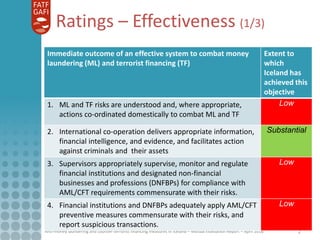

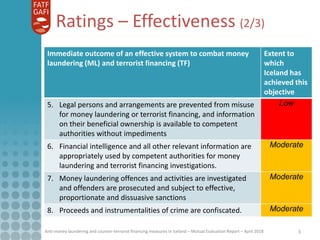

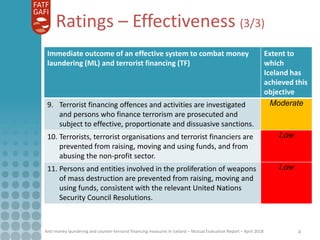

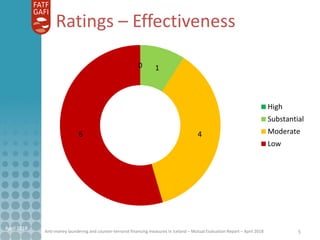

The document is a mutual evaluation report from April 2018 that assesses Iceland's anti-money laundering and counter-terrorist financing regime. It finds that Iceland has a basic understanding of risks but its national risk assessment is theoretical rather than based on factual threats. Coordination of competent authorities is limited. Financial intelligence is used for some cases but several impediments remain. No terrorist financing prosecutions have occurred and authorities do not consider terrorist financing vulnerabilities. Key priority actions identified include revising the risk assessment, improving coordination, increasing guidance to reporting entities, and establishing a framework for targeted financial sanctions.