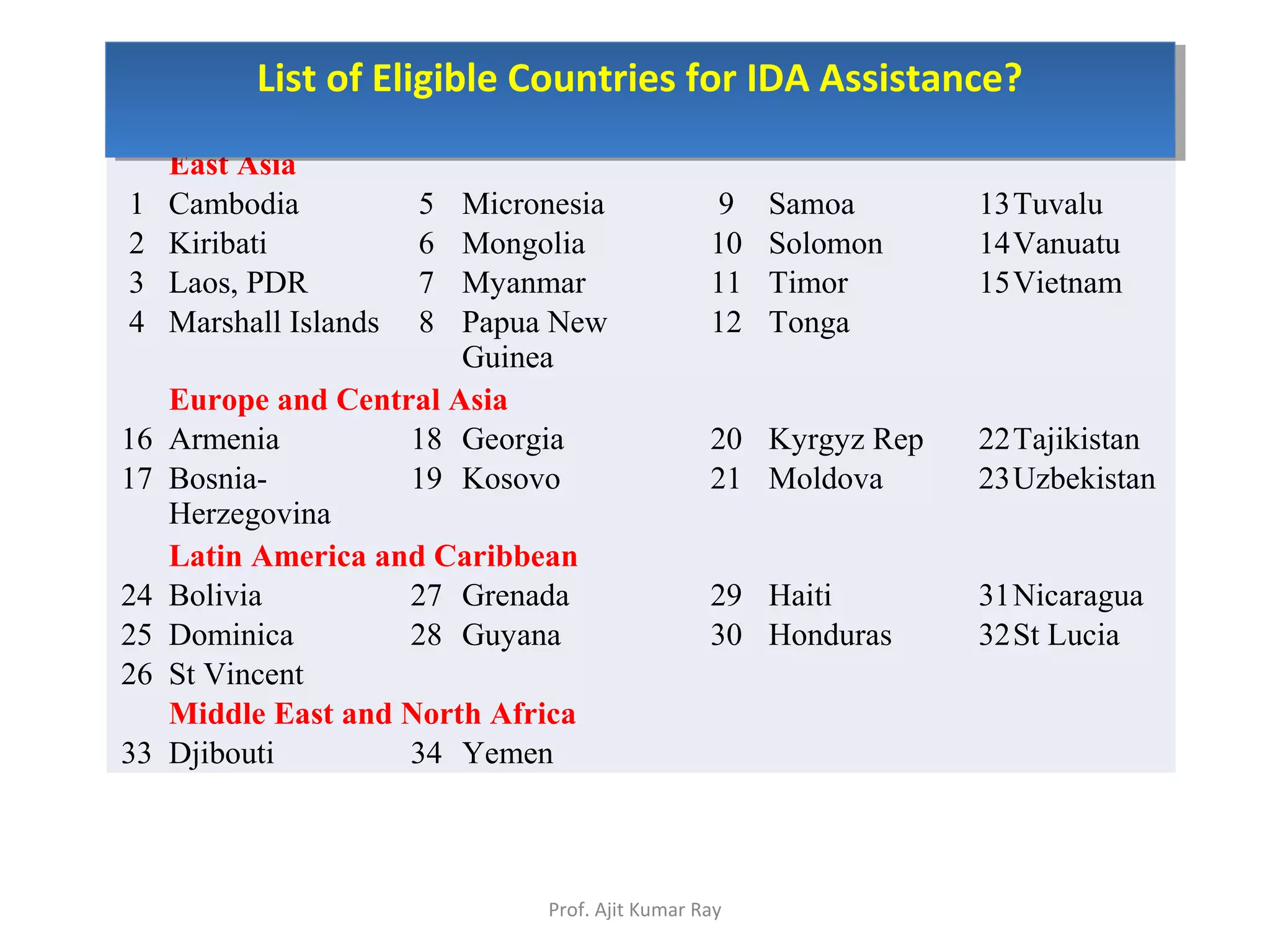

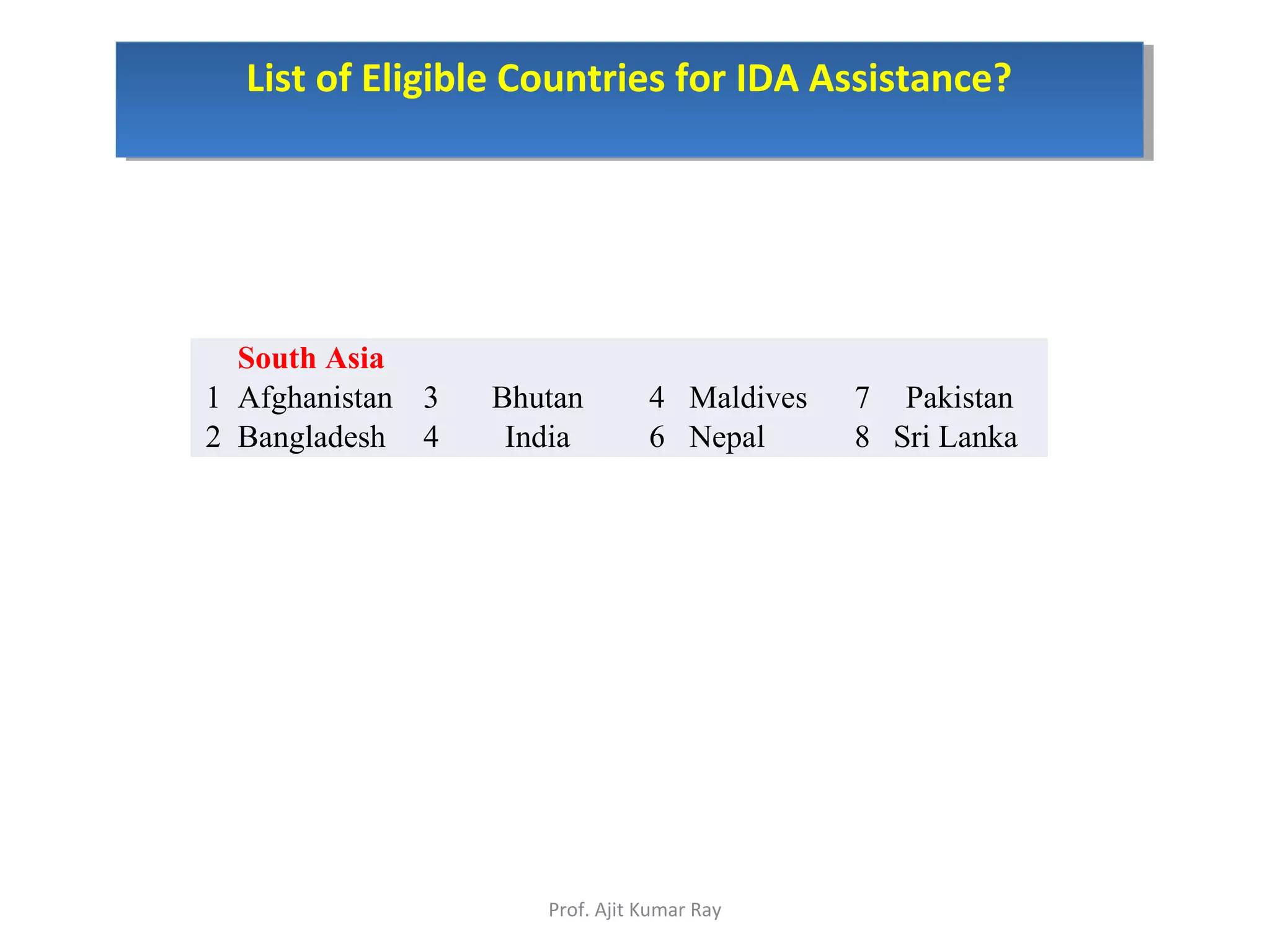

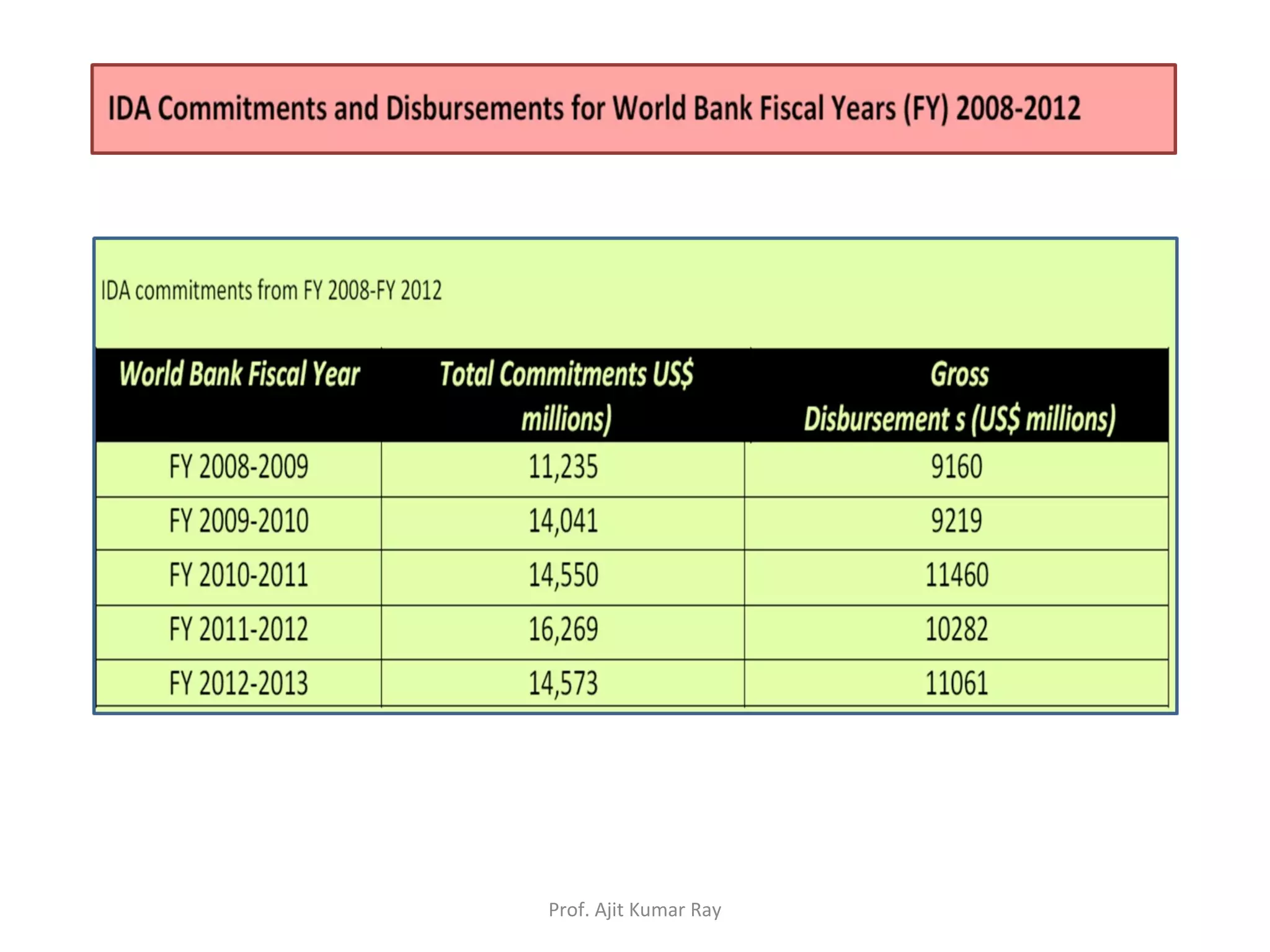

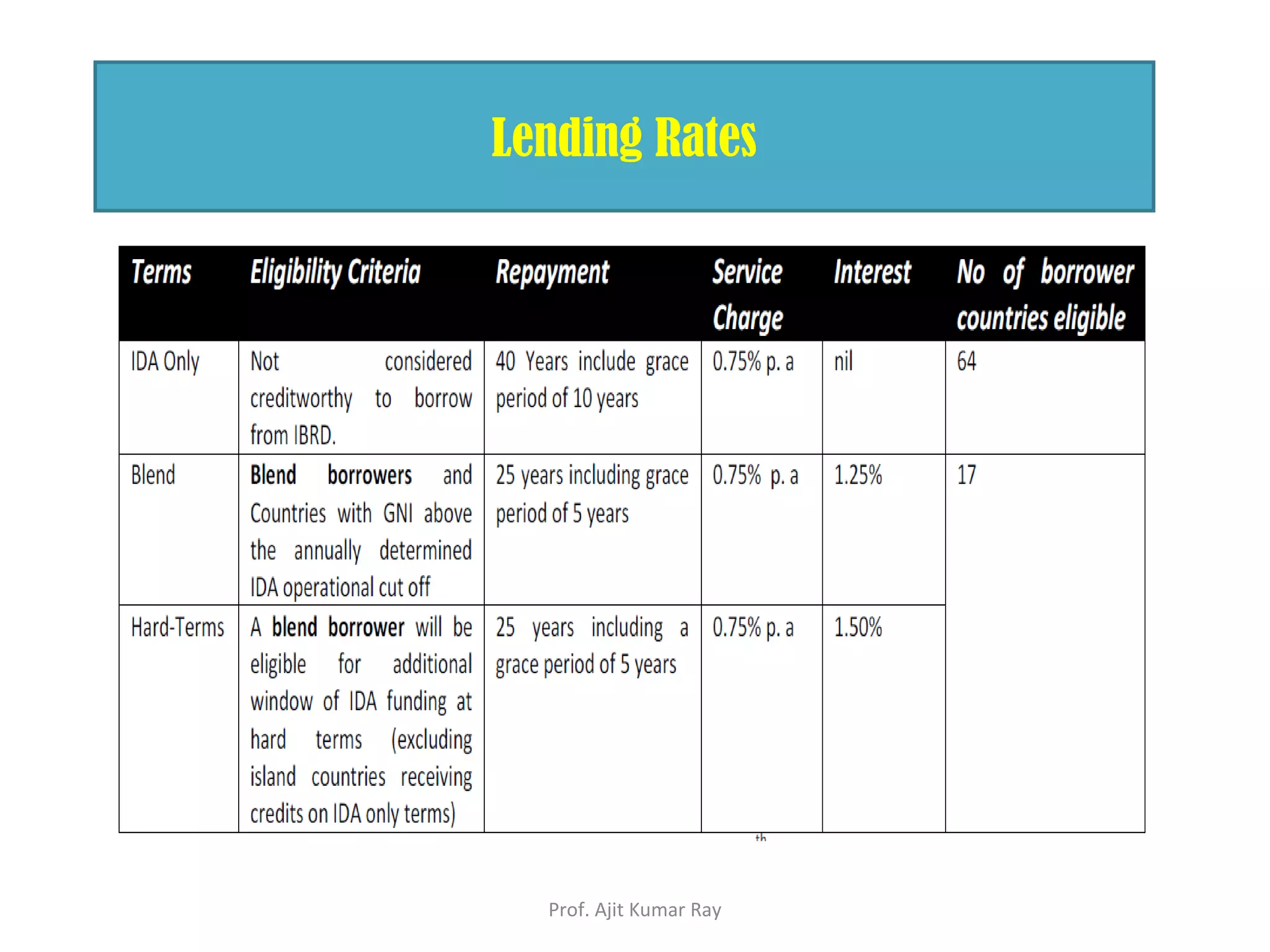

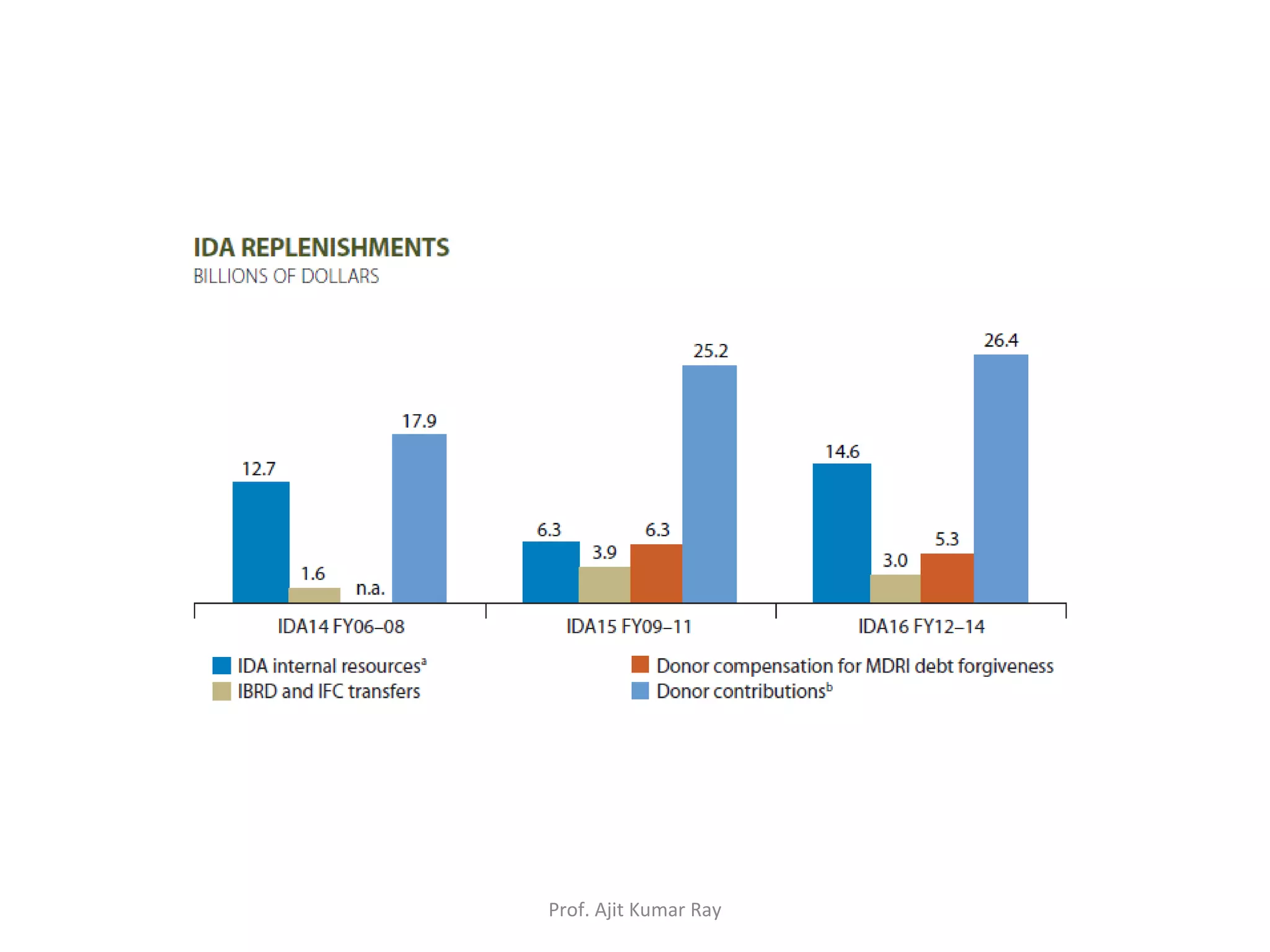

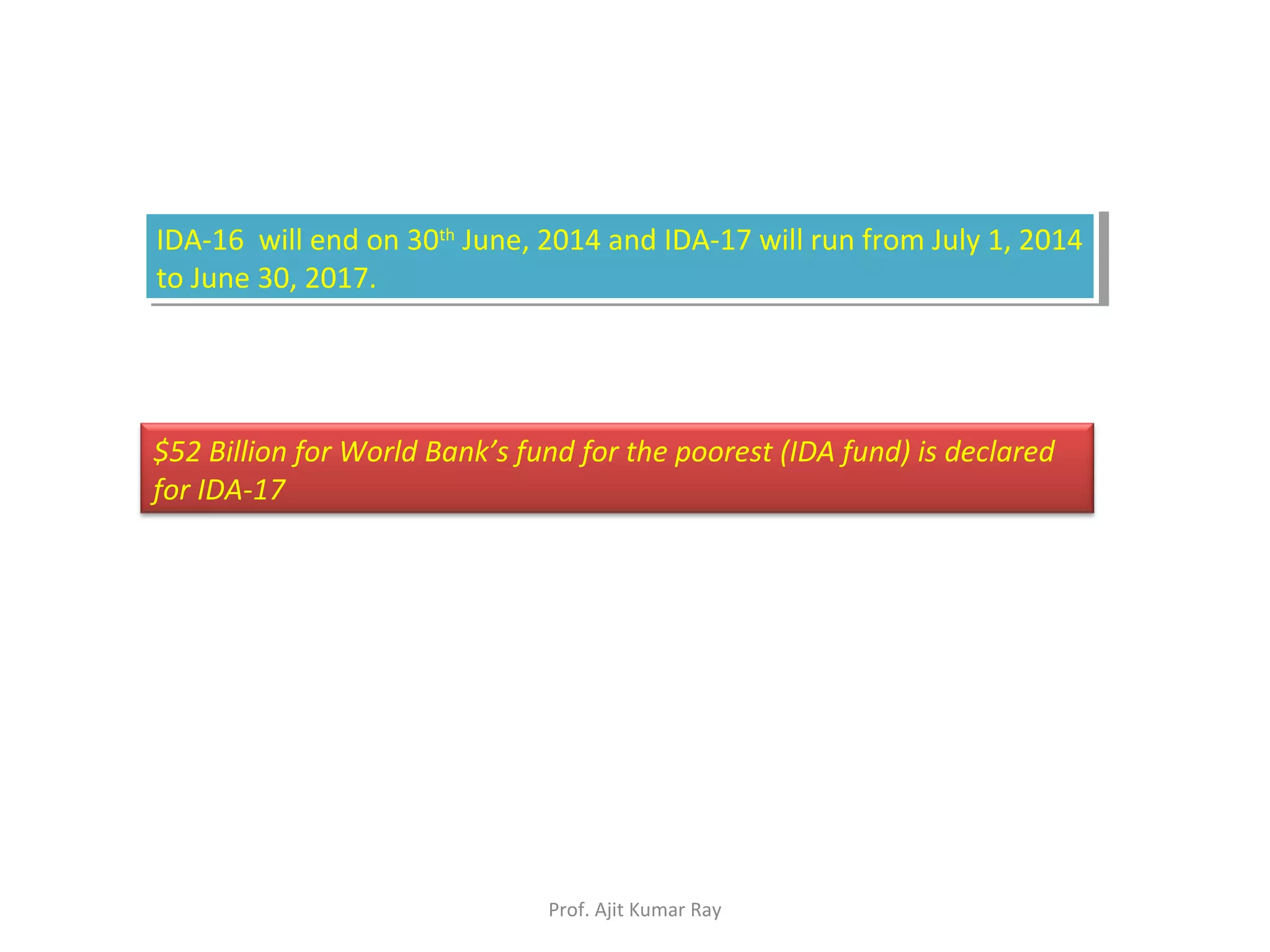

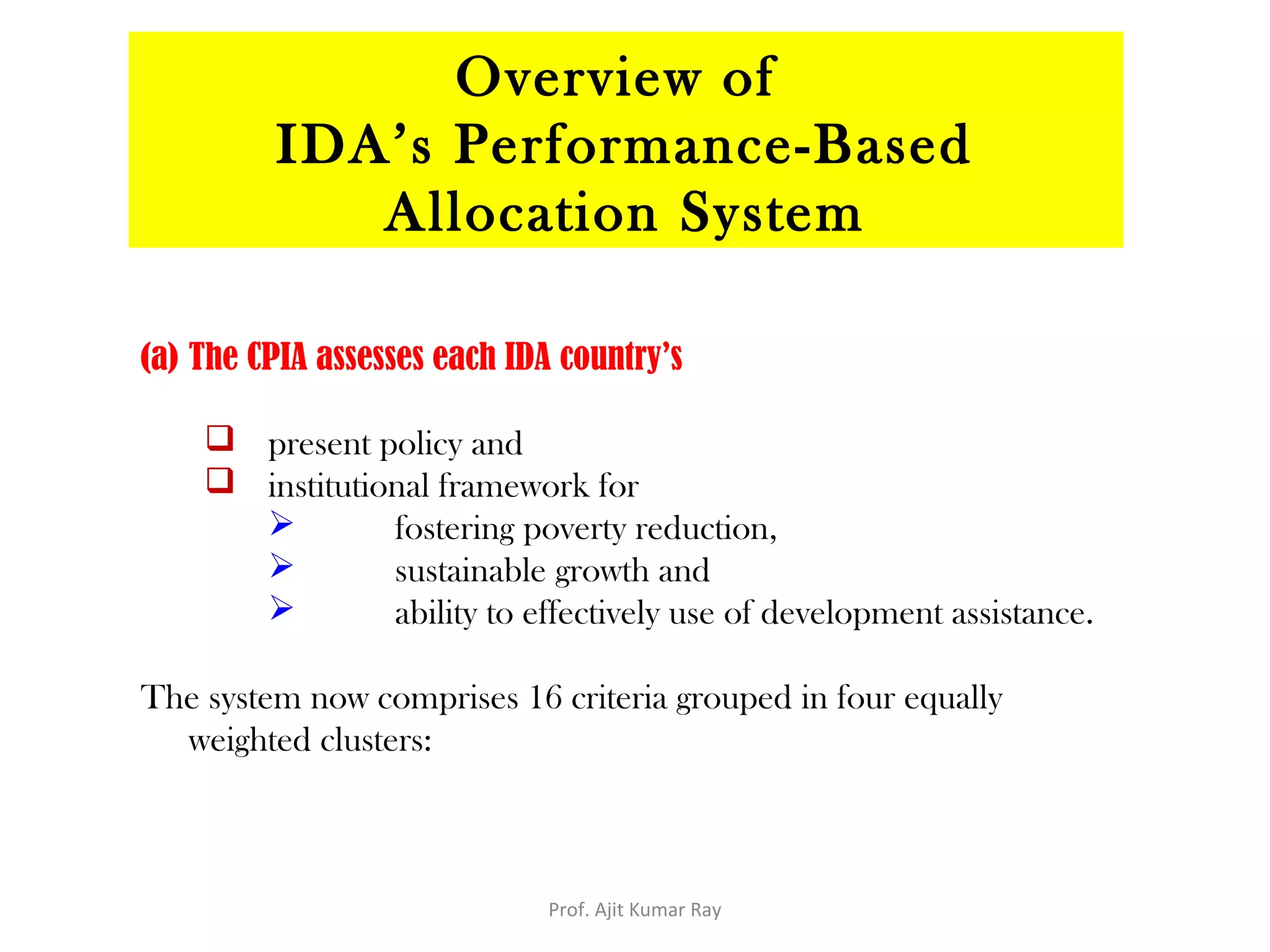

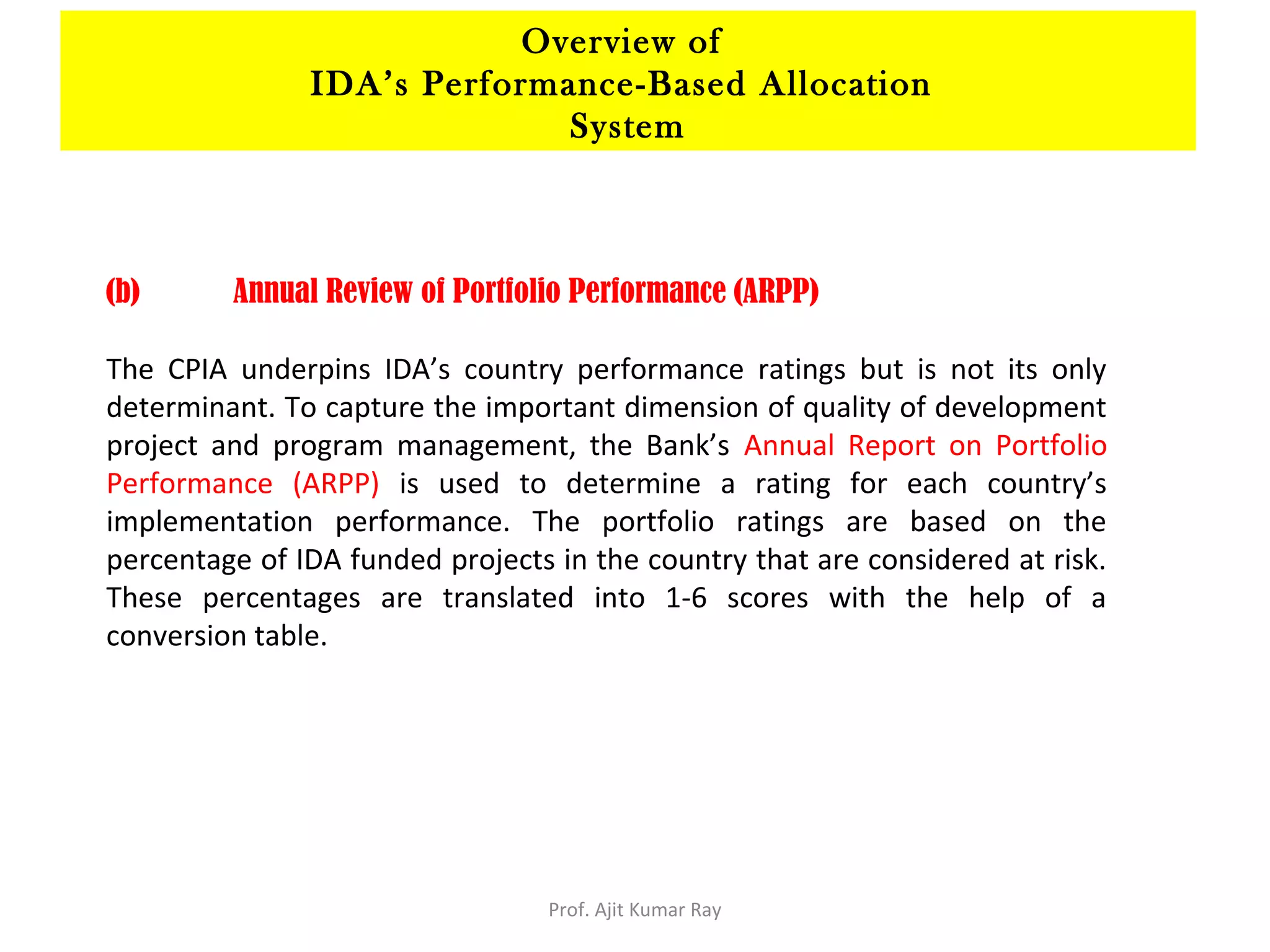

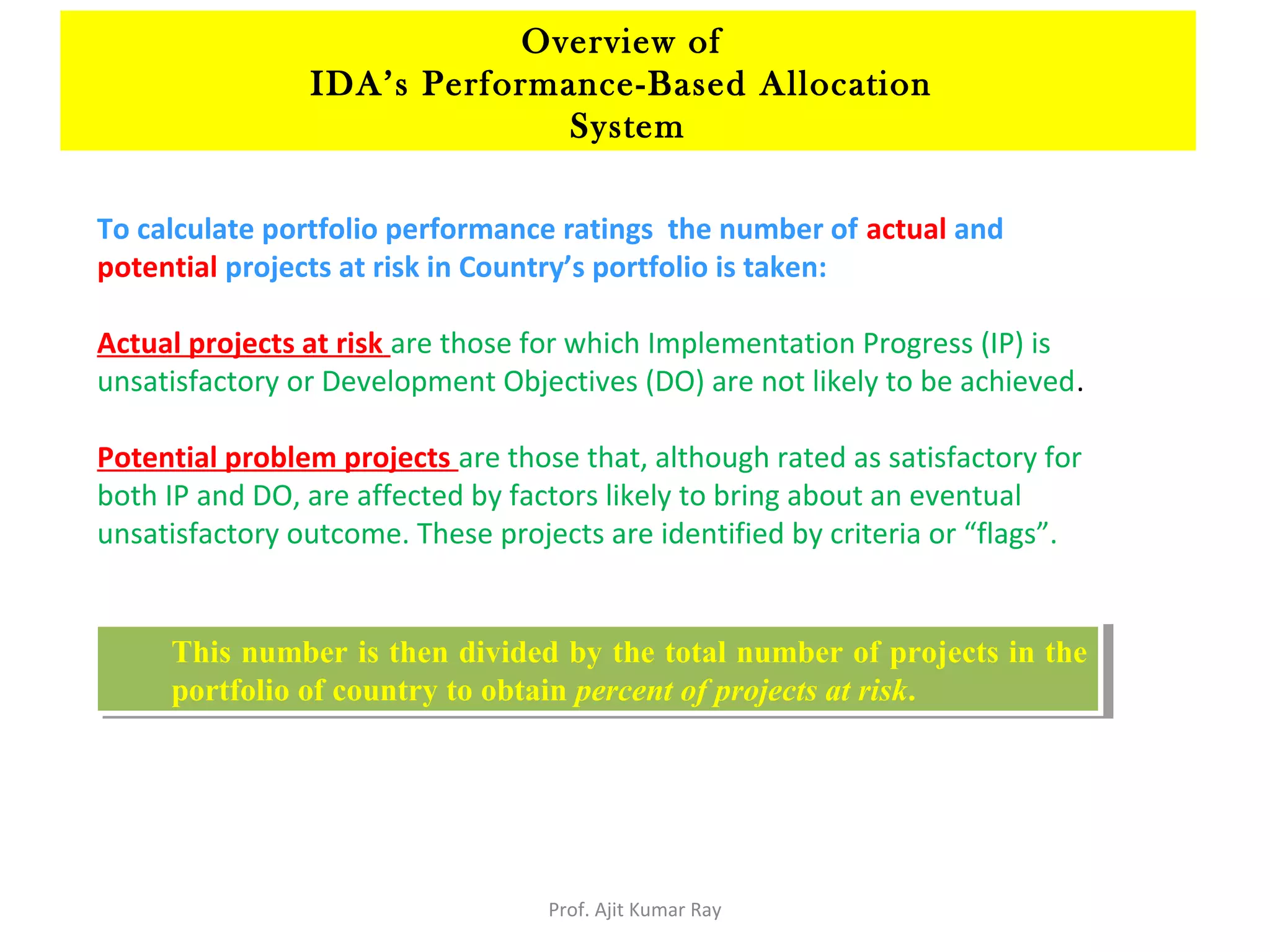

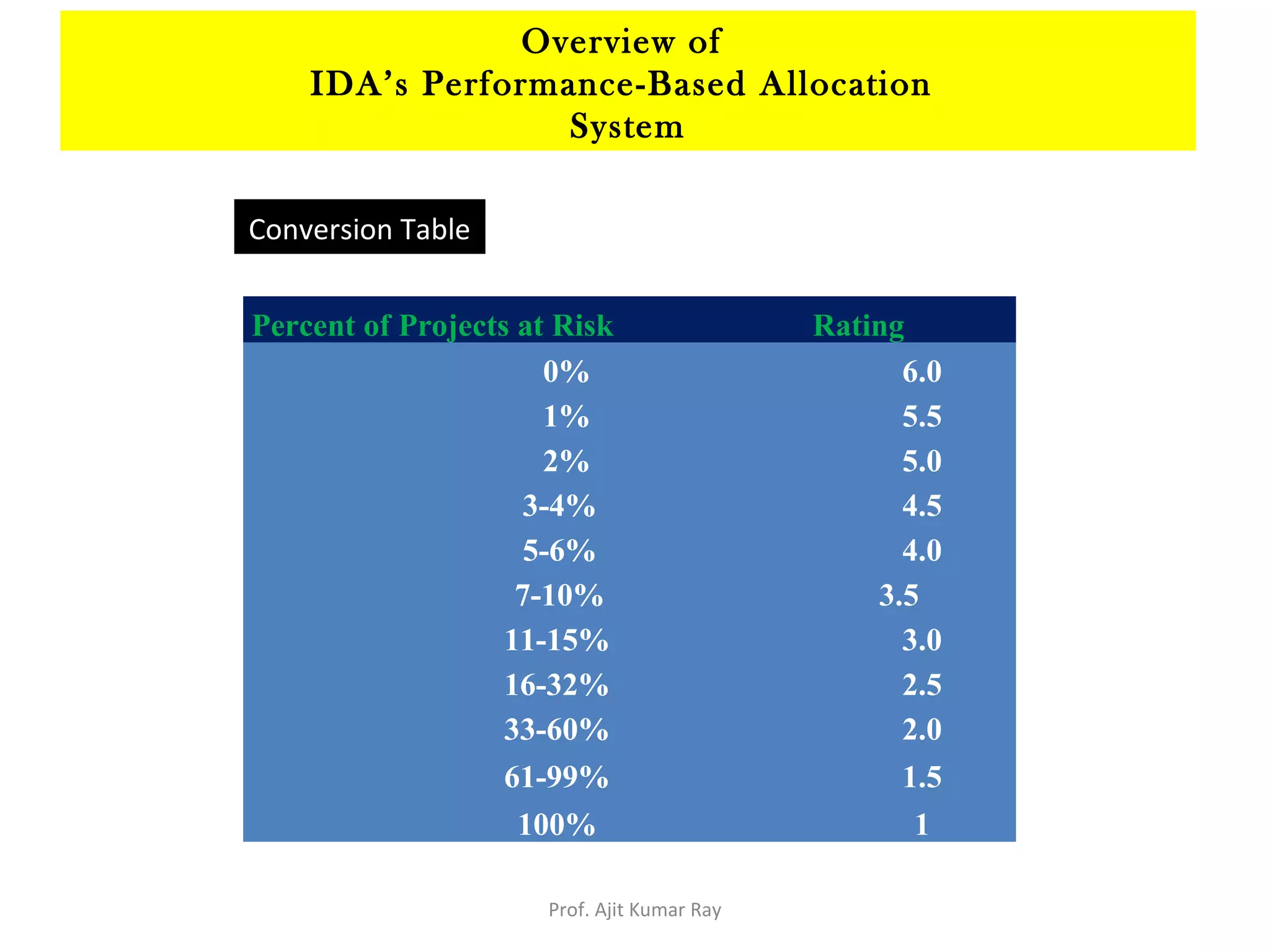

The International Development Association (IDA) is the World Bank’s fund for the poorest countries, focusing on various sectors like health, education, and infrastructure through concessional loans and grants. In 2013, IDA committed $16.3 billion, benefiting 82 countries, with a significant portion of funding coming from developed and developing nations. IDA also utilizes a performance-based allocation system to assess country eligibility and allocate its resources effectively.

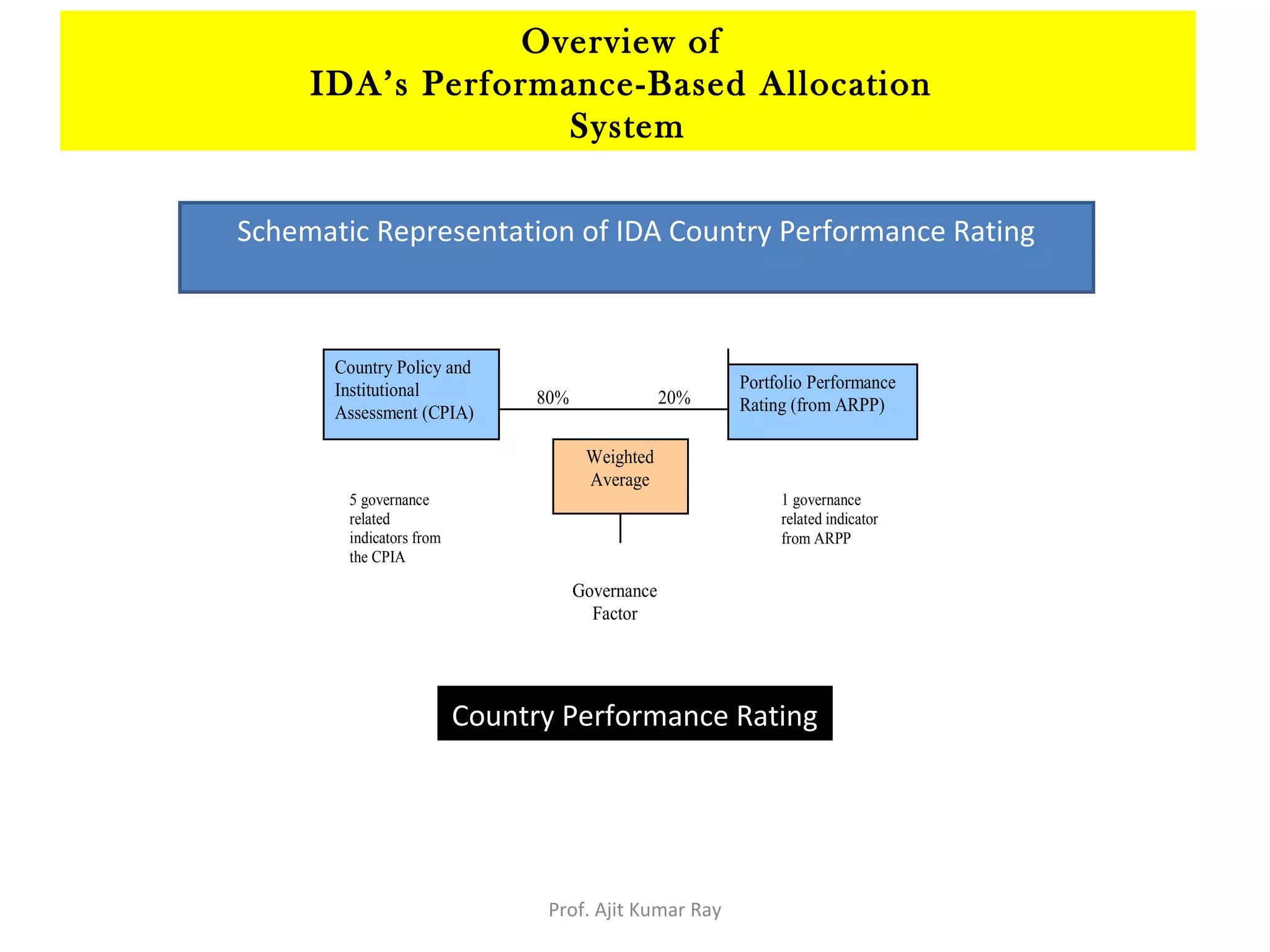

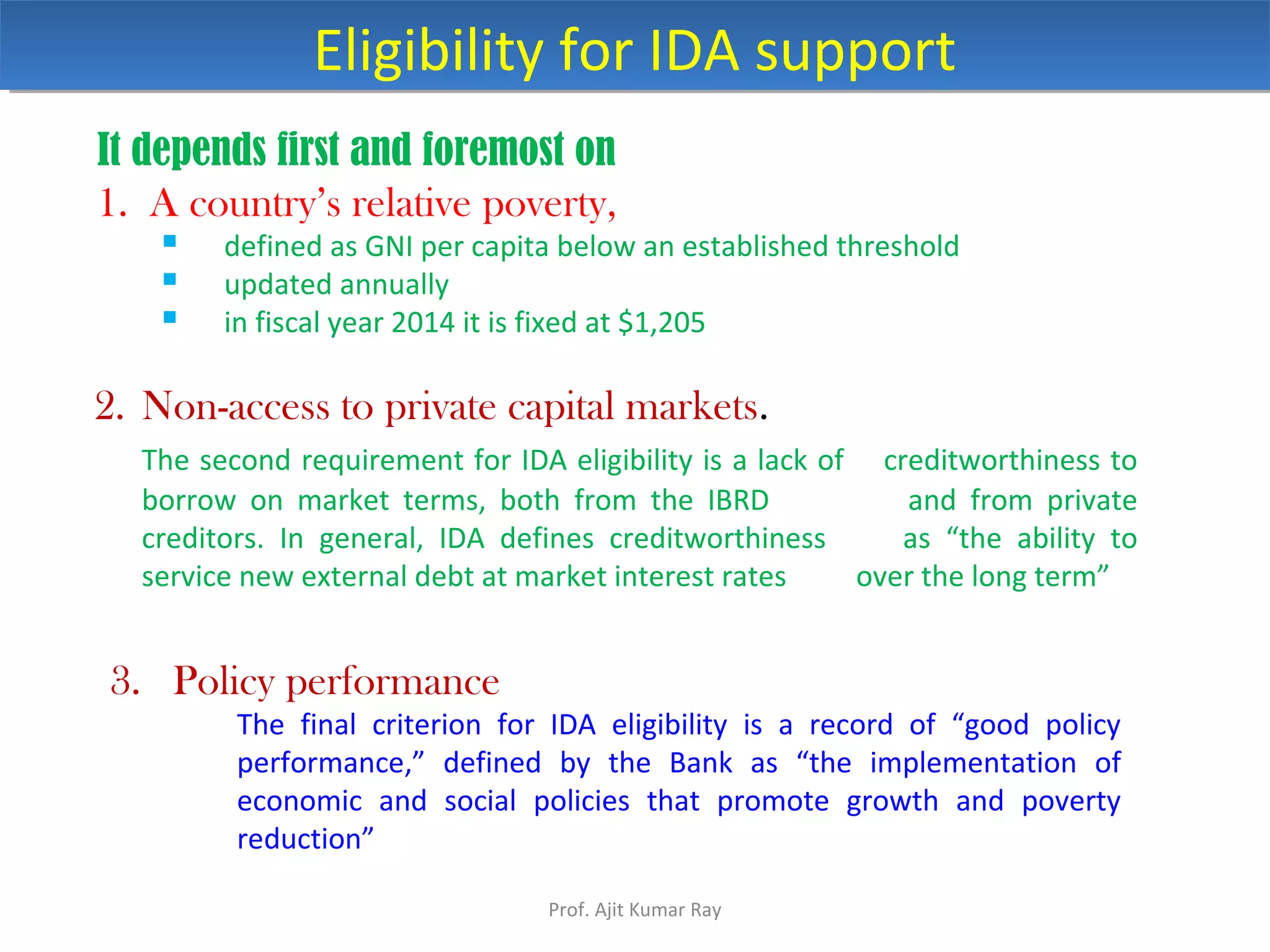

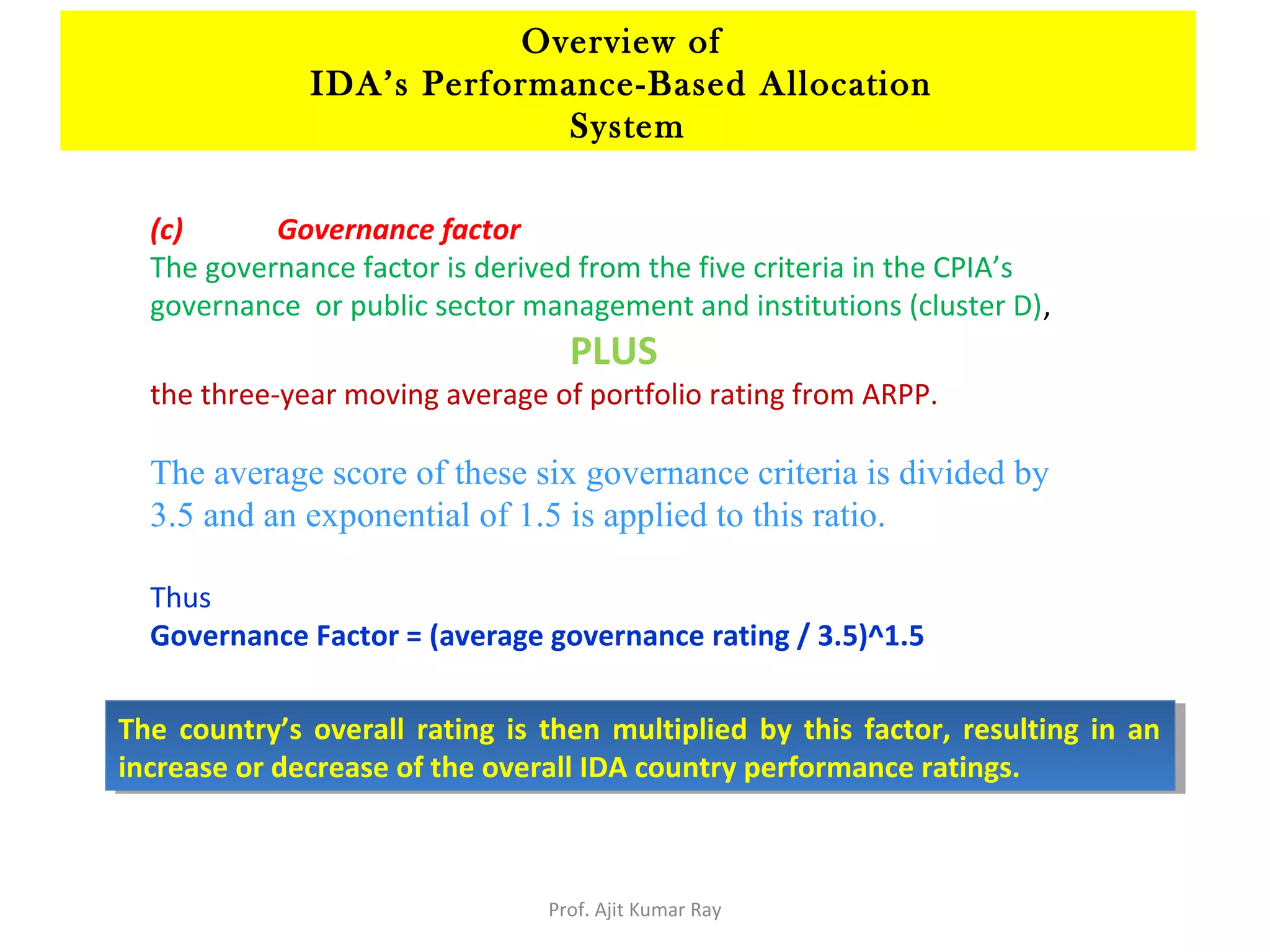

![Country performance ratings:

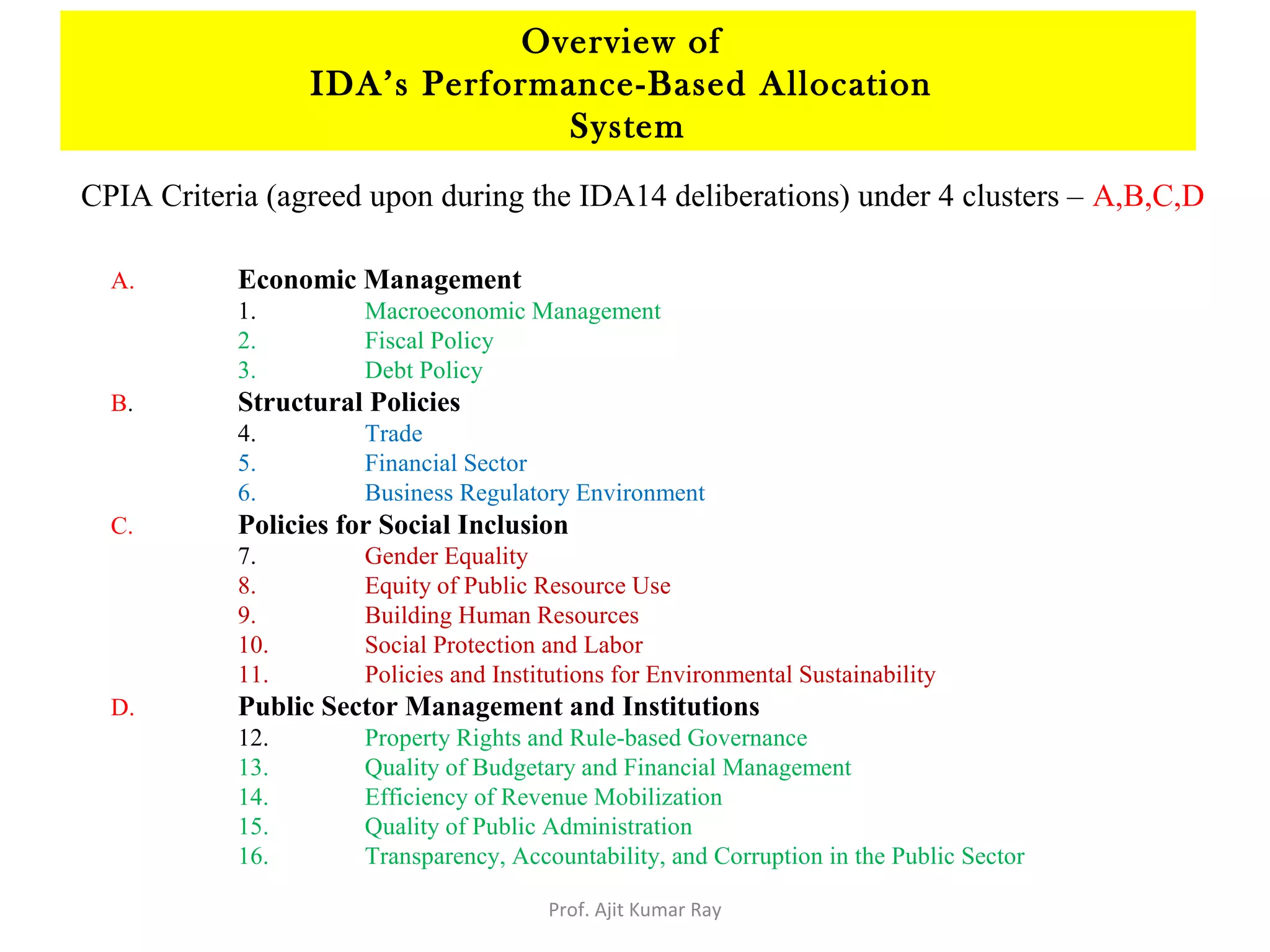

FIRST STEP:

A weighted average rating is calculated of the CPIA (80 percent) and the

portfolio rating ARPP (20 percent).

SECOND STEP:

This composite rating is multiplied by the “governance factor” to

produce the country’s IDA country performance ratings.

Calculation of the country performance rating

Country performance rating = (0.8*CPIA + 0. 2*Portfolio rating)*(governance factor)

Suppose for a country X, CPIA score=3.42, ARPP score = 3.5 and Governance factor =

2.9. Then

Country performance rating = [(0.8*3.42) + (0.2*3.5)]* (2.9 / 3.5)^1.5 = 2.65

Overview of

IDA’s Performance-Based Allocation

System

Prof. Ajit Kumar Ray](https://image.slidesharecdn.com/ida-partonetwo-140429070120-phpapp01/75/IDA-part-one-two-29-2048.jpg)