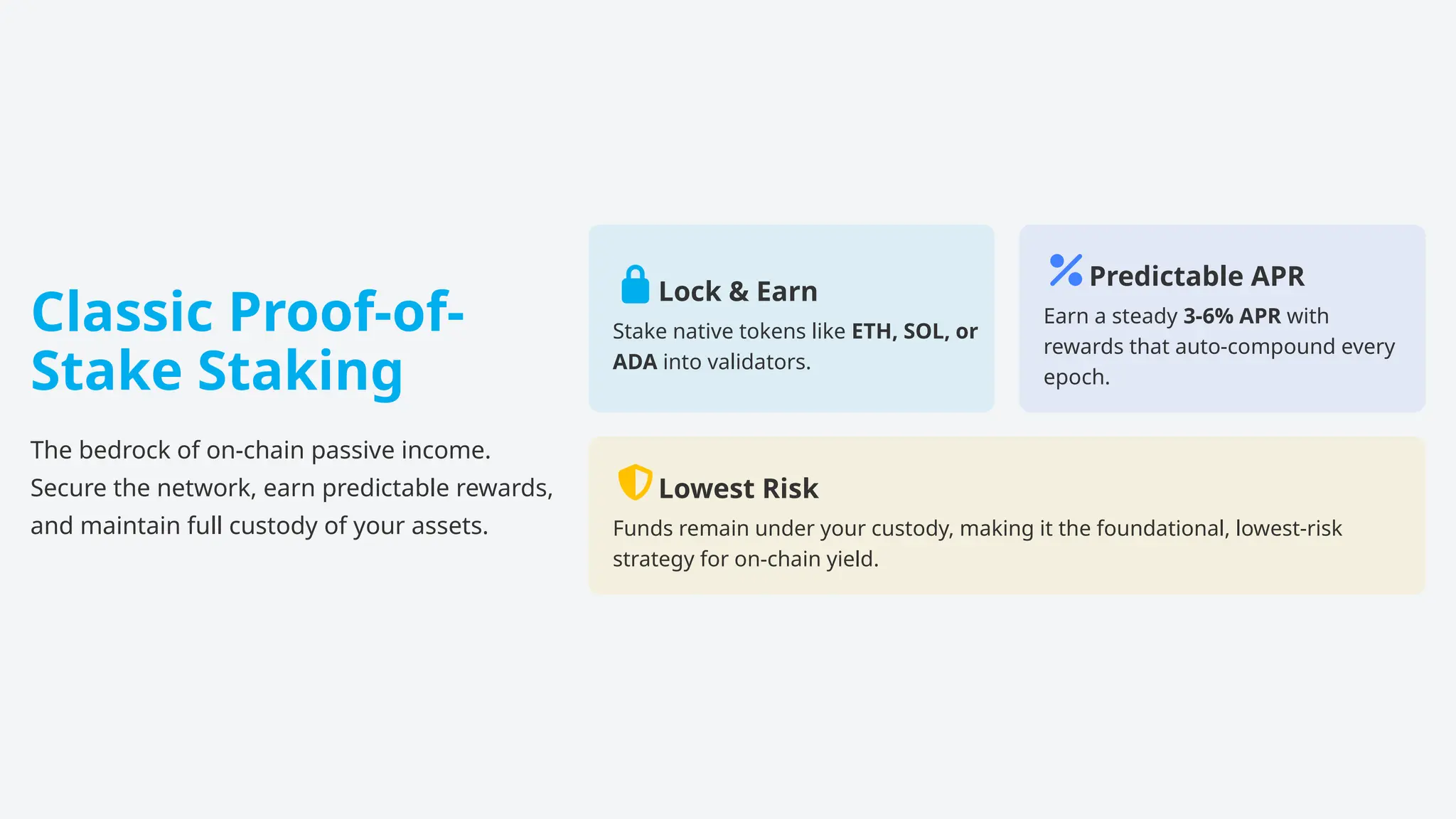

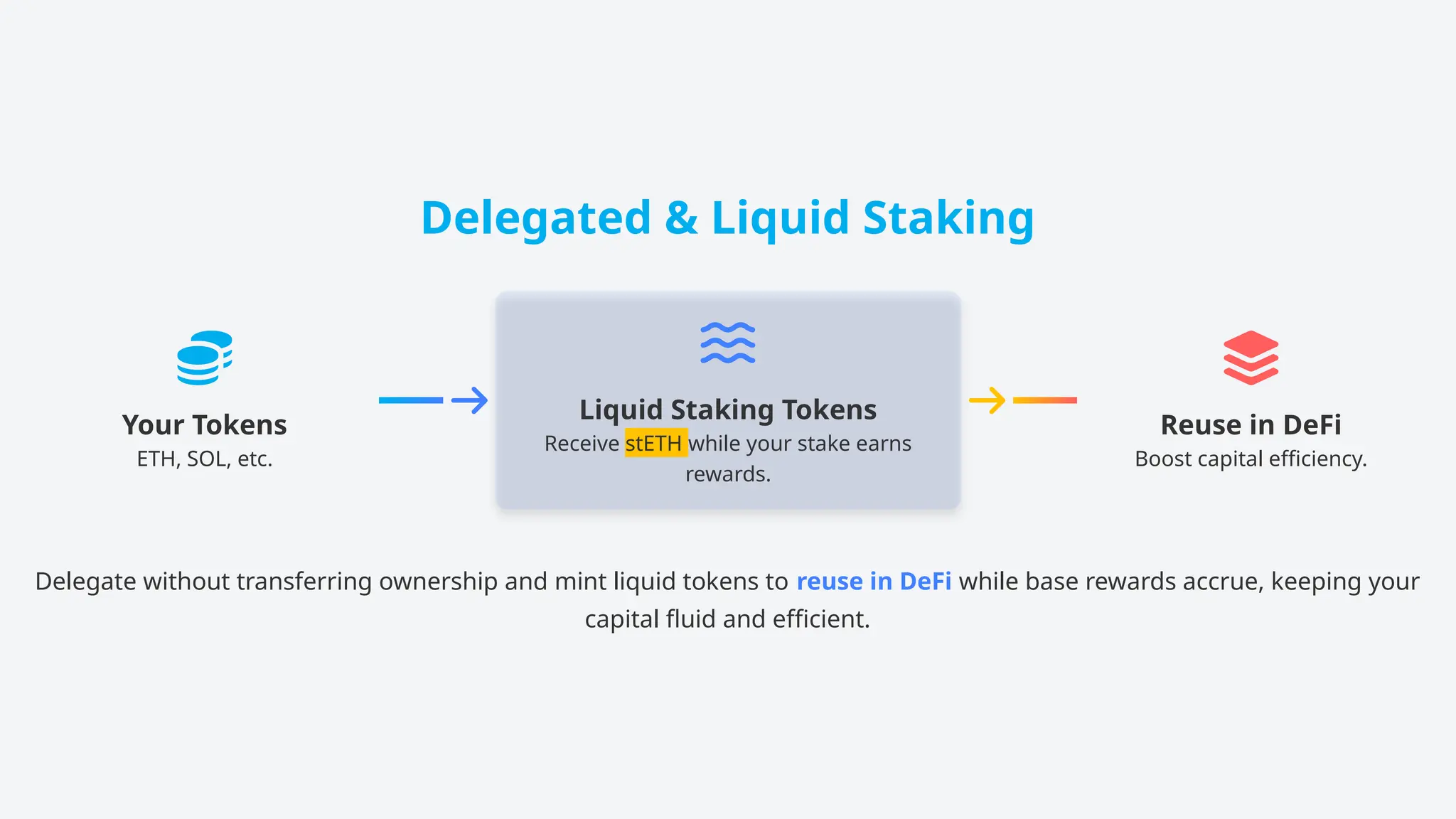

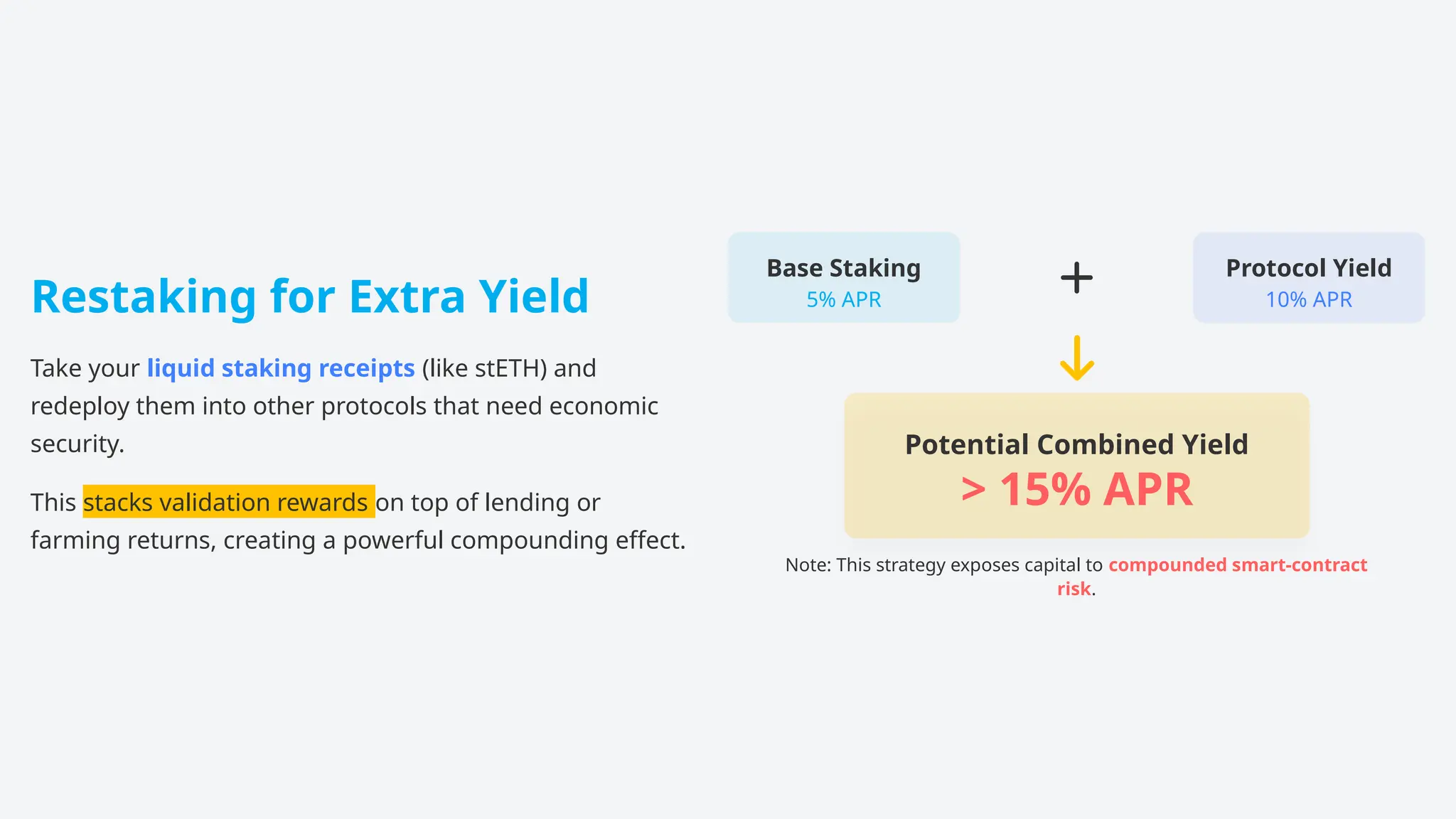

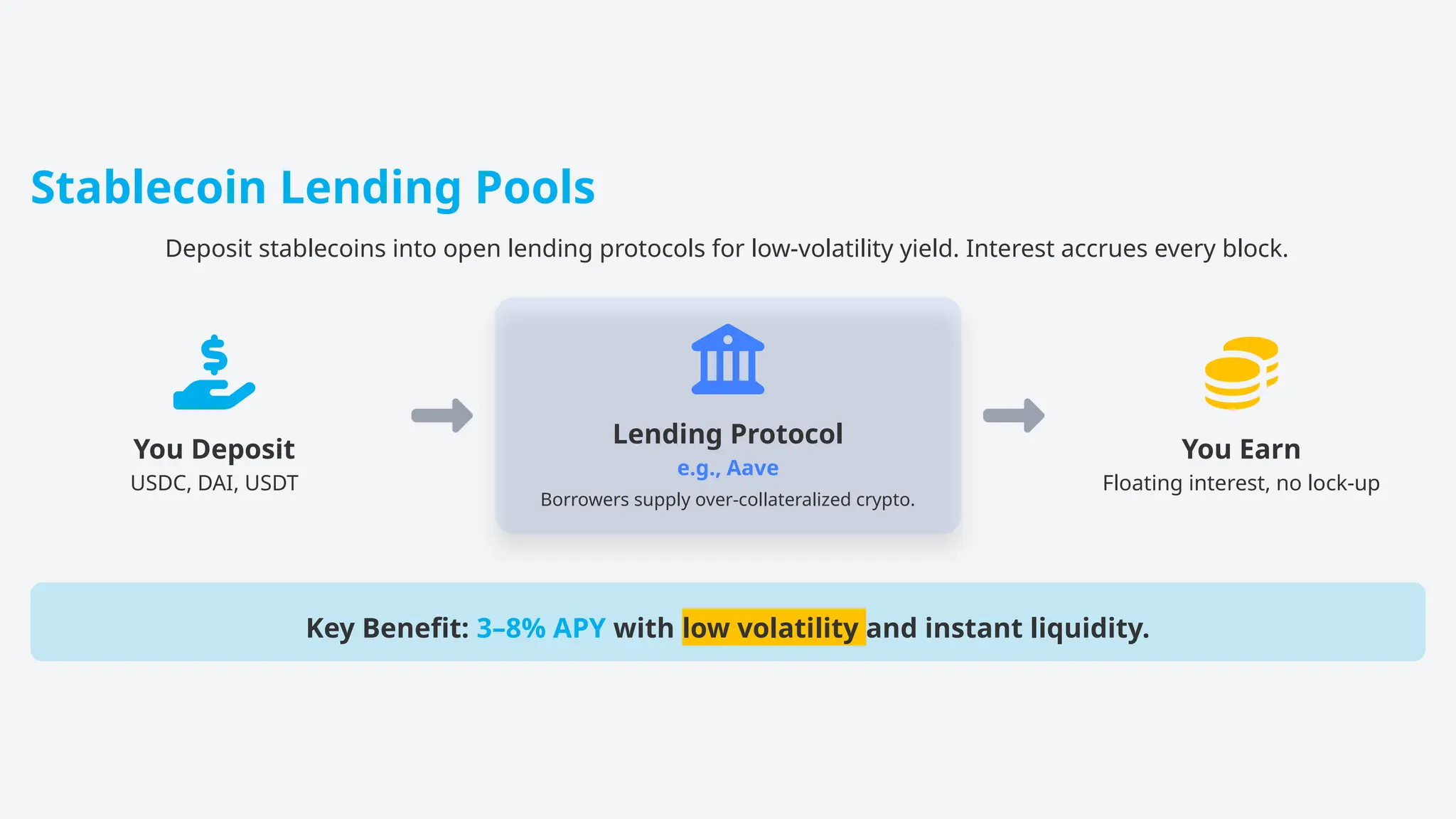

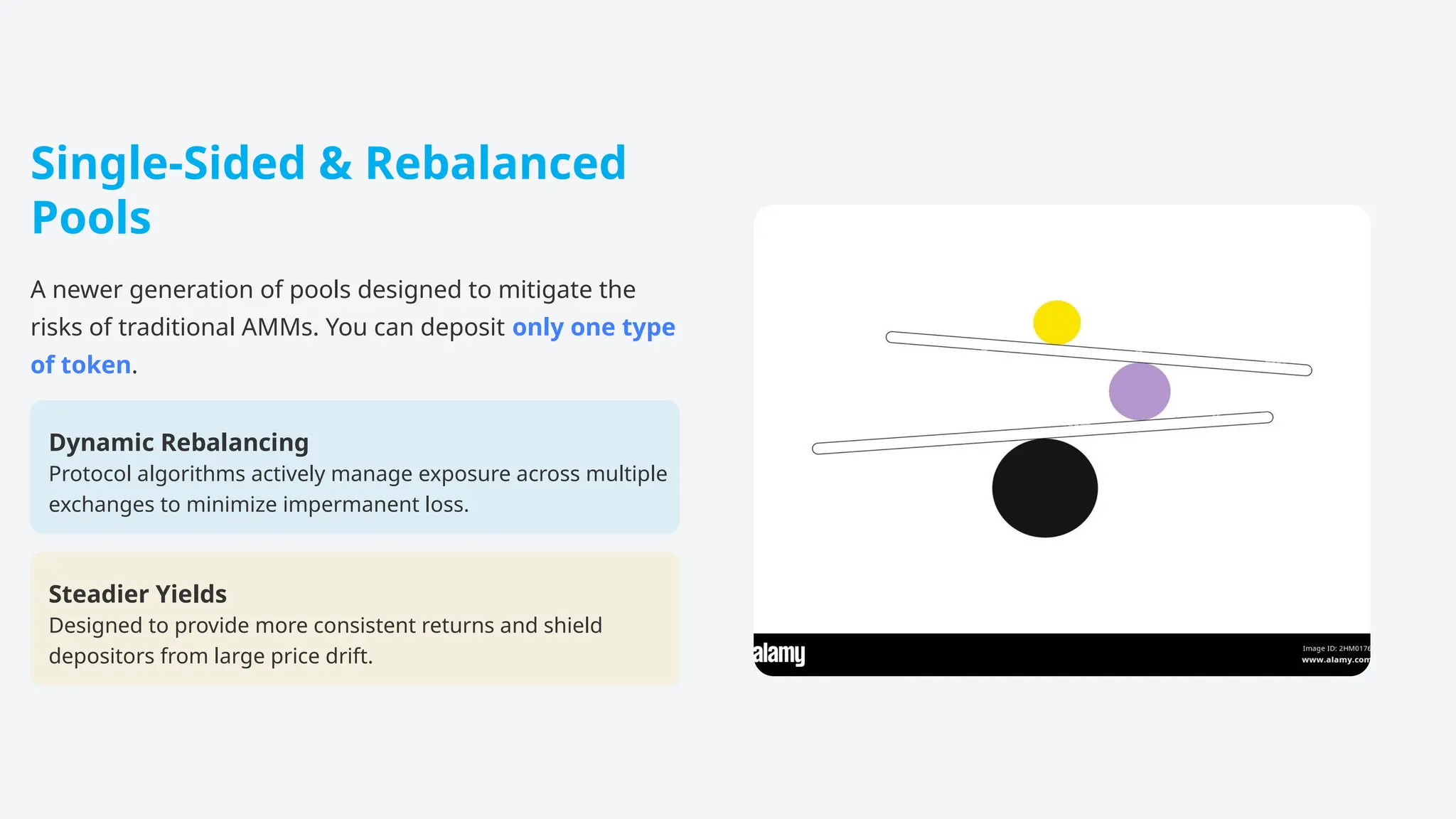

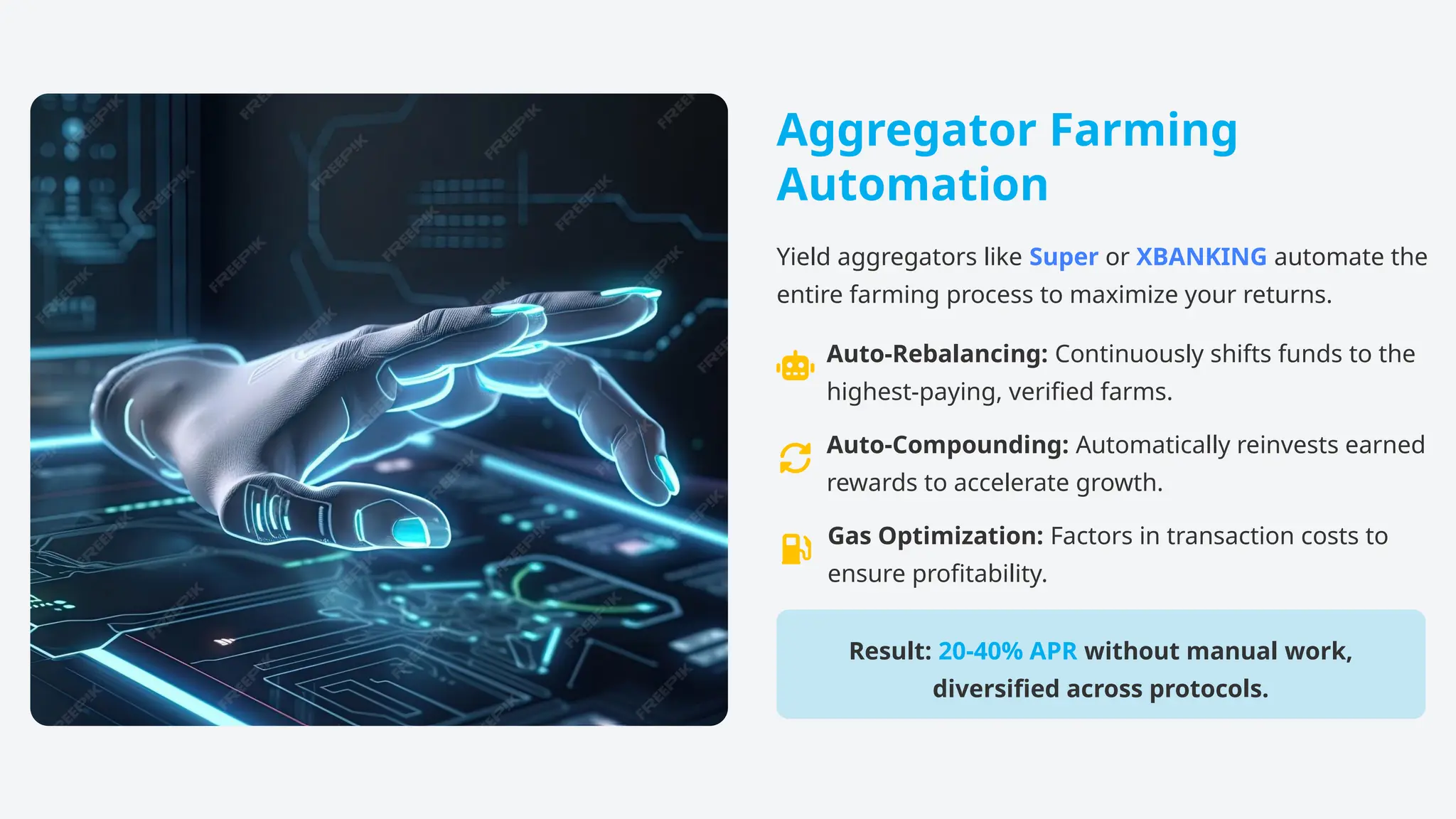

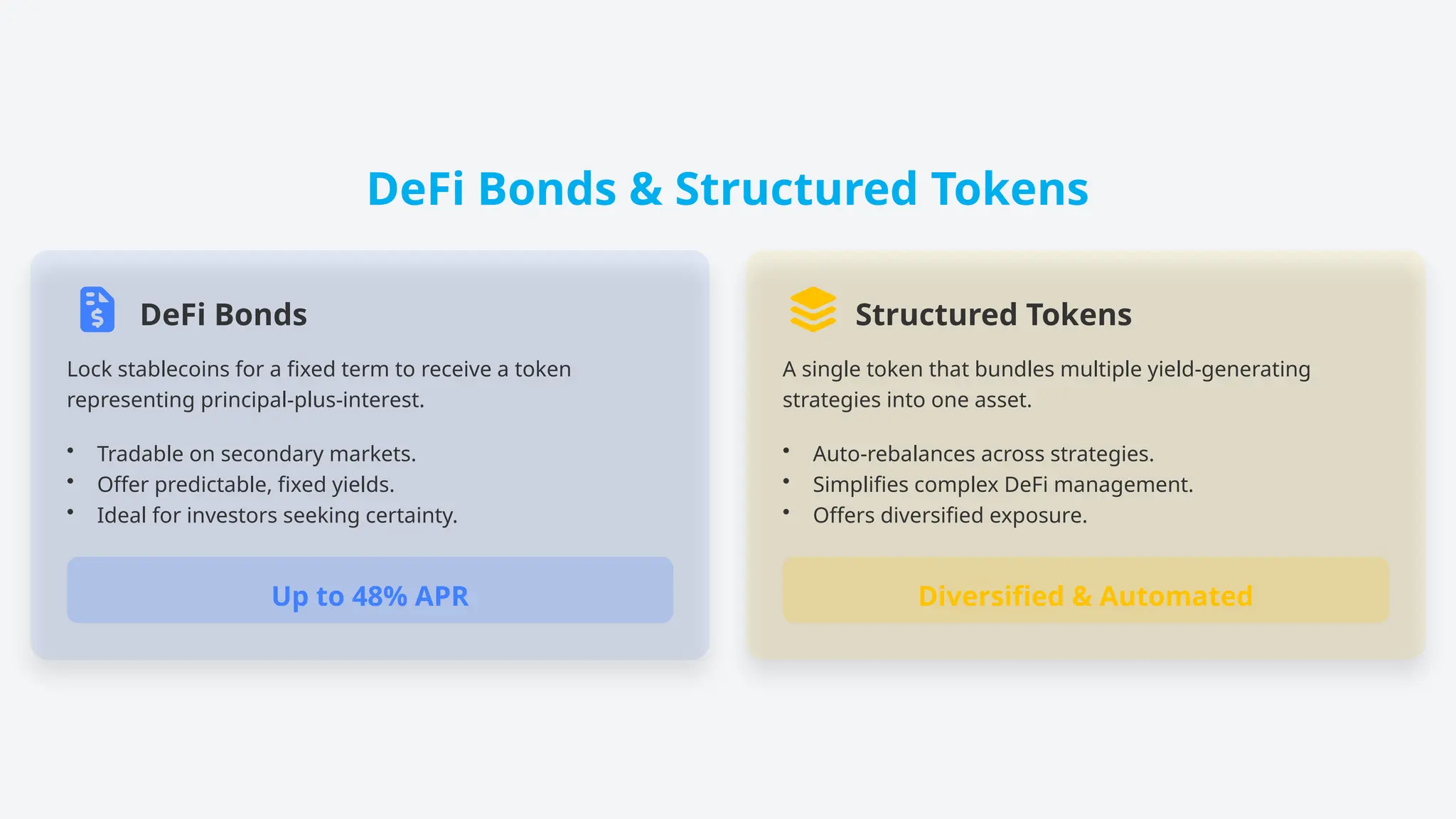

In DeFi, passive income is earned by supplying crypto assets to protocols that pay you for participation: stake ETH to a validator and receive ~4% APR in fresh ETH; deposit stablecoins into Aave and collect variable interest from over-collateralized borrowers; add token pairs to Uniswap liquidity pools and earn a share of trading fees while accepting impermanent-loss risk; or farm governance tokens by locking LP receipts, boosting yields above 20% until emissions taper. Liquid-staking derivatives like stETH let you keep exposure while re-using the receipt elsewhere, and yield aggregators automatically rotate funds to the highest audited farms, compound rewards, and cover gas, delivering double-digit returns with minimal user action.