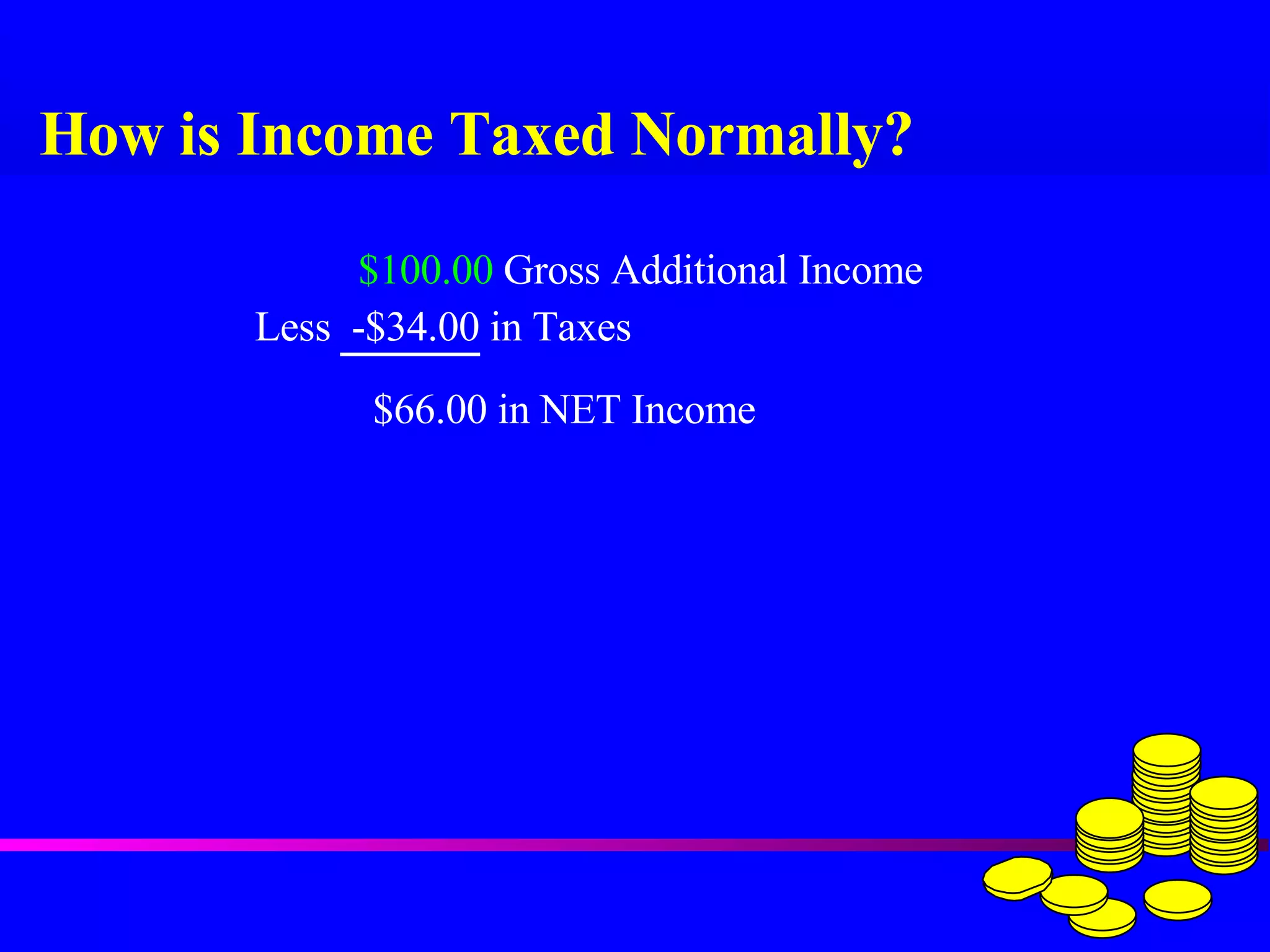

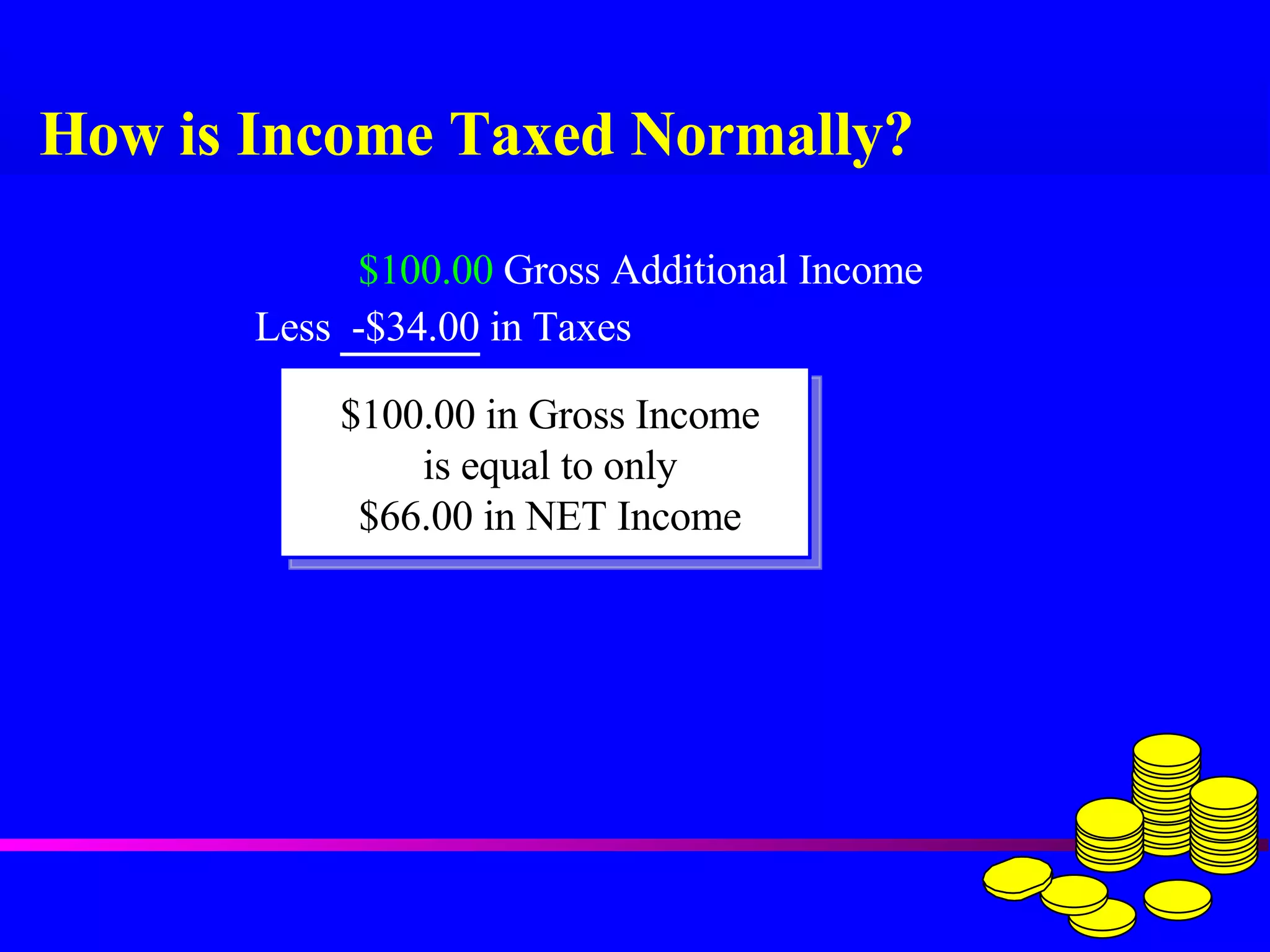

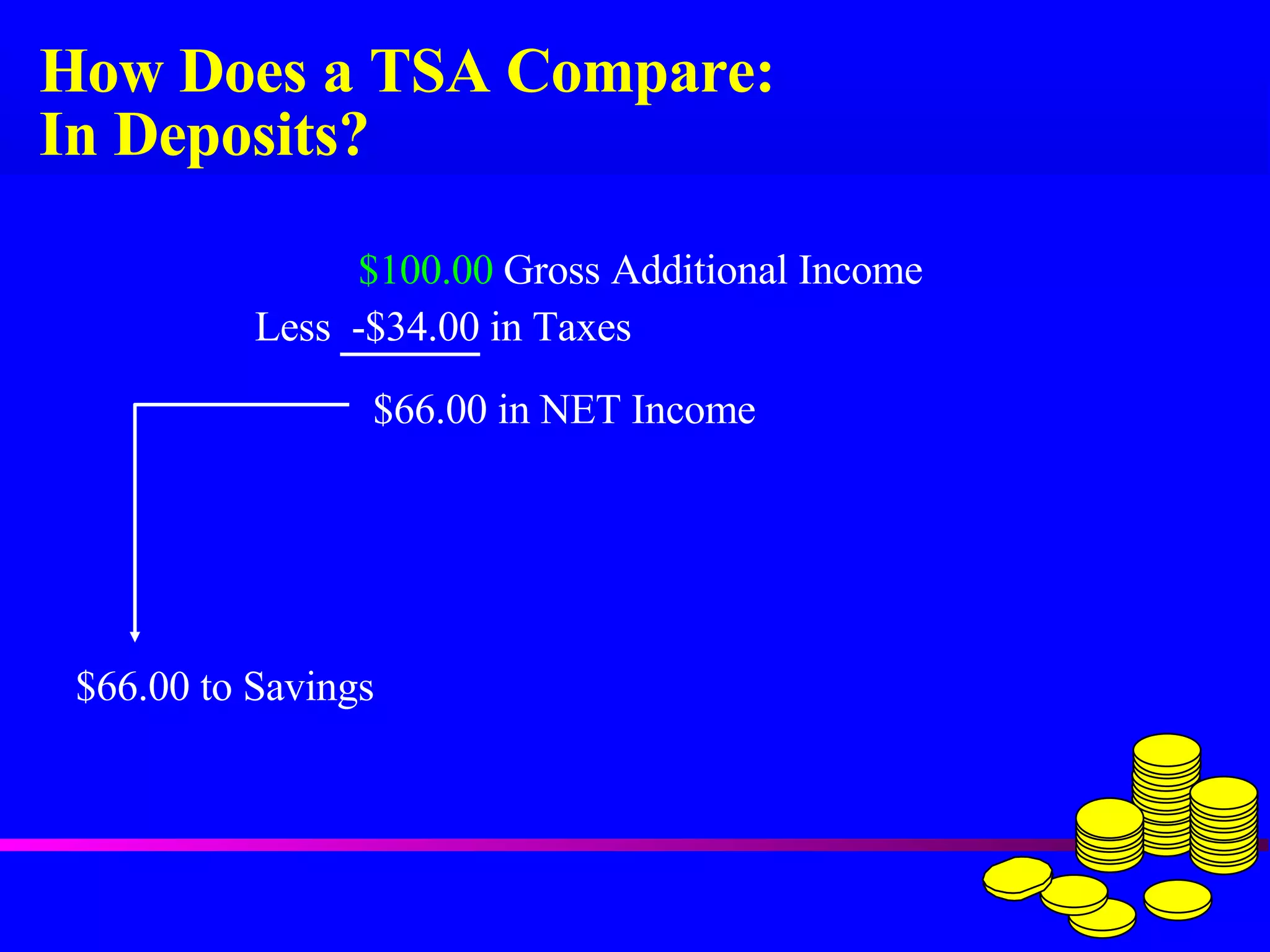

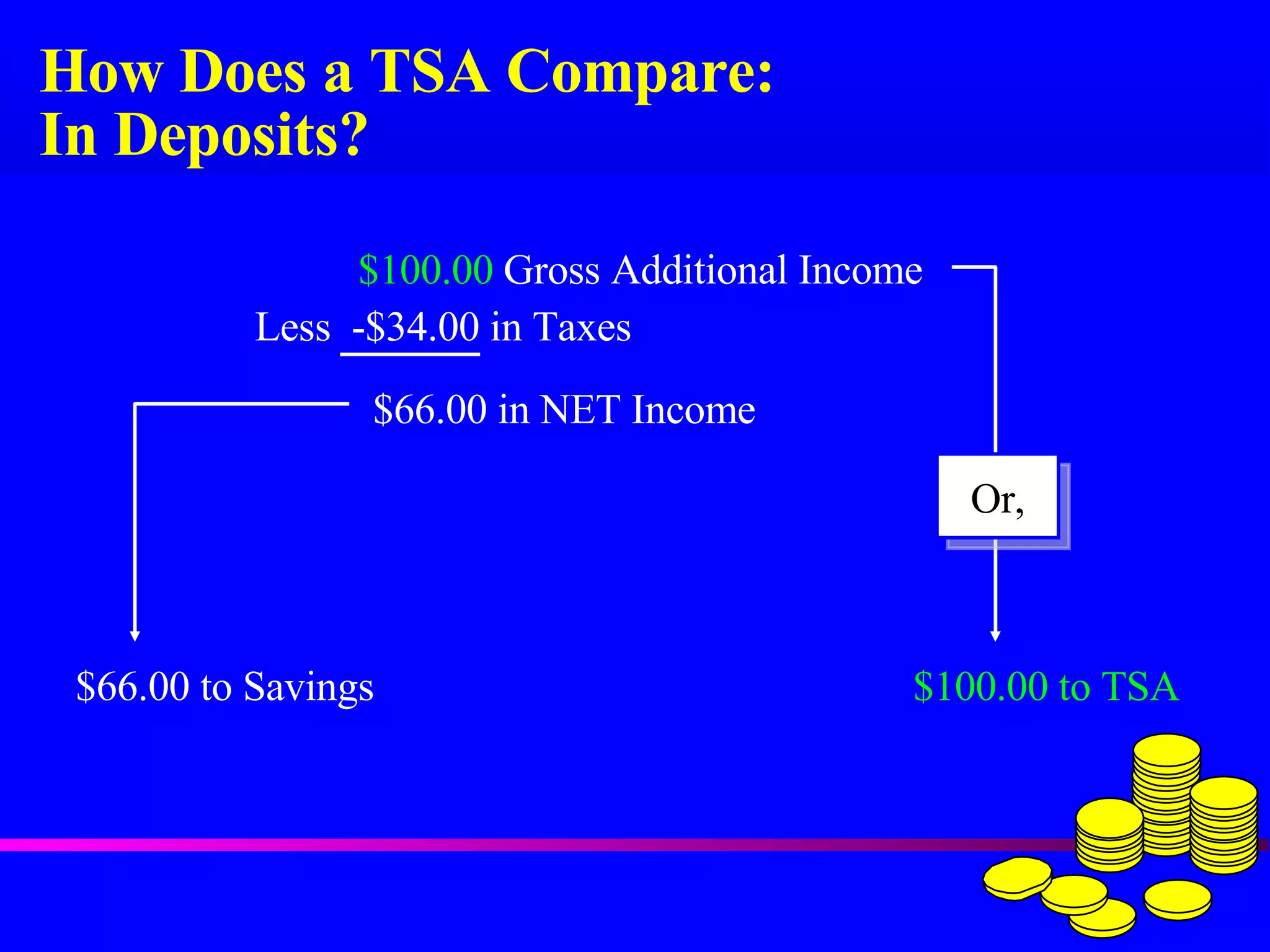

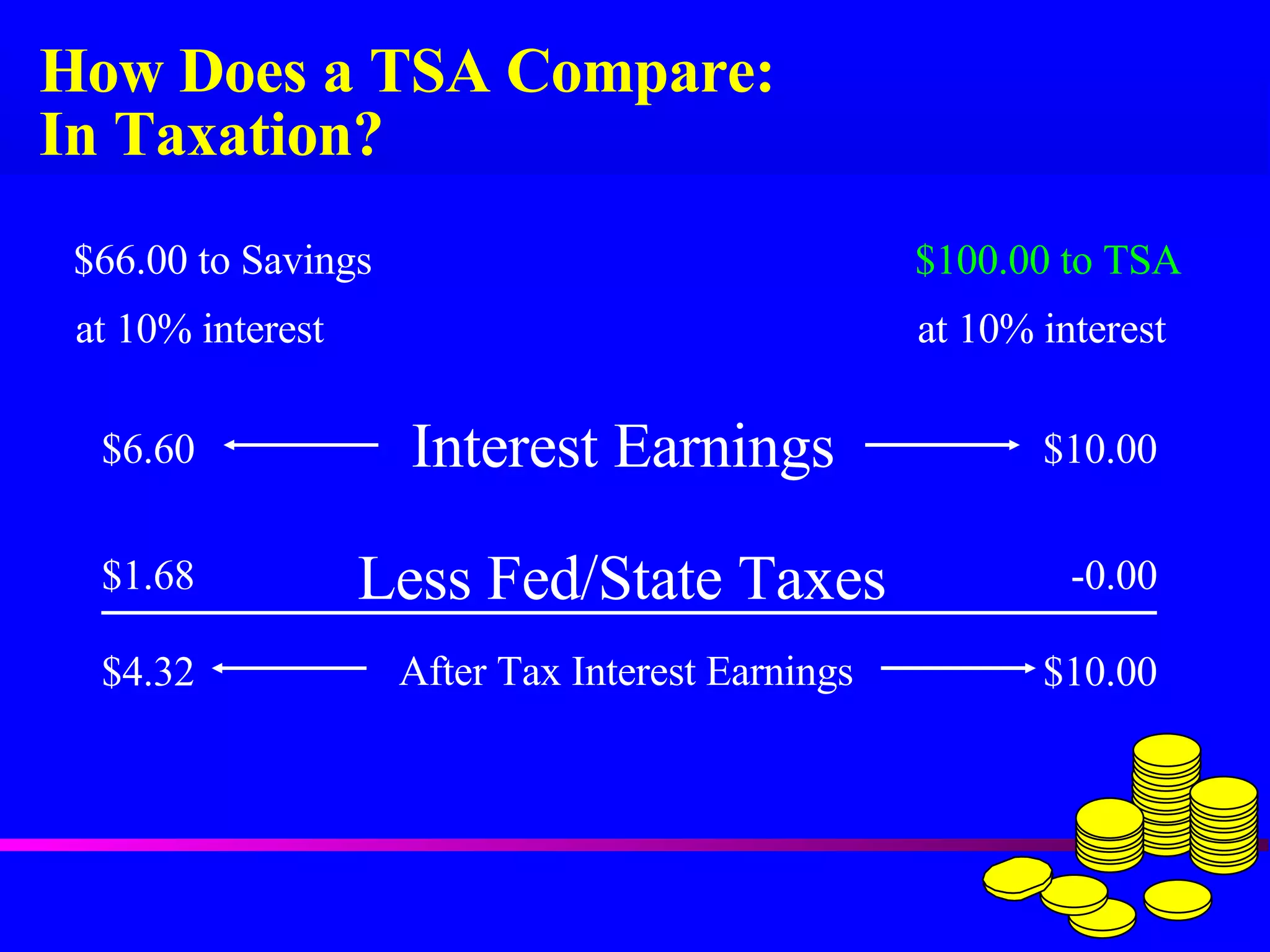

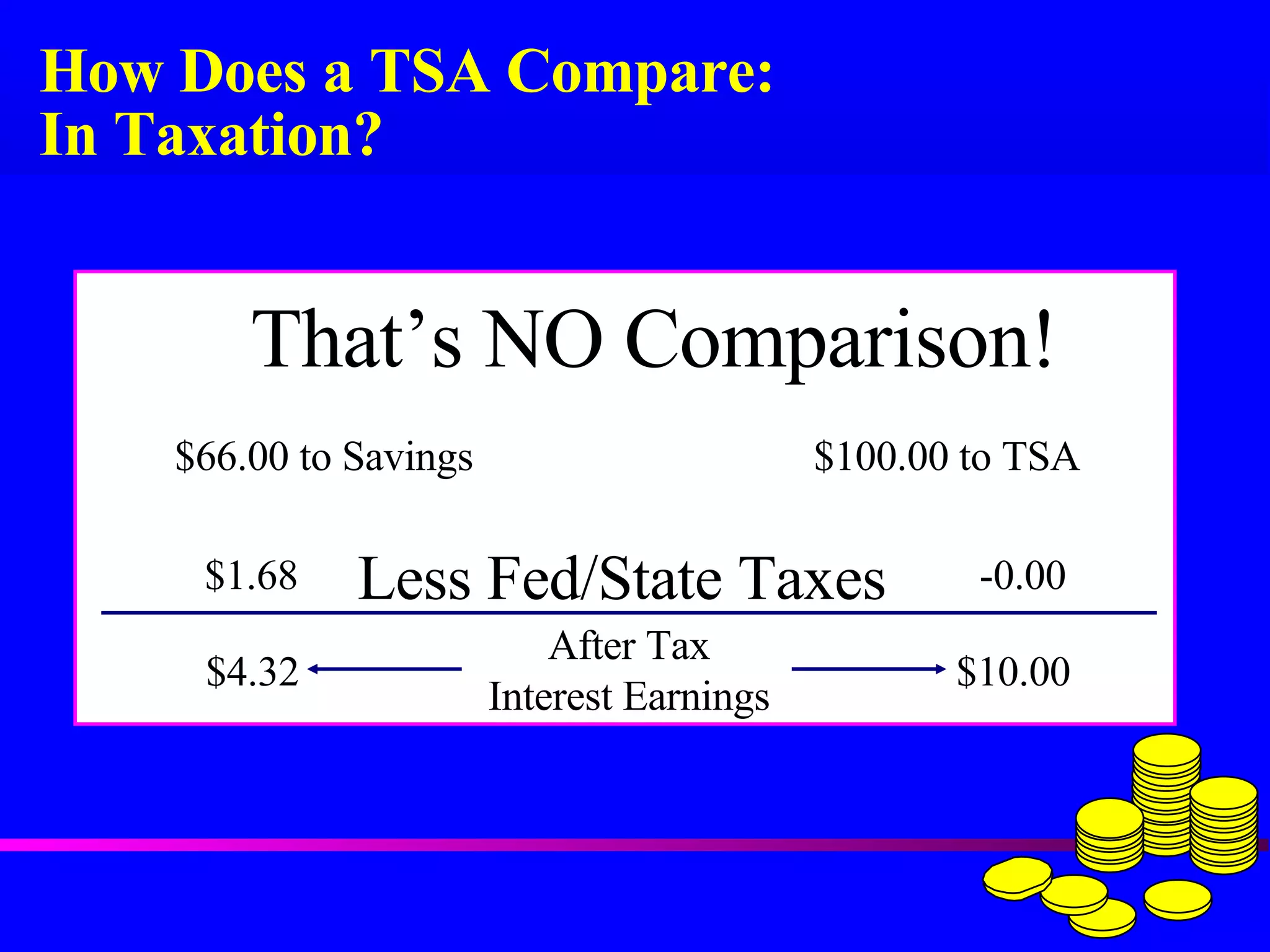

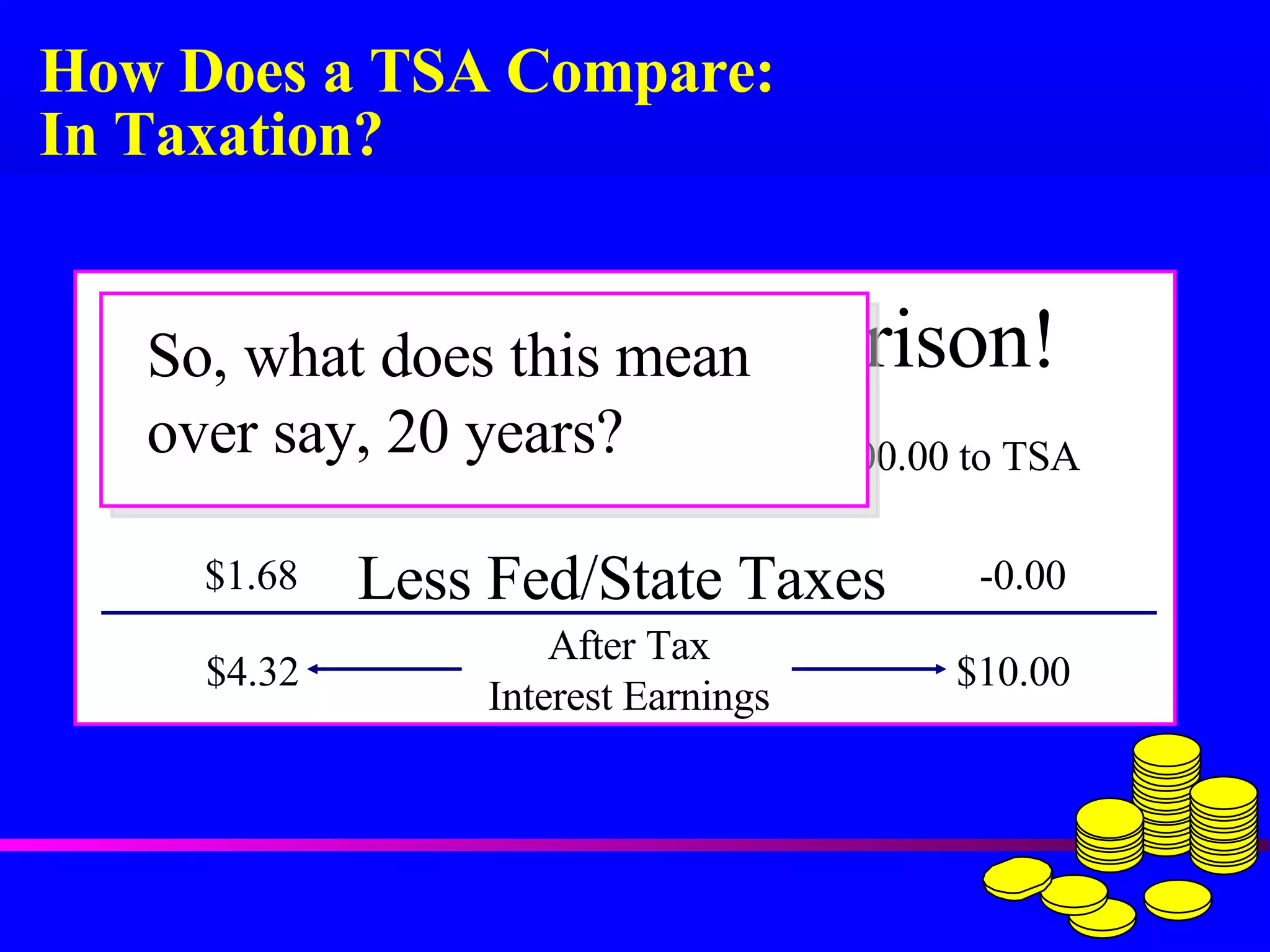

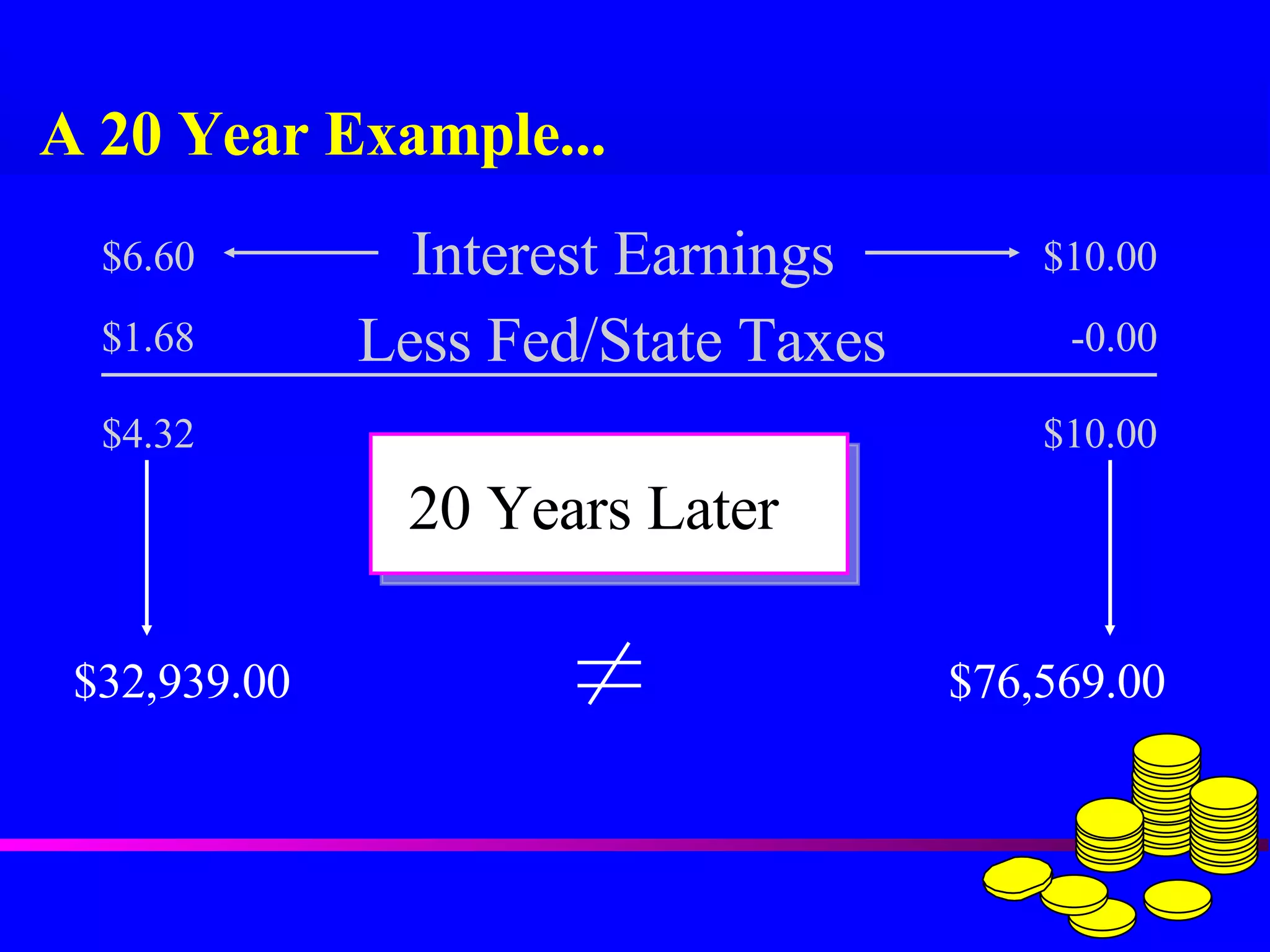

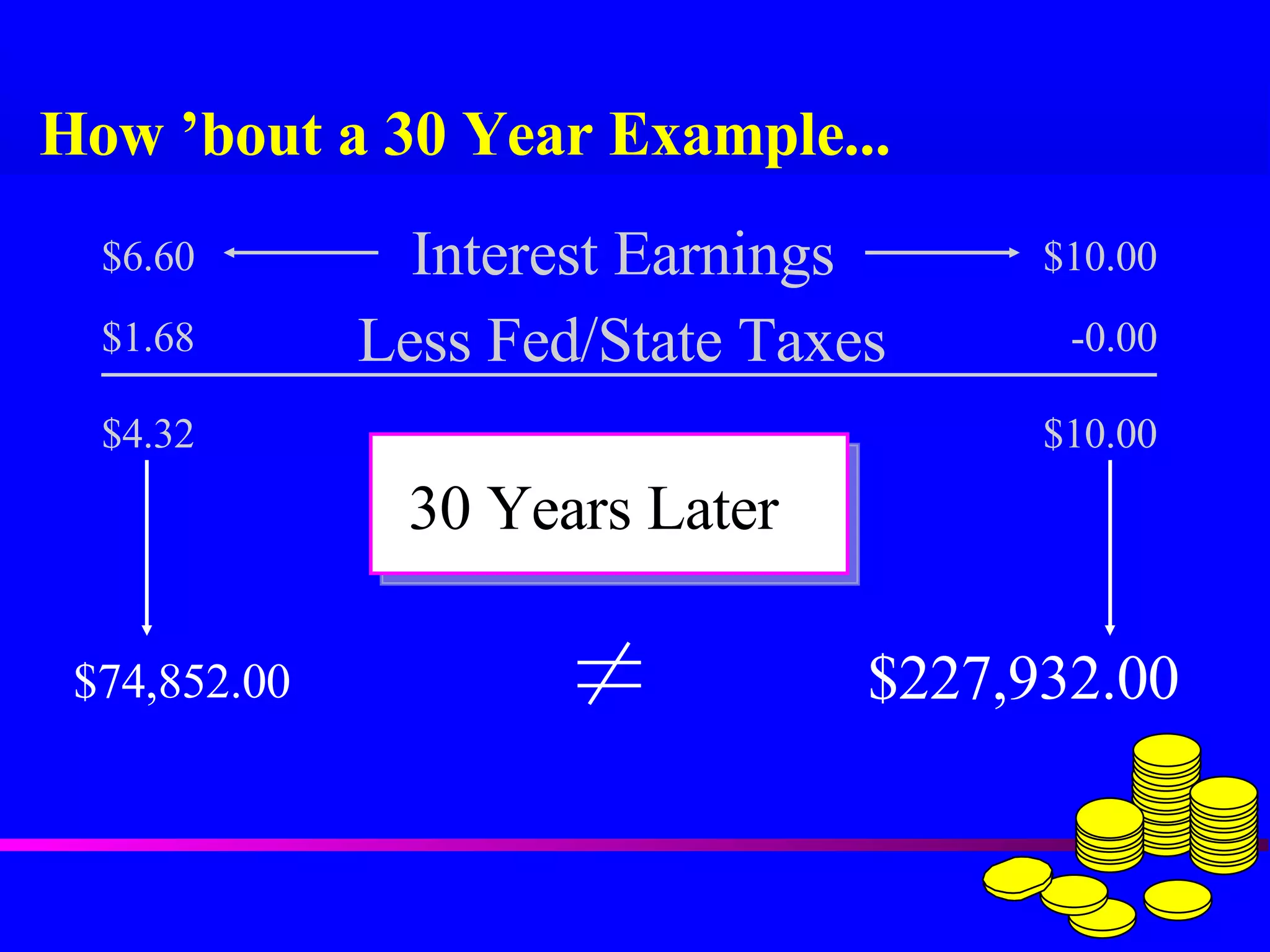

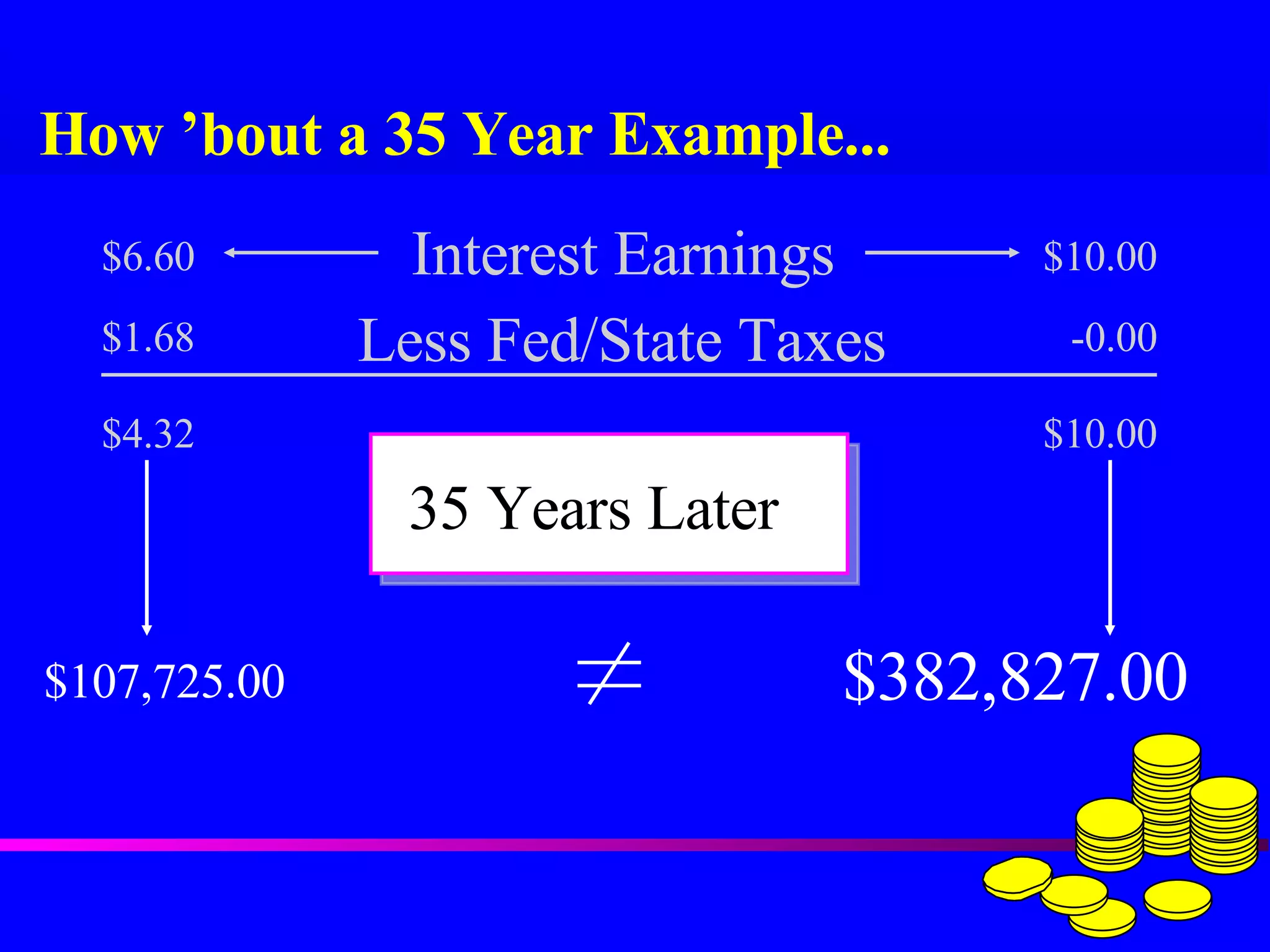

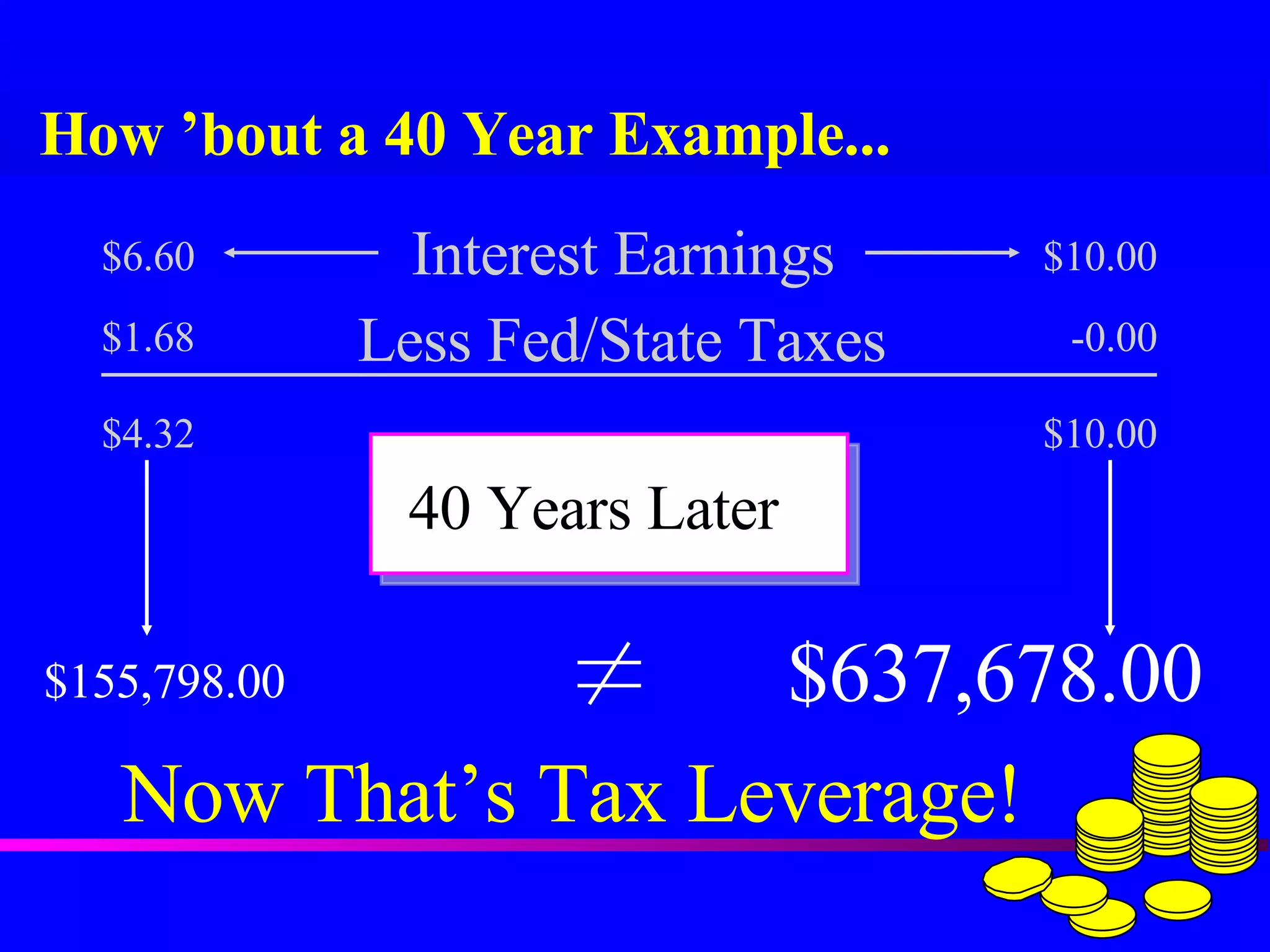

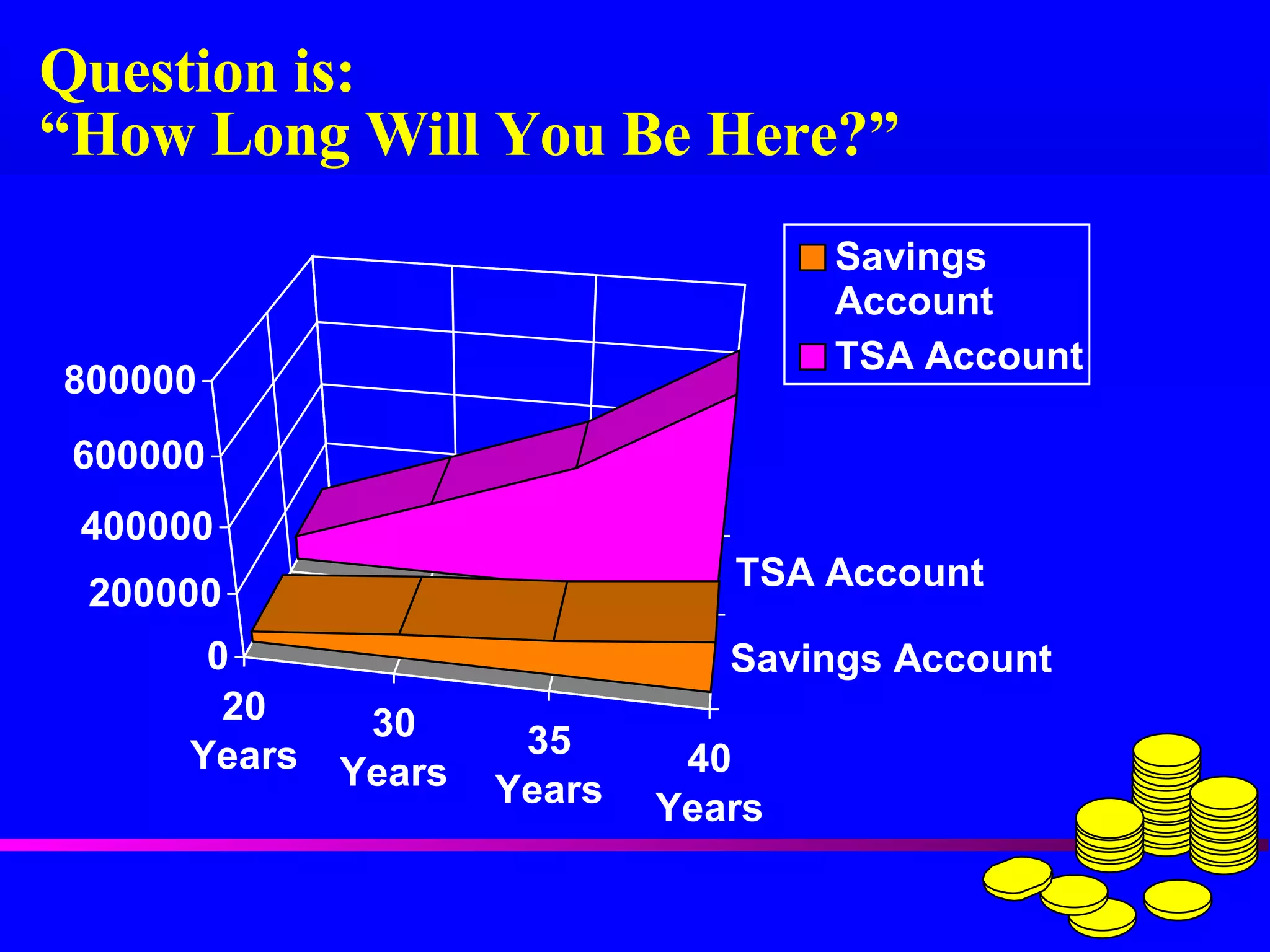

The document compares saving money in a regular savings account versus a Tax-Sheltered Annuity (TSA) over different time periods. It shows that with a $100 monthly raise, saving in a TSA results in $10 monthly interest that is not taxed, while the same amount saved in a regular account generates only $6.60 in monthly interest due to taxes. This tax-free compounding results in much higher balances in a TSA compared to a regular savings account over long periods, such as $155,798 in a regular account after 40 years versus $637,678 in a TSA.