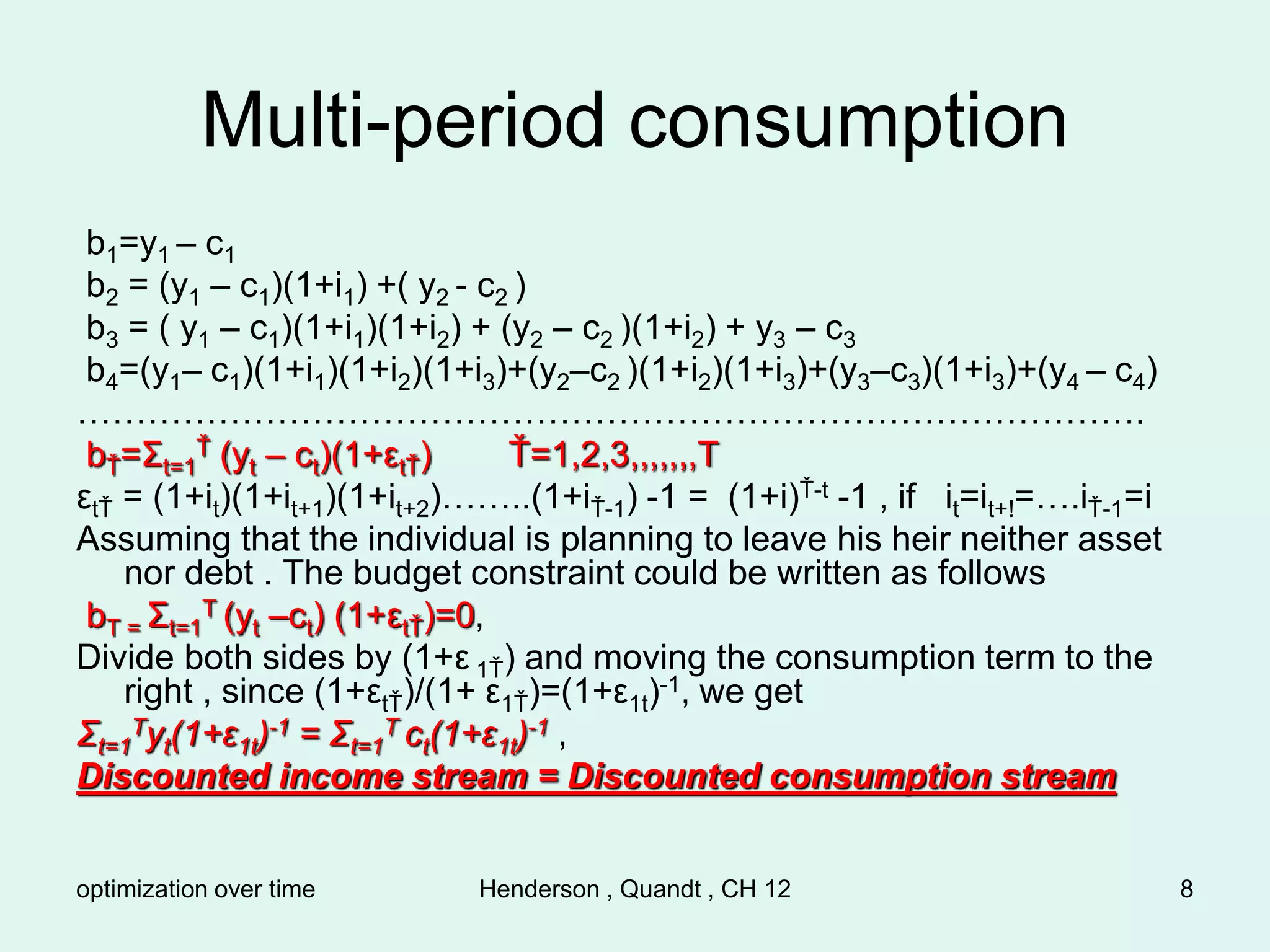

1) The document introduces multi-period optimization, where consumers maximize utility over multiple time periods rather than just one. Consumers can borrow and lend between periods.

2) Basic assumptions include the availability of one-period bonds for borrowing and lending, with interest rate i. Consumers maximize a multi-period utility function subject to their intertemporal budget constraint.

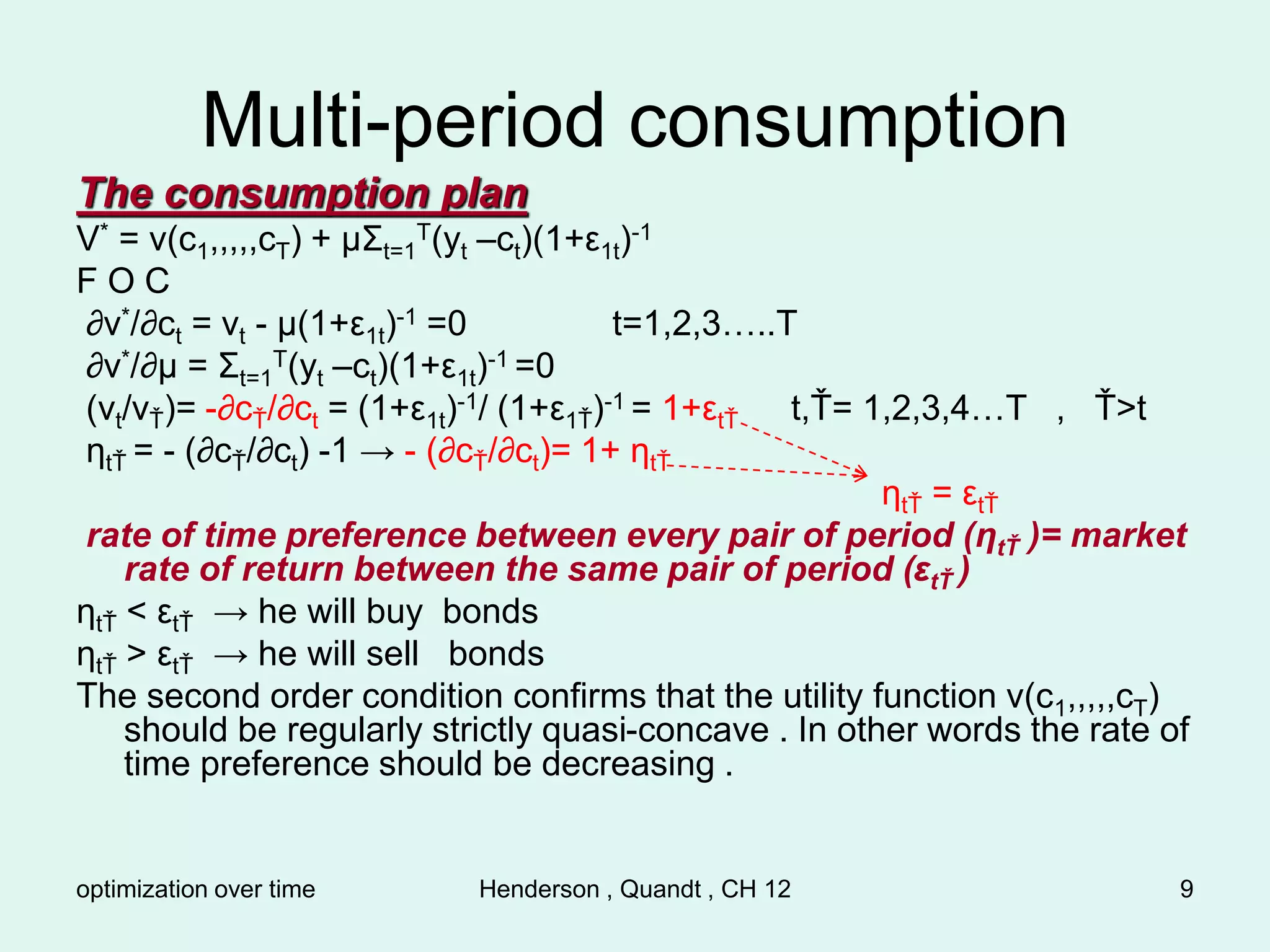

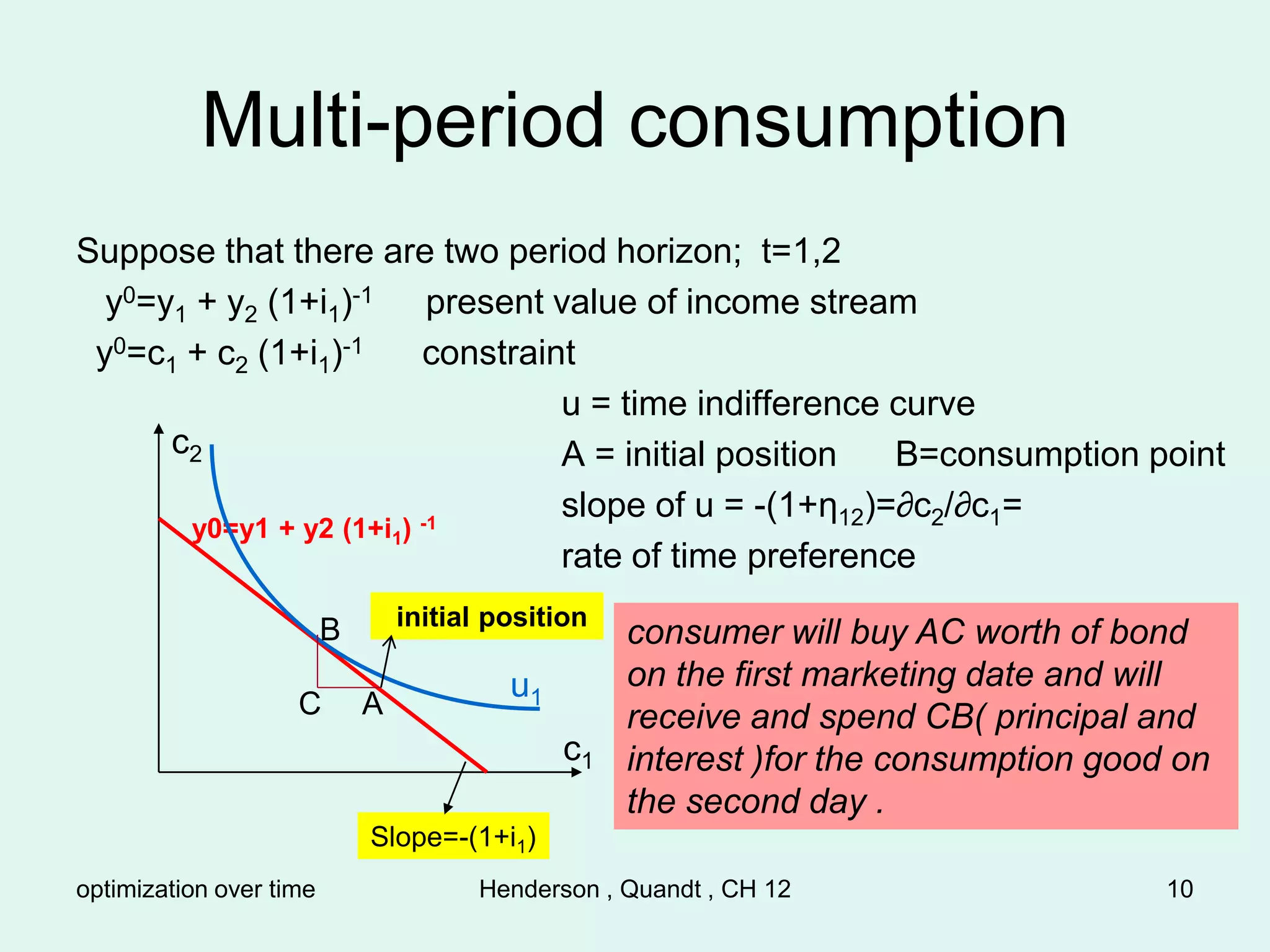

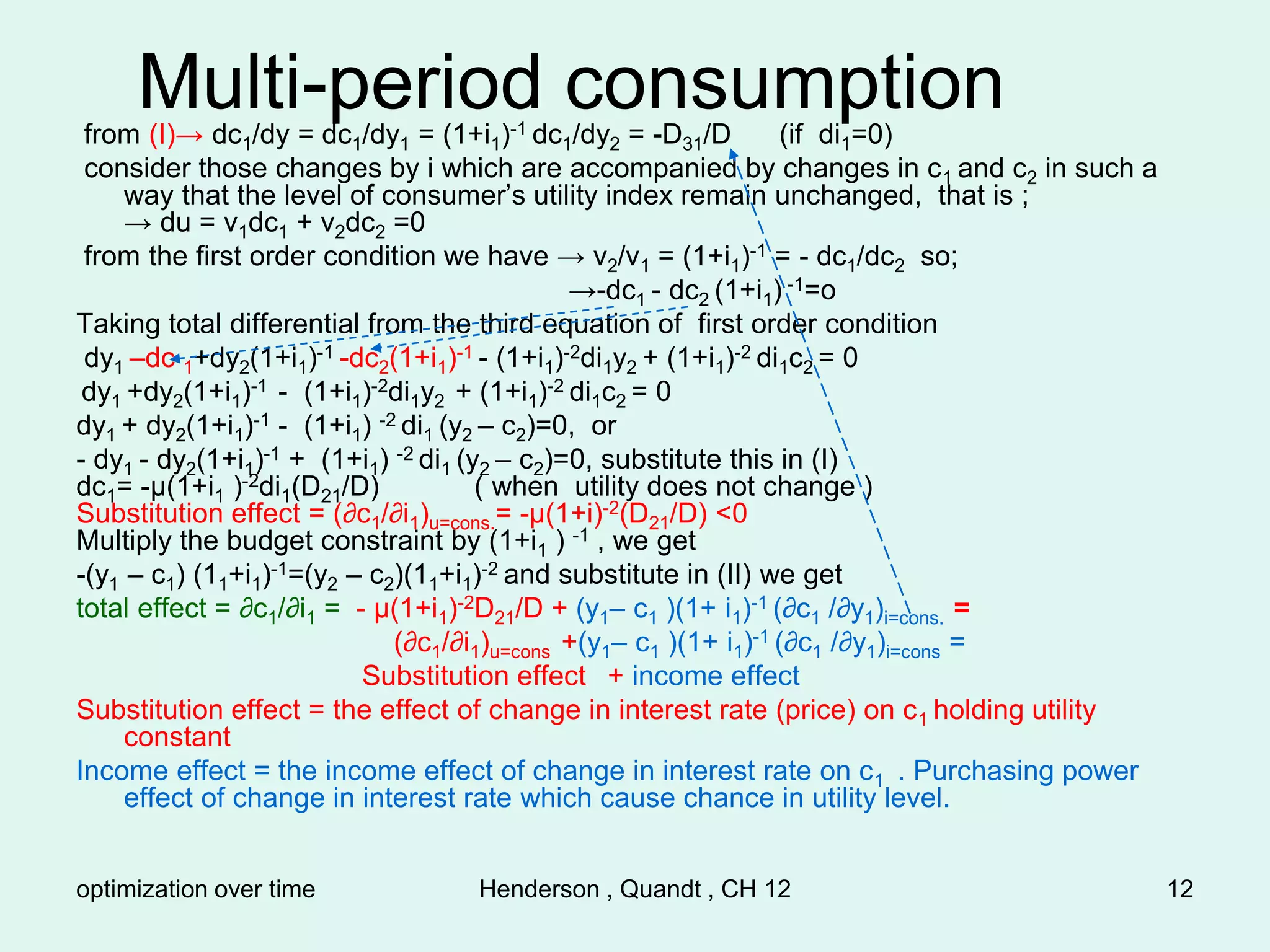

3) The consumer's rate of time preference η between any two periods should equal the market interest rate ε between those periods for an optimal consumption plan. If η is less than ε, the consumer will borrow, and vice versa if η is greater than ε.

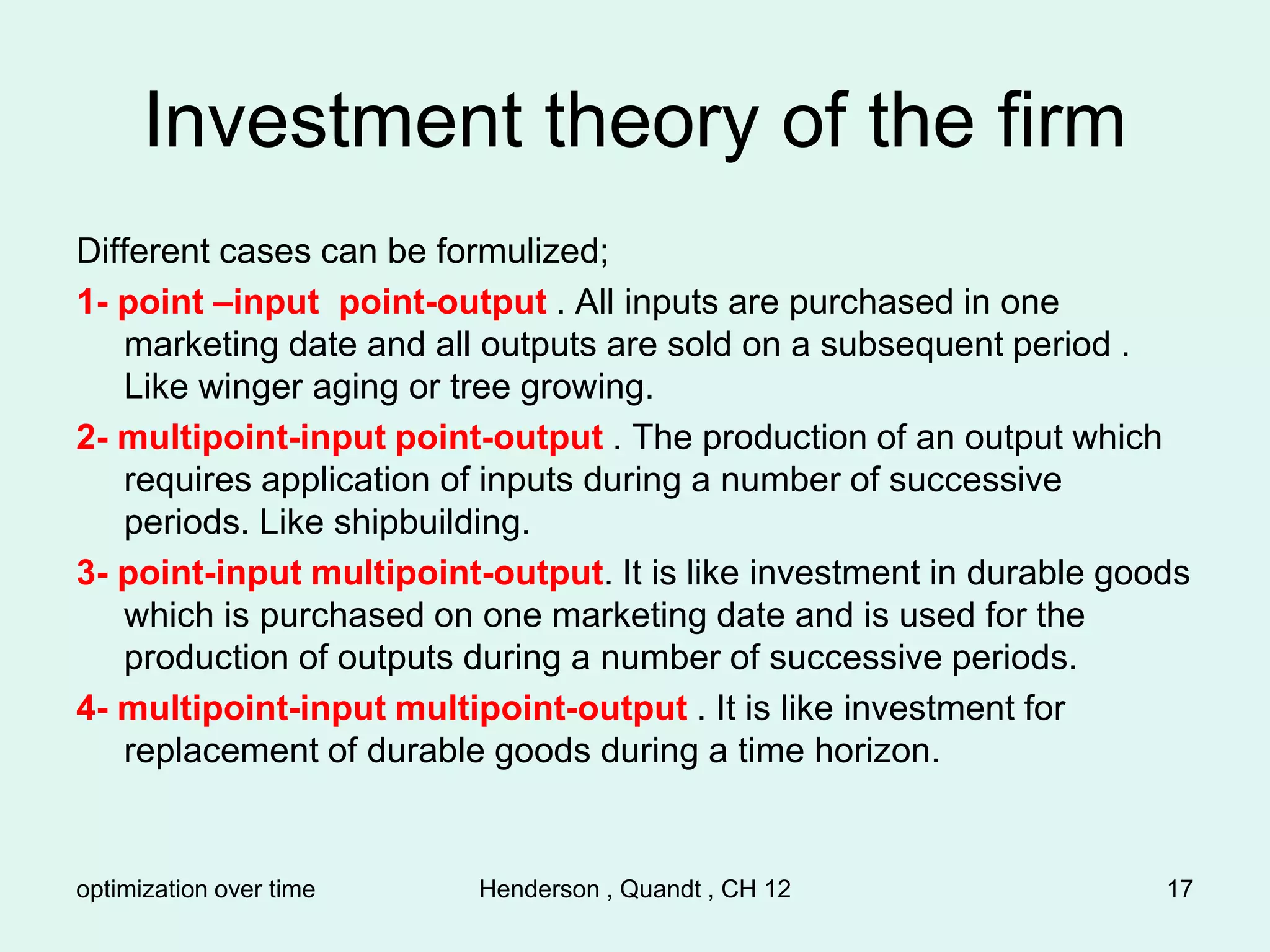

![optimization over time Henderson , Quandt , CH 12 3

Basic concepts

Market rate of interest.

Suppose that a consumer receives bt on the tth marketing date and

continues to reinvest both principal and the interest until the Ť

marketing date.

t=0→→→→→t=t→→→→→→t=Ť→→→→t=T

bt= value of consumer’s investment in the beginning of tth marketing

date.

b t+bt it =bt (1+it) = value of consumer’s investment in the beginning of

( t+1) marketing date

bt (1+it) +[ bt (1+it) ] it+1 = bt(1+it)(1+it+1)= value of investment in the

beginning of (t+2) marketing date.

bt(1+it)(1+it+1)……(1+iŤ-1)= value of investment in the beginning of the Ť

marketing date.

J= bt(1+it)(1+it+1)……(1+iŤ-1) – bt = total return on investment .

εtŤ=(J/bt)=(dJ/dbt)= [ (1+it)(1+it+1)……(1+iŤ-1) – 1 ] = average rate of

return= marginal rate of return.

εtt = 1 -1 =0 , εtt+1 = ( 1 + it ) -1= it

If it = it+1 = it+2 = it+3 =….. =iŤ-1 = i , then εtŤ = (1+ i)Ť-t – 1 ;

as it is seen the level of interest rates and not the order of their

sequence affects the rate of return](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-3-2048.jpg)

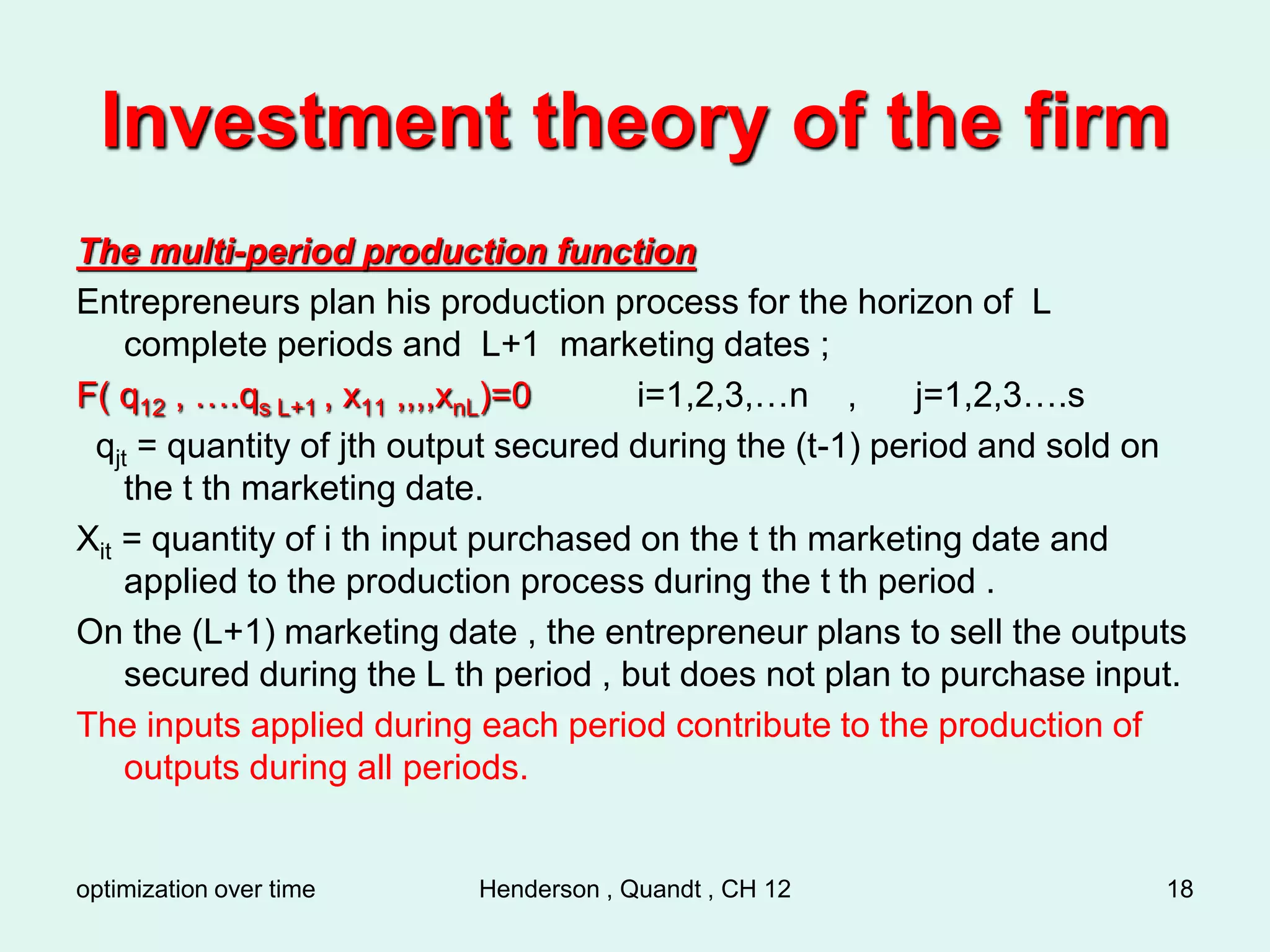

![optimization over time Henderson , Quandt , CH 12 4

Basic concepts

Discount rate and present value

Rational consumer will not consider one dollar payable on the current

marketing date equivalent to one dollar payable on some future

marketing date. Because , consumption at present time has more

utility than consumption in future. Delaying consumption will lower

the utility (assuming constant price and no inflation) .

Discount rate payable on the tth ( t=1→→→t=t ) marketing date

(beginning from t=1) is equal to ;

[ (1+i1)(1+i2)…….(1+it-1) ] -1 = ( 1+ ε1t)-1

Investing one dollar in first marketing date (t=1) will result in ( 1+ ε1t)

dollars in the tth marketing date. in other words ( 1+ ε1t)-1 dollars in

the tth marketing date worth one dollar on the first marketing date

In the same way the present value of the income stream (y1,y2,y3,,,yŤ)

would be equal to Y= y1+[y2/(1+ε12)]+[y3/(1+ε13)]+….+[yŤ/(1+ε1Ť)]

If all the interest rates are positive then denominator will increase and

the discounted values would decrease .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-4-2048.jpg)

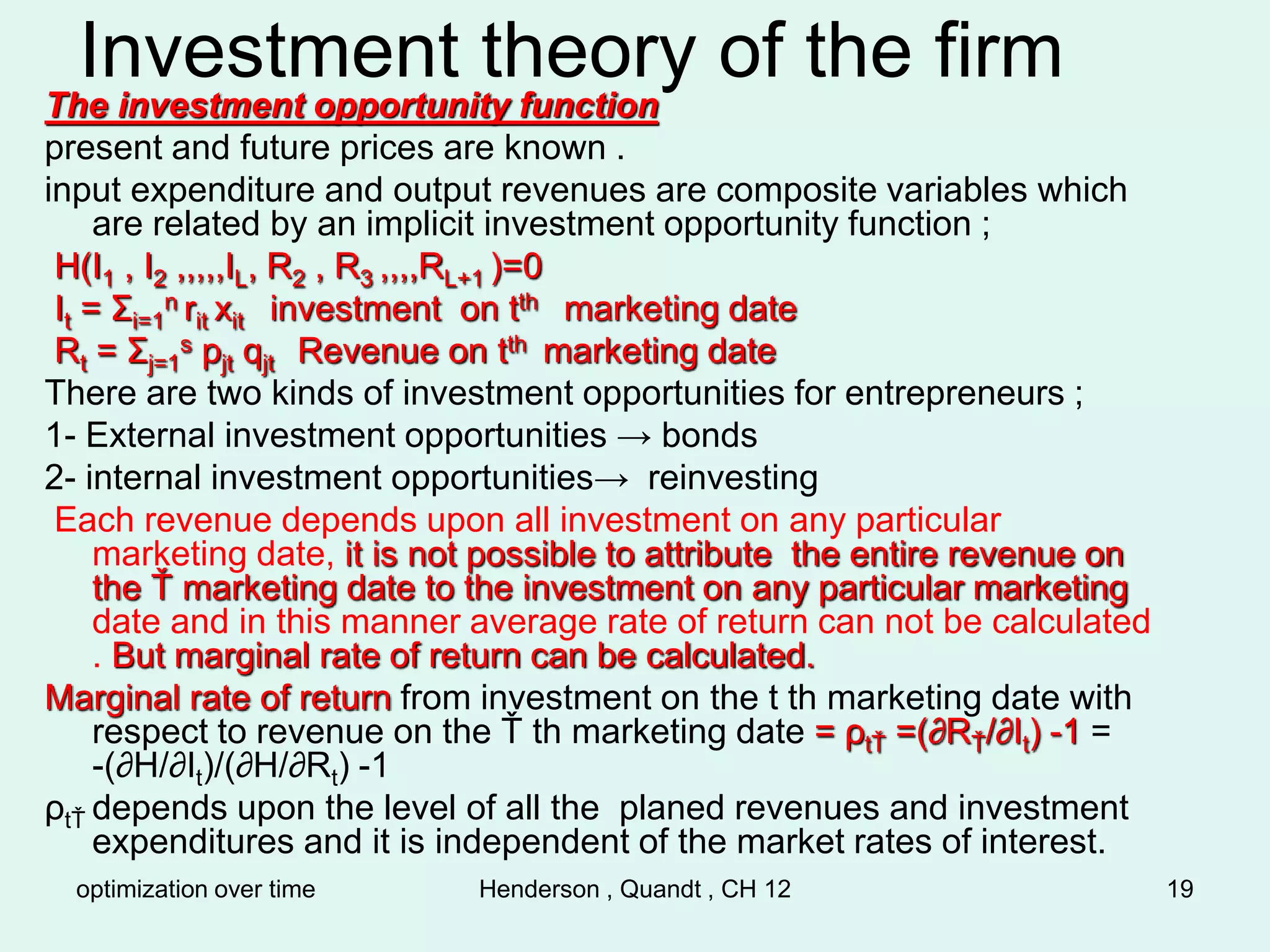

![optimization over time Henderson , Quandt , CH 12 5

Multi-period consumption

Multi-period utility function

U=U(q11,,,qn1 , q12,,,,qn2 , q13,,,,,qn3 ,,,,,, q1T,,,,,qnT)

qjt= quantity of qj consumed during the tth period .

Actual and expected commodity prices are fixed in values and

remained unchanged.

Ct= Σj=1

n pjtqjt = consumer total expenditure for commodities consumed

on the tth marketing date. t = 1,2,3,4,,,T.

Redefine the utility function as follows ;

V=V(c1, c2 , c3 ,,,,cT) indirect utility function

dv= [∂v/∂cŤ]dcŤ + [∂v/∂ct]dct= vŤdcŤ + vtdct =0 (indifference locus )

(vt/vŤ)=-(dcŤ/dct) = the rate of return at which consumption expenditure

on the Ť th marketing date must be increased to compensate for a

reduction of consumption expenditure on the tth marketing date to

leave the consumer satisfaction level unchanged during the time

horizon. This is called time substitution rate](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-5-2048.jpg)

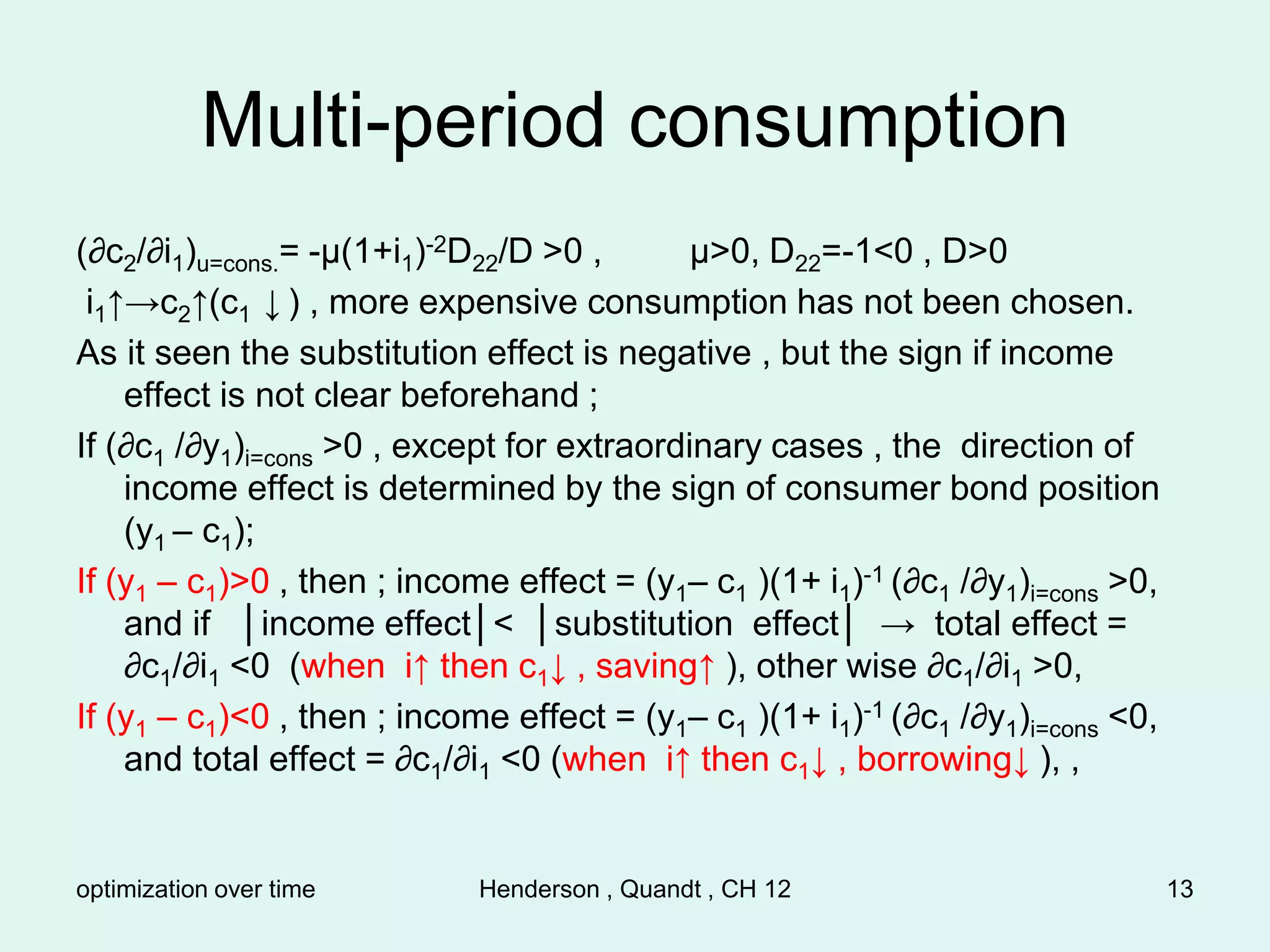

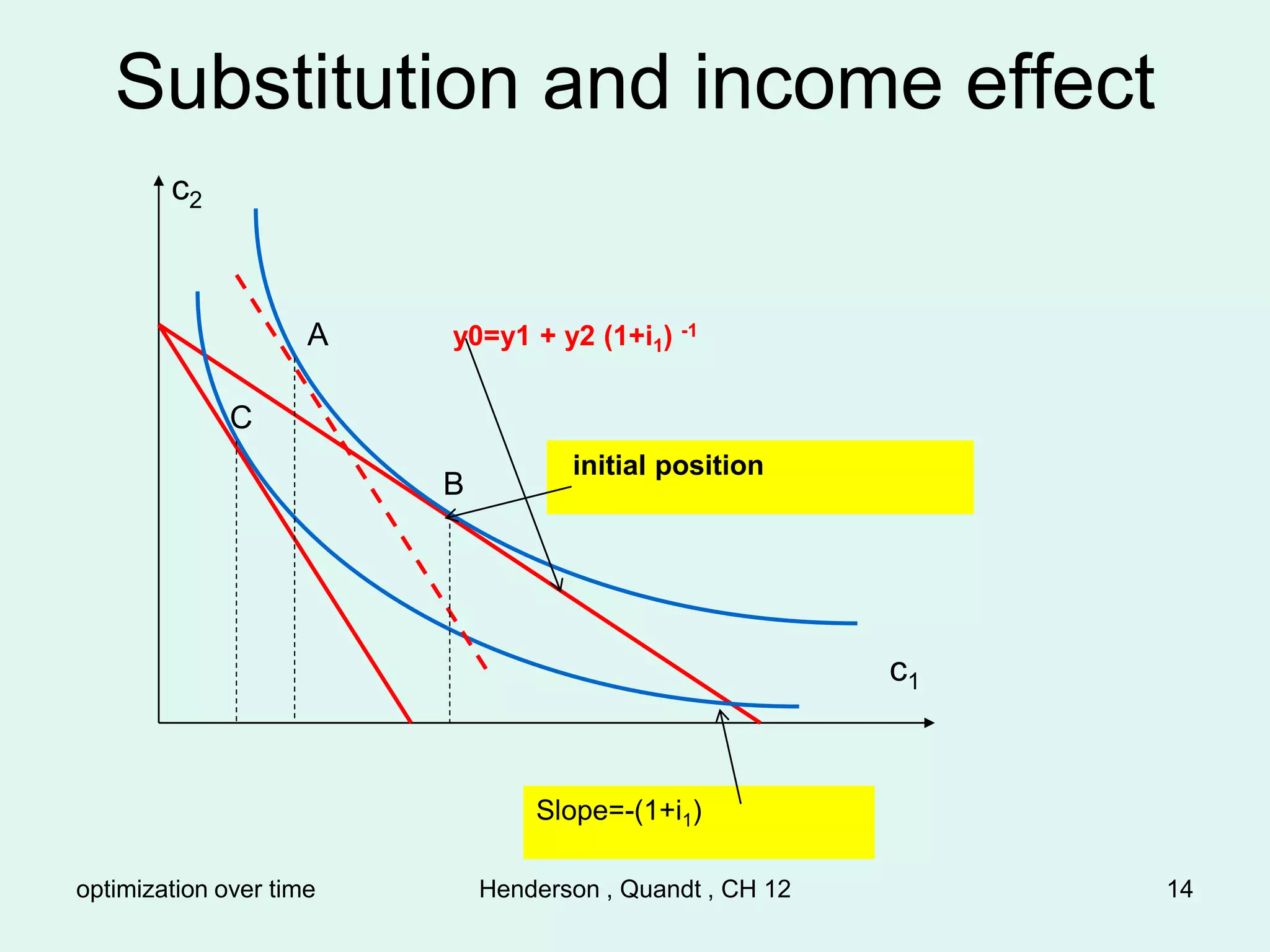

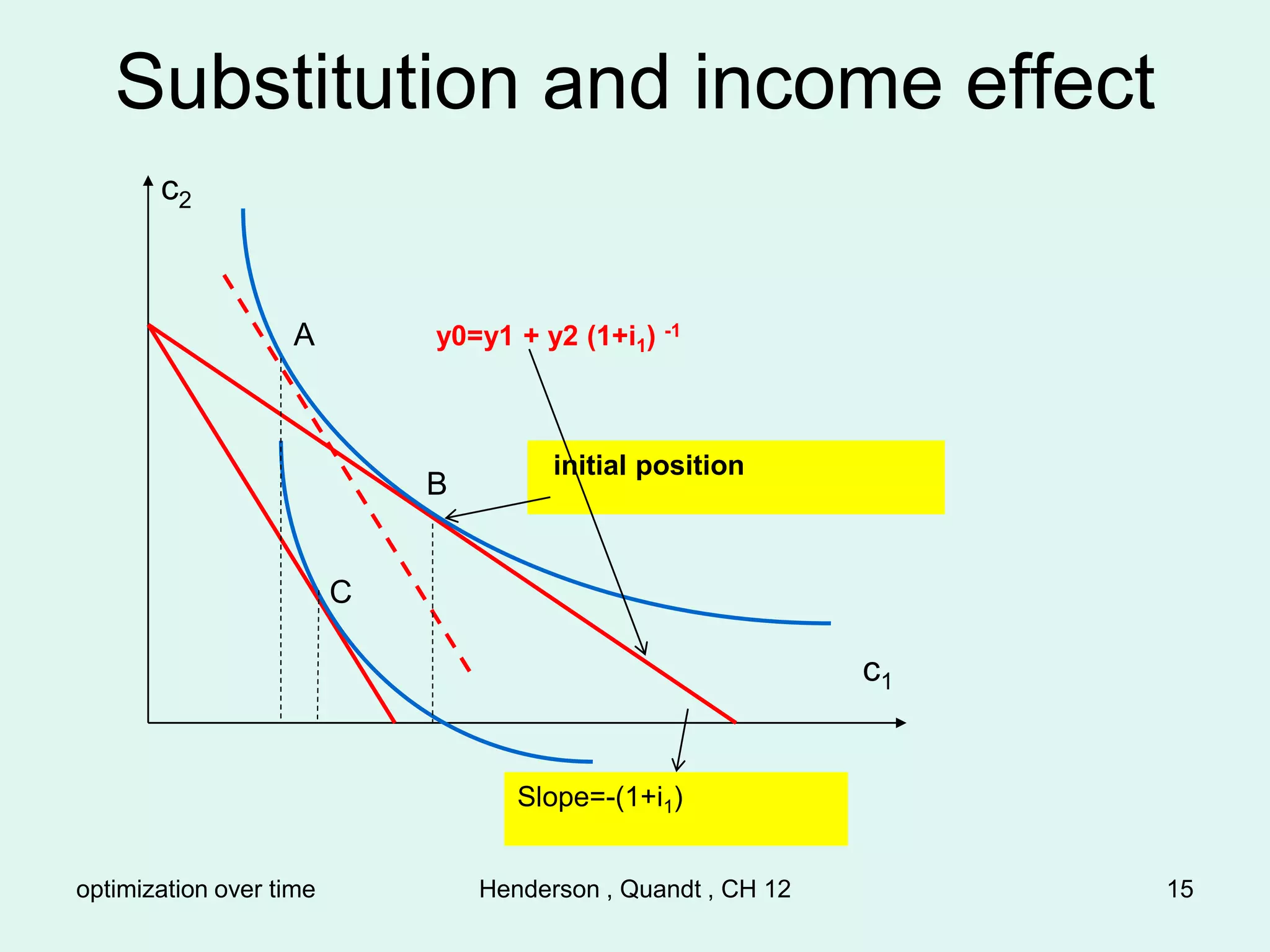

![optimization over time Henderson , Quandt , CH 12 11

Multi-period consumption

Substitution and Income effect

V* = v(c1,c2) + µ[(y1 – c1) +(y2 – c2)(11+i1)-1]

F .O .C.

∂v*/∂c1 = v1 - µ = 0

∂v*/∂c2 = v2 - µ(1+i1)-1=0

∂v*/∂µ = (y1 – c1) +(y2 – c2)(11+i1)-1 = 0

Differentiate totally from the first order condition

v11 v12 -1 dc1 0

v21 v22 -(1+i1)-1 dc2 = - µ (1+i1)-2 di

-1 -(1+i1)-1 0 dµ -dy1 – (1+i1)-1dy2+(y2-c2)(1+i1)-2di1

Using Cramer’s rule ;

dc1=(0)(D11/D)-µ(1+i)-2di1(D21/D)+[-dy1–(1+i1)-1dy2+(y2-c2)(1+i1)-2di1]D31/D (I)

Where Dij is the cofactor of element in ith row and jth column

If di1≠0 , and dy1 = dy2 = =0 , then ;

∂c1/∂i1 = total effect = -µ(1+i1)-2D21/D + (y2 – c2 )(1+ i1)-2D31/D (II)

Y = y1 +y2(1+i1)-1 , present value of the consumer’s earned income .

An increase in y1 by one or y2 by (1+i1) would increase Y by one . So;](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-11-2048.jpg)

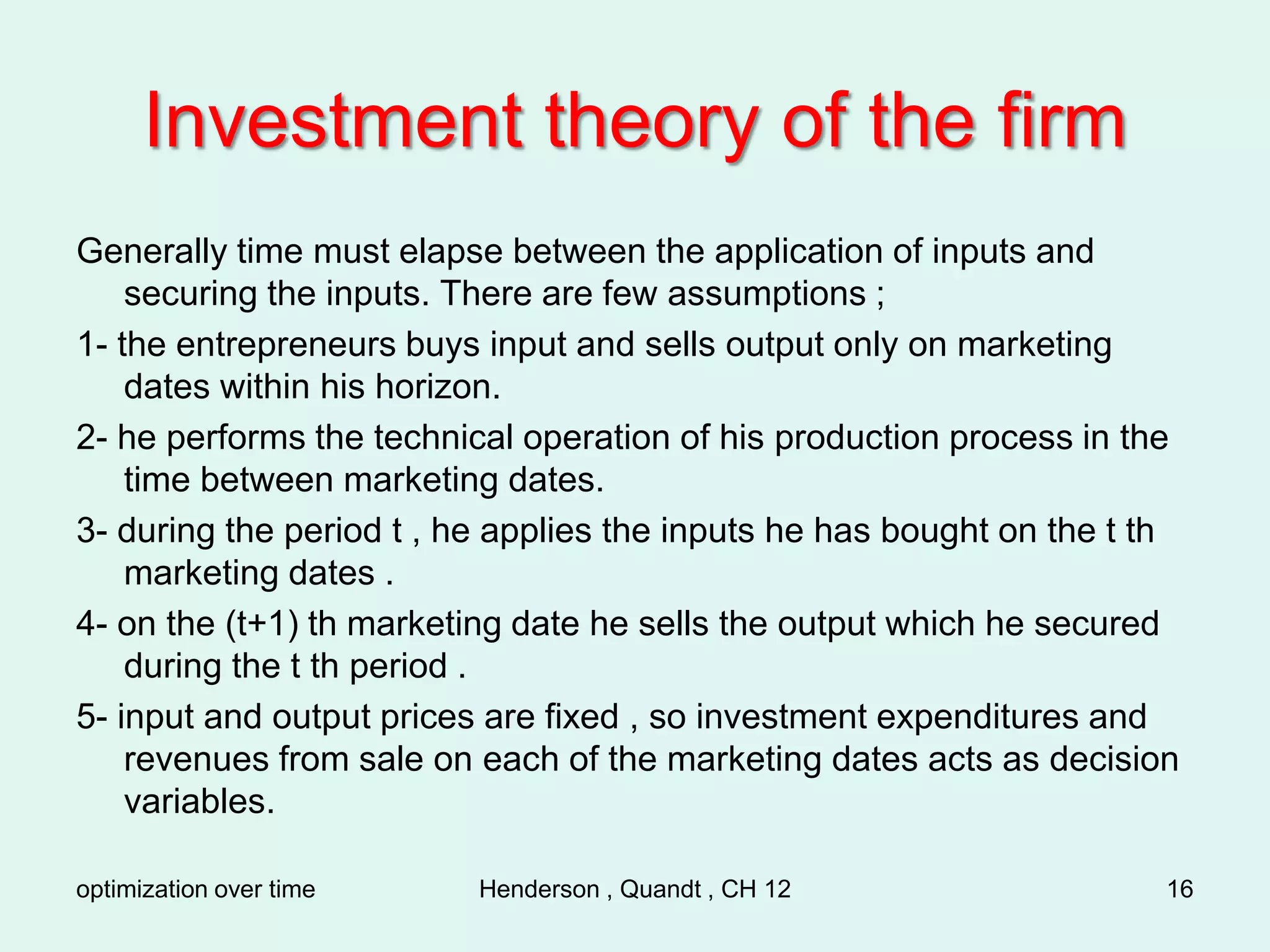

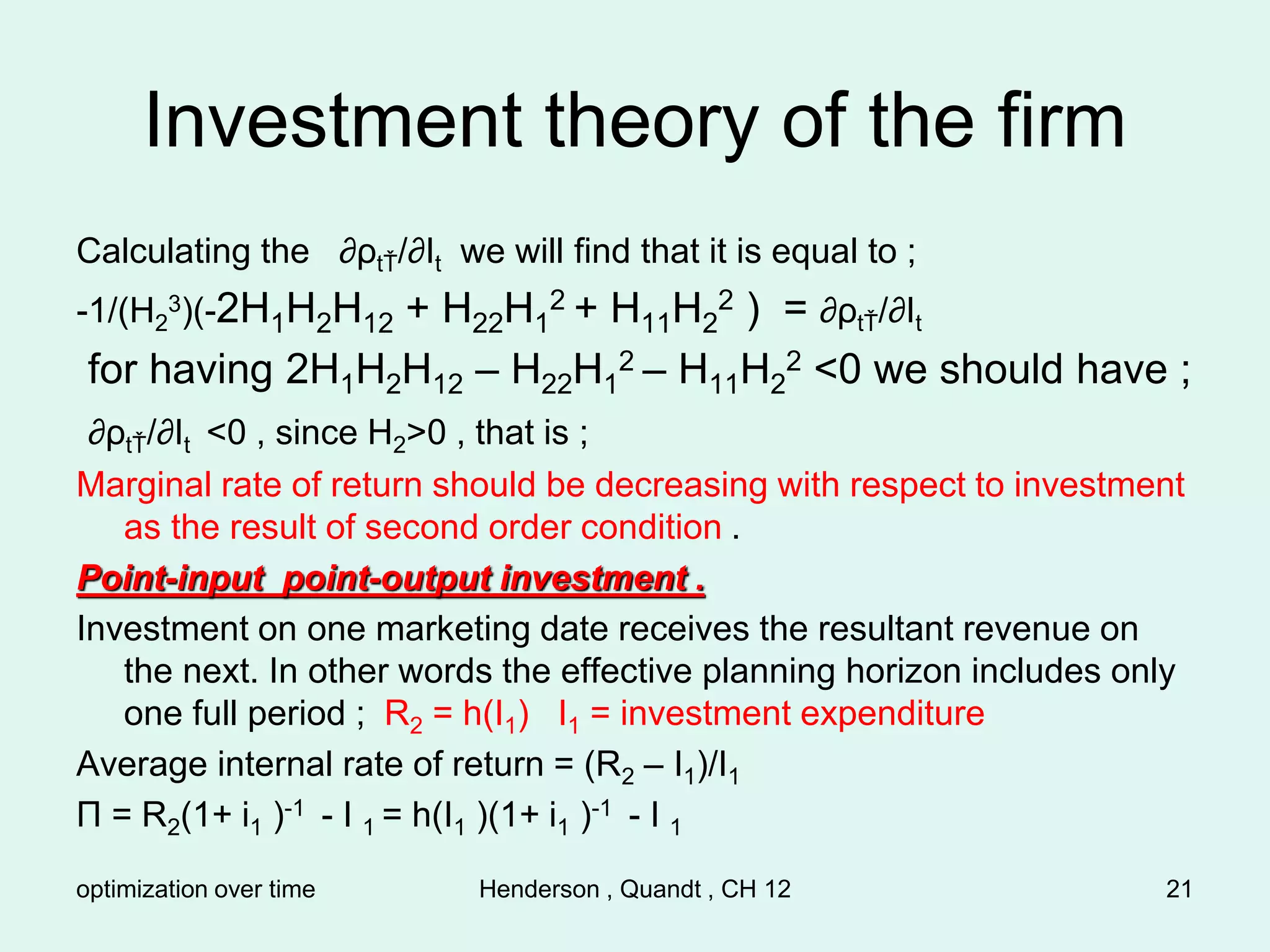

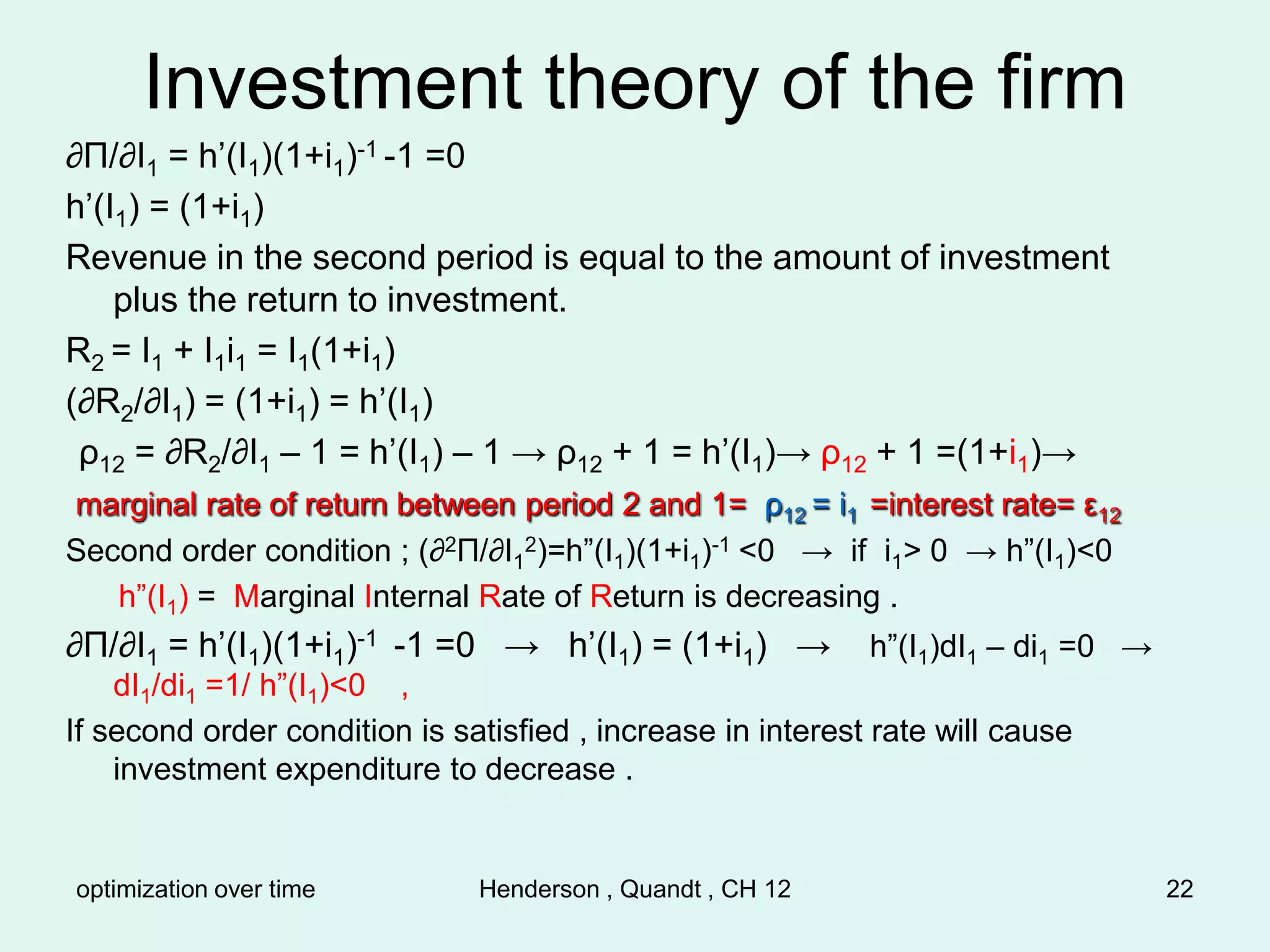

![optimization over time Henderson , Quandt , CH 12 20

Investment theory of the firm

The investment plan

Max Π* = Σt=2

L+1 Rt(1+ ε1t)-1 - Σt=1

L It(1+ ε1t)-1 +µH(I1, ,,,,,RL+1)

∂Π*/∂RŤ = (1 + ε1Ť)-1 + µ ∂H/∂RŤ = 0 Ť =2,3,4,,,,,L+1

∂Π*/∂It = - (1 + ε1t)-1 + µ ∂H/∂It = 0 t=1,2,3……L

∂Π*/∂µ = H(I1, ,,,,,RL+1) = 0

(∂H/∂It )/(∂H/∂RŤ )=[(1+i1)….(1+it-1)-1+1]-1 / [(1+i1)….(1+iŤ-1)-1+1]-1 =

1/ [(1+it)….(1+iŤ-1)-1+1]-1= [(1+it)….(1+iŤ-1)] = - (1+ εtŤ)

(∂H/∂It )/(∂H/∂RŤ)=-(1+ρtŤ)=-(1+ εtŤ) →ρtŤ=εtŤ optimum level of investment

Marginal internal rate of return (internal investment )=ρtŤ = εtŤ = market rate of

return (external investment )

t=1,2,3..L , Ť= 2,3,4,,,,L+1

ρtŤ < εtŤ , entrepreneur buy bonds , contract investment

ρtŤ > εtŤ , entrepreneur sell bonds , expand investment

S . O. C.

H11 H12 H1 H11 H12 H13 H1

H21 H22 H2 < 0 → 2H1H2H12 – H22H1

2 – H11H2

2 <0 H21 H22 H23 H2 > 0

H1 H2 0 H31 H32 H33 H3

H1 H2 H3 0](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-20-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 25

Investment theory and the role

of the firm .

Interest rate theory is characterized by the fact that time elapse between the

application of inputs and the attainment of the resultant output.

Continuous compounding and discounting.

We should note that time is continuous and transaction may take place at any

point in time.

If Wt is the interest of one dollar investment at the end of t years period ;

$1 at t=0→t=1[W1=(1+i)] →t=2 [W2= (1+i)2 ]→t=3 [W3=(1+i)3 ]→…t=t [Wt=(1+i)t ]

Wt = (1+ i) t

,, if interest rate compound once a year.

Wt = (1+ i/2) 2t

,, if interest rate compound twice a year , one half of i would

compound every six months .(1/2 of a year )

Wt = (1+ i/n)nt

,, if interest rate compound n times a year , 1/n of i would

compound every 1/n of a month.

Z=(1+i/n)nt ,→ Ln Z = nt Ln (1+i/n) → Ln Z =[Ln(1+i/n)] / (1/nt)

if n → ∞(continuous time)→Lim Ln Zn→∞ = 0/0

Using Hopital rule → Lim Ln Zn→∞ =(i)(t) → Lim Z n→∞ = eit

So the present value of u dollars payable at time t is equal to ue-it](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-25-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 26

Investment theory and the role

of the firm .

Point and flow variables

Transaction may take place at any point in time and their values may

be the function of the time at which they occur.

R(T) =revenue (dollar value) , realized at time t =T

R(T)e-iT = present value of the revenue at time T

d[R(T)e-iT ]/dT = [R’(T) –iR(T)]e-iT = marginal discounted revenue with

respect to time.

We should note that inputs , outputs , costs, and revenues may be

realized as flow variables over time . Flow variables may occur at

constant rate over time or their rate may be a function of the time .

R=R(t) = rate of flow of income at instant t measured in dollars per

year.

R=R(T) denotes point value at time T .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-26-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 27

Investment theory and the role

of the firm .

R0T = ∫0

T R(T)e-it dt = present value of revenue stream R(T) from

t=0 to t=T

dR0T/dT = R(T) e-iT , marginal revenue of an income stream with

respect to time

Consider a income stream R(t) from t=0 to t=T , and a point value at T

with equal present value , RT e-iT = ∫0

TR(t)e-it dt , then ;

RT= ∫0

TR(t)e-i(T-t) dt , as it is seen a flow variable , R(t) , could be

converted into an equivalent point variable , R(T).

Consider a constant income flow , α , with present value equal to that of

a point value T , RT e-iT = ∫0

T αe-it dt = α ∫0

T e-it dt = α δ in which δ

equal to δ= [(1-e-iT)/i ] = ∫0

T e-it dt = present value of one dollar

income stream for T years .

Finding α from the RT e-iT = ∫0

T αe-it dt , and substituting from

[(1-e-iT)/i ] = ∫0

T e-it dt , we will find α = [i / (e-iT -1)] RT ,, which

provides a mean for converting a point value into an equivalent

constant flow.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-27-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 28

Investment theory and the role

of the firm .

Point –input Point-output

All inputs are applied at one point in time and all outputs are sold at a later

point in time. Winger aging .

I0 = cost for buying cask of grape juice . Frgmantation and aging is costless .

The only other cost is interest paid for I0

R(T) = sales value of winger at point T . T is the aging period .

Profit max→Π = R(T)e-iT – I0 , dΠ/dT = [R’(T)– i R(T)]e-it=0 (I)→ [R’(T)/R(T)] = i

[R’(T)/R(T)]= Proportionate rate of return with respect to time= i =

proportionate marginal rate of return with respect to time

S. O. C.→ d2Π/dT2 = [R”(T)-2iR’(T)+i2R’(T)]e-iT<0

Substituting from FOC →[ R”(T)R(T)–[R’(T)]2 ] / [R(T)]2 <0 →d[R’(T)/R(T)]/dT <0

Solving the first order equation we will get T=T0

If investment period = T0 , marginal earning from winger aging = earning from

investing R(T) in bond market.

If investment period < T0 , marginal earning from winger aging > earning from

investing R(T) in bond market.

If investment period > T0 , marginal earning from winger aging < earning from

investing R(T) in bond market.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-28-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 29

Investment theory and the role

of the firm .

Totally differentiate the first order condition we get;

R”(T)dT – iR’(T)dT – R(T)di =0

dT/di = R(T) / [R”(T) – i R’(T)] < 0 [R”(T) – i R’(T)] < 0

if i goes up it will force the entrepreneur to shorten his aging period

Continuous-Input Point-Output

Example ; tree growing , ship building .

Seedling cost = I0 (initial fixed cost )

Cultivation cost = G(t) per year , (variable cost during the investment

period)

Selling price of the tree at time t=T R=R(T)

Π=R(T)e-it – I0 - ∫0

TG(t)e-itdt =present value of profit

dΠ/dT = [R’(T) – iR(T) – G(T)]e-iT = 0

[R’(T) – G(T)] / R(T) = i →

proportionate rate of return net of cultivation cost=interest rate](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-29-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 30

Investment theory and the role

of the firm .

Point-Input Continuous-Output

Investment in durable equipment which yields a revenue stream over

time . (swing machinery)

Suppose that the equipment yields revenue at a constant rate of R

dollars per year during its life.

I0 = I(T) = investment cost T =life time of machine .

Π = ∫0

T Re-itdt – I(T)

dΠ/dT = Re-iT – I’(T) = 0 → Re-iT = I’(T)

Present value of additional revenue from increased durability =

marginal cost of durability

S. O. C. → d2Π/dT2 = -iRe-iT – I”(T) < 0 → S.O.C. is satisfied if the

marginal cost of durability is increasing over time → I”(T)>0

Differentiating the first order condition →dT/di =[TRe-iT]/ [-iRe-iT-I”(T)] <0

if interest rate goes up (i↑)→ life time of machine should shorten (T)↓.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-30-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 33

Investment theory and the role

of the firm

Retirement of a single machine

Max Π1 = [ ∫0

T Z(t)e-iT dt ] – I0 + S(T)e-iT , T= life time of machine ,

Π1 = present value of the profit stream for the first machine

dΠ1/dT = [ Z(T) – i S(T) + S’(T) ] e-iT = 0

Z(T) – i S(T) + S’(T) =0 → Z(T) + S’(T) = i S(T) F.O.C.

Z(T)= marginal quasi rent

S’(T) <0 , depreciation flow or marginal loss of scrap value

i S(T)= interest from investing the scrap value ,

S.O.C. ; d[ Z(T) – i S(T) + S’(T) ]/dT <0

d[ Z(T) + S’(T) ]/dT < d [i S(T) ]/dT S’(T)<0

Quasi-rent less depreciation flow decrease more rapidly than the

alternative bond-market return.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-33-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 34

Investment theory and the role of the firm

Replacement of a chain of machine (Continuous-Input Continuous-Output)

Infinite horizon , infinite chain of machine succeeding each other. Quasi-rent

function , initial cost, planned life of the machine and scrap value are the

same for each machine except for the dates of obtaining them. Πi = present

value from the operation of ith machine.

Π1=∫0

T Z(t)e-it dt – I0 + S(T)e-iT

Π2=∫T

2T Z(t-T)e-it dt – I0e-iT + S(T)e –i2T = Π1e-iT

Π3=∫2T

3T Z(t-2T)e-it dt – I0e-i2T + S(T)e-i3T =Π1e-i2T

……………………………………………………..

Πk=Π1e-i(k-1)T = [∫0

T Z(t)e-it dt – I0 + S(T)e-iT ]e-i(k-1)T

Π= Σk=1

∞ Πk = total profit from the chain of the machine

Π = Σk=1

∞ Πk = Π1(1 + e-iT + e-i2T +…. +e-i(k-1)T) , k →∞ Π = Π1[1/(1-e-iT)]

dΠ/dT = {[Z(T)–iS(T)+S’(T)]e-iT(1-e-iT)-ie-iT[ ∫0

T Z(t)e-it dt–I0 + S(T)e-iT]}/(1-e-iT)2

Multiplying the both sides by e-iT(1-e-iT) and rearranging the terms ,

Z(T) + S’(T) = (1/δ ) [∫0

T [Z(t)e-it dt – I0 + S(T)] ,

δ=(1-e-iT)/i=∫0

Te-itdt = present value of one dollar income stream for T years.

∫0

T Z(t)e-it dt – I0 + S(T)= present value of the return of new machine

( with life time equal to T years )net of its investment cost plus the scrap value

of the old machine.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-34-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 35

Investment theory and the role of the firm

Income stream per year fot T years present value of the investment

after T years.

one dollar δ

X [∫0

T Z(t)e-it dt – I0 + S(T)]

(1/δ ) [∫0

T Z(t)e-it dt – I0 + S(T)] = present value of the average return per

year of new machine net of its investment cost plus the scrap value of

the old machine.

[(Z(T) + S’(T)] = marginal rate of quasi-rent flow net of depreciation

machine is replaced when its marginal rate of quasi-rent flow net of

depreciation equals the present value of the average return per year of

new machine net of its investment cost plus the scrap value of the old

machine.

The first order condition in this case and one machine case are different in

the sense that;

In the one machine case , entrepreneur is looking for continuing to operate

the machine or investing its scrap value in the bond market. While in the

infinite number of machine case the entrepreneur is looking for operating

an existing machine or operating a new one .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-35-2048.jpg)

-t + λ(q0- Σt=1

nqt)

∂V/∂qt = [pt – c’(qt)](1+i)-t - λ =0

∂V/∂λ = q0 - Σt=1

n qt =0

[pt – c’(qt)](1+i)-t = λ , λ is the measure of scarcity

Present value of the difference between price and marginal cost for all

periods should be the same .

If pt = fixed , when time (t)↑ →(1+i)-t } ↓ → so we should have c’(qt)↓ →

qt ↓ , (if marginal cost is increasing as the result of second order

condition) .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-36-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 38

Human Capital

We could see the above alternative income streams in following figure;

T = working life time period .

yt

t

g(t)

f(t)

t0 t1 Ť T

Investment cost for college education =∫0

Ť [g(t)-f(t)]dt=Sa+Sb=

opportunity cost forgone (b) + direct cost (a)

Return from investment = ∫Ť

T [ f(t) – g(t) ] dt

When present value of investment cost =present value of the return

from investment ,→ the equilibrium rate of return (r) will be found which

could equalize the cost and return from the investment .

a

b

negative

income

=

cost](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-38-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 39

Human Capital

If r* is the rate at which present value of net return is equal to present

value of investment cost, then ;

=∫0

Ť [g(t)-f(t)] e-r*t dt = ∫Ť

T[ f(t) – g(t) ] e-r*t dt → ∫0

T [g(t)-f(t)] e-r*t dt =0

g(t) and f(t) are function of rate of return of income after graduation (r* ).

If r* > i college education is desirable

If r* < i college education is not desirable

i=market interest rate ,

Investment in training

In a competitive market labor will be paid according to his value of

marginal product.

Suppose that the government requires that the firm should hires some

members of a disadvantaged group whose initial marginal product is

less than the current wage (w) , but should be paid the same current

wage rate.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-39-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 40

Investment in training

For the disadvantaged group suppose that;

MP=f(t) , marginal product of labor is a function of time

VMPL = P MP = f(t) < w = the current wage rate If P=1→ VMPL = MP

Suppose the firm provides on job training program for this disadvantage

group till at time t=T , their marginal productivity would increase and

be equal to w , the current wage rate .

∫0

T[w-f(t)]e-it dt = Money paid to the disadvantage group in excess of

their marginal productivity till they productivity increase to w

cost of training = direct cost of training plus money paid to the

disadvantage group in excess of their marginal productivity. The

distribution of this cost depends upon the institutional setting . In a

competitive market the entire cost will be born by disadvantage

group, since in these markets the labor will be paid only by their

value of marginal product .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-40-2048.jpg)

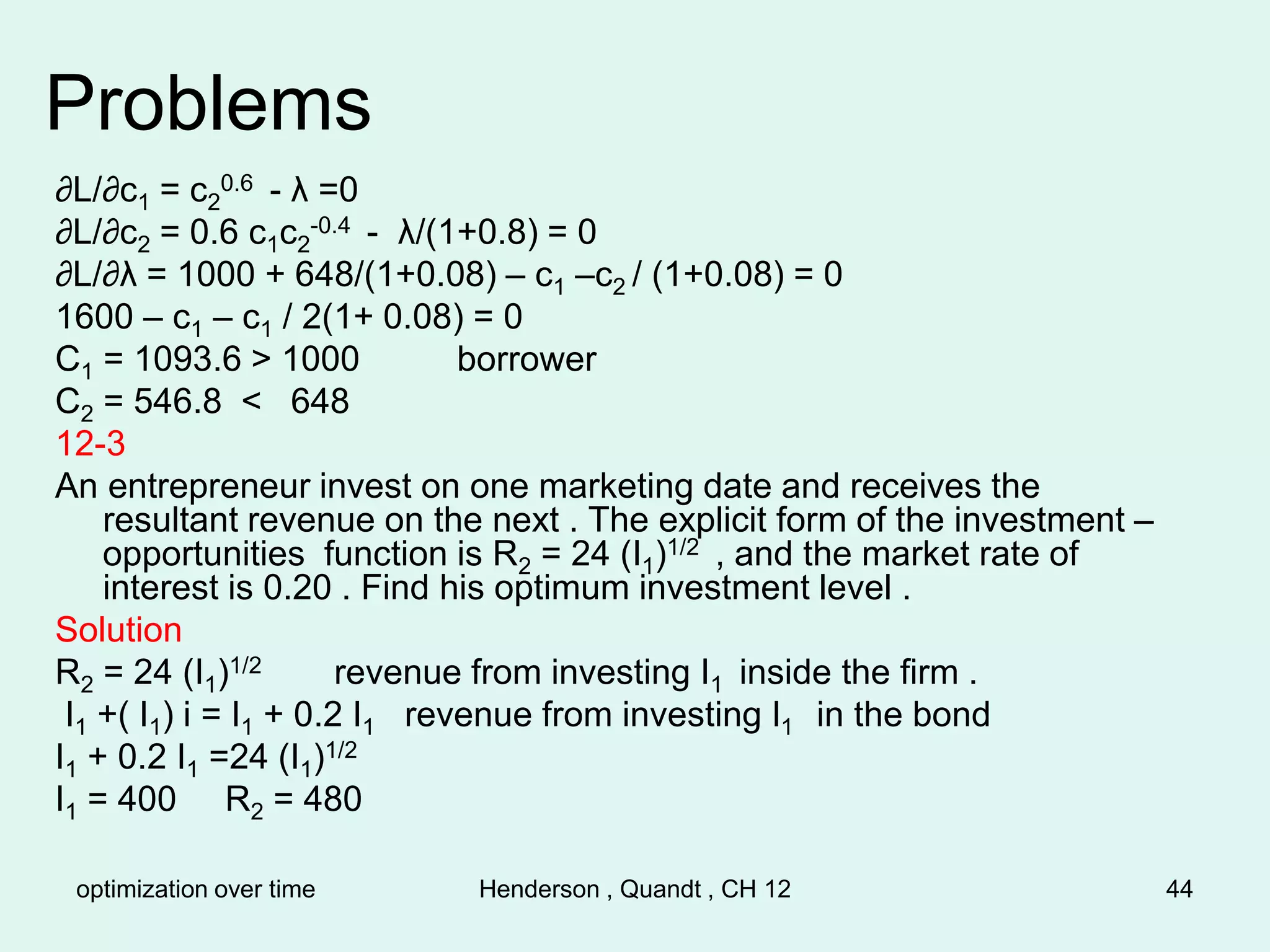

![optimization over time Henderson , Quandt , CH 12 43

Problems

12-1

Consider two alternative income streams ; y1 = 300 , and y2 =321 ,and

y1 =100 , and y2 =535 . For what rate of interest would the consumer

be indifferent between the two streams .

solution

300 + 321/(1+r) = 100 + 535/(1+r)

r = 0.07

12-2

A consumer consumption–utility function for a two period horizon is

U=c1c2

0.6 . His income stream is y1=1000 , y2=648 , and the market

rate of interest is 0.08. determine values for c1 and c2 that

maximizes his utility function . Is he a borrower or lender ?

Solution

Max U=c1c2

0.6

s.t. 1000 + 648/(1+0.08) = c1 + c2/(1+0.08)

L =c1c2

0.6 + λ [ 1000 + 648/(1+0.08) – c1 –c2 / (1+0.08) ]](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-43-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 45

Problems

12-4

Consider a bond market in which only the consumers borrow and lend. Assume

that all 150 consumers have the same two-period consumption –utility

function : U=c1c2 . Let each of the 100 consumers have the expected

income stream y1=10000 , y2=8400 , and let each of the remaining 50

consumers have the expected income stream y1= 8000 , y2 = 14000 . At

what rate of interest will the bond market be in equilibrium ?

Solution

The Lagrangian function for each consumer group is

V*= c1c2 +µ [ (y1 – c1 ) + (y2 – c2) (1+i)-1 ]

F. O. C.

∂V*/ ∂c1 = c2 - µ = 0

∂V*/ ∂c2 = c1 - µ (1+i)-1 = 0

∂V*/ ∂ µ = (y1 – c1 ) + (y2 – c2) (1+i)-1 = 0 , and solve for c1 ;

C1 = [ y1 + y2(1+i)-1 ] / 2 The consumer excess demand for bond is ;

y1 - c 1 = [y1 – y2(1+i)-1]/2 ,

Bond market equilibrium requires that aggregate excess demand by the two

groups of consumers equal zero ;

100[5000–4200(1+i)-1]+50[4000–7000(1+ i)-1]=700000–770000(1+i)-1=0→

i=0.10](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-45-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 46

Problems

12-5

An entrepreneur receives 100 dollars at t=5 , determine an equivalent

constant continuous income-stream from t=0 to t=5 if the interest

rate is 10 percent . Note that e0.5 = 1.64872 .

Solution

t=0→→→→→→t=5 . RT = 100

RT e-it = ∫0

t y e-it dt

y =[ i/(e-it - 1)]RT = 154.149

12-6

Consider an entrepreneur engaged in a point input point output vinegar

aging process .his initial cost is 20 , the sales value of the vinegar is

R(T)=100 T1/2 . And the rate of interest is 0.05 . How long is his

optimal investment period .](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-46-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 47

Problems

12-6 solution

Π=R(T) e-iT - Io = 100 T1/2 e-iT - 20

dΠ/dT = [ R’(T) – iR(T) ]e-iT = [50T-1/2 – (0.05)(100)T1/2 ] e-iT = 0

i= R’(T)/R(T)→→→0.05 = 50T-1/2 / 100 T1/2 →→→→T =10 .

12-7

An entrepreneur is engaged in a repeated point input point output

investment process . He invests Io dollars and receives a revenue of

R(T) dollars T years later . At T he will again invest Io dollars and

receive another revenue of of R(T) dollars at 2T . Assume that he

repeats this process indefinitely . Interest is compound continuously

at constant rate of i .

What is the present value of the entrepreneurs profit from such an

infinite chain ? Formulate his first order condition for profit

maximization . Compare this result with the first order condition for

the unrepeated case.](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-47-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 48

Problems

12-7 solution

Π1 = R(T) e-iT – I0 ; unrepeated case

Π2 = R(T) e-2iT - Ioe-iT = Π1 e-iT

Π3 = Π1 e-2iT

……………….

Πn = Π1 e-(n-1)iT

Π= Σi=1

∞ Πi =Π1(1+e-iT +e-2iT+e-3iT+...∞)=Π1/(1 - e-iT)=

[R(T) e-iT- I0 ]/(1 - e-iT)

dΠ/dT ={ (1 - e-iT)[R’(T) – iR(T)] e-iT - i e-iT [R(T) e-iT – Io ]} / (1 - e-iT)2 =0

(1 - e-iT)[R’(T) – iR(T)] =i [R(T) e-iT – Io]

∫o

T e-iT = (1 - e-iT)/ i = γ present value of one dollar income stream

[R’(T) – iR(T)] = 1/γ [R(T) e-iT – Io] F .O . C . Repeated case

[R’(T) – iR(T)] =marginal present value of profit (or net revenue) of increasing

the life of first casting (T) by one year .

[R(T) e-iT – Io] = net present revenue of profit from a new casting process after

T years .

1/γ [R(T) e-iT – Io]= net present revenue of profit from a new casting process for

the first year ( during the T years life of investment ).

Unrepeated case:

d(Π1 )/dT=d[R(T) e-iT – I0 )] / dT =0 → [R’(T) – iR(T)]=0 → R’(T) = iR(T)](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-48-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 49

Problems

12-8

an entrepreneur is engaged in tree growing . He purchases a seedling

for 4 dollars , incurs a cultivation cost flow at a rate G(t) = 0.4t

dollars per year during the life of a tree and sells the tree at t=T for

R(T) = 4+ 8T – T2 dollars . The market rate of interest is 20 percent.

Determine an optimal length for his cultivation period , T . Apply the

appropriate second order condition to verify that your solution is a

maximum .

12-8 solution

Π = R(T) e-iT - Io - ∫o

T G(t) e-it dt

dΠ/dT = [ R’(T) – iR(T) – G(T) ] e-iT = 0

[R’(T) – G(T) ] / R(T) = i

(-2T + 8 – 0.4T )/( 4+ 8T – T 2 ) = 0.20

T2 – 20T +36 =0 , T =2 , T=18 .

d2Π/dT2 <0 →→→T=2](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-49-2048.jpg)

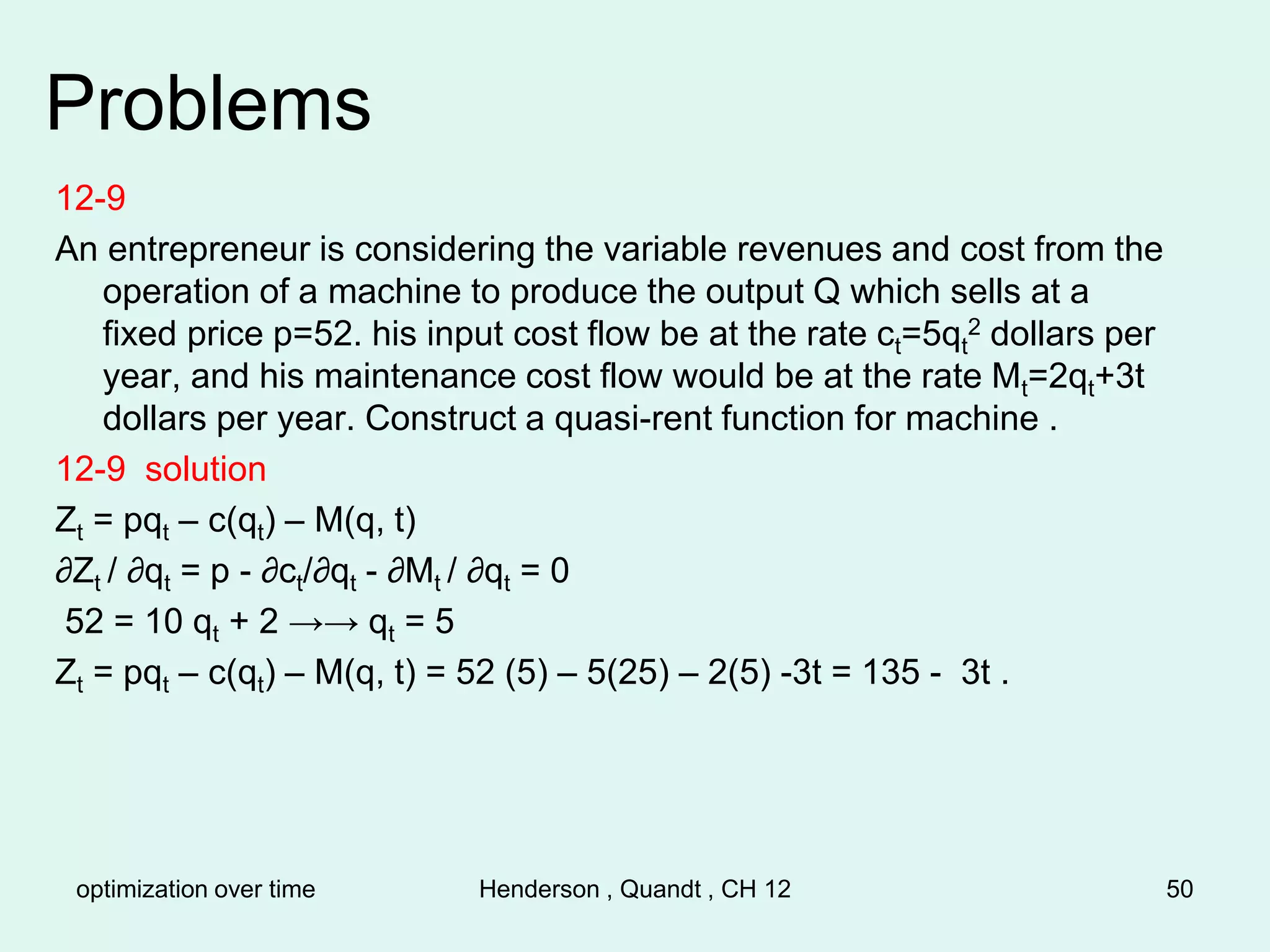

![optimization over time Henderson , Quandt , CH 12 51

Problems

12-10

An entrepreneur plans for a one-machine horizon. He purchases the

machine for 500 dollars . Its scrap value at time T is S(T)=500-40T.

The rate of interest is 0.05. The machine yields a quasi-rent flow at

the rate Zt = 85 – 4t dollars per year . When should the entrepreneur

retire this machine ?

12-10 solution

Π= ∫o

T Z(t) e-iT dt – I0 +S(T)e-iT

dΠ/dT = [Z(T) – iS(T) +S’(T)]e-iT = 0

Z(T) + S’(T) = iS(T)

85 – 4T -40 = 0.05(500 -40 T) , →→t=10

12-11

An entrepreneur with a two years horizon decides to extract 100 units

of output from an exhaustible resource . His extraction cost is

Ct=0.5qt

2 and the interest rate is 0.10 percent , and the constant

selling price for the output is 100 dollars . How much output should

he extract in each year ?](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-51-2048.jpg)

![optimization over time Henderson , Quandt , CH 12 52

Problems

12-11 solution

Max Π= Σt=1

t=2 [ ptqt – c(qt) ] (1+i)-t + λ(q0 – Σt=1

t=2 qt)

dΠ/dqt = 0 →→→ [Pt - c’(qt) ] (1+i)-t = λ

[P1 - c’(q1 ) ] (1+i)-1 = λ

[P2 - c’(q2 ) ] (1+i)-2 = λ

[P1 - c’(q1 ) ] = [P2 - c’(q2 ) ] (1+i)-1

(100 –q1) = (100 – q2)(1.01)-1

q1+q2=100

q1 = 52.3 q2 = 47.7

THE END](https://image.slidesharecdn.com/hqch12optimizationovertime-230226160121-4944a946/75/H-Q-CH-12-Optimization-over-time-ppt-52-2048.jpg)