The document provides information on initial coin offerings (ICOs), including how they work, characteristics of ICOs, and guidelines for launching an ICO. Some key points:

- ICOs allow companies to raise funds by issuing digital tokens in exchange for cryptocurrency contributions from investors. This provides an alternative to traditional fundraising methods like equity sales or debt issuance.

- Characteristics of ICOs include a lack of regulatory safeguards, light identity verification of investors and founders, tiered pricing that advantages early investors, and an expectation that token values will appreciate for profit.

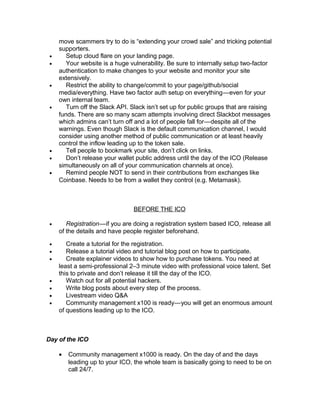

- Launching a successful ICO requires thorough planning around the token design and purpose, legal structure, communication strategy, and managing