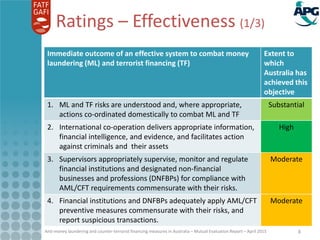

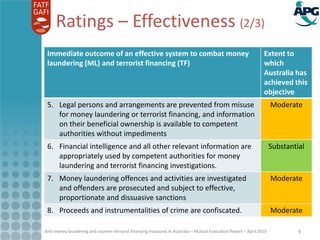

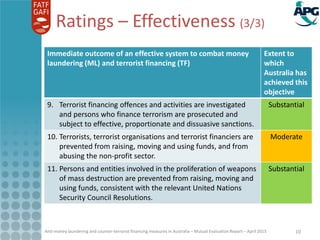

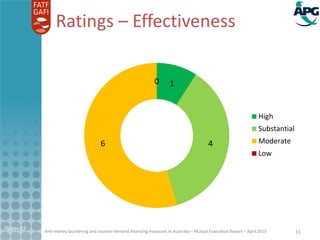

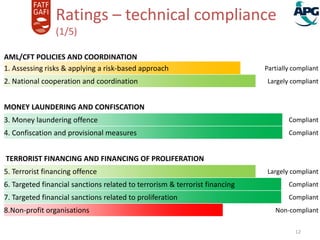

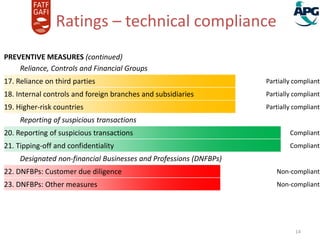

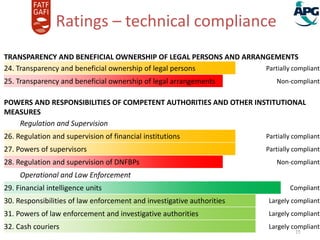

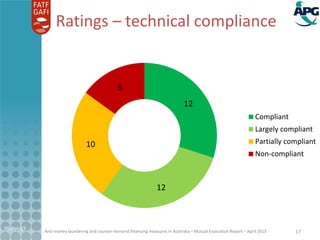

This document is a mutual evaluation report on Australia's anti-money laundering and counter-terrorist financing measures. It finds that while Australia has a good understanding of its main money laundering and terrorist financing risks, some key risks remain unaddressed. It rates Australia as having moderate effectiveness in areas like supervision and applying preventive measures. Priority actions identified for Australia include reassessing money laundering risks, increasing pursuit of money laundering prosecutions, and ensuring designated non-financial businesses understand and mitigate risks.