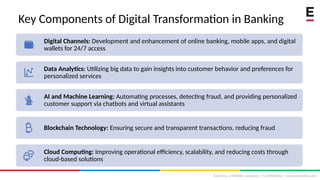

Digital transformation in banking incorporates advanced technologies to enhance customer experiences, improve efficiency, and strengthen security. Key components include digital channels, data analytics, AI and machine learning, blockchain, and cloud computing, contributing to a projected market growth from USD 68.2 billion in 2022 to USD 310.6 billion by 2031. The banking sector leads this shift, driven by customer-centric innovations and the integration of technology.