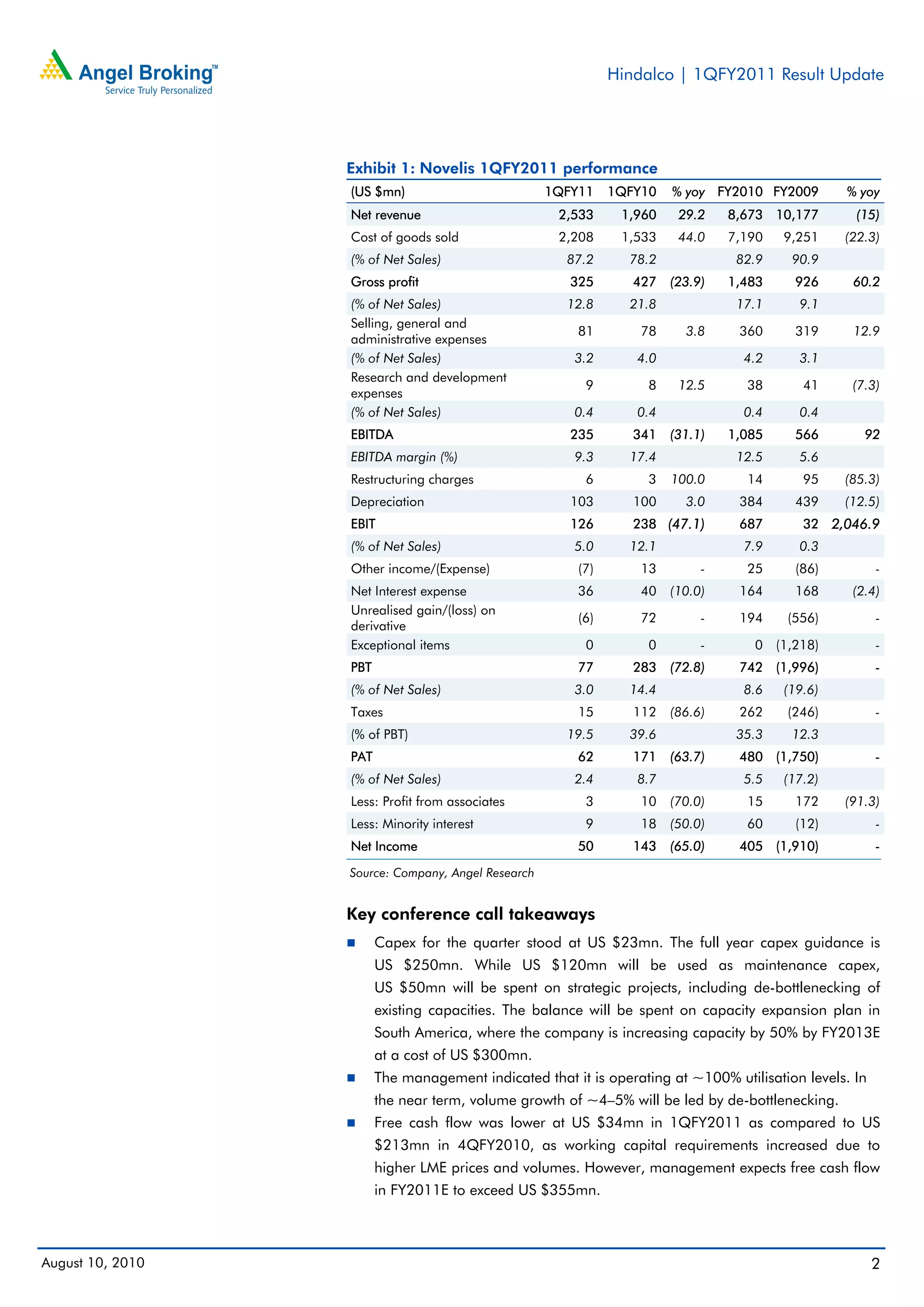

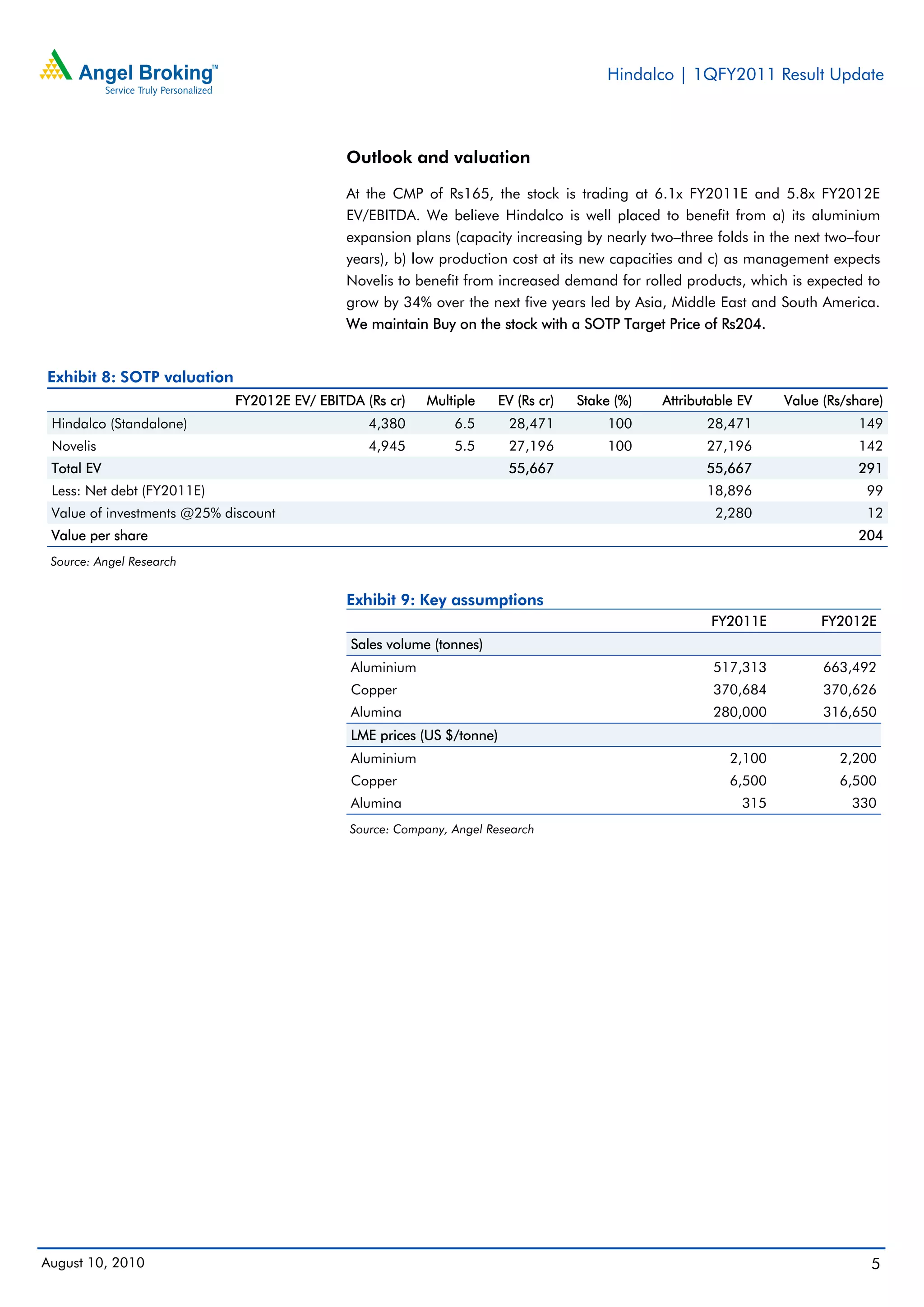

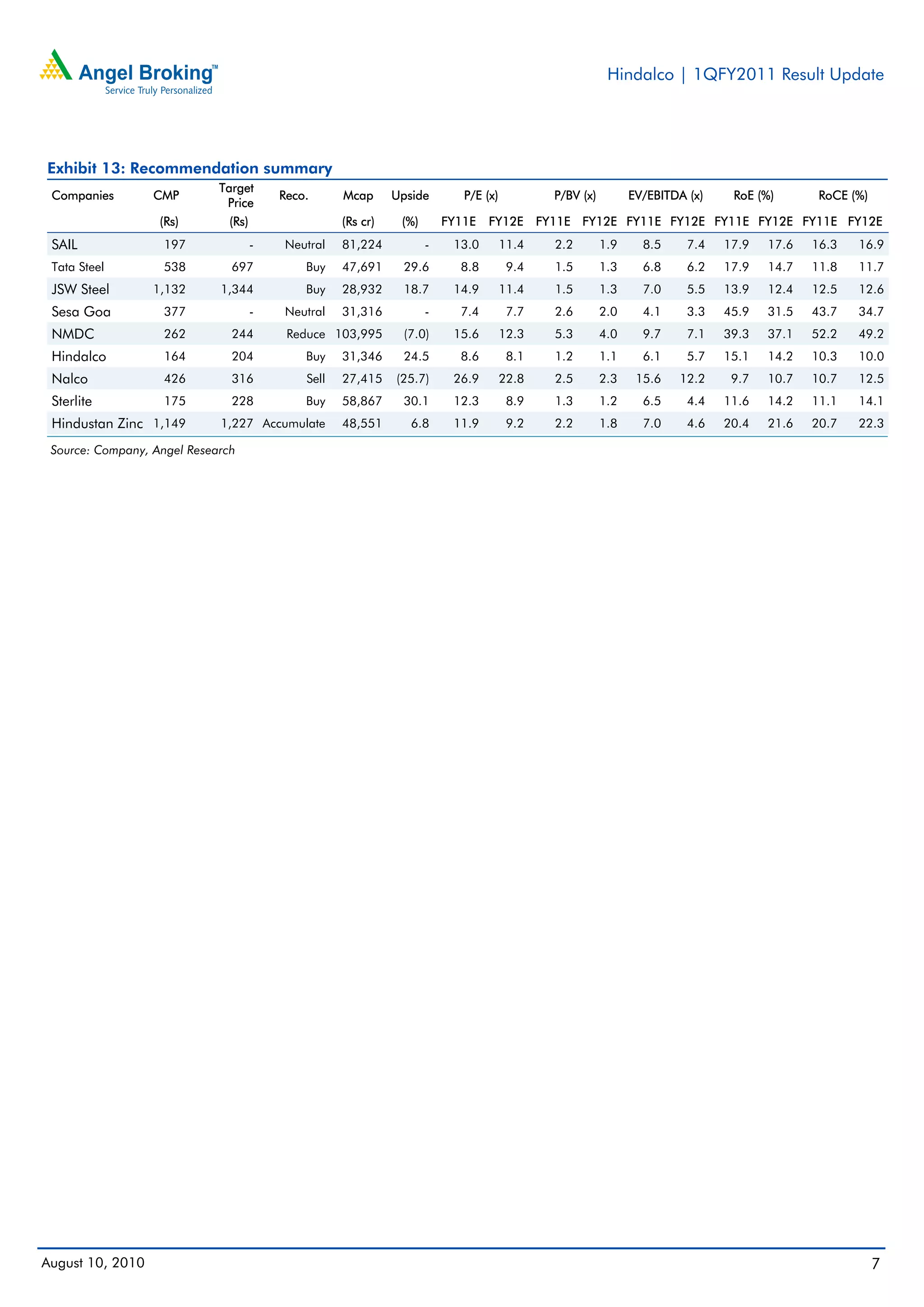

Hindalco reported strong results for the first quarter of fiscal year 2011. Revenue grew 29.2% year-over-year to Rs. 2,533 crore, driven by a 12.7% increase in aluminum shipments. Adjusted EBITDA more than doubled to Rs. 263 crore, resulting in adjusted EBITDA margins of 10.4%. However, net profit declined 65% to Rs. 50 crore due to higher interest and tax expenses. Management expects continued growth in demand and benefits from capacity expansions. The stock currently trades at attractive valuations and the analyst maintains a Buy rating with a target price of Rs. 204.