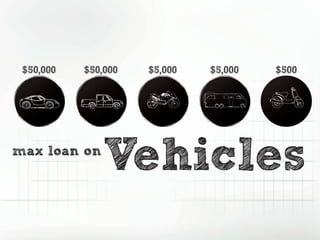

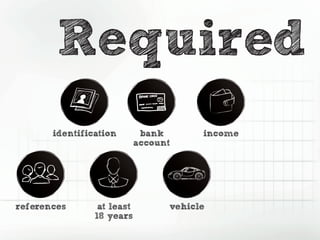

Title loans, also known as secured loans, allow individuals to borrow money using their vehicle title as collateral, making them ideal for those with bad or no credit. The application process can be done online or in-person, but a physical vehicle inspection is required, along with proof of income and identification. Loan terms vary, offering options for shorter terms with higher payments or longer terms with lower payments, while repayment is structured based on the borrower's pay schedule.