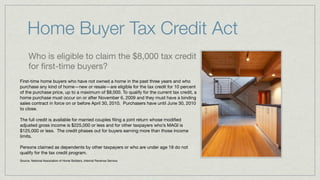

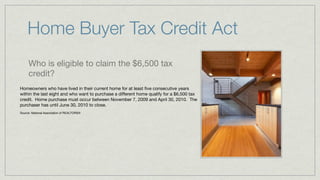

This document provides a comprehensive guide to the home buying process, covering essential topics such as financing, types of real estate agents, and the importance of pre-approval. It emphasizes the need for buyers to understand their personal needs and financial position while exploring their options. The document also outlines various aspects of closing the transaction, including necessary inspections and insurance, to ensure a smooth purchasing experience.