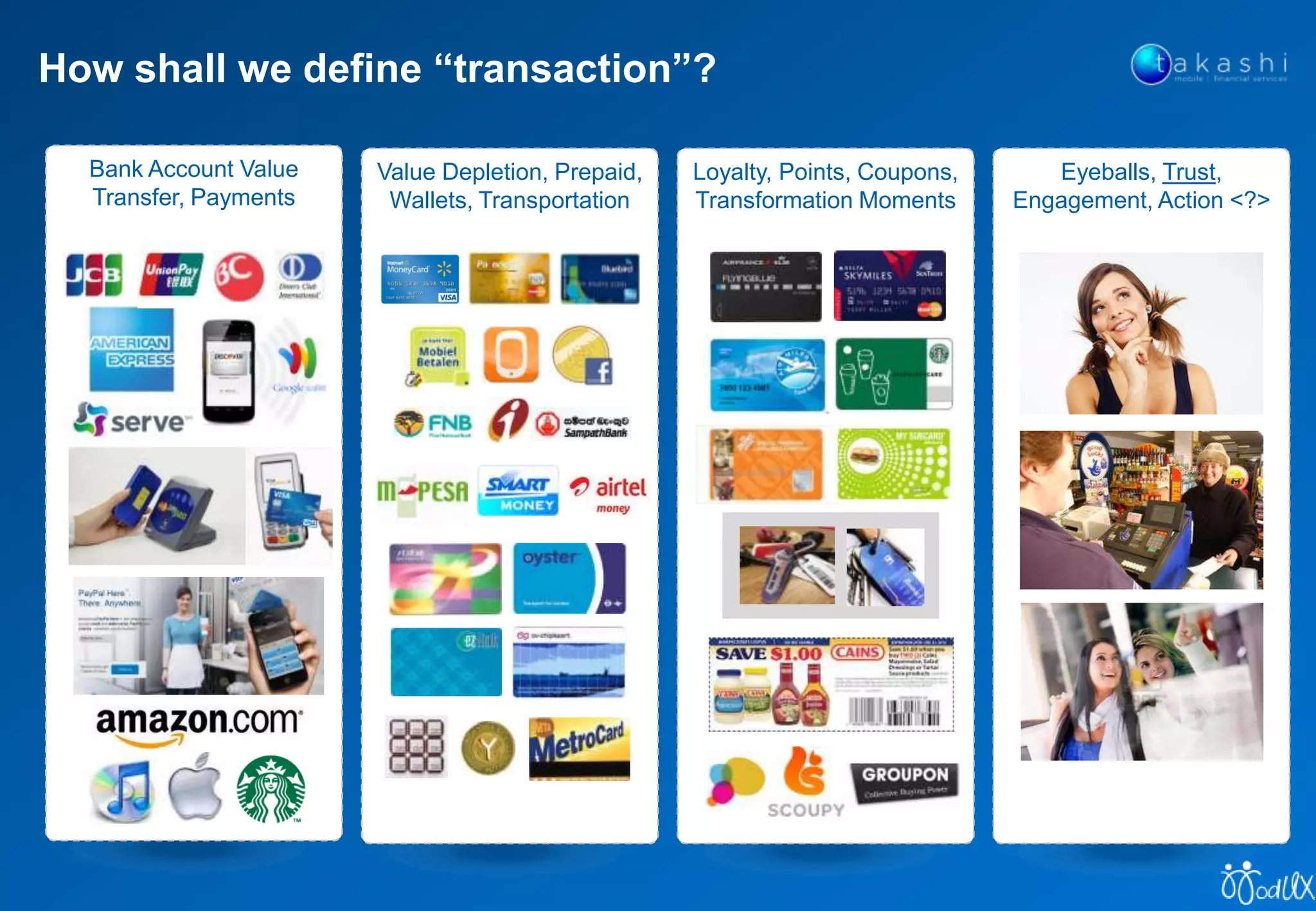

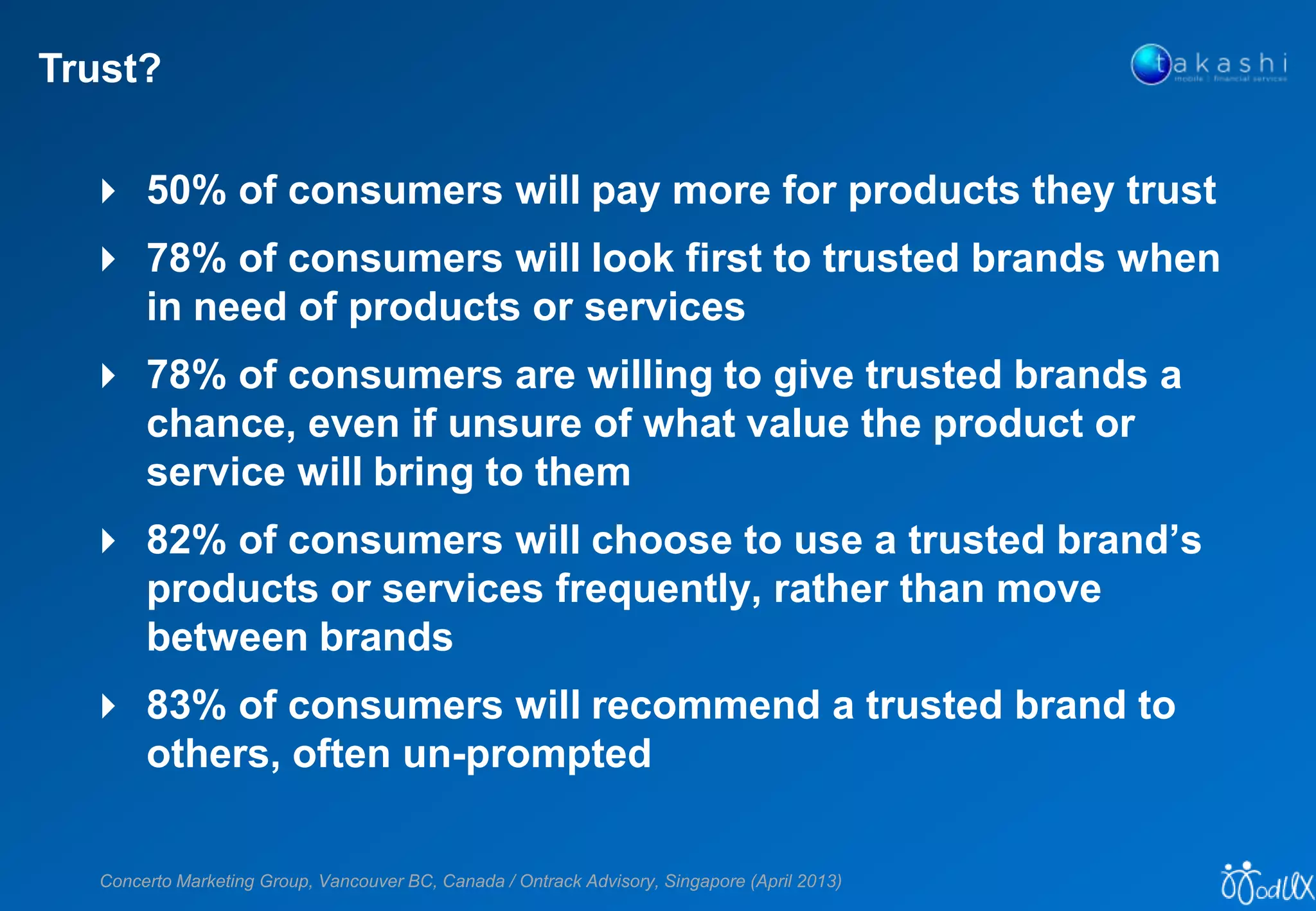

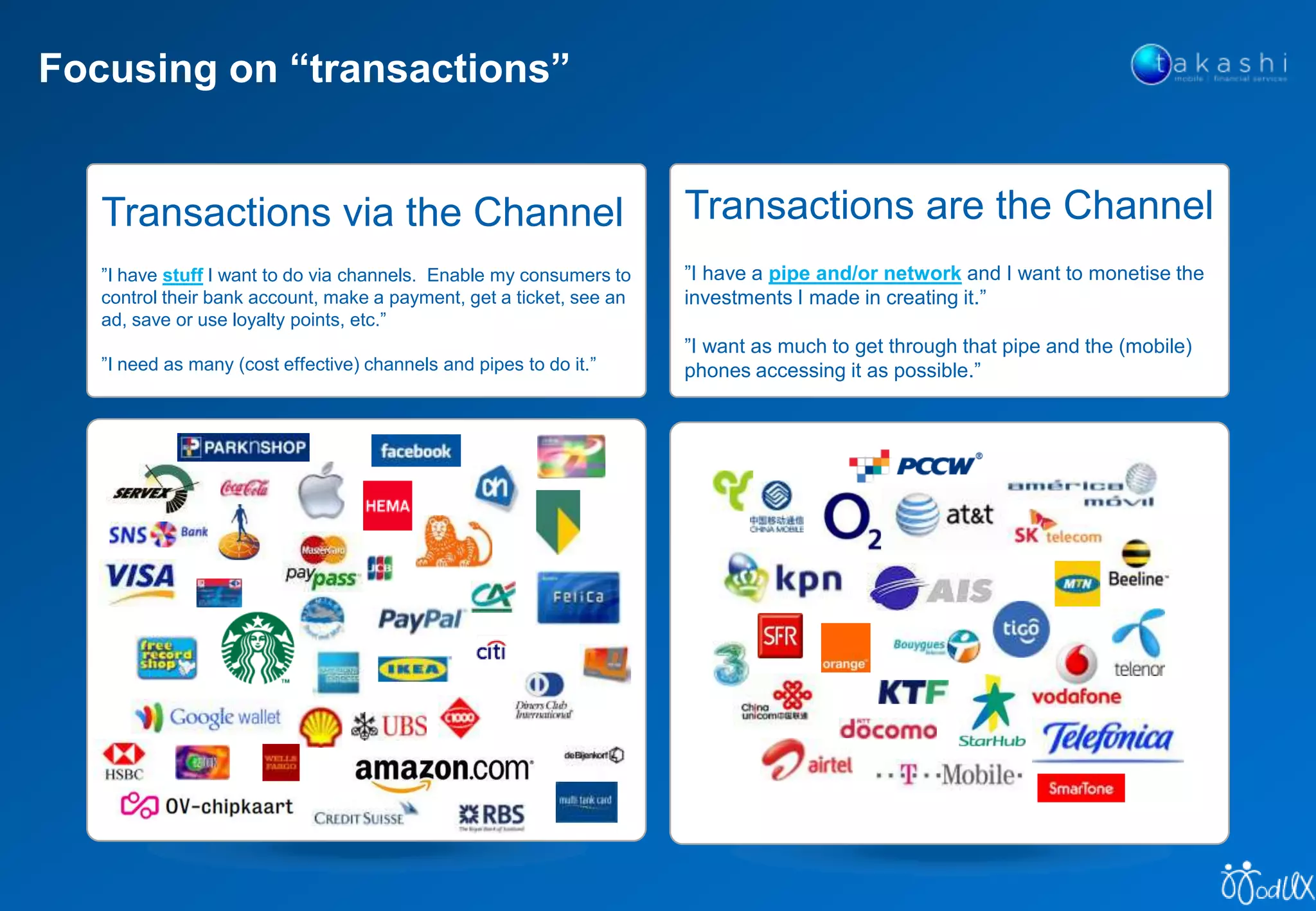

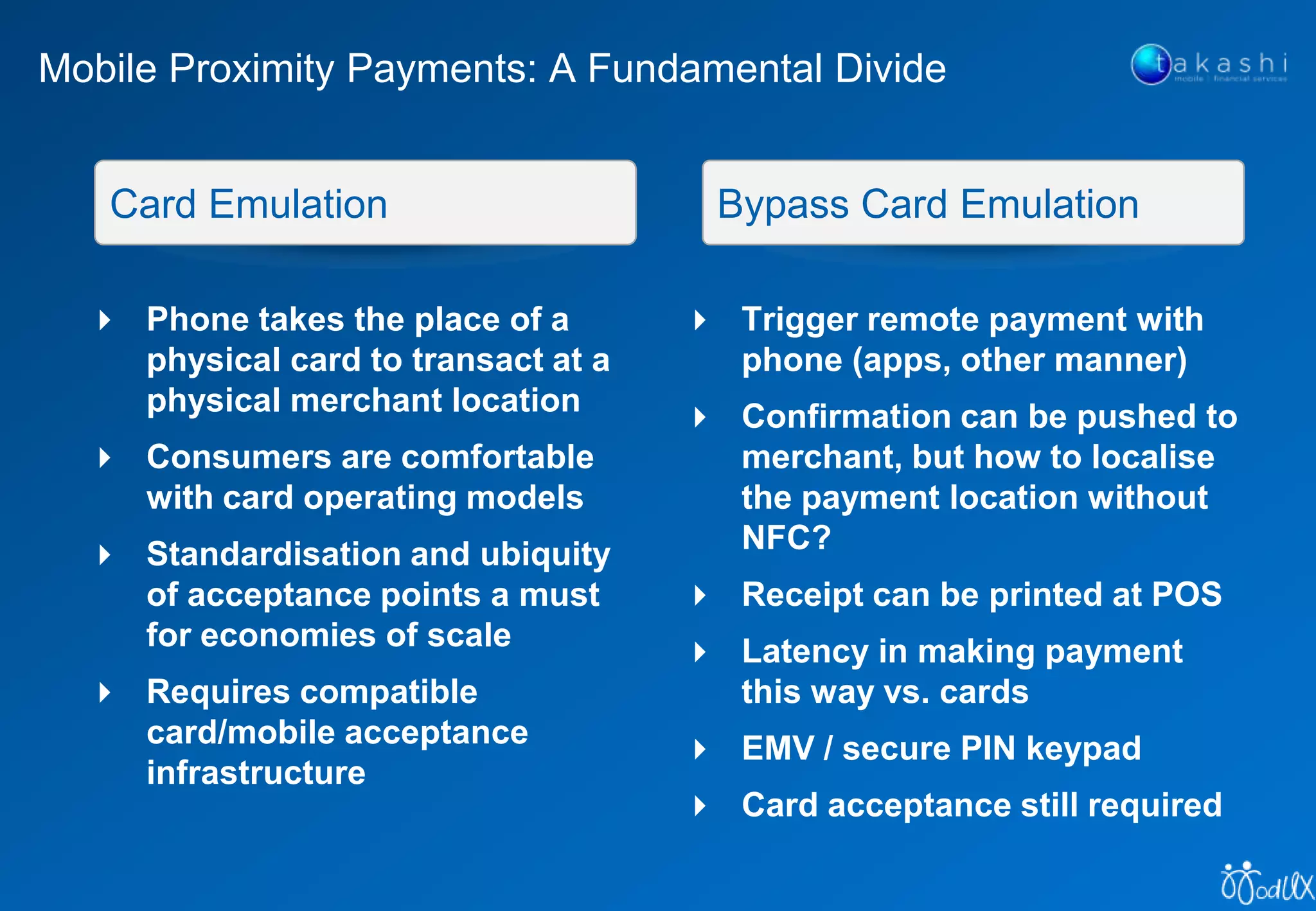

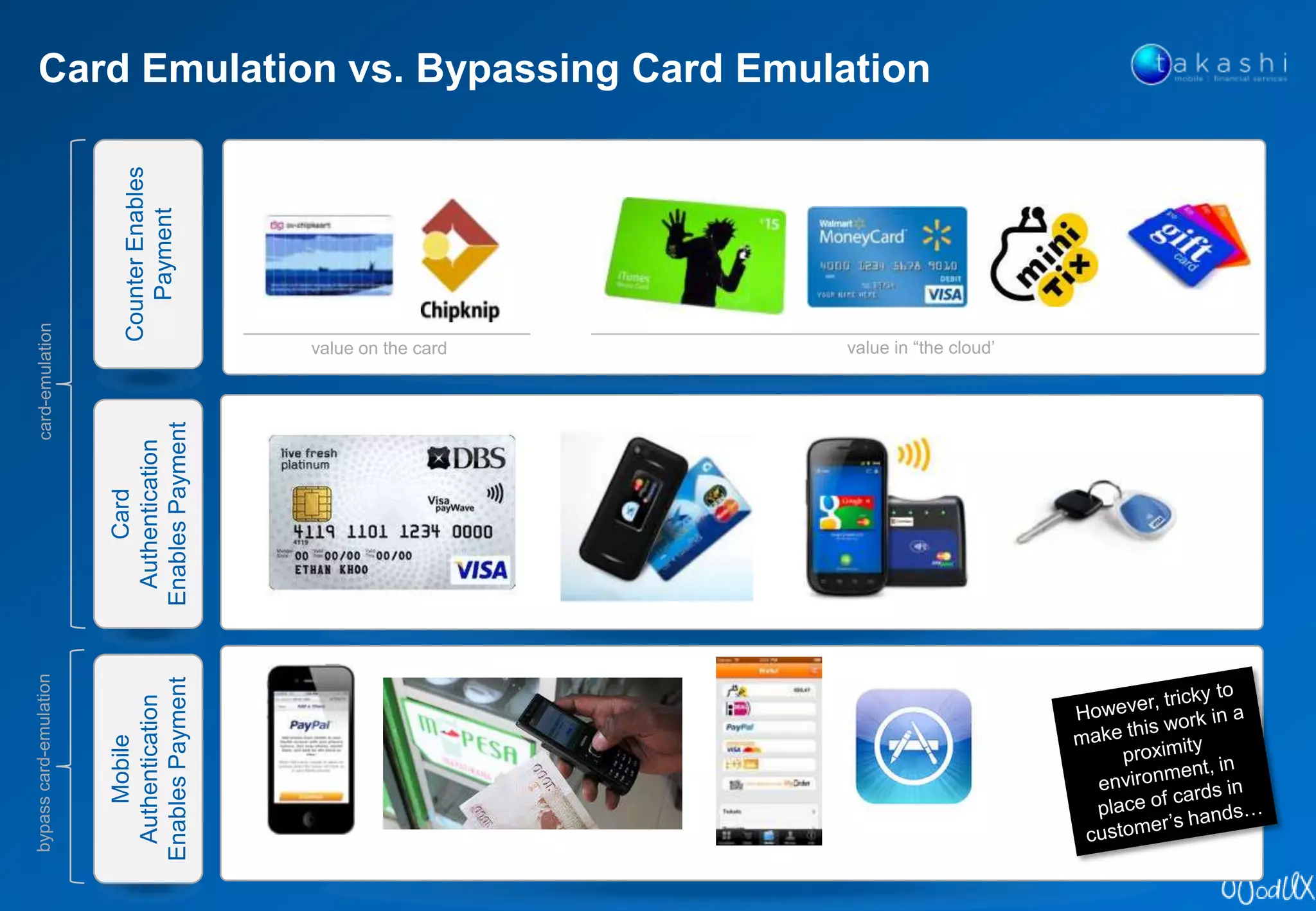

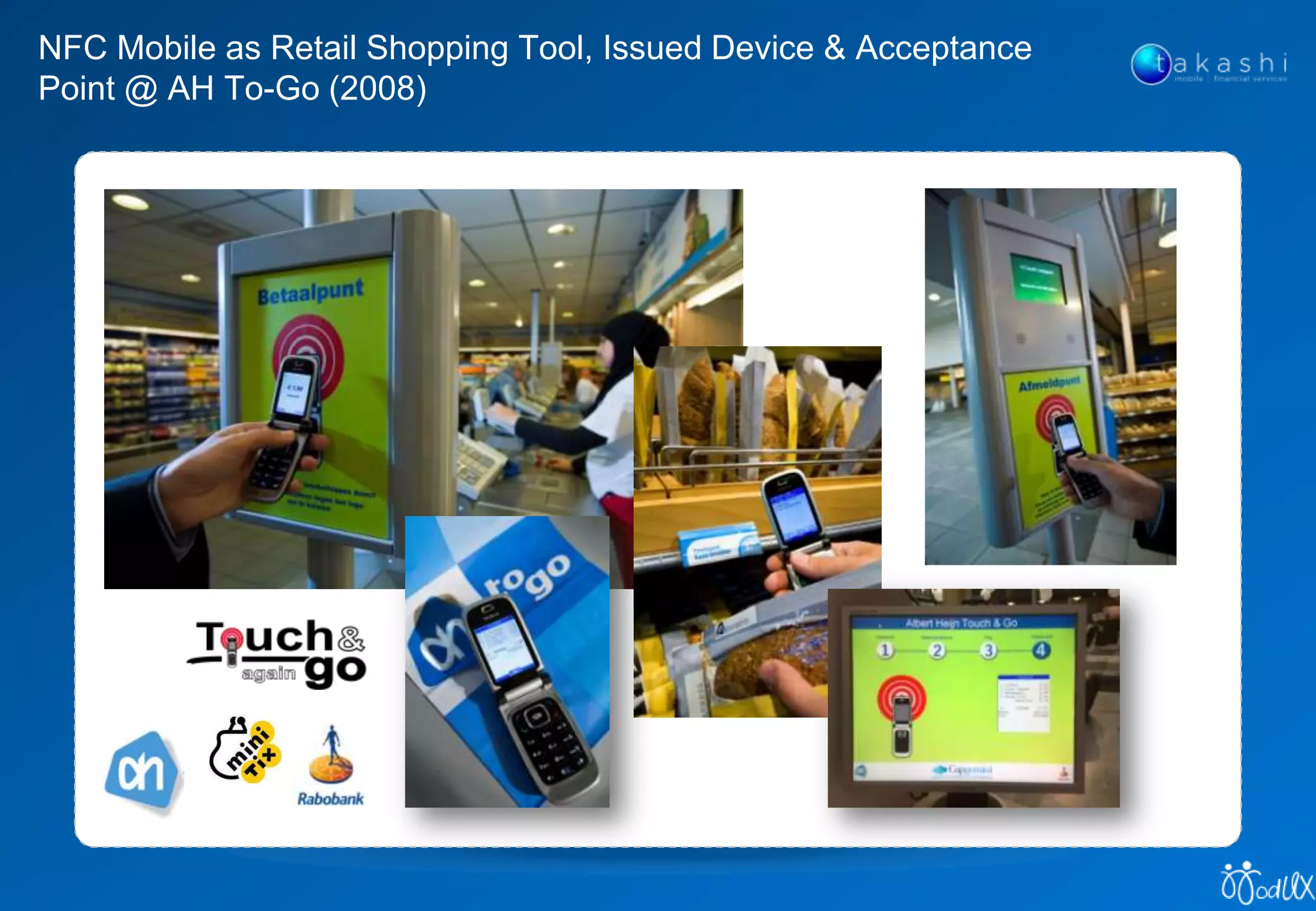

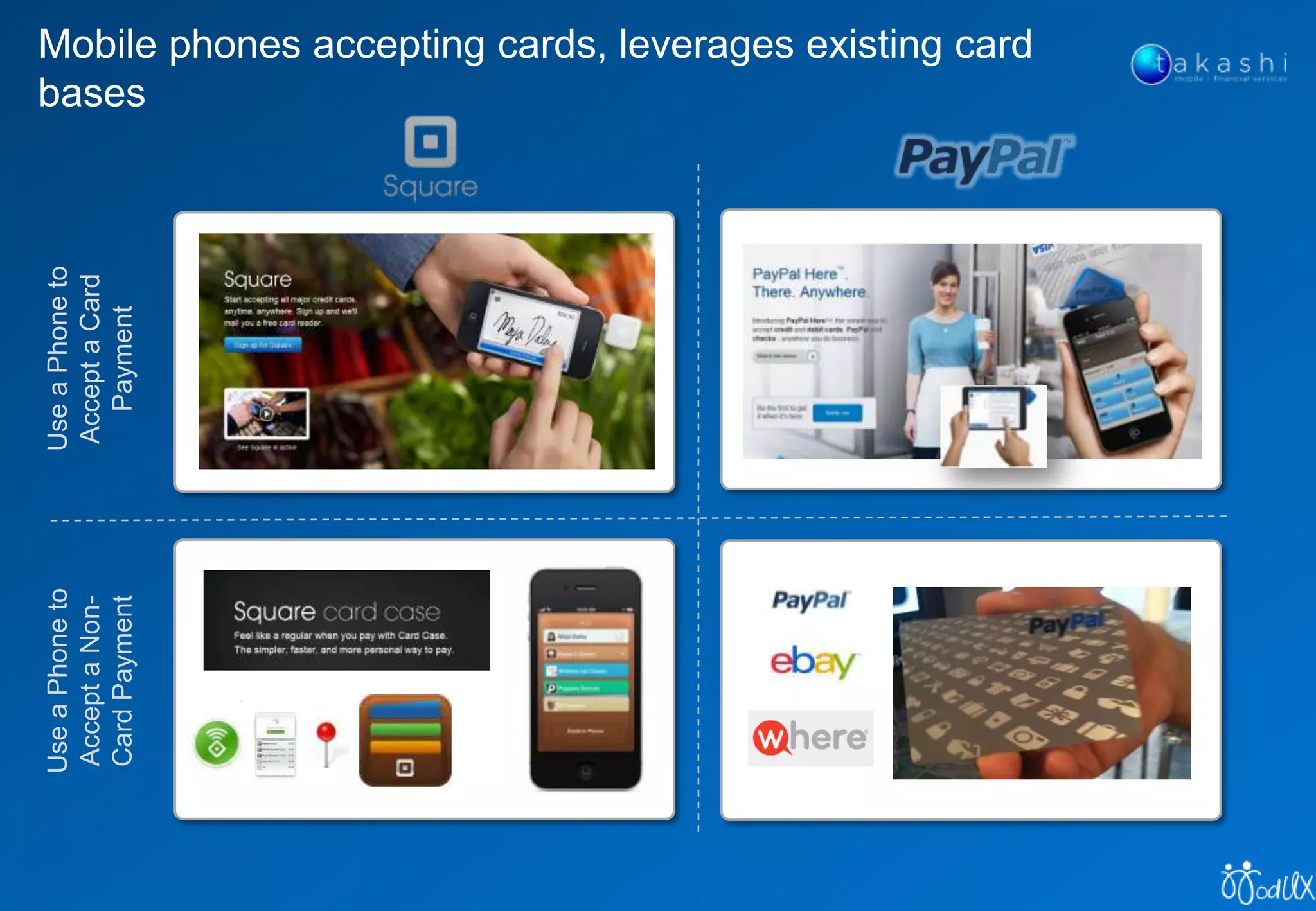

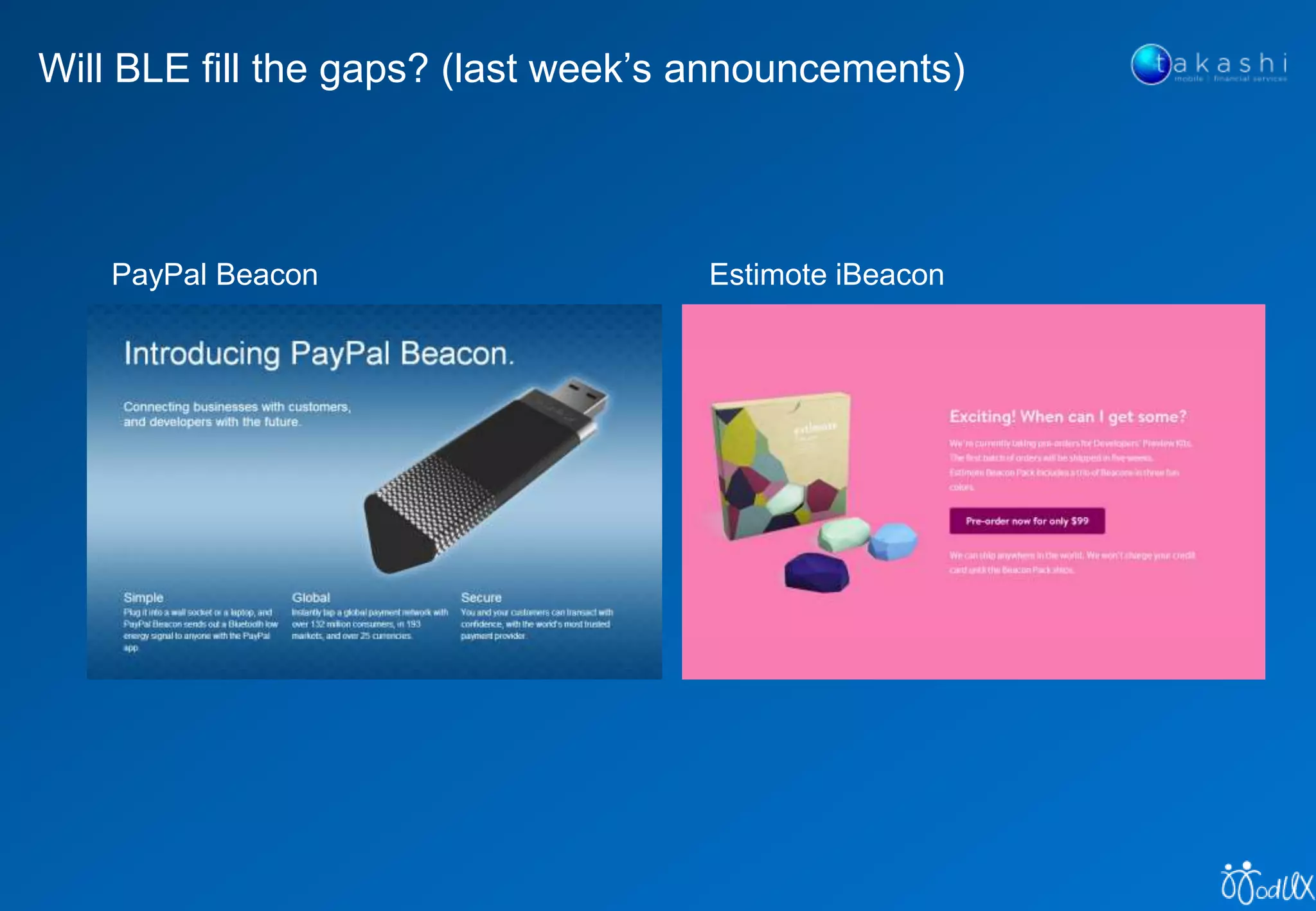

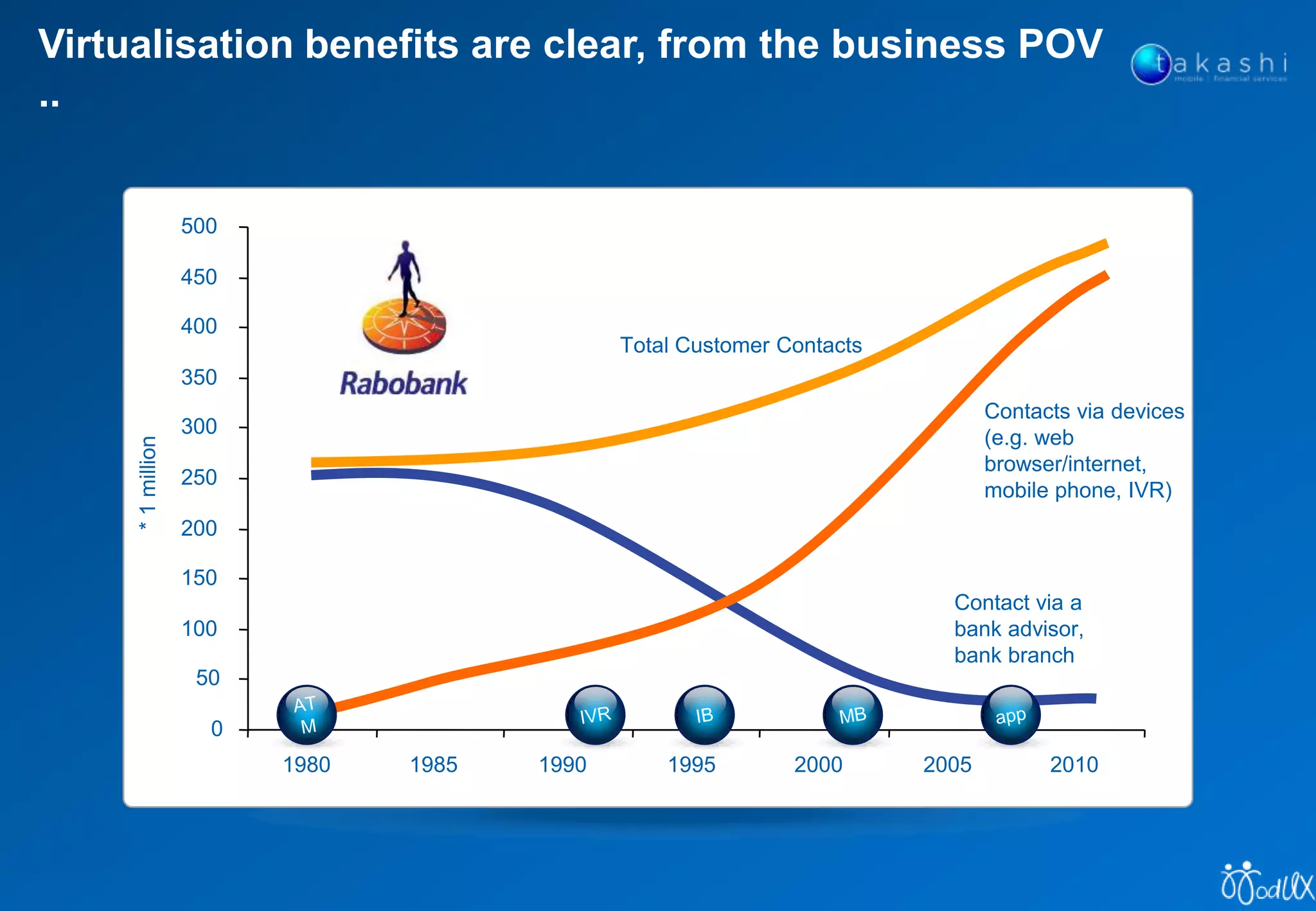

The document discusses consumer trust in brands, noting that a significant majority of consumers prefer and are willing to pay more for trusted products and services. It further explores the evolving landscape of mobile payments, emphasizing the importance of transaction technology, consumer control, and the integration of mobile devices as payment tools. The document also raises questions about the future relevance of physical wallets versus digital alternatives and the potential impact of NFC technology on consumer behavior and transactions.